Enterprise Risk Management Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439821 | Date : Jan, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Enterprise Risk Management Market Size

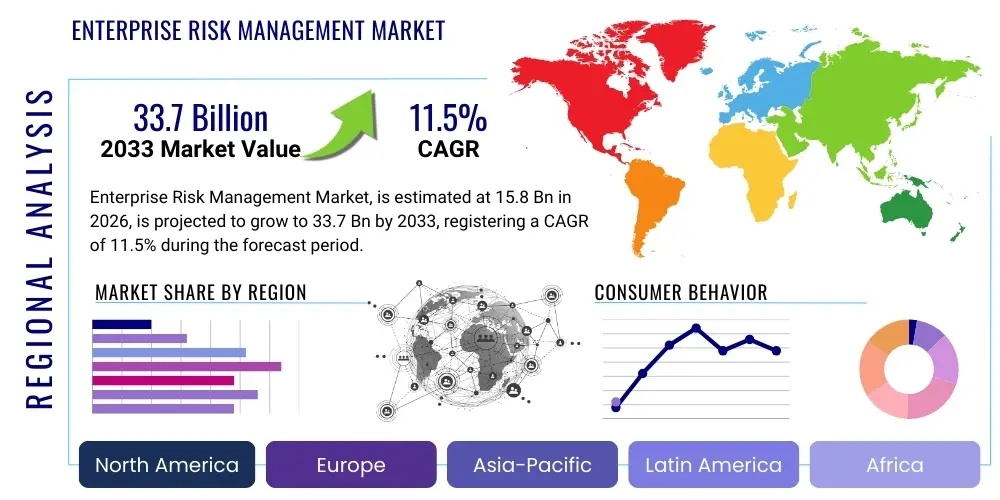

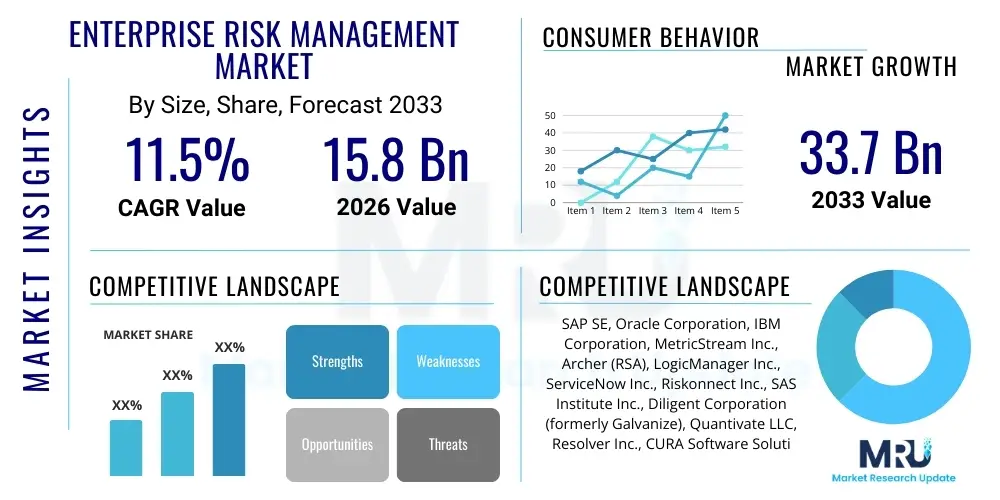

The Enterprise Risk Management Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 15.8 billion in 2026 and is projected to reach USD 33.7 billion by the end of the forecast period in 2033.

Enterprise Risk Management Market introduction

The Enterprise Risk Management (ERM) market encompasses a comprehensive suite of solutions and services designed to identify, assess, mitigate, and monitor risks across an organization's operations, strategy, finances, and compliance. ERM systems provide a holistic framework that integrates risk management activities into strategic planning and daily business processes, moving beyond traditional siloed approaches to risk. This integrated perspective allows organizations to understand the interconnectedness of various risks, facilitating proactive decision-making and enhancing resilience in a volatile business landscape. The core offering typically includes software platforms, consulting services, and implementation support that enable enterprises to standardize risk assessment methodologies, centralize risk data, and automate reporting processes.

Major applications of ERM span across virtually all industry verticals, including banking, financial services, and insurance (BFSI), healthcare, manufacturing, retail, IT & telecommunications, and government sectors. Organizations leverage ERM solutions to address a wide array of challenges, from financial and operational risks to strategic, reputational, and compliance-related threats. The inherent benefits of implementing a robust ERM framework are manifold: improved strategic planning through better risk intelligence, enhanced regulatory compliance, optimized resource allocation, reduction in potential losses, and ultimately, increased stakeholder confidence. ERM empowers businesses to navigate uncertainty, seize opportunities with calculated risks, and protect their long-term value.

Driving factors propelling the growth of the Enterprise Risk Management market include the increasing complexity of global business environments, a rapidly evolving regulatory landscape that demands greater accountability and transparency, and the proliferation of sophisticated cyber threats. Furthermore, the digital transformation initiatives undertaken by enterprises worldwide necessitate advanced risk management capabilities to address new digital risks. The growing awareness among C-suite executives regarding the strategic importance of risk management in achieving organizational objectives and maintaining competitive advantage also significantly contributes to market expansion. The shift towards integrated governance, risk, and compliance (GRC) solutions further underpins the demand for comprehensive ERM frameworks.

Enterprise Risk Management Market Executive Summary

The Enterprise Risk Management (ERM) market is experiencing significant growth, driven by a confluence of evolving business trends and an increasingly complex global operating environment. Key business trends include the accelerated pace of digital transformation, which introduces new layers of technological and cybersecurity risks, necessitating more sophisticated risk identification and mitigation strategies. The increasing focus on Environmental, Social, and Governance (ESG) factors is also compelling organizations to integrate sustainability risks into their ERM frameworks, moving beyond traditional financial and operational concerns. Furthermore, the rise of hybrid work models and a globally distributed workforce has expanded the attack surface for cyber threats and introduced new operational complexities, making comprehensive risk oversight critical. Organizations are increasingly seeking integrated solutions that can provide a real-time, consolidated view of risks across all functions and geographies, moving away from disparate, siloed systems.

Regional trends indicate robust adoption rates in developed economies such as North America and Europe, primarily driven by stringent regulatory mandates, a high degree of digital maturity, and a mature understanding of risk management's strategic value. These regions are characterized by early adoption of advanced ERM technologies, including AI and machine learning. Conversely, the Asia Pacific region is emerging as a high-growth market, propelled by rapid economic expansion, increasing foreign investments, and a growing awareness of risk management best practices among local enterprises. Governments and regulatory bodies in APAC are also tightening compliance requirements, further fueling demand. Latin America and the Middle East & Africa regions are also witnessing gradual adoption, primarily influenced by infrastructure development projects, increasing regulatory pressures, and a desire to align with global standards of corporate governance.

In terms of segmentation trends, the software component segment continues to dominate, with a growing preference for cloud-based ERM solutions due to their scalability, flexibility, and cost-effectiveness. The demand for integrated ERM platforms that offer a unified approach to governance, risk, and compliance (GRC) is also on the rise, as organizations seek to streamline processes and reduce operational overheads. Services, particularly consulting and implementation, form a crucial part of the market, as enterprises require expert guidance to effectively deploy and optimize ERM systems. From an industry vertical perspective, the BFSI sector remains the largest consumer of ERM solutions due to its highly regulated nature and inherent exposure to complex financial and operational risks. However, other sectors such as healthcare, manufacturing, and IT & telecommunications are exhibiting substantial growth, driven by data privacy concerns, supply chain disruptions, and intellectual property protection requirements, respectively. The market is also seeing increasing adoption among Small and Medium-sized Enterprises (SMEs) as they become more aware of the benefits of proactive risk management and as more accessible, tailored solutions become available.

AI Impact Analysis on Enterprise Risk Management Market

Users frequently inquire about how Artificial Intelligence (AI) can transform and enhance traditional Enterprise Risk Management practices. Common questions revolve around AI's capability to automate risk identification, improve predictive accuracy, and provide real-time insights into emerging threats. There's significant interest in AI's role in processing vast amounts of unstructured data from diverse sources to detect anomalies and patterns that human analysts might miss, thereby offering a more comprehensive and proactive approach to risk. Concerns often include the ethical implications of AI, the potential for algorithmic bias in risk assessment, the need for transparent AI models, and the necessary human oversight to ensure accountability. Users also want to understand the practical applications, such as AI-driven fraud detection, compliance monitoring, and stress testing, as well as the challenges associated with integrating AI into existing ERM frameworks, including data quality requirements and the scarcity of skilled AI professionals.

The integration of AI and Machine Learning (ML) is fundamentally reshaping the Enterprise Risk Management landscape, moving it from a reactive function to a more predictive and proactive discipline. AI algorithms can analyze historical data, market trends, geopolitical events, and even social media sentiment to identify nascent risks and forecast their potential impact with greater accuracy than traditional methods. This capability is particularly valuable in dynamic environments where risks evolve rapidly. Furthermore, AI tools can automate repetitive tasks such as data aggregation, risk classification, and report generation, freeing up risk professionals to focus on strategic analysis and mitigation planning. The ability of AI to process and interpret vast datasets, including unstructured information from news feeds, regulatory updates, and internal communications, allows for a more granular and holistic understanding of an organization's risk exposure.

However, the widespread adoption of AI in ERM is not without its challenges. The quality and volume of data are paramount for training effective AI models; poor data inputs can lead to inaccurate risk assessments and potentially biased outcomes. Ensuring the explainability and transparency of AI models, often referred to as "black box" issues, is critical for gaining trust and meeting regulatory requirements, especially in highly regulated sectors like financial services. Organizations must also address the ethical implications of using AI in risk management, particularly concerning privacy and fairness. Despite these hurdles, the consensus among users and industry experts is that AI will become an indispensable component of future ERM strategies, enabling organizations to build more resilient and adaptive risk management programs that can effectively navigate an increasingly complex and interconnected world.

- Enhanced Predictive Analytics: AI/ML models analyze historical and real-time data to forecast potential risks, improving the accuracy of risk assessments.

- Automated Risk Identification: AI algorithms scan vast datasets, including unstructured text, to identify emerging risks, anomalies, and patterns far quicker than human analysis.

- Real-time Monitoring: AI-powered systems continuously monitor operational activities, financial transactions, and external events for indicators of risk, enabling immediate alerts.

- Improved Compliance: AI assists in monitoring regulatory changes and ensuring adherence to policies, reducing manual effort and potential for non-compliance.

- Optimized Resource Allocation: Predictive insights from AI help organizations prioritize and allocate resources more effectively to mitigate the most impactful risks.

- Fraud Detection: AI excels at identifying subtle patterns indicative of fraudulent activities that may evade traditional rule-based systems.

- Sentiment Analysis: AI processes public and internal sentiment from various sources to gauge reputational risks and stakeholder perception.

- Stress Testing and Scenario Analysis: AI can simulate complex scenarios and model the impact of various risk factors on organizational performance.

- Reduced Human Error: Automation of data collection and initial analysis minimizes human intervention, leading to more consistent and objective risk evaluations.

- Personalized Risk Profiles: AI can tailor risk assessments to specific business units, projects, or even individual roles based on their unique risk exposure and activities.

DRO & Impact Forces Of Enterprise Risk Management Market

The Enterprise Risk Management market is shaped by a dynamic interplay of drivers, restraints, and opportunities, alongside significant impact forces. Key drivers include the ever-increasing complexity of the global business environment, marked by rapid technological advancements, geopolitical uncertainties, and evolving market dynamics. The proliferation of stringent regulatory frameworks and compliance mandates across various industries, such as GDPR, CCPA, and industry-specific regulations, is a significant catalyst, compelling organizations to adopt robust ERM solutions to avoid hefty penalties and reputational damage. Furthermore, the escalating frequency and sophistication of cyber threats necessitate advanced risk management capabilities to protect critical assets and data. The growing recognition among corporate boards and C-suite executives of ERM's strategic value in enhancing organizational resilience, improving decision-making, and protecting shareholder value also fuels market demand. Finally, the digital transformation initiatives, including cloud adoption and IoT integration, introduce new types of risks that can only be effectively managed through integrated ERM platforms.

Despite the strong growth drivers, the ERM market faces several notable restraints. High initial implementation costs and the complexities associated with integrating ERM solutions with existing legacy systems can deter potential adopters, especially Small and Medium-sized Enterprises (SMEs) with limited budgets. The scarcity of skilled professionals with expertise in both risk management and the technological aspects of ERM platforms poses a significant challenge, impacting effective deployment and utilization. Concerns regarding data privacy, security, and the accuracy of risk data inputs also act as restraints, as organizations are hesitant to centralize sensitive information without robust safeguards. Moreover, organizational resistance to change and a lack of a strong risk-aware culture can hinder the successful adoption and integration of ERM frameworks, as it often requires significant shifts in internal processes and mindsets. The perception that ERM is a cost center rather than a value generator can also limit investment.

Opportunities within the ERM market are abundant and primarily driven by technological innovation and evolving business needs. The integration of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and blockchain into ERM solutions presents significant avenues for growth, enabling more predictive analytics, automated risk assessment, and enhanced data security. The growing convergence of Governance, Risk, and Compliance (GRC) platforms offers opportunities for vendors to provide integrated, holistic solutions that streamline operations and reduce redundancy. Furthermore, the increasing adoption of cloud-based ERM solutions, particularly among SMEs, presents a scalable and cost-effective deployment model. The demand for specialized ERM solutions catering to emerging risks like ESG (Environmental, Social, and Governance) factors, supply chain vulnerabilities, and geopolitical instability also represents a fertile ground for innovation and market expansion. Expanding into emerging economies with growing regulatory maturity and digital transformation efforts offers further growth prospects.

The impact forces influencing the ERM market are multifaceted. Regulatory bodies globally are continuously updating compliance requirements, pushing organizations towards more stringent risk management practices. Technological advancements, particularly in data analytics, AI, and cloud computing, are rapidly transforming the capabilities of ERM solutions, creating a competitive landscape where innovation is key. Global economic conditions, including inflation, recessions, and market volatility, directly impact an organization's risk profile and their urgency to implement effective ERM strategies. Geopolitical stability or instability can introduce new levels of operational, strategic, and financial risks, forcing enterprises to re-evaluate their risk management frameworks. Finally, the ever-present threat of sophisticated cybersecurity attacks necessitates continuous evolution of ERM solutions to protect against evolving digital risks. These forces collectively shape the trajectory and demand within the Enterprise Risk Management market.

Segmentation Analysis

The Enterprise Risk Management (ERM) market is extensively segmented to reflect the diverse needs and operational structures of organizations across various industries. This segmentation allows for a granular understanding of market dynamics, identifying specific growth opportunities and challenges within each category. The market can be broadly segmented based on components, deployment models, organization size, and industry verticals, each addressing distinct facets of the risk management landscape. Understanding these segments is crucial for solution providers to tailor their offerings and for organizations to select the most appropriate ERM tools and services that align with their specific risk profiles and strategic objectives.

- By Component:

- Software

- Standalone Software

- Integrated Software (part of GRC platforms)

- Risk Analytics Software

- Compliance Software

- Audit Management Software

- Policy Management Software

- Services

- Consulting Services

- Implementation & Integration Services

- Support & Maintenance Services

- Training & Education Services

- Managed Risk Services

- Software

- By Deployment:

- On-Premises

- Cloud-Based

- Public Cloud

- Private Cloud

- Hybrid Cloud

- By Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Life Sciences

- IT & Telecommunications

- Manufacturing

- Retail and Consumer Goods

- Government and Public Sector

- Energy and Utilities

- Transportation and Logistics

- Media and Entertainment

- Education

- Others (e.g., Real Estate, Professional Services)

Value Chain Analysis For Enterprise Risk Management Market

The value chain for the Enterprise Risk Management (ERM) market is a complex ecosystem involving various stages, from software development and service provision to distribution and end-user adoption. At the upstream stage, the primary participants are technology providers and independent software vendors (ISVs) who focus on research and development to create sophisticated ERM software platforms, modules, and analytical tools. This involves developing core functionalities such as risk assessment engines, compliance management systems, audit management tools, and reporting dashboards. Key activities include software engineering, data science for predictive analytics and AI integration, cybersecurity development for platform protection, and intellectual property management. These upstream players invest heavily in innovation to incorporate emerging technologies like AI, machine learning, blockchain, and cloud computing, ensuring their solutions remain cutting-edge and address evolving risk landscapes. Their ability to deliver robust, scalable, and secure platforms forms the foundation of the entire ERM value chain.

Moving downstream, the value chain encompasses various intermediaries responsible for the delivery, customization, and support of ERM solutions to end-users. This segment includes system integrators, IT consulting firms, and specialized risk management consultants. These entities play a crucial role in adapting generic ERM software to an organization's unique requirements, integrating it with existing IT infrastructure, and ensuring seamless deployment. They often provide expert advisory services, helping clients define their risk appetite, develop risk policies, conduct risk assessments, and establish governance frameworks. The distribution channel involves both direct sales by software vendors, particularly to large enterprises, and indirect channels through value-added resellers (VARs), managed service providers (MSPs), and channel partners. These indirect channels help expand market reach, especially to Small and Medium-sized Enterprises (SMEs) that may prefer packaged solutions or require localized support. The effectiveness of these downstream activities directly impacts customer satisfaction and the overall success of ERM implementations.

The direct distribution channel often involves the ERM software vendor directly engaging with potential clients, offering tailored demonstrations, complex negotiations, and post-sales support through dedicated account managers. This approach is common for large-scale enterprise deployments where custom solutions and deep vendor expertise are required. In contrast, the indirect distribution channel leverages partners to reach a broader customer base, particularly in regional markets or for specialized industry verticals. These partners may bundle ERM software with other services, provide local support, and offer a more personalized sales experience. Effective collaboration between upstream technology providers and downstream service/distribution partners is essential for maximizing market penetration and ensuring that ERM solutions are not only technologically advanced but also properly implemented, supported, and aligned with client needs. The entire value chain is driven by the end-user's demand for comprehensive, efficient, and integrated risk management capabilities to navigate an increasingly complex and uncertain business environment.

Enterprise Risk Management Market Potential Customers

The Enterprise Risk Management (ERM) market caters to a broad spectrum of potential customers, essentially encompassing any organization seeking to proactively manage its risks and enhance strategic decision-making. At the highest level, the primary buyers of ERM solutions are C-suite executives, including Chief Risk Officers (CROs), Chief Financial Officers (CFOs), Chief Information Security Officers (CISOs), and Chief Executive Officers (CEOs), who are ultimately responsible for the organization's resilience, compliance, and long-term value creation. These leaders are driven by the need to meet regulatory obligations, protect corporate reputation, optimize capital allocation, and ensure business continuity amidst growing uncertainties. They seek integrated platforms that provide a holistic view of risks across the enterprise, enabling them to make informed strategic decisions and communicate risk posture effectively to boards and stakeholders. Their decision-making often involves evaluating the return on investment (ROI) of ERM solutions in terms of loss prevention, operational efficiency, and competitive advantage.

Beyond the executive level, other key end-users and buyers include departmental heads and managers within risk management, compliance, audit, IT security, and operational departments. Risk Managers and Analysts are direct users of ERM software, leveraging its capabilities for daily risk identification, assessment, monitoring, and reporting. Compliance Officers utilize ERM tools to track regulatory changes, ensure policy adherence, and manage compliance audits. Internal Auditors rely on ERM systems to plan and execute audits, identify control weaknesses, and ensure the effectiveness of risk mitigation strategies. IT Security Teams integrate ERM with their security operations to manage cyber risks, assess vulnerabilities, and respond to security incidents. These functional users require intuitive interfaces, robust analytical capabilities, and customizable reporting features to perform their specialized tasks efficiently and effectively, contributing to the overall risk maturity of the organization.

From an industry perspective, potential customers span across virtually all sectors. The Banking, Financial Services, and Insurance (BFSI) industry represents a cornerstone segment due to its highly regulated nature and inherent exposure to complex financial, market, operational, and credit risks. Healthcare organizations are increasingly investing in ERM to manage patient data privacy (e.g., HIPAA compliance), operational risks, and regulatory adherence. Manufacturing firms utilize ERM to mitigate supply chain disruptions, operational inefficiencies, and quality control issues. The IT & Telecommunications sector requires ERM to address cybersecurity threats, data breaches, and service continuity. Government agencies, retail companies managing reputational and operational risks, and energy & utilities facing environmental and regulatory challenges are also significant adopters. Furthermore, the burgeoning Small and Medium-sized Enterprises (SMEs) market represents a growing segment of potential customers, as they become more aware of the necessity for structured risk management and as more affordable, scalable cloud-based solutions become available to them. Essentially, any organization aiming to safeguard its assets, uphold its reputation, and achieve its strategic objectives in a predictable manner stands as a potential customer for Enterprise Risk Management solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.8 billion |

| Market Forecast in 2033 | USD 33.7 billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SAP SE, Oracle Corporation, IBM Corporation, MetricStream Inc., Archer (RSA), LogicManager Inc., ServiceNow Inc., Riskonnect Inc., SAS Institute Inc., Diligent Corporation (formerly Galvanize), Quantivate LLC, Resolver Inc., CURA Software Solutions, Camms, BWise (Navex Global), LockPath (now part of ProcessUnity), ProcessUnity Inc., Sword GRC, Protecht Group, Riskwatch International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Enterprise Risk Management Market Key Technology Landscape

The Enterprise Risk Management (ERM) market is undergoing a significant technological transformation, driven by advancements that enable more sophisticated, predictive, and integrated risk management capabilities. At the forefront are Artificial Intelligence (AI) and Machine Learning (ML) technologies, which are revolutionizing how risks are identified, assessed, and monitored. AI-powered algorithms can process vast quantities of structured and unstructured data, including text, speech, and images, to detect subtle anomalies, forecast potential risks, and identify complex patterns that traditional rule-based systems might miss. Machine learning models enable systems to learn from historical data and continuously improve their accuracy in predicting future risk events, thereby providing more proactive intelligence to risk managers. These technologies are crucial for tasks such as real-time fraud detection, compliance monitoring, predictive analytics for market and credit risk, and automated threat intelligence analysis, moving ERM beyond reactive reporting.

Cloud computing stands as another foundational technology enabling the expansion and efficiency of the ERM market. Cloud-based ERM solutions offer unparalleled scalability, flexibility, and accessibility, allowing organizations of all sizes to deploy and manage risk systems without significant upfront infrastructure investments. This deployment model facilitates faster implementation, reduces IT overheads, and enables remote access to risk data and dashboards, which is particularly beneficial for distributed workforces. Furthermore, cloud environments foster collaboration and data sharing across different departments and geographies, promoting a unified view of risk. The adoption of public, private, and hybrid cloud models provides organizations with choices that align with their specific security, compliance, and operational requirements, making ERM solutions more adaptable and cost-effective. The "as-a-Service" model (SaaS for ERM) is gaining immense traction, lowering the barrier to entry for many enterprises.

Beyond AI/ML and cloud computing, several other technologies are contributing to the modern ERM landscape. Big data analytics tools are essential for handling and extracting insights from the massive volumes of risk-related data generated internally and externally. These tools provide the infrastructure to store, process, and analyze diverse datasets, supporting AI/ML applications and enabling comprehensive risk reporting. Blockchain technology is emerging as a powerful tool for enhancing data integrity, transparency, and security, particularly in areas like supply chain risk management and financial transaction verification, by creating immutable and distributed ledgers. Robotic Process Automation (RPA) is also being utilized to automate routine, high-volume risk management tasks, such as data entry, reconciliation, and report generation, thereby improving efficiency and reducing human error. The convergence of these technologies within integrated Governance, Risk, and Compliance (GRC) platforms is creating a holistic risk management ecosystem, providing organizations with a robust, real-time, and predictive capability to navigate an increasingly complex and uncertain global business environment. These technological advancements are continuously pushing the boundaries of what is possible in enterprise risk management, driving innovation and shaping the future of the market.

Regional Highlights

- North America: This region holds the largest market share in the Enterprise Risk Management market, driven by stringent regulatory frameworks (e.g., Sarbanes-Oxley Act, Dodd-Frank Act), a mature IT infrastructure, and a high degree of awareness among enterprises regarding the strategic importance of risk management. The presence of numerous key market players and early adoption of advanced technologies like AI and cloud computing further bolster its dominance. Industries such as BFSI, healthcare, and IT are significant contributors to ERM solution adoption.

- Europe: Europe represents a significant market for ERM solutions, primarily influenced by strong regulatory environments like GDPR (General Data Protection Regulation), MiFID II, and various national compliance mandates. The region emphasizes data privacy, corporate governance, and sustainable business practices, leading to a strong demand for integrated GRC and ERM solutions. Countries like the UK, Germany, and France are leading the adoption, with increasing investment in advanced analytics and cloud-based platforms.

- Asia Pacific (APAC): The APAC region is projected to witness the highest growth rate in the ERM market. This surge is attributed to rapid economic development, increasing foreign direct investment, growing awareness of corporate governance, and evolving regulatory landscapes in countries such as China, India, Japan, and Australia. Digital transformation initiatives across various industries and the increasing sophistication of cyber threats are also key drivers for ERM adoption in this region.

- Latin America: This region is an emerging market for Enterprise Risk Management, with gradual but steady adoption rates. Factors such as increasing regulatory compliance requirements, economic liberalization, and a growing recognition of the need for robust risk management in sectors like BFSI and manufacturing are driving demand. Brazil and Mexico are leading the way, with a focus on improving corporate governance and mitigating operational risks.

- Middle East and Africa (MEA): The MEA market for ERM is experiencing growth driven by ambitious infrastructure projects, economic diversification efforts, and increasing regulatory pressure, particularly in the financial and energy sectors. Countries like UAE, Saudi Arabia, and South Africa are investing in ERM solutions to enhance corporate transparency, manage geopolitical risks, and safeguard critical assets as they integrate into the global economy.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Enterprise Risk Management Market.- SAP SE

- Oracle Corporation

- IBM Corporation

- MetricStream Inc.

- Archer (RSA)

- LogicManager Inc.

- ServiceNow Inc.

- Riskonnect Inc.

- SAS Institute Inc.

- Diligent Corporation (formerly Galvanize)

- Quantivate LLC

- Resolver Inc.

- CURA Software Solutions

- Camms

- BWise (Navex Global)

- LockPath (now part of ProcessUnity)

- ProcessUnity Inc.

- Sword GRC

- Protecht Group

- Riskwatch International

Frequently Asked Questions

What is Enterprise Risk Management (ERM)?

Enterprise Risk Management (ERM) is a strategic process that organizations use to identify, assess, manage, and monitor risks across all business functions and processes. It provides a holistic framework for understanding how different risks are interconnected and impact organizational objectives, enabling proactive decision-making and enhancing overall resilience. ERM aims to minimize negative impacts while capitalizing on opportunities.

What are the primary benefits of implementing an ERM framework?

Implementing an ERM framework offers numerous benefits, including improved strategic planning through better risk intelligence, enhanced regulatory compliance, optimized resource allocation, and a reduction in potential financial losses. It also fosters a strong risk-aware culture, improves operational efficiency, and strengthens stakeholder confidence by demonstrating a commitment to robust governance and accountability. ERM enables organizations to adapt more effectively to changes in the business environment.

How is Artificial Intelligence (AI) impacting the Enterprise Risk Management market?

AI is profoundly impacting ERM by enabling more predictive, automated, and real-time risk management. AI/ML algorithms analyze vast datasets to identify emerging risks, forecast potential impacts with greater accuracy, and automate routine tasks like data aggregation and reporting. This enhances fraud detection, improves compliance monitoring, and allows risk professionals to focus on strategic analysis, moving ERM from a reactive to a proactive discipline, though requiring careful management of data quality and bias.

What are the key challenges in adopting Enterprise Risk Management solutions?

Key challenges in ERM adoption include high initial implementation costs and the complexities of integrating new solutions with existing legacy IT systems. Organizations often face a scarcity of skilled professionals with expertise in both risk management and ERM technology. Other significant hurdles include data privacy concerns, the need for robust data quality, organizational resistance to change, and developing a strong risk-aware culture across all levels of the enterprise. Addressing these requires strategic planning and executive buy-in.

What are the future trends shaping the Enterprise Risk Management market?

Future trends in the ERM market are characterized by greater integration of advanced technologies, an expanding scope of risk, and a focus on resilience. Key trends include the widespread adoption of AI and machine learning for predictive analytics, the growth of cloud-based ERM solutions for scalability, and the convergence of GRC platforms for holistic management. There's also an increasing emphasis on managing new risks such as ESG factors, cyber threats, supply chain disruptions, and geopolitical volatility, necessitating more adaptive and comprehensive ERM frameworks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager