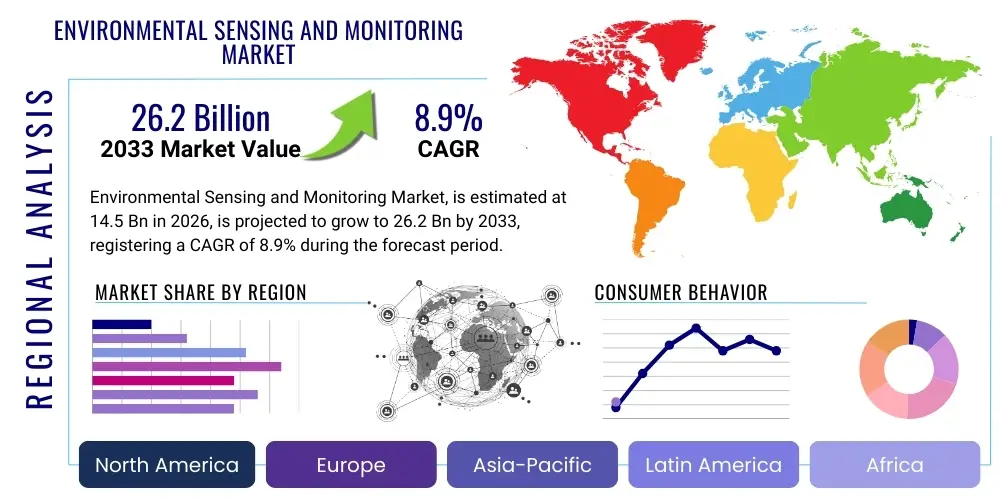

Environmental Sensing and Monitoring Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440504 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Environmental Sensing and Monitoring Market Size

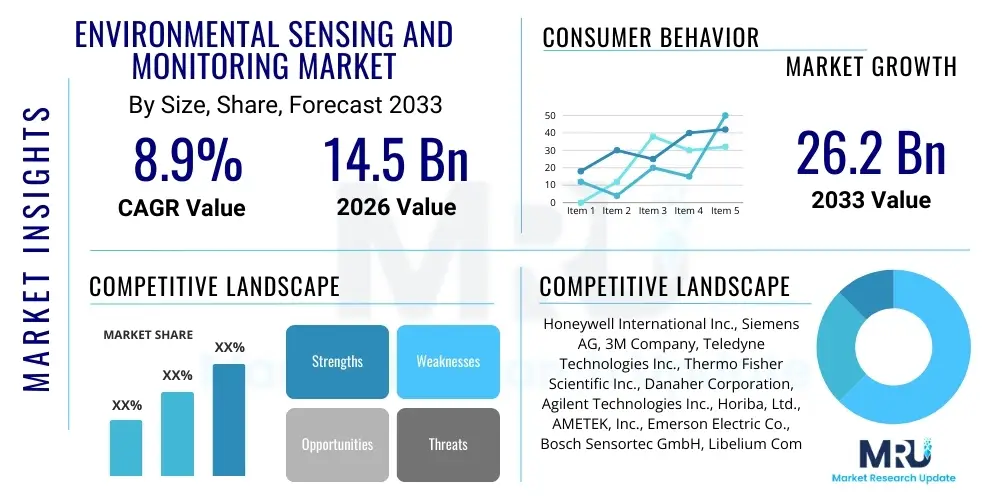

The Environmental Sensing and Monitoring Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 14.5 Billion in 2026 and is projected to reach USD 26.2 Billion by the end of the forecast period in 2033. This robust growth trajectory is underpinned by increasing global awareness regarding environmental degradation, stringent regulatory frameworks aimed at pollution control, and the rapid adoption of advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), and sophisticated sensor networks for real-time data acquisition and analysis. The market's expansion is further fueled by the rising demand for actionable environmental intelligence across various sectors, including industrial, governmental, and commercial applications, to foster sustainable practices and mitigate ecological risks.

Environmental Sensing and Monitoring Market introduction

The Environmental Sensing and Monitoring Market encompasses a wide array of technologies, devices, and services designed to detect, measure, and analyze various environmental parameters to assess the health of ecosystems, identify pollution sources, and predict potential hazards. This market is crucial for understanding the complex interactions within natural and built environments, providing data essential for policy-making, resource management, and public health protection. Products in this domain range from sophisticated air and water quality sensors to complex remote sensing platforms and integrated data management systems. These tools enable the continuous or periodic collection of data on critical metrics such as air pollutants, water contaminants, soil composition, noise levels, radiation, and meteorological conditions, offering a comprehensive view of environmental status.

Major applications for environmental sensing and monitoring span across diverse sectors, including industrial emission control, urban air quality management, agricultural land optimization, water resource protection, climate change research, and disaster preparedness. For instance, in industrial settings, monitoring systems ensure compliance with environmental regulations by tracking effluent discharge and stack emissions. In urban areas, networks of sensors provide real-time data on air pollution levels, helping authorities issue warnings and implement remedial measures. The benefits derived from these technologies are manifold, including improved public health outcomes, enhanced biodiversity protection, efficient resource utilization, increased operational efficiency for industries, and informed decision-making for sustainable development initiatives. The ability to proactively identify environmental risks and assess the effectiveness of mitigation strategies makes these solutions indispensable in today's world.

Several key driving factors propel the growth of this market. Foremost among them is the escalating concern over climate change and its far-reaching consequences, necessitating precise environmental data for modeling and mitigation efforts. Global population growth and rapid urbanization lead to increased demand for robust environmental management systems to cope with heightened pollution and resource strain. Furthermore, the proliferation of Internet of Things (IoT) devices and advanced analytics capabilities has revolutionized environmental data collection and interpretation, making these systems more accessible, efficient, and cost-effective. Regulatory pressures from international agreements and national environmental protection agencies also play a significant role, compelling industries and governments to invest in advanced monitoring solutions to ensure compliance and promote environmental stewardship.

Environmental Sensing and Monitoring Market Executive Summary

The Environmental Sensing and Monitoring Market is currently undergoing a transformative period, driven by converging technological advancements, heightened environmental awareness, and evolving regulatory landscapes. Business trends indicate a strong shift towards integrated platforms offering comprehensive data analytics, predictive capabilities, and cloud-based services, moving beyond mere data collection to delivering actionable insights. Companies are increasingly investing in research and development to create more compact, energy-efficient, and highly accurate sensors, alongside developing sophisticated software solutions that can process vast amounts of disparate environmental data. The market also observes a growing trend in public-private partnerships, where governments collaborate with technology providers to deploy large-scale environmental monitoring networks, addressing issues such as smart city initiatives and regional pollution control. This collaborative approach enhances deployment efficiency and leverages specialized expertise, accelerating market penetration and innovation.

Regional trends highlight North America and Europe as mature markets with high adoption rates due to stringent environmental regulations and significant investments in smart infrastructure. These regions are characterized by a focus on advanced R&D, sophisticated sensor deployment, and integrated data platforms. The Asia Pacific region is emerging as the fastest-growing market, primarily fueled by rapid industrialization, increasing urbanization, and growing environmental concerns in countries like China, India, and Southeast Asian nations. Governments in APAC are allocating substantial budgets towards environmental protection and sustainable development projects, driving demand for monitoring solutions. Latin America, the Middle East, and Africa are also showing promising growth, albeit from a smaller base, driven by increasing awareness, infrastructure development, and international support for environmental initiatives. These regions present significant untapped potential, particularly in areas related to water resource management, agricultural monitoring, and industrial compliance.

Segmentation trends reveal that the services segment, including installation, calibration, maintenance, and data analysis, is experiencing robust growth as clients seek end-to-end solutions rather than just hardware. The market for air quality monitoring continues to dominate due to persistent issues of urban pollution and industrial emissions, alongside increasing public health concerns. However, water quality monitoring is also gaining significant traction, propelled by global water scarcity, contamination issues, and the need for efficient water resource management. Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) into monitoring systems is creating new sub-segments focused on predictive analytics, anomaly detection, and automated reporting, significantly enhancing the value proposition of these solutions across all application areas. The trend towards miniaturization and wireless connectivity is making sensors more deployable in remote and hazardous environments, broadening the market's reach and utility.

AI Impact Analysis on Environmental Sensing and Monitoring Market

Users commonly query how Artificial Intelligence will revolutionize the environmental sensing and monitoring market, focusing on its capacity to enhance data accuracy, automate complex analysis, and provide predictive insights. Key themes revolve around AI's ability to process massive datasets from diverse sources, identify subtle patterns indicative of environmental changes, and improve the efficiency of monitoring operations. Concerns often include the reliability of AI models in varied environmental conditions, the ethical implications of autonomous decision-making in environmental management, and the potential for job displacement among human analysts. Expectations are high for AI to enable more proactive environmental protection, reduce operational costs, and unlock deeper understandings of ecological systems, ultimately leading to more effective conservation and mitigation strategies.

- AI-driven analytics enhance the speed and accuracy of environmental data processing, allowing for real-time anomaly detection and trend identification that would be impossible with traditional methods.

- Predictive modeling capabilities, powered by AI, enable proactive environmental management by forecasting pollution events, natural disasters, or resource depletion, allowing for timely interventions.

- Automation of data collection, sensor calibration, and system maintenance through AI and robotics reduces human error and operational costs, improving the overall efficiency of monitoring networks.

- Improved data fusion and integration, leveraging AI algorithms, combine information from disparate sensor types and remote sensing platforms to create a more comprehensive environmental picture.

- AI facilitates personalized and localized environmental insights, providing granular data tailored to specific geographic areas or community needs, enhancing public engagement and local policy effectiveness.

- Development of smart sensor networks with embedded AI for edge computing, reducing the need for constant data transmission and enabling immediate localized decision-making in remote areas.

- Enhanced identification and classification of pollutants and species through AI-powered image and sound recognition, improving biodiversity monitoring and targeted pollution source identification.

- Optimization of resource deployment for environmental inspections and interventions, as AI identifies high-risk areas or critical monitoring points requiring immediate attention, maximizing impact.

DRO & Impact Forces Of Environmental Sensing and Monitoring Market

The Environmental Sensing and Monitoring Market is primarily driven by escalating global concerns over climate change, pollution, and resource depletion, which necessitate robust data collection and analysis for effective mitigation and adaptation strategies. Stringent environmental regulations imposed by governmental and international bodies compel industries and municipalities to adopt advanced monitoring solutions to ensure compliance and avoid penalties. Furthermore, rapid technological advancements in sensor miniaturization, IoT connectivity, big data analytics, and artificial intelligence are making monitoring systems more affordable, accurate, and accessible, driving their widespread adoption across various sectors. The growing public awareness and demand for environmental transparency also push organizations to invest in monitoring to demonstrate their commitment to sustainability and corporate social responsibility.

However, the market faces significant restraints, including the high initial cost associated with deploying sophisticated sensing infrastructure, which can be a barrier for smaller organizations or developing economies. The complexity of integrating diverse sensor technologies and managing large volumes of heterogeneous data poses technical challenges, requiring specialized expertise. Additionally, the lack of standardized protocols for data collection and interoperability across different systems can hinder seamless data exchange and comprehensive analysis. Economic downturns or budget constraints in public and private sectors can also slow down investment in new environmental monitoring projects, impacting market growth. The need for continuous maintenance and calibration of sensors further adds to the operational costs, which can be a deterrent for long-term deployments.

Opportunities within this market are vast, particularly in the development of integrated smart environmental solutions for smart cities, precision agriculture, and industrial automation, where monitoring can provide real-time operational insights. The increasing demand for sustainable resource management, especially in water and waste management, presents fertile ground for innovative monitoring technologies. Emerging economies, with their rapid industrialization and growing environmental challenges, offer substantial untapped potential for market expansion. Furthermore, the development of subscription-based models for environmental data as a service (EDaaS) and remote monitoring solutions can lower entry barriers and provide recurring revenue streams. The continuous evolution of AI and machine learning will unlock new capabilities for predictive analytics and autonomous monitoring, creating advanced solutions for complex environmental issues.

The impact forces influencing this market are multifaceted. Technological advancements are a strong positive force, continually enhancing the capabilities and reducing the cost of sensing and monitoring. Regulatory pressures exert a powerful push, enforcing compliance and driving investment. Economic conditions can be a double-edged sword, providing growth during prosperity but hindering during recessions. Societal awareness acts as a demand pull, influencing public and private sector priorities towards environmental protection. Environmental degradation itself, through events like extreme weather or pollution crises, acts as a critical impact force, creating urgent demand for more effective monitoring solutions to prevent future occurrences and respond to immediate threats. These forces collectively shape the market's trajectory, driving innovation and adoption while also presenting challenges that require strategic navigation.

Segmentation Analysis

The Environmental Sensing and Monitoring Market is broadly segmented across various dimensions to provide a comprehensive understanding of its structure and dynamics. These segmentations are critical for identifying key growth areas, understanding customer needs, and tailoring solutions to specific applications. The market can be dissected by component, application, end-user, and technology, each revealing distinct trends and opportunities that influence market strategies and product development. Analyzing these segments helps stakeholders, from manufacturers to service providers, to pinpoint areas of high demand and competitive advantage, enabling more targeted market penetration and resource allocation. The interplay between these segments often drives innovation, particularly with the integration of new technologies across different application areas and end-user requirements, fostering a dynamic and evolving market landscape. This detailed segmentation analysis is crucial for navigating the complexities of the environmental monitoring ecosystem and for forecasting future market trajectories effectively.

- By Component:

- Sensors and Devices:

- Particulate Matter Sensors

- Gas Sensors (CO, CO2, NOx, SOx, O3, VOCs)

- Temperature Sensors

- Humidity Sensors

- Pressure Sensors

- Flow Sensors

- Radiation Sensors

- Water Quality Sensors (pH, Conductivity, DO, Turbidity)

- Noise Sensors

- Soil Moisture Sensors

- Software and Platforms:

- Data Acquisition and Processing Software

- Environmental Data Management Systems (EDMS)

- Cloud-based Monitoring Platforms

- Geographic Information Systems (GIS)

- Predictive Analytics Software

- Services:

- Installation and Integration Services

- Calibration and Maintenance Services

- Consulting and Advisory Services

- Data Analysis and Reporting Services

- Training and Support Services

- Sensors and Devices:

- By Application:

- Air Quality Monitoring (Indoor & Outdoor)

- Water Quality Monitoring (Surface Water, Groundwater, Wastewater)

- Soil Quality Monitoring

- Noise Pollution Monitoring

- Radiation Monitoring

- Meteorological Monitoring (Climate & Weather)

- Greenhouse Gas Monitoring

- Ecosystem and Biodiversity Monitoring

- Waste Management Monitoring

- By End-User:

- Government and Municipalities

- Industrial (Manufacturing, Oil & Gas, Mining, Power Generation)

- Commercial (Real Estate, Retail)

- Residential

- Research and Academia

- Agriculture

- Forestry

- Utilities

- By Technology:

- Wireless Sensor Networks (WSN)

- Internet of Things (IoT)

- Remote Sensing (Satellite, Drone-based)

- Geographic Information Systems (GIS)

- Artificial Intelligence (AI) and Machine Learning (ML)

- Big Data Analytics

- Cloud Computing

- Spectroscopy

- Chromatography

Value Chain Analysis For Environmental Sensing and Monitoring Market

The value chain for the Environmental Sensing and Monitoring Market is complex and multi-layered, beginning with upstream activities focused on component manufacturing and extending through to downstream services and end-user applications. Upstream analysis involves the raw material suppliers and manufacturers of individual sensor components, circuit boards, communication modules, and software platforms. These specialized providers are crucial for developing the foundational technologies that enable environmental monitoring systems. Innovation at this stage, such as the creation of more accurate, durable, and cost-effective sensors, directly impacts the capabilities and affordability of the final products. Key players in this segment include semiconductor companies, specialized sensor manufacturers, and embedded software developers, all contributing to the core technological building blocks of the monitoring solutions.

Midstream activities involve the integration and assembly of these components into complete monitoring systems, including hardware and software integration, system design, and the development of robust data processing units. This stage often includes original equipment manufacturers (OEMs) and system integrators who customize solutions based on specific application requirements, such as air quality stations, water monitoring buoys, or industrial emission control systems. These integrators are responsible for ensuring interoperability between different sensors and platforms, developing user-friendly interfaces, and ensuring the reliability and accuracy of the assembled system. Their role is pivotal in translating raw components into functional, deployable monitoring solutions that meet diverse client needs and regulatory standards.

Downstream analysis encompasses the distribution, deployment, and operational phases, leading to the end-users. Distribution channels can be direct, where manufacturers or system integrators sell directly to large industrial clients or government agencies, often involving custom project development and long-term service contracts. Indirect channels involve value-added resellers (VARs), distributors, and specialized consulting firms that provide local sales, installation, maintenance, and support services to a broader range of customers, including smaller businesses, research institutions, and individual communities. These indirect channels are essential for market penetration and providing localized expertise. Post-sales services, including calibration, maintenance, data analysis as a service (DAaaS), and technical support, constitute a significant portion of the downstream value chain, ensuring the longevity, accuracy, and effectiveness of the deployed monitoring systems throughout their operational lifecycle.

Environmental Sensing and Monitoring Market Potential Customers

The Environmental Sensing and Monitoring Market caters to a diverse range of potential customers, spanning across governmental bodies, various industries, research institutions, and increasingly, the commercial and residential sectors. Governments and municipalities represent a significant customer base, as they are responsible for public health, environmental regulation, and urban planning. They utilize these solutions for city-wide air and water quality management, waste monitoring, climate change initiatives, and disaster early warning systems. This includes national environmental protection agencies, local city councils, and public utility departments that require extensive data for compliance, policy formulation, and citizen services. Their demand is often driven by regulatory mandates and public pressure for a cleaner environment, making them consistent and large-scale buyers of comprehensive monitoring solutions.

Industrial sectors, particularly those with high environmental impact such as manufacturing, oil and gas, mining, power generation, and chemical processing, are crucial end-users. These industries leverage environmental sensing and monitoring to comply with emissions standards, manage wastewater discharge, monitor hazardous waste, and ensure workplace safety. The primary drivers for industrial adoption include regulatory compliance, risk management, operational efficiency, and enhancing corporate social responsibility. By proactively monitoring their environmental footprint, industries can avoid penalties, optimize resource use, and improve their public image. This segment often requires specialized, robust, and often customized monitoring solutions capable of operating in harsh industrial environments.

Other significant customer segments include research and academic institutions, which use these technologies for scientific studies, ecological research, and developing new environmental management techniques. The agriculture sector is increasingly adopting soil and weather monitoring for precision farming, optimizing irrigation, and improving crop yields. The commercial sector, encompassing real estate developers and building management, uses indoor air quality monitoring for occupant health and energy efficiency. Even the residential sector is showing nascent demand for personal environmental sensors for home air quality and water purity. Each of these customer groups has unique requirements, driving innovation and diversification in product offerings and service models across the environmental sensing and monitoring market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 26.2 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Siemens AG, 3M Company, Teledyne Technologies Inc., Thermo Fisher Scientific Inc., Danaher Corporation, Agilent Technologies Inc., Horiba, Ltd., AMETEK, Inc., Emerson Electric Co., Bosch Sensortec GmbH, Libelium Comunicaciones Distribuidas S.L., Envea (formerly Environnement S.A.), Vaisala Oyj, Suez S.A., Xylem Inc., Campbell Scientific, Inc., General Electric (GE), Rockwell Automation, Inc., Omega Engineering Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Environmental Sensing and Monitoring Market Key Technology Landscape

The technological landscape of the Environmental Sensing and Monitoring Market is characterized by rapid innovation and the convergence of several advanced fields, transforming how environmental data is collected, processed, and utilized. At its core, the market relies on sophisticated sensor technologies, ranging from highly sensitive electrochemical and optical sensors for gas and particulate matter detection to advanced photometric and spectroscopic instruments for water quality analysis. Miniaturization, improved accuracy, and enhanced durability are continuous areas of focus, enabling the deployment of sensors in previously inaccessible or harsh environments. The development of micro-electromechanical systems (MEMS) sensors has significantly contributed to creating smaller, more power-efficient devices, paving the way for ubiquitous environmental monitoring.

The proliferation of the Internet of Things (IoT) has revolutionized data connectivity, allowing a vast network of disparate sensors to communicate seamlessly and transmit real-time data to centralized platforms. Wireless Sensor Networks (WSNs), often powered by low-power wide-area network (LPWAN) technologies like LoRaWAN and NB-IoT, are critical for large-scale deployments across urban areas, agricultural fields, and remote wildernesses. These networks enable continuous monitoring and reduce the infrastructure costs associated with wired systems. Complementing ground-based sensors, remote sensing technologies, including satellite imagery and drone-mounted sensors, provide large-scale geographical coverage and aerial perspectives, crucial for monitoring climate change impacts, deforestation, and widespread pollution events. The integration of high-resolution cameras and multispectral/hyperspectral sensors on these platforms delivers rich, contextual environmental data.

Furthermore, the market heavily leverages advanced data processing and analytical technologies. Cloud computing platforms provide the necessary infrastructure for storing and processing the massive volumes of data generated by sensor networks, offering scalability and accessibility. Big data analytics tools are employed to identify patterns, correlations, and anomalies within this complex data, transforming raw measurements into meaningful environmental intelligence. Artificial Intelligence (AI) and Machine Learning (ML) algorithms are increasingly integral, enabling predictive modeling for pollution forecasts, automating data quality control, identifying sources of environmental degradation, and optimizing monitoring network deployments. Geographic Information Systems (GIS) play a vital role in visualizing spatial data, mapping environmental conditions, and facilitating location-based decision-making, providing a comprehensive and intuitive understanding of environmental challenges and interventions.

Regional Highlights

- North America: This region is a mature and significant market, characterized by stringent environmental regulations, substantial government funding for environmental protection, and a strong presence of key technology providers. The U.S. and Canada are leading in the adoption of advanced environmental monitoring solutions for air quality management, industrial emissions control, and smart city initiatives. High R&D investments and a focus on integrating AI and IoT are key drivers.

- Europe: Europe is another dominant market, driven by the European Union's ambitious environmental policies, such as the European Green Deal, and a high level of environmental awareness among its populace. Countries like Germany, the UK, France, and Scandinavia are at the forefront of adopting innovative solutions for water resource management, circular economy principles, and sustainable urban development. Emphasis is placed on real-time data, regulatory compliance, and cross-border environmental monitoring.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market due to rapid industrialization, burgeoning populations, and increasing urbanization, particularly in China, India, Japan, and Southeast Asian countries. These factors contribute to severe environmental challenges, necessitating significant investments in air, water, and waste monitoring infrastructure. Governments are proactively implementing environmental protection policies, boosting demand for advanced sensing and monitoring technologies.

- Latin America: This region is an emerging market with growing awareness of environmental issues such as deforestation, water pollution, and climate change impacts. Countries like Brazil, Mexico, and Argentina are gradually increasing their investments in environmental monitoring, driven by regulatory pressures and international conservation efforts. Opportunities exist in biodiversity monitoring, agricultural environmental management, and sustainable resource extraction.

- Middle East and Africa (MEA): The MEA region is experiencing growth, particularly in areas related to water scarcity, desertification, and oil and gas industry monitoring. Gulf countries are investing in smart city projects and sustainable development initiatives, which include advanced environmental sensing. Africa, while facing significant environmental challenges, is also seeing increased support from international organizations for climate change adaptation and resource management projects, slowly driving market adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Environmental Sensing and Monitoring Market.- Honeywell International Inc.

- Siemens AG

- 3M Company

- Teledyne Technologies Inc.

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Agilent Technologies Inc.

- Horiba, Ltd.

- AMETEK, Inc.

- Emerson Electric Co.

- Bosch Sensortec GmbH

- Libelium Comunicaciones Distribuidas S.L.

- Envea (formerly Environnement S.A.)

- Vaisala Oyj

- Suez S.A.

- Xylem Inc.

- Campbell Scientific, Inc.

- General Electric (GE)

- Rockwell Automation, Inc.

- Omega Engineering Inc.

Frequently Asked Questions

What are the primary drivers of growth in the Environmental Sensing and Monitoring Market?

The primary drivers include escalating global environmental concerns, increasingly stringent government regulations on pollution, rapid technological advancements in sensors and IoT, the growth of smart city initiatives, and rising public awareness about environmental health and sustainability.

How does AI impact the Environmental Sensing and Monitoring Market?

AI significantly impacts the market by enhancing data accuracy, enabling predictive analytics for early warning systems, automating complex data processing, optimizing monitoring network efficiency, and facilitating the integration of diverse data sources for comprehensive environmental insights.

Which regions are leading in the adoption of environmental sensing and monitoring technologies?

North America and Europe currently lead in market adoption due to advanced infrastructure, robust regulatory frameworks, and significant investments in environmental protection. However, Asia Pacific is projected to experience the fastest growth due to rapid industrialization and increasing environmental concerns.

What are the main types of environmental parameters monitored by these systems?

These systems monitor a wide range of parameters including air quality (particulate matter, gases), water quality (pH, dissolved oxygen, turbidity, contaminants), soil quality (moisture, nutrients), noise levels, radiation, and various meteorological conditions to assess environmental health.

What are the key challenges faced by the Environmental Sensing and Monitoring Market?

Key challenges include the high initial cost of deployment, complexity in integrating diverse sensor data, lack of standardized protocols for data interoperability, the need for continuous maintenance and calibration, and potential budget constraints in both public and private sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager