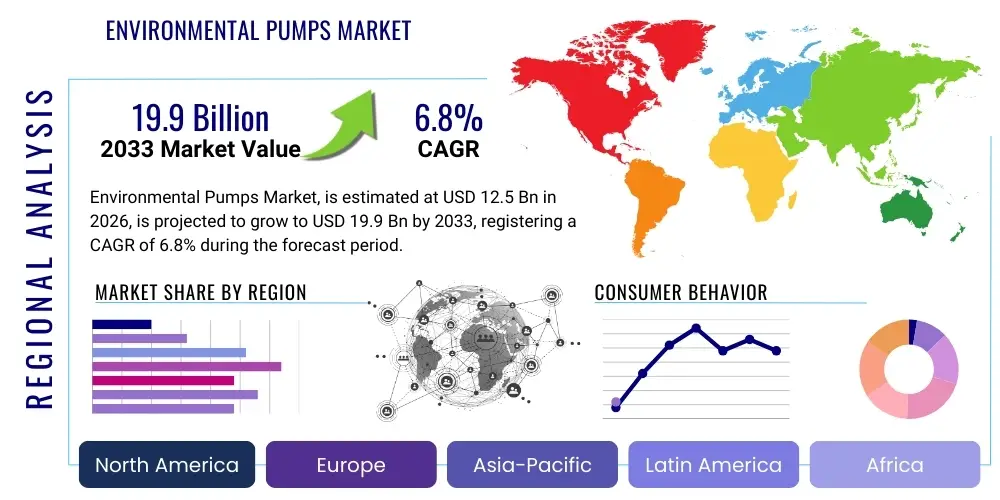

Environmental Pumps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437824 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Environmental Pumps Market Size

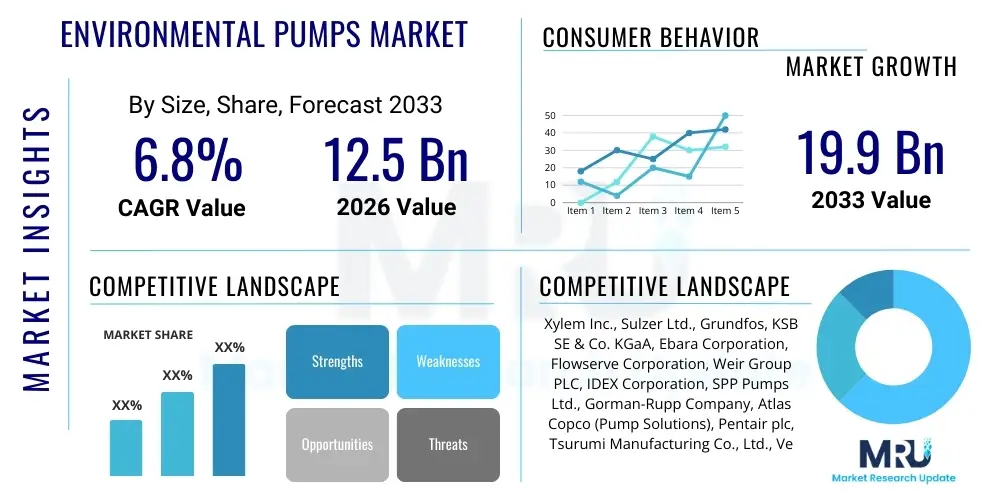

The Environmental Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $12.5 Billion in 2026 and is projected to reach $19.9 Billion by the end of the forecast period in 2033.

Environmental Pumps Market introduction

The Environmental Pumps Market encompasses the design, manufacturing, and distribution of specialized pumping equipment essential for managing and treating water, wastewater, chemicals, and slurries across municipal and industrial sectors. These pumps are critical components in environmental management infrastructure, including wastewater treatment plants, industrial effluent processing facilities, flood control systems, and chemical handling operations. The core function of these pumps is often related to ensuring compliance with stringent environmental regulations concerning discharge quality and resource management. Environmental pumps are distinct from general industrial pumps due to their requirement for high efficiency, resistance to corrosive or abrasive media, and non-clogging capabilities, particularly when handling sludge or highly viscous fluids.

Product categories within this market range from highly reliable centrifugal pumps and positive displacement pumps, such as diaphragm and peristaltic pumps, to robust submersible and sewage pumps designed for challenging conditions. Major applications driving demand include tertiary wastewater treatment, desalination projects, and the extraction and remediation of groundwater contaminants. The increasing global focus on sustainable water management practices and the necessity for industrial players to minimize their environmental footprint are key demand drivers. Furthermore, aging water infrastructure in developed economies necessitates replacement and upgrade cycles, boosting the demand for modern, energy-efficient environmental pumping solutions that comply with current energy consumption standards and smart operational requirements.

The primary benefits derived from the implementation of advanced environmental pumps include significant reductions in energy consumption, enhanced operational longevity, and improved reliability in handling complex fluid dynamics, leading to lower total cost of ownership (TCO). Driving factors for market growth include rapid urbanization, leading to increased wastewater volumes; stringent governmental regulations, particularly in Europe and North America, mandating higher treatment standards; and technological advancements such as the integration of IoT and remote monitoring capabilities (smart pumping). This convergence of regulatory pressure and technological innovation is shaping a market focused on efficiency, sustainability, and predictive maintenance capabilities.

Environmental Pumps Market Executive Summary

The Environmental Pumps Market is characterized by robust growth, driven primarily by accelerating global investments in water infrastructure modernization and adherence to increasingly strict pollution control regulations. Key business trends indicate a strong shift towards intelligent pumping solutions, incorporating sensors, variable speed drives (VSDs), and connectivity features to optimize performance and reduce energy usage. Consolidation among major players, focused on acquiring specialized technology providers, is prominent, alongside strategic partnerships aimed at delivering full-service environmental solutions. Manufacturers are focusing heavily on developing corrosion-resistant materials and modular designs that facilitate easier maintenance and higher uptime, catering specifically to the challenging environment of municipal wastewater treatment and industrial chemical processing. Sustainability remains a central business driver, influencing procurement decisions toward pumps offering the lowest lifetime environmental impact.

Regionally, the market exhibits varied dynamics. Asia Pacific (APAC) leads in terms of market volume growth, fueled by massive infrastructure projects, industrial expansion, and the necessity to establish basic sanitation and advanced water treatment facilities in rapidly urbanizing countries like China and India. North America and Europe, while possessing mature infrastructure, show significant demand for replacement pumps and advanced digital integration, driven by high labor costs and strict regulations concerning energy efficiency and effluent quality (e.g., EU Water Framework Directive). The Middle East and Africa (MEA) are seeing growth spurred by desalination projects and the urgent need for water resource security, particularly in arid regions, favoring high-capacity, specialized pumps designed for handling saline and processed water.

Segment trends highlight the dominance of the wastewater treatment application, which consumes the largest share, followed closely by the industrial chemical processing sector. By product type, centrifugal pumps remain the mainstay due to their versatility and capacity, but positive displacement pumps, especially diaphragm and peristaltic variants, are gaining traction in chemical dosing and sludge handling applications where precise flow control and gentle handling are paramount. Furthermore, the industrial end-user segment is increasingly adopting smart, robust pumps capable of handling corrosive chemicals and extreme temperatures, driven by compliance requirements and the imperative to minimize operational disruptions. The technological trend points towards magnetic drive pumps and specialized non-clogging designs for municipal solids handling.

AI Impact Analysis on Environmental Pumps Market

Common user inquiries concerning the integration of Artificial Intelligence (AI) in the Environmental Pumps Market revolve primarily around predictive maintenance capabilities, energy optimization potential, and the feasibility of real-time autonomous operation. Users are keenly interested in how AI algorithms can process vast amounts of operational data—such as vibration, pressure, flow rate, and energy consumption—to anticipate mechanical failures, thereby minimizing unplanned downtime and reducing maintenance costs. Another key theme is the expectation that AI can dynamically adjust pump speed and operation cycles based on fluctuating demand and variable environmental conditions (e.g., stormwater influx), leading to measurable reductions in electricity consumption and ensuring regulatory compliance with discharge limits. Concerns often center on the security of connected systems (IoT vulnerability) and the integration challenges associated with retrofitting AI capabilities into legacy infrastructure, highlighting the need for robust, scalable, and secure AI-driven solutions tailored for long lifecycle assets like environmental pumps.

- AI-driven Predictive Maintenance (PdM): Algorithms analyze sensor data (vibration, temperature) to forecast equipment failure, shifting maintenance from reactive to proactive, significantly boosting Mean Time Between Failures (MTBF).

- Energy Consumption Optimization: AI models dynamically manage Variable Speed Drives (VSDs) based on real-time flow demand and energy tariffs, achieving energy savings of up to 15-25% in large municipal systems.

- Anomaly Detection and Early Warning: Utilizes machine learning to identify abnormal operational patterns indicative of clogs, cavitation, or component wear, triggering alerts before critical system failures occur.

- Optimized Chemical Dosing: AI enhances the precision of chemical injection pumps in water treatment by correlating dosing rates with real-time water quality parameters, improving treatment efficacy and reducing chemical waste.

- Autonomous Control Systems: Implementation of closed-loop AI control systems in complex pumping stations (e.g., flood control) allows for autonomous decision-making based on environmental variables and system constraints, improving responsiveness.

- Digital Twin Simulation: AI models create virtual replicas of pumping systems, allowing operators to simulate operational changes, test maintenance strategies, and train personnel without impacting live infrastructure.

- Asset Management and Lifecycle Planning: AI provides detailed insights into asset health and remaining useful life (RUL), optimizing capital expenditure planning for pump replacement and refurbishment programs.

DRO & Impact Forces Of Environmental Pumps Market

The Environmental Pumps Market is fundamentally shaped by a confluence of regulatory enforcement (Driver), infrastructure complexity (Restraint), and the rapid shift towards circular economy models (Opportunity). The primary driver is the accelerating global necessity to address water scarcity and pollution through mandatory advanced treatment standards, particularly in emerging economies where regulatory compliance is catching up with industrial expansion. This regulatory push forces industries and municipalities to invest in high-efficiency, reliable pumping solutions. Restraints largely center on the high initial capital expenditure associated with sophisticated pumping systems and the significant energy costs incurred during operation, despite advancements in efficiency. Furthermore, the inherent complexity of handling highly corrosive, abrasive, and viscous fluids in applications like mining and heavy chemical processing requires specialized materials and engineering, which limits the number of qualified suppliers and increases procurement timelines. The lack of standardized infrastructure maintenance practices in various global regions also acts as a restraint, leading to premature pump failures.

Opportunities are predominantly emerging from the technological sphere and the global push for sustainability. The opportunity lies in the burgeoning market for smart pumps and intelligent monitoring systems utilizing IoT and AI for predictive maintenance and energy optimization, enabling manufacturers to offer value-added services beyond the hardware itself. The global focus on resource recovery—such as nutrient recovery from wastewater and brine mining from desalination reject streams—opens new niche applications requiring specialized high-pressure and corrosion-resistant pumps. Additionally, the increasing adoption of decentralized wastewater treatment systems (DWWTs) in rural and peripheral areas provides a significant market expansion avenue for smaller, modular pumping units. Successful players are those who can integrate digital capabilities seamlessly with physical pump robustness.

The core impact forces shaping this market include stringent governmental environmental policies (the strongest positive force, guaranteeing minimum demand thresholds), fluctuating raw material costs (especially for specialized alloys and corrosion-resistant coatings, acting as a cost restraint), and rapid advancements in fluid dynamics engineering aimed at improving efficiency (a positive technological force). Economic stability in major industrial regions directly influences capital spending on new treatment plant construction and infrastructure upgrades, determining the pace of market penetration for new technologies. The interplay of these forces ensures sustained market expansion but emphasizes the need for manufacturers to balance cost-efficiency with high-performance, environmentally compliant specifications.

- Drivers:

- Increasing stringency of global wastewater discharge and water quality regulations (e.g., EPA, EU directives).

- Rapid urbanization and population growth leading to higher volumes of municipal wastewater requiring treatment.

- Growing industrial focus on water reuse, recycling, and closed-loop systems to meet sustainability goals.

- Government investments in modernizing aging water infrastructure, particularly in developed economies.

- Technological advancements in energy-efficient pumps (IE4/IE5 motors) and integrated smart systems (IoT).

- Restraints:

- High initial investment costs associated with advanced, specialized environmental pumping systems.

- Significant operational energy consumption, despite efficiency improvements, often representing a high TCO.

- Technical complexity and maintenance demands when handling highly abrasive, corrosive, and solid-laden media (slurries, sludge).

- Market fragmentation in specific regional markets with strong competition from local, lower-cost manufacturers.

- Opportunities:

- Expansion of the market for AI and cloud-based predictive maintenance and asset performance management solutions.

- Growing demand for decentralized and modular treatment solutions suitable for remote and rural areas.

- Focus on specialized pumping solutions for emerging applications like aquaculture, ballast water treatment, and carbon capture (CCUS).

- Development of pumps manufactured using sustainable materials and optimized for circular economy models.

Segmentation Analysis

The Environmental Pumps Market is systematically segmented based on Type, Application, and End-User, reflecting the diverse operational environments and fluid handling requirements encountered across the environmental management spectrum. The segmentation by type is crucial as it dictates the pump’s mechanism and suitability for handling specific fluids—whether clean water requiring high flow (centrifugal) or viscous sludge demanding precise movement (positive displacement). Application segmentation identifies the primary demand sources, with water and wastewater treatment dominating, followed by highly specialized industrial processes such as chemical manufacturing and mining, each requiring unique material specifications and hydraulic characteristics for optimal performance and regulatory compliance.

End-user segmentation differentiates between large-scale public utility infrastructure (Municipal) and specialized private sector usage (Industrial and Commercial). Municipal applications demand rugged, high-volume pumps with emphasis on low maintenance and non-clogging capabilities for sewage handling, whereas industrial users prioritize corrosion resistance, precision dosing, and robust performance under extreme conditions (temperature, pressure). This detailed segmentation allows manufacturers to tailor their product offerings, sales strategies, and service models to the specific pain points and regulatory landscapes facing each user group. Furthermore, the segmentation analysis highlights the increasing premium placed on high-efficiency pumps across all segments, largely due to rising global energy prices and sustainability mandates.

Geographically, market growth is bifurcated: mature markets like North America and Europe prioritize replacement, upgrading, and technological integration (smart pumps), while emerging markets in Asia Pacific and Latin America drive demand for new installations proportional to rapid infrastructure development. The growth rate differential between these regional segments necessitates a nuanced understanding of local regulatory drivers, water scarcity issues, and the maturity of existing treatment infrastructure when developing long-term market forecasts and competitive strategies. The specialized nature of certain pump types, like metering pumps for chemical dosing, ensures stable demand regardless of broader economic fluctuations in industrial sectors.

- By Type:

- Centrifugal Pumps (Horizontal, Vertical, Submersible)

- Positive Displacement Pumps (Diaphragm, Peristaltic/Hose, Piston/Plunger, Rotary Lobe)

- Submersible Pumps (Dry Pit, Wet Pit)

- Non-Clogging Pumps

- Metering/Dosing Pumps

- By Application:

- Wastewater Treatment (Primary, Secondary, Tertiary, Sludge Handling)

- Potable Water Treatment and Distribution

- Chemical Processing and Transfer

- Oil & Gas (Produced Water Handling, Refinery Processes)

- Mining and Dewatering

- Agriculture and Irrigation Water Management

- Pharmaceutical and Biotechnology

- By End-User:

- Municipal (Public Water Utilities, Sewage Authorities)

- Industrial (Chemical, Food & Beverage, Power Generation, Manufacturing, Pulp & Paper)

- Commercial & Residential

- By Operating Power:

- Electric Pumps

- Engine-Driven Pumps

Value Chain Analysis For Environmental Pumps Market

The value chain for the Environmental Pumps Market begins with raw material sourcing, primarily specialized metals (cast iron, stainless steel, nickel alloys), composites, and elastomers required for corrosion and abrasion resistance. Upstream activities involve component manufacturing, including the production of high-efficiency motors, sophisticated impellers, seals, and control mechanisms. The high technical specification required for environmental pumps—especially those handling caustic or abrasive slurries—necessitates specialized material suppliers, making this phase critical for product quality and longevity. Key upstream challenges include managing price volatility of specialty metals and maintaining a robust supply chain for precision components used in VSDs and intelligent controls. Manufacturers often integrate vertically to control critical processes like casting and motor assembly to ensure quality assurance.

Midstream activities encompass the actual pump manufacturing, assembly, testing, and quality control. This phase is characterized by intense research and development focused on hydraulic efficiency, reducing cavitation, and integrating smart technology (IoT sensors). Following manufacturing, the product moves through complex distribution channels. Distribution often involves a mix of direct sales to large municipal and industrial clients (who require bespoke solutions and long-term service contracts) and indirect channels utilizing authorized distributors, system integrators, and engineering, procurement, and construction (EPC) firms for standardized products and localized support. The reliance on EPC contractors is particularly high in large-scale infrastructure projects, where the pump is often supplied as part of a larger engineered system, necessitating strong relationships between pump manufacturers and these global engineering firms.

Downstream analysis focuses on installation, commissioning, after-sales service, and maintenance. Given the long lifecycle of environmental pumps, aftermarket services, including spare parts supply, repairs, and preventative maintenance contracts, represent a substantial and highly profitable segment of the value chain. Direct engagement by manufacturers in maintenance and service provides invaluable feedback for product improvement and design optimization. Potential customers are heavily influenced by the availability of rapid, reliable local service and the total lifecycle cost (TLC) of the pump, which includes energy consumption and maintenance expenses. Manufacturers are increasingly using digital platforms to manage maintenance schedules and provide remote diagnostics, enhancing the overall efficiency of the downstream segment and cementing customer loyalty.

Environmental Pumps Market Potential Customers

The primary consumers and end-users of environmental pumps span the public utility sector, various heavy industries, and specialized environmental remediation agencies. Municipal water and wastewater authorities represent the largest volume buyers, as their operations are non-discretionary and are strictly regulated by governmental bodies to ensure public health and environmental compliance. These customers require robust, energy-efficient pumps for lifting, primary sedimentation, activated sludge processes, and final effluent discharge, often operating 24/7/365, prioritizing durability and non-clogging capabilities, particularly in sewage applications. Investment cycles here are often tied directly to public funding and infrastructure bonds.

Industrial sectors constitute the second major customer base, encompassing chemical manufacturers, power generation facilities, food and beverage processing, and mining operations. Industrial customers have highly specific and demanding needs; for instance, chemical plants require pumps made of exotic alloys for resistance to aggressive media (acids, bases), while food and beverage companies require hygienic, clean-in-place (CIP) compatible pumps. Mining and power sectors rely on heavy-duty slurry pumps for dewatering and handling abrasive tailings. Procurement decisions in the industrial segment are heavily driven by operational safety, minimizing process downtime, and compliance with industrial discharge permits.

A rapidly growing segment of potential customers includes specialized environmental consultancies and remediation firms involved in cleanup operations for contaminated sites, groundwater restoration, and specialized chemical spills. These buyers often require portable, modular, and highly adaptable pumping systems, such as mobile diaphragm or peristaltic pumps for precise transfer of hazardous or variable viscosity fluids. Furthermore, the agricultural sector, particularly in regions facing water scarcity, represents a key customer base for high-efficiency irrigation pumps and water management systems designed to minimize resource waste and maximize crop yield, often influenced by governmental subsidies for sustainable farming practices.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $12.5 Billion |

| Market Forecast in 2033 | $19.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Xylem Inc., Sulzer Ltd., Grundfos, KSB SE & Co. KGaA, Ebara Corporation, Flowserve Corporation, Weir Group PLC, IDEX Corporation, SPP Pumps Ltd., Gorman-Rupp Company, Atlas Copco (Pump Solutions), Pentair plc, Tsurumi Manufacturing Co., Ltd., Verder International B.V., Metso Outotec, Wilo SE, Zoeller Company, Shanghai Kaiquan Pump (Group) Co., Ltd., Roper Technologies, Baker Hughes. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Environmental Pumps Market Key Technology Landscape

The technological landscape of the Environmental Pumps Market is rapidly transitioning from reliance on simple mechanical reliability to sophisticated digital integration and optimized hydraulic design. A paramount focus is placed on enhancing energy efficiency through the adoption of IE4 and IE5 super-premium efficiency motors, often combined with advanced Variable Speed Drives (VSDs). VSDs allow pumps to adjust output precisely to match fluctuating demand (e.g., diurnal flow variations in wastewater systems), drastically reducing energy waste compared to fixed-speed operation. Furthermore, advanced hydraulic modeling and Computational Fluid Dynamics (CFD) are routinely used during the design phase to optimize impeller and volute geometry, minimizing turbulence, reducing shear stress on sensitive media (like activated sludge), and enhancing non-clogging performance in solid-laden environments.

A critical trend is the pervasive integration of Information and Communication Technology (ICT), leading to the development of 'smart pumps.' These pumps are equipped with embedded IoT sensors that monitor key operational parameters, including vibration, temperature, current draw, and pressure, transmitting data to cloud-based platforms. This connectivity enables advanced diagnostics, remote control capabilities, and, most importantly, predictive maintenance (PdM) powered by machine learning algorithms. The shift towards PdM allows end-users, particularly large municipalities, to significantly extend the lifespan of their assets, reduce catastrophic failures, and streamline maintenance schedules, transforming the operational economics of pumping stations.

In specialized applications, materials science innovation is key. The necessity to handle highly corrosive chemicals (in industrial effluent) or extremely abrasive slurries (in mining) drives the demand for pumps made from highly resistant materials such as specialized duplex stainless steels, ceramics, and advanced polymers. For chemical dosing, magnetically coupled drive pumps are gaining traction as they eliminate the need for traditional shaft seals, thereby preventing leakage of hazardous fluids and meeting stringent safety standards. Furthermore, the development of specialized self-priming and self-cleaning mechanisms is enhancing the operational autonomy and reducing the manual intervention required for pumps deployed in challenging, remote, or fluctuating fluid environments, such as flood control or temporary dewatering projects.

Regional Highlights

Regional dynamics play a crucial role in shaping demand and technology adoption in the Environmental Pumps Market, reflecting variations in regulatory maturity, economic development, and water resource stress across the globe. Each major region possesses unique market drivers and challenges, influencing the type of pumping solution prioritized by municipal and industrial end-users. The global market's expansion is fundamentally linked to the uneven pace of urbanization and industrialization, necessitating tailored strategies for growth in each geographical area.

North America: This region is characterized by high operational costs and aging infrastructure, leading to strong demand for replacement and upgrade projects focused on high efficiency and smart technology integration. Strict Environmental Protection Agency (EPA) regulations drive investment in advanced tertiary treatment and resource recovery processes. The U.S. and Canada are leaders in adopting IoT-enabled smart pumps and predictive maintenance platforms to mitigate high labor costs and maximize asset utilization. Demand is stable and premium-focused.

Europe: Driven by the European Union’s Water Framework Directive and energy efficiency mandates, the market here emphasizes the lowest lifecycle cost (LCC) and sustainability. Germany, the UK, and France are key markets focusing on reducing carbon footprint, leading to rapid adoption of IE5 motor technology and precise metering pumps for compliance. There is a high concentration of sophisticated manufacturers, contributing to technological innovation and demanding quality compliance across the supply chain.

Asia Pacific (APAC): APAC is the fastest-growing region globally, fueled by massive government investments in new water and wastewater infrastructure necessitated by rapid industrialization and population migration to urban centers, particularly in China and India. The market favors volume, robustness, and cost-effectiveness for primary and secondary treatment. While initial technology adoption may lag behind the West, there is increasing investment in localized smart water systems in major metropolitan areas, making it a pivotal growth engine for the forecast period.

Latin America: This region presents significant opportunities driven by low rates of existing wastewater connectivity and large-scale government programs aimed at expanding basic sanitation coverage. Brazil and Mexico are primary markets where infrastructure build-out drives demand for standard, reliable, and durable submersible and centrifugal pumps. Economic instability and currency fluctuations remain key challenges, often impacting the pace of large infrastructure project execution.

Middle East and Africa (MEA): Growth is heavily concentrated around water scarcity mitigation strategies, particularly desalination and water reuse projects in the GCC countries. This necessitates specialized, high-pressure, corrosion-resistant pumps (e.g., reverse osmosis boosting pumps). In Africa, the focus is on expanding access to potable water and basic sanitation, driving demand for affordable, robust solar-powered pumping solutions and small-scale package treatment plants.

- North America (USA, Canada): Focus on infrastructure replacement, smart pump adoption, and energy efficiency upgrades due to high operational costs and strict EPA regulations concerning tertiary treatment.

- Europe (Germany, UK, France): Driven by EU mandates (Water Framework Directive, energy efficiency standards); emphasis on sustainability, low lifecycle cost (LCC), and advanced chemical dosing systems.

- Asia Pacific (China, India, Japan): Highest volume growth attributed to urbanization, massive industrial expansion, and investment in new basic and advanced wastewater treatment facilities.

- Latin America (Brazil, Mexico): Market driven by government initiatives to improve sanitation coverage and industrial water management efficiency; economic stability remains a factor influencing large project timelines.

- Middle East & Africa (UAE, Saudi Arabia, South Africa): Strong demand for pumps in desalination plants, wastewater reuse programs, and remote area water supply systems, often favoring specialized high-pressure and submersible units.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Environmental Pumps Market.- Xylem Inc.

- Sulzer Ltd.

- Grundfos

- KSB SE & Co. KGaA

- Ebara Corporation

- Flowserve Corporation

- Weir Group PLC

- IDEX Corporation

- SPP Pumps Ltd.

- Gorman-Rupp Company

- Atlas Copco (Pump Solutions)

- Pentair plc

- Tsurumi Manufacturing Co., Ltd.

- Verder International B.V.

- Metso Outotec

- Wilo SE

- Zoeller Company

- Shanghai Kaiquan Pump (Group) Co., Ltd.

- Roper Technologies

- Baker Hughes

Frequently Asked Questions

Analyze common user questions about the Environmental Pumps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Environmental Pumps Market?

Growth is primarily driven by increasingly strict global environmental regulations regarding wastewater discharge, accelerated urbanization necessitating expanded municipal treatment infrastructure, and sustained industrial demand for efficient pumps for water recycling and chemical handling.

How is the integration of smart technology impacting environmental pumping operations?

Smart technology, including IoT sensors and AI-driven analytics, enables predictive maintenance, significantly reduces unplanned downtime, and optimizes pump energy consumption through dynamic adjustment of Variable Speed Drives (VSDs), leading to lower operational costs and enhanced reliability.

Which pump types are most commonly used in municipal wastewater treatment applications?

Non-clogging centrifugal pumps and robust submersible pumps are predominantly used for municipal wastewater, sewage lifting, and sludge transfer due to their ability to handle large solids and high flow rates efficiently without frequent clogging or maintenance issues.

What role does energy efficiency play in the procurement of new environmental pumps?

Energy efficiency is a critical procurement factor, particularly in developed markets. End-users prioritize pumps with IE4/IE5 motors and VSD compatibility, aiming to minimize the Total Cost of Ownership (TCO) over the long lifecycle, as energy consumption often accounts for the largest portion of operational expenditure.

Which region holds the highest growth potential for environmental pump manufacturers?

The Asia Pacific (APAC) region currently exhibits the highest growth potential, driven by vast governmental investments in new water infrastructure projects and sanitation expansion across rapidly industrializing nations such as China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager