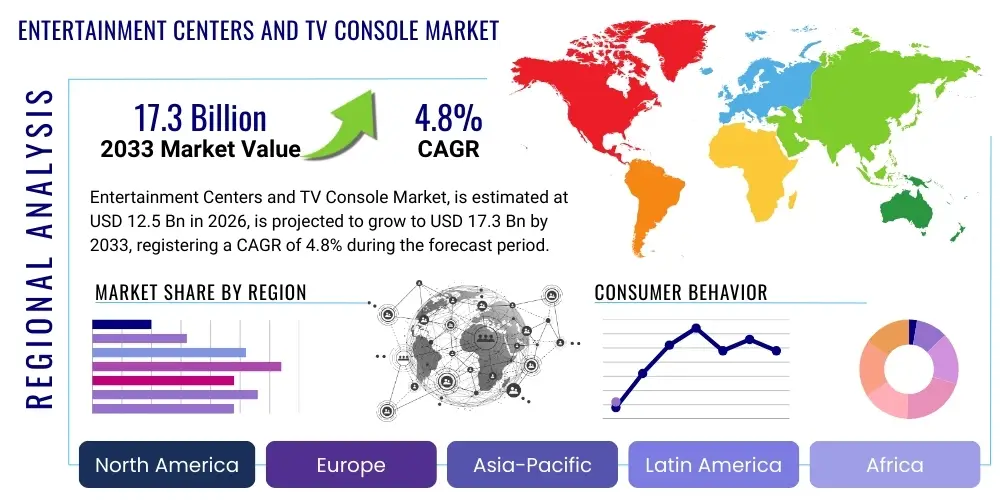

Entertainment Centers and TV Console Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437328 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Entertainment Centers and TV Console Market Size

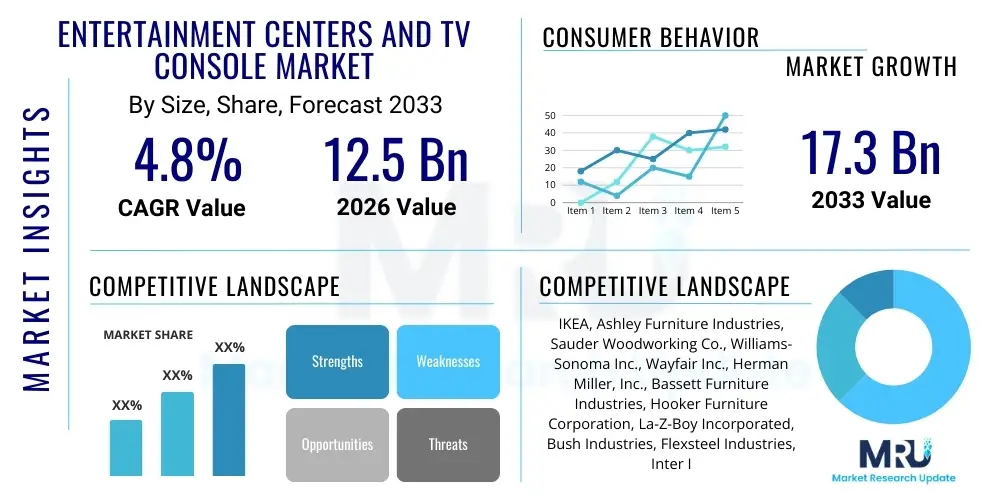

The Entertainment Centers and TV Console Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $12.5 Billion in 2026 and is projected to reach $17.3 Billion by the end of the forecast period in 2033. This consistent growth is primarily fueled by increasing disposable income, rapid urbanization leading to enhanced home decor investments, and the continuous advancement and adoption of larger, high-definition television sets requiring robust and aesthetically pleasing support structures. Consumer preferences are shifting towards multi-functional, modular furniture that integrates seamlessly with smart home ecosystems, driving innovation in design and material usage across key regions.

Entertainment Centers and TV Console Market introduction

The Entertainment Centers and TV Console Market encompasses furniture solutions designed specifically to house, support, and organize home entertainment systems, including televisions, gaming consoles, soundbars, and related media accessories. These products range from minimalist TV stands and floating shelves to expansive, multi-component entertainment centers offering substantial storage and display capabilities. Functionally, these units serve both aesthetic and practical purposes, concealing wiring, managing clutter, and acting as focal points within living spaces. The fundamental market driver is the pervasive global expansion of digital content consumption, particularly high-definition streaming and immersive gaming, necessitating dedicated and ergonomically sound display solutions.

Major applications for entertainment centers and TV consoles reside predominantly in residential settings, where they form the cornerstone of living rooms and media rooms. However, commercial applications, particularly in the hospitality sector (hotels, short-term rentals) and corporate environments (conference rooms, collaborative spaces), are also contributing significantly to demand. The key benefits derived by end-users include optimized viewing angles, enhanced safety for expensive electronics, and significant space management improvements. Driving factors include technological convergence, where consoles are expected to accommodate integrated charging solutions, cable management systems, and smart connectivity features, alongside a strong consumer trend towards personalized interior design reflecting modern, contemporary, or classic aesthetics.

The product description has evolved from simple wooden cabinets to complex media furniture systems incorporating diverse materials like engineered wood, glass, metal, and sustainable composites. The integration of technology, such as built-in power strips and ventilation mechanisms for electronics, is becoming standard. Market dynamics are heavily influenced by housing market trends and renovation cycles, with sustained demand coming from both new homeowners furnishing their primary residences and established consumers upgrading their living environments to accommodate larger, thinner screen formats and immersive audio systems. This confluence of technology and interior design is redefining the functional and stylistic requirements for all market participants.

Entertainment Centers and TV Console Market Executive Summary

The Entertainment Centers and TV Console Market exhibits strong momentum driven by convergent business trends, including the proliferation of Direct-to-Consumer (DTC) furniture brands utilizing Augmented Reality (AR) tools for visualization, and a robust focus on supply chain resilience through nearshoring strategies. Business innovation centers around modularity and customization, allowing consumers to design units tailored to specific television sizes and room configurations, thereby maximizing space efficiency and personalization. Regional trends highlight North America and Europe as mature markets prioritizing smart furniture integration and premium materials, while the Asia Pacific region demonstrates rapid volume growth spurred by expanding middle classes, increasing apartment ownership, and a high rate of first-time adoption of large-screen TVs. E-commerce platforms are the preferred distribution channel globally due to superior logistical capabilities and the ability to showcase extensive product portfolios.

Segment trends indicate that the Material segment is undergoing a significant shift, with Engineered Wood retaining market dominance due to cost-effectiveness and versatility, but sustainable and reclaimed wood options experiencing the fastest growth trajectory, driven by environmentally conscious millennials and Gen Z consumers. The Product Type segment shows a rising preference for Floating Consoles and Corner Units in smaller urban dwellings, reflecting a move towards minimalist and space-saving designs. Conversely, large, comprehensive Entertainment Wall Units remain popular in suburban and spacious residential environments. Furthermore, the application segment sees steady growth in the commercial sector, particularly within high-end boutique hotels seeking furniture that blends advanced cable management with sophisticated, high-design aesthetics.

In summary, the market is poised for expansion fueled by technological demands (larger screens, smart integration), material innovation (sustainability, durability), and distribution agility (e-commerce dominance). Key strategic imperatives for market players include optimizing the online shopping experience, investing in quick assembly mechanisms (RTA—Ready-to-Assemble), and developing products that address the growing consumer need for sophisticated yet simple cable and device management. The competitive landscape is fragmented, with local craft manufacturers competing alongside global furniture giants, necessitating differentiation through design patents and proprietary smart features.

AI Impact Analysis on Entertainment Centers and TV Console Market

User inquiries regarding the impact of Artificial Intelligence on the Entertainment Centers and TV Console Market frequently revolve around personalization, smart furniture integration, and supply chain optimization. Common questions include: "How will AI change the way I choose a TV console?" and "Can AI recommend the perfect console size for my room and TV?" This analysis confirms that consumers are keen on leveraging AI for predictive analytics in interior design, expecting tools that can instantly visualize console placement using uploaded room dimensions and existing decor styles. The key themes are enhanced customization through predictive modeling, inventory management automation reducing lead times, and the potential for consoles to become central, adaptive hubs in the smart home, managing devices and optimizing performance based on user patterns, thereby transcending their traditional role as mere supports.

- AI-Powered Personalized Recommendations: Algorithms analyze consumer style preferences, room dimensions, TV size, and budget to suggest optimal console models, materials, and colors, significantly reducing decision friction.

- Augmented Reality (AR) Visualization Tools: AI integrates with AR applications, allowing customers to virtually place specific console models in their actual living spaces via smartphone cameras, improving purchase confidence and reducing return rates.

- Predictive Inventory and Supply Chain Management: AI analyzes sales data, material costs, and regional demand forecasts to optimize manufacturing scheduling and stocking levels, ensuring faster delivery times and reducing inventory holding costs for manufacturers.

- Smart Console Integration and Device Management: Future consoles may use embedded AI to monitor device temperatures, manage power consumption, automatically route cables based on components, and optimize peripheral placement (e.g., soundbar alignment).

- Generative Design for Custom Furniture: AI tools assist furniture designers in rapidly generating modular and custom components based on manufacturing constraints and consumer specifications, accelerating product development cycles.

DRO & Impact Forces Of Entertainment Centers and TV Console Market

The Entertainment Centers and TV Console Market is currently influenced by powerful driving forces centered on technology adoption and urbanization, balanced against significant constraints related to material costs and logistical complexities. Opportunities arise primarily from the growing demand for highly customizable and sustainable furniture options. The key drivers include the universal trend towards larger, thinner televisions necessitating specialized support, the explosion of subscription-based streaming services (Netflix, Disney+, gaming platforms) that solidify the home entertainment area as a primary functional space, and rising global disposable incomes enabling consumers to invest in premium, designer furniture. These forces exert consistent positive pressure on market growth, encouraging manufacturers to innovate in design and embedded technology.

Restraints largely stem from the volatile nature of raw material pricing, particularly wood and steel, impacting production costs and consumer prices. Furthermore, the longevity and durability of existing furniture pieces mean replacement cycles can be relatively long, limiting immediate high-volume growth in mature markets. The complexity of shipping large, heavy furniture items also presents significant logistical and environmental challenges, particularly for international e-commerce. These factors necessitate continuous innovation in lightweight, durable materials and flat-pack, easy-to-assemble designs that minimize shipping volume and streamline the final mile delivery process, thereby mitigating logistical restraints.

Opportunities are abundant in the integration of smart home features into furniture, transforming consoles into central hubs for charging, connectivity, and environmental control. Developing products utilizing sustainable, reclaimed, or rapidly renewable materials presents a strong avenue for market penetration, appealing to the environmentally conscious demographic. The strongest impact forces are the dual pressures of technological integration (demanding smart features) and aesthetic evolution (favoring minimalist, customizable designs). These forces are reshaping product differentiation, compelling manufacturers to move beyond simple storage toward integrated, technologically sophisticated solutions that justify premium pricing and accelerate consumer upgrading cycles. Companies failing to adapt to these technological and design trends risk rapid market erosion.

Segmentation Analysis

The Entertainment Centers and TV Console Market is broadly segmented based on Product Type, Material, Distribution Channel, and Application, providing a detailed view of consumer preferences and market dynamics across various categories. The structure of segmentation helps stakeholders understand which product specifications and channels are experiencing the fastest uptake and where strategic investment should be directed. The primary differentiation often lies in the balance between pure functionality (storage, device housing) and aesthetic design (material finish, style compatibility). Regional requirements significantly influence the preferred Product Type, with high-density urban areas favoring compact, wall-mounted solutions, while spacious markets prefer large, multi-component entertainment wall units. This analysis is crucial for tailored product development and marketing strategies.

In terms of materials, the segment is highly fragmented, reflecting diverse consumer budgets and sustainability concerns. While cost-conscious segments gravitate toward particleboard and medium-density fiberboard (MDF), the premium segment increasingly demands solid wood (e.g., oak, walnut) or high-grade composites with environmentally friendly certifications. The shift towards online purchasing has fundamentally altered the Distribution Channel landscape, necessitating robust e-commerce capabilities, including high-quality product visualization and sophisticated logistics networks capable of handling large, often heavy, items efficiently. The application split between residential and commercial use highlights stable demand from general consumers versus specialized, high-volume procurement from the hospitality and corporate sectors, each requiring different performance and durability standards.

- By Product Type:

- Standard TV Stands

- Floating Consoles/Wall Mounts

- Media Chests

- Corner Units

- Entertainment Wall Units/Centers (Full Systems)

- By Material:

- Wood (Solid Wood, Engineered Wood/MDF, Plywood)

- Glass

- Metal (Steel, Aluminum)

- Composite and Sustainable Materials

- By Distribution Channel:

- Offline Retail (Specialty Furniture Stores, Department Stores, Home Improvement Centers)

- Online Retail (E-commerce Platforms, Direct-to-Consumer Websites)

- By Application:

- Residential

- Commercial (Hospitality, Corporate Offices, Educational Institutions)

Value Chain Analysis For Entertainment Centers and TV Console Market

The value chain for the Entertainment Centers and TV Console Market starts with upstream activities involving the sourcing and processing of raw materials, predominantly lumber, metal, and engineered wood panels. Raw material quality, responsible sourcing practices, and proximity to manufacturing facilities are critical factors influencing cost and final product integrity. Manufacturers focus on design, cutting, assembly, finishing, and quality control. Significant value addition occurs here through aesthetic design differentiation, the integration of complex assembly mechanisms (e.g., RTA), and the incorporation of technological features like cable management systems and integrated charging ports, requiring specialized expertise in both carpentry and electronics.

Midstream activities involve sophisticated distribution and logistics. Given the bulky nature of the product, efficient warehousing, containerization, and transport management are paramount to controlling costs. The market utilizes both direct and indirect distribution channels. Direct channels involve manufacturers selling straight to consumers via proprietary websites or brand showrooms, offering higher profit margins but requiring significant investment in logistics and customer service infrastructure. Indirect channels, which remain dominant, utilize wholesale distributors, large retail chains, and, increasingly, major third-party e-commerce marketplaces (downstream analysis).

The downstream segment is dominated by the retail ecosystem. Offline retail provides customers with a physical touchpoint for examining material quality and scale, which is crucial for large furniture purchases. However, online retail is rapidly gaining dominance due to its reach, convenience, and superior ability to offer variety and customization options. Successful downstream operation hinges on effective marketing, customer support for assembly, and robust post-sale services. The shift toward personalized purchasing experiences means retailers who leverage data analytics and AR visualization tools gain a significant competitive edge in the final consumer interaction phase.

Entertainment Centers and TV Console Market Potential Customers

The primary potential customers for the Entertainment Centers and TV Console Market are households undergoing home renovations, first-time homeowners, and renters looking to optimize their living spaces for entertainment and aesthetics. Demographically, the key purchasing power resides with Millennials and Gen Z, who are early adopters of new display technology and prioritize multi-functional, aesthetically pleasing furniture that complements smaller living spaces. These consumers are technologically savvy and often seek consoles with integrated smart features, minimalist design profiles, and sustainable materials. They are typically accessed through online retail channels and social media marketing focused on interior design inspiration.

A significant secondary customer base is the upscale demographic and high-net-worth individuals who demand custom-built, premium furniture fabricated from exotic or solid hardwoods. These customers prioritize bespoke design, immaculate craftsmanship, and seamless integration with high-end, custom audio-visual systems. This segment is typically targeted through interior design firms, high-end specialty furniture retailers, and architect collaborations. Commercial clients, including the hospitality sector (e.g., five-star hotels upgrading room amenities) and corporate offices (installing integrated media walls for collaboration), represent another key segment, characterized by bulk purchasing, standardized specifications, and high durability requirements.

In essence, potential buyers range from the mass market seeking cost-effective, RTA (Ready-to-Assemble) solutions through large retail chains, to niche markets demanding highly specialized, custom-engineered media furniture. Effective segmentation and targeting require market participants to understand the differing purchasing drivers—price sensitivity, material preference, demand for smart features, and required level of professional service (delivery and assembly). The sustained upgrade cycle of consumer electronics acts as a perpetual trigger for new console purchases across all these customer groups, ensuring continuous market replenishment and growth.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $12.5 Billion |

| Market Forecast in 2033 | $17.3 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IKEA, Ashley Furniture Industries, Sauder Woodworking Co., Williams-Sonoma Inc., Wayfair Inc., Herman Miller, Inc., Bassett Furniture Industries, Hooker Furniture Corporation, La-Z-Boy Incorporated, Bush Industries, Flexsteel Industries, Inter IKEA Systems B.V., Universal Furniture, Coaster Fine Furniture, Palliser Furniture, South Shore Industries, Walker Edison Furniture, NovaSolo, Zinus, Restoration Hardware. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Entertainment Centers and TV Console Market Key Technology Landscape

The technology landscape within the Entertainment Centers and TV Console Market is rapidly moving beyond traditional carpentry towards the integration of sophisticated electronic and digital features. A primary technological focus is on enhancing the utility of the console as a media hub. This includes advanced cable management systems, incorporating modular routing channels and magnetic closures to handle the increasing number of peripherals (soundbars, gaming consoles, set-top boxes) required for modern home entertainment. Furthermore, the standardization of integrated charging solutions, such as embedded Qi wireless charging pads and discreet USB-C ports, is crucial for market competitiveness, responding directly to the consumer demand for clutter-free device charging within the living room environment. Manufacturers are increasingly utilizing computer-aided design (CAD) and simulation software to optimize structural integrity while achieving thinner, more modern profiles, ensuring consoles can safely support ultra-large screen televisions without compromising aesthetics.

Another significant technological advancement lies in the manufacturing process, specifically the adoption of RTA (Ready-to-Assemble) technology paired with patented quick-assembly mechanisms. Techniques such as cam-lock fasteners, specialized click-and-connect systems, and pre-installed hardware significantly reduce the time and complexity required for end-user assembly, addressing a major pain point historically associated with furniture purchases. This reliance on precision engineering not only improves the customer experience but also lowers shipping costs by enabling more compact packaging. Alongside physical design, digital technology plays an essential role in retail, with e-commerce platforms heavily investing in augmented reality (AR) technology, allowing consumers to virtually visualize the console in their space before purchase, minimizing the risk of returns due to size or fit discrepancies.

The most transformative area of technological integration is the introduction of smart furniture concepts. This involves embedding sensors and microprocessors into the consoles themselves. Future iterations may include environmental sensors (monitoring humidity and temperature to protect electronics), integrated ambient lighting systems that synchronize with on-screen content (e.g., Philips Hue synchronization), and smart connectivity that allows the console structure to automatically optimize speaker placement or adjust TV height based on viewing profiles. The material technology landscape is also evolving, with increasing use of durable, scratch-resistant laminates and eco-friendly finishes, enabled by advanced material science. This convergence of hardware engineering, digital retail tools, and smart home technology defines the competitive edge in the modern Entertainment Centers and TV Console Market.

The development of advanced manufacturing techniques, such as 3D printing for specialized internal components and rapid prototyping, allows for quicker iteration of designs catering to evolving TV and audio equipment standards. This agility is vital in a market driven by consumer electronics cycles. Furthermore, environmental technology is becoming integrated, focusing on low-VOC (Volatile Organic Compound) finishes and adhesives to meet stringent indoor air quality standards, a growing concern for residential consumers. The overall technology trajectory pushes consoles from static display furniture to dynamic, adaptive components of the smart home ecosystem.

In summary, the key technology trends are focused on user convenience, including simplified assembly and embedded charging; seamless aesthetic integration, achieved through minimalist design and advanced cable management; and strategic digital commerce tools like AR visualization to facilitate informed purchasing decisions. Market leaders must maintain investments in both material science for sustainability and structural integrity, and electronic engineering for smart home compatibility, ensuring their products meet the functional demands of the modern, connected consumer.

Regional Highlights

- North America: This region is characterized by high consumer spending power and a rapid adoption rate of advanced, large-screen television and sophisticated audio equipment. The demand here is centered around premium, multi-functional entertainment centers and floating consoles with integrated smart features, such as wireless charging and extensive cable management systems. The U.S. and Canada represent mature markets where replacement demand, driven by home renovation trends and the desire for customized interior aesthetics, is the primary growth engine. E-commerce penetration is extremely high, demanding excellence in logistics and customer service, particularly in the ready-to-assemble segment.

- Europe: The European market displays a diverse set of preferences, with Western Europe (Germany, UK, France) prioritizing sustainable and ethically sourced materials (e.g., FSC-certified wood) and minimalist Scandinavian design. Due to smaller average living spaces in dense urban centers, there is a strong preference for space-saving solutions like corner units and floating shelves. Eastern Europe is experiencing faster growth rates driven by modernization of housing stock and increasing consumer electronics consumption. Strict European Union regulations regarding material safety and environmental impact significantly influence product development and manufacturing processes in this region.

- Asia Pacific (APAC): APAC is the fastest-growing region globally, fueled by rapid urbanization, substantial growth in the middle-class population, and mass adoption of affordable, large-screen TVs. China and India are the dominant volume drivers. The market is highly price-sensitive but shows increasing demand for higher-quality, durable furniture as disposable incomes rise. In countries like Japan and South Korea, which lead in smart home technology adoption, there is a growing niche for technologically integrated consoles that interact seamlessly with AI assistants and complex home automation systems. Local manufacturers often dominate due to highly specific logistical and consumer requirements.

- Latin America (LATAM): Growth in LATAM is moderately steady, supported by economic recovery and increasing investment in residential infrastructure. The market is primarily driven by affordability and practicality, with traditional, sturdy TV cabinets remaining popular, though modern designs are gaining traction, particularly in major urban centers like São Paulo and Mexico City. Distribution relies heavily on physical retail and local manufacturing chains, though e-commerce is rapidly expanding its footprint, creating opportunities for international players willing to adapt their supply chains.

- Middle East and Africa (MEA): This region exhibits dual market characteristics. The Middle East (especially GCC countries) is characterized by demand for luxury, large, custom-built entertainment centers that fit expansive home designs and utilize high-end materials. Africa, conversely, is highly price-sensitive, focusing on essential, durable, and entry-level TV stands. Infrastructure development and high-net-worth investments drive the luxury segment, while the increasing availability of affordable electronics catalyzes the basic functionality segment across the broader African continent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Entertainment Centers and TV Console Market.- IKEA

- Ashley Furniture Industries

- Sauder Woodworking Co.

- Williams-Sonoma Inc.

- Wayfair Inc.

- Herman Miller, Inc.

- Bassett Furniture Industries

- Hooker Furniture Corporation

- La-Z-Boy Incorporated

- Bush Industries

- Flexsteel Industries

- Inter IKEA Systems B.V.

- Universal Furniture

- Coaster Fine Furniture

- Palliser Furniture

- South Shore Industries

- Walker Edison Furniture

- NovaSolo

- Zinus

- Restoration Hardware

Frequently Asked Questions

Analyze common user questions about the Entertainment Centers and TV Console market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the market growth for entertainment centers?

Market growth is primarily driven by the increasing size and widespread adoption of high-definition televisions and streaming services, which necessitate robust, aesthetically pleasing, and functionally integrated furniture solutions for optimized home viewing and organization.

What materials are most popular for modern TV consoles?

While engineered wood (MDF/particleboard) remains popular for cost-effectiveness, high-growth trends indicate increasing consumer preference for sustainable materials, solid wood (oak, walnut), and combinations of metal and glass for minimalist, contemporary designs.

How is technology influencing the design of new entertainment centers?

Technology is driving the integration of smart features, including built-in wireless charging pads, advanced cable management systems, ambient lighting controls, and IoT compatibility, transforming consoles into central hubs for smart home devices rather than just support structures.

Which distribution channel is experiencing the highest growth?

Online retail (e-commerce) is experiencing the highest growth, driven by consumer demand for wide product variety, competitive pricing, virtual visualization tools (AR), and the convenience of direct home delivery, despite the logistical challenges associated with bulky items.

What are the key design trends for TV consoles in urban living spaces?

In high-density urban areas, the key design trends favor space-saving, minimalist solutions such as floating consoles, wall-mounted units, and modular systems that maximize floor space and integrate seamlessly into compact apartment layouts.

What are the primary factors consumers consider when purchasing a new TV console?

Consumers prioritize four key factors: suitability for the specific TV size (load-bearing and width), compatibility with existing interior design aesthetics, effective cable management capabilities to maintain a clean look, and the quality/durability of the construction materials.

Are Ready-to-Assemble (RTA) consoles dominating the market?

RTA consoles hold a significant market share, particularly in the mid-range and budget segments, due to lower manufacturing and shipping costs. Their popularity is further boosted by technological advancements that simplify and speed up the assembly process for end-users.

How does sustainability impact purchasing decisions in this market?

Sustainability is an increasingly important factor, particularly in North America and Europe. Consumers are willing to pay a premium for consoles made from reclaimed wood, recycled materials, or those certified by organizations like the Forest Stewardship Council (FSC), reflecting growing environmental consciousness.

What role do gaming consoles play in the demand for entertainment centers?

The proliferation of gaming consoles (e.g., PlayStation, Xbox) significantly contributes to demand, requiring specialized consoles with adequate ventilation, specific storage dimensions for hardware and accessories, and convenient access points for frequent connectivity adjustments.

What challenges do manufacturers face regarding international shipping of these products?

Manufacturers face challenges related to the high volume and weight of furniture, which drives up freight costs. To mitigate this, they are focusing on engineering complex, sturdy RTA designs that can be flat-packed into smaller, more manageable boxes for efficient containerization and reduced damage during transit.

How do floating consoles benefit small apartments?

Floating consoles, which are mounted directly to the wall, maximize space efficiency by freeing up floor area, creating a sense of openness, and simplifying floor cleaning. They offer a modern, sleek aesthetic ideal for compact urban living environments.

What distinguishes a media chest from a standard TV console?

A media chest is typically taller and narrower than a standard console, resembling a dresser, offering deep drawers for vertical storage of media, clothes, or accessories, and is often used in bedrooms or smaller dedicated media spaces where height is preferred over width.

What is the significance of the commercial application segment?

The commercial segment, primarily hospitality and corporate, demands durable, highly standardized, and often bulk-ordered units with specific security and wiring features. This segment ensures consistent revenue and drives innovation in robust, high-wear materials suitable for frequent public use.

How are furniture companies utilizing Augmented Reality (AR) in sales?

Furniture companies use AR to enable customers to overlay 3D models of potential entertainment centers onto their actual room environment via their smartphones, ensuring correct sizing, spatial fit, and visual compatibility with existing decor before making a purchase commitment.

What are the projections for demand in the Asia Pacific region?

The Asia Pacific region is projected to witness the highest growth rate, driven by significant increases in disposable income, rapid urbanization leading to new residential construction, and the high rate of first-time adoption of modern electronic entertainment systems among the expanding middle class.

What is the current trend regarding the height of entertainment centers?

The trend favors lower-profile, minimalist consoles that align with the growing preference for large-screen TVs, ensuring the center of the screen remains at an optimal, ergonomic viewing height when seated, consistent with modern interior design principles.

Why is ventilation a key design consideration for modern consoles?

Modern gaming consoles and media players generate significant heat. Effective ventilation, achieved through strategic open shelving or integrated fans, is essential in console design to prevent electronic overheating, prolong component lifespan, and maintain optimal performance of expensive equipment.

How does modular design affect the consumer market?

Modular design offers consumers maximum flexibility, allowing them to customize the size, configuration, and storage elements of their entertainment system to perfectly fit their specific room dimensions, evolving electronics collection, and personal aesthetic requirements.

What is the market outlook for luxury, custom-built entertainment centers?

The market outlook for luxury, custom-built centers remains strong, particularly in affluent regions and the hospitality sector, driven by demand for bespoke sizing, premium materials (solid exotic wood, custom metal finishes), and professional installation for seamless integration of high-end audio-visual systems.

What are the differences between solid wood and engineered wood consoles?

Solid wood offers superior durability, longevity, and natural aesthetic appeal but comes at a higher cost. Engineered wood (MDF/Plywood) is more affordable, resistant to warping due to humidity, and offers greater uniformity for mass production and sophisticated finishing techniques.

What is the primary restraint affecting profitability for manufacturers?

The primary restraint is the volatility and rapid fluctuation of raw material costs, particularly global lumber and composite board prices, which significantly impacts production expenses and requires sophisticated supply chain hedging strategies to maintain stable profit margins.

How is the rise of virtual reality (VR) impacting console design?

The rise of VR necessitates consoles that can store and power VR peripherals and headsets, often requiring specific drawers or shelving units with integrated charging capabilities, ensuring all components of the immersive entertainment system are neatly organized and ready for use.

What are the growth opportunities in developing markets like Africa?

Growth opportunities in developing African markets are concentrated in the entry-level segment, focused on basic, durable, and highly affordable TV stands and small cabinets, catering to the first-time purchasers of consumer electronics.

Why is cable management becoming a non-negotiable feature?

Cable management has become non-negotiable because modern entertainment setups involve numerous devices (TV, sound system, gaming, streaming boxes), creating clutter. Consumers demand consoles with integrated routing channels, rear cutouts, and concealed compartments to maintain a clean, organized, and aesthetically pleasing living space.

How do customer return rates affect the e-commerce segment?

High return rates due to mismatched size or material expectations significantly erode profitability in the e-commerce furniture segment. Companies mitigate this through the use of high-fidelity product photography, accurate dimensional specifications, and robust AR visualization tools.

Which aesthetic style is currently most popular globally?

While regional preferences vary, the global market currently shows a strong preference for the Modern/Contemporary and Mid-Century Modern aesthetic styles, characterized by clean lines, natural wood finishes, and minimalist, functional forms.

How are environmental concerns shaping the market?

Environmental concerns are driving manufacturers to adopt certified sustainable wood, minimize chemical finishes (low-VOC), and invest in closed-loop manufacturing processes, creating a competitive advantage for brands that demonstrate clear ecological commitment.

What are the expectations for AI's influence on console design within the next five years?

Within the next five years, AI is expected to significantly influence console design by enabling more sophisticated customization tools for consumers, optimizing complex assembly instructions via interactive digital guides, and streamlining manufacturer inventory based on predictive regional demand models.

What differentiates a floating console from a standard wall-mounted unit?

While often used interchangeably, a floating console typically refers to a low-profile, long cabinet designed purely for media and display, whereas a wall-mounted unit can encompass larger, often multi-shelf components that form a complete wall system, both offering the benefit of zero floor footprint.

How are furniture manufacturers adapting to accommodate ultra-thin OLED and QLED screens?

Manufacturers are adapting by designing consoles that emphasize stability, minimizing bulk, and integrating features like built-in LED lighting systems that complement the sleek profiles of modern screens, moving away from deep cabinets required by older CRT or plasma TVs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager