Enterprise Network Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433641 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Enterprise Network Equipment Market Size

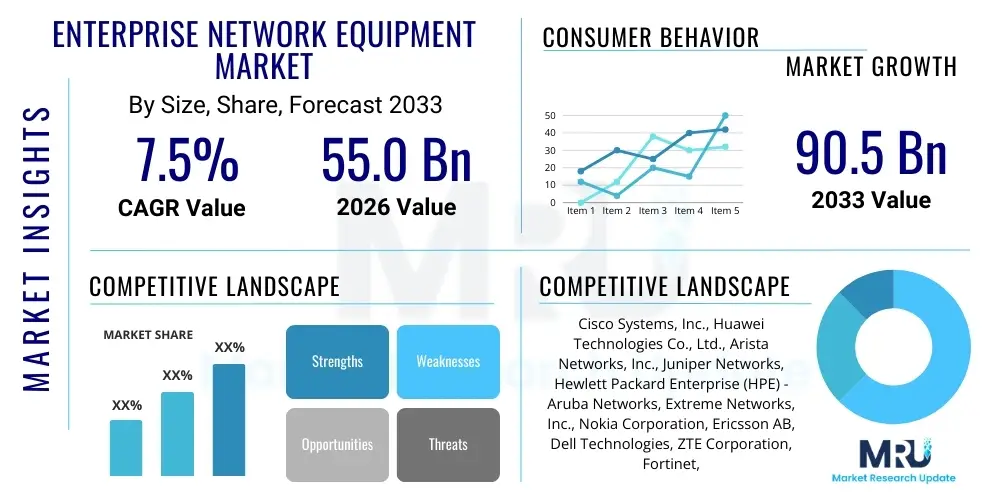

The Enterprise Network Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $55.0 Billion USD in 2026 and is projected to reach $90.5 Billion USD by the end of the forecast period in 2033.

Enterprise Network Equipment Market introduction

The Enterprise Network Equipment Market encompasses hardware and software infrastructure essential for connecting devices, systems, and users within large organizations, ensuring robust and scalable communication and data transfer. This market includes core components such as routers, switches, wireless local area network (WLAN) access points, security appliances (firewalls and intrusion detection systems), and sophisticated network management solutions (NMS). These products are critical for establishing secure, reliable, and high-performance networks necessary to support modern enterprise operations, digital transformation initiatives, and the increasing reliance on cloud computing and distributed workforces. The proliferation of data-intensive applications, coupled with the necessity for real-time analytics and enhanced security protocols, continuously drives innovation and demand within this sector.

Major applications of enterprise networking gear span across various verticals, including financial services, healthcare, telecommunications, manufacturing, and education, each requiring tailored network solutions to meet specific compliance and operational demands. For instance, in healthcare, network reliability is paramount for Electronic Health Records (EHR) access and telehealth services, while in manufacturing, low latency is crucial for supporting Industrial IoT (IIoT) applications. The fundamental benefit provided by high-quality network equipment is the facilitation of seamless internal and external communication, ensuring operational efficiency, data integrity, and business continuity. Furthermore, contemporary equipment offers advanced features like Software-Defined Networking (SDN) and Network Function Virtualization (NFV), enabling greater flexibility, simplified management, and reduced total cost of ownership (TCO).

Key driving factors propelling market growth include the pervasive adoption of hybrid cloud architectures, necessitating secure and efficient connections between on-premises infrastructure and public cloud environments. The shift towards remote and hybrid work models has accelerated the demand for robust, secure WLAN and VPN solutions that extend the corporate network perimeter safely to remote locations. Moreover, the continuous rollout of 5G technology is opening up new opportunities for high-speed, low-latency connectivity, especially for edge computing and mobile enterprise applications. Increased cyber threats also mandate organizations to invest in next-generation firewall technologies and integrated Zero Trust Network Access (ZTNA) solutions, further stimulating the refresh and expansion cycles of enterprise networking infrastructure.

Enterprise Network Equipment Market Executive Summary

The Enterprise Network Equipment Market is undergoing a rapid evolution characterized by the dominance of software-defined architectures and heightened security integration, moving away from traditional hardware-centric models. Business trends emphasize simplified operational models, primarily through Cloud-Managed Networking (CMN), allowing enterprises to deploy, monitor, and scale networks centrally and efficiently across geographically dispersed locations. Furthermore, the convergence of wired and wireless access into unified fabric architectures (like Wi-Fi 6/6E and 5G enterprise solutions) is becoming a standard expectation. Investment is heavily skewing towards infrastructure that supports high bandwidth, low latency, and programmable interfaces, driven by the massive scale needed for IoT devices and data center interconnectivity. Vendor competition is intensifying based not only on hardware specifications but crucially on the richness of integrated security features and AI-driven automation capabilities for network management and troubleshooting.

Regional trends indicate North America retaining its leadership due to early adoption of advanced technologies like SD-WAN and a high concentration of major technology companies and data centers. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by large-scale digital transformation initiatives, rapid urbanization, and significant government investments in smart city infrastructure and widespread broadband connectivity rollout, particularly in countries like China, India, and Southeast Asia. Europe is characterized by stringent data sovereignty regulations (such as GDPR), leading to robust investment in secure, localized networking solutions, focusing heavily on managed services and cyber resilience. Emerging markets in Latin America and MEA are seeing steady growth as basic digitalization efforts mature into more complex cloud and mobility deployments.

Segmentation trends highlight that the WLAN segment, particularly Wi-Fi 6 and Wi-Fi 6E equipment, is experiencing high demand due to the necessity of supporting high-density user environments and bandwidth-intensive applications. The Router and Switch segment remains foundational but is transitioning rapidly towards modular, high-port density 400G switches for data centers and secure, programmable SD-WAN routers for branch offices. From an industry vertical perspective, the BFSI (Banking, Financial Services, and Insurance) sector and the IT & Telecom sector are the largest consumers, driven by the need for ultra-low latency trading platforms and massive data transport capacity. Services, specifically professional and managed services related to network implementation and security monitoring, are growing faster than the core equipment sales, reflecting the complexity of modern network management and the preference for operational expenditure models.

AI Impact Analysis on Enterprise Network Equipment Market

User inquiries regarding AI's influence on enterprise networking primarily revolve around three core themes: network automation, security enhancement, and predictive performance management. Users frequently question how AI/ML will fundamentally change the role of network engineers, asking if AI can autonomously detect and resolve complex network anomalies (AIOps). They are highly concerned about integrating AI tools seamlessly into existing, often heterogeneous, network infrastructures and ensuring that AI-driven security features can effectively counter sophisticated, fast-moving cyber threats. Furthermore, enterprises seek clarity on the return on investment (ROI) derived from AI infrastructure, specifically expecting detailed proof that AI reduces downtime, improves quality of service (QoS), and optimizes resource allocation (e.g., energy consumption and bandwidth management) across sprawling, multi-cloud environments. The underlying expectation is that AI will transform reactive network operations into proactive, self-healing systems.

The implementation of Artificial Intelligence and Machine Learning (AI/ML) is moving the enterprise network equipment paradigm toward intelligent, self-optimizing networks, commonly referred to as AIOps (Artificial Intelligence for IT Operations). This shift is profound, fundamentally altering how network infrastructure is managed, troubleshot, and secured. AI models analyze colossal amounts of telemetry data—from traffic patterns, log files, configuration changes, and performance metrics—to establish behavioral baselines. Once established, these models can identify deviations in real-time that human operators might miss, automatically correlating events across different network domains (e.g., WAN, LAN, and Cloud) to pinpoint root causes, significantly reducing Mean Time to Resolution (MTTR).

AI’s influence extends critically into the security domain, enabling next-generation threat detection that moves beyond signature-based identification. AI-powered security appliances, such as firewalls and Secure Access Service Edge (SASE) platforms, use behavioral analytics to identify zero-day attacks, internal threats, and subtle indicators of compromise by analyzing user and device behavior patterns. This capability enhances the efficacy of Zero Trust architectures by continuously evaluating the trust level of every connection attempt. Additionally, AI optimizes resource planning by accurately predicting capacity requirements based on historical and projected workload growth, allowing organizations to scale network resources dynamically and efficiently, thus minimizing over-provisioning and ensuring consistent Quality of Experience (QoE) for end-users.

- AI-Driven AIOps Implementation: Automation of routine network maintenance, configuration changes, and proactive fault detection, minimizing human intervention.

- Enhanced Security Analytics: Use of machine learning for real-time behavioral threat detection, identification of anomalies, and zero-day attack prevention in security appliances.

- Predictive Capacity Planning: Accurate forecasting of bandwidth and hardware needs based on data consumption trends, optimizing CapEx and OpEx.

- Intelligent Traffic Steering: Dynamic optimization of data paths in SD-WAN environments based on application requirements and link performance metrics.

- Self-Healing Networks: Automated isolation and resolution of network issues, leading to improved uptime and system resilience.

DRO & Impact Forces Of Enterprise Network Equipment Market

The market is primarily driven by the mandatory upgrade cycles necessitated by digital transformation, particularly the widespread adoption of cloud computing and the imperative for robust cybersecurity measures. These drivers are tempered by significant restraints, primarily the high initial capital expenditure required for deploying complex, high-performance networking gear and the challenges associated with finding personnel skilled enough to manage highly sophisticated, software-defined environments. However, substantial opportunities exist through the monetization of 5G private networks for industry-specific use cases (e.g., smart factories) and the increasing enterprise shift toward outsourced Managed Services (NaaS or Network as a Service), which lowers entry barriers and shifts costs from CapEx to OpEx. These forces collectively shape the market's trajectory, mandating vendors to offer integrated, simplified, and consumption-based networking solutions.

Drivers: The explosive growth in data volume generated by IoT, edge devices, and multimedia applications demands continuous capacity upgrades across the enterprise backbone. Furthermore, the migration of critical business applications to multi-cloud environments requires resilient, low-latency interconnection solutions, bolstering the demand for high-speed switches and sophisticated SD-WAN platforms capable of managing hybrid connectivity efficiently. Regulatory compliance requirements, such as those governing data privacy and transaction security in finance and healthcare, compel organizations to adopt state-of-the-art security-integrated networking devices, replacing legacy systems that lack modern encryption and access control capabilities. The shift towards hybrid work models necessitates pervasive Wi-Fi 6/6E coverage and high-performance remote access technologies, accelerating the refresh cycle for WLAN and VPN hardware.

Restraints: Significant restraints include the complex interoperability issues arising from integrating equipment from multiple vendors across disparate network segments (LAN, WAN, Data Center, and Cloud). The initial investment barrier for high-end networking solutions, particularly 400G switches and advanced security platforms, remains prohibitive for many small and mid-sized enterprises (SMEs). Moreover, the global supply chain volatility, which has sporadically affected the availability of semiconductor components, introduces uncertainty and delays in network deployment schedules. A crucial operational restraint is the ongoing shortage of specialized network security and software-defined networking expertise, forcing many organizations to rely heavily on managed service providers, which adds to operational costs over time.

Opportunities: Major growth opportunities lie in the deployment of campus-wide and industrial 5G private networks, providing enterprises with dedicated, high-performance wireless connectivity tailored to latency-sensitive operational technology (OT) requirements. The emerging Secure Access Service Edge (SASE) model, which converges network security functions (like ZTNA, Firewall as a Service, and SWG) with WAN capabilities (SD-WAN) into a unified cloud-delivered service, represents a significant greenfield opportunity. Furthermore, the burgeoning demand for Network as a Service (NaaS) models allows vendors to shift toward recurring revenue models while providing customers with financial flexibility and simplified operations, effectively bypassing the traditional high CapEx restraints and making advanced networking features more accessible.

Segmentation Analysis

The Enterprise Network Equipment Market is systematically segmented based on Component (Hardware, Software, and Services), End-User Industry, and Enterprise Size, reflecting the diverse requirements across the commercial landscape. The component segmentation reveals a clear trend toward software and services growth, outpacing traditional hardware revenue, largely driven by the adoption of subscription-based SD-WAN controllers, cloud-managed network platforms, and ongoing managed service contracts that handle complex security and compliance tasks. Industry vertical analysis highlights the unique demands placed on network reliability, security, and scalability by sectors such as finance, IT/telecom, and healthcare, which are typically early adopters of 400G infrastructure and Zero Trust architectures. Geographically, the segmentation confirms regional disparities in technological maturity and investment priorities, with North America focusing on optimization and APAC prioritizing foundational connectivity expansion.

The enterprise size segmentation—Small and Medium Enterprises (SMEs) versus Large Enterprises—demonstrates divergent purchasing behaviors and technology preferences. Large enterprises drive the demand for high-capacity, proprietary, and highly customizable equipment, focusing on multi-vendor interoperability and advanced features like high-speed data center switches and private cloud interconnection tools. Conversely, SMEs show a strong preference for simplified, unified, and cost-effective solutions, particularly those offered through Cloud-Managed Networking (CMN) services. This allows smaller firms to access enterprise-grade performance and security without the complexity and expense of maintaining specialized IT teams. This dual market strategy is crucial for vendors, requiring them to offer both modular, high-performance solutions for the top-tier market and consumption-based, easy-to-deploy platforms for the high-volume SME segment.

Further granularity in the segmentation by Product Type (e.g., Switches, Routers, WLAN, Security Devices) shows distinct growth patterns. The Switch segment is being dominated by high-density 100G/400G data center switches, while the WLAN segment is focused on Wi-Fi 6E adoption to leverage the 6 GHz band for high-capacity internal communications. Security Devices, specifically Next-Generation Firewalls (NGFWs) and SASE elements, represent one of the fastest-growing sub-segments due to the persistent and escalating global cyber threat landscape, coupled with the need to secure increasingly distributed access points resulting from remote work policies. The services segment, encompassing consulting, integration, and training, is essential for translating advanced technologies into functional, optimized network infrastructure, underscoring the vital role of channel partners and system integrators.

- By Component

- Hardware (Routers, Switches, WLAN Equipment, Security Appliances, Cabling Infrastructure)

- Software (Network Management Systems, SD-WAN Controllers, Operating Systems, Monitoring Tools)

- Services (Managed Services, Professional Services, Maintenance and Support)

- By Product Type

- Switches (Access, Distribution, Core, Data Center Switches - 10G, 25G, 100G, 400G)

- Routers (Core Routers, Edge Routers, SD-WAN Appliances)

- WLAN (Access Points - Wi-Fi 5, Wi-Fi 6, Wi-Fi 6E; Controllers)

- Network Security Appliances (Firewalls, IDS/IPS, VPN Gateways)

- By Enterprise Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By End-User Industry

- IT & Telecommunications

- Banking, Financial Services, and Insurance (BFSI)

- Government and Public Sector

- Healthcare

- Manufacturing

- Retail and Consumer Goods

- Education

Value Chain Analysis For Enterprise Network Equipment Market

The value chain for enterprise network equipment begins with the Upstream segment, dominated by semiconductor manufacturers, component suppliers (e.g., specialized ASIC/FPGA providers, memory suppliers), and software developers who create the fundamental operating systems and virtualization technologies. This stage is characterized by high capital investment in R&D and manufacturing capacity, particularly for advanced chipsets that dictate the performance (e.g., throughput, power efficiency) of the final networking product. Major equipment vendors (Tier 1 OEMs) integrate these components, focusing on proprietary hardware design, firmware development, and rigorous testing. Strategic sourcing and inventory management capabilities within the upstream section are critical determinants of the final product cost and delivery timelines, especially given recent global supply chain disruptions.

The Midstream component involves the manufacturing, assembly, and distribution channels. Major vendors utilize highly automated manufacturing processes, often leveraging contract manufacturers (ODMs) to produce core routers, switches, and security devices at scale. Distribution channels are complex and highly differentiated, involving both direct sales forces for large, strategic enterprise accounts and an extensive network of indirect channels. The indirect channel ecosystem includes value-added resellers (VARs), system integrators (SIs), and specialized distributors. These partners provide localization, pre-sales consulting, custom configuration, and post-sales support, playing a vital role in integrating sophisticated equipment into heterogeneous customer environments and addressing specific compliance requirements across regions.

The Downstream segment focuses on the deployment, operation, and maintenance of the equipment at the end-user site. This stage involves professional services for installation and configuration, as well as ongoing managed services (NaaS) provided either by the OEM, the VAR, or specialized Managed Service Providers (MSPs). The trend is shifting toward cloud-delivered and consumption-based networking services, meaning the long-term value in the downstream segment is increasingly derived from recurring software licenses, network security subscriptions, and maintenance contracts rather than one-time hardware sales. Effective downstream support and service delivery are paramount for customer retention and determining the overall longevity and satisfaction associated with the networking infrastructure investment.

Enterprise Network Equipment Market Potential Customers

Potential customers for enterprise network equipment are any organization requiring reliable, secure, and scalable digital infrastructure to support their operations, ranging from government agencies managing vast public data to global corporations facilitating complex transactions. The primary driver for these buyers is the need for operational resilience, enhanced data security, and seamless connectivity to support digital transformation goals, encompassing cloud migration, the adoption of IoT devices, and the facilitation of hybrid work environments. Large enterprises (Fortune 500 companies) are consistent, high-volume purchasers, focusing on data center switching, high-performance edge routing, and comprehensive Zero Trust security stacks, demanding solutions capable of 400G speeds and deep integration with hyperscale cloud providers.

The financial services sector, including banks, insurance companies, and trading firms, represents a crucial segment characterized by extremely high demands for low latency and transactional security. Their investment focus is on high-frequency trading networks, robust disaster recovery infrastructure, and compliance-driven encryption capabilities embedded within networking gear. Simultaneously, the IT and Telecommunications sectors are continuous buyers, updating their core infrastructure to support new services like 5G and enhanced broadband offerings, necessitating massive investments in core routers and carrier-grade Ethernet switches capable of handling multi-terabit capacity, thereby acting as major anchors for market growth.

Furthermore, Small and Medium Enterprises (SMEs), while having lower individual purchase power, represent a vast and growing customer base. These organizations are increasingly adopting network equipment delivered via an 'as-a-Service' model, prioritizing ease of deployment, centralized cloud management, and bundled security features to minimize IT overhead. Educational institutions and healthcare providers are also strong potential customers, with the former requiring high-density WLAN for large student populations and the latter prioritizing resilient, segregated networks to handle sensitive patient data (EHR) and support specialized medical IoT devices. These diverse requirements ensure a constantly expanding and evolving potential customer base across nearly every economic sector globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $55.0 Billion USD |

| Market Forecast in 2033 | $90.5 Billion USD |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cisco Systems, Inc., Huawei Technologies Co., Ltd., Arista Networks, Inc., Juniper Networks, Hewlett Packard Enterprise (HPE) - Aruba Networks, Extreme Networks, Inc., Nokia Corporation, Ericsson AB, Dell Technologies, ZTE Corporation, Fortinet, Inc., Palo Alto Networks, Inc., Broadcom Inc., ADTRAN, Inc., Allied Telesis, Inc., NETGEAR, Inc., Ruckus Networks (CommScope), TP-Link Technologies Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Enterprise Network Equipment Market Key Technology Landscape

The technological landscape of the Enterprise Network Equipment Market is rapidly being redefined by several foundational shifts aimed at increasing agility, capacity, and security. Software-Defined Networking (SDN) and its practical application in Wide Area Networks (SD-WAN) remain foundational, allowing enterprises to decouple network control and forwarding functions. This facilitates centralized management, enables dynamic path selection based on application requirements, and drastically improves overall network visibility and operational efficiency compared to rigid, hardware-centric approaches. The integration of 5G connectivity is also emerging as a pivotal technology, especially for fixed wireless access and the potential deployment of private enterprise 5G networks, offering unprecedented bandwidth and ultra-low latency necessary for sophisticated Industrial IoT and real-time operational technology (OT) applications.

Furthermore, security convergence is driving technology adoption, specifically through the Secure Access Service Edge (SASE) framework. SASE platforms integrate networking components (like SD-WAN) with critical security functions (such as Zero Trust Network Access (ZTNA), Cloud Access Security Broker (CASB), and Firewall as a Service (FWaaS)) into a single, cloud-native architecture. This architectural shift is essential for securing the modern perimeter-less enterprise and hybrid workforce. ZTNA is replacing traditional VPNs as the preferred secure access method, ensuring that access is granted based on continuous verification of user identity and device posture, regardless of location, thus significantly reducing the attack surface by enforcing least-privilege principles.

In the physical infrastructure domain, the shift to higher speed Ethernet standards is relentless, driven by demanding data center workloads and AI/ML processing requirements. The adoption of 100G, 200G, and increasingly 400G switches is becoming mainstream in large enterprise data centers to handle East-West traffic proliferation. Concurrently, the proliferation of Wi-Fi 6 and the newer Wi-Fi 6E standards provides substantial upgrades to wireless capacity and reliability within campus environments, leveraging the 6 GHz band to mitigate congestion and support dense device deployment. Vendor focus is heavily invested in AIOps tools, using AI/ML to automate network performance monitoring, configuration, and proactive anomaly detection, moving the industry toward truly autonomous network management systems capable of self-optimization and self-healing capabilities.

Regional Highlights

Regional dynamics play a crucial role in shaping demand and technology adoption within the Enterprise Network Equipment Market. North America holds the largest market share globally, largely due to high IT spending, the presence of major technology hubs, and the early, aggressive adoption of cutting-edge technologies like SD-WAN, SASE, and 400G data center switches. Enterprises in this region frequently embark on ambitious digital transformation projects, characterized by deep integration of cloud services (multi-cloud and hybrid environments) and robust regulatory compliance requiring continuous investment in advanced network security infrastructure. This region's maturity translates into a high demand for advanced managed services and AIOps solutions to optimize complex, distributed networks.

The Asia Pacific (APAC) region is projected to register the fastest growth rate during the forecast period. This accelerated growth is primarily attributed to large-scale infrastructure development projects, rapid digitalization across industries (especially banking, manufacturing, and retail), and massive government initiatives to establish smart cities and expand internet connectivity penetration across diverse geographical areas. Countries like China, India, and Japan are investing heavily in both 5G infrastructure and enterprise-grade networking gear to support expanding manufacturing bases and burgeoning e-commerce markets. The demand in APAC is dual-pronged: a need for basic, reliable connectivity in emerging markets and demand for state-of-the-art 100G/400G technology in developed economies like Singapore and South Korea to support dense data center ecosystems.

Europe represents a stable and mature market driven by stringent regulatory environments (such as GDPR) that necessitate significant investment in network resilience and localized data management solutions. European enterprises prioritize vendor security certification and adherence to data sovereignty principles, which influences purchasing decisions toward robust, audited network equipment and associated services. The focus in Europe is often on updating aging infrastructure in line with green IT initiatives, seeking energy-efficient switches and power-optimized data center equipment. Latin America and the Middle East & Africa (MEA) are emerging regions showing substantial growth, fueled by rising foreign direct investment, expanding digital economies, and increased focus on securing critical national infrastructure, leading to consistent demand for foundational enterprise switches, routers, and essential security appliances.

- North America: Market leader; early and extensive adoption of SASE and SD-WAN; high investment in data center modernization (400G); dominant focus on hybrid cloud networking and security optimization.

- Asia Pacific (APAC): Fastest-growing region; driven by large-scale digitalization, 5G rollout, and infrastructure expansion in emerging economies (India, Southeast Asia); strong emphasis on networking for manufacturing and urbanization projects.

- Europe: Mature market; driven by strict regulatory requirements (GDPR); high demand for energy-efficient networking gear and certified security solutions; growing reliance on local managed service providers.

- Latin America (LATAM): Steady growth fueled by expanding digital services and cloud adoption; increasing need for secure connectivity in financial services and government sectors.

- Middle East and Africa (MEA): Emerging market focused on building foundational digital infrastructure; increasing investments in smart city projects and essential network security appliances.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Enterprise Network Equipment Market.- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Arista Networks, Inc.

- Juniper Networks

- Hewlett Packard Enterprise (HPE) - Aruba Networks

- Extreme Networks, Inc.

- Fortinet, Inc.

- Palo Alto Networks, Inc.

- Dell Technologies

- Nokia Corporation

- Ericsson AB

- ZTE Corporation

- Broadcom Inc.

- CommScope (Ruckus Networks)

- ADTRAN, Inc.

- Ciena Corporation

- H3C Technologies Co., Limited

- F5 Networks, Inc.

- Check Point Software Technologies Ltd.

- Alcatel-Lucent Enterprise (Nokia)

Frequently Asked Questions

Analyze common user questions about the Enterprise Network Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for current enterprise network equipment refresh cycles?

The primary driver is the need to support high-density traffic from hybrid workforces and multi-cloud architectures. Enterprises must upgrade to Wi-Fi 6/6E, SD-WAN, and 100G/400G data center switches to ensure adequate bandwidth, security, and low latency for mission-critical, cloud-hosted applications.

How is Software-Defined Wide Area Networking (SD-WAN) impacting traditional routing equipment?

SD-WAN is transitioning the market from hardware-centric routing to centralized, software-driven traffic management. It allows organizations to use cheaper internet connections while prioritizing applications and enhancing security, reducing reliance on expensive, proprietary MPLS circuits and complex legacy router configurations.

What role does the Secure Access Service Edge (SASE) model play in enterprise networking?

SASE integrates core networking functions (SD-WAN) with essential security capabilities (ZTNA, FWaaS) into a unified, cloud-delivered service. SASE simplifies management, improves security posture for distributed users, and reduces operational complexity by converging disparate network and security stacks.

Which technology segment is expected to show the highest growth in the next five years?

The Network Security Appliances and Services segments, particularly those related to Zero Trust Network Access (ZTNA) and Cloud-Managed Networking (CMN)/AIOps, are projected to show the highest growth. This growth is fueled by escalating cyber threats and the demand for autonomous, secure, and simplified network operations.

What are the main differences in networking needs between large enterprises and SMEs?

Large enterprises demand customized, high-capacity 400G switches and extensive multi-vendor interoperability. SMEs prioritize simplified, consumption-based networking solutions, preferring cloud-managed Wi-Fi and SD-WAN services to minimize CapEx and operational IT complexity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager