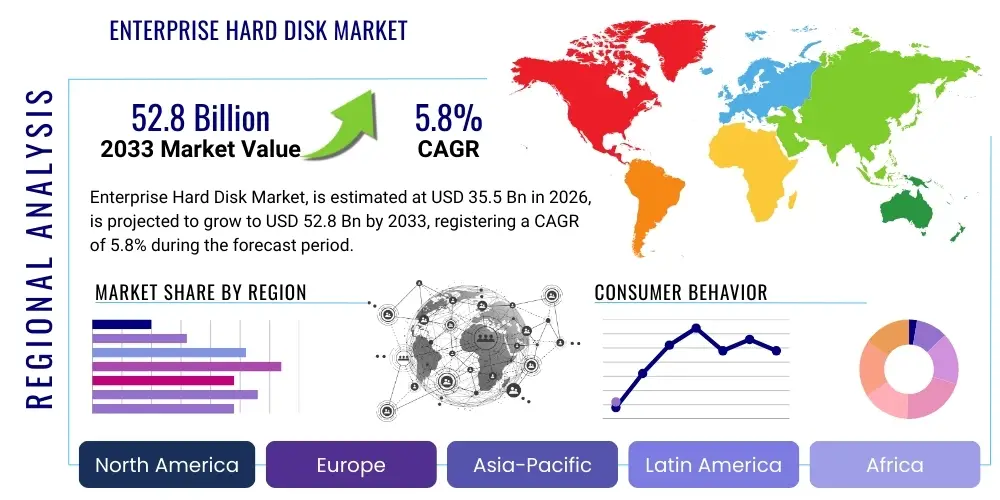

Enterprise Hard Disk Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438736 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Enterprise Hard Disk Market Size

The Enterprise Hard Disk Market is experiencing robust expansion driven by the incessant proliferation of data across global business infrastructures, particularly within hyperscale data centers and cloud computing environments. The escalating need for massive, cost-effective storage solutions that offer high reliability and sustained performance is the primary catalyst fueling this growth trajectory. These specialized storage devices are foundational to modern digital ecosystems, managing everything from transactional databases and archived records to large-scale analytical datasets crucial for contemporary business intelligence operations.

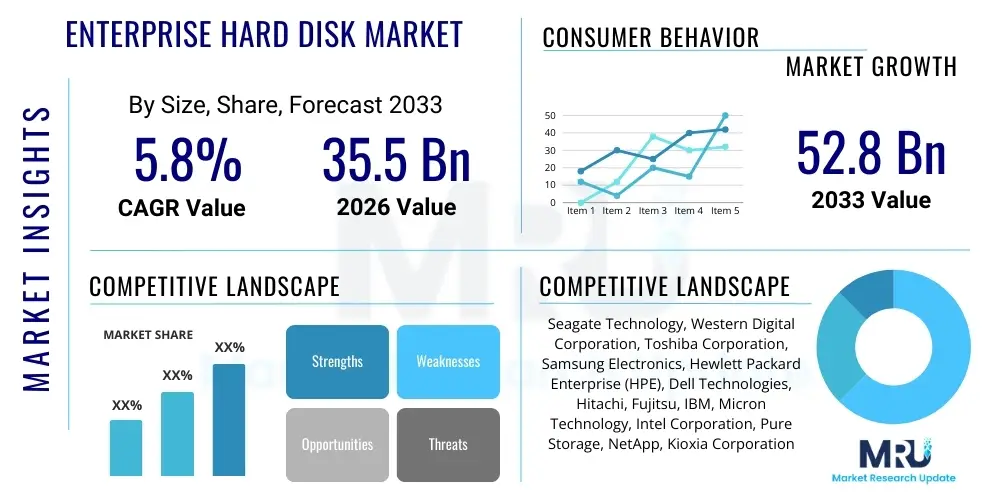

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. This consistent growth reflects the ongoing investment cycles in global IT infrastructure, especially in emerging economies and vertical sectors undergoing rapid digital transformation. While Solid State Drives (SSDs) capture high-performance segments, the Enterprise Hard Disk Drive (HDD) market maintains dominance in nearline and archival storage due to its superior cost-per-gigabyte metric, a critical factor for large-volume data repositories.

The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 52.8 Billion by the end of the forecast period in 2033. This substantial valuation underscores the persistent requirement for high-capacity mechanical drives, particularly those utilizing advanced technologies like Helium-filled enclosures and Energy-Assisted Magnetic Recording (EAMR), including Heat-Assisted Magnetic Recording (HAMR) and Microwave-Assisted Magnetic Recording (MAMR), which significantly increase areal density and overall capacity per drive.

Enterprise Hard Disk Market introduction

The Enterprise Hard Disk Market encompasses high-reliability, high-performance mechanical storage devices specifically engineered for continuous operation, high workload rates, and rigorous data integrity requirements typical of corporate data centers, server farms, and cloud storage providers. These products differ significantly from consumer-grade HDDs in terms of Mean Time Between Failures (MTBF), rotational vibration tolerance, and advanced error correction mechanisms. They are crucial for mission-critical applications where data availability and long-term retention are paramount, acting as the backbone for petabyte-scale storage infrastructure globally.

Major applications of enterprise hard disks span various sectors, including cloud services (providing infrastructure for Platform as a Service (PaaS) and Software as a Service (SaaS)), financial services (handling large-scale transactional data and regulatory compliance archiving), telecommunications, and government bodies. Key benefits include the lowest total cost of ownership (TCO) for massive storage volumes, scalable capacity scaling, and established reliability standards based on decades of operational deployment. They are optimized for sequential read/write operations common in archival and nearline data storage, offering an essential balance between performance and economic viability.

The market is primarily driven by the exponential growth in unstructured data generated by IoT devices, video surveillance, social media, and advanced analytics. Furthermore, the sustained build-out of hyperscale data centers by tech giants like Google, Amazon, Microsoft, and Alibaba, coupled with increasing regulatory demands for data retention and archival, necessitates continuous investment in high-density enterprise HDDs. Technological advancements aimed at increasing areal density, such as HAMR and MAMR, along with the adoption of optimized interfaces like SAS and increasingly robust SATA versions, further solidify the market's trajectory.

Enterprise Hard Disk Market Executive Summary

The Enterprise Hard Disk Market Executive Summary highlights a period of sustained, moderate growth primarily fueled by global hyperscale infrastructure expansion and the persistent demand for cost-effective, high-capacity archival solutions. Business trends indicate a bifurcation in the storage landscape, where performance-intensive workloads increasingly migrate to Solid State Drives (SSDs), while capacity-intensive, bulk-storage workloads remain firmly dependent on high-density Enterprise HDDs. Key manufacturers are consolidating their focus on developing ultra-high-capacity drives (20TB and above) utilizing Helium technology and next-generation recording methods (HAMR/MAMR) to maintain competitiveness against the rising threat of lower-cost NAND flash memory in certain segments.

Regional trends reveal that North America, driven by the concentration of global cloud service providers and major data center operators, currently holds the largest market share and remains the primary driver of technological adoption and demand volume. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to massive investments in digital infrastructure, rapid urbanization, and accelerated digital transformation initiatives in countries like China, India, and Southeast Asia. Europe maintains a steady growth trajectory, supported by stringent data localization regulations and increasing requirements for secure, long-term storage across diverse industries, including banking and manufacturing.

Segment trends confirm that the 16TB to 20TB and 22TB+ capacity segments are experiencing the most rapid adoption, reflecting the critical need for density optimization in space-constrained data centers. End-user segmentation emphasizes the dominance of the Cloud and Hyperscale segment, which accounts for the vast majority of unit shipments and revenue. Interface technology shows a stable preference for Serial Attached SCSI (SAS) in high-end mission-critical systems requiring robust dual-port capabilities, while Serial Advanced Technology Attachment (SATA) remains prevalent in large-scale archival and lower-performance nearline storage applications, valued for its simplicity and reduced cost structure.

AI Impact Analysis on Enterprise Hard Disk Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Enterprise Hard Disk Market frequently revolve around two primary themes: the dual role of AI in generating massive datasets that require storage, and the potential displacement of traditional HDDs by AI-optimized flash storage. Common user concerns include whether the high-speed requirements of AI model training (requiring NVMe/SSDs) will negate the need for bulk HDD storage, or if the sheer volume of data ingested and archived for AI operations (data lakes, raw sensor inputs, training caches) will sustain or even accelerate HDD demand. There is also significant interest in how AI and Machine Learning (ML) can be applied to optimize the operational efficiency and predictive maintenance of large HDD arrays, thereby reducing TCO and increasing reliability.

The consensus emerging from market analysis is that AI serves as a powerful accelerator for data generation and subsequent storage demand, thus benefiting the HDD market indirectly. While AI training and inference require extremely fast, low-latency storage (typically SSDs), the input data pipelines—terabytes of logs, images, and video needed to feed these models—must reside on cost-effective, high-density media. Therefore, AI drives the need for a tiered storage architecture: fast flash for hot data processing, and massive HDDs for warm and cold data archiving. This symbiosis ensures the continued relevance of the enterprise HDD sector, particularly as data scientists seek to leverage ever-larger datasets for more accurate model development.

Furthermore, AI-driven analytics systems themselves are becoming integral to enterprise storage management. These systems utilize ML algorithms to predict drive failures, optimize data placement (tiering), and streamline capacity planning. This application enhances the intrinsic value proposition of HDDs by improving their operational longevity and minimizing downtime in large storage clusters. The long-term impact of AI is therefore seen as volume-driving and reliability-enhancing for the HDD market, solidifying its role as the dominant medium for cost-optimized bulk data storage.

- AI-driven data generation necessitates petabyte-scale archival, sustaining HDD volume demand.

- Creation of vast data lakes and cold storage tiers for machine learning input heavily relies on low-cost-per-gigabyte HDDs.

- AI algorithms are increasingly used for predictive maintenance and failure analysis in large HDD storage arrays, enhancing reliability.

- Tiered storage architectures, essential for AI workloads, ensure HDDs remain crucial for warm and cold data layers.

- High-speed training and inference data remain primarily on flash (SSDs), but bulk input data generation scales the need for cost-effective HDD capacity.

DRO & Impact Forces Of Enterprise Hard Disk Market

The Enterprise Hard Disk Market is shaped by a complex interplay of rapid technological advancements (Drivers), economic constraints and competitive pressures (Restraints), and emerging technological frontiers (Opportunities), all filtered through the lens of significant Impact Forces such as regulatory changes and geopolitical stability. The overall market dynamics point toward continued growth, albeit moderated by the increasing performance parity and price reductions observed in high-density Solid State Drives (SSDs). Successful market navigation requires manufacturers to continuously push the limits of areal density while simultaneously improving energy efficiency and reliability metrics to maintain a favorable cost advantage over flash technologies, especially for capacity-optimized applications.

Key drivers include the relentless expansion of cloud services, which require massive, scalable, and cost-efficient storage capacity for customer data and internal infrastructure. The proliferation of IoT devices and 5G networks is generating unprecedented volumes of unstructured data that must be stored and analyzed, positioning HDDs as the logical choice for long-term archival. Restraints principally revolve around the competitive threat posed by high-density NAND flash and NVMe SSDs, which are decreasing in cost, challenging HDDs even in some warm data segments. Furthermore, the operational complexity and higher power consumption associated with large-scale HDD deployments compared to flash arrays present ongoing challenges for data center operators focused on sustainability and efficiency.

Opportunities reside predominantly in the widespread adoption of next-generation recording technologies like HAMR and MAMR, which promise to dramatically increase storage capacity per platter, securing the cost-per-gigabyte advantage well into the future. The growth of specialized markets, such as high-definition video surveillance and emerging edge computing environments requiring localized, robust storage, also opens new avenues for specialized enterprise HDDs. The primary Impact Force is the sustained globalization of data centers and the critical reliance of the digital economy on reliable bulk storage, making supply chain resilience and technological leadership paramount for market dominance. Regulatory impacts concerning data retention and localization further enforce the need for dense, compliant storage solutions.

- Drivers:

- Exponential growth of global data volumes across cloud and enterprise environments.

- Continuous build-out of hyperscale and co-location data centers globally.

- Superior cost-per-gigabyte economics compared to SSDs for nearline and archival storage.

- Demand for higher capacity drives enabled by Helium technology and advanced magnetic recording.

- Restraints:

- Increasing price competitiveness and density improvements of high-capacity Solid State Drives (SSDs).

- Higher power consumption and latency compared to flash-based storage solutions.

- Vulnerability to mechanical failure compared to solid-state technology.

- Supply chain disruptions impacting component availability and manufacturing costs.

- Opportunities:

- Widespread commercialization and deployment of Heat-Assisted Magnetic Recording (HAMR) and Microwave-Assisted Magnetic Recording (MAMR).

- Growth in specialized storage applications such as video surveillance (VSaaS) and Big Data analytics archives.

- Development of highly energy-efficient, shingled magnetic recording (SMR) drives optimized for cold storage.

- Impact Forces:

- Rapid digital transformation and cloud migration across all major industry verticals.

- Strict regulatory requirements (e.g., GDPR, HIPAA) driving the need for long-term, compliant data archival.

- Geopolitical tensions affecting critical component manufacturing and semiconductor supply.

- Focus on sustainability and power efficiency in data centers necessitates optimized drive architectures.

Segmentation Analysis

The Enterprise Hard Disk Market is systematically segmented based on key functional and technical attributes, including Capacity, Interface Type, and End-User Industry. This segmentation provides a granular view of demand patterns and technological priorities across different applications. Capacity segmentation is perhaps the most dynamic, driven by the data center imperative to maximize storage density per rack unit, pushing demand toward ultra-high capacity drives (20TB and above). Interface segmentation reflects the balance between high-performance mission-critical requirements (SAS) and cost-optimized bulk storage (SATA). End-user segmentation clearly illustrates the disproportionate market influence wielded by Hyperscale Cloud Providers, who dictate production volumes and next-generation specifications.

Analysis of these segments reveals that while smaller capacity drives (up to 10TB) still serve legacy enterprise systems and niche markets, the core growth engine is situated in the high-density nearline segment. Manufacturers are heavily investing in product differentiation within the 16TB to 22TB+ range to satisfy the capacity needs of Tier 1 cloud operators. The increasing adoption of specific technologies like Shingled Magnetic Recording (SMR) is limited almost exclusively to the largest cloud providers who possess the specialized software infrastructure to manage SMR's unique write characteristics, further polarizing the market.

Geographically, while demand is global, the regional concentration of hyperscale data center operations in North America and emerging APAC markets significantly influences segmentation demand. For instance, North American cloud providers rapidly transition to new capacity points, driving volume uptake of HAMR/MAMR technologies, while enterprises in Europe often maintain a more cautious adoption curve, balancing capacity needs with robust data security and redundancy requirements, often favoring established SAS interfaces for sensitive applications.

- By Capacity:

- Less than 8 TB (Legacy and entry-level server use)

- 8 TB to 14 TB (Standard enterprise and nearline storage)

- 16 TB to 20 TB (Current primary capacity segment for hyperscale deployment)

- 22 TB and Above (Next-generation, ultra-high density drives, HAMR/MAMR focus)

- By Interface:

- Serial Advanced Technology Attachment (SATA) (Cost-optimized bulk storage)

- Serial Attached SCSI (SAS) (High reliability, mission-critical, dual-port capability)

- Fibre Channel (FC) (Niche, highly reliable, legacy storage area networks)

- By End-User:

- Cloud Service Providers (Hyperscale, Tier 1, and regional CSPs)

- Traditional Enterprises (Banking, Finance, Insurance, Healthcare)

- Government and Defense

- Telecommunications

- Small and Medium-sized Enterprises (SMEs)

Value Chain Analysis For Enterprise Hard Disk Market

The value chain for the Enterprise Hard Disk Market is highly complex, extending from specialized raw material extraction and component manufacturing to sophisticated global distribution and integration into final enterprise systems. Upstream activities are characterized by intense technological control over critical components, particularly magnetic media, recording heads, and specialized motor mechanisms. Only a few global players control the intellectual property and manufacturing capability for these precise components, creating significant barriers to entry and influencing the final product cost and performance parameters. The supply of rare earth elements and specialized alloys used in magnets and platters forms a critical, often geopolitically sensitive, upstream bottleneck that impacts global production scalability.

Midstream activities involve the highly automated assembly, testing, and qualification of the HDDs. Given the stringent reliability requirements of the enterprise segment (24/7 operation, high MTBF), rigorous quality assurance processes are mandatory, adding to the manufacturing cycle time and cost. The distribution channel is bifurcated: Direct sales dominate engagement with hyperscale customers, where Original Equipment Manufacturers (OEMs) negotiate massive, customized contracts for integration into their proprietary server and storage arrays. Indirect channels, involving authorized distributors and value-added resellers (VARs), serve traditional enterprise customers, SMEs, and system integrators who require bundled solutions, technical support, and localized inventory management.

Downstream analysis focuses on the integration and deployment by the end-users. Hyperscale customers often develop their own proprietary storage software (e.g., Google File System, Amazon S3) to manage drive arrays, allowing them to utilize cost-effective SMR drives and dictate customized firmware requirements directly to the manufacturers. Traditional enterprises rely on established storage platform vendors (e.g., Dell, HPE, NetApp) who purchase enterprise HDDs from the primary manufacturers, integrate them into storage systems (SANs, NAS), and provide the necessary software, warranties, and maintenance services. This downstream service layer adds significant value through system integration, data management software, and post-sales support, bridging the technological gap between the component and the complex enterprise environment.

Enterprise Hard Disk Market Potential Customers

The Enterprise Hard Disk Market targets sophisticated buyers who prioritize three core metrics: high capacity, exceptional reliability, and optimal cost efficiency for bulk data storage. The primary buyers are large organizations that manage massive, continuously growing datasets and require resilient infrastructure. End-users fall broadly into two categories: high-volume, price-sensitive hyperscale customers, and mission-critical, reliability-sensitive traditional enterprise customers. The key decision-makers often include Chief Information Officers (CIOs), VPs of Infrastructure, and Data Center Operations Managers who are tasked with long-term capacity planning and Total Cost of Ownership (TCO) optimization.

Hyperscale Cloud Service Providers (CSPs) represent the single largest and most influential customer segment. Companies like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud dictate market trends by purchasing millions of drives annually, often demanding the newest, highest-density technologies (like 22TB+ HAMR/MAMR drives) directly from manufacturers under tailored specifications. Their purchasing decisions are primarily driven by the ability to maximize storage density and minimize operational costs (power and cooling per terabyte).

Traditional large enterprises—particularly those in financial services, telecommunications, and healthcare—constitute the second major segment. These customers require highly reliable, typically SAS-interfaced, drives for regulatory compliance, transactional logging, and long-term data archiving. They generally purchase through established IT vendors and resellers, prioritizing reliability, warranty service, and integration compatibility over cutting-edge capacity points, ensuring market stability for proven drive models in the 8TB to 14TB range.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 52.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Seagate Technology, Western Digital Corporation, Toshiba Corporation, Samsung Electronics, Hewlett Packard Enterprise (HPE), Dell Technologies, Hitachi, Fujitsu, IBM, Micron Technology, Intel Corporation, Pure Storage, NetApp, Kioxia Corporation, SK Hynix, Lenovo, Super Micro Computer, Quantum Corporation, Inspur, Cisco Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Enterprise Hard Disk Market Key Technology Landscape

The Enterprise Hard Disk Market is defined by a technological arms race focused entirely on increasing areal density and improving energy efficiency without compromising the demanding reliability standards of data centers. Historically, Perpendicular Magnetic Recording (PMR) has been the cornerstone technology, but its capacity ceiling has been largely reached, necessitating the transition to next-generation recording methods. The current landscape is dominated by Helium-filled drives, which reduce internal air turbulence, decrease power consumption, and allow for the stacking of more platters (up to 10 in some cases), significantly boosting overall capacity within the standard 3.5-inch form factor. This technological advancement is foundational for all high-capacity enterprise HDDs today, providing a critical density advantage.

The most transformative technology currently being deployed is Energy-Assisted Magnetic Recording (EAMR), primarily realized through Heat-Assisted Magnetic Recording (HAMR) and Microwave-Assisted Magnetic Recording (MAMR). HAMR utilizes a laser to momentarily heat the recording media, allowing magnetic bits to be written at much higher densities than PMR, potentially enabling drives exceeding 30TB in the near term. MAMR achieves similar density gains using a spin torque oscillator to generate microwaves, which aids in the writing process. The successful large-scale commercialization and deployment of HAMR and MAMR are crucial for the long-term viability of the HDD market against competitive flash technologies, ensuring the cost-per-gigabyte advantage is maintained and expanded.

Furthermore, technology used for optimizing data management on the drives, such as Shingled Magnetic Recording (SMR), plays a significant role in capacity enhancement, albeit with specific application limitations. SMR overlaps magnetic tracks like roof shingles, maximizing data density, but its write performance characteristics make it suitable primarily for sequential-write, archival-focused workloads. Enterprise SSD caching layers and intelligent firmware optimization, designed to minimize mechanical movement (e.g., through multi-actuator technology), are also essential components of the technology landscape, providing performance enhancements necessary for the drives to operate effectively within modern tiered data center storage architectures.

Regional Highlights

The Enterprise Hard Disk Market exhibits significant regional disparities in terms of demand drivers, technological adoption rates, and market maturity, largely correlated with the concentration of hyperscale data centers and the pace of digital infrastructure investment. North America holds the predominant position in terms of market size and revenue contribution. This dominance is attributed directly to the presence of nearly all major global cloud service providers (CSPs) and technology giants, who act as the largest consumers of high-capacity HDDs, driving early adoption of next-generation technologies like HAMR and high-density Helium drives. The robust legal framework and massive internal data creation within the US financial and tech sectors further solidify its leading role.

The Asia Pacific (APAC) region is projected to be the fastest-growing market segment throughout the forecast period. This rapid expansion is fueled by massive government and private sector investments in data localization, rapid digital transformation initiatives in countries like India, Indonesia, and Australia, and the burgeoning regional cloud ecosystems driven by players like Alibaba, Tencent, and Baidu. China, in particular, represents a huge market for domestic enterprise HDD demand, driven by its expansive telecommunications infrastructure and state-owned enterprises requiring localized data centers. Growth in APAC often involves both hyperscale build-outs and traditional enterprise adoption as developing economies accelerate their IT maturation.

Europe represents a mature and stable market, characterized by stringent regulatory environments, most notably the General Data Protection Regulation (GDPR), which mandates robust and secure data archival capabilities, favoring reliable enterprise-grade storage. Demand is driven by financial institutions, automotive manufacturing, and research sectors. While adoption of new capacity points may be slower than in North America, there is a strong focus on high-reliability SAS drives and compliance-focused storage solutions. Latin America and the Middle East & Africa (MEA) are emerging markets, displaying substantial growth potential tied to ongoing efforts in cloud expansion, sovereign data initiatives, and oil & gas industry digital requirements, though market penetration and IT spending maturity lag behind other major regions.

- North America: Market leader; driven by hyperscale cloud operations (AWS, Azure, Google Cloud); high adoption rate of ultra-high capacity drives (20TB+).

- Asia Pacific (APAC): Fastest-growing region; massive data center investment in China and India; rapid digital transformation and cloud localization demands.

- Europe: Stable growth; stringent regulatory environment (GDPR) driving demand for secure, long-term archival storage; strong uptake in financial and industrial sectors.

- Latin America: Emerging market; growth tied to regional cloud infrastructure expansion and modernization of telecommunications networks.

- Middle East and Africa (MEA): Growth accelerating due to sovereign data initiatives and investments in smart city projects and digitalization of oil & gas industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Enterprise Hard Disk Market. These companies are characterized by their massive manufacturing scale, extensive patent portfolios related to magnetic recording technology, and deep integration with Tier 1 cloud providers. Their strategic focus is predominantly on increasing areal density and improving power-per-terabyte metrics to maintain their competitive edge in capacity-optimized storage solutions.- Seagate Technology

- Western Digital Corporation

- Toshiba Corporation

- Samsung Electronics

- Hewlett Packard Enterprise (HPE)

- Dell Technologies

- Hitachi

- Fujitsu

- IBM

- Micron Technology

- Intel Corporation

- Pure Storage

- NetApp

- Kioxia Corporation

- SK Hynix

- Lenovo

- Super Micro Computer

- Quantum Corporation

- Inspur

- Cisco Systems

Frequently Asked Questions

Analyze common user questions about the Enterprise Hard Disk market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Enterprise HDDs and Consumer HDDs?

Enterprise HDDs are specifically engineered for 24/7 operation, higher workload rates (typically 550TB/year vs. 180TB/year for consumer drives), superior Mean Time Between Failures (MTBF, often over 2 million hours), and enhanced rotational vibration tolerance, making them suitable for multi-drive server environments where data integrity and longevity are critical.

How are technologies like HAMR and MAMR influencing the market?

Heat-Assisted Magnetic Recording (HAMR) and Microwave-Assisted Magnetic Recording (MAMR) are crucial next-generation technologies designed to overcome the physical limits of traditional magnetic recording. They enable manufacturers to achieve ultra-high storage capacities (25TB and above) at significantly lower cost-per-gigabyte ratios, securing the HDD's cost advantage against competing high-density SSDs for years to come.

Will Solid State Drives (SSDs) eventually replace Enterprise Hard Disks entirely?

SSDs are unlikely to fully replace Enterprise HDDs in the near to medium term. While SSDs dominate the high-performance, low-latency 'hot data' market segment, HDDs maintain a decisive cost-per-terabyte advantage for massive 'warm' and 'cold data' archival storage, especially in hyperscale and nearline applications. The market is evolving into a complementary tiered storage architecture rather than outright displacement.

Which capacity segment drives the most growth in the Enterprise HDD market?

The 16 TB to 20 TB and the emerging 22 TB and Above capacity segments are driving the most significant volume and revenue growth. This trend reflects the strong demand from hyperscale cloud providers who prioritize maximizing storage density per server rack to reduce operational expenditure (OpEx) related to power, cooling, and floor space.

What role does the cloud computing industry play in Enterprise HDD demand?

Cloud computing providers are the single most important factor driving Enterprise HDD demand. Hyperscale companies purchase the vast majority of high-capacity drives to build their foundational storage infrastructure (e.g., S3, Google Cloud Storage). Their exponential data growth dictates manufacturing volumes and accelerates the adoption curve for new capacity breakthroughs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager