Environmentally Rubber Process Oil Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438166 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Environmentally Rubber Process Oil Market Size

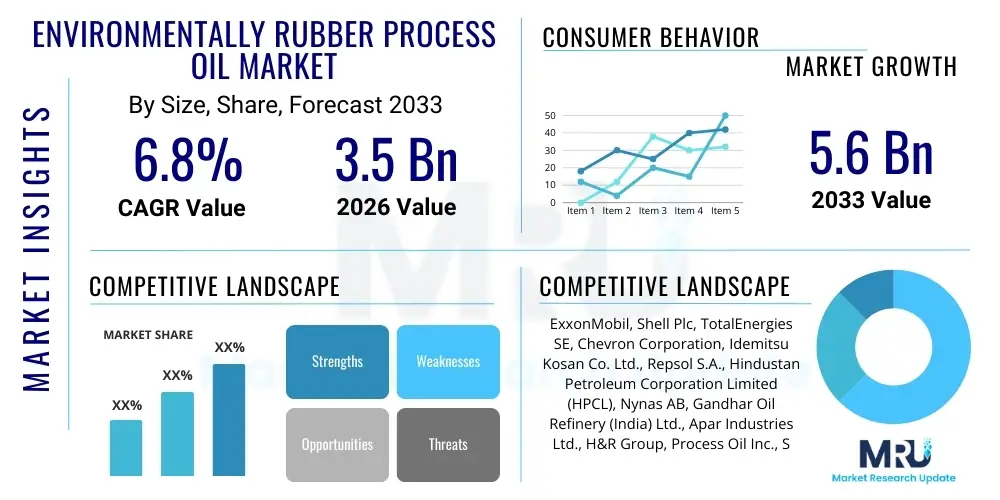

The Environmentally Rubber Process Oil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

Environmentally Rubber Process Oil Market introduction

The Environmentally Rubber Process Oil (ERPO) market encompasses specialized hydrocarbon oils and bio-based alternatives used in the processing of rubber, primarily to reduce viscosity, improve compound mixing, and enhance the physical properties of the final elastomer products, such as tires, footwear, and industrial components. Unlike traditional highly aromatic (HA) or Distillate Aromatic Extracts (DAE) oils, ERPOs comply with stringent global environmental and health regulations, notably the European Union's REACH directive, which restricts the use of polycyclic aromatic hydrocarbons (PAHs) deemed carcinogenic. This shift has necessitated the adoption of cleaner alternatives, predominantly Treated Distillate Aromatic Extracts (TDAE), Mild Extracted Solvates (MES), and Residual Aromatic Extracts (RAE), alongside innovative paraffinic and naphthenic oils, ensuring both performance and regulatory compliance.

Key applications driving the demand for ERPOs include the tire manufacturing industry, which mandates high performance, low rolling resistance, and enhanced grip while adhering to 'green tire' initiatives aimed at improving fuel efficiency and reducing environmental impact. Beyond tires, ERPOs are crucial in producing high-quality automotive components, wires and cables, and construction materials where durability and non-toxicity are paramount. The essential function of these oils is to act as plasticizers and extenders, facilitating the processing of synthetic and natural rubbers while optimizing characteristics like tensile strength, elasticity, and heat aging resistance. The transition towards high-performance specialty rubbers, often used in electric vehicles (EVs) and advanced infrastructure projects, further amplifies the need for specialized, environmentally compliant process oils that maintain formulation integrity.

The core benefits of utilizing ERPOs extend beyond mere compliance; they provide superior performance characteristics compared to older, toxic alternatives, including better color stability, lower volatility, and improved compatibility with various synthetic rubber polymers like Styrene-Butadiene Rubber (SBR) and Butyl Rubber (IIR). Driving factors for market expansion include escalating regulatory scrutiny globally, particularly across developed economies like North America and Europe, coupled with increasing consumer awareness regarding sustainable products. Furthermore, advancements in bio-based process oils derived from renewable resources, such as vegetable oils, are creating new segments, offering pathways to achieve complete sustainability goals within the rubber industry supply chain.

Environmentally Rubber Process Oil Market Executive Summary

The Environmentally Rubber Process Oil (ERPO) market is characterized by a strong regulatory push driving foundational structural changes within the rubber industry supply chain. Business trends indicate a consolidation among key petroleum refiners and increased investment in advanced hydrogenation and extraction technologies to produce cleaner, high-purity naphthenic and paraffinic oils compliant with low-PAH standards. There is a discernible trend toward vertical integration, with major petrochemical companies partnering directly with large tire manufacturers to ensure a consistent supply of tailored, specialized process oils. Furthermore, significant research and development efforts are focused on commercializing entirely bio-based or renewable process oils, aiming to future-proof formulations against potential stricter environmental mandates.

Regionally, Asia Pacific, led by China and India, dominates the consumption landscape due to the sheer scale of automotive production and infrastructural development, although adoption rates of high-end, environmentally sensitive oils still lag slightly behind European and North American standards. Europe, driven by the pioneering REACH regulation and strict tire labeling schemes, exhibits the highest adoption rate of premium ERPOs, acting as the global benchmark for safety and performance specifications. North America is experiencing steady growth, buoyed by domestic regulatory shifts and increasing consumer demand for sustainable tires and automotive parts, prompting local manufacturers to rapidly phase out older aromatic oil variants.

Segmentation analysis reveals that the paraffinic oil segment holds a substantial market share owing to its excellent compatibility, low volatility, and relatively cost-effective production via advanced refining techniques. However, the bio-based oil segment, though currently smaller, is projected to register the fastest growth rate as manufacturers seek complete sustainability solutions and reduced reliance on petroleum feedstocks. Application-wise, the tire industry remains the largest consumer, dictating specifications and volume demand, followed by non-tire applications such as belts, hoses, seals, and footwear, where specific regulatory requirements concerning skin contact or volatile organic compounds (VOCs) drive the choice of high-pquality, safe process oils.

AI Impact Analysis on Environmentally Rubber Process Oil Market

Users frequently inquire about how Artificial Intelligence (AI) can enhance the sustainable production and utilization of Environmentally Rubber Process Oils, specifically focusing on optimizing raw material input, improving refining processes, and validating the environmental compliance of specialized blends. Key user concerns revolve around AI's capacity to predict the exact quantities and types of ERPOs needed to achieve specific performance metrics in complex rubber formulations, minimize waste generation during manufacturing, and ensure real-time compliance tracking of PAHs and other restricted substances. The expectation is that AI will streamline research and development (R&D) cycles, allowing manufacturers to quickly prototype and test novel bio-based oils or highly customized petrochemical blends that meet stringent environmental criteria while maintaining or exceeding performance standards.

- AI-driven optimization of refining processes leading to higher yields of low-PAH paraffinic and naphthenic oils, improving purity and reducing energy consumption.

- Predictive modeling of rubber compound formulations, accelerating the R&D cycle for bio-based oils by simulating compatibility and final product performance characteristics.

- Enhanced supply chain visibility and risk management, using AI to track the sustainability credentials and sourcing of raw materials for both synthetic and natural ERPOs.

- Quality control improvements via machine learning algorithms analyzing spectral data for rapid, non-destructive detection of contaminants or non-compliant PAH levels in finished oil batches.

- Optimizing inventory and logistics based on real-time demand forecasts from major tire manufacturers, ensuring timely delivery of specialized, environmentally certified process oils.

DRO & Impact Forces Of Environmentally Rubber Process Oil Market

The dynamics of the Environmentally Rubber Process Oil market are shaped by a complex interplay of regulatory pressures, technological innovation, and shifting raw material costs. The primary drivers revolve around the mandatory adoption of non-carcinogenic alternatives, particularly in mature markets like Europe and North America, necessitating the phase-out of traditional aromatic oils. This is significantly complemented by consumer demand for sustainable and 'green' tires and automotive components, pushing Original Equipment Manufacturers (OEMs) to demand environmentally certified inputs. The opportunity landscape is vast, primarily centered on the development and commercialization of next-generation bio-based process oils derived from sustainable sources, offering a complete decoupling from petrochemical volatility and providing a high-value, niche product line for specialty chemical producers.

Restraints in this market mainly concern the higher initial cost of high-purity, specialty ERPOs compared to legacy aromatic oils, which can challenge adoption in price-sensitive emerging economies. Additionally, the complex refining processes required to produce low-PAH oils, such as deep hydrogenation, require significant capital investment, potentially limiting market entry for smaller players. Furthermore, the volatility of petrochemical feedstock prices remains a persistent restraint for the synthetic ERPO segments, impacting profitability margins. The technical challenge of ensuring that bio-based oils offer equivalent or superior performance characteristics (e.g., thermal stability, compatibility with synthetic rubbers) to traditional oils is another significant hurdle requiring continued R&D.

The impact forces are predominantly driven by regulatory shifts, acting as a non-negotiable compliance factor for global market participation. Legislative changes, such as tighter restrictions on VOC emissions or new criteria for bio-degradability, immediately reshape the market structure and favor compliant innovators. Technological advancements in refining (deep hydrotreating) and green chemistry represent a continuous transformational force, creating sustained competitive advantage for companies investing heavily in R&D. Furthermore, the increasing global integration of the tire manufacturing supply chain mandates consistent quality and compliance across all operating regions, exerting pressure for rapid global standardization of environmentally compliant process oils.

Segmentation Analysis

The Environmentally Rubber Process Oil market is fundamentally segmented based on the type of oil (differentiating by source and chemical composition), the specific application within the rubber industry, and the geographic region, which often dictates the level of regulatory strictness applied to the product. Segmentation by type is crucial as it reflects the major technological investment and compliance pathway chosen by manufacturers, ranging from highly refined petrochemical derivatives to novel bio-based options. Application segmentation highlights the tire sector's dominance, while regional analysis underscores the disparate rates of adoption influenced by local environmental policies and economic development stages.

- By Type:

- Paraffinic Oils

- Naphthenic Oils

- Treated Distillate Aromatic Extracts (TDAE)

- Mild Extracted Solvates (MES)

- Residual Aromatic Extracts (RAE)

- Bio-based Oils (Vegetable Oil Derivatives)

- By Application:

- Tire Manufacturing (Passenger Vehicles, Commercial Vehicles, Off-the-Road)

- Non-Tire Applications

- Industrial Rubber Goods (Hoses, Belts, Gaskets, Seals)

- Footwear

- Automotive Components (Engine Mounts, Bushings)

- Wires and Cables

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Environmentally Rubber Process Oil Market

The value chain for Environmentally Rubber Process Oils begins with the upstream segment, primarily involving crude oil exploration, extraction, and initial refining, particularly for synthetic-based oils (paraffinic, naphthenic, and TDAE). For bio-based oils, the upstream phase involves sourcing sustainable agricultural feedstocks like soybean, sunflower, or rapeseed oil. The refining stage is critical, requiring advanced and expensive processes such as deep hydrotreating and severe solvent extraction to remove carcinogenic Polycyclic Aromatic Hydrocarbons (PAHs) and produce high-purity, environmentally compliant base oils. Key players in this stage are major integrated oil companies and specialized lubricant base oil producers who possess the requisite capital and technical expertise to meet stringent regulatory standards.

The midstream component encompasses the formulation, blending, and distribution activities. Formulators take the refined base oils and often add specific performance additives to meet the precise requirements of rubber compounding houses, optimizing parameters such as viscosity, flash point, and compatibility with specific elastomers (e.g., EPDM, SBR). The distribution channel is multifaceted, relying heavily on specialized chemical distributors who handle bulk logistics, ensuring product integrity and supply consistency to large multinational tire manufacturers. Direct distribution, where major petrochemical producers supply directly to tier-one tire OEMs under long-term contracts, is also prevalent, facilitating quality control and specialized technical support.

The downstream analysis focuses on the end-user industries, dominated by the rubber compounding and finished goods manufacturing sectors, particularly the global tire industry. The final decision-makers (buyers) prioritize regulatory compliance, technical performance (e.g., impact on tire rolling resistance and wet grip), and security of supply. The value chain is characterized by strong vertical pull, meaning strict regulatory and technical demands originating from global automotive OEMs and large tire companies significantly influence the production specifications set upstream at the refinery level, driving continuous investment in cleaner oil technologies. Indirect distribution plays a key role in serving smaller, regional rubber goods manufacturers, while direct channels serve the massive volume needs of global tire giants.

Environmentally Rubber Process Oil Market Potential Customers

The primary potential customers and end-users of Environmentally Rubber Process Oils are global rubber compounding facilities, specifically those supplying the high-volume tire manufacturing sector. Tire production represents the single largest demand pool, driven by the strict performance and environmental standards mandated by regional regulatory bodies like the European Union and the U.S. Environmental Protection Agency. These buyers require consistent, bulk supply of certified low-PAH oils (TDAE, MES, or high-purity Paraffinics) that allow their finished tires to comply with labeling requirements concerning fuel efficiency, noise, and wet braking performance, making them highly selective based on supplier credibility and product certification.

Another significant customer segment includes manufacturers of industrial rubber goods, such as conveyor belts, transmission belts, seals, and specialized hoses used in automotive and infrastructure industries. For these applications, ERPOs are chosen not just for compliance but also for their ability to impart excellent heat and abrasion resistance, ensuring the longevity and reliability of critical components. Customers in this space often require smaller, tailored batches of specialized naphthenic or high-purity paraffinic oils, necessitating distributors capable of handling complex logistics and offering technical guidance on formulation compatibility.

A rapidly growing customer base is the specialized rubber sector catering to electric vehicles (EVs) and high-performance applications. EV tires require low rolling resistance and enhanced durability due to the heavy battery packs and high torque characteristics, mandating the use of the highest quality, most advanced ERPOs, including next-generation bio-based solutions. Furthermore, manufacturers of medical rubber stoppers, food-grade seals, and consumer products like footwear and sporting goods constitute a high-value, albeit smaller, segment where the requirement for non-toxic, non-staining, and odor-free process oils (often high-purity paraffinics or bio-based) is paramount to ensure consumer safety and regulatory adherence.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ExxonMobil, Shell Plc, TotalEnergies SE, Chevron Corporation, Idemitsu Kosan Co. Ltd., Repsol S.A., Hindustan Petroleum Corporation Limited (HPCL), Nynas AB, Gandhar Oil Refinery (India) Ltd., Apar Industries Ltd., H&R Group, Process Oil Inc., S-Oil Corporation, Phillips 66, LUKOIL, Petroliam Nasional Berhad (PETRONAS), Panama Petrochem Ltd., Orlen Oil, Renkert Oil, Sunoco LP |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Environmentally Rubber Process Oil Market Key Technology Landscape

The Environmentally Rubber Process Oil market is fundamentally shaped by advanced refining techniques designed to strip detrimental aromatic compounds while maintaining desirable viscosity and plasticizing characteristics. The foremost technology is deep hydrogenation, also known as severe hydrotreating, which is essential for converting traditional aromatic base stocks into safer, low-PAH alternatives like TDAE, MES, and high-purity paraffinic oils. This process involves reacting the oil with hydrogen at high pressures and temperatures in the presence of a specialized catalyst, effectively saturating the aromatic ring structures, thus significantly reducing the content of harmful polycyclic aromatic hydrocarbons to comply with modern toxicological standards. Continued innovation in catalyst development is critical for increasing the efficiency and selectivity of this expensive process, aiming to minimize production costs while maximizing compliance purity.

A second crucial technological area involves the development and scale-up of renewable and bio-based oil production. This includes enzymatic transesterification and advanced refining of natural oils (e.g., soybean, palm, rapeseed). The key technological challenge here is modifying the chemical structure of natural triglycerides to enhance thermal stability and compatibility with synthetic rubbers, often requiring proprietary chemical modifications or targeted fractionation. Companies are focusing on optimizing the fatty acid profile of these bio-oils to meet the specific performance requirements of the tire industry, ensuring that the "green" alternatives do not compromise on essential rubber properties such as grip and abrasion resistance. Success in this area is dependent on both sustainable sourcing and cost-effective conversion technologies.

Furthermore, technology plays a vital role in quality assurance and compliance monitoring. Advanced analytical techniques, including Gas Chromatography-Mass Spectrometry (GC-MS) and High-Performance Liquid Chromatography (HPLC), are mandatory for accurately measuring minute traces of restricted substances, particularly PAHs, ensuring batch-to-batch consistency and regulatory adherence. The integration of digitalization and sensors within manufacturing allows for real-time process monitoring, minimizing deviations and optimizing energy usage during the complex refining stages. The technology landscape is moving towards integrated smart manufacturing processes that link feedstock quality directly to the formulation requirements of the downstream rubber industry, promoting transparency and traceability throughout the value chain.

Regional Highlights

- Europe: Pioneer in regulatory compliance (REACH), driving demand for premium TDAE and bio-based oils; high penetration of "green tire" technologies and stringent automotive emissions standards.

- Asia Pacific (APAC): Dominates consumption volume due to massive automotive production and infrastructure expansion; rapid shift from traditional DAE to TDAE and other low-PAH oils, particularly in China and Southeast Asia.

- North America: Strong emphasis on high-performance paraffinic oils; driven by local environmental regulations and sophisticated consumer markets prioritizing sustainable and high-quality tire performance.

- Latin America (LATAM): Emerging market characterized by growing adoption of global standards; increasing investment in local tire manufacturing capacity necessitates compliant oil imports and local blending capabilities.

- Middle East and Africa (MEA): Primarily a source region for base oil feedstocks; consumption of compliant oils is rising, often imported to meet international export standards for manufactured goods.

Europe remains the cornerstone of environmental compliance within the rubber process oil market. Driven initially by Directive 2005/69/EC and subsequently reinforced by the comprehensive REACH regulation, the region enforces the lowest permissible limits for PAHs in rubber products, making the utilization of highly refined TDAE, MES, and specialized paraffinic oils mandatory. This rigorous regulatory environment fosters innovation, positioning Europe as the lead market for advanced, high-cost, bio-based alternatives. The strong presence of global tire R&D centers and premium automotive manufacturers dictates a continuous demand for superior-performing, certified compliant products, ensuring Europe maintains a high average selling price for ERPOs.

The Asia Pacific region, specifically China, India, and Japan, represents the largest volume market, accounting for a significant share of global rubber and tire production capacity. While price sensitivity remains higher than in Western markets, the pressure to comply with export standards for tires and automotive parts sold to Europe and North America is rapidly accelerating the transition to compliant oils. Local governments, particularly in China, are implementing stricter domestic environmental policies, which, combined with the tremendous scale of urbanization and automotive proliferation, guarantee robust, long-term demand growth for ERPOs, favoring regional suppliers who can scale hydrotreating operations efficiently.

North America demonstrates a mature market structure characterized by stability and a preference for high-quality paraffinic oils, backed by domestic refining capabilities. Regulatory oversight, combined with growing sustainability commitments from major tire brands operating in the region, ensures steady demand for low-PAH alternatives. The focus is shifting towards enhancing oil performance for EV tires and specialty industrial applications, demanding tailored viscosity grades and improved compatibility with advanced elastomers. The regional market benefits from close integration between the petrochemical base oil producers and the large rubber goods manufacturing infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Environmentally Rubber Process Oil Market.- ExxonMobil

- Shell Plc

- TotalEnergies SE

- Chevron Corporation

- Idemitsu Kosan Co. Ltd.

- Repsol S.A.

- Hindustan Petroleum Corporation Limited (HPCL)

- Nynas AB

- Gandhar Oil Refinery (India) Ltd.

- Apar Industries Ltd.

- H&R Group

- Process Oil Inc.

- S-Oil Corporation

- Phillips 66

- LUKOIL

- Petroliam Nasional Berhad (PETRONAS)

- Panama Petrochem Ltd.

- Orlen Oil

- Renkert Oil

- Sunoco LP

Frequently Asked Questions

Analyze common user questions about the Environmentally Rubber Process Oil market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between traditional and environmentally compliant rubber process oils?

The primary difference lies in the concentration of Polycyclic Aromatic Hydrocarbons (PAHs). Traditional oils (like DAE) contain high levels of carcinogenic PAHs, whereas Environmentally Rubber Process Oils (ERPOs), such as TDAE, MES, paraffinic, and bio-based oils, are severely refined to ensure PAH content is below the stringent regulatory thresholds mandated by bodies like the EU's REACH regulation, ensuring safer manufacturing and consumer products.

How is the growth of electric vehicles (EVs) impacting the demand for ERPOs?

The EV sector significantly increases demand for premium, high-performance ERPOs. EV tires require specific properties, including enhanced abrasion resistance and low rolling resistance, to manage heavier battery loads and high torque. Manufacturers rely on specialized, high-purity paraffinic and naphthenic oils to meet these demanding performance and durability specifications without compromising sustainability goals.

Which regulatory framework is the main driver for the global shift to environmentally compliant oils?

The European Union's Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation is the main global driver. REACH imposed strict limits on PAH content in tires and rubber articles sold in the EU market, effectively forcing global manufacturers to adopt low-PAH oils worldwide, thus setting a non-negotiable benchmark for international trade and market access.

Are bio-based process oils a commercially viable alternative to petroleum-derived ERPOs?

Bio-based oils derived from renewable agricultural feedstocks are emerging as commercially viable alternatives, particularly driven by long-term sustainability mandates. While they often have a higher initial cost and require specific chemical modification to match the performance of synthetic oils, ongoing R&D is rapidly improving their thermal stability and compatibility, making them increasingly attractive for premium and specialty non-tire applications.

What are the key technological challenges associated with producing high-purity Environmentally Rubber Process Oils?

The main technological challenge is the high capital investment and operating cost associated with severe hydrotreating (deep hydrogenation) required to reduce PAH content effectively in synthetic oils. For bio-based oils, the challenge lies in scaling up extraction and modification processes while ensuring consistent quality and chemical structure necessary to maintain elastomer performance, especially under extreme conditions like high temperatures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager