Environmental and Social Consulting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436212 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Environmental and Social Consulting Market Size

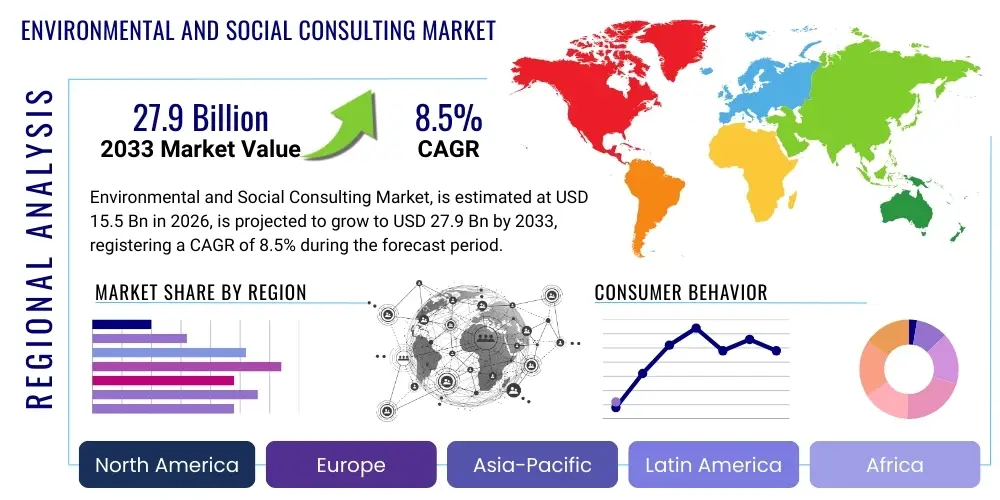

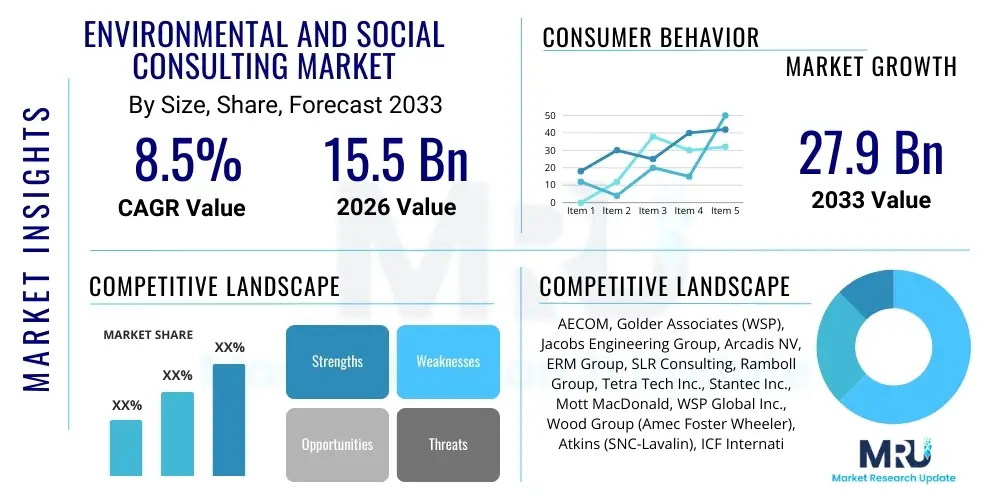

The Environmental and Social Consulting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $15.5 Billion USD in 2026 and is projected to reach $27.9 Billion USD by the end of the forecast period in 2033. This substantial growth is fundamentally driven by increasing global regulatory pressure, heightened corporate focus on Environmental, Social, and Governance (ESG) criteria, and the urgent need for sustainable infrastructure development worldwide. The consulting services play a crucial role in ensuring compliance, managing risk, and optimizing resource efficiency across diverse industries, making them indispensable for modern corporate operations aiming for long-term viability and social license to operate.

Environmental and Social Consulting Market introduction

The Environmental and Social Consulting (E&SC) Market encompasses specialized advisory services provided to organizations across the public and private sectors to address complex environmental and social challenges, ensure regulatory compliance, and promote sustainable practices. These services include environmental impact assessments (EIAs), social impact assessments (SIAs), regulatory permitting support, climate change strategy development, waste management planning, resource efficiency audits, and comprehensive ESG reporting frameworks. The market acts as a critical intermediary, translating intricate global and local environmental standards into actionable business strategies, thereby mitigating risks associated with non-compliance, reputational damage, and operational inefficiencies. Furthermore, E&SC firms help clients navigate the rapidly evolving landscape of sustainability reporting and mandatory due diligence requirements.

Major applications of environmental and social consulting span highly regulated sectors such as energy, infrastructure, manufacturing, chemicals, and mining, where large-scale projects necessitate rigorous impact analysis and stakeholder engagement. In the energy sector, consultants assist with renewable energy project development and decommissioning planning for fossil fuel assets. Within infrastructure, services are critical for ensuring compliance with land use and biodiversity standards during construction. The core benefits derived by clients include enhanced operational resilience, access to sustainable finance opportunities linked to ESG performance, improved public perception and stakeholder trust, and strategic alignment with global initiatives like the Paris Agreement and the Sustainable Development Goals (SDGs). These advisory services are increasingly transitioning from purely compliance-driven functions to strategic value drivers.

The market is primarily driven by the confluence of stringent governmental regulations, particularly concerning carbon emissions, pollution control, and biodiversity loss, coupled with overwhelming investor and consumer demand for corporate transparency and accountability on social issues. The adoption of mandatory climate-related financial disclosures (e.g., TCFD, CSRD) significantly pushes corporate entities to seek expert external assistance for data collection, analysis, and assurance. Moreover, the increasing frequency and intensity of extreme weather events underscore the necessity for robust climate risk and adaptation consulting, further bolstering the demand for specialized environmental and social expertise globally. The need to implement circular economy models and manage complex supply chain ethics also acts as a primary catalyst for market expansion.

Environmental and Social Consulting Market Executive Summary

The Environmental and Social Consulting Market exhibits robust growth, characterized by significant shifts towards technology-enabled solutions and integration of holistic ESG strategies. Business trends highlight a strong consolidation among major players seeking to expand geographical reach and service specialization, particularly in digital environmental solutions such as remote sensing, advanced data analytics, and Artificial Intelligence (AI) for real-time monitoring and predictive modeling. Furthermore, there is a pronounced move towards advisory services focused on transition risk management, specifically assisting clients in decarbonization pathways and developing credible net-zero commitments. The shift from post-facto compliance checking to upfront strategic sustainability planning defines the contemporary business landscape, demanding consultants act as integrated partners rather than external auditors. The market is highly competitive, emphasizing expertise in emerging regulatory frameworks and digital competence.

Regionally, North America and Europe maintain dominance, driven by mature regulatory environments, high corporate awareness of climate risks, and substantial investment in sustainable infrastructure. However, the Asia Pacific (APAC) region is poised for the highest growth trajectory due to rapid urbanization, escalating pollution levels, and increasing governmental adoption of comprehensive environmental protection policies, particularly in China and India. Latin America and the Middle East & Africa (MEA) are also experiencing accelerated growth, largely fueled by large-scale mining, oil and gas projects requiring stringent environmental impact assessments (EIAs), and emerging requirements for resource management consulting related to water scarcity and energy transition projects. Globalization of supply chains necessitates consistent cross-border environmental due diligence, stimulating global demand.

Segment trends reveal that the climate change and sustainability segment is growing fastest, superseding traditional core environmental segments like regulatory compliance and permitting. This growth is linked directly to global corporate commitments on net-zero emissions and the integration of Task Force on Climate-related Financial Disclosures (TCFD) into mainstream reporting. Demand for social consulting services, including human rights due diligence, stakeholder engagement, and community development planning, is also experiencing rapid acceleration, reflecting the 'S' component of ESG gaining prominence. By service area, advisory services consistently outperform analytical and technical services, as corporations prioritize strategic guidance for long-term sustainability transformation and value creation over purely technical assessment work.

AI Impact Analysis on Environmental and Social Consulting Market

Common user questions regarding AI's impact on the Environmental and Social Consulting Market typically revolve around efficiency gains, data accuracy, job displacement, and the ethical implications of using automated systems for sensitive social assessments. Users frequently inquire about how AI can enhance the speed and scope of environmental impact assessments (EIAs), specifically asking whether AI-driven predictive models can provide more accurate forecasts of climate risks and resource degradation than traditional methodologies. Concerns often focus on the reliability and validation of AI algorithms in complex ecological systems and how consultants can maintain professional judgment and ethical standards while leveraging machine learning for stakeholder analysis. The overarching expectation is that AI will automate routine data processing and monitoring tasks, freeing consultants to focus on high-value strategic decision-making and client engagement, thereby transforming the consultancy delivery model rather than eliminating the need for human expertise.

The deployment of Artificial Intelligence, including machine learning algorithms and advanced data processing capabilities, fundamentally reshapes the environmental and social consulting landscape by enabling previously impossible levels of data ingestion, analysis, and visualization. AI is rapidly being adopted for continuous environmental monitoring, utilizing satellite imagery, IoT sensor data, and geospatial information to detect anomalies, track pollution plumes, and monitor biodiversity changes in real-time. This enhanced monitoring capability allows E&SC firms to provide proactive risk management advice, moving away from periodic site visits toward dynamic, predictive assessments. Furthermore, AI tools are streamlining the arduous process of regulatory compliance reporting, automatically flagging deviations from standards and generating customized reporting formats required by multiple jurisdictions, significantly reducing time and resource expenditure for clients.

AI's influence extends deeply into social consulting, particularly in advanced stakeholder mapping and sentiment analysis. Machine learning algorithms can process vast amounts of public commentary, social media data, and local news archives to accurately gauge community sentiment regarding large-scale projects, allowing consultants to identify potential social risks and tailor engagement strategies more effectively. In the context of climate risk, AI models simulate complex climate scenarios to provide granular, location-specific vulnerability assessments, which is crucial for infrastructure resilience planning and TCFD-aligned financial disclosures. While AI optimizes data handling and technical analysis, the core role of the consultant shifts towards interpreting these sophisticated outputs, integrating them into strategic advice, and facilitating human-centric dialogue with affected stakeholders and regulatory bodies.

- AI enhances predictive environmental modeling for climate risk and resource depletion forecasts.

- Machine learning accelerates the analysis of complex regulatory texts, ensuring rapid and accurate compliance checks across jurisdictions.

- Automated satellite and drone imagery analysis facilitates real-time environmental monitoring, detecting pollution incidents and land-use changes instantaneously.

- AI algorithms improve the efficiency and accuracy of biodiversity mapping and ecological restoration site prioritization.

- Natural Language Processing (NLP) tools streamline the compilation and analysis of extensive ESG disclosure reports and corporate sustainability documentation.

- Predictive maintenance schedules for environmental control systems (e.g., wastewater treatment, air filtration) are optimized using AI-driven operational data.

- Advanced geospatial analytics powered by AI support site selection for large infrastructure projects, minimizing environmental and social footprint risks.

- AI-based stakeholder sentiment analysis provides nuanced, large-scale feedback for social impact assessments and community engagement strategies.

- Intelligent systems automate the aggregation and normalization of vast amounts of sensor data from IoT devices deployed in field monitoring applications.

- AI assists in developing customized decarbonization pathways by simulating cost-benefit analyses of various energy transition technologies and operational changes.

- Data integrity and transparency in ESG reporting are bolstered by AI-enabled automated audit trails and data verification processes.

- Risk assessment models leverage machine learning to identify latent social vulnerabilities within supply chains, particularly concerning forced labor and human rights abuses.

- Digital twins of industrial facilities and ecological systems are built and simulated using AI to test the efficacy of various mitigation and adaptation measures before implementation.

- AI supports the development of circular economy strategies by optimizing material flow tracking and identifying resource reuse opportunities at scale.

- The efficiency of mandatory due diligence processes, particularly cross-border supplier checks for environmental violations, is dramatically increased by AI tools.

DRO & Impact Forces Of Environmental and Social Consulting Market

The Environmental and Social Consulting Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the core Impact Forces shaping its direction. Key drivers include the global mandate for ESG integration in finance and corporate strategy, stringent regulatory enforcement across major economies, and the increasing corporate recognition that climate change represents a material financial risk. These drivers create a non-negotiable demand for specialized external expertise to navigate complexity and achieve compliance while maintaining competitiveness. Conversely, the market faces significant restraints, primarily stemming from the high upfront costs associated with sophisticated consulting engagements, the pervasive challenge of data standardization and quality across diverse client operations, and a global shortage of highly specialized environmental data scientists capable of bridging technical expertise with strategic business insight. This supply-demand imbalance in high-skill consulting personnel limits the scalability of service delivery, particularly for niche technological areas.

Opportunities for market expansion are substantial and primarily center on the digital transformation of services. The shift toward advisory services focused on resilience and adaptation, rather than solely mitigation, opens new revenue streams, especially in infrastructure planning and financial sector risk modeling. The growth of emerging markets, coupled with global supply chain mandates requiring environmental and social due diligence (e.g., German Supply Chain Act, EU Green Deal), necessitates expansive geographical coverage and localized expertise, creating avenues for specialized regional firms and global expansion for established players. Furthermore, the burgeoning demand for verifiable carbon accounting, biodiversity footprint analysis, and impact investment verification presents fertile ground for new service development. The integration of technology, particularly geospatial analysis and machine learning, offers a transformative opportunity to deliver services more efficiently and accurately, moving beyond traditional report generation to providing real-time strategic monitoring platforms.

The impact forces are fundamentally shifting the market structure. Regulatory tightening acts as a constant upward pressure (Driver), forcing companies to invest in consulting regardless of immediate internal capabilities. This regulatory environment is often amplified by investor activism and shareholder resolutions, which act as a powerful supplementary force. However, economic downturns or regulatory uncertainty (Restraints) can temporarily curb discretionary spending on long-term strategic sustainability projects. The inherent complexity of global environmental challenges (e.g., climate transition, water stress) and the corresponding need for highly specialized, often multi-disciplinary consulting teams ensure that demand remains structurally robust (Opportunity). Ultimately, the core impact force driving long-term market valuation is the realization that environmental and social risks are intrinsically linked to financial performance and corporate resilience, thereby embedding E&SC services into fundamental business strategy rather than peripheral compliance.

Segmentation Analysis

The Environmental and Social Consulting Market is typically segmented based on service type, client industry, and geographical region, reflecting the specialized needs of different market verticals and regulatory environments. This segmentation allows consulting firms to tailor their offerings precisely, from broad strategic advice to highly technical environmental monitoring and analytical services. The service type segmentation differentiates between core environmental services (such as site assessment, remediation, and air quality management) and strategic sustainability services (including ESG strategy, climate risk, and circular economy design). Industry segmentation is crucial because regulatory requirements, social risks, and environmental impacts vary significantly between sectors like Mining, Oil & Gas, Manufacturing, and the Public Sector. The complexity and scale of projects in the infrastructure and energy sectors often drive the highest demand for integrated environmental and social consulting packages.

- By Service Type:

- Climate Change and Sustainability Services

- Environmental Health and Safety (EHS) Management

- Environmental Impact Assessment (EIA) and Permitting

- Site Assessment and Remediation Services

- Waste Management Consulting

- Water and Resource Management Consulting

- Social Impact Assessment (SIA) and Stakeholder Engagement

- Regulatory Compliance and Due Diligence

- Air Quality Consulting

- Noise and Vibration Consulting

- Ecosystem Services and Biodiversity Assessment

- ESG Strategy and Reporting

- By Client Industry:

- Energy and Utilities (Oil & Gas, Power Generation, Renewables)

- Manufacturing and Industrial (Chemicals, Automotive, Heavy Industry)

- Infrastructure and Development (Transportation, Real Estate, Urban Planning)

- Mining and Natural Resources

- Government and Public Sector

- Financial Services and Insurance

- Water and Wastewater Management

- Construction and Engineering

- Technology and Telecommunications

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (U.K., Germany, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Environmental and Social Consulting Market

The value chain for the Environmental and Social Consulting Market starts with upstream activities involving talent acquisition, knowledge generation, and intellectual property development, particularly in creating proprietary methodologies, advanced data models, and specialized software tools (e.g., carbon accounting platforms). Upstream analysis also involves maintaining essential accreditations, certifications (like ISO standards), and strong relationships with regulatory bodies, ensuring that consultants possess the most current knowledge base required for complex regulatory advice. The value derived at this stage hinges on the firm's ability to invest in continuous training and technological innovation, distinguishing their service offering through superior data analytical capabilities and deep sectoral expertise. Firms that excel here often acquire small, specialized technology providers to bolster their internal capabilities.

The core midstream activities involve the delivery of consulting services, encompassing project management, data collection (field sampling, surveys, remote sensing), technical analysis, stakeholder consultation, and report generation. The quality of execution is paramount at this stage, focusing on rigorous methodologies, transparency in data handling, and effective communication of complex scientific and social findings to diverse client stakeholders. Distribution channels are predominantly direct, characterized by long-term strategic contracts and framework agreements with major corporate and governmental entities. Indirect channels, although less common, involve partnerships with law firms, private equity funds, and engineering procurement and construction (EPC) companies, where E&SC services are embedded within a larger project mandate. The relationship-driven nature of the business necessitates senior consultant involvement throughout the delivery phase.

Downstream analysis focuses on the impact and post-delivery success, which includes client support for implementing recommendations, performance monitoring against sustainability targets, and providing assurance services for public disclosure (e.g., verifying ESG reports). Value is captured downstream by establishing lasting client relationships built on trust and demonstrating quantifiable improvements in environmental performance, risk reduction, or social outcomes. Effective downstream engagement often leads to recurring revenue through long-term managed services, monitoring contracts, and ongoing strategic advisory roles. The shift towards outcome-based consulting models, where fees are partially linked to achieving predetermined sustainability goals, is a growing trend in the downstream segment, reinforcing the consultant's vested interest in the client's long-term success and cementing their position as essential strategic partners.

Environmental and Social Consulting Market Potential Customers

Potential customers for Environmental and Social Consulting services are expansive, ranging from large multinational corporations mandated by investors to report on ESG performance, to governmental agencies responsible for infrastructure planning and regulatory enforcement, and smaller private entities requiring initial permitting for operations. The primary end-users are those operating in capital-intensive sectors with significant environmental footprints or complex social licensing requirements, such as the Oil & Gas, Mining, and Heavy Manufacturing industries. These customers require comprehensive services spanning the entire project lifecycle, from initial exploration and impact assessment to operational compliance, remediation, and eventual decommissioning. Financial institutions, including banks and asset managers, are rapidly becoming major consumers, seeking expertise to conduct climate risk stress tests on their portfolios and verify the sustainability credentials of their investment products to meet increasing regulatory requirements like the EU Sustainable Finance Disclosure Regulation (SFDR).

Government and Public Sector bodies, at local, regional, and national levels, represent a crucial customer segment, particularly for infrastructure planning (roads, utilities, public transport) and regulatory development consulting. These entities often contract external consultants for strategic environmental assessment (SEA) of policy plans, development of climate action plans, and technical guidance on implementing national environmental laws. Furthermore, utilities and water management companies, facing intensified scrutiny over resource scarcity and quality, regularly engage consultants for water balance studies, pollution control strategies, and regulatory permitting for infrastructure upgrades. The necessity of maintaining public services while adhering to strict environmental standards makes these organizations steady consumers of E&SC expertise.

The burgeoning sectors of Renewable Energy and Sustainable Technology are also core potential customers. Developers of solar farms, wind power projects, and battery manufacturing facilities require specialized consulting for site selection, biodiversity impact mitigation, and navigating complex permitting processes related to land use and interconnection. Finally, companies involved in complex global supply chains, across sectors like apparel, electronics, and food and beverage, are increasingly turning to consultants to manage social risks, human rights due diligence, and ethical sourcing compliance under international frameworks, broadening the customer base beyond traditional heavy industry into consumer-facing markets where reputational risk is paramount.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $15.5 Billion USD |

| Market Forecast in 2033 | $27.9 Billion USD |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AECOM, Golder Associates (WSP), Jacobs Engineering Group, Arcadis NV, ERM Group, SLR Consulting, Ramboll Group, Tetra Tech Inc., Stantec Inc., Mott MacDonald, WSP Global Inc., Wood Group (Amec Foster Wheeler), Atkins (SNC-Lavalin), ICF International, Antea Group, Trinity Consultants, Advisian (WorleyParsons), Fichtner Group, Environmental Resources Management (ERM), Cardno Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Environmental and Social Consulting Market Key Technology Landscape

The technological landscape of the Environmental and Social Consulting market is rapidly evolving, driven by the need for enhanced efficiency, improved data accuracy, and the capability to manage complex, large-scale environmental datasets. Geographic Information Systems (GIS) and remote sensing technology form the foundation of modern environmental data acquisition, enabling consultants to conduct detailed land-use analysis, monitor ecological changes, and map risks over vast areas without extensive physical fieldwork. This technology is critical for pre-feasibility studies, environmental impact assessments, and remediation site monitoring, providing verifiable visual and spatial data that significantly strengthens the credibility of consulting reports. The integration of high-resolution satellite imagery, coupled with drone-based aerial surveys, allows for rapid response mapping and detailed topographical analysis, moving beyond static data to dynamic, multi-temporal insights into environmental degradation or restoration progress.

The proliferation of Internet of Things (IoT) sensors and smart monitoring devices is revolutionizing data collection, particularly in areas like air quality, water resource management, and industrial emissions control. These sensors provide continuous, real-time data streams, shifting the consulting paradigm from retrospective compliance checking to proactive performance management. This constant stream of data feeds into centralized data lakes, where sophisticated analytical platforms, often utilizing machine learning, process information to detect anomalies, predict equipment failures (e.g., in wastewater treatment), and optimize resource consumption. For social consulting, digital platforms facilitate secure, structured communication and consultation with stakeholders, allowing for systematic capture and analysis of community feedback, streamlining the often resource-intensive process of social impact assessment and ongoing public engagement.

Furthermore, the increased reliance on advanced modeling and simulation tools, including Computational Fluid Dynamics (CFD) for pollution dispersion modeling and complex climate modeling software, is critical for strategic advisory services. These technologies allow consultants to simulate the effects of various operational scenarios or climate change variables on a client’s assets or surrounding environment, providing the evidence base for robust adaptation strategies. Blockchain technology is also emerging, primarily in supply chain environmental tracking and carbon credit verification, offering immutable records that enhance transparency and trust in sustainability claims. The blend of real-time monitoring (IoT), spatial intelligence (GIS), and predictive analysis (AI/ML) is transforming consulting output from static reports into dynamic, integrated digital dashboards, empowering clients with actionable intelligence for daily decision-making and long-term strategic planning.

Regional Highlights

- North America: This region holds a significant market share, characterized by high regulatory maturity and sophisticated corporate governance demanding comprehensive ESG reporting. The United States market is driven by state-level climate initiatives and federal regulatory actions focusing on infrastructure resilience, PFAS remediation, and stricter controls over methane emissions. Corporate demand is notably strong from the financial sector, where climate risk disclosure and sustainable finance mandates are rapidly institutionalizing. Canada shows robust demand, particularly in the oil sands and mining sectors, requiring extensive environmental assessment and indigenous engagement consulting. The reliance on advanced technologies like digital remediation and sophisticated data analytics is higher here than in other regions, positioning North America at the forefront of technological integration in E&SC.

- Europe: Europe is the fastest-growing market in terms of mandatory ESG and sustainability services, propelled by the ambitious objectives of the European Green Deal, the EU Taxonomy, and the Corporate Sustainability Reporting Directive (CSRD). These regulations impose mandatory due diligence across value chains and require detailed, verifiable reporting, creating an immediate and vast market for strategic advisory services focused on transition planning and compliance assurance. The demand for biodiversity consulting, circular economy modeling, and human rights due diligence (driven by local supply chain acts) is particularly high. Countries like Germany, France, and the UK are global leaders in mandating transparency, forcing even small- and medium-sized enterprises (SMEs) to engage environmental and social consultants to remain competitive and compliant within the supply chain.

- Asia Pacific (APAC): APAC is projected to exhibit the highest CAGR due to rapid industrialization, urbanization, and a growing governmental commitment to addressing severe environmental challenges, particularly air and water pollution, and climate change vulnerability. Countries like China and India are enacting more rigorous environmental protection laws and enforcement mechanisms, specifically targeting high-polluting industries. The infrastructure boom across Southeast Asia necessitates massive environmental impact assessments (EIAs) for large projects (e.g., Belt and Road Initiative infrastructure). While regulatory enforcement maturity varies, the region's increasing adoption of sustainable finance principles and the necessity for global companies operating there to meet international ESG standards are key growth stimulants, particularly for localized expertise and capacity building services.

- Latin America (LATAM): The market in Latin America is strongly influenced by natural resource exploitation, particularly mining, oil and gas, and large-scale agriculture, making environmental impact assessment, permitting, and social consulting critical components of project development. The region faces significant social challenges related to indigenous rights, land use conflicts, and biodiversity conservation, driving high demand for complex social performance consulting and stakeholder engagement services. Regulatory frameworks are evolving, often influenced by international lending standards (e.g., World Bank IFC Performance Standards), which mandate strict environmental and social safeguards for financing. Brazil, Mexico, and Chile are the dominant markets, where consultants are crucial in navigating political and regulatory complexities associated with resource extraction and infrastructure development.

- Middle East and Africa (MEA): Growth in the MEA region is driven by large-scale government-led diversification projects, often focusing on sustainable infrastructure, renewable energy (solar and green hydrogen), and managing the impacts of climate change, particularly water scarcity. In the Middle East, mega-projects and "Vision" strategies (e.g., Saudi Vision 2030) integrate sustainability and ESG goals, generating demand for high-end strategic consulting and sophisticated environmental technology implementation. In Africa, the market is heterogeneous, with demand largely concentrated around major mining projects, infrastructure development, and managing biodiversity offset requirements. Consultants in MEA specialize in translating international best practices into locally appropriate solutions, often dealing with extreme environmental conditions and unique social governance structures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Environmental and Social Consulting Market.- AECOM

- Golder Associates (WSP)

- Jacobs Engineering Group

- Arcadis NV

- ERM Group

- SLR Consulting

- Ramboll Group

- Tetra Tech Inc.

- Stantec Inc.

- Mott MacDonald

- WSP Global Inc.

- Wood Group (Amec Foster Wheeler)

- Atkins (SNC-Lavalin)

- ICF International

- Antea Group

- Trinity Consultants

- Advisian (WorleyParsons)

- Fichtner Group

- Environmental Resources Management (ERM)

- Cardno Limited

Frequently Asked Questions

Analyze common user questions about the Environmental and Social Consulting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Environmental and Social Consulting Market?

The primary drivers are stringent global regulatory mandates, particularly those related to climate change disclosure (e.g., TCFD, CSRD), high investor pressure for corporate ESG performance transparency, and the increasing corporate recognition that effective management of environmental and social risks is essential for long-term financial resilience and access to capital. The necessity for strategic guidance on achieving corporate net-zero targets also significantly fuels demand.

How is digital technology, specifically AI and IoT, transforming the delivery of environmental consulting services?

AI and IoT enable real-time, continuous environmental monitoring and data collection, replacing traditional periodic assessments. AI algorithms enhance predictive modeling for climate risks, optimize resource management efficiency, and automate compliance reporting processes. This transformation allows consultants to shift focus from data gathering to providing strategic, proactive advisory services based on dynamic, verifiable insights.

Which geographical region exhibits the highest growth potential for Environmental and Social Consulting?

The Asia Pacific (APAC) region is projected to show the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by rapid industrialization, increasing urbanization, escalating pollution challenges, and the introduction of increasingly stringent national environmental protection policies, particularly in major economies like China and India seeking sustainable development pathways.

What is the difference between traditional Environmental Consulting and modern Sustainability/ESG Consulting?

Traditional Environmental Consulting typically focuses on regulatory compliance, permitting, and site-specific risks (e.g., pollution control, remediation). Modern Sustainability/ESG Consulting is broader and more strategic, focusing on integrating environmental and social factors (climate strategy, human rights, governance) into core business models, aiming for long-term value creation, stakeholder alignment, and comprehensive non-financial risk management and reporting.

What specific social consulting services are seeing the strongest demand currently?

The strongest demand is for Human Rights Due Diligence (HRDD) across global supply chains, mandated by evolving legislation in Europe, alongside sophisticated Stakeholder Engagement and Social Impact Assessment (SIA) services required for large infrastructure and resource extraction projects. Furthermore, consulting on developing robust Diversity, Equity, and Inclusion (DEI) strategies and assuring ethical labor practices are areas of accelerated growth under the 'S' component of ESG.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager