Enterprise ICT Spending Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432351 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Enterprise ICT Spending Market Size

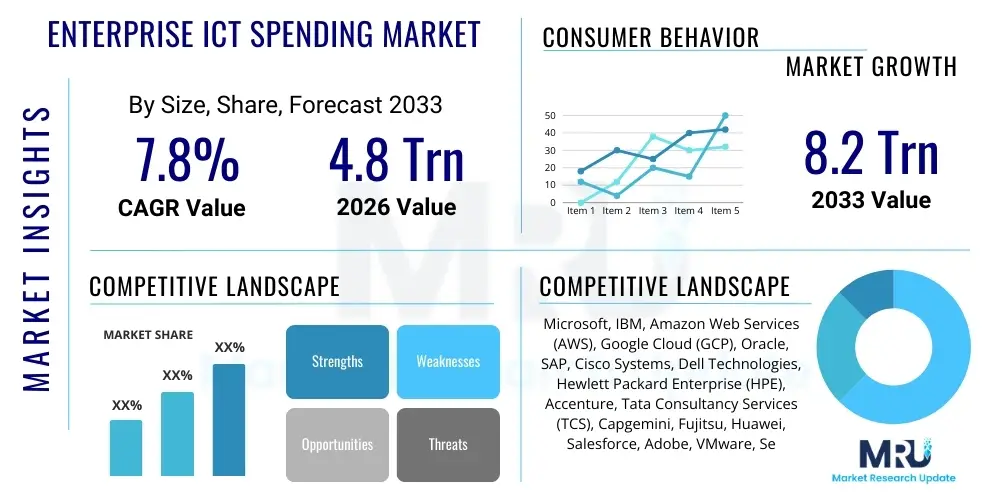

The Enterprise ICT Spending Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.8 Trillion in 2026 and is projected to reach USD 8.2 Trillion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerated pace of digital transformation across global industries, mandatory compliance requirements, and the necessity for enhanced operational resilience. Enterprises are increasingly shifting capital expenditure (CapEx) to operational expenditure (OpEx) models, favoring subscription-based software and cloud services over traditional owned infrastructure, which is redefining the market dynamics and ensuring sustainable, incremental growth throughout the forecast period.

Enterprise ICT Spending Market introduction

The Enterprise Information and Communication Technology (ICT) Spending Market encompasses all expenditures made by businesses and governmental organizations on technology infrastructure, software applications, IT services, and telecommunication services designed to support core business operations, connectivity, data processing, and innovation. This expenditure spans critical categories including hardware components such as servers, storage devices, and networking equipment; packaged software solutions ranging from enterprise resource planning (ERP) and customer relationship management (CRM) systems to specialized analytics tools; and a wide array of IT services including consulting, system integration, outsourcing, and managed services. The comprehensive nature of ICT spending makes it a primary indicator of global business investment in productivity and future growth capabilities.

Key applications driving investment include the modernization of legacy IT systems, the implementation of complex cybersecurity frameworks to combat escalating digital threats, the migration of workloads to scalable public and private cloud environments, and the deployment of advanced data analytics tools to derive actionable business intelligence. Furthermore, the persistent demand for supporting hybrid work models necessitates significant investment in unified communications and collaboration (UCC) platforms, secure remote access technologies, and optimized network infrastructure designed for elasticity and high availability. These investments are no longer discretionary but are viewed as essential operating costs required to maintain competitive parity and regulatory adherence in a rapidly evolving digital economy.

The core benefits derived from strategic ICT spending include significant improvements in operational efficiency, reductions in long-term operating costs through automation, enhanced customer experience via optimized digital channels, and the acceleration of product and service innovation cycles. Major driving factors propelling market expansion include the exponential increase in enterprise data volumes requiring robust storage and processing capabilities, the pervasive adoption of hybrid and multi-cloud strategies offering unparalleled scalability, and stringent global regulatory environments (such as GDPR and HIPAA) mandating advanced data protection and governance solutions. The competitive imperative to leverage emerging technologies like Artificial Intelligence (AI) and the Internet of Things (IoT) further reinforces the necessity for sustained and increasing ICT investment.

Enterprise ICT Spending Market Executive Summary

The Enterprise ICT Spending Market is characterized by a significant structural shift away from traditional hardware procurement towards service-centric, cloud-native solutions, reflecting a major business trend favoring agility and scalability. Business trends indicate accelerated investment in areas that directly contribute to revenue generation and risk mitigation, specifically focusing on data centers (driven by AI workloads), security software, and specialized industry-specific applications delivered as a service (SaaS). Large enterprises are dominating the total spend but Small and Medium Enterprises (SMEs) are exhibiting the highest growth rates, enabled by accessible cloud platforms that democratize advanced technology capabilities previously reserved for large corporations. Cybersecurity spending remains non-negotiable, evolving from simple perimeter defense to comprehensive Zero Trust architectures that span endpoints, networks, data, and identities, forming the foundation of modern digital trust.

Regionally, North America maintains the highest market share due to its concentration of technology pioneers, early adoption of emerging technologies, and robust financial services and IT sectors. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by rapid industrialization, burgeoning digital economies in countries like China and India, and large-scale governmental investment in foundational digital infrastructure. Europe, while mature, is seeing significant ICT investment driven primarily by strict regulatory mandates concerning data privacy and sustainability, necessitating substantial upgrades in data governance software and energy-efficient data center technologies. These regional differences highlight varied maturity levels and regulatory pressures influencing localized investment priorities.

In terms of segment trends, the Software segment, particularly SaaS and platform as a service (PaaS), is experiencing explosive growth, outpacing traditional hardware refresh cycles. Within the Services segment, managed services and professional services related to cloud migration and cybersecurity implementation represent the most significant expenditure categories. Hardware spending, while slowing in traditional data centers, is shifting dramatically towards high-performance computing (HPC) and specialized infrastructure optimized for AI and machine learning tasks at the edge. The BFSI and Telecom verticals remain leading spenders due to regulatory necessity and consumer-facing digitalization, respectively, while the Healthcare sector is increasing its share rapidly, focusing on telemedicine, electronic health records (EHR), and patient data security.

AI Impact Analysis on Enterprise ICT Spending Market

Common user questions regarding AI's impact on Enterprise ICT spending center around three primary themes: the necessary infrastructure upgrade costs, the shift in software spending towards AI-native platforms, and the return on investment (ROI) derived from AI implementation projects. Users frequently inquire about the feasibility of running generative AI models on current hardware, the optimal mix of GPU versus CPU processing, and the security implications of utilizing large language models (LLMs). There is a significant concern regarding talent acquisition costs necessary to manage and develop AI initiatives, suggesting a potential shift in ICT service spending towards AI consulting and specialized managed services. Ultimately, users are seeking clarity on whether AI represents an incremental cost or a fundamental pivot requiring complete architectural overhauls.

The consensus emerging from market analysis is that AI is fundamentally reshaping the allocation of ICT budgets. Initial spending is concentrated on foundational infrastructure capable of handling intensive parallel processing required for training and inference, leading to increased demand for high-end servers, specialized accelerators (GPUs, TPUs), and high-speed networking solutions. This infrastructure expenditure often involves expanding cloud capacity or building out dedicated private cloud environments. Simultaneously, software spending is redirecting toward Machine Learning Operations (MLOps) tools, AI governance platforms, and vertical-specific AI applications embedded within existing enterprise software suites (e.g., AI in CRM, AI in ERP). This requires enterprises to prioritize vendors offering integrated AI capabilities rather than purely foundational IT tools.

Furthermore, AI deployment is directly influencing the Services segment. The complexity of integrating AI models into existing business workflows necessitates extensive professional services, covering data preparation, model training, ethical vetting, and deployment scaling. This shift increases reliance on IT consulting firms specializing in data science and digital transformation. In the long term, AI promises efficiency gains and automation, potentially restraining spending on general operational IT services, but initially, it acts as a strong catalyst for new capital expenditure on specialized hardware and high-value integration services. The impact is dual: immediate increase in specialized hardware/service spending, followed by efficiency gains in software development and operational management.

- AI demands significant investment in high-performance computing (HPC) hardware, specifically GPU-accelerated servers and optimized storage fabrics.

- Increased allocation of software budgets towards MLOps platforms, specialized AI development tools, and licenses for large language models (LLMs).

- Acceleration of cloud spending driven by the need for scalable, on-demand AI training environments provided by hyperscalers.

- Shift in IT service expenditure towards specialized AI consulting, data engineering, and ethical AI governance services.

- Automation potential generated by AI models is anticipated to reduce spending on routine, low-value IT support and maintenance tasks over the long term.

- Cybersecurity spending is increasing to protect AI intellectual property, proprietary training data, and to defend against AI-powered cyberattacks.

DRO & Impact Forces Of Enterprise ICT Spending Market

The dynamics of the Enterprise ICT Spending Market are governed by powerful forces that simultaneously propel growth (Drivers), impose limitations (Restraints), and present future growth avenues (Opportunities). Major drivers include the mandatory acceleration of digital transformation initiatives across nearly every industry vertical, necessitated by evolving customer expectations and operational requirements. The increasing complexity and frequency of global cyber threats serve as a significant non-discretionary driver, mandating continuous and substantial investment in advanced security solutions. Moreover, the global shift towards hybrid work necessitates major upgrades in networking, cloud infrastructure, and collaboration platforms, forcing sustained spending across all enterprise sizes. These drivers collectively ensure a baseline level of continued ICT investment.

Restraints, however, temper the growth trajectory. Primary among these is the prevailing global economic uncertainty and inflationary pressures, which often lead organizations to scrutinize large capital expenditures (CapEx) and defer non-essential IT projects, especially in sectors highly sensitive to economic cycles. The acute global shortage of specialized IT talent, particularly in niche areas like cloud architecture, AI development, and advanced cybersecurity, hinders the deployment and management of complex systems, thereby dampening related service spending. Furthermore, the inherent challenges associated with integrating disparate legacy systems with modern cloud-native architectures create technical friction and budget overruns, acting as a frictional drag on implementation timelines and ROI realization.

Opportunities in the market center around disruptive technological innovations and emerging operational models. The increasing viability of Edge Computing represents a vast opportunity, requiring substantial new infrastructure investment to process data closer to its source, particularly in manufacturing, retail, and healthcare. The focus on Environmental, Social, and Governance (ESG) standards is opening up a new segment for ‘Green IT’ solutions, focusing on sustainable data centers and energy-efficient hardware, driven by regulatory and public pressure. Additionally, the proliferation of industry-specific cloud solutions (vertical clouds) tailored to unique regulatory and operational needs offers vendors a highly differentiated market pathway, providing precision-fit software and compliance services that attract premium spending. These opportunities promise sustained revenue streams for agile market participants.

Segmentation Analysis

The Enterprise ICT Spending Market is analyzed through multiple dimensions to provide granular insights into expenditure patterns, technology adoption rates, and regional preferences. Segmentation across components (hardware, software, services), deployment models (cloud vs. on-premise), enterprise size (large vs. SME), and industry vertical provides a comprehensive view of how capital is being allocated. Currently, the Services component holds the largest market share, reflecting the complexity of modern technology stacks and the reliance on third parties for managed infrastructure, security, and digital transformation consulting. However, the Software segment, particularly cloud-based applications and platforms, is registering the fastest expansion due to the scalability and continuous innovation inherent in SaaS models, fundamentally altering how organizations consume and refresh their technology portfolios.

- Component:

- Hardware (Servers, Storage, Networking Equipment, End-User Devices)

- Software (Application Software, System Infrastructure Software, Software Development Tools)

- IT Services (Consulting, Integration, Outsourcing, Managed Services, Data Processing Services)

- Telecommunication Services (Fixed Voice, Mobile Services, Data Services)

- Deployment Model:

- On-Premise

- Cloud (Public Cloud, Private Cloud, Hybrid Cloud)

- Enterprise Size:

- Large Enterprises (1,000+ Employees)

- Small and Medium Enterprises (SMEs) (1-999 Employees)

- Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- IT & Telecom

- Manufacturing

- Retail & Consumer Goods

- Healthcare & Life Sciences

- Government & Public Sector

- Energy & Utilities

- Others (Media, Education, Transportation)

Value Chain Analysis For Enterprise ICT Spending Market

The value chain of the Enterprise ICT Spending Market is a complex ecosystem beginning with foundational upstream activities involving hardware component manufacturing and core software development. Upstream analysis focuses on the providers of silicon chips (CPUs, GPUs), operating systems, and virtualization technologies, where innovation dictates the performance and cost structures of subsequent downstream offerings. Key factors in this segment include supply chain resilience, geopolitical stability impacting raw material sourcing, and continuous research and development investment in next-generation processors and security embedded at the chip level. The consolidation among key chip manufacturers and the rising complexity of integrated circuit design underscore the high barrier to entry at this foundational level.

The downstream segment primarily involves system integrators, managed service providers (MSPs), cloud service providers (CSPs), and specialized technology consultants who aggregate, customize, and deploy ICT solutions for end-user enterprises. This segment is highly fragmented and competitive, defined by the ability to deliver comprehensive, outcome-based solutions rather than just selling products. System integrators play a crucial role in customizing ERP, CRM, and cloud architectures to fit specific business processes, driving significant service revenue. Cloud providers (AWS, Azure, GCP) act as both infrastructure providers and distributors, offering standardized platforms that bypass traditional hardware supply chains, thereby exerting immense influence over deployment preferences and future spending trajectories.

Distribution channels are multifaceted, encompassing direct sales models (especially for large, customized infrastructure deals), robust indirect channels utilizing value-added resellers (VARs) and distributors for standardized products, and the pervasive shift towards cloud marketplaces for software and services. The dominance of the indirect channel for SME market penetration remains crucial due to the localized support and financing offered by VARs. However, the proliferation of subscription models has amplified the importance of software vendors distributing directly through their own online platforms, reducing dependency on physical distribution. Effective distribution in this market relies heavily on strong technical partnerships, deep domain expertise, and a global presence to cater to multinational enterprise requirements.

Enterprise ICT Spending Market Potential Customers

Potential customers for Enterprise ICT Spending are virtually all organizations, but the intensity and focus of spending vary significantly based on industry vertical and size. Large enterprises, characterized by massive data processing needs, complex international operations, and stringent compliance requirements, represent the largest overall spenders. Their spending is typically centered on large-scale digital transformation projects, global cloud migration efforts, advanced cybersecurity defenses, and specialized industry applications such as algorithmic trading platforms in BFSI or smart factory systems in Manufacturing. Procurement is usually highly structured, involving multi-year contracts and rigorous vendor selection processes focusing on resilience and global support capabilities.

Small and Medium Enterprises (SMEs) constitute a high-growth customer segment, primarily driven by the accessibility and affordability of pay-as-you-go cloud services (SaaS and PaaS). SMEs prioritize solutions that offer immediate operational benefits, requiring minimal internal IT overhead, such as cloud-based accounting, collaboration tools, and foundational security suites. Their buying decisions are heavily influenced by ease of deployment, total cost of ownership (TCO), and robust localized support from managed service providers (MSPs) and value-added resellers (VARs). The shift to cloud allows SMEs to leverage high-end applications that were historically too costly or complex, making them highly receptive customers for scalable, modular ICT offerings.

Furthermore, highly regulated sectors such as BFSI, Healthcare, and Government are consistently high-priority customers, characterized by mandatory spending on compliance and data integrity. BFSI entities invest heavily in security, fraud detection systems, and customer-facing digital platforms. Healthcare organizations are compelled to modernize electronic health records (EHR) systems and invest in telemedicine infrastructure, all while adhering to strict patient data protection regulations (like HIPAA). Government entities prioritize infrastructure modernization, secure citizen services delivery, and resilience planning, often driving large, multi-vendor projects focusing on national security and public sector efficiency gains, thereby ensuring stable, long-term expenditure commitment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Trillion |

| Market Forecast in 2033 | USD 8.2 Trillion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Microsoft, IBM, Amazon Web Services (AWS), Google Cloud (GCP), Oracle, SAP, Cisco Systems, Dell Technologies, Hewlett Packard Enterprise (HPE), Accenture, Tata Consultancy Services (TCS), Capgemini, Fujitsu, Huawei, Salesforce, Adobe, VMware, ServiceNow, Intel, Broadcom |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Enterprise ICT Spending Market Key Technology Landscape

The contemporary Enterprise ICT Spending landscape is defined by the rapid maturation and integration of several core technological pillars, necessitating continuous investment in innovation and infrastructure refresh. The foundational technology remains Cloud Computing, specifically hybrid and multi-cloud environments, which dictates architecture across software, storage, and networking. Enterprises are not just migrating workloads but are building cloud-native applications utilizing microservices and containers (Kubernetes), driving significant expenditure in platform-as-a-service (PaaS) and specialized development tools. Furthermore, serverless computing and Function-as-a-Service (FaaS) are gaining traction, allowing organizations to optimize operational costs and enhance developer productivity, contributing to a measurable shift in software budget allocation from licensing to consumption models.

Another crucial technological area driving spending is Advanced Cybersecurity, particularly the transition toward Zero Trust Network Architecture (ZTNA). This shift requires investment not only in perimeter security tools but also in identity and access management (IAM), endpoint detection and response (EDR), and Security Information and Event Management (SIEM) solutions capable of handling massive telemetry data streams. Simultaneously, the rise of Generative AI demands specialized infrastructure, specifically high-throughput networking solutions (like 400G and 800G Ethernet) and specialized hardware accelerators (e.g., NVIDIA GPUs and custom AI chips) to support the computationally intensive tasks of training and inference, leading to a new wave of capital investment in optimized data centers and co-location facilities.

Edge Computing represents a paradigm shift, pushing processing power away from centralized data centers to geographically distributed locations, impacting spending in sectors like retail, manufacturing (Industrial IoT), and logistics. This requires investment in ruggedized, low-latency infrastructure and specialized edge platforms for data aggregation and real-time processing, often integrated with 5G connectivity for enhanced mobility and bandwidth. Finally, Data Analytics and Business Intelligence platforms continue to attract substantial budgets, moving beyond historical reporting to predictive and prescriptive analytics, often utilizing integrated machine learning models to inform strategic business decisions. The need for robust Data Governance frameworks to manage data quality and compliance across distributed systems further strengthens the expenditure in data management software and services.

Regional Highlights

- North America: North America holds the largest market share in global ICT spending, primarily driven by the United States’ high concentration of technology innovation hubs, major hyperscale cloud providers, and aggressive adoption of cutting-edge technologies like AI and quantum computing. The region is characterized by mature digital infrastructure, stringent data privacy regulations which necessitate continuous spending on compliance software and robust cybersecurity solutions, and high expenditure within the BFSI and IT & Telecom sectors. Corporate strategies here prioritize digital experience, operational resilience, and the rapid deployment of cloud-native architectures, making it the leading market for high-value services and premium software subscriptions. Investment focus remains heavy on AI-optimized infrastructure and sophisticated managed security services.

- Europe: The European market demonstrates steady growth, strongly influenced by regulatory mandates, most notably the General Data Protection Regulation (GDPR) and emerging EU AI Act legislation, driving mandatory spending on data governance, sovereignty tools, and compliant cloud solutions. Western Europe (Germany, UK, France) dominates the expenditure, focusing heavily on modernizing legacy systems, implementing sophisticated automation in the manufacturing sector (Industry 4.0), and prioritizing green ICT solutions to meet sustainability targets. The adoption of hybrid cloud models is extremely prevalent, balancing local regulatory needs with the scalability benefits of global public cloud services, creating sustained demand for system integration and localized consulting services.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region in terms of ICT spending, fueled by rapid digitalization in emerging economies (China, India, Southeast Asia). This growth is primarily driven by massive government investments in smart cities and digital infrastructure, the rapid expansion of mobile and internet penetration, and strong growth in the manufacturing and retail sectors. China leads the spending volume, focusing intensely on domestic cloud platforms and 5G deployment, while India is a major consumer of IT services and digital public infrastructure (like Aadhaar and UPI). The region’s trajectory is characterized by leapfrogging older technologies, resulting in immediate adoption of mobile-first and cloud-native strategies, driving demand for scalable SaaS and telecommunication services.

- Latin America (LATAM): LATAM presents a developing ICT market, exhibiting significant growth potential, particularly in countries like Brazil and Mexico. Spending is largely concentrated on basic digitalization efforts, infrastructure modernization, and the adoption of foundational SaaS solutions to improve operational efficiency and competitiveness against international players. Key drivers include the expansion of e-commerce, the need for robust financial technology (FinTech) solutions, and overcoming infrastructure challenges through cloud-based platforms. However, economic volatility and inconsistent regulatory frameworks sometimes restrain the pace of large-scale CapEx projects, leading to a preference for flexible, OpEx-heavy managed services.

- Middle East and Africa (MEA): The MEA region shows diverse spending patterns. The Middle East (especially GCC countries) invests heavily in large, strategic national digitalization projects, often tied to economic diversification goals (e.g., Saudi Vision 2030, UAE Centennial 2071). This results in substantial spending on smart infrastructure, high-end data center construction, and advanced cybersecurity solutions, typically driven by the government, energy, and financial sectors. Africa’s spending is more focused on mobile connectivity and basic cloud services, addressing high telecommunication costs and enabling financial inclusion through mobile money platforms, reflecting high demand for core network services and low-cost SaaS solutions suitable for local market dynamics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Enterprise ICT Spending Market.- Microsoft

- IBM

- Amazon Web Services (AWS)

- Google Cloud (GCP)

- Oracle

- SAP

- Cisco Systems

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- Accenture

- Tata Consultancy Services (TCS)

- Capgemini

- Fujitsu

- Huawei

- Salesforce

- Adobe

- VMware

- ServiceNow

- Intel

- Broadcom

Frequently Asked Questions

Analyze common user questions about the Enterprise ICT Spending market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver influencing current Enterprise ICT Spending growth?

The predominant driver is the mandatory acceleration of enterprise-wide digital transformation, fueled by the imperative to improve customer experience, achieve operational efficiencies through automation, and comply with escalating cybersecurity and data governance regulations globally. Cloud migration remains central to this transformation, shifting spending from CapEx to OpEx models.

How is cloud computing impacting traditional hardware spending patterns?

Cloud computing is causing a structural reallocation of hardware spending. While traditional on-premise server and storage procurement is slowing, the overall market still demands significant infrastructure. However, this demand is concentrated in hyperscale data centers (owned by AWS, Azure, GCP) and for highly specialized, AI-optimized hardware at the enterprise edge, rather than in conventional corporate data centers.

Which segment of the Enterprise ICT Market is projected to experience the highest growth rate?

The Software segment, specifically Software as a Service (SaaS) and Platform as a Service (PaaS) solutions, is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This growth is driven by the ease of deployment, scalability, subscription models, and the continuous integration of emerging technologies like AI and analytics directly into enterprise applications.

What role does AI adoption play in Enterprise ICT budget allocation?

AI adoption acts as a major catalyst for increased ICT spending, requiring significant foundational investment in high-performance computing (HPC) infrastructure, specialized accelerators (GPUs), high-speed networking, and AI governance software. Initially, AI increases CapEx for specialized hardware and OpEx for cloud-based AI services and skilled professional services.

Which geographical region offers the most significant growth opportunities for ICT vendors?

The Asia Pacific (APAC) region, driven by fast-growing economies like India and China, offers the most significant growth opportunities. This is due to large-scale government-led digitalization projects, increasing internet and mobile penetration, and substantial greenfield deployment opportunities allowing for immediate adoption of modern cloud and 5G infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager