Enteral Nutrition (EN) Solutions Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436133 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Enteral Nutrition (EN) Solutions Market Size

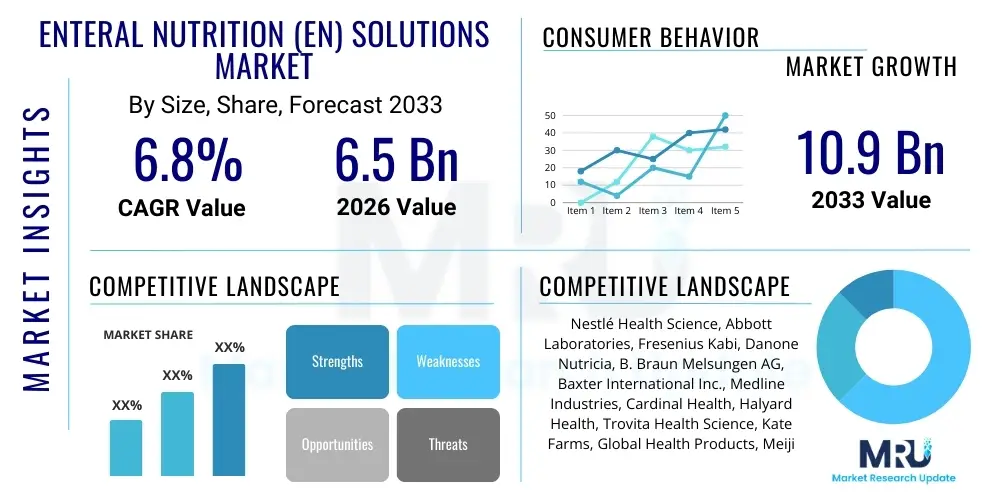

The Enteral Nutrition (EN) Solutions Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 10.9 Billion by the end of the forecast period in 2033.

Enteral Nutrition (EN) Solutions Market introduction

The Enteral Nutrition (EN) Solutions Market encompasses the supply of specialized nutritional formulas and associated delivery systems designed to provide sustenance directly to the gastrointestinal tract when oral intake is impossible, inadequate, or contraindicated. These solutions are critical for patients suffering from dysphagia, malabsorption disorders, critical illnesses, or those requiring post-operative support, ensuring adequate caloric and nutrient intake necessary for recovery and maintaining bodily functions. Products range from standard polymeric formulas, which provide complete nutrition, to highly specialized, disease-specific formulas tailored for conditions like renal failure, diabetes, or hepatic impairment, alongside modular formulas used to supplement specific macronutrients. The primary applications span across hospitals, where solutions are used intensively in intensive care units (ICUs) and surgical wards, and increasingly in home care settings, driven by the desire for patient convenience and reduced healthcare costs.

The core benefit of EN solutions lies in maintaining gut integrity, preventing bacterial translocation, and reducing the risk of infection compared to parenteral nutrition, making it the preferred route of feeding when the gut is functional. The sophisticated nature of modern EN solutions includes specialized amino acid profiles, modified fat compositions (such as medium-chain triglycerides), and added prebiotics/probiotics to support gut microbiome health. Driving factors for market expansion include the rapidly aging global population, which exhibits a higher prevalence of chronic conditions requiring nutritional support; the escalating incidence of cancer, neurological disorders, and gastrointestinal diseases; and continuous innovations in both formula composition and the user-friendly design of feeding tubes, pumps, and administration sets. Furthermore, educational initiatives aimed at healthcare professionals emphasizing the benefits of early and appropriate enteral feeding protocols significantly contribute to market dynamics.

Enteral Nutrition (EN) Solutions Market Executive Summary

The Enteral Nutrition (EN) Solutions Market is currently characterized by robust expansion driven by demographic shifts, particularly the increasing global geriatric population requiring sustained nutritional intervention. Business trends indicate a strong focus on personalization and disease-specific nutrition, moving away from generic formulas toward highly tailored solutions that address specific metabolic requirements, such as those associated with diabetes or wound healing. Key industry participants are heavily investing in research and development to enhance formula palatability, reduce osmotic load, and incorporate functional ingredients like immune-boosting nutrients and fiber blends. There is a palpable shift in the point of care delivery, with Home Enteral Nutrition (HEN) witnessing the fastest growth, primarily facilitated by advancements in portable feeding pumps and increasing reimbursement coverage for home-based care, compelling manufacturers to design products optimized for patient self-management and ease of use outside clinical environments. Strategic mergers, acquisitions, and partnerships are common strategies employed by major players to consolidate market share and expand geographic reach, particularly in high-growth emerging economies.

Regionally, North America and Europe maintain dominance, attributed to high healthcare expenditure, well-established clinical guidelines endorsing EN, and significant awareness among clinicians. However, the Asia Pacific (APAC) region is projected to experience the highest growth rate due to rapidly improving healthcare infrastructure, a large patient pool, rising prevalence of chronic diseases, and increasing disposable incomes leading to better access to specialized medical nutrition products. Within segmentation, the disease-specific formulas segment is exhibiting accelerated growth, reflecting the precision medicine trend and the recognized need for nutritional support integrated into comprehensive disease management protocols. Hospitals remain the largest end-user segment, especially for acute care, but the shift towards decentralized care is redefining market distribution, positioning home care settings as critical future revenue streams. Challenges persist primarily related to the high capital investment required for product formulation and manufacturing, alongside the need to overcome clinician resistance to changing established feeding protocols and addressing patient compliance issues outside the structured hospital environment.

AI Impact Analysis on Enteral Nutrition (EN) Solutions Market

User inquiries regarding the application of Artificial Intelligence (AI) in Enteral Nutrition (EN) Solutions predominantly center on optimizing nutritional delivery, predicting patient nutritional requirements, and enhancing supply chain efficiency for specialized formulas. Common questions revolve around how AI algorithms can personalize feeding protocols based on real-time physiological data (e.g., fluid status, metabolic markers, activity levels) and whether AI can improve the adherence and safety of home enteral feeding. Users are keenly interested in the potential of machine learning to analyze large datasets derived from electronic health records (EHRs) and feeding pump logs to identify optimal feeding schedules, detect potential complications such as feeding intolerance or tube displacement earlier, and reduce waste by forecasting demand for specific formula types in hospitals and community pharmacies. Expectations are high regarding AI’s ability to move EN from generalized clinical protocols to genuinely individualized nutritional therapy, especially in complex critical care settings where nutritional status changes rapidly and requires continuous reassessment.

The practical integration of AI involves developing sophisticated predictive models that analyze patient characteristics, disease severity, caloric needs, and formula performance metrics. This capability allows dietitians and clinical teams to move beyond standardized calculations, enabling precision nutrition planning that minimizes adverse events, such as refeeding syndrome or hyperglycemia, thereby improving patient outcomes and shortening recovery times. Furthermore, AI tools are expected to significantly streamline the operational aspects of EN care, including inventory management of varied formula types, optimizing logistics for home delivery services, and potentially automating documentation tasks associated with nutritional assessment and monitoring. While regulatory approval and data privacy remain key concerns for users, the consensus is that AI represents a pivotal technological shift that will transform EN from a reactive intervention into a proactive, data-driven therapeutic strategy, enhancing the overall efficacy and safety profile of nutritional support services.

- Personalized Protocol Generation: AI algorithms use patient data (age, weight, lab results, disease state) to calculate and adjust optimal feeding rates and formula concentrations in real-time, minimizing underfeeding or overfeeding risks.

- Predictive Monitoring and Safety: Machine learning models analyze trends in pump data and physiological markers to predict and alert clinicians to potential complications, such as feeding intolerance, bowel ischemia, or aspiration pneumonia, enabling preemptive intervention.

- Inventory and Supply Chain Optimization: AI forecasts demand for specific disease-specific formulas across various healthcare facilities, reducing stockouts and minimizing inventory waste in complex supply chains.

- Enhanced Diagnostic Support: AI assists clinicians in accurately diagnosing nutritional deficiencies and determining eligibility for EN versus Parenteral Nutrition (PN) based on complex clinical input data.

- Home Care Adherence and Education: AI-powered apps and devices provide personalized reminders, troubleshooting guidance, and automated compliance tracking for patients utilizing Home Enteral Nutrition (HEN).

DRO & Impact Forces Of Enteral Nutrition (EN) Solutions Market

The dynamics of the Enteral Nutrition (EN) Solutions market are fundamentally shaped by a complex interplay of demographic shifts, clinical endorsements, and technological progress, all summarized under Drivers, Restraints, and Opportunities (DRO). The primary driver is the accelerating increase in the global population aged 65 and above, a cohort with high susceptibility to chronic conditions and age-related swallowing difficulties (dysphagia), necessitating nutritional support. Concurrently, the rising incidence of diseases such as cancer (leading to cachexia and chemotherapy side effects), neurological disorders (like stroke and Parkinson’s disease), and critical care admissions substantially boost the demand for clinical nutrition. Impact forces emphasize that clinical guidelines from major medical societies increasingly mandate EN as the first line of nutritional therapy when the gut is functional, reinforcing its therapeutic acceptance and integration into standard hospital protocols. Furthermore, technological improvements in pump design, making devices smaller, safer, and easier to program, significantly support the expansion of EN into the less restrictive and cost-effective home care setting, representing a powerful opportunity for market growth.

Restraints, however, pose significant constraints on market expansion. A major limiting factor is the high per-unit cost of specialized, disease-specific formulas, which can create affordability barriers, particularly in developing markets and for patients without robust insurance coverage. Moreover, the lack of widespread awareness and adequate training among some primary care providers regarding the initiation and management of specialized enteral feeding can lead to suboptimal utilization or delayed adoption. Regulatory hurdles, particularly in obtaining approvals for novel formula ingredients and advanced delivery systems, introduce complexity and increase the time-to-market for innovative products. Opportunities predominantly lie in aggressively expanding into emerging markets across Asia and Latin America, where healthcare infrastructure is rapidly developing and patient access to specialized medical care is improving. Additionally, the development of highly personalized nutrition strategies, possibly utilizing advanced diagnostics and nutrigenomics, offers a substantial pathway for product differentiation and premium pricing, capitalizing on the increasing consumer and clinical demand for tailored health solutions.

Segmentation Analysis

The Enteral Nutrition (EN) Solutions Market is comprehensively segmented based on product type, application, end user, and route of administration, reflecting the diversity of patient needs and clinical settings requiring nutritional support. This detailed segmentation allows manufacturers to target specific demographic and clinical groups with highly specialized offerings, maximizing therapeutic efficacy and commercial reach. The complexity of segment needs, ranging from simple polymeric formulas for long-term care to complex elemental diets for severe gastrointestinal disorders, drives continuous innovation across all segments. Analysis of these segments is crucial for understanding current market penetration, forecasting future growth trajectories, and identifying high-potential areas, such as the accelerating growth observed in home care settings and in the disease-specific formula category tailored for metabolic stress and critical illness management.

- By Product Type:

- Standard Formulas

- Disease-Specific Formulas (e.g., Renal, Diabetic, Hepatic, Pulmonary, Immune-Modulating)

- Modular Formulas (Protein, Carbohydrate, Fat)

- By Route of Administration:

- Oral

- Tube Feeding (Nasoenteric, Gastrostomy, Jejunostomy)

- By Application:

- Oncology

- Neurology

- Gastroenterology

- Critical Care

- Metabolic Disorders

- Others (e.g., Trauma, Pre/Post-Surgery)

- By End User:

- Hospitals

- Home Care Settings

- Nursing Homes and Assisted Living Facilities

Value Chain Analysis For Enteral Nutrition (EN) Solutions Market

The value chain for the Enteral Nutrition (EN) Solutions Market begins with the upstream procurement and processing of raw materials, involving specialized sourcing of macro and micronutrients, including high-quality proteins (like casein or whey hydrolysates), complex carbohydrates, lipids (MCTs, omega fatty acids), and essential vitamins and minerals. The efficiency of this stage is critical, as the quality and stability of these inputs directly affect the shelf life and therapeutic efficacy of the final formula. Following procurement, advanced R&D and manufacturing processes are undertaken, focusing on precise formulation, sterile production, and packaging (often in ready-to-use liquid formats or specialized powder systems) to meet stringent regulatory standards imposed by bodies like the FDA and EMA. Innovation in packaging, such as closed-system administration bags, is a key value-added activity at the manufacturing stage, aimed at minimizing contamination risk.

The midstream segment is dominated by distribution, where specialized logistics are essential given the often temperature-sensitive nature and relatively high volume of EN products. Distribution channels are complex, involving both direct sales to large hospital systems and indirect sales through specialized medical distributors and wholesalers, especially for reaching smaller clinics and the burgeoning home care segment. For Home Enteral Nutrition (HEN), establishing efficient, reliable direct-to-patient delivery services is paramount, often requiring coordination with Durable Medical Equipment (DME) providers who manage the feeding pumps and administration sets. The ability of companies to manage cold chains and ensure timely delivery is a significant competitive differentiator in this phase.

The downstream segment focuses on the point of consumption and support services. Direct channels involve sales teams targeting hospital procurement officers and specialized nutrition support teams (dietitians, clinical pharmacists). Indirect channels heavily rely on relationships with insurance providers and specialized home healthcare agencies that manage patient intake and formula replenishment. Post-sale services, including patient education, troubleshooting assistance for feeding devices, and ongoing clinical support (often provided remotely by specialized nurses or dietitians), are integral to maintaining patient adherence and safety, especially in the home setting. The effectiveness of this downstream support ultimately dictates long-term brand loyalty and market success in a highly competitive therapeutic area.

Enteral Nutrition (EN) Solutions Market Potential Customers

The primary end-users and potential customers of Enteral Nutrition (EN) solutions are diverse healthcare institutions and patient populations defined by specific clinical needs requiring sustained or supplemental nutritional support. Hospitals, particularly intensive care units (ICUs), surgical recovery wards, oncology units, and burn centers, constitute the largest segment of potential customers due to the high incidence of acute conditions and critical illnesses that necessitate immediate and often short-term specialized feeding. These institutional buyers prioritize product safety, clinical efficacy, compliance with established feeding protocols, and robust supply chain reliability, often relying on group purchasing organizations (GPOs) to negotiate favorable contracts for high-volume formula purchases and standardized delivery systems. Critical care physicians, gastroenterologists, and clinical dietitians act as key decision-makers within this setting, dictating product choice based on therapeutic necessity and formulary restrictions.

A rapidly expanding customer base is represented by the Home Care Settings, encompassing patients receiving nutritional support in their private residences or through specialized infusion clinics. This segment is characterized by long-term nutritional needs stemming from chronic conditions like Crohn's disease, short bowel syndrome, or neurological impairment resulting in permanent dysphagia. Potential customers in this domain include home health agencies, specialized DME providers, and individual patients/caregivers who value ease of use, portability of equipment (feeding pumps), and efficient, discreet logistical support for formula delivery. The decision-making process here is heavily influenced by insurance coverage, ease of patient training, and the formula's characteristics suitable for extended, non-clinical use, emphasizing smaller, ready-to-hang packaging and user-friendly administration kits.

Further key customer groups include Nursing Homes and Assisted Living Facilities (ALFs). These facilities serve a large geriatric population often battling multiple comorbidities, chronic malnutrition, and severe swallowing difficulties. For these institutions, EN solutions represent a necessary intervention to maintain or improve the quality of life and manage complex nutritional deficits. Buyers in this segment prioritize cost-effectiveness, formula diversity to address various geriatric health profiles (e.g., specialized formulas for pressure ulcers or diabetes management), and training support for facility staff. Long-term care facilities seek partnership with providers that can offer consistent product availability and educational resources to ensure compliance with nutritional care standards and regulatory requirements specific to long-term residency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 10.9 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé Health Science, Abbott Laboratories, Fresenius Kabi, Danone Nutricia, B. Braun Melsungen AG, Baxter International Inc., Medline Industries, Cardinal Health, Halyard Health, Trovita Health Science, Kate Farms, Global Health Products, Meiji Holdings Co., Ltd., Otsuka Pharmaceutical Co., Ltd., Hormel Foods Corporation, Ajinomoto Co., Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Enteral Nutrition (EN) Solutions Market Key Technology Landscape

The technological landscape of the Enteral Nutrition (EN) Solutions Market is rapidly evolving, focusing predominantly on enhancing safety, precision, and ease of use in delivery systems, alongside refining formula composition for superior clinical outcomes. The most significant advancements involve smart feeding pumps, which are integral to modern EN therapy. These pumps incorporate sophisticated software with dose error reduction systems (DERS), ensuring that prescribed flow rates and volumes are maintained within safe clinical parameters, minimizing the risk of adverse events like rapid fluid infusion or formula misadministration. Modern pumps are increasingly programmable, featuring Wi-Fi or Bluetooth connectivity for data logging, remote monitoring by clinicians, and integration with Electronic Health Records (EHRs), streamlining documentation and allowing for proactive patient management, especially crucial in the rapidly growing Home Enteral Nutrition segment.

In terms of formula technology, there is a strong focus on developing formulas optimized for specific disease states. This includes micro-nutrient encapsulation techniques to improve stability and bioavailability, utilization of specialized lipid emulsions (e.g., structured lipids and fish oil derivatives rich in Omega-3 fatty acids) to manage inflammatory responses, and incorporating novel fiber blends (prebiotics and synbiotics) to support a healthy gut microbiome, which is particularly vital for critically ill and immune-compromised patients. Furthermore, manufacturers are investing in aseptic processing and packaging technologies, particularly closed-system administration sets and ready-to-use liquid formulas, which drastically reduce the potential for microbial contamination during preparation and administration, a crucial safety feature highly valued by hospitals and regulatory bodies.

Another crucial technological area is the development of innovative feeding tubes and securement devices. Newer generation tubes are designed to be softer, more pliable, and resistant to clogging, utilizing specialized materials like polyurethane or silicone to enhance patient comfort and longevity. Securement technology has also improved, moving beyond simple tape to sophisticated devices that reduce migration and accidental dislodgement, minimizing the need for costly and invasive tube replacements. Looking forward, emerging technologies involve applying sensor technology to feeding tubes to continuously monitor placement confirmation (e.g., pH or magnetic sensors) and utilizing AI-driven diagnostics to tailor formula delivery schedules based on real-time gastric residual volume monitoring, marking a significant step towards truly closed-loop, automated nutritional care systems.

Regional Highlights

North America, comprising the United States and Canada, currently dominates the Enteral Nutrition (EN) Solutions Market in terms of revenue share. This market dominance is primarily driven by exceptionally high healthcare expenditures, the presence of major industry players, well-established clinical practice guidelines that strongly endorse EN, and high awareness levels among healthcare professionals regarding specialized nutrition intervention. The U.S. market is characterized by significant demand for disease-specific formulas, particularly for managing diabetes and critical care patients, supported by comprehensive reimbursement frameworks from both public and private payers. Furthermore, the region is a leader in adopting advanced technological delivery systems, including smart pumps and integrated EHR systems, accelerating the transition of complex enteral feeding regimens to safe and effective home care settings. However, intense price competition among key manufacturers and stringent regulatory scrutiny remain defining regional characteristics.

Europe represents the second-largest market, exhibiting steady and mature growth fueled by an aging population, universal healthcare systems that provide good access to specialized medical nutrition, and a high prevalence of chronic conditions across major economies like Germany, France, and the UK. European market growth is strongly influenced by local nutritional guidelines and strong patient advocacy groups that emphasize quality of life and comprehensive care, driving demand for innovative, palatable, and fiber-enriched formulas. The region demonstrates a strong trend toward decentralization of care, with governments actively promoting Home Enteral Nutrition (HEN) to manage escalating hospital costs. Regulations, particularly the European Union's regulatory frameworks regarding medical devices and food for special medical purposes (FSMP), ensure high product quality but also necessitate significant investment in compliance for manufacturers.

Asia Pacific (APAC) is projected to be the fastest-growing region throughout the forecast period. This rapid expansion is attributed to large, untapped patient populations, dramatic improvements in healthcare infrastructure in countries such as China, India, and Japan, and rising disposable incomes that increase access to advanced medical treatments. The APAC market is characterized by a significant incidence of gastrointestinal and liver diseases, fueling demand for specialized enteral products. While formula adoption is lower than in Western markets, public and private investments in clinical nutrition education and standardized hospital feeding protocols are rapidly increasing. Local manufacturers are emerging as significant competitors, often offering more cost-effective solutions, though international players hold the edge in advanced, disease-specific formulas and cutting-edge delivery technology.

Latin America (LATAM) and the Middle East and Africa (MEA) currently represent smaller but vital segments. Growth in LATAM is driven by improving economic stability in countries like Brazil and Mexico and expanding access to health insurance, coupled with an increasing recognition of the role of nutritional support in clinical outcomes. Challenges include variable healthcare access and fragmented regulatory environments. The MEA region’s growth is fueled by substantial investments in healthcare infrastructure in the Gulf Cooperation Council (GCC) countries and a high burden of lifestyle diseases such as diabetes, which often require specialized nutritional management. However, market penetration remains complex due to political instability and limited healthcare budgets in many African nations.

- North America (U.S., Canada): Market leader due to advanced healthcare systems, high disposable income, established EN protocols, and strong adoption of smart feeding pump technology. Focus on critical care and specialized metabolic formulas.

- Europe (Germany, UK, France): Mature market growth driven by demographic aging, comprehensive public health coverage, and strong governmental support for transitioning stable patients to Home Enteral Nutrition (HEN).

- Asia Pacific (China, India, Japan): Highest growth potential owing to rapidly expanding healthcare expenditure, increasing chronic disease burden, and significant investments in modernizing clinical nutrition practices.

- Latin America (Brazil, Mexico): Emerging market driven by improving medical infrastructure and increasing awareness of the critical role of nutritional support in acute and chronic disease management.

- Middle East and Africa (GCC Countries): Segment growth concentrated in oil-rich nations with significant healthcare infrastructure development and a need to address high rates of chronic non-communicable diseases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Enteral Nutrition (EN) Solutions Market.- Nestlé Health Science

- Abbott Laboratories

- Fresenius Kabi

- Danone Nutricia

- B. Braun Melsungen AG

- Baxter International Inc.

- Medline Industries

- Cardinal Health

- Halyard Health

- Trovita Health Science

- Kate Farms

- Global Health Products

- Meiji Holdings Co., Ltd.

- Otsuka Pharmaceutical Co., Ltd.

- Hormel Foods Corporation

- Ajinomoto Co., Inc.

Frequently Asked Questions

Analyze common user questions about the Enteral Nutrition (EN) Solutions market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Enteral Nutrition market?

The primary factor driving market growth is the significant increase in the global geriatric population, who frequently require nutritional support due to age-related conditions like dysphagia and a higher incidence of chronic diseases such as cancer and neurological disorders that impede normal oral intake.

How are disease-specific formulas different from standard enteral formulas?

Disease-specific formulas are nutritionally engineered with modified macronutrient and micronutrient profiles to meet the unique metabolic demands of specific conditions (e.g., renal failure, diabetes, hepatic impairment). They help manage symptoms, reduce metabolic stress, and improve clinical outcomes, unlike standard formulas designed for general caloric and nutrient replacement.

Which end-user segment is experiencing the fastest rate of adoption for EN solutions?

The Home Care Settings segment is experiencing the fastest rate of adoption. This acceleration is driven by technological advancements in portable feeding pumps, favorable reimbursement policies promoting home-based care, and the overall clinical trend toward reducing hospital stays.

What role does Artificial Intelligence (AI) play in modern Enteral Nutrition therapy?

AI is increasingly utilized to personalize feeding protocols based on real-time patient physiological data, predict potential complications like feeding intolerance, and optimize supply chain logistics for specialized formulas, thereby moving nutritional intervention towards greater precision and safety.

What are the main regional challenges in the global EN Solutions Market?

The main challenges vary regionally, including high product costs limiting access in developing economies, regulatory complexities related to novel formula ingredients and medical devices, and the need for standardized training and education for healthcare providers, particularly in managing long-term Home Enteral Nutrition.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager