Enoxaparin Sodium Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434101 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Enoxaparin Sodium Market Size

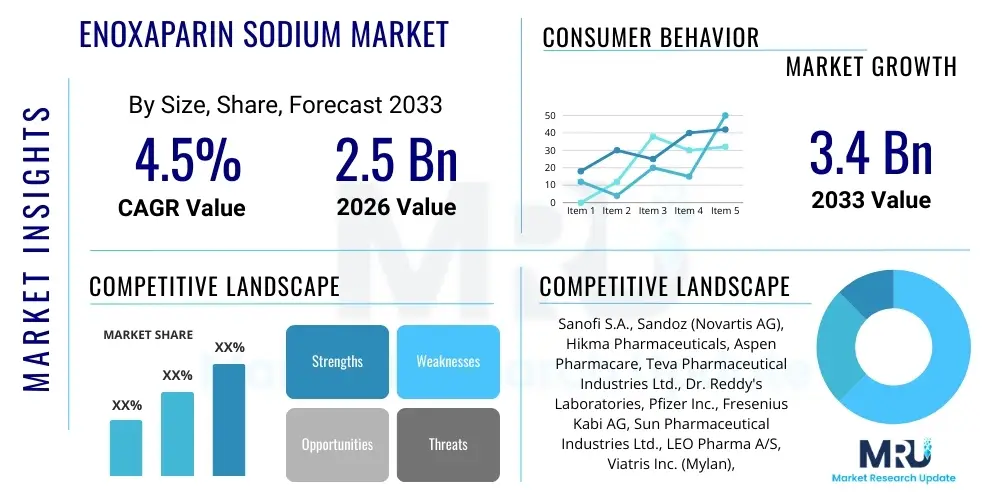

The Enoxaparin Sodium Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 2.5 billion in 2026 and is projected to reach USD 3.4 billion by the end of the forecast period in 2033.

Enoxaparin Sodium Market introduction

The Enoxaparin Sodium Market centers on the pharmaceutical distribution and utilization of a low molecular weight heparin (LMWH). Enoxaparin sodium is a critical anticoagulant medication, primarily used for the prophylaxis and treatment of deep vein thrombosis (DVT) and pulmonary embolism (PE), as well as unstable angina and non-Q-wave myocardial infarction (MI). Its mechanism involves potentiating the activity of antithrombin III, leading to the inhibition of Factor Xa, which is crucial in the coagulation cascade. This targeted action provides a predictable anticoagulant response, minimizing the need for continuous laboratory monitoring often associated with unfractionated heparin, thereby enhancing patient safety and convenience.

The primary driving factors for market growth include the increasing prevalence of chronic conditions such as cardiovascular diseases (CVDs) and obesity, which significantly raise the risk of venous thromboembolism (VTE). Furthermore, the expanding geriatric population globally is highly susceptible to VTE due to reduced mobility and co-morbidities requiring surgical intervention, particularly orthopedic procedures where Enoxaparin is routinely used for post-operative prophylaxis. The product is typically administered via subcutaneous injection, often available in pre-filled syringes, making it suitable for both hospital settings and home-based patient care, significantly broadening its therapeutic reach.

Major applications span across acute medical conditions, surgical prophylaxis, and chronic disease management. Benefits such as a long half-life, high bioavailability, and standardized dosing regimens contribute to its widespread adoption by healthcare providers. Despite patent expirations leading to strong generic competition, the market remains robust, sustained by continuous clinical guideline endorsements and the drug’s indispensable role in acute care settings. Future growth is expected to be fueled by expanded use in outpatient settings and continuous efforts to improve patient adherence through optimized delivery systems.

Enoxaparin Sodium Market Executive Summary

The Enoxaparin Sodium Market is characterized by intense generic competition following the entry of biosimilar versions of Lovenox, the originator drug. Business trends indicate a strategic pivot by major pharmaceutical companies towards differentiating their LMWH offerings through advanced delivery mechanisms, comprehensive patient support programs, and robust supply chain resilience to maintain market share against lower-cost alternatives. Pricing pressure remains a dominant factor, particularly in established markets like North America and Europe, compelling manufacturers to seek efficiency gains in production and distribution. Emerging markets, conversely, are experiencing rapid adoption driven by improving healthcare infrastructure and increasing awareness regarding VTE management, presenting significant growth opportunities for both branded and generic players.

Regional trends highlight North America’s dominance, primarily due to high healthcare expenditure, sophisticated VTE treatment guidelines, and high rates of complex surgical procedures requiring prophylactic anticoagulation. However, the Asia Pacific (APAC) region is projected to register the highest growth rate (CAGR) due to rapid economic development, increasing accessibility to advanced treatments, and a large, aging population base contributing to a higher incidence of thrombotic events. European markets maintain stable growth, supported by national healthcare system protocols that mandate the use of LMWHs in relevant clinical scenarios. Latin America and the Middle East & Africa (MEA) are witnessing moderate expansion, contingent on regulatory approval speeds and procurement policies.

Segment trends reveal that the prophylaxis application segment holds the largest market share, driven by its extensive use pre- and post-surgery, especially in orthopedic and general surgery wards. The treatment segment, while smaller, is growing steadily due to the rising incidence of acute DVT and PE. In terms of distribution channels, hospital pharmacies remain the primary channel for immediate care settings, although the retail and online pharmacy segments are gaining traction, especially for long-term patient management and continuity of care following hospital discharge. The pre-filled syringe formulation dominates due to its superior convenience, accuracy, and reduced risk of dosing errors compared to multi-dose vials.

AI Impact Analysis on Enoxaparin Sodium Market

Users frequently inquire about how Artificial Intelligence (AI) can optimize the prescription and management of anticoagulants, specifically Enoxaparin Sodium, amidst complex patient profiles and the need for personalized dosing, particularly concerning weight variations, renal impairment, and drug interactions. Key themes revolve around AI's ability to enhance risk stratification for VTE in hospitalized patients, minimize adverse drug reactions like heparin-induced thrombocytopenia (HIT), and streamline supply chain logistics for temperature-sensitive drugs. Concerns often center on the validation and regulatory approval of AI-driven diagnostic and therapeutic support systems, ensuring data privacy, and the integration challenges within existing Electronic Health Record (EHR) systems used in hospitals.

- AI-powered predictive modeling for patient specific VTE risk assessment, optimizing prophylactic dosing schedules.

- Enhanced supply chain management using machine learning algorithms to predict demand fluctuations and manage cold chain logistics efficiently.

- Development of clinical decision support systems (CDSS) utilizing AI to flag contraindications, monitor renal function effects, and prevent potential bleeding complications.

- Accelerated drug discovery and formulation optimization processes, potentially identifying novel delivery routes or modifying LMWH structure for improved efficacy.

- Automated analysis of patient monitoring data to detect early signs of adverse events, such as HIT, leading to timely intervention and improved patient safety outcomes.

DRO & Impact Forces Of Enoxaparin Sodium Market

The Enoxaparin Sodium Market is propelled by the escalating global incidence of venous thromboembolism (VTE) coupled with an aging demographic highly susceptible to thrombotic events, acting as primary market drivers. However, market growth is severely constrained by intense pricing pressure due to the widespread availability of low-cost generic and biosimilar versions of Enoxaparin, leading to margin erosion for established players. Opportunities lie in expanding the drug’s use in novel indications, such as oncology-associated VTE prophylaxis, and penetrating emerging markets with untapped patient populations. These forces collectively shape the competitive landscape, pushing companies toward innovation in delivery and strategic market access to sustain profitability.

Drivers: The rising volume of major surgical procedures, particularly high-risk orthopedic surgeries (knee and hip replacements), necessitates aggressive VTE prophylaxis, directly increasing Enoxaparin consumption. Furthermore, changing lifestyles leading to high rates of obesity and diabetes, major risk factors for thrombosis, fuel the demand for effective anticoagulation therapy. Global guidelines consistently recommend LMWHs as the gold standard for many VTE prevention scenarios, solidifying their market position. The convenience of once- or twice-daily dosing compared to continuous infusion options further supports its widespread clinical adoption.

Restraints: The primary restraint is the significant threat posed by alternative oral anticoagulants (NOACs/DOACs) such as Rivaroxaban and Apixaban, which offer the convenience of oral administration, eliminating the need for injections, although LMWHs remain superior in specific populations (e.g., pregnant patients or those with severe renal impairment). Additionally, the potential side effect profile, particularly the risk of bleeding complications and the development of heparin-induced thrombocytopenia (HIT), requires careful clinical monitoring and limits usage in certain high-risk patient groups. High manufacturing complexity and stringent regulatory oversight for biosimilar production also act as barriers to entry for new competitors.

Opportunities: Manufacturers can capitalize on the growing demand for home healthcare services by focusing on patient education and self-administration training programs, expanding the usage outside traditional hospital settings. Exploration of therapeutic combinations and advanced formulations that improve stability or reduce injection site discomfort represents another significant opportunity. Furthermore, targeting underserved geographies in APAC and Latin America, characterized by improving healthcare infrastructure and rising disposable incomes, offers substantial avenues for market expansion beyond saturated Western economies.

Impact Forces: The impact forces are predominantly driven by regulatory shifts concerning biosimilar approval pathways, which can rapidly alter market dynamics by introducing highly competitive, cost-effective options. Clinical evidence from large-scale randomized control trials continually impacts prescribing habits, reinforcing or challenging the established use cases for Enoxaparin Sodium. Payer pressure from government agencies and private insurance companies seeking cost containment measures strongly influences procurement decisions, favoring generics where possible. Technological advancements in diagnostic tools that precisely identify high-risk VTE patients ensure appropriate therapeutic targeting, thereby stabilizing demand for the drug.

Segmentation Analysis

The Enoxaparin Sodium market is intricately segmented based on application, distribution channel, and formulation, providing a comprehensive view of therapeutic utilization and commercial pathways. Application segmentation is critical as it delineates the primary therapeutic areas driving demand, with prophylaxis dominating due to the massive volume of surgical interventions performed globally. Distribution analysis reveals the critical role of hospital procurement channels versus the growing influence of retail and online dispensing for long-term patient care. Formulation differentiation, particularly the shift toward pre-filled syringes, addresses key user needs related to ease of use and patient safety, underscoring the market's focus on efficient administration.

Understanding these segments is essential for strategic planning, allowing market participants to tailor their marketing and distribution strategies to specific end-user requirements. For instance, companies targeting the prophylaxis segment must focus on institutional sales and bulk purchasing agreements, while those addressing the growing retail channel must prioritize patient-friendly packaging and strong pharmacy partnerships. The interplay between generic erosion and innovation in delivery systems continues to define segment dynamics, particularly in mature markets where pricing sensitivity is high.

- By Application:

- Prophylaxis (VTE Prophylaxis in surgical and medical patients, VTE Prophylaxis in critically ill patients)

- Treatment (Acute Deep Vein Thrombosis (DVT), Pulmonary Embolism (PE), Unstable Angina and Non-Q-wave Myocardial Infarction (MI))

- Others (Hemodialysis)

- By Formulation:

- Pre-filled Syringes (PFS)

- Vials (Multi-dose and Single-dose)

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Value Chain Analysis For Enoxaparin Sodium Market

The value chain for the Enoxaparin Sodium market begins with the complex upstream analysis, primarily involving the sourcing and processing of porcine intestinal mucosa, the crude material from which unfractionated heparin (UFH) is derived, subsequently undergoing controlled depolymerization to produce LMWH. Key upstream activities include securing stable supplies of raw materials, ensuring purification standards meet stringent pharmaceutical guidelines, and maintaining high-quality control in the active pharmaceutical ingredient (API) synthesis phase. Manufacturers must navigate geopolitical risks associated with raw material sourcing, particularly the reliance on international suppliers, demanding robust traceability protocols.

The midstream focuses on manufacturing and formulation, encompassing the specialized process of converting the API into final dosage forms, predominantly sterile pre-filled syringes or vials. This stage requires significant investment in specialized sterile manufacturing facilities and quality assurance systems to comply with Good Manufacturing Practices (GMP). The value is added through specialized packaging designed for patient self-administration, focusing on needle safety mechanisms and dose accuracy. The downstream analysis involves distribution, where complex supply chains manage the temperature-sensitive nature of the injectable product, utilizing established distribution channels.

Distribution is segmented into direct and indirect routes. Direct distribution involves large pharmaceutical companies negotiating directly with major hospital groups, integrated healthcare networks, and government procurement agencies, securing large-volume tenders, which is crucial for the prophylaxis segment. Indirect channels utilize wholesalers and distributors to reach smaller clinics, retail pharmacies, and increasingly, online pharmacy platforms for outpatient prescriptions. The efficiency of the distribution network, particularly the cold chain logistics, significantly impacts product efficacy and market penetration. Final value addition occurs at the point of dispensing, where pharmacists and healthcare providers offer patient counseling on injection techniques and monitoring, ensuring appropriate use.

Enoxaparin Sodium Market Potential Customers

The primary end-users and buyers of Enoxaparin Sodium are institutional healthcare providers, including large multi-specialty hospitals, specialized cardiac and orthopedic centers, and ambulatory surgical centers, which collectively account for the majority of purchase volumes due to the immediate need for VTE prophylaxis in acute care settings. These institutions prioritize procurement based on efficacy, price, contract terms for bulk purchasing, and reliability of supply, often selecting generic or biosimilar versions if clinical equivalence is demonstrated to manage drug expenditure budgets effectively. Group Purchasing Organizations (GPOs) play a pivotal role in negotiating large contracts on behalf of these institutional buyers.

A rapidly growing segment of potential customers includes home healthcare agencies and individual patients managing chronic conditions or recovering from surgery outside of a hospital setting, receiving the medication through retail or mail-order pharmacies. These patients and their caregivers value the convenience of pre-filled syringes and access to patient support programs provided by manufacturers. Specialized clinics, such as oncology centers, also represent significant buyers, utilizing LMWHs for prophylaxis in high-risk cancer patients whose disease and treatment significantly elevate their risk of thrombosis.

Government healthcare systems, particularly in Europe and Asia, act as massive single payers or centralized procurement bodies, determining which Enoxaparin products are reimbursed and influencing national clinical guidelines. Procurement decisions in this sector are heavily weighted towards pharmacoeconomic data, favoring products that offer the best value proposition in terms of cost-effectiveness and demonstrated clinical outcomes in real-world settings, thereby creating intense competition between branded and non-branded suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 3.4 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sanofi S.A., Sandoz (Novartis AG), Hikma Pharmaceuticals, Aspen Pharmacare, Teva Pharmaceutical Industries Ltd., Dr. Reddy's Laboratories, Pfizer Inc., Fresenius Kabi AG, Sun Pharmaceutical Industries Ltd., LEO Pharma A/S, Viatris Inc. (Mylan), Emcure Pharmaceuticals, Bristol Myers Squibb (BMS), Jiangsu Wanbang Biopharma, Coherus BioSciences. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Enoxaparin Sodium Market Key Technology Landscape

The technology landscape surrounding the Enoxaparin Sodium market is primarily focused on enhancing delivery systems and ensuring regulatory compliance through advanced analytical techniques. The dominant technological advancement involves the development and refinement of pre-filled syringe (PFS) technology, which incorporates ergonomic design elements, integrated safety features (such as automated needle retraction mechanisms), and sophisticated filling techniques to ensure high dose accuracy and sterility. These innovations are crucial for maintaining patient safety, reducing needlestick injuries for healthcare workers, and facilitating self-administration in non-clinical settings, differentiating premium products from standard generics.

Another significant technological area is the utilization of advanced bioanalytical methods, such as high-performance liquid chromatography (HPLC) and anti-Factor Xa assays, crucial for characterizing and ensuring the biosimilarity of generic Enoxaparin products. Regulatory bodies demand rigorous data demonstrating physicochemical equivalence and comparable biological activity between biosimilars and the reference product (Lovenox). Manufacturers invest heavily in these analytical technologies to navigate complex regulatory pathways, particularly in jurisdictions like the US (FDA) and EU (EMA), where biosimilar approval requires extensive comparative structural analysis.

Furthermore, technology is applied heavily in the manufacturing upstream, specifically in optimizing the depolymerization and purification processes of heparin derived from porcine sources to achieve the precise molecular weight profile required for Enoxaparin Sodium. Future technological focuses are shifting towards integrating digital health solutions, such as companion apps and connectivity features in injection devices, which could monitor patient adherence, track injection sites, and report data back to healthcare providers, thereby enhancing the overall efficacy and safety profile of the treatment regimen. Investment in cold chain monitoring technology, using IoT sensors for real-time temperature tracking during distribution, is also paramount given the sensitivity of LMWHs.

Regional Highlights

- North America: This region dominates the global Enoxaparin Sodium market, driven by high per capita healthcare spending, well-established VTE treatment guidelines favoring LMWHs, and a large population undergoing high-risk surgical procedures. The US market, in particular, is mature and highly competitive, characterized by the successful penetration of biosimilars leading to intense price negotiations, particularly within large hospital systems and government procurement contracts (e.g., Veterans Affairs). Canada also maintains significant consumption, supported by robust governmental healthcare programs. Technological adoption, especially in safety syringes and integrated care pathways, is high, sustaining market value despite generic erosion.

- Europe: The European market represents the second largest consumer, displaying stable growth fueled by clear clinical protocols across major economies like Germany, France, and the UK. Pricing pressure here is managed through centralized tender systems and health technology assessments (HTA) which rigorously evaluate cost-effectiveness. The availability of multiple registered biosimilars in the EU has significantly increased patient access while simultaneously driving down the average selling price. Eastern European countries are rapidly integrating Enoxaparin into their standard treatment protocols as healthcare modernization progresses.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing regional market throughout the forecast period. This accelerated growth is primarily attributed to the massive population base, increasing prevalence of cardiovascular diseases and lifestyle-related disorders, and significant improvements in healthcare infrastructure across countries like China, India, and South Korea. Local manufacturers are rapidly developing and launching domestic generic versions, often supported by government initiatives aiming for self-sufficiency in essential medicines. Economic growth and rising disposable incomes enable greater patient access to injectable treatments, shifting demand from basic care towards advanced pharmacological agents like Enoxaparin.

- Latin America (LATAM): The LATAM region, including Brazil and Mexico, exhibits moderate growth, largely dependent on macroeconomic stability and fluctuating government healthcare budgets. Market penetration is variable, often relying on tenders and direct purchases by national health systems. Regulatory complexity and slower approval processes for biosimilars can sometimes delay market entry, but increasing awareness of VTE prophylaxis in high-risk patients provides a consistent demand floor. The focus often remains on cost-effective options due to constrained public health budgets.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) countries, benefiting from high healthcare investment, rapid adoption of international clinical standards, and medical tourism infrastructure. In contrast, Africa faces challenges related to infrastructure, supply chain inconsistencies, and limited patient affordability, although donor-funded programs and growing pharmaceutical manufacturing hubs are gradually improving access to essential anticoagulants like Enoxaparin Sodium. The market remains sensitive to external geopolitical and economic factors impacting trade and pharmaceutical procurement.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Enoxaparin Sodium Market.- Sanofi S.A.

- Sandoz (Novartis AG)

- Hikma Pharmaceuticals

- Aspen Pharmacare

- Teva Pharmaceutical Industries Ltd.

- Dr. Reddy's Laboratories

- Pfizer Inc.

- Fresenius Kabi AG

- Sun Pharmaceutical Industries Ltd.

- LEO Pharma A/S

- Viatris Inc. (Mylan)

- Emcure Pharmaceuticals

- Bristol Myers Squibb (BMS)

- Jiangsu Wanbang Biopharma

- Coherus BioSciences

- Bausch Health Companies Inc.

- Baxter International Inc.

- Cipla Ltd.

- Zydus Cadila

- Hospira (a Pfizer company)

Frequently Asked Questions

Analyze common user questions about the Enoxaparin Sodium market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor restraining growth in the Enoxaparin Sodium market?

The primary constraint is the severe competitive pricing pressure caused by the widespread market penetration of generic and biosimilar Enoxaparin alternatives, alongside the increasing clinical adoption of convenient oral anticoagulants (DOACs) in non-acute settings.

Which region currently leads the Enoxaparin Sodium Market in terms of market share?

North America holds the largest market share, driven by advanced healthcare infrastructure, high incidence of conditions requiring VTE prophylaxis, established clinical guidelines, and substantial expenditure on acute hospital care and specialized surgery.

How does the formulation of Enoxaparin Sodium impact its market adoption?

Pre-filled syringes (PFS) dominate the formulation segment due to superior patient safety, reduced dosing errors, convenience for self-administration in outpatient settings, and enhanced ergonomic features compared to traditional multi-dose vials.

What role does AI technology play in the future of Enoxaparin Sodium usage?

AI is crucial for developing predictive models that assess patient-specific VTE risk, optimizing individualized dosing, and creating advanced clinical decision support systems (CDSS) to monitor for adverse events like bleeding or HIT, improving overall patient management.

What key differences distinguish Enoxaparin Sodium from oral anticoagulants (DOACs)?

Enoxaparin Sodium, an injectable LMWH, is preferred in specific high-risk scenarios such as pregnancy, immediate pre- and post-surgical prophylaxis, and patients with certain mechanical heart valves or severe renal impairment, where DOACs may be contraindicated or less effective.

Why is the Asia Pacific region projected to exhibit the highest Compound Annual Growth Rate (CAGR)?

APAC’s high CAGR is attributed to rapid improvements in healthcare access, significant growth in the geriatric population, rising prevalence of chronic diseases increasing VTE risk, and the accelerating development and adoption of affordable generic LMWHs by local manufacturers.

Which application segment accounts for the largest utilization of Enoxaparin Sodium?

The prophylaxis application segment, specifically VTE prevention in surgical (especially orthopedic) and acutely ill medical patients, constitutes the largest portion of market volume, driven by mandatory clinical guidelines for patient safety protocols.

What are the primary challenges in the upstream value chain for Enoxaparin Sodium production?

Upstream challenges primarily involve securing reliable, sustainable, and high-quality sources of porcine intestinal mucosa, the raw material for heparin, and managing the complex purification and depolymerization processes to meet precise molecular weight and purity standards.

How significant is the role of biosimilar competition in recent market trends?

Biosimilar competition is highly significant, acting as a major impact force by intensifying price wars, eroding market share from originator brands, and accelerating the adoption of cost-containment strategies by hospital procurement departments globally.

What is the typical shelf life and storage requirement for Enoxaparin Sodium?

Enoxaparin Sodium generally requires specific cold chain management during distribution, typically stored at controlled room temperatures or refrigerated, and manufacturers must provide robust data ensuring its stability and efficacy throughout the labeled shelf life, which is usually two to three years.

Are there ongoing efforts to develop non-porcine sourced LMWH alternatives?

Yes, significant research efforts are dedicated to developing synthetic or recombinant forms of LMWHs, or alternative anticoagulants, primarily to mitigate the risk of supply disruptions associated with animal-derived raw materials and concerns related to potential viral transmission.

What is the influence of Group Purchasing Organizations (GPOs) on the market?

GPOs wield substantial influence by consolidating the purchasing power of numerous hospitals, enabling them to negotiate highly favorable volume discounts and multi-year contracts, effectively shaping which specific brands of Enoxaparin Sodium are adopted across integrated healthcare networks.

Which clinical area is providing a new opportunity for market expansion?

The area of cancer-associated thrombosis (CAT) offers a significant opportunity, as clinical guidelines increasingly recommend LMWHs, including Enoxaparin Sodium, for extended prophylaxis and treatment in high-risk oncology patients to reduce life-threatening thrombotic events.

What regulatory complexities exist specifically for Enoxaparin biosimilars?

Biosimilar manufacturers face immense regulatory complexity, specifically demonstrating equivalent quality, efficacy, and safety profile to the reference product (Lovenox) through detailed comparative physicochemical analysis and clinical testing, a rigorous process mandated by agencies like the FDA and EMA.

How important are patient support programs for Enoxaparin manufacturers?

Patient support programs are critical, especially for the outpatient segment, as they provide essential training on self-injection techniques, help manage adherence, and offer financial assistance, thereby enhancing overall patient compliance and brand loyalty in a highly competitive market environment.

Does the rise of telemedicine affect the distribution of Enoxaparin Sodium?

Telemedicine indirectly boosts the online pharmacy and retail distribution channels by facilitating remote prescription renewals and follow-ups, making it easier for patients to manage chronic LMWH therapy without frequent physical visits to the hospital.

What is the impact of obesity trends on Enoxaparin market growth?

Increasing global obesity rates significantly drive market growth because obesity is a major independent risk factor for VTE, requiring tailored and often higher prophylactic doses of Enoxaparin Sodium for both surgical and non-surgical management.

What is the key technological focus for differentiating Enoxaparin products?

The key technological focus is on developing advanced safety pre-filled syringes that incorporate automatic needle guards and enhanced ergonomic designs, improving user safety and convenience, which provides a non-price based competitive advantage.

In which distribution channel is the largest volume of Enoxaparin sales currently generated?

Hospital pharmacies remain the largest distribution channel, as Enoxaparin Sodium is primarily administered in acute care settings for initial VTE treatment and mandatory surgical prophylaxis immediately preceding and following procedures.

How do varying global clinical guidelines influence market dynamics?

Global guidelines issued by bodies like the ACCP or AHA critically influence market dynamics by setting the standard of care; strong recommendations for Enoxaparin in specific high-risk patient groups ensure sustained, mandatory demand across diverse international markets.

What are the major challenges related to monitoring Enoxaparin therapy?

While routine monitoring is usually unnecessary, challenges arise in specific populations (renal impairment, extreme body weight) where anti-Factor Xa level monitoring is required, demanding specialized laboratory resources and precise interpretation to prevent inadequate dosing or excessive bleeding risk.

How does the historical patent expiration of Lovenox affect current market structure?

The patent expiration of Lovenox dramatically reshaped the market structure by facilitating the entry of multiple generic and biosimilar manufacturers, transitioning the market from a monopoly to a highly competitive, price-sensitive environment dominated by volume sales.

What opportunities exist for market players in Latin America?

Opportunities in Latin America stem from improving public healthcare systems, rising awareness regarding VTE management protocols, and the potential for establishing local manufacturing or strategic partnerships to overcome logistical and import duty challenges.

Which segments are most likely to adopt digital health integration for adherence?

The outpatient and home-care segments are most likely to adopt digital health tools, using smart injection devices or companion apps to track compliance, remind patients of doses, and log administration data for remote physician review.

How does raw material sourcing risk influence manufacturing stability?

Raw material sourcing risk, primarily concerning the supply of porcine mucosa from regions like China, significantly influences manufacturing stability; major outbreaks or trade disputes can severely restrict API supply, necessitating diversified sourcing and high inventory levels.

Why is Enoxaparin still preferred over DOACs for VTE prophylaxis during pregnancy?

Enoxaparin is preferred during pregnancy because, unlike most DOACs, it does not cross the placental barrier, minimizing fetal exposure risk while effectively providing necessary maternal anticoagulation, making it the safer, guideline-recommended choice.

What market trend is observed regarding the use of vials versus pre-filled syringes?

There is a pronounced trend favoring pre-filled syringes (PFS) over traditional vials, driven by the convenience, ease of patient self-injection, and reduced risk of microbial contamination or dosing errors associated with drawing doses from multi-use vials.

How do mergers and acquisitions (M&A) influence the competitive landscape?

M&A activities allow large players to quickly consolidate market share, acquire specialized manufacturing capabilities, gain access to broader geographic distribution networks, and eliminate smaller generic competitors, thus stabilizing or influencing pricing dynamics.

What is the significance of the anti-Factor Xa assay in the market?

The anti-Factor Xa assay is significant both clinically, for monitoring dosage in special populations, and commercially, as it is the benchmark regulatory standard used by health authorities to confirm the bioequivalence and biological potency of generic Enoxaparin products.

What is the estimated contribution of orthopedic surgery to prophylactic Enoxaparin usage?

Orthopedic surgery, particularly major hip and knee replacement procedures, contributes a substantial percentage to the prophylactic usage of Enoxaparin, as patients undergoing these operations face one of the highest risks of post-operative venous thromboembolism.

How do governments in high-income regions control the cost of Enoxaparin?

Governments control costs through mandatory centralized tendering processes, utilization of Health Technology Assessments (HTA) to evaluate cost-effectiveness, and preferential reimbursement policies that favor the lowest-cost generic or biosimilar options available on the market.

What technological challenge is associated with the large-scale production of Enoxaparin?

A key technological challenge is ensuring batch-to-batch consistency and high purity across large volumes of the API, which is critical due to the natural variability of the raw porcine material and the complexity of the chemical depolymerization process.

Beyond DVT and PE, what is an emerging application for Enoxaparin Sodium?

An emerging application is its use in specific protocols for patients hospitalized with COVID-19, particularly those with severe disease, where the high inflammatory state significantly increases the risk of microvascular and macrovascular thrombotic complications.

In the Value Chain, where is the highest margin generated for generic manufacturers?

For generic manufacturers, the highest margins are typically generated in the manufacturing and formulation phase, achieved through optimized large-scale production, efficient procurement of raw materials, and minimizing costs associated with complex clinical trials required by originator brands.

What specific benefit does Enoxaparin offer over unfractionated heparin (UFH)?

Enoxaparin offers higher bioavailability, a longer half-life, and a more predictable dose response compared to UFH, eliminating the need for frequent activated partial thromboplastin time (aPTT) monitoring, thereby making patient management simpler and safer.

How does the increased focus on patient safety influence product design?

The increased focus on patient safety directly drives product design improvements, such as incorporating tamper-evident seals, clearer dosing markings, and intuitive, single-use needle safety features in pre-filled syringes to prevent needlestick injuries and accidental over-dosing.

What demographic shift primarily fuels the long-term demand for anticoagulants?

The global aging demographic shift is the primary long-term demand fuel, as elderly populations inherently face higher cumulative risks of developing chronic conditions, requiring frequent surgical interventions, and reduced mobility, all contributing factors to VTE.

How do trade policies affect the international supply chain of Enoxaparin?

Trade policies, including tariffs and import/export restrictions on both finished drugs and porcine raw materials, significantly impact the international supply chain, potentially leading to price volatility and regional shortages if diversification strategies are not robust.

What are the key differentiating factors used by branded manufacturers against biosimilars?

Branded manufacturers differentiate themselves primarily through established reputation, comprehensive patient support programs, investment in advanced safety syringe technology, and often by securing exclusive contracts with specific hospital networks based on service quality and historical trust.

How is the retail pharmacy segment adapting to the demand for Enoxaparin?

Retail pharmacies are adapting by maintaining rigorous cold chain storage protocols, improving inventory management for different dosage strengths, and increasing staff training to counsel patients on the correct technique for self-administering the subcutaneous injection at home.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager