Enterprise SSD Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432820 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Enterprise SSD Market Size

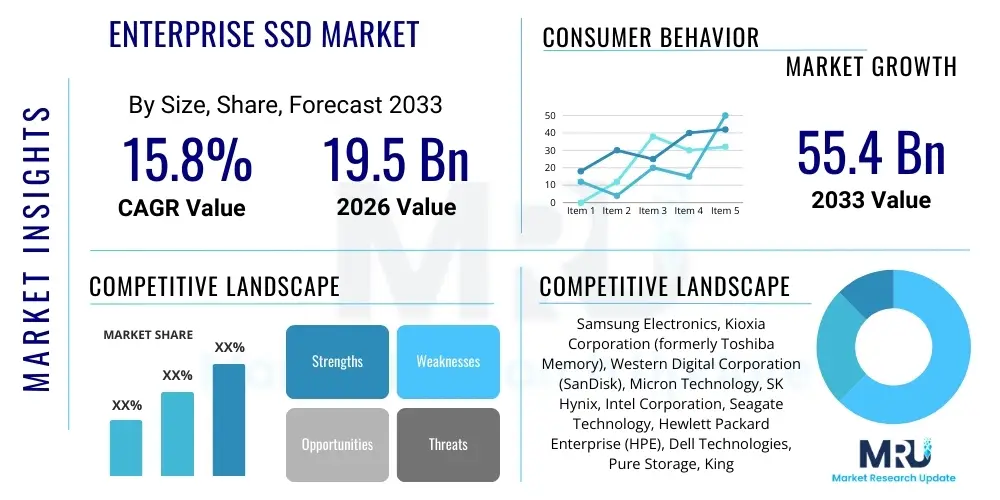

The Enterprise SSD Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 19.5 Billion in 2026 and is projected to reach USD 55.4 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by the accelerating proliferation of cloud computing infrastructure, the exponential growth in data generation across various sectors, and the urgent need for high-performance, low-latency storage solutions in modern data centers and enterprise environments. The shift from traditional Hard Disk Drives (HDDs) to Solid State Drives (SSDs) is a foundational trend driving this market valuation increase, ensuring enhanced operational efficiency and reduced total cost of ownership (TCO) for large-scale data operations.

Enterprise SSD Market introduction

The Enterprise Solid State Drive (SSD) Market encompasses advanced non-volatile storage devices specifically engineered for mission-critical applications within data centers, cloud infrastructure, and enterprise IT environments. Unlike consumer-grade SSDs, enterprise drives prioritize characteristics such as endurance (measured in Drive Writes Per Day, DWPD), reliability, sustained performance, and sophisticated error correction mechanisms to handle continuous, high-intensity workloads and ensure data integrity over extended periods. Key technologies driving these products include various grades of NAND Flash memory (TLC, QLC), high-speed interconnect standards like NVMe (Non-Volatile Memory Express), and standardized form factors designed for server racks.

Major applications for Enterprise SSDs span a wide range of use cases crucial to modern digital economies, including high-frequency trading (HFT) platforms requiring microsecond latency, large-scale database management systems (OLTP and OLAP), virtualization and containerized environments, and critical data caching layers within distributed computing architectures. The inherent performance benefits of flash memory, such as rapid random read/write speeds and significantly reduced power consumption compared to spinning media, make them indispensable for enterprises seeking to maximize computational throughput and minimize operational expenditures associated with cooling and power. This necessity for speed and efficiency underpins the widespread adoption across technology, finance, and telecommunications sectors.

The principal driving factors include the massive global push toward digital transformation, which necessitates scalable and fast storage resources; the rapid expansion of hyperscale cloud providers demanding massive volumes of high-density storage; and the increasing complexity of modern workloads, such as big data analytics, machine learning training, and real-time processing. The continuous innovation in NAND density, particularly the transition to 3D NAND technology and the refinement of QLC (Quad-Level Cell) flash to improve endurance for enterprise applications, offers compelling capacity and cost-per-gigabyte benefits, further accelerating the displacement of legacy storage solutions within core enterprise infrastructure.

Enterprise SSD Market Executive Summary

The Enterprise SSD Market is characterized by intense technological competition and strategic investments aimed at optimizing storage infrastructure for the cloud and AI era. Key business trends show a decisive shift towards the adoption of NVMe over traditional SATA and SAS interfaces, driven by NVMe’s ability to leverage the full potential of PCIe connectivity, drastically reducing latency and increasing Input/Output Operations Per Second (IOPS). Hyperscale cloud providers, including Amazon Web Services, Microsoft Azure, and Google Cloud, remain the primary consumption engine, driving demand for high-capacity, cost-efficient QLC SSDs for warm and cold storage tiers, while retaining high-endurance TLC drives for mission-critical applications. Furthermore, market consolidation, strategic partnerships between NAND manufacturers and controller developers, and the emphasis on supply chain resilience are crucial business themes impacting pricing and product availability across the forecast period.

Regional trends indicate that North America, heavily populated by global technology giants and hyperscale data centers, maintains the largest market share, serving as the epicenter for NVMe and cutting-edge storage technology deployment. However, the Asia Pacific (APAC) region, particularly China, Japan, and India, is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration in APAC is attributed to rapidly growing digital economies, massive government-backed digital initiatives, and substantial foreign investment in local data center construction, particularly in Southeast Asian hubs. Europe is also showing strong growth, driven by stringent data privacy regulations like GDPR, which necessitate localized, secure, and highly reliable storage infrastructure, fueling demand for specialized enterprise SSDs focusing on security features like encryption and data immutability.

Segment trends reveal that the interface segment is dominated by NVMe, rapidly diminishing the market relevance of SATA and SAS interfaces in high-performance enterprise settings. Capacity-wise, the demand is heavily skewed towards high-capacity drives (4TB to 8TB and above), reflecting the need to maximize density within limited rack space, a critical factor for reducing data center footprints and associated operating costs. The technology segment is witnessing rapid evolution, with TLC NAND still foundational due to its balance of cost and endurance, but QLC is gaining significant traction as manufacturers introduce innovative error correction and wear-leveling algorithms to extend its lifespan sufficiently for read-intensive enterprise workloads. The application segmentation highlights cloud/hyperscale as the dominant revenue generator, followed closely by traditional enterprise data centers and emerging applications in edge computing and 5G network infrastructure.

AI Impact Analysis on Enterprise SSD Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) workloads is fundamentally reshaping the performance requirements and demand structure within the Enterprise SSD Market. Common user inquiries revolve around whether current SSD technology can handle the sheer volume and unpredictable patterns of AI data, specifically asking about latency requirements for real-time inference, the necessary endurance for continuous model training (which involves massive write amplification), and the optimal storage tiering strategy for multi-petabyte AI datasets. Users are keenly interested in how specialized SSDs, such as Computational Storage Drives (CSDs), can accelerate data pre-processing tasks and relieve bottlenecks between the CPU and storage. The overarching concern is ensuring the storage infrastructure can scale linearly with rapidly increasing AI model complexity and data ingestion rates without becoming the primary performance limiter.

AI adoption directly translates into an escalating requirement for ultra-low latency, high-throughput storage devices capable of parallel processing and high IOPS density. Generative AI models, specifically, demand immense datasets for training and retraining, creating unprecedented stress on storage infrastructure write cycles, thereby favoring high-endurance NVMe SSDs. Furthermore, the future of AI at the edge, facilitated by 5G networks, necessitates rugged, high-reliability enterprise SSDs capable of performing real-time inference in remote or environmentally challenging locations. This dual demand—massive capacity and extreme performance—is accelerating the development of PCIe Gen 5 and Gen 6 interfaces and driving architectural shifts towards storage-class memory (SCM) to bridge the speed gap between DRAM and traditional NAND storage, directly responding to the demands of sophisticated AI pipelines.

- AI drives demand for ultra-high random read IOPS essential for rapid data serving during inference tasks.

- Increased endurance requirements (high DWPD) are critical for continuous Machine Learning model training cycles and data iteration.

- The deployment of high-density QLC SSDs is growing for storing massive, static AI training datasets (cold/warm tiers).

- Accelerated development of Computational Storage Drives (CSDs) to offload AI data processing tasks from the central CPU.

- Adoption of Storage-Class Memory (SCM) solutions to minimize latency for critical AI metadata and intermediate calculation storage.

- Heightened emphasis on security features (e.g., hardware encryption) to protect proprietary AI models and sensitive training data.

- Expansion of specialized enterprise SSDs optimized for high-bandwidth interfaces (PCIe Gen 5 and Gen 6) to handle large AI workload parallelism.

DRO & Impact Forces Of Enterprise SSD Market

The Enterprise SSD Market is primarily propelled by the relentless demand for faster, denser, and more power-efficient data storage solutions stemming from massive cloud expansion and the requirements of emerging technologies like AI and IoT. Simultaneously, the market faces constraints related to the volatility of NAND flash pricing, the complexities inherent in managing increased write amplification in newer, high-density flash technologies (QLC/PLC), and the lingering challenge of integrating next-generation interfaces (e.g., CXL-attached storage) into existing legacy server architectures. These constraints, however, are counterbalanced by significant opportunities, including the explosive potential within the edge computing sector, the adoption of storage-class memory (SCM) as a new performance tier, and strategic governmental and private investment in massive domestic data centers globally, particularly in developing economies.

Drivers include the accelerating transition to NVMe SSDs as the standard interface for primary enterprise storage, offering performance improvements orders of magnitude greater than legacy SATA/SAS. The increasing adoption of virtualization and hyper-converged infrastructure (HCI) demands flash storage to maintain consistent performance under heavy consolidation loads. Furthermore, the maturation and increasing density of 3D NAND technology (moving towards 176+ layers) continues to drive down the cost-per-gigabyte, making flash an economically viable replacement for HDDs across various enterprise storage tiers. This relentless pursuit of density and speed forms a positive feedback loop, driving product innovation and market penetration.

Key impact forces shaping the competitive landscape involve the rapid shift in data center architecture towards software-defined storage (SDS), which places a premium on highly flexible and programmable SSDs. The growing importance of sustainability and power efficiency also acts as a powerful driver, as SSDs consume significantly less power and generate less heat than comparable HDD arrays, aiding enterprises in meeting strict environmental and operational efficiency goals. Regulatory requirements concerning data sovereignty and data integrity further influence product development, pushing manufacturers to integrate advanced features such as tamper-proof firmware and comprehensive logging capabilities into their enterprise-grade offerings. The convergence of these drivers, restraints, and opportunities creates a highly dynamic environment favoring providers capable of delivering customized, high-performance storage solutions tailored to specific workload profiles.

Segmentation Analysis

The Enterprise SSD Market is extensively segmented based on capacity, technology, interface, and application, reflecting the diverse and specialized requirements of enterprise data environments, ranging from high-transaction database systems to massive archival storage. This multi-layered segmentation is crucial for understanding market dynamics, as procurement decisions are highly sensitive to optimizing the cost-per-IOPS, cost-per-TB, and endurance characteristics for a specific workload. For instance, high-endurance segments (3 DWPD+) focus on specialized NAND controllers and SLC/MLC architectures, targeting financial trading and high-frequency transaction processing, while high-density segments (QLC) focus on maximizing capacity for cloud object storage and big data repositories.

Analyzing the interface segmentation, NVMe continues to solidify its dominant position across all high-performance and cloud-based deployments due to its direct path to the CPU via PCIe, inherently reducing latency compared to SAS or SATA protocols. Conversely, SAS and SATA interfaces, while declining in overall market share, maintain a niche presence in environments requiring backward compatibility with existing server infrastructure or where cost sensitivity outweighs the need for maximum performance, such as certain legacy archival systems. The capacity segment is witnessing a pronounced shift towards ultra-high-capacity drives (15TB and 30TB+), driven by hyperscalers seeking to maximize storage density per server rack and reduce the physical footprint of their rapidly expanding data centers.

Furthermore, technology segmentation, particularly concerning NAND type, is critical. TLC (Triple-Level Cell) remains the cornerstone of the market, offering a balanced combination of endurance and cost. However, QLC (Quad-Level Cell) is the fastest-growing segment, projected to capture a significant portion of the read-intensive workload market, including media streaming, content delivery networks (CDNs), and large-scale data lakes. The market's complexity demands manufacturers offer a precise matrix of products, ensuring that enterprise customers can select the optimal SSD based on the precise blend of cost, endurance, and performance required by their specific applications, thereby facilitating targeted procurement strategies and optimizing the total cost of ownership (TCO).

- By Technology

- Single-Level Cell (SLC)

- Multi-Level Cell (MLC)

- Triple-Level Cell (TLC)

- Quad-Level Cell (QLC)

- By Interface

- SATA

- SAS

- NVMe (PCIe)

- By Capacity

- Under 1TB

- 1TB – 4TB

- 4TB – 8TB

- 8TB and Above

- By Endurance Level (DWPD)

- High Endurance (3 DWPD and Above)

- Mixed Use (1 to 3 DWPD)

- Read Intensive (Under 1 DWPD)

- By Application

- Cloud and Hyperscale Data Centers

- Enterprise Data Centers (Traditional IT)

- Edge Computing and IoT

- Government and Defense

- Telecommunications

- By Form Factor

- 2.5-inch

- M.2

- AIC (Add-in Card)

- EDSFF (Enterprise and Data Center SSD Form Factor)

Value Chain Analysis For Enterprise SSD Market

The Enterprise SSD value chain is highly integrated and complex, spanning raw material sourcing, semiconductor manufacturing, controller design, integration, and final distribution to end-users. The upstream segment is dominated by a few global players responsible for the fabrication of NAND flash memory (wafers) and the specialized controllers and DRAM components required for enterprise-grade performance. Since the production of high-density 3D NAND requires massive capital investment and highly specialized fabrication plants (Fabs), entry barriers are exceptionally high, concentrating supply power among a limited number of vertically integrated companies. Any disruption in raw material sourcing (e.g., silicon, specialized chemicals) or fabrication capacity directly impacts pricing and supply stability downstream.

Midstream activities involve the highly technical process of module assembly, firmware development, and rigorous quality assurance testing essential for meeting enterprise reliability standards. Enterprise SSD manufacturers invest heavily in developing proprietary controllers and complex firmware algorithms dedicated to wear-leveling, garbage collection, and robust error correction (e.g., LDPC codes). This proprietary technology differentiates competing products, particularly concerning performance consistency and longevity (endurance). The distribution channel then plays a crucial role, often involving highly specialized distribution partners and value-added resellers (VARs) who bundle SSDs with server infrastructure, network equipment, and software-defined storage solutions, providing crucial integration and support services to enterprise clients.

Downstream activities center on direct sales to large Original Equipment Manufacturers (OEMs), such as server and storage system vendors (e.g., HPE, Dell Technologies, Cisco), and massive direct purchasing by hyperscale cloud providers (e.g., Google, Amazon, Microsoft). These large buyers wield significant negotiating power, driving demand for cost-optimized, custom specifications, particularly in high-volume orders. Indirect sales occur through the channel ecosystem targeting smaller enterprise data centers and mid-market organizations. The overall efficiency of the value chain is critical; optimizing the transition from NAND wafer production to final server deployment determines the overall market cost structure and the speed at which technological innovations, such as new NAND generations or interface standards (e.g., EDSFF), can be brought to the enterprise customer base.

Enterprise SSD Market Potential Customers

Potential customers for Enterprise SSDs are primarily large organizations and service providers with extensive data processing and storage requirements where performance, reliability, and uptime are non-negotiable factors. The largest segment remains the Cloud and Hyperscale Providers, which utilize vast quantities of SSDs to power their Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS) offerings globally. These customers prioritize high capacity (QLC and TLC) and high-density form factors (EDSFF) to maximize storage per rack unit and reduce cooling overheads, driven by the sheer scale of their operations and the need for cost optimization at the petabyte level.

The second major group includes traditional Enterprise Data Centers, encompassing finance, healthcare, and manufacturing sectors. Financial institutions, for instance, demand ultra-low-latency SSDs (often SLC or high-end TLC) for real-time transaction processing and algorithmic trading systems where milliseconds translate directly into profit or loss. Healthcare providers utilize enterprise SSDs for high-speed access to electronic health records (EHRs) and large-scale medical imaging data (PACS), prioritizing data integrity and regulatory compliance. These customers often procure solutions through large OEMs and System Integrators, focusing on established, reliable technologies (SAS and NVMe TLC) that offer proven compatibility within complex, multi-vendor environments.

Emerging potential customers are concentrated in the Edge Computing and Telecommunications industries, spurred by the global deployment of 5G networks. Telcos require robust, industrial-grade enterprise SSDs to handle massive data streams generated at base stations and edge nodes for localized processing and caching before transmission to central data centers. These edge deployments demand specific attributes, including enhanced temperature resilience, high durability in non-ideal environmental conditions, and high security features, representing a growing niche market for specialized Enterprise SSD offerings designed for distributed, decentralized data processing infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 19.5 Billion |

| Market Forecast in 2033 | USD 55.4 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung Electronics, Kioxia Corporation (formerly Toshiba Memory), Western Digital Corporation (SanDisk), Micron Technology, SK Hynix, Intel Corporation, Seagate Technology, Hewlett Packard Enterprise (HPE), Dell Technologies, Pure Storage, Kingston Technology, ADATA Technology, NetApp, Huawei Technologies, IBM, PNY Technologies, Smart Modular Technologies, InnoDisk, Virtium, Silicon Motion |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Enterprise SSD Market Key Technology Landscape

The Enterprise SSD market is fundamentally shaped by rapid advancements in non-volatile memory technology and interface standards designed to eliminate storage bottlenecks in high-performance computing environments. Key technological developments center around the continual scaling of 3D NAND flash, where manufacturers are pushing layer counts beyond 200, enabling higher capacities and lower manufacturing costs per bit. Specifically, the commercial viability of QLC (Quad-Level Cell) flash for enterprise read-intensive workloads has been enabled by sophisticated error correction codes (LDPC) and improved wear-leveling algorithms, making high-density storage economically accessible to hyperscalers, despite the inherent decrease in individual cell endurance compared to TLC or MLC.

Interface innovation is dominated by the transition from PCIe Gen 4 to PCIe Gen 5, offering double the bandwidth and significantly increasing the IOPS ceiling for demanding applications like AI training and high-transaction databases. Furthermore, the market is aggressively adopting the NVMe-oF (NVMe over Fabrics) protocol, which allows storage resources to be pooled and shared across a network, treating remote flash storage as local. This decouples storage from compute, offering immense architectural flexibility and efficiency gains, crucial for software-defined data centers and large-scale virtualized environments. The development of specialized form factors like EDSFF (Enterprise and Data Center SSD Form Factor), particularly E1.S and E3.S, is also critical, as these optimize thermal management and density within modern 1U and 2U servers, moving beyond the limitations of legacy U.2/2.5-inch designs.

Another transformative technology is Computational Storage (CSD), which integrates processing capabilities directly into the SSD controller, allowing certain data manipulation tasks, such as filtering, compression, and encryption, to be performed directly on the drive. This architectural shift significantly reduces the data movement between the storage layer and the host CPU, conserving CPU cycles and reducing power consumption, thereby enhancing overall system performance, particularly beneficial for complex data analytics and machine learning applications. Concurrently, Storage-Class Memory (SCM), utilizing technologies like 3D XPoint or high-speed persistent DRAM, is emerging as a critical tier between traditional NAND and volatile DRAM, providing extremely high endurance and ultra-low latency, addressing the performance gap for critical metadata and high-priority, write-intensive application logs.

Regional Highlights

Regional dynamics heavily influence the Enterprise SSD market, reflecting variations in data center maturity, regulatory environments, and digital investment strategies. North America currently dominates the market, primarily due to the presence of the world's largest hyperscale cloud providers (e.g., AWS, Google Cloud, Microsoft Azure) and major technological innovation hubs. This region sets the pace for high-end product adoption, driving immediate demand for the latest NVMe-oF solutions, PCIe Gen 5 SSDs, and advanced QLC implementations for massive storage needs. The consistent investment in cutting-edge server technology and the rapid deployment of AI infrastructure cement North America's leadership position in both volume and value.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by massive digital transformation initiatives in emerging economies like India, Southeast Asia, and China. Government policies supporting local data sovereignty and the rapid expansion of domestic cloud providers are driving significant investment in new data center capacity. Furthermore, the sheer volume of data generated by APAC’s large populations and burgeoning manufacturing bases creates an enormous appetite for high-density storage. China, in particular, is a crucial market, with domestic technology giants rapidly deploying vast SSD resources to support e-commerce, mobile services, and localized AI development, creating robust demand for both domestically produced and imported enterprise storage.

Europe demonstrates steady growth, highly influenced by stringent data protection laws (GDPR) and the need for localized cloud infrastructure. European enterprises prioritize data security, reliability, and TCO, leading to strong demand for enterprise SSDs with advanced security features, including robust hardware encryption and validated firmware. Germany, the UK, and the Nordics are key growth areas, spurred by governmental efforts to digitize public services and increased adoption of hybrid cloud models. The focus in Europe is often balanced between high-performance NVMe for critical workloads and energy-efficient SSDs to meet sustainability mandates within modern European data centers.

Latin America and the Middle East & Africa (MEA) represent emerging markets with substantial growth potential, driven by improving network infrastructure and foreign investment in data center facilities. In MEA, the UAE and Saudi Arabia are leading the digital charge, implementing national cloud strategies and building large-scale data centers, resulting in increased procurement of high-capacity storage solutions. Latin America, led by Brazil and Mexico, is seeing increased digitalization across the financial and retail sectors, transitioning from legacy storage to modern NVMe-based infrastructure to handle localized data processing needs and enhance service delivery performance.

- North America: Market leader; driven by hyperscale cloud and early adoption of PCIe Gen 5 and SCM technologies. Focus on extreme performance and density.

- Asia Pacific (APAC): Highest CAGR; accelerated data center construction in China, India, and Southeast Asia. Strong governmental support for digital infrastructure.

- Europe: Steady growth; emphasis on data security, regulatory compliance (GDPR), and energy-efficient SSDs (Green Data Centers).

- Latin America (LATAM): Emerging market; increasing adoption in financial services and government sectors transitioning to localized cloud services.

- Middle East & Africa (MEA): Growth driven by national digital transformation agendas and foreign investment in cloud facilities (Saudi Arabia, UAE).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Enterprise SSD Market.- Samsung Electronics Co., Ltd.

- Kioxia Corporation (formerly Toshiba Memory)

- Western Digital Corporation (SanDisk)

- Micron Technology, Inc.

- SK Hynix Inc.

- Intel Corporation (SSD Business acquired by SK Hynix/Solidigm)

- Solidigm

- Seagate Technology Holdings plc

- Hewlett Packard Enterprise (HPE)

- Dell Technologies Inc.

- NetApp, Inc.

- Pure Storage, Inc.

- Kingston Technology Company, Inc.

- ADATA Technology Co., Ltd.

- Huawei Technologies Co., Ltd.

- InnoDisk Corporation

- Smart Modular Technologies, Inc.

- Virtium LLC

- Microchip Technology Inc.

- Baidu (Cloud Infrastructure Developer)

Frequently Asked Questions

Analyze common user questions about the Enterprise SSD market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the Enterprise SSD Market?

The primary driver is the exponential expansion of hyperscale cloud computing infrastructure globally, coupled with the critical need for ultra-low latency storage to support demanding AI, Big Data analytics, and real-time processing workloads, necessitating a shift from HDDs to high-performance NVMe SSDs.

How does NVMe technology compare to traditional SAS/SATA in enterprise environments?

NVMe (Non-Volatile Memory Express) is significantly superior, offering vastly lower latency and higher IOPS by communicating directly with the CPU via the PCIe bus, bypassing the limitations of legacy interfaces like SAS and SATA, which were originally designed for slower rotating media.

What role does QLC NAND play in the future of enterprise storage?

QLC (Quad-Level Cell) NAND is vital for maximizing storage density and reducing the cost-per-gigabyte. While having lower endurance than TLC, QLC is rapidly penetrating the market for read-intensive workloads such as archival storage, large data lakes, and content delivery networks (CDNs) in cloud data centers.

What is the impact of AI workloads on Enterprise SSD endurance requirements?

AI workloads, particularly model training, are write-intensive, significantly increasing the write amplification factor and demanding higher endurance SSDs (measured in DWPD). This necessity is driving innovation in firmware and controller design to extend the lifespan of high-capacity NAND under continuous, heavy usage.

Which form factors are becoming standard in modern enterprise data centers?

While the 2.5-inch U.2 form factor remains common, modern data centers are rapidly adopting the EDSFF (Enterprise and Data Center SSD Form Factor), particularly E1.S and E3.S, due to their superior thermal efficiency, higher density, and optimized physical design tailored for next-generation rack server architectures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager