Enhanced Flight Vision Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435580 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Enhanced Flight Vision Systems Market Size

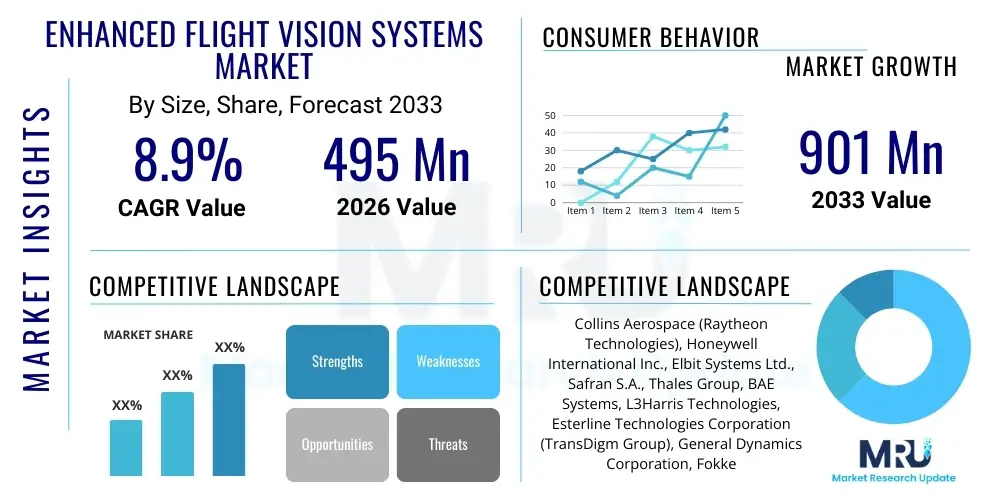

The Enhanced Flight Vision Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 495 Million in 2026 and is projected to reach USD 901 Million by the end of the forecast period in 2033.

Enhanced Flight Vision Systems Market introduction

The Enhanced Flight Vision Systems (EFVS) Market encompasses advanced technologies designed to improve pilot situational awareness and operational safety, particularly during low visibility conditions such as heavy fog, rain, or snow. EFVS leverages multi-spectral sensors, including infrared cameras, millimeter-wave radar, and low-light television, to provide pilots with a clear, synthetic view of the external environment, often displayed on a Head-Up Display (HUD) or Head-Mounted Display (HMD). This capability allows aircraft to operate efficiently under conditions that would otherwise necessitate diversions or delays, dramatically increasing operational flexibility and schedule reliability across commercial, military, and business aviation sectors.

The core product integrates high-fidelity imagery and avionics data, merging real-time sensor data with terrain databases and navigation information. Key applications involve leveraging EFVS for authorized descent below standard Decision Height (DH) or Minimum Descent Altitude (MDA), enabling near-Category III approach capabilities without requiring full Cat III ground infrastructure. The principal benefit is the reduction of weather-related operational downtime and the associated costs, alongside a substantial increase in safety margins during critical phases of flight, such as approach and landing.

Driving factors for market expansion include evolving regulatory mandates by agencies such as the FAA (Federal Aviation Administration) and EASA (European Union Aviation Safety Agency) that increasingly permit EFVS use for operational credit, thereby making the technology an essential investment for new aircraft programs and fleet retrofits. Furthermore, the rising demand for all-weather operations in rapidly growing regional aviation markets, combined with technological advancements in sensor miniaturization, fusion algorithms, and high-resolution display systems, significantly fuels the global adoption of Enhanced Flight Vision Systems across various aerial platforms.

Enhanced Flight Vision Systems Market Executive Summary

The global Enhanced Flight Vision Systems (EFVS) Market is poised for robust expansion driven primarily by stringent aviation safety regulations and the sustained modernization of commercial and general aviation fleets globally. Business trends indicate a shift towards sensor fusion technologies that integrate multiple spectral bands (Visible, Near-Infrared, Mid-Infrared) to produce a highly resilient and detailed synthetic vision. Major manufacturers are focusing on miniaturization, enhancing display clarity (particularly HUD technology), and developing advanced processing units capable of real-time image rendering and anomaly detection. Competitive dynamics are intensifying, pushing system integration costs down while increasing performance standards, making EFVS more accessible across mid-sized business jets and regional carriers.

Regional trends highlight North America and Europe as leading markets due to established aviation infrastructure, high concentration of major aerospace OEMs, and early regulatory adoption granting operational credits for EFVS usage. However, the Asia Pacific region is expected to demonstrate the fastest growth rate, fueled by massive investment in new airport infrastructure, rapidly expanding air passenger traffic, and corresponding fleet expansion and modernization programs, particularly in China and India. Military applications, focused on reconnaissance and low-altitude flight, also provide a steady demand stream across all regions, emphasizing ruggedized and covert EFVS solutions.

Segment trends underscore the dominance of the commercial aviation segment, driven by the massive backlog of aircraft orders and the requirement for compliance with global all-weather operation standards. Within components, high-resolution infrared sensors and advanced image processing units are the highest growth segments, reflecting the constant push for improved image fidelity and latency reduction. Furthermore, the retrofit market for older aircraft is gaining traction as airlines seek cost-effective ways to enhance existing fleets with EFVS capabilities without purchasing entirely new aircraft platforms, sustaining demand for integration services and aftermarket support.

AI Impact Analysis on Enhanced Flight Vision Systems Market

User queries regarding AI's influence on the EFVS market frequently center on how artificial intelligence can move the technology beyond simple imagery presentation toward predictive analysis and autonomous decision support. Common themes include the potential for AI-powered sensor fusion to automatically filter noise and atmospheric distortions, improving image quality and reliability in zero-visibility environments. Users also express strong interest in AI algorithms that can detect, classify, and track non-cooperative objects (such as drones or unexpected debris) faster than human pilots, effectively enhancing obstacle avoidance. Expectations are high that machine learning will be leveraged to personalize display symbology and alert thresholds based on pilot cognitive load and mission phase, minimizing information overload and maximizing timely awareness, ultimately leading to higher levels of operational autonomy and standardized safety procedures.

- AI enhances sensor fusion algorithms, integrating data from multiple sources (infrared, radar, LiDAR) to generate a seamless, highly reliable synthetic view.

- Machine learning improves image processing by automatically filtering atmospheric interference (fog, smoke) and compensating for sensor degradation.

- AI enables advanced object recognition and classification, rapidly identifying runway incursions, wildlife hazards, and non-cooperative air traffic in real time.

- Predictive maintenance schedules for EFVS components are optimized using AI analysis of performance data and operational environment factors.

- Cognitive load management systems utilize AI to adapt EFVS display content and alert severity based on pilot stress levels and current flight phase.

- Autonomous decision support features, driven by neural networks, can provide recommendations for optimal approach path adjustments in rapidly changing low-visibility conditions.

- AI algorithms facilitate the rapid certification and testing of new EFVS hardware and software updates by automating scenario simulations and performance validations.

DRO & Impact Forces Of Enhanced Flight Vision Systems Market

The Enhanced Flight Vision Systems (EFVS) market is significantly influenced by a dynamic interplay of factors. Key drivers include stringent regulatory support for operational credit, which provides tangible economic benefits for adopting the technology, coupled with the relentless pursuit of improved aviation safety standards across commercial operations. However, restraints persist, primarily centered on the high initial cost of integration, especially for complex retrofits on older aircraft, and the substantial certification hurdles that sophisticated avionics systems must overcome to gain operational approval across different international jurisdictions. Opportunities are emerging through the expansion into unmanned aerial vehicles (UAVs) and rotorcraft markets, alongside continuous technological miniaturization and cost reduction, making EFVS viable for smaller aircraft platforms and regional airlines. The primary impact forces pushing the market forward are the regulatory push for Cat III equivalent operations and the competitive necessity for airlines to maintain operational continuity regardless of weather conditions.

Segmentation Analysis

The Enhanced Flight Vision Systems Market is segmented based on Component, Platform, Application, and Technology. This granular segmentation allows for a precise understanding of market dynamics and investment areas. The Component segmentation, covering sensors, display units, and processing computers, highlights the technological drivers of image acquisition and presentation. The Platform segmentation distinguishes between commercial, military, and business aviation sectors, each possessing unique regulatory requirements and system demands. Application segmentation focuses on operational phases such as taxi, takeoff, and landing, where the benefits of EFVS are most pronounced. Finally, Technology segmentation categorizes systems based on the primary sensing method utilized, such as infrared or multispectral fusion, providing insights into future innovation trends and adoption rates.

- By Component

- Sensors (Infrared, CMOS/CCD, Radar, Fusion Sensors)

- Display Units (Head-Up Displays (HUD), Head-Mounted Displays (HMD), Primary Flight Displays (PFD))

- Processing and Control Units

- By Platform

- Commercial Aircraft (Narrow-body, Wide-body, Regional Jets)

- Business Jets (Light, Mid-size, Large/Ultra-long Range)

- Military and Special Mission Aircraft (Transport, Fighter, Reconnaissance)

- Rotorcraft (Civil Helicopters, Military Helicopters)

- By Technology

- Infrared Imaging Systems

- Combined Vision Systems (CVS)

- Synthetic Vision Systems (SVS) - often integrated with EFVS

- Multi-Spectral Fusion Systems

- By Application

- Ground Operations (Taxi, Takeoff)

- Approach and Landing (Descent below Decision Height)

- En-Route Navigation

Value Chain Analysis For Enhanced Flight Vision Systems Market

The value chain for the Enhanced Flight Vision Systems Market begins with upstream analysis, involving the specialized suppliers of core technological components. This includes manufacturers of high-performance infrared detectors (e.g., indium antimonide, uncooled microbolometers), high-resolution projection engines for displays (OLED, LCoS), and dedicated avionics processors (ASICs, FPGAs) crucial for complex image fusion algorithms. These suppliers provide the foundational technology that dictates system performance and cost. The intermediate stage involves Tier 1 aerospace system integrators who design, manufacture, and assemble the complete EFVS, ensuring seamless integration of the sensor head, display unit, and processing computers, while rigorously adhering to aviation certification standards (e.g., DO-178C, DO-254). Key activities at this stage include sensor calibration, software development for image manipulation, and human-machine interface design.

Downstream analysis focuses on the distribution channels and the ultimate installation and service phases. Distribution channels predominantly involve direct sales to Original Equipment Manufacturers (OEMs) for line-fit installations on new aircraft, providing the largest volume of units. Alternatively, systems are supplied to Maintenance, Repair, and Overhaul (MRO) providers and specialized avionics retrofit centers for aftermarket installation on existing fleets. Direct interaction with major airframers (Boeing, Airbus, Gulfstream) is critical for securing long-term contracts and standardizing integration processes. The value chain concludes with post-installation support, including software updates, maintenance services, and pilot training on system usage, which forms a significant revenue stream for the key players.

The market employs both direct and indirect distribution methods. Direct channels involve Tier 1 suppliers selling systems directly to large aircraft OEMs or major military programs, emphasizing tailored solutions and deep integration partnerships. Indirect channels utilize specialized distributors and MRO networks, particularly vital for reaching the vast global fleet of general and business aviation aircraft requiring retrofit solutions. The complexity of EFVS mandates extensive technical support and certification expertise at every point in the value chain, making specialized technical sales and integration services more important than traditional volume-based retail distribution.

Enhanced Flight Vision Systems Market Potential Customers

The primary customers for Enhanced Flight Vision Systems span the commercial aviation sector, specialized military operations, and the high-end business jet market. Commercial airlines represent the largest end-user segment, driven by the need to maximize operational efficiency and maintain high schedule reliability by minimizing weather-related diversions and delays. Major buyers include flag carriers and low-cost carriers operating in regions frequently impacted by adverse weather conditions, seeking regulatory credit to operate in lower visibility environments. Fleet modernization programs often mandate EFVS installation for new acquisitions and require retrofit solutions for older, yet capable, wide-body and narrow-body aircraft.

The business aviation segment, comprising owners and operators of large-cabin and ultra-long-range jets (e.g., Gulfstream, Bombardier, Dassault), constitutes a high-value customer base. These operators prioritize mission capability, safety, and access to smaller, challenging airfields in all weather, making EFVS a standard, often mandatory, feature. Military end-users, including global air forces and naval aviation units, purchase EFVS for tactical advantages, enabling low-level flight, enhanced targeting, and superior situational awareness during night or degraded visual environment (DVE) operations for transport, surveillance, and combat platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 495 Million |

| Market Forecast in 2033 | USD 901 Million |

| Growth Rate | CAGR 8.9% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Collins Aerospace (Raytheon Technologies), Honeywell International Inc., Elbit Systems Ltd., Safran S.A., Thales Group, BAE Systems, L3Harris Technologies, Esterline Technologies Corporation (TransDigm Group), General Dynamics Corporation, Fokker Technologies (GKN Aerospace), United Technologies Corporation (Legacy), Astronics Corporation, Max-Viz (Elbit Systems), Universal Avionics (A Head-Up Display Segment), Garmin International, Leonardo S.p.A., Meggitt PLC, Dassault Aviation, Bombardier Aerospace, FlightSafety International |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Enhanced Flight Vision Systems Market Key Technology Landscape

The technological landscape of the Enhanced Flight Vision Systems Market is rapidly evolving, driven by the demand for higher image fidelity, reduced latency, and improved integration capabilities. A cornerstone technology is multi-spectral imaging, which combines data from different parts of the electromagnetic spectrum—typically using Long Wave Infrared (LWIR) and Short Wave Infrared (SWIR) sensors—to create a robust and high-contrast external view, minimizing the effect of fog and smoke. Advanced sensor fusion algorithms are critical; these computational techniques merge the distinct outputs from the various sensors (IR, visible light, sometimes radar) with stored Synthetic Vision System (SVS) terrain databases to produce a cohesive, conformal, and highly reliable image presented to the pilot, ensuring that the synthetic view aligns perfectly with the real-world perspective once visual contact is made.

Display technology constitutes another vital area of innovation. Head-Up Displays (HUDs) remain the dominant interface, offering pilots the ability to view the EFVS imagery overlayed directly onto the external scene without shifting focal length, which is crucial during critical phases of flight. The shift toward higher-resolution micro-displays, such as Organic Light-Emitting Diodes (OLED) and Liquid Crystal on Silicon (LCoS), is improving the brightness, contrast, and field-of-view of HUD projections. Concurrently, the increasing adoption of Head-Mounted Displays (HMDs) is providing EFVS solutions for rotorcraft and military platforms where cockpit space or configuration makes traditional fixed HUDs impractical, offering an even wider field of regard and greater flexibility in image presentation.

Furthermore, the market is heavily investing in high-speed, miniaturized processing units. These units must handle terabytes of sensor data, performing complex real-time processing, geometric correction, and fusion within milliseconds to meet stringent latency requirements mandated for flight safety. The incorporation of AI and deep learning techniques into these processors is enhancing image stabilization, obstacle detection, and automated cueing, moving EFVS from a passive viewing aid to an active decision support tool. Ongoing research also targets integrating EFVS outputs with autopilot and flight control systems to enable automated landings in extremely low visibility, pushing the boundaries towards true all-weather operational capability without human intervention.

Regional Highlights

- North America: Dominates the market due to the presence of key aerospace OEMs (Boeing, Gulfstream, Lockheed Martin) and proactive regulatory support from the FAA, which pioneered operational credit for EFVS to Decision Height (DH) 100 feet. The region benefits from substantial defense spending and a high adoption rate in the lucrative business jet sector, driven by operators seeking maximum dispatch reliability.

- Europe: Represents a mature market characterized by rigorous safety standards established by EASA. Growth is sustained by modernization programs for large commercial fleets and strong manufacturing capabilities from companies like Airbus and Safran. Regulatory harmonization across the EU facilitates widespread adoption, emphasizing Combined Vision Systems (CVS) to enhance existing infrastructure capabilities.

- Asia Pacific (APAC): Positioned as the fastest-growing region, fueled by unprecedented growth in air travel, corresponding airport infrastructure expansion, and large-scale procurement of new generation aircraft (both commercial and military). Countries like China, India, and Japan are heavily investing in avionics upgrades to cope with increasing traffic density and regional weather challenges.

- Latin America (LATAM): Exhibits steady growth, primarily driven by the need for better operational capabilities in diverse and often challenging geographical and atmospheric conditions. The retrofit market is particularly important here, as regional airlines seek cost-effective ways to enhance the safety and performance of their existing fleets.

- Middle East and Africa (MEA): Growth is tied to robust defense spending, particularly in the Middle East for advanced military aviation systems, and the expansion of major international carriers seeking cutting-edge technology to maintain competitiveness and safety standards, particularly for long-haul operations facing varied climate conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Enhanced Flight Vision Systems Market.- Collins Aerospace (Raytheon Technologies)

- Honeywell International Inc.

- Elbit Systems Ltd.

- Safran S.A.

- Thales Group

- BAE Systems

- L3Harris Technologies

- Esterline Technologies Corporation (TransDigm Group)

- General Dynamics Corporation

- Fokker Technologies (GKN Aerospace)

- United Technologies Corporation (Legacy)

- Astronics Corporation

- Max-Viz (Elbit Systems)

- Universal Avionics (A Head-Up Display Segment)

- Garmin International

- Leonardo S.p.A.

- Meggitt PLC

- Dassault Aviation

- Bombardier Aerospace

- FlightSafety International

Frequently Asked Questions

Analyze common user questions about the Enhanced Flight Vision Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Enhanced Flight Vision Systems (EFVS) and Synthetic Vision Systems (SVS)?

EFVS uses real-time sensors (like infrared cameras) to provide an enhanced view of the external environment, especially in low visibility. SVS, conversely, uses a computerized database of terrain and obstacles to create a graphical representation. Modern systems often merge the two into Combined Vision Systems (CVS).

How does EFVS provide operational credit for lowering minimum descent altitude (MDA)?

Regulatory bodies, such as the FAA, grant operational credit, allowing EFVS-equipped aircraft to descend to 100 feet above the touchdown zone elevation before requiring natural visual confirmation, effectively enabling near-Category III equivalent operations safely and reliably.

Which platform segment is driving the highest demand for EFVS installations?

The commercial aircraft segment currently represents the largest market share, driven by major airlines investing in fleet modernization and efficiency to meet stringent global standards for all-weather operation and schedule reliability, particularly in emerging markets.

What are the main technical challenges facing the proliferation of EFVS technology?

Key challenges include managing the high complexity and cost associated with integrating multi-spectral sensor arrays, achieving extremely low latency in real-time image processing, and navigating the rigorous, platform-specific certification requirements across international jurisdictions.

What role does Artificial Intelligence (AI) play in the future of Enhanced Flight Vision Systems?

AI is crucial for optimizing sensor fusion, automatically filtering environmental noise, enhancing real-time object detection and classification (e.g., detecting runway debris or non-cooperative drones), and improving the overall reliability and predictive capabilities of the system.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager