Enterprise Architecture Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434447 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Enterprise Architecture Market Size

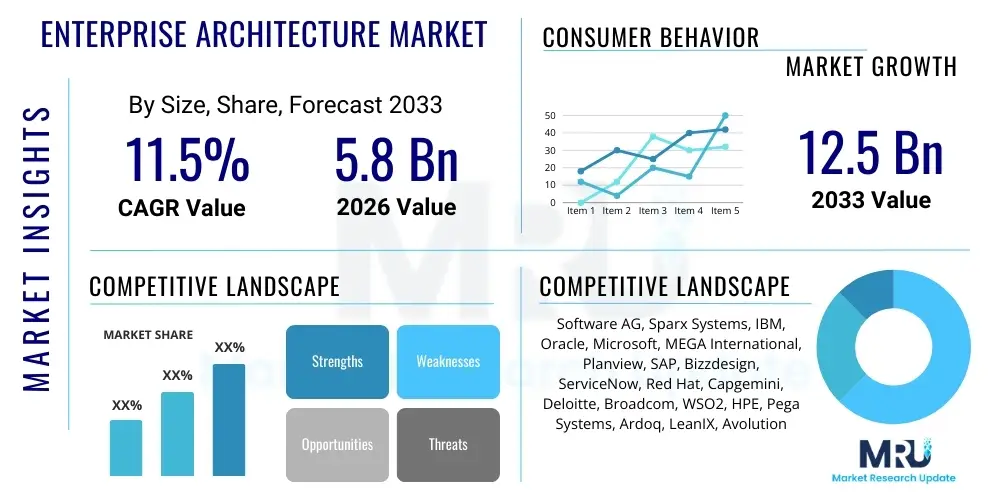

The Enterprise Architecture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $12.5 Billion by the end of the forecast period in 2033.

Enterprise Architecture Market introduction

The Enterprise Architecture (EA) Market encompasses the tools, frameworks, methodologies, and consulting services employed by organizations to strategically manage the complexity inherent in their business processes, information systems, and technological infrastructure. EA provides a critical blueprint that aligns IT investments directly with core business objectives, ensuring that technological capabilities support future strategic growth. Products typically include sophisticated software platforms designed for modeling, visualization, analysis, and governance of the enterprise landscape, moving beyond simple documentation to active strategic planning and execution guidance. Major applications span across IT portfolio management, digital transformation initiatives, risk management, and regulatory compliance adherence, serving as the connective tissue between executive strategy and operational implementation.

The fundamental benefit of adopting robust EA solutions lies in enhanced organizational agility and reduced operational expenditure. By providing a clear, integrated view of the enterprise, EA helps eliminate redundant systems, standardize technologies, and accelerate the decision-making process regarding new investments. Furthermore, it significantly lowers IT risk by identifying dependencies and vulnerabilities proactively, particularly crucial in today's highly complex hybrid and multi-cloud environments. The market is increasingly characterized by a shift from static, documentation-heavy models to dynamic, outcome-driven platforms that integrate directly into agile and DevOps workflows, making EA essential for continuous modernization.

The primary driving factor sustaining this market expansion is the relentless pace of digital transformation across all industries. As organizations adopt complex technologies such as cloud computing, IoT, and advanced analytics, the need for a cohesive structure to govern these distributed assets becomes paramount. Additionally, stringent regulatory requirements, particularly in highly governed sectors like BFSI and Healthcare, necessitate comprehensive oversight of data flow and system security, making EA governance tools indispensable. The ongoing convergence of operational technology (OT) and information technology (IT) also mandates a unified architectural approach to manage risks and maximize synergies, fueling demand for modern, integrated EA solutions that can handle both technological and business perspectives seamlessly.

Enterprise Architecture Market Executive Summary

The Enterprise Architecture market is experiencing a significant paradigm shift driven by evolving business trends that prioritize speed, agility, and business outcome realization over traditional centralized control. A key trend involves the integration of EA platforms with other critical enterprise tools, such as project portfolio management (PPM), IT service management (ITSM), and DevOps pipelines, transitioning EA from a standalone planning function into a continuous governance mechanism embedded within daily operations. This focus on operational integration is complemented by the rising demand for Software-as-a-Service (SaaS) based EA solutions, which offer greater scalability, lower barriers to entry, and accelerated deployment compared to traditional on-premise implementations, particularly appealing to mid-sized organizations seeking rapid architectural insights.

Regionally, North America maintains its dominance in the market due to the early and high adoption rate of sophisticated EA tools, driven by large enterprises in the technology and financial services sectors that possess mature IT governance frameworks and significant budgets for strategic technology initiatives. However, the Asia Pacific (APAC) region is poised for the highest growth rate, fueled by massive investments in digital infrastructure, rapid industrialization, and an increasing awareness among local enterprises regarding the need for IT-business alignment to remain competitive internationally. Europe continues to show stable growth, primarily driven by stringent data privacy regulations (like GDPR) and the need for comprehensive architecture visibility to ensure compliance and robust security across complex multinational operations.

Segment trends highlight the robust growth in specialized EA tooling, moving beyond generalized charting software towards platforms that offer specialized capabilities like application portfolio management (APM) and technology risk assessment. The services segment, particularly consulting and implementation support, remains crucial, as organizations often lack the internal expertise to effectively establish and maintain a value-driven EA practice. Furthermore, large enterprises, recognizing the limitations of manual processes in highly dynamic environments, are increasingly investing in EA platforms that leverage artificial intelligence for data mapping, predictive scenario modeling, and automated compliance checking, signaling a future where EA is highly automated and predictive rather than merely descriptive.

AI Impact Analysis on Enterprise Architecture Market

Common user questions regarding AI's impact on Enterprise Architecture revolve around the automation of repetitive tasks, the ability of AI to manage architectural complexity at scale, and the potential displacement of human EA professionals. Key concerns center on how AI can effectively digest vast amounts of disparate enterprise data (from configuration management databases, network logs, and business process models) and synthesize meaningful, actionable architectural insights. Users are particularly keen on understanding AI’s role in predictive modeling—specifically, if AI can accurately forecast the downstream impact of architectural changes or predict future IT resource needs based on business growth projections. The consensus expectation is that AI will transform EA from a reactive documentation function to a proactive, real-time strategic guidance system, enhancing data accuracy, accelerating decision cycles, and focusing human architects on strategic alignment rather than manual mapping.

The introduction of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the Enterprise Architecture domain by automating the laborious processes associated with data collection, validation, and maintenance of architectural repositories. AI algorithms are now capable of continuously scanning IT landscapes, identifying outdated technologies, redundant applications, and potential security vulnerabilities with far greater speed and precision than traditional manual auditing processes. This capability allows EA teams to maintain highly accurate, real-time views of the enterprise, significantly reducing the "drift" between the documented architecture and the reality of the operational environment, thereby increasing the trustworthiness and utility of the EA function for strategic decision-making.

Furthermore, AI-driven analytics are enabling truly predictive Enterprise Architecture. Instead of merely describing the current state, these tools can analyze historical performance data, simulate the consequences of proposed architectural changes (e.g., migrating a core system to the cloud), and provide optimization recommendations tailored to specific business outcomes, such as minimizing latency or reducing technical debt. This transition empowers Enterprise Architects to act as strategic advisors, leveraging AI to run 'what-if' scenarios, optimize IT roadmaps based on risk and value assessments, and ensure long-term scalability, positioning EA as a core driver of organizational strategy rather than just an oversight function.

- Automated discovery and mapping of IT assets, reducing manual effort.

- Predictive modeling for forecasting the risk and impact of architectural changes.

- Real-time architecture drift detection and automated remediation alerts.

- Optimization of application portfolios based on AI-driven cost and value analysis.

- Enhanced security posture through AI-driven identification of vulnerabilities and compliance gaps.

- Streamlining of governance processes by automatically checking adherence to established standards.

DRO & Impact Forces Of Enterprise Architecture Market

The Enterprise Architecture Market is propelled by powerful drivers centered on managing organizational complexity and seizing digital opportunities, yet it faces significant constraints related to implementation challenges and specialized skill requirements. The overarching force driving demand is the mandatory shift towards digital business models, forcing companies to restructure their technology environments rapidly. Opportunities are abundant, particularly in leveraging cloud-native deployment models and integrating EA tools with advanced technologies like process mining and AI. The collective impact of these forces is accelerating the market's evolution from a slow, compliance-focused discipline to a dynamic, strategy-enabling function essential for competitive advantage in the modern business landscape.

Drivers: The dominant driver remains the increasing complexity of IT landscapes, characterized by hybrid cloud adoption, microservices, and distributed applications, which necessitate centralized oversight for cost optimization and risk mitigation. Secondly, the urgency of digital transformation initiatives across industries requires a foundational architectural blueprint to guide technology selection and ensure alignment with strategic goals. Finally, regulatory pressure (e.g., data governance, security standards) compels organizations to adopt formal EA processes to demonstrate compliance and control over their interconnected systems.

Restraints: Significant restraints include the high initial investment cost associated with advanced EA tools and the related consulting services, which can be prohibitive for Small and Medium Enterprises (SMEs). Furthermore, a critical lack of skilled Enterprise Architects who possess both deep technical knowledge and strategic business acumen acts as a persistent bottleneck to adoption and successful implementation. Resistance to change within organizations, particularly reluctance from various IT departments to standardize and share comprehensive data with EA teams, also hinders the effectiveness and value realization of EA initiatives.

Opportunities: Major opportunities are emerging through the expansion of SaaS-based delivery models, making EA accessible and flexible for a broader range of companies globally. There is also a substantial opportunity in integrating EA platforms seamlessly with Agile, DevOps, and Product Management tools, embedding architectural governance directly into the development lifecycle (DevSecOps). Lastly, the increasing relevance of specialized EA domains like Application Portfolio Management (APM) and Technology Risk Management (TRM) offers vendors avenues for developing highly targeted, high-value solutions.

Segmentation Analysis

The Enterprise Architecture market is broadly segmented based on the component type, deployment model, organization size, and the vertical industry served. Component segmentation dictates whether the revenue is derived from the actual software tools or the crucial supporting services required for implementation, training, and maintenance. Deployment models distinguish between traditional on-premise solutions, favored by organizations with strict data control needs, and the rapidly growing cloud-based options, preferred for their flexibility and subscription models. The vertical segmentation reflects the specialized requirements of industries like BFSI, which demands regulatory rigor, versus Manufacturing, which focuses on supply chain and operational technology (OT) integration.

- By Component:

- Software (Tools)

- Services (Consulting, Integration, Training, Support)

- By Deployment Type:

- On-Premise

- Cloud (SaaS)

- By Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Information Technology (IT) and Telecom

- Government and Public Sector

- Healthcare and Life Sciences

- Retail and Consumer Goods

- Manufacturing

- Others (Energy, Utilities, Transportation)

Value Chain Analysis For Enterprise Architecture Market

The value chain for the Enterprise Architecture market commences upstream with software developers and technology providers who specialize in creating the core modeling, repository, and visualization engines. This segment involves high levels of R&D investment focused on developing sophisticated data ingestion capabilities and AI/ML algorithms necessary for continuous architectural monitoring and predictive analytics. Key upstream players include major software vendors and niche technology startups specializing in specific EA domains like Application Rationalization or Business Process Modeling. The quality and robustness of these upstream platforms directly dictate the capability ceiling for the entire market, focusing heavily on integrating open standards like ArchiMate and TOGAF while ensuring interoperability with major cloud environments.

The core segment of the value chain involves implementation, integration, and service delivery. This is typically handled by system integrators, large management consultancies, and specialized EA consulting firms. These players translate the core software capabilities into tangible business value by tailoring the platforms to specific organizational needs, defining governance frameworks, and driving the initial data collection and mapping efforts. This midstream activity is highly labor-intensive and margin-rich, representing a crucial link where theoretical architectural concepts are applied operationally. Distribution channels for the software tools themselves are varied, including direct sales from vendors for proprietary platforms and indirect channels managed through global or regional partners who bundle EA tools with broader digital transformation services.

Downstream, the value chain focuses on the end-user consumption and maintenance. This includes continuous support, training, and ongoing data validation required to keep the EA repository accurate and relevant. Direct distribution, where large enterprises contract directly with a specific EA software vendor, is common for long-term strategic licenses. However, the influence of indirect channels, particularly Value-Added Resellers (VARs) and Managed Service Providers (MSPs), is growing, especially in the SME segment and specific regions like APAC, where localized support and integration expertise are critical. Success in the downstream phase is measured by the sustained utilization of the EA tool and its impact on strategic decisions, necessitating strong continuous engagement between the vendor/consultant and the client’s internal EA office.

Enterprise Architecture Market Potential Customers

Potential customers for Enterprise Architecture solutions are primarily large enterprises operating in highly regulated or technologically complex environments, seeking to manage substantial IT expenditure and drive organizational change efficiently. The core buyers typically sit within the C-suite and senior management, specifically the Chief Information Officer (CIO), Chief Technology Officer (CTO), and the Chief Digital Officer (CDO), as EA is inherently a strategic planning tool affecting large-scale investments and organizational agility. These executives are motivated by the need to eliminate technical debt, optimize IT costs, and ensure that technology roadmaps are strictly aligned with business strategy to facilitate rapid market response and innovation.

Beyond the C-suite, the direct users and champions of EA tools are the dedicated Enterprise Architects and Business Process Managers, who require the platforms for their daily tasks of modeling, analyzing dependencies, and assessing the impact of change. Key industry verticals demonstrate distinct purchasing motivations: BFSI institutions require EA to navigate complex regulatory mandates (like Basel III or GDPR) and modernize legacy core banking systems without disrupting service. Healthcare organizations utilize EA to manage patient data security, system interoperability (EHRs), and clinical workflow optimization across large, distributed networks, driven by HIPAA and similar privacy laws.

The government and public sector represents a substantial market segment, continually seeking EA solutions to manage vast, often decentralized IT landscapes, standardize procurement across agencies, and improve citizen service delivery through efficient technology use. The primary purchasing drivers in the public sector are mandate-driven modernization, fiscal responsibility, and ensuring the resilience of critical infrastructure. While large enterprises remain the main revenue generators due to the high complexity of their architectures, the rapid adoption of cloud-based, subscription models is opening the door for mid-market companies to become significant potential customers, particularly those undergoing rapid growth or merger activities that require immediate architectural clarity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $12.5 Billion |

| Growth Rate | CAGR 11.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Software AG, Sparx Systems, IBM, Oracle, Microsoft, MEGA International, Planview, SAP, Bizzdesign, ServiceNow, Red Hat, Capgemini, Deloitte, Broadcom, WSO2, HPE, Pega Systems, Ardoq, LeanIX, Avolution |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Enterprise Architecture Market Key Technology Landscape

The technological landscape of the Enterprise Architecture market is rapidly evolving, driven by the need for real-time data synchronization and tighter integration with modern development methodologies. Central to this evolution is the adoption of Cloud-Native Enterprise Architecture platforms, which leverage microservices, containerization (like Docker and Kubernetes), and modern APIs to ensure scalability, resilience, and ease of integration with other operational tools. These platforms move away from monolithic architectures, enabling EA teams to deploy and update features rapidly, aligning with the agility required by the business. Furthermore, the pervasive use of integration platforms and data connectors allows EA tools to seamlessly ingest data from diverse sources, including configuration management databases (CMDBs), project management tools, and financial planning systems, ensuring the architectural repository is fed by the operational reality rather than relying on manual inputs.

Another crucial technological development involves the increasing incorporation of AI and Machine Learning capabilities directly into EA tools. This integration allows for sophisticated data cleansing, automated application dependency mapping, and predictive modeling for future state analysis. AI algorithms analyze patterns in system usage and performance data to flag potential bottlenecks, recommend application rationalization candidates based on usage metrics, and assess technical debt with minimal human intervention. This shift elevates EA from a static documentation function to a dynamic, intelligence-driven advisory service, enhancing the value proposition significantly across complex organizations undergoing rapid modernization.

Finally, the growing maturity of standards and meta-models, such as the widely adopted TOGAF and ArchiMate frameworks, remains foundational. However, modern EA tools are now focusing on making these complex standards accessible and usable in a non-dogmatic way, embedding framework-specific guidance directly into the tooling interface. The move towards collaborative platforms that support concurrent modeling by distributed teams—using features often seen in collaborative development tools—is also prominent. The emphasis is on enabling continuous architecture validation within the DevOps pipeline, ensuring that architectural constraints are codified and checked automatically before code deployment, fundamentally shifting EA governance leftward into the development lifecycle.

Regional Highlights

The global Enterprise Architecture market demonstrates significant variation in maturity and growth drivers across major geographic regions. North America, encompassing the United States and Canada, holds the dominant market share, primarily driven by the presence of large multinational corporations, high technology adoption rates, and a mature ecosystem of skilled EA professionals and consulting services. The demand here is fueled by advanced use cases focusing on M&A integration, complex cloud migration strategies, and leveraging AI for predictive architectural intelligence. The technological infrastructure and high spending capacity of industries like BFSI and IT & Telecom ensure continued market leadership in terms of innovation and revenue generation.

Europe represents the second-largest market, characterized by stringent regulatory environments, particularly around data protection (GDPR) and financial stability. This necessitates the strong adoption of EA tools to maintain compliance, transparency, and effective risk management across decentralized EU operations. Key growth drivers include the need for digital sovereignty and governmental initiatives pushing public sector modernization. Germany, the UK, and the Nordic countries are central to the European EA landscape, prioritizing robust governance models and architectural support for sustainable IT environments.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is primarily attributed to rapid urbanization, massive government investments in digital infrastructure (e.g., Digital India, Smart Cities initiatives), and the growing need for strategic planning among rapidly expanding domestic enterprises in countries like China, India, and Southeast Asian nations. While the maturity of EA adoption is generally lower than in North America, the transition directly to cloud-native and SaaS-based EA solutions bypasses legacy implementation challenges, driving swift market expansion and presenting substantial opportunities for vendors focusing on flexible, scalable deployment models.

- North America: Market leader; driven by advanced cloud adoption, M&A integration needs, and mature IT governance practices.

- Europe: Strong growth based on strict regulatory compliance (GDPR, DORA) and public sector digitization mandates.

- Asia Pacific (APAC): Fastest-growing region; fueled by large-scale digital transformation projects, industrial modernization, and high adoption of SaaS solutions.

- Latin America (LATAM): Emerging market focused on financial technology modernization and regional economic stabilization initiatives.

- Middle East and Africa (MEA): Growth centered around government vision programs (e.g., Saudi Vision 2030, UAE strategies) requiring large-scale infrastructure planning and digital service delivery.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Enterprise Architecture Market.- Software AG

- Sparx Systems

- IBM

- Oracle

- Microsoft

- MEGA International

- Planview

- SAP

- Bizzdesign

- ServiceNow

- Red Hat

- Capgemini

- Deloitte

- Broadcom

- WSO2

- HPE

- Pega Systems

- Ardoq

- LeanIX

- Avolution

Frequently Asked Questions

Analyze common user questions about the Enterprise Architecture market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of Enterprise Architecture in digital transformation?

The primary role of Enterprise Architecture (EA) in digital transformation is to provide a comprehensive, structured blueprint that aligns IT investments and technological capabilities directly with strategic business goals, ensuring that modernization efforts are cohesive, cost-effective, and minimize disruption while accelerating the adoption of new digital models.

How does the deployment model (Cloud vs. On-Premise) affect the adoption of EA tools?

Cloud-based (SaaS) deployment significantly lowers initial costs, offers quicker implementation, and provides scalability, driving adoption among SMEs and organizations prioritizing agility. On-premise deployment is preferred by large enterprises, especially in BFSI and Government sectors, that require stringent control over sensitive architectural data and adhere to specific internal security policies.

Which industry vertical is driving the highest demand for Enterprise Architecture solutions?

The Banking, Financial Services, and Insurance (BFSI) sector is driving the highest demand due to immense regulatory pressure, the critical need to modernize complex legacy core systems, and the imperative to rapidly innovate digital customer services while managing high levels of security and operational risk across diverse systems.

What is the impact of AI on the future job role of an Enterprise Architect?

AI will automate data collection, architectural mapping, and compliance checking, shifting the Enterprise Architect's role from manual documentation and data management towards higher-value activities such as strategic consulting, running predictive scenarios, and collaborating with business leaders to define future-state architectures.

What are the key challenges hindering the widespread adoption of modern EA practices?

Key challenges include the high cost of advanced tooling, a global shortage of Enterprise Architects possessing the required blend of business acumen and technical expertise, and organizational resistance to standardizing processes and ensuring continuous data integrity within the architectural repository.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Business-Outcome-Driven Enterprise Architecture Consulting and Solutions Market Statistics 2025 Analysis By Application (SME (Small and Medium Enterprises), Large Enterprise), By Type (Cloud-Based, On-Premise), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Enterprise Architecture Tools Market Statistics 2025 Analysis By Application (Large Enterprises 1000 , Medium-Sized Enterprise 499-1000 Users , Small Enterprises 1-499 Users ), By Type (Basic ($299-499/Month), Standards ($499-649/Month), Senior ($649-899/Month)), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager