Enterprise Video Conferencing Endpoint Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433278 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Enterprise Video Conferencing Endpoint Market Size

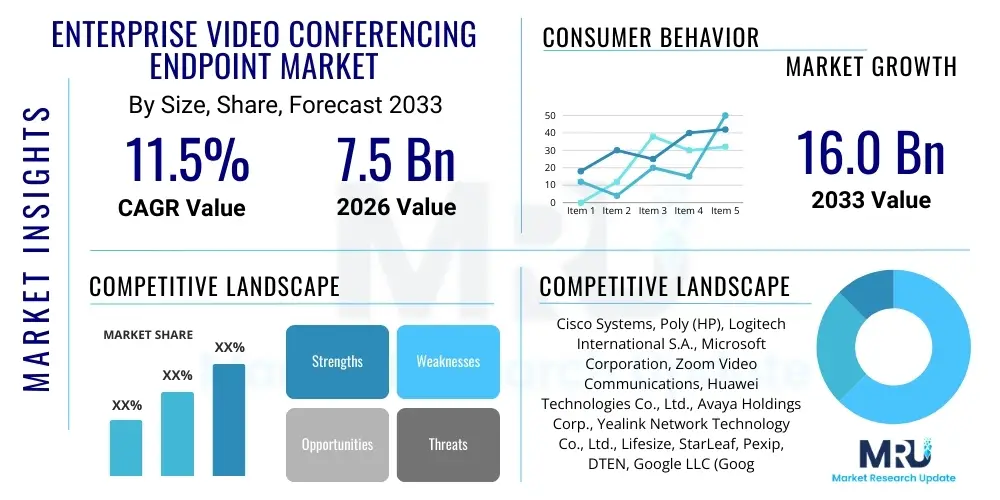

The Enterprise Video Conferencing Endpoint Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $7.5 Billion in 2026 and is projected to reach $16.0 Billion by the end of the forecast period in 2033.

Enterprise Video Conferencing Endpoint Market introduction

The Enterprise Video Conferencing Endpoint Market encompasses dedicated hardware and software solutions deployed within organizational settings to facilitate high-definition, real-time audio and video communication among geographically dispersed participants. These endpoints range from high-end room-based systems utilized in large boardrooms to personal, dedicated devices tailored for individual executive offices and huddle spaces. The core function of these products is to provide superior quality of experience (QoE), reliability, and advanced features such as multi-stream capabilities, content sharing, and integration with unified communications (UC) platforms, distinguishing them significantly from standard consumer-grade communication tools.

Major applications for these sophisticated systems span internal corporate meetings, client consultations, remote training, and global collaborative projects. Benefits derived from the adoption of enterprise-grade endpoints include reduced operational travel costs, accelerated decision-making processes, enhanced employee engagement in remote or hybrid environments, and improved overall organizational efficiency. These systems are pivotal in modern digital transformation strategies, enabling seamless transition to geographically decentralized operational models while maintaining rigorous standards for security and regulatory compliance necessary for multinational corporations and government entities.

The primary driving factors propelling market expansion include the sustained global adoption of hybrid work models, necessitated by shifts in workforce dynamics and organizational flexibility requirements. Furthermore, continuous technological advancements, particularly the integration of Artificial Intelligence (AI) for features like automated framing, noise reduction, and transcription, significantly enhance the utility and user experience of these endpoints. The increasing demand across sectors such as healthcare for telemedicine and education for virtual classrooms further solidifies the market’s robust growth trajectory, demanding enterprise-level reliability and data security standards.

Enterprise Video Conferencing Endpoint Market Executive Summary

The Enterprise Video Conferencing Endpoint Market is characterized by accelerating integration of intelligent features and a distinct polarization in product demand, favoring both compact, high-performance huddle room solutions and large, immersive telepresence suites, reflecting the structural normalization of hybrid work environments globally. Business trends indicate strong capital expenditure reallocation towards enhancing existing meeting infrastructure rather than entirely new construction, focusing on backward compatibility and scalable deployment across diverse real estate portfolios. Key vendors are strategically moving towards Subscription-as-a-Service (SaaS) models for hardware deployment and management, offering enterprises operational expenditure flexibility and predictable upgrade cycles, thereby blurring the lines between hardware provision and software services.

Regionally, North America maintains its dominance due to high technology readiness, early adoption of unified communication platforms, and the substantial presence of major technology corporations and financial institutions demanding premium solutions. The Asia Pacific (APAC) region, however, is emerging as the fastest-growing market, driven by rapid urbanization, substantial investments in digital infrastructure by developing economies like India and China, and the expansion of multinational operations requiring seamless cross-border communication capabilities. European market growth remains steady, primarily influenced by stringent data privacy regulations (like GDPR) which necessitate secure, compliant endpoint solutions, pushing demand toward hardware with robust, on-device encryption capabilities.

In terms of segment trends, the dedicated room systems segment, particularly those designed for medium-to-large conference spaces, continues to command the largest revenue share, albeit with moderate growth, due to the high average selling price (ASP) associated with these complex installations. Conversely, the USB/PC-based and integrated video bars segment is experiencing the most rapid growth rate, fueled by the widespread adoption of smaller huddle rooms and the need for scalable, easily deployable solutions across standardized corporate offices. Technology adoption emphasizes ultra-high-definition resolution (4K and moving towards 8K), integrated IoT management capabilities for resource monitoring, and AI-driven enhancements that simplify user interaction and automate meeting management tasks, improving return on investment for end-users.

AI Impact Analysis on Enterprise Video Conferencing Endpoint Market

Users are intensely focused on how Artificial Intelligence will fundamentally redefine the meeting experience, transitioning from simple communication to intelligent collaboration spaces. Common questions revolve around the efficacy of AI-driven noise suppression in highly dynamic environments, the reliability of automatic speaker tracking and framing across diverse seating arrangements, and the integration of virtual meeting assistants capable of summarizing meetings, assigning tasks, and facilitating real-time language translation. There is also significant interest in the security implications of utilizing cloud-based AI processing for sensitive corporate data, prompting users to evaluate vendors that offer edge-computing capabilities for enhanced privacy. The overriding expectation is that AI must deliver measurable improvements in meeting efficiency, reduce cognitive load on participants, and ensure equitable participation regardless of physical location, thereby maximizing the value proposition of high-cost endpoint investments.

The convergence of AI with endpoint hardware is moving these devices beyond mere transmission tools into sophisticated collaborative instruments. Machine learning algorithms embedded within the endpoints are now responsible for optimizing microphone arrays and camera focus dynamically, learning room acoustics and lighting profiles to consistently deliver professional-grade output without manual intervention. This level of automation significantly lowers the barrier to entry for end-users, ensuring that complex technologies are accessible and reliable for routine corporate use. The continuous refinement of deep learning models dedicated to computer vision and natural language processing is leading to endpoints that proactively anticipate user needs.

Furthermore, the strategic application of AI extends into the realm of network management and diagnostics. Endpoint devices equipped with AI can autonomously monitor network quality, identify potential bottlenecks, and dynamically adjust bandwidth usage and video codecs to prevent service degradation, ensuring an uninterrupted and high-quality meeting experience even under challenging network conditions. This shift toward self-optimizing hardware reduces the burden on IT departments for troubleshooting and maintenance, contributing significantly to the overall operational efficiency gains derived from modern conferencing infrastructure. The future trajectory involves endpoints serving as central hubs for personalized AI interactions, securely managing access and contextual information pertinent to meeting attendees.

- AI-powered noise reduction and echo cancellation drastically improve audio clarity in challenging environments.

- Automatic speaker tracking and intelligent framing ensure all participants are visible and focused without manual camera adjustments.

- Real-time transcription, translation, and meeting summarization tools enhance accessibility and post-meeting productivity.

- Facial recognition and biometric authentication enhance security and streamline user sign-in processes for room systems.

- Predictive maintenance and self-diagnostic capabilities reduce downtime and operational complexity for IT support teams.

- Integration of virtual assistants (e.g., Alexa for Business, Cortana) enables voice-activated meeting control and scheduling.

DRO & Impact Forces Of Enterprise Video Conferencing Endpoint Market

The market dynamics are governed by a powerful interplay between surging demand for flexible workplace solutions and persistent challenges related to capital investment and technological fragmentation. Drivers, such as the irreversible trend towards hybrid work structures and the global push for digital transformation across regulated industries, provide strong momentum. Conversely, high initial hardware costs, coupled with potential interoperability issues arising from proprietary protocols maintained by legacy vendors, act as significant restraints that can hinder widespread adoption among Small and Medium Enterprises (SMEs). The primary opportunity lies in developing AI-enhanced, cost-effective solutions tailored for niche applications such as immersive training or highly secure remote diagnostics in healthcare. The net impact of these forces is generally positive, skewing towards sustained high growth, particularly as vendors focus on mitigating restraints through flexible pricing models and open standards compliance, thereby capitalizing on pervasive market drivers.

The dominant driving force remains the enterprise need for effective, high-quality distributed team communication. Following widespread remote transitions, businesses recognized that consumer-grade tools lack the security, manageability, and superior audiovisual fidelity required for crucial business interactions, leading to mandated upgrades to dedicated enterprise endpoints. This shift is further amplified by the necessity for endpoints to seamlessly integrate into broader Unified Communications (UC) ecosystems, allowing for unified management and streamlined workflow automation. Furthermore, the global expansion of multinational corporations necessitates reliable, standardized communication tools that can operate efficiently across varied international regulatory and technical infrastructures, thus driving investment into robust, dedicated hardware solutions.

However, significant restraining factors persist, particularly around the total cost of ownership (TCO) which includes initial purchasing, complex installation, and continuous software licensing fees for advanced features. For organizations managing hundreds or thousands of conference rooms, this capital expenditure can be prohibitive, especially when existing infrastructure is still functional but lacks modern capabilities. Another considerable restraint is the complexity of achieving flawless interoperability across diverse vendor ecosystems (e.g., Microsoft Teams Rooms, Zoom Rooms, Cisco Webex). Although standards like SIP and H.323 exist, proprietary enhancements often lead to feature degradation when crossing platform boundaries, creating friction points for users and IT administrators who must manage multi-vendor environments. Opportunities exist in the development of modular, open-architecture hardware that simplifies cross-platform compatibility and reduces dependency on single-vendor ecosystems, opening new revenue streams through enhanced managed services.

Segmentation Analysis

The enterprise video conferencing endpoint market is structurally segmented based on product type, deployment method, and end-use application, reflecting the diverse needs of modern businesses ranging from small startups operating out of co-working spaces to massive multinational conglomerates utilizing specialized telepresence centers. Product type segmentation distinguishes between highly integrated, all-in-one solutions that simplify deployment (such as video bars) and traditional dedicated systems requiring multiple components (camera, codec, display, microphone arrays) for large venues. Application analysis is crucial, as requirements drastically differ across verticals; for instance, a healthcare provider demands extremely secure, HIPAA-compliant endpoints for telemedicine, while an educational institution prioritizes interactive whiteboarding and large-scale broadcasting capabilities.

The increasing maturation of cloud-based video conferencing services (e.g., Zoom, Webex, Teams) has profoundly influenced the deployment segment, leading to a rapid expansion of hardware designed specifically to interface optimally with these cloud services, often marketed as "Room Systems." This shift prioritizes ease of management and scalability over traditional on-premise infrastructure, which is now generally reserved for highly sensitive government or financial organizations that mandate strict internal control over data traffic. Understanding these nuanced segments is vital for vendors to tailor their product development roadmaps and marketing efforts, ensuring that endpoint features—such as lens quality, processing power, and API integration—are precisely aligned with the specific performance requirements and regulatory constraints of target end-user verticals.

- By Product Type:

- Dedicated Room Systems (Traditional CODEC-based)

- Integrated Video Systems (All-in-one Video Bars)

- Personal/Desktop Video Systems

- USB/PC-based Peripherals (Cameras, Mic/Speakerphones)

- Immersive Telepresence Systems

- By End-User Application:

- Corporate Offices and Enterprises (BFSI, Manufacturing, Retail)

- Government and Public Sector

- Healthcare (Telemedicine)

- Education (Virtual Classrooms, Remote Learning)

- Legal and Judicial Systems

- Media and Entertainment

- By Deployment:

- On-Premise

- Cloud-Based

- Hybrid

- By Room Size:

- Huddle Rooms (Up to 4 participants)

- Medium Conference Rooms (5-10 participants)

- Large Conference Rooms and Boardrooms (10+ participants)

Value Chain Analysis For Enterprise Video Conferencing Endpoint Market

The value chain for enterprise video conferencing endpoints is complex, starting with highly specialized upstream component providers and extending through sophisticated manufacturing, intricate distribution channels, and culminating in post-sales managed services. Upstream analysis highlights the critical reliance on specialized component suppliers, including manufacturers of high-fidelity 4K/8K sensors, sophisticated digital signal processors (DSPs) for audio processing, and advanced System-on-Chip (SoC) solutions that handle video encoding and AI algorithms. Innovation and cost control at this stage significantly influence the final product’s performance and pricing, leading to intense competition among component providers to supply proprietary, low-latency technologies to endpoint manufacturers.

Midstream activities involve the actual design, assembly, and software integration performed by major endpoint vendors. This stage involves complex hardware-software optimization to ensure seamless interoperability with major UC platforms and compliance with international standards. Following manufacturing, the downstream segment focuses heavily on distribution, which is bifurcated into direct sales to large enterprise accounts (often leveraging global account managers for tailored solutions) and indirect channels utilizing a network of certified value-added resellers (VARs), system integrators (SIs), and specialized IT distributors. VARs are crucial as they provide the necessary consultation, installation services, and customization required for integrating endpoints into complex enterprise IT infrastructures, offering end-users a comprehensive, turn-key solution.

The direct channel is preferred by Fortune 500 companies demanding bespoke solutions and specific security clearances, offering manufacturers higher margins and direct customer feedback loops. The indirect channel, dominating the SMB market and routine upgrades, relies on efficient logistics and the integrator’s expertise to reach a broader customer base rapidly. Effective channel management, training, and incentivization of partners are paramount to market penetration. Post-sales services, including maintenance, software updates, and cloud management platforms, are increasingly critical, often becoming a sustained revenue driver, cementing the relationship between the vendor and the enterprise client long after the initial hardware sale is finalized.

Enterprise Video Conferencing Endpoint Market Potential Customers

The primary customers for enterprise video conferencing endpoints are organizations across virtually every commercial and public sector that require reliable, secure, and high-quality collaborative communication capabilities to support their core business functions. This includes large multinational corporations (MNCs) that possess extensive global footprints and rely on high-definition video to manage supply chains, conduct remote audits, and coordinate R&D across continents. These customers prioritize enterprise-level features such as robust security protocols, centralized management tools, and seamless integration with existing IT infrastructure like Active Directory and Exchange Servers, often demanding immersive telepresence solutions for executive communications.

A rapidly expanding segment of potential customers includes institutions in the regulated sectors of healthcare and education. Hospitals and clinical networks utilize these endpoints for telemedicine consultations, remote specialist access, and administrative meetings, requiring strict adherence to privacy regulations (e.g., HIPAA in the US, GDPR in Europe) which necessitates advanced encryption and secure data handling capabilities embedded directly into the hardware. Educational institutions, from K-12 districts to large research universities, adopt these systems for hybrid learning models, remote faculty meetings, and guest lectures, focusing on scalability and ease of use for non-technical faculty and students, often preferring cloud-managed, integrated video bars for smaller classrooms.

Furthermore, government and defense agencies represent significant, albeit highly specialized, customers. These entities require endpoints that meet stringent security classifications, often necessitating entirely on-premise or closed-network deployments with physical tamper-proofing and certification for classified communications. Their purchasing decisions are heavily influenced by security compliance, vendor trust, and established track records of delivering robust, high-availability solutions. The transition to hybrid working models has expanded the customer base further into the professional services sector, including legal and financial firms, where high-stakes remote client interaction demands the professional presentation and reliability afforded only by dedicated enterprise-grade endpoints.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Billion |

| Market Forecast in 2033 | $16.0 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cisco Systems, Poly (HP), Logitech International S.A., Microsoft Corporation, Zoom Video Communications, Huawei Technologies Co., Ltd., Avaya Holdings Corp., Yealink Network Technology Co., Ltd., Lifesize, StarLeaf, Pexip, DTEN, Google LLC (Google Meet Hardware), Crestron Electronics, Inc., Barco NV, Vaddio (Legrand AV), Huddly AS, ClearOne, Inc., Sony Corporation, Panasonic Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Enterprise Video Conferencing Endpoint Market Key Technology Landscape

The technological evolution of enterprise video conferencing endpoints is heavily centered on enhancing visual and auditory fidelity, optimizing user experience through intelligence, and ensuring robust security necessary for high-stakes corporate communication. Current market leaders are aggressively adopting Ultra-High Definition (UHD) capabilities, making 4K resolution a standard for mid-to-high-end systems, with early implementations of 8K technology beginning to appear in immersive telepresence suites, designed to provide near-perfect visual clarity that minimizes screen fatigue and enhances detail presentation, critical for design reviews and medical imaging applications. This drive for visual excellence requires significantly more powerful dedicated processing hardware, often employing specialized GPUs and codecs optimized for H.265/HEVC compression to manage bandwidth requirements while maintaining low latency.

Audio technology represents an equally important frontier, moving beyond simple omnidirectional microphones to sophisticated, AI-driven beamforming and acoustic fencing solutions. These technologies utilize complex digital signal processing (DSP) arrays to isolate speech from background noise and precisely track the active speaker, creating a focused auditory experience that replicates in-person conversation dynamics. Furthermore, the integration of Internet of Things (IoT) management and sensory technologies allows endpoints to act as smart room controllers, automatically managing lighting, temperature, and room occupancy. This integration not only enhances the meeting environment but also provides valuable real-time utilization data to facility managers, enabling optimized resource allocation and energy savings across large corporate campuses.

Security and interoperability standards are constantly being updated to meet growing enterprise concerns. Modern endpoints feature hardware-level encryption (often AES 256-bit) and secure boot processes to mitigate malware risks. The shift towards certified room systems for platforms like Zoom and Microsoft Teams reflects the imperative for seamless, one-touch join functionality, reducing the time spent initiating meetings and minimizing support calls. Future innovation will focus on pervasive integration of spatial computing concepts, leveraging augmented reality (AR) and virtual reality (VR) technologies to create truly immersive, collaborative 3D environments, potentially redefining the definition of a video conferencing "endpoint" to include wearable or projected interfaces, further blurring the line between physical and virtual workspaces.

Regional Highlights

- North America: This region consistently leads the global market in terms of revenue share and early adoption rates, primarily driven by the massive concentration of large technology firms, financial institutions, and pharmaceutical companies in the United States and Canada. These organizations have robust budgets for IT infrastructure and are quick to implement the latest high-end, AI-enabled endpoints to support their sophisticated hybrid work requirements. The market here is highly mature, characterized by strong competition among established vendors and a high demand for cloud-based, managed services. Furthermore, stringent security requirements, particularly in the defense and government sectors, necessitate investment in highly secure, often custom-built, on-premise solutions. Innovation is rapid, often setting the global standard for feature sets and integration capabilities, particularly with specialized UC platforms.

- Europe: Europe represents a significant market, characterized by mature economies and a high focus on data privacy compliance, heavily influenced by the General Data Protection Regulation (GDPR). Market growth is steady, fueled by the adoption of hybrid models across the UK, Germany, and France, particularly within the manufacturing and professional services sectors. Demand is strong for endpoint solutions that offer localized data processing capabilities and certified compliance frameworks. The European market often shows a preference for integrated, energy-efficient video bars for huddle spaces, reflecting a focus on sustainable and modular office design. Vendor success in Europe depends heavily on robust partnerships with local system integrators who can navigate the complex regulatory and language requirements of different member states.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market, driven by rapid digital transformation, increasing foreign direct investment, and the expanding presence of multinational corporations establishing regional hubs in major economies such as China, India, Japan, and Australia. The market is highly diverse; while developed markets like Japan prioritize high-fidelity, large telepresence systems, emerging markets like India and Southeast Asia are seeing explosive growth in demand for cost-effective, scalable cloud-based systems suitable for rapid deployment across numerous branch offices and educational institutions. The mobile-first culture in many APAC nations also drives demand for seamless integration between room systems and personal mobile devices, requiring robust wireless content sharing features in endpoints.

- Latin America (LATAM): The LATAM market is experiencing steady, moderate growth, primarily concentrated in major economic hubs like Brazil and Mexico. Adoption is accelerating due to the need for operational resilience, particularly within the financial and energy sectors that require secure communication across geographically dispersed facilities. Market penetration is often constrained by variable internet infrastructure quality, pushing demand towards endpoints capable of performing efficiently with lower bandwidth, favoring advanced compression codecs and intelligent network optimization features embedded within the hardware. Governmental investment in public sector modernization and distance education is also a key growth factor.

- Middle East and Africa (MEA): Growth in the MEA region is driven by significant infrastructure investments, especially in the UAE and Saudi Arabia, focused on creating smart cities and diversified economies. The oil and gas sector, along with governmental and defense agencies, are the primary consumers of high-end enterprise endpoints, prioritizing security and reliability for critical communications. Africa is witnessing increased adoption in the education and telemedicine sectors, although deployment is often challenged by infrastructure variability and high import duties, making cost-effectiveness a critical purchasing determinant for potential buyers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Enterprise Video Conferencing Endpoint Market.- Cisco Systems, Inc.

- Poly (HP Inc.)

- Logitech International S.A.

- Microsoft Corporation

- Zoom Video Communications, Inc.

- Huawei Technologies Co., Ltd.

- Avaya Holdings Corp.

- Yealink Network Technology Co., Ltd.

- Lifesize (Enghouse Systems)

- StarLeaf (Pexip)

- Pexip AS

- DTEN Inc.

- Google LLC (Google Meet Hardware)

- Crestron Electronics, Inc.

- Barco NV

- Vaddio (Legrand AV)

- Huddly AS

- ClearOne, Inc.

- Sony Corporation

- Panasonic Corporation

Frequently Asked Questions

Analyze common user questions about the Enterprise Video Conferencing Endpoint market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Enterprise Video Conferencing Endpoint Market?

The market is projected to expand significantly, exhibiting an estimated Compound Annual Growth Rate (CAGR) of 11.5% during the forecast period from 2026 to 2033, driven largely by sustained hybrid work adoption and technological integration of AI features.

How is Artificial Intelligence (AI) transforming enterprise video endpoints?

AI is fundamentally enhancing endpoints by providing features such as intelligent framing, automated noise suppression, real-time transcription, and predictive maintenance, significantly improving meeting accessibility, productivity, and the overall user experience without manual intervention.

Which segment is experiencing the fastest growth in the Enterprise Video Conferencing Endpoint Market?

The Integrated Video Systems segment, particularly all-in-one video bars and USB/PC-based peripherals optimized for huddle rooms and small conference spaces, is witnessing the fastest revenue growth due to their scalability, ease of deployment, and cost-effectiveness for decentralized corporate environments.

What are the primary factors restraining market adoption?

Key restraints include the high initial capital investment required for dedicated room systems, coupled with persistent technical challenges related to achieving seamless cross-platform interoperability among competing unified communication ecosystems and managing proprietary vendor protocols.

Which region currently holds the largest market share for enterprise video conferencing endpoints?

North America maintains the largest market share, characterized by high technological maturity, substantial corporate IT spending, and the early, widespread adoption of advanced unified communication and collaboration platforms across major industries like finance and technology.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager