Environmental Liability Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431409 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Environmental Liability Insurance Market Size

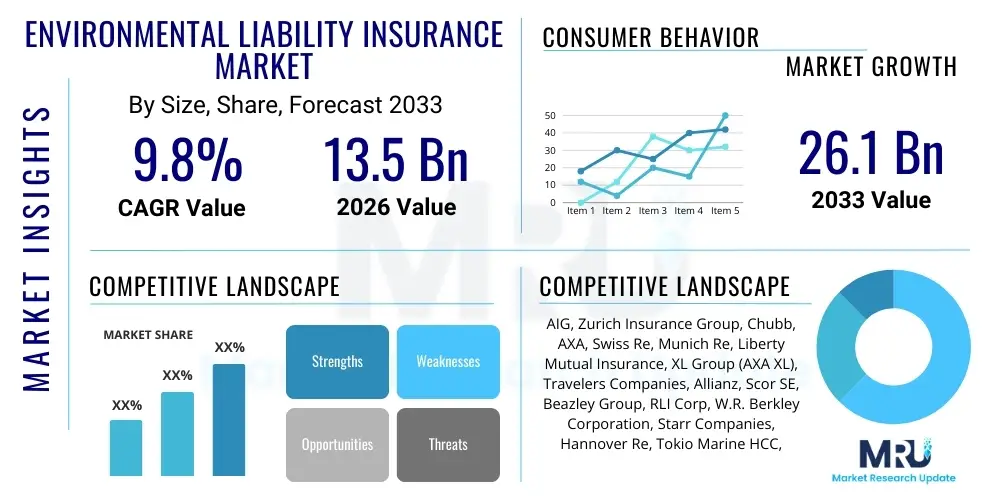

The Environmental Liability Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 13.5 Billion in 2026 and is projected to reach USD 26.1 Billion by the end of the forecast period in 2033.

Environmental Liability Insurance Market introduction

The Environmental Liability Insurance (ELI) Market encompasses insurance products designed to protect businesses against financial losses arising from pollution events, contamination clean-up costs, bodily injury, and property damage caused by environmental hazards. These policies are critical for mitigating risks associated with historic or sudden pollution incidents, non-compliance with increasingly stringent global environmental regulations, and third-party claims. The core product provides specialized coverage extending beyond standard general liability policies, which typically exclude pollution-related damages. Major applications span high-risk sectors such as manufacturing, energy, chemicals, and construction, where the potential for environmental impact is significant. The principal benefit of ELI is financial stability, allowing organizations to manage unforeseen environmental remediation expenses and legal defense costs without jeopardizing core operations.

Driving factors propelling market expansion include the global shift towards stricter environmental governance, spearheaded by initiatives focused on corporate sustainability and Environmental, Social, and Governance (ESG) reporting requirements. Governments worldwide are imposing higher penalties for non-compliance and expanding the scope of responsible parties for clean-up, increasing the necessity for robust insurance solutions. Furthermore, heightened public awareness and activism regarding environmental damage are leading to an increase in third-party litigation against corporations. This regulatory and societal pressure is forcing businesses, particularly those engaged in high-risk activities like resource extraction or waste management, to seek comprehensive ELI coverage.

The market also benefits from innovative product offerings, such as Contractors Pollution Liability (CPL) tailored for construction and remediation firms, and Site-Specific Pollution Legal Liability (PLL) policies for owned or operated properties. These specialized products address the unique exposures faced by different industries, making insurance more accessible and relevant. As climate change increases the frequency and severity of natural disasters, the potential for pollution events triggered by extreme weather—such as flooding releasing contaminants—further stimulates demand for robust environmental risk transfer mechanisms. This sophisticated risk landscape underscores the essential role ELI plays in modern corporate risk management.

Environmental Liability Insurance Market Executive Summary

The Environmental Liability Insurance (ELI) Market is currently defined by robust expansion driven primarily by escalating global regulatory complexity and a powerful surge in corporate commitment to ESG standards. Business trends highlight a strong movement toward integrated risk solutions, where traditional property and casualty insurers are partnering with specialized underwriters to offer comprehensive environmental risk management packages. Insurers are leveraging advanced data analytics to model complex contamination risks, moving beyond traditional actuarial methods. A key trend involves increased demand for contingent and non-owned disposal site liability coverage, reflecting the complexities of modern supply chains and outsourcing practices. Furthermore, the growth of renewable energy projects, while environmentally positive, introduces new liability profiles related to construction, waste disposal (e.g., solar panels, batteries), necessitating specialized ELI products.

Regional trends indicate North America maintains market dominance due to highly established regulatory frameworks like CERCLA (Superfund) and robust litigation environments. Europe is witnessing accelerated growth, fueled by the EU's Green Deal and stringent national environmental directives, requiring companies to demonstrate financial provision for potential environmental harm. The Asia Pacific (APAC) region is emerging as the fastest-growing market, spurred by rapid industrialization, large-scale infrastructure development, and the increasing implementation of Western-style environmental liability statutes in countries like China and India. These regional dynamics necessitate customized policy wording and local regulatory expertise from global insurance providers.

Segmentation trends reveal that Site-Specific Pollution Legal Liability (PLL) remains the largest segment by premium volume, reflecting the need for long-term protection for fixed industrial sites. However, Contractors Pollution Liability (CPL) is showing the highest growth rate, correlated directly with the global boom in civil engineering, remediation projects, and infrastructure upgrades, where pollution risk is immediate and project-based. Insurers are also focusing on developing modular policies that can combine various types of environmental coverage (e.g., clean-up, bodily injury, transportation liability) into a single, comprehensive package, simplifying the purchasing process for large multinational corporations and specialized industrial firms.

AI Impact Analysis on Environmental Liability Insurance Market

Common user inquiries concerning the influence of Artificial Intelligence on the Environmental Liability Insurance market center on its capability to refine complex risk assessment, expedite claims processing, and ensure precise regulatory compliance. Users often question how AI can quantify risks previously deemed too variable, such as those associated with gradually evolving contamination or climate change-induced events. There is significant interest in AI's role in predictive modeling—specifically, anticipating pollution events before they occur by analyzing geospatial data, operational sensor inputs, and historical incident patterns. Key expectations revolve around AI reducing the high administrative costs associated with environmental claims, improving underwriting accuracy by identifying granular risk factors, and potentially lowering premiums for proactively managed risks, thereby driving wider market adoption of ELI products.

- AI-Powered Risk Quantification: Utilizing machine learning algorithms to process vast datasets—including satellite imagery, geological surveys, and historical regulatory violation records—to generate highly accurate environmental risk scores for properties and operations, thereby enabling more precise pricing of premiums.

- Predictive Claims Modeling: Employing natural language processing (NLP) to analyze policy language and historical claim outcomes, automating the initial triage of environmental incidents, and forecasting the ultimate financial loss associated with contamination cleanup, speeding up reserve setting.

- Enhanced Due Diligence: Implementing AI tools during mergers and acquisitions (M&A) environmental due diligence to rapidly review thousands of site assessment reports and permit documents, identifying undisclosed or systemic environmental liabilities that might impact policy issuance.

- Real-time Monitoring and Loss Prevention: Integrating AI with IoT sensors deployed at industrial facilities or waste sites to monitor environmental metrics (e.g., pH levels, chemical concentrations) continuously, providing proactive alerts to policyholders and insurers to prevent minor incidents from escalating into major insured events.

- Regulatory Compliance and Monitoring: Using AI to track changes in complex international, federal, and state environmental regulations, automatically flagging policyholders whose operations or existing coverage may become non-compliant, ensuring coverage validity and mitigating insurer risk exposure.

- Fraud Detection: Applying anomaly detection algorithms to environmental remediation billing and claims documentation to identify inflated costs, duplicate invoicing, or fraudulent cleanup activities, protecting both insurers and legitimate remediation contractors.

DRO & Impact Forces Of Environmental Liability Insurance Market

The Environmental Liability Insurance (ELI) market is shaped by a powerful confluence of drivers, constraints, and opportunities, all summarized by significant impact forces. The primary drivers include the global tightening of environmental regulations, notably the "polluter pays" principle being enforced more strictly across jurisdictions, which mandates financial responsibility for remediation regardless of fault or timing. Concurrently, the increasing focus on corporate ESG reporting pushes companies to secure ELI as a clear demonstration of responsible risk management. However, market growth is restrained by the high cost of premiums, particularly for smaller firms or those operating in regions where environmental enforcement is historically lax. Furthermore, a perceived lack of standardization in policy wording across international markets and complexity in quantifying long-tail risks, such as groundwater contamination occurring over decades, create friction in policy adoption.

Opportunities for market expansion are vast, primarily centered on underdeveloped segments like the small and medium enterprise (SME) market, which often underestimates its environmental exposure but faces significant financial threats from even minor incidents. Another major opportunity lies in adapting ELI products to address emerging risks associated with climate change, such as contingent business interruption caused by environmental degradation or specific coverage for carbon capture and storage projects. Technological advancements, particularly in real-time monitoring and predictive modeling (as discussed under AI impact), offer the ability to mitigate long-standing restraints by making risk quantification more precise and therefore premiums potentially more justifiable and stable. The penetration of ELI into sectors like agriculture and municipal infrastructure, previously overlooked, also presents substantial growth avenues.

The most profound impact forces governing the market are Regulatory Rigor and Climate Risk Integration. Regulatory Rigor dictates mandatory compliance and determines the financial necessity of the product; any legislative rollback or tightening directly impacts demand. Climate Risk Integration forces insurers to re-evaluate traditional underwriting models, incorporating perils such as increased flooding or drought that can mobilize contaminants. These forces demand continuous product innovation, pushing insurers toward dynamic policy structures that can adjust coverage based on changing operational and environmental conditions. The ongoing balance between stringent regulatory demands and the inherent complexity and high cost of pollution risk management defines the competitive landscape and future trajectory of the ELI sector.

Segmentation Analysis

The Environmental Liability Insurance market is segmented primarily based on the type of coverage offered, the specific industry applications served, and the size of the enterprise purchasing the policy. The structural segmentation allows providers to tailor risk transfer solutions precisely to the diverse operational profiles and risk exposures encountered by various businesses. Coverage types delineate whether the policy targets historical contamination (e.g., Site-Specific PLL), project-based risks (CPL), or risks associated with waste transportation and disposal (Non-Owned Disposal Sites or NODS). The industry vertical segmentation recognizes that the nature of pollution risk varies dramatically between a chemical manufacturer and a construction company, necessitating industry-specific underwriting expertise and policy endorsements. This granular approach ensures that clients receive adequate protection calibrated to their unique environmental footprint and regulatory obligations, optimizing premium efficiency and claim payout reliability across the market.

- By Coverage Type:

- Site-Specific Pollution Legal Liability (PLL)

- Contractors Pollution Liability (CPL)

- Environmental Consultants Professional Liability

- Transportation Pollution Liability

- Non-Owned Disposal Site (NODS) Liability

- Storage Tank Liability

- By Industry Application:

- Energy and Utilities (Oil & Gas, Power Generation, Renewable Energy)

- Manufacturing (Heavy and Light Industry)

- Chemical and Petrochemical Industry

- Construction and Real Estate Development

- Waste Management and Recycling

- Transportation and Logistics

- Healthcare and Pharmaceuticals

- By Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises (SMEs)

Value Chain Analysis For Environmental Liability Insurance Market

The value chain in the Environmental Liability Insurance market begins with upstream activities dominated by data providers, environmental consultants, and modeling firms. Upstream analysis involves the gathering and processing of complex environmental risk data, including historical contamination records, geological surveys, satellite imagery, and regulatory compliance histories. Environmental consulting firms play a crucial role here, performing Phase I and Phase II Environmental Site Assessments (ESAs) that form the basis for underwriting decisions. Accurate and detailed risk data is paramount, as it directly impacts the insurer's ability to price the policy effectively and manage portfolio risk exposure. Technological providers offering risk modeling software and geospatial analytics are increasingly integrated into this upstream phase, enhancing the precision of risk quantification before the policy is even crafted.

The core midstream activity involves the actual underwriting and product structuring, performed by insurance carriers and specialized Managing General Agents (MGAs). Direct involvement occurs when large corporations negotiate policies directly with carriers, particularly those requiring highly customized coverage for complex, long-tail risks. However, the distribution channel is predominantly indirect. Brokers and agents act as critical intermediaries, possessing the necessary specialized expertise to explain the nuances of ELI policies—which are often complex and exclusionary—to end-users. Brokers are responsible for matching the client's specific environmental exposures (e.g., underground storage tanks, chemical transportation, brownfield redevelopment) with the appropriate policy type (PLL, CPL, etc.). Reinsurance companies also sit midstream, providing essential capital and capacity to absorb catastrophic losses and stabilize the high-severity risks characteristic of environmental incidents.

Downstream analysis focuses on claims management, remediation services, and loss control. When an environmental incident occurs, the claims process involves the policyholder, the insurer, legal counsel specializing in environmental law, and environmental remediation contractors. The efficiency of the downstream segment is highly dependent on the insurer's claims handling expertise and its network of pre-approved, qualified contractors capable of rapid response and effective cleanup. Loss control measures, often implemented in partnership with environmental consultants (a loop back to upstream knowledge), involve ongoing risk monitoring and preventative maintenance programs mandated or encouraged by the insurer to reduce the probability and severity of future claims, thereby enhancing the overall value proposition of the ELI product.

Environmental Liability Insurance Market Potential Customers

The primary buyers and end-users of Environmental Liability Insurance are organizations operating in industries characterized by significant environmental footprints, exposure to hazardous materials, or involvement in large-scale land development projects. These include heavy manufacturing facilities, where chemical storage and waste generation present high ongoing pollution risks, and the energy sector, particularly oil and gas drilling, refining, and pipeline operations, which face substantial catastrophic risk. Potential customers also heavily include the construction and real estate development sectors, especially those involved in brownfield remediation or infrastructure build-out, requiring Contractors Pollution Liability (CPL) to protect against project-specific risks and sudden contamination discoveries.

Beyond the traditionally high-risk sectors, the customer base is expanding rapidly to include mid-market companies and even some service industries that face non-owned or non-operational pollution risks, such as logistics companies transporting hazardous materials or corporate entities relying on numerous third-party disposal sites (NODS exposure). Municipalities and governmental bodies are also significant purchasers, often needing ELI to cover public infrastructure, water treatment facilities, and historical landfill sites. The driver for these customers is typically mandatory regulatory compliance combined with the financial necessity of protecting balance sheets from clean-up costs that can easily escalate into the tens or hundreds of millions of dollars, far exceeding the resources of self-insurance.

In the context of the global emphasis on sustainability and ESG metrics, any company with a public profile or significant investor scrutiny becomes a potential customer. Securing robust ELI is increasingly viewed not merely as a cost, but as an essential element of corporate responsibility and investor assurance. Therefore, potential customers span the entire spectrum of industries that use chemicals, generate waste, or manage large tracts of land, from petrochemical giants needing multi-layered, global coverage to specialized environmental consultants requiring professional liability coverage integrated with pollution risk protection.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 13.5 Billion |

| Market Forecast in 2033 | USD 26.1 Billion |

| Growth Rate | CAGR 9.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AIG, Zurich Insurance Group, Chubb, AXA, Swiss Re, Munich Re, Liberty Mutual Insurance, XL Group (AXA XL), Travelers Companies, Allianz, Scor SE, Beazley Group, RLI Corp, W.R. Berkley Corporation, Starr Companies, Hannover Re, Tokio Marine HCC, CNA Financial, HCC Insurance Holdings, Aspen Insurance Holdings |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Environmental Liability Insurance Market Key Technology Landscape

The Environmental Liability Insurance market is rapidly adopting advanced technology to overcome traditional challenges related to data scarcity and risk quantification uncertainty. A cornerstone of this technological transformation is the deployment of sophisticated Geospatial Information Systems (GIS) and high-resolution satellite imagery. These tools enable insurers to conduct comprehensive remote site assessments, monitor changes in land use over time, detect potential unauthorized dumping, and track the migration of contaminants, which is particularly vital for underwriting Site-Specific Pollution Legal Liability (PLL). The use of drones equipped with thermal and spectroscopic sensors further enhances initial site investigation and claims adjustment processes, providing quick, accurate, and safe data collection post-incident, drastically reducing response times.

Furthermore, the integration of the Internet of Things (IoT) sensors and Industrial Control Systems (ICS) data is becoming standard practice for large industrial policyholders. These sensors provide continuous, real-time monitoring of operational parameters relevant to environmental risk, such as pressure vessel integrity, effluent quality, and emissions data. This stream of real-time data allows for dynamic underwriting models where premiums or coverage conditions can be adjusted based on demonstrable risk management efforts, moving the industry toward a preventative risk-sharing model rather than a purely reactive one. For insurers, access to verifiable sensor data provides confidence in the client's ongoing compliance and operational safety.

Advanced predictive analytics and machine learning (ML) models are foundational technologies used to process the influx of GIS, IoT, and historical claims data. These models are employed to forecast the likelihood and potential severity of future pollution events, moving beyond simple statistical correlation to complex pattern recognition. Specifically, ML is used to model the long-tail effects of groundwater contamination, factoring in localized hydrology and geology—risks that traditional actuarial methods struggle to price accurately. This technological landscape not only improves the profitability and stability of the underwriting portfolios but also drives product innovation by enabling insurers to offer tailored, usage-based, or performance-based environmental policies.

Regional Highlights

The global Environmental Liability Insurance market exhibits distinct growth patterns and maturity levels across key geographical regions, largely influenced by the stringency of local regulations and the maturity of industrial sectors. North America, encompassing the United States and Canada, remains the largest market share holder globally. This dominance is attributed to highly evolved environmental statutes, such as the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA) in the U.S., which imposes strict, joint, and several liability for clean-up costs. The high frequency of environmental litigation, coupled with a dense concentration of large-scale manufacturing and petrochemical operations, ensures continuous high demand for comprehensive ELI coverage, making it a critical risk management tool rather than a voluntary acquisition.

Europe demonstrates substantial and accelerating growth, propelled by the European Union’s ambitious environmental directives, particularly the Environmental Liability Directive (ELD), which institutionalizes the polluter pays principle across member states. European regulation often extends the scope of liability to include damage to protected species and natural habitats, broadening the potential financial exposure for businesses. Countries like Germany, France, and the UK are mature markets, but emerging economies in Central and Eastern Europe are rapidly increasing their adoption rates as they align with EU environmental mandates. The focus in Europe is strongly integrated with ESG metrics and the transition towards a circular economy, demanding new ELI products focused on waste streams and sustainable practices.

The Asia Pacific (APAC) region is projected to be the fastest-growing market segment. This rapid growth is fueled by massive infrastructure investment, urbanization, and industrial expansion in countries such as China, India, and Southeast Asian nations. While regulatory enforcement has historically lagged behind the West, key economies are now implementing stricter environmental protection laws and remediation mandates in response to severe pollution challenges. This shift is creating an urgent need for ELI products. The challenge in APAC remains heterogeneity in regulatory frameworks, requiring insurers to localize policy offerings significantly and invest heavily in local risk assessment expertise to capitalize on the region’s vast untapped potential.

- North America (Dominant Market): Characterized by established legal frameworks (CERCLA, Superfund), high levels of environmental litigation, and sophisticated risk management practices among large corporations. Key demand areas include legacy site contamination (brownfields) and energy sector liability.

- Europe (Accelerating Growth): Driven by the EU's Environmental Liability Directive (ELD) and stringent national clean-up standards. Growth is concentrated in insuring against damage to biodiversity and mandatory financial provisioning for environmental risk, particularly in chemical and industrial manufacturing sectors.

- Asia Pacific (Fastest Growing): Expansion driven by rapid industrialization, increasing governmental commitment to environmental protection in China and India, and large-scale construction projects requiring Contractors Pollution Liability (CPL). Market penetration is rapidly increasing but is highly localized based on regulatory maturity.

- Latin America (Emerging Market): Growth is episodic, often linked to major mining, oil & gas, and infrastructure developments. Regulatory enforcement is increasing, particularly in nations like Brazil and Mexico, pushing local and international operators to secure basic ELI coverage.

- Middle East and Africa (MEA): Market presence is concentrated around major infrastructure, petrochemical, and resource extraction projects. Demand is primarily driven by contractual requirements imposed by international investors and financiers rather than comprehensive local regulatory pressure, though this is gradually changing in certain Gulf states.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Environmental Liability Insurance Market.- AIG (American International Group)

- Zurich Insurance Group

- Chubb

- AXA

- Swiss Re

- Munich Re

- Liberty Mutual Insurance

- Travelers Companies

- Allianz

- Scor SE

- Beazley Group

- RLI Corp

- W.R. Berkley Corporation

- Starr Companies

- Hannover Re

- Tokio Marine HCC

- CNA Financial

- HCC Insurance Holdings

- Aspen Insurance Holdings

Frequently Asked Questions

Analyze common user questions about the Environmental Liability Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Environmental Liability Insurance and why is it necessary?

Environmental Liability Insurance (ELI) provides specialized coverage for financial losses arising from pollution events, including mandated clean-up costs, bodily injury, property damage, and legal defense expenses resulting from contamination. It is necessary because standard General Liability (GL) policies typically exclude coverage for pollution, leaving businesses exposed to severe, often catastrophic, financial penalties under environmental laws like the 'polluter pays' principle. ELI is essential for businesses across high-risk sectors like manufacturing, construction, and energy to manage increasing regulatory and litigation risks.

What is the difference between Site-Specific Pollution Liability (PLL) and Contractors Pollution Liability (CPL)?

Site-Specific Pollution Legal Liability (PLL) is designed to protect owners and operators of fixed properties (e.g., factories, commercial real estate) against environmental risks associated with past, present, or future contamination at their specific location, including unknown pre-existing conditions. Contractors Pollution Liability (CPL), conversely, is project-based and covers general contractors, subcontractors, and consultants for pollution conditions arising from their specific contracting operations and services performed at a third-party site, such as accidental spills, sudden releases, or faulty remediation work during a construction project.

How do global ESG requirements influence the demand for Environmental Liability Insurance?

Global Environmental, Social, and Governance (ESG) requirements significantly drive ELI demand by making comprehensive risk management a mandatory component of corporate reporting and investor scrutiny. Investors and stakeholders increasingly view adequate environmental risk transfer, such as ELI, as evidence of responsible corporate stewardship and financial stability. Compliance failures or uncovered pollution events can severely damage a company's ESG score and valuation, compelling firms to purchase robust ELI policies to mitigate reputational and financial risk exposure.

Which geographical region holds the largest market share and why?

North America currently holds the largest market share for Environmental Liability Insurance. This dominance is primarily due to the maturity and strict enforcement of environmental regulations in the United States and Canada, notably the U.S. Superfund legislation (CERCLA), which imposes strict, retroactive, and joint and several liability. This highly litigious environment and the deep penetration of ELI products among large industrial entities ensure high premium volumes and market leadership.

What technological advancements are shaping the future of environmental risk assessment in insurance?

Technological advancements, particularly in the areas of Artificial Intelligence (AI) and remote sensing, are revolutionizing environmental risk assessment. Key technologies include Geospatial Information Systems (GIS) and high-resolution satellite imagery for remote site monitoring, IoT sensors for real-time operational pollution detection, and advanced Machine Learning models for predictive risk quantification. These tools enable insurers to underwrite complex, long-tail pollution risks with greater precision, improve loss control, and expedite claims processing by providing verifiable, data-driven insights.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager