Enterprise Switches Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435241 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Enterprise Switches Market Size

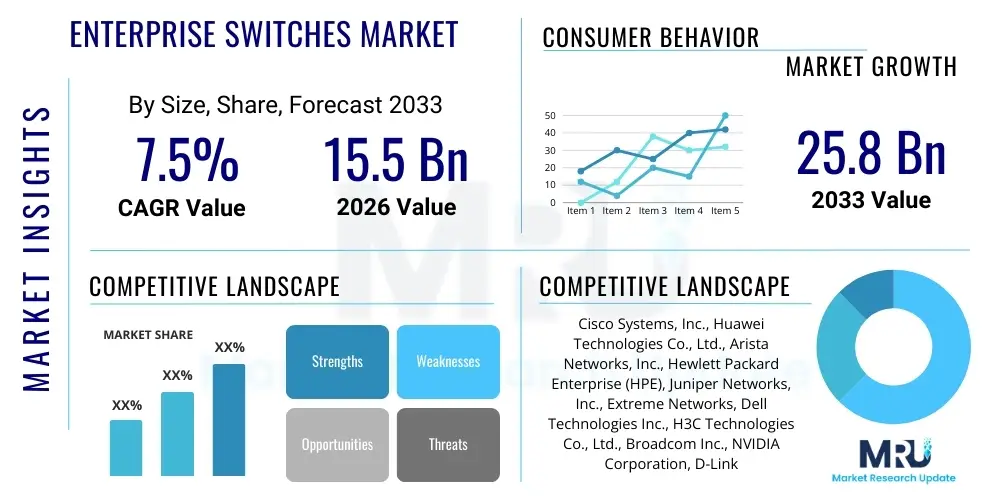

The Enterprise Switches Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 25.8 Billion by the end of the forecast period in 2033.

Enterprise Switches Market introduction

The Enterprise Switches Market encompasses networking hardware devices crucial for connecting devices within a Local Area Network (LAN) or a corporate Wide Area Network (WAN). These switches function primarily at Layer 2 (data link layer) and often Layer 3 (network layer) of the OSI model, enabling efficient data packet forwarding, managing network traffic, and ensuring Quality of Service (QoS) across complex corporate infrastructures. Products range from high-density core switches deployed in data centers to access layer switches connecting end-user devices across office environments. The demand is heavily influenced by the global shift towards digital transformation, requiring resilient, high-speed, and secure networking foundations capable of handling massive volumes of data generated by cloud services, IoT deployments, and sophisticated enterprise applications. The core product definition revolves around devices offering high port density, advanced security features, and programmability through technologies like Software-Defined Networking (SDN).

Major applications of enterprise switches span various sectors, including large-scale corporate data centers, branch offices, educational institutions, government agencies, and healthcare facilities. They are the backbone enabling critical services such as Voice over IP (VoIP), video conferencing, seamless cloud access, and virtual desktop infrastructure (VDI). The primary benefits derived from modern enterprise switch deployment include enhanced network performance through reduced latency and improved throughput, heightened security posture via features like access control lists (ACLs) and MAC-based authentication, and operational efficiency stemming from centralized management tools and automation capabilities. Furthermore, advanced switches support Power over Ethernet (PoE/PoE+), simplifying the deployment of endpoints like IP cameras and wireless access points.

Several significant factors are driving the robust expansion of this market. Foremost among these is the exponential growth in enterprise data traffic, fueled by the widespread adoption of bandwidth-intensive applications and the mandatory migration of business processes to hybrid and multi-cloud environments. The necessity for high-speed connectivity, particularly 100G, 200G, and increasingly 400G Ethernet in data centers, is pushing the replacement cycle for older infrastructure. Additionally, the proliferation of Internet of Things (IoT) devices within the enterprise perimeter mandates a more dense, reliable, and intelligent network edge, necessitating smarter access switches capable of granular policy enforcement and device segmentation. The continuous push toward network automation and Intent-Based Networking (IBN) also serves as a strong driver, encouraging organizations to invest in programmable switches that can adapt dynamically to business requirements.

Enterprise Switches Market Executive Summary

The Enterprise Switches Market is currently undergoing a pivotal transformation characterized by accelerating demand for higher port speeds and the integration of advanced automation capabilities. Key business trends indicate a definitive shift away from traditional chassis-based switches toward fixed-configuration, high-density, and highly scalable spine-and-leaf architectures, particularly within hyperscale and private cloud data centers. Enterprises are prioritizing investments in programmable infrastructure that supports Software-Defined Networking (SDN) and Network Functions Virtualization (NFV), allowing for agile deployment of services and substantial reduction in operational complexity. Furthermore, security remains paramount, leading to increased adoption of zero-trust networking principles enforced directly at the switch level, often utilizing microsegmentation techniques to limit lateral movement of threats within the corporate LAN.

Regionally, North America maintains its dominance due to high concentration of major technology companies, early adoption of cutting-edge networking standards (such as 400G Ethernet), and substantial IT spending on cloud infrastructure modernization projects. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by massive digitization initiatives across emerging economies, especially in China and India, coupled with rapid deployment of 5G infrastructure requiring robust backhaul networking. European markets are characterized by strong regulatory focus on data privacy and resilience, driving demand for secure, high-performance switches compliant with stringent European Union standards like GDPR, while Latin America and MEA continue to show steady growth driven by foundational telecom and governmental infrastructure upgrades.

In terms of segmentation trends, the Managed Switches segment holds the largest market share due to the complex requirements of modern large enterprises that necessitate sophisticated traffic control, detailed performance monitoring, and advanced security policies that unmanaged switches cannot provide. Geographically, the 100G and 400G speed segments are experiencing the most rapid growth in the data center environment, reflecting the intensifying need for faster interconnectivity supporting Machine Learning (ML) workloads and high-frequency trading. Conversely, in the access layer, the demand is concentrated on 1G and 10G PoE switches, tailored to power and connect a vast array of endpoints efficiently. The Telecommunications and IT & Data Center end-user segments remain the primary revenue drivers, continually investing in infrastructure to manage surging internet traffic and cloud services demand.

AI Impact Analysis on Enterprise Switches Market

User inquiries regarding AI's influence on the Enterprise Switches Market predominantly focus on three critical areas: How AI workload acceleration dictates switch architecture, the role of Artificial Intelligence for IT Operations (AIOps) in managing networks, and the resulting change in bandwidth requirements. Users frequently question whether existing switch infrastructure is sufficient for deep learning clusters and if specialized AI-optimized switches are necessary. The consensus expectation is that AI will revolutionize network management by enabling predictive maintenance, automated troubleshooting, and proactive resource allocation. Furthermore, the immense data transfer demands created by AI/ML training models necessitate a radical shift towards higher-speed, ultra-low-latency interconnects, such as those leveraging RoCE (RDMA over Converged Ethernet) technologies, fundamentally altering the buying criteria for enterprise and data center switches.

The integration of AI directly impacts hardware design and network fabric intelligence. Switches are increasingly required to handle massive, sustained east-west traffic flows generated by distributed computing clusters used for AI training. This necessitates highly non-blocking architectures, sophisticated congestion control mechanisms, and the ability to operate effectively within an Ethernet-based infrastructure optimized for RDMA, often preferred over traditional TCP/IP for its lower overhead and higher throughput. Vendors are responding by embedding specialized telemetry capabilities within switch ASICs, allowing real-time data collection vital for AI-driven network monitoring and security anomaly detection. This transition from reactive troubleshooting to proactive, intelligent network optimization marks a significant technological inflection point in the enterprise networking sector.

The concept of AIOps is perhaps the most immediate application of AI impacting the switch market. AIOps platforms utilize machine learning algorithms to analyze vast amounts of network performance data, including switch logs, telemetry, and configuration changes, to identify patterns indicative of potential failures or security vulnerabilities before they escalate. This reduces the reliance on manual configuration and monitoring, decreasing operational expenditure and improving network uptime. Enterprises are seeking switches that integrate seamlessly with these AIOps platforms, providing rich, granular data streams required for accurate model training and decision-making, thereby driving the adoption of switches that support standardized, open telemetry protocols like gRPC Network Management Interface (gNMI).

- AI-Driven Network Management (AIOps): Automation of troubleshooting, capacity planning, and configuration changes using machine learning models.

- Demand for High-Speed Interconnects: Accelerated adoption of 100G, 200G, and 400G ports to handle intense, parallel AI training data transfers.

- Low-Latency Optimization: Increased focus on ultra-low-latency switches supporting RoCE (RDMA over Converged Ethernet) to improve performance of AI clusters.

- Enhanced Network Telemetry: Switches incorporating advanced silicon capabilities for deep packet inspection and real-time data export required for AI analysis.

- Security Enhancement: AI/ML models utilized for detecting complex network anomalies and zero-day threats enforced via switch-level policies.

- Intent-Based Networking (IBN) Advancement: AI enables the network to proactively adjust configurations based on high-level business intents, automating switch operations.

DRO & Impact Forces Of Enterprise Switches Market

The Enterprise Switches Market is governed by a dynamic interplay of stimulating growth drivers, restricting factors, and evolving opportunities, collectively defining the market's trajectory and profitability. Key drivers include the relentless global surge in data center traffic, stemming from cloud migration and the deployment of 5G networks, which necessitates continuous upgrades to high-density, high-speed switching infrastructure. Simultaneously, the proliferation of Internet of Things (IoT) devices across industrial and commercial settings compels enterprises to invest in advanced access layer switches featuring increased port density, robust security segmentation capabilities, and Power over Ethernet (PoE) support to manage decentralized endpoints effectively. This combination of top-down bandwidth pressure and bottom-up device proliferation forms a powerful demand catalyst.

However, significant restraints impede faster market expansion. The high initial capital expenditure (CapEx) associated with purchasing and deploying cutting-edge enterprise switches, especially those capable of 400G and advanced programmability features, presents a barrier, particularly for Small and Medium Enterprises (SMEs). Furthermore, complex configuration and management of advanced Software-Defined Networking (SDN) environments require highly specialized networking talent, which is often scarce, contributing to operational expenditure (OpEx) challenges. Supply chain volatility, particularly concerning critical semiconductor components necessary for high-performance switching silicon, has historically caused price instability and extended lead times, directly impacting enterprise procurement timelines and investment decisions.

Opportunities for future growth are plentiful, primarily centered around technological integration and market expansion. The emerging role of switches in supporting edge computing environments and 5G network backhaul represents a major opportunity, requiring specialized, ruggedized, and high-performance switches deployed outside traditional data centers. The transition towards Intent-Based Networking (IBN) and AIOps offers vendors a chance to differentiate their products by providing highly automated, self-healing network solutions, reducing total cost of ownership (TCO) for enterprises. Additionally, the growing focus on sustainability and energy efficiency is driving the development of 'green' switches, offering energy consumption advantages that appeal to environmentally conscious organizations seeking to reduce their data center power footprint. These opportunities suggest sustained investment in R&D focusing on efficiency and automation.

- Drivers: Massive growth in cloud and data center traffic; enterprise digital transformation initiatives; proliferation of IoT devices requiring smart connectivity; mandatory transition to higher speeds (100G/400G).

- Restraints: High capital investment required for cutting-edge infrastructure; complexity in managing advanced programmable networks (SDN/IBN); persistent global semiconductor supply chain constraints; dependence on highly skilled IT professionals.

- Opportunities: Integration with 5G backhaul and edge computing infrastructure; development of sophisticated AIOps and Intent-Based Networking solutions; increasing demand for energy-efficient ('green') networking hardware; growth in security-centric switching for zero-trust architectures.

- Impact Forces: Technological innovation velocity (high); economic conditions (medium, tied to CapEx budgets); competitive intensity (high); regulatory compliance (medium, especially around security).

Segmentation Analysis

The Enterprise Switches Market is comprehensively segmented based on product type, port speed, deployment location, and end-user industry, allowing for granular analysis of demand patterns and competitive dynamics. Segmentation by product type—Managed, Unmanaged, and Smart Switches—reflects the varying complexity and management needs across different organizational sizes. Managed switches, offering advanced control and security features, dominate the high-end enterprise sector, while unmanaged switches cater to basic connectivity needs in smaller offices. Segmentation by port speed (e.g., 1G, 10G, 25G, 100G, 400G) directly correlates with the required bandwidth and deployment environment, with higher speeds reserved for data center cores and lower speeds utilized at the network edge.

Analysis of deployment location divides the market into Data Center Networking and Campus/Access Networking. Data center switching is characterized by demands for ultra-high density, extremely low latency, and support for sophisticated protocols like RoCE, driving the adoption of 100G and 400G fixed-configuration switches arranged in non-blocking spine-and-leaf topologies. Conversely, Campus/Access networking focuses on resiliency, PoE capabilities (PoE++, supporting higher power devices), and integration with wireless access points, favoring modular or stackable chassis switches that prioritize management simplicity and security segmentation at the edge.

End-user segmentation highlights the industries driving the most significant revenue and technological change. The IT & Telecommunications sector remains the largest consumer, constantly requiring upgrades to handle surging internet backbone traffic and cloud service delivery. The Banking, Financial Services, and Insurance (BFSI) sector demands low-latency, secure switches for transactional processing, while Government and Healthcare sectors focus heavily on regulatory compliance, security, and high availability. Understanding these segment-specific requirements is crucial for vendors to tailor product offerings and maintain relevance in a rapidly evolving technological landscape.

- By Product Type:

- Managed Switches

- Unmanaged Switches

- Smart Switches

- By Port Speed:

- 1 Gigabit Ethernet (1G)

- 10 Gigabit Ethernet (10G)

- 25 Gigabit Ethernet (25G)

- 40 Gigabit Ethernet (40G)

- 100 Gigabit Ethernet (100G)

- 400 Gigabit Ethernet (400G and above)

- By Deployment Location:

- Data Center

- Campus / Access Network

- By End-User Industry:

- IT & Telecommunications

- BFSI (Banking, Financial Services, and Insurance)

- Government and Public Sector

- Healthcare

- Manufacturing

- Retail and E-commerce

- Education

Value Chain Analysis For Enterprise Switches Market

The value chain for the Enterprise Switches Market begins with sophisticated upstream activities focused on component sourcing and manufacturing. This segment is highly concentrated, relying heavily on specialized semiconductor manufacturers (ASIC vendors) who design the core switching silicon (chipsets) that determine the product’s speed, density, and performance features. Key upstream inputs also include optical transceivers, power supplies, and highly specialized PCBs. The cost and technical specifications of these components are paramount, making supplier relationships and supply chain resilience critical factors determining the final product’s profitability and time-to-market. Intense R&D investment at the manufacturing stage focuses on integrating advanced security features and supporting future high-speed standards like 800G Ethernet.

The middle segment of the value chain involves Original Equipment Manufacturers (OEMs) who design, assemble, and brand the switches, developing the proprietary operating systems and management software that differentiate their offerings. This phase includes hardware integration, rigorous quality control, and the development of supporting software for network orchestration, telemetry, and security policy enforcement. After assembly, the downstream segment focuses on distribution and sales. The majority of enterprise switches are sold through indirect channels, including value-added resellers (VARs), system integrators, and specialized distributors, who provide crucial pre-sales consulting, integration services, and post-sales support tailored to the complex needs of enterprise clients. Direct sales models are typically reserved for large-scale, strategic accounts, such as hyperscale cloud providers.

The final stage involves implementation and ongoing maintenance, often carried out by the channel partners or specialized managed service providers (MSPs). Since enterprise switches are long-life assets, post-sales support, firmware updates, and maintenance contracts represent a significant recurring revenue stream for manufacturers. Effective channel partner management, ensuring partners possess the necessary technical certifications and expertise, is vital for market penetration. The trend toward subscription-based software licensing for network management and security features (often termed 'NetDevOps' or 'Network-as-a-Service' models) is increasingly integrating software revenue deeper into the downstream value activities, shifting the focus from purely hardware sales to comprehensive solution delivery.

Enterprise Switches Market Potential Customers

Potential customers for the Enterprise Switches Market are fundamentally any organization requiring robust, high-performance, and secure internal connectivity to support their operational and digital infrastructure. The largest and most demanding segment includes hyperscale cloud providers and co-location data center operators, who require continuous investment in 400G and 800G fixed switches to manage unprecedented east-west traffic volumes associated with virtualization, containerization, and distributed computing models. These customers prioritize non-blocking architecture, ultra-low latency, and high energy efficiency to maintain cost-effective operations at massive scale. Their purchasing decisions are often highly technical, focusing on ASIC performance and software integration capabilities.

The second major customer group comprises large multinational corporations across regulated industries like BFSI, Healthcare, and Government. These customers are driven by regulatory compliance, security mandates (Zero Trust implementation), and the need for high availability (HA). They typically purchase high-end chassis-based and managed stackable switches for their campus networks, favoring vendors that offer comprehensive security integration, advanced Quality of Service (QoS), and centralized management platforms. Their procurement cycles are often tied to major infrastructure upgrade projects aimed at supporting hybrid work models and migrating legacy applications to private cloud environments, necessitating features like PoE++ for modern workplace devices.

A rapidly expanding customer base is found within the mid-market and SME sector, often utilizing smart or entry-level managed switches. Although these organizations have smaller IT budgets, their connectivity needs are increasing due to cloud service adoption (SaaS) and the requirement for basic network segmentation. Their decision-making process emphasizes ease of deployment, simple configuration interfaces, and cost-effectiveness. The education and retail sectors also represent consistent demand, driven by the need to support high-density wireless access (Wi-Fi 6/7) and numerous IoT endpoints (POS systems, surveillance cameras), making PoE capabilities a decisive factor in switch selection for these specific environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 25.8 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cisco Systems, Inc., Huawei Technologies Co., Ltd., Arista Networks, Inc., Hewlett Packard Enterprise (HPE), Juniper Networks, Inc., Extreme Networks, Dell Technologies Inc., H3C Technologies Co., Ltd., Broadcom Inc., NVIDIA Corporation, D-Link Corporation, NETGEAR, Allied Telesis, ZTE Corporation, Nokia, Fortinet, Trend Micro, VMware, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Enterprise Switches Market Key Technology Landscape

The Enterprise Switches market is fundamentally driven by four interconnected technological pillars: Software-Defined Networking (SDN), Intent-Based Networking (IBN), advanced physical layer technologies (400G/800G Ethernet), and sophisticated Power over Ethernet (PoE) standards. SDN continues to mature, moving control plane functionality away from individual hardware units to centralized controllers, enabling simplified, standardized, and rapid provisioning of network services across the data center and campus. This architecture allows organizations to treat network resources as a pool, significantly improving resource utilization and agility compared to manually configured traditional networks. Switches supporting SDN are required to expose programmatic interfaces (APIs) for controller interaction, fostering greater integration with virtualization and cloud management platforms.

Building upon SDN principles, Intent-Based Networking (IBN) represents the next evolutionary step, leveraging machine learning and automation to translate high-level business goals (the "intent") into specific network configurations across the switch fabric. IBN systems continuously monitor the network state, verify compliance against the stated intent, and automatically adjust configurations or resolve issues without human intervention. This shift necessitates switches with integrated sensors and advanced telemetry features capable of feeding real-time performance and security data back to the IBN controller. The adoption of IBN is crucial for enterprises seeking to manage complexity associated with hybrid multi-cloud environments and enhance overall operational resilience.

At the hardware level, the deployment of 400 Gigabit Ethernet (400G) is becoming standard in core data centers, driven by the escalating bandwidth demands of artificial intelligence, high-performance computing (HPC), and virtualization density. Switches must support specialized components like high-density QSFP-DD optics and advanced switching ASICs (Application-Specific Integrated Circuits) to handle these speeds efficiently while maintaining exceptionally low latency. Concurrently, in the access layer, the evolution of PoE standards to PoE++ (802.3bt) is transformative, enabling switches to deliver up to 90W of power per port. This capacity is essential for powering modern endpoints such as high-definition PTZ cameras, large digital signage displays, and complex smart building systems, consolidating both power and data delivery onto a single cable infrastructure and reducing overall deployment costs.

Regional Highlights

Regional dynamics within the Enterprise Switches Market are highly diverse, reflecting varying levels of technological maturity, IT spending patterns, and infrastructure needs. North America stands as the dominant regional market, primarily due to the presence of global technology headquarters, high enterprise IT budgets, and the early, aggressive adoption of cutting-edge technologies like 400G Ethernet and Intent-Based Networking (IBN). The rapid expansion of hyperscale and co-location data centers in the U.S. and Canada drives sustained high-volume demand for high-density, low-latency switches. Additionally, robust cybersecurity regulations foster continuous investment in network infrastructure capable of supporting advanced security paradigms like Zero Trust Architecture directly at the switching layer.

Asia Pacific (APAC) is anticipated to be the fastest-growing region over the forecast period. This accelerated growth is attributed to massive governmental initiatives supporting digitalization, the rapid build-out of 5G networks in countries like China, Japan, and South Korea, and significant foreign investment in establishing large manufacturing and IT hubs across Southeast Asia. The expanding middle class and the increasing deployment of smart city projects further fuel the demand for resilient and scalable enterprise network infrastructure. While price sensitivity remains a factor in certain developing APAC nations, the sheer scale of network expansion required to support the rapidly growing online user base ensures substantial long-term market expansion.

Europe represents a mature yet dynamic market characterized by stringent data protection laws (GDPR) and a strong focus on industrial automation (Industry 4.0). European enterprises prioritize vendor reliability, security features, and compliance, driving demand for robust managed switches with comprehensive auditing and policy enforcement capabilities. Western European countries lead in adopting SDN and cloud-based networking management solutions. Meanwhile, the Middle East and Africa (MEA) region exhibits steady growth, primarily driven by large-scale government-funded infrastructure projects, particularly in the UAE and Saudi Arabia, focused on diversifying their economies away from oil and gas and establishing themselves as regional data and technology hubs.

- North America: Market leader, driven by hyperscale cloud investments, early adoption of 400G technology, and high emphasis on Zero Trust security frameworks.

- Asia Pacific (APAC): Fastest-growing region, fueled by extensive 5G network rollout, increasing foreign investment, and large-scale digitalization programs across China and India.

- Europe: Strong demand for highly compliant, secure switches supporting GDPR and Industrial IoT (IIoT) applications; high penetration of managed services and SDN solutions.

- Latin America (LATAM): Growth driven by telecom infrastructure modernization and increasing demand from the BFSI sector for reliable, secure connectivity.

- Middle East and Africa (MEA): Growth concentrated around governmental digital transformation initiatives, large smart city projects, and data center build-outs in Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Enterprise Switches Market.- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Arista Networks, Inc.

- Hewlett Packard Enterprise (HPE)

- Juniper Networks, Inc.

- Extreme Networks

- Dell Technologies Inc.

- H3C Technologies Co., Ltd.

- Broadcom Inc.

- NVIDIA Corporation

- D-Link Corporation

- NETGEAR

- Allied Telesis

- ZTE Corporation

- Nokia

- Fortinet

- Trend Micro

- VMware, Inc.

- Mellanox (now part of NVIDIA)

- MikroTik

Frequently Asked Questions

Analyze common user questions about the Enterprise Switches market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Managed and an Unmanaged Enterprise Switch?

Managed switches offer advanced features like VLAN segmentation, QoS traffic prioritization, security protocols (e.g., 802.1X), and remote configuration capabilities, making them suitable for complex, large-scale enterprise environments. Unmanaged switches are plug-and-play, offering basic connectivity without configuration options, typically used in small offices or for simple network extensions.

How is the adoption of 400G Ethernet switches impacting data center architecture?

400G Ethernet adoption is enabling the crucial shift to flatter, higher-density spine-and-leaf architectures within data centers. This speed supports the massive east-west traffic generated by AI workloads and virtualization, reducing network latency, and improving overall fabric scalability necessary for modern cloud infrastructure.

What role does AIOps play in the future of Enterprise Switches?

AIOps (Artificial Intelligence for IT Operations) leverages machine learning to analyze network telemetry data provided by switches, enabling predictive fault detection, automated configuration adjustments, and real-time security anomaly identification, significantly enhancing operational efficiency and network reliability.

Why are Power over Ethernet (PoE++) capabilities increasingly important in the enterprise market?

PoE++ is essential because it delivers up to 90W of power per port, enabling switches to centrally power high-demand devices like advanced Wi-Fi 6 access points, high-definition surveillance cameras, and complex IoT sensors, simplifying installation and reducing the need for local power outlets in the access layer.

Which geographic region is projected to experience the fastest growth rate in the Enterprise Switches Market?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, driven by extensive government investments in 5G infrastructure, continuous digitalization efforts across major economies like China and India, and a rapidly expanding ecosystem of data centers and cloud services.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager