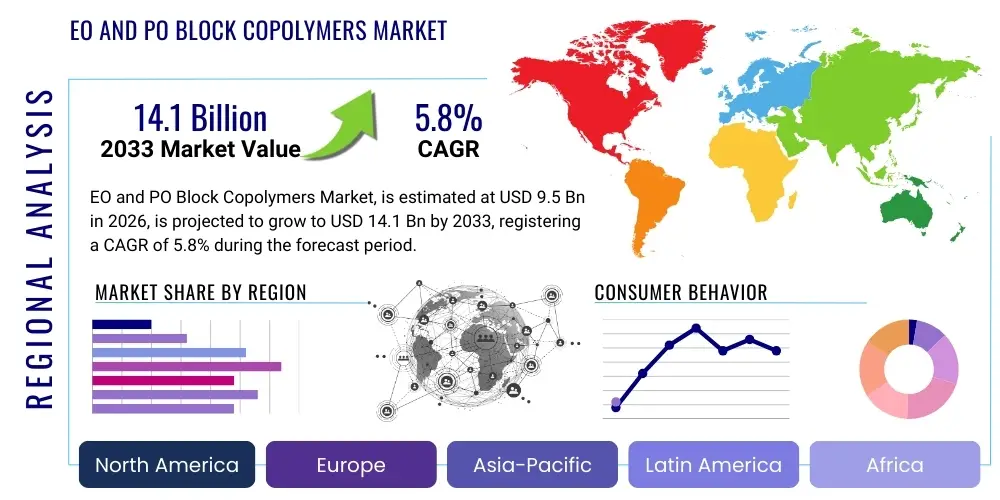

EO and PO Block Copolymers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438769 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

EO and PO Block Copolymers Market Size

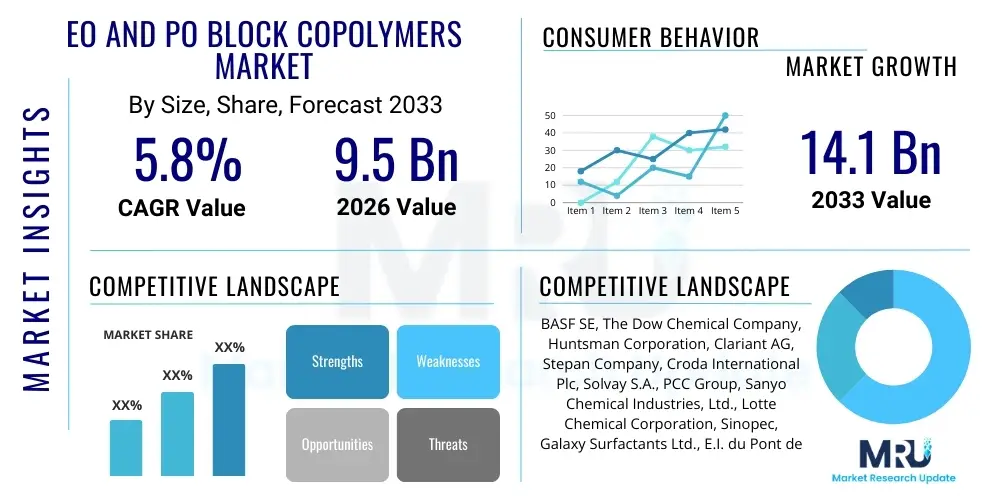

The EO and PO Block Copolymers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 9.5 Billion in 2026 and is projected to reach USD 14.1 Billion by the end of the forecast period in 2033.

EO and PO Block Copolymers Market introduction

EO (Ethylene Oxide) and PO (Propylene Oxide) Block Copolymers, often referred to as Poloxamers or Pluronics, represent a class of non-ionic surfactants characterized by their unique amphiphilic structure. These synthetic polymers typically consist of blocks of hydrophilic polyoxyethylene (PEO) and hydrophobic polyoxypropylene (PPO), arranged in triblock configurations (PEO-PPO-PEO) or other sequences. Their molecular architecture, which allows them to self-assemble into micelles in aqueous solutions, makes them indispensable in numerous industrial and specialized applications, particularly where emulsification, dispersion, detergency, or stabilization are required. The versatility of these copolymers stems from the ability to precisely control the ratio and molecular weight of the EO and PO segments, tailoring the final product's hydrophile-lipophile balance (HLB) and thermoreversible properties to specific end-user needs.

The primary applications of EO and PO block copolymers span pharmaceuticals, personal care products, industrial cleaning, and specialized coatings. In the pharmaceutical sector, their low toxicity and excellent compatibility make them critical components in drug delivery systems, serving as solubilizers, emulsifiers, and stabilizers for poorly soluble active pharmaceutical ingredients (APIs). Their capacity to form temperature-dependent gels is utilized extensively in controlled release formulations and topical drug applications. Furthermore, in industrial settings, these copolymers function as highly effective defoamers and dispersants in water treatment, papermaking, and oil and gas recovery processes, capitalizing on their superior surface activity.

Market expansion is significantly driven by the accelerating demand from the pharmaceutical industry for advanced drug solubilization technologies and the increasing utilization of high-performance surfactants in consumer products, especially in emerging economies. The inherent benefits, including low foaming characteristics, excellent chemical stability, and biodegradability in certain formulations, solidify their position as preferred alternatives to conventional surfactants. Key market drivers include stringent regulations promoting biodegradable and eco-friendly chemical inputs and sustained innovation in polymer synthesis techniques, allowing manufacturers to create custom-designed copolymers optimized for demanding technological requirements.

EO and PO Block Copolymers Market Executive Summary

The EO and PO Block Copolymers Market demonstrates robust growth, primarily fueled by shifting business trends favoring high-performance specialty chemicals and targeted therapeutic applications. Key business trends include aggressive capacity expansion by major manufacturers, strategic mergers and acquisitions focused on securing proprietary synthesis technologies, and a profound shift towards bio-based alternatives driven by sustainability mandates. Companies are increasingly investing in research and development to create novel copolymer structures that offer enhanced functionality, particularly those suitable for gene therapy vectors and advanced nanoscale drug delivery systems, thereby cementing their premium positioning within the specialty chemical landscape.

Regionally, Asia Pacific (APAC) stands out as the epicenter of market growth, propelled by rapid industrialization, burgeoning pharmaceutical manufacturing capabilities, and escalating demand for cosmetic and personal care products in countries like China and India. North America and Europe maintain significant market shares, characterized by mature regulatory environments and high penetration rates in specialized medical applications, including injectable drug formulations and surgical device coatings. Regional trends also show a growing preference in developed markets for domestically sourced, high-purity copolymers that comply with stringent Pharmacopoeia standards, encouraging localized production and resilient supply chain establishment.

Segment trends highlight the dominance of the pharmaceutical and personal care sectors, particularly the application segment utilizing copolymers as solubilizers and emulsifiers. The triblock PEO-PPO-PEO structure remains the most commercially relevant due to its balance of properties. Future growth is anticipated in the industrial segment, driven by the need for high-efficiency defoamers and wetting agents in textile and pulp and paper industries. Furthermore, the market is witnessing increasing traction in the food and beverage industry, where specific grades of Poloxamers are utilized as stabilizers and processing aids, adhering to food-grade safety standards and contributing to product texture and shelf life extension.

AI Impact Analysis on EO and PO Block Copolymers Market

User queries regarding AI's impact on EO and PO Block Copolymers often revolve around optimizing synthesis processes, predicting copolymer performance in complex biological systems, and accelerating material discovery. Users are primarily concerned with how computational methods, such as Machine Learning (ML) algorithms, can predict the optimal block length and EO/PO ratio required to achieve a specific HLB or micellar size, thereby drastically reducing extensive laboratory screening time. The key themes summarized from this analysis indicate high expectations for AI to enhance process efficiency, streamline quality control by predicting potential impurities or structural variations during polymerization, and, crucially, unlock new applications by designing copolymers with unprecedented precision for highly specialized fields like targeted drug delivery and nanomedicine.

- AI-driven optimization of polymerization kinetics and reaction conditions, reducing synthesis time and energy consumption.

- Machine learning models used to predict the critical micelle concentration (CMC) and thermoreversible properties of new copolymer formulations based on molecular input data.

- Enhanced predictive modeling for copolymer interaction with biological membranes, improving the efficacy and safety profile in drug delivery applications.

- Automated quality assurance systems utilizing AI for real-time monitoring of batch consistency and purity during manufacturing.

- Accelerated discovery of novel EO/PO block architectures with specialized functions, such as enhanced dispersancy in non-aqueous environments.

DRO & Impact Forces Of EO and PO Block Copolymers Market

The EO and PO Block Copolymers Market is significantly influenced by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O). The primary drivers include the escalating demand for advanced drug delivery systems leveraging the unique solubilizing properties of Poloxamers, alongside robust growth in the personal care and cosmetics industries which favor mild, non-irritating surfactants. Simultaneously, the inherent price volatility of key raw materials, namely ethylene oxide and propylene oxide, which are crude oil derivatives, presents a significant restraint. Regulatory hurdles, particularly the rigorous safety assessments required for pharmaceutical-grade excipients, also act as a constraining factor, increasing the time-to-market for new formulations. Despite these restraints, substantial opportunities exist in the development of biodegradable alternatives and the expansion into niche applications such as enhanced oil recovery (EOR) and advanced specialty coatings.

Impact forces acting on the market further define its trajectory. The substitution threat is moderate; while competitive surfactants exist (e.g., specific grades of fatty alcohol ethoxylates), the unique thermoreversible gelling capabilities of block copolymers are difficult to replicate cost-effectively, particularly in medical applications. The bargaining power of buyers, especially large pharmaceutical corporations, is high due to the standardized nature of many commercial grades and the potential for dual sourcing. Conversely, the bargaining power of suppliers is also strong, given the high capital intensity and complex technology required for EO and PO polymerization, limiting the number of high-quality raw material providers.

Technological impact forces are paramount, with continuous innovation focused on producing narrow molecular weight distribution polymers and customized low-foaming grades for industrial use. Environmental impact forces are increasingly pushing manufacturers towards sustainable production methods and bio-based feedstocks (e.g., bio-glycols), transforming the long-term chemical landscape. The overall market dynamics suggest a balanced environment where technological superiority and strategic supply chain management will be critical determinants of success.

Segmentation Analysis

The EO and PO Block Copolymers market is segmented primarily based on Type, Application, and End-Use Industry. Understanding these segments is crucial for strategic market positioning, as product properties directly dictate their suitability across diverse high-value and high-volume sectors. The segmentation by Type focuses on the arrangement of the EO and PO blocks, with PEO-PPO-PEO (Pluronic or Poloxamer type) dominating due to its established efficacy and widespread use across pharmaceuticals and detergents. Application-wise, the market is highly fragmented, reflecting the versatility of the material, ranging from complex drug solubilization to routine use in foam control and industrial dispersancy, demanding varying degrees of purity and structural customization.

- By Type:

- PEO-PPO-PEO (Triblock Copolymers)

- PPO-PEO-PPO (Reverse Triblock Copolymers)

- Multi-block and Star-shaped Copolymers

- By Application:

- Emulsifiers and Solubilizers

- Dispersants and Wetting Agents

- Defoamers and Anti-foaming Agents

- Thickening and Gelling Agents

- Detergency and Cleaning

- By End-Use Industry:

- Pharmaceuticals and Healthcare

- Personal Care and Cosmetics

- Industrial and Institutional Cleaning

- Oil and Gas (Enhanced Oil Recovery)

- Pulp and Paper

- Textiles and Leather Processing

- Agrochemicals

Value Chain Analysis For EO and PO Block Copolymers Market

The value chain for EO and PO Block Copolymers begins with the upstream procurement of essential raw materials, principally ethylene oxide and propylene oxide, which are derived from petrochemical refining processes. This upstream segment is characterized by high capital investment and reliance on global oil and gas prices, making supply stability a critical factor. Manufacturers then undertake complex polymerization reactions, utilizing specialized reactors and catalysts to synthesize the block copolymers. This manufacturing stage requires high precision to control molecular weight and block distribution, directly impacting the final product's HLB and therapeutic functionality, particularly for high-purity pharmaceutical grades.

The downstream segment involves formulation, distribution, and end-use application. Direct distribution channels are often favored for high-volume industrial clients and key pharmaceutical accounts, allowing for direct technical support and customized product blending. Indirect channels, utilizing specialized chemical distributors, facilitate reach to smaller manufacturers and regional markets. Value addition occurs significantly at the formulation level, where copolymers are incorporated into complex mixtures—for instance, creating stable nano-emulsions for cosmetics or sterile, injectable drug vehicles. The efficiency of the distribution channel is vital, especially for pharmaceutical excipients requiring strict quality control and traceability throughout the supply chain.

Upstream stability is constantly managed through long-term supply agreements and hedging against feedstock price fluctuations. Downstream success relies on strong technical service capabilities, educating end-users on optimal product selection (based on HLB requirements) and formulation guidelines. The critical link in the middle involves process innovation to improve yields and reduce the energy intensity of polymerization, thereby enhancing cost competitiveness and maintaining compliance with increasingly strict environmental, social, and governance (ESG) standards across the entire manufacturing and distribution footprint.

EO and PO Block Copolymers Market Potential Customers

The potential customers for EO and PO block copolymers are highly diversified, spanning multiple high-value industries globally. Pharmaceutical companies constitute a paramount end-user segment, relying on these polymers as essential excipients for enhancing the solubility and bioavailability of poorly water-soluble drugs, as well as for developing advanced controlled-release oral and injectable formulations. These buyers demand extremely high purity, consistent batch quality, and comprehensive regulatory documentation (e.g., DMF filing support) to ensure compliance with global pharmacopoeial standards. The cosmetic and personal care sector represents another critical customer base, utilizing the copolymers as mild emulsifiers, thickeners, and foam stabilizers in products like shampoos, lotions, and specialized skin treatments.

Industrial sectors form the high-volume consumer base. This includes manufacturers in the Industrial and Institutional (I&I) cleaning segment who utilize these materials for their excellent detergency and low-foaming properties in automated washing systems. Furthermore, companies involved in oil and gas extraction are increasingly becoming significant buyers, leveraging specific copolymer grades in Enhanced Oil Recovery (EOR) operations as mobility control agents and microemulsion stabilizers. These buyers prioritize bulk supply, cost-efficiency, and performance under extreme temperature and pressure conditions typical of subterranean reservoirs.

Finally, niche yet high-growth customer groups include agrochemical producers, where copolymers are essential for formulating stable pesticide and herbicide dispersions, and the pulp and paper industry, which relies on them as effective defoamers during processing. These diverse buyer needs—ranging from ultra-high purity required by injectables to bulk performance specifications needed for industrial applications—necessitate a highly tailored product portfolio from copolymer manufacturers, emphasizing technical customization and specialized grade offerings to satisfy distinct customer requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 14.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, The Dow Chemical Company, Huntsman Corporation, Clariant AG, Stepan Company, Croda International Plc, Solvay S.A., PCC Group, Sanyo Chemical Industries, Ltd., Lotte Chemical Corporation, Sinopec, Galaxy Surfactants Ltd., E.I. du Pont de Nemours and Company, KAO Corporation, Mitsui Chemicals Inc., Shell Chemicals, Evonik Industries AG, Sasol Limited, Nouryon, Chem-Block. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

EO and PO Block Copolymers Market Key Technology Landscape

The manufacturing technology for EO and PO Block Copolymers primarily involves anionic or cationic ring-opening polymerization of ethylene oxide and propylene oxide monomers. Advancements in this landscape are centered on achieving tighter control over molecular weight distribution (MWD) and minimizing polydispersity (PDI). Traditional processes often result in broader MWD, which can compromise the performance of the copolymer, particularly in sensitive pharmaceutical applications where consistent micelle size and HLB are non-negotiable. Modern technological improvements focus on using specialized initiators and controlled reaction environments, such as continuous flow reactors, which enhance reaction precision and scalability, leading to superior material properties and improved batch-to-batch consistency for specialty grades.

A significant technological shift is the adoption of living polymerization techniques, which allow for the precise synthesis of complex block structures, including multi-block and star-shaped architectures. These complex polymers often exhibit enhanced shear stability, superior gelling properties, and better performance in high-salt environments compared to traditional triblocks. Furthermore, catalyst innovation plays a crucial role; manufacturers are moving away from traditional alkali metal catalysts towards cleaner, highly efficient organometallic catalysts that minimize by-product formation and purification costs, thereby increasing the purity level required for medical-grade applications.

Sustainability and process efficiency are driving investment in bio-based technology integration. Research is actively exploring the use of bio-derived ethylene glycol and propylene glycol precursors, aiming to produce 'green' EO and PO block copolymers. This not only aligns with global sustainability initiatives but also potentially offers supply chain resilience against petrochemical volatility. The integration of advanced analytical tools, such as spectroscopic techniques and automated rheometers, into the production line provides real-time data feedback, crucial for optimizing the polymerization process and ensuring the polymers meet the exacting standards of the high-growth pharmaceutical and advanced materials sectors.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by extensive industrial expansion, particularly in China and India. These countries are seeing massive increases in pharmaceutical manufacturing capacity and escalating demand for affordable and effective personal care products. The relatively lower cost of manufacturing and the growing regional consumer base attract significant foreign direct investment into copolymer production facilities, focusing heavily on industrial-grade dispersants and emulsifiers.

- North America: This region holds a significant market share, characterized by high investment in advanced research and development, especially within the pharmaceutical and biotechnology sectors. North America is a primary consumer of high-purity, specialized EO/PO copolymers used in cutting-edge drug delivery, gene therapy formulations, and sophisticated medical devices. Strict regulatory standards ensure high product quality, commanding premium prices.

- Europe: The European market is mature and highly regulated, emphasizing sustainability and eco-friendliness. Demand is strong in the personal care, I&I cleaning, and specialty chemicals sectors. European manufacturers are leaders in developing bio-based copolymers and implementing closed-loop manufacturing processes. Germany, France, and the UK are key markets due to their established chemical and cosmetic industries.

- Latin America (LATAM): Growth in LATAM is driven by expanding industrial activity and increasing urbanization, boosting demand for industrial cleaning agents and agrochemicals. Brazil and Mexico are leading consumers, focusing on balancing performance and cost-effectiveness across various sectors.

- Middle East and Africa (MEA): The MEA market is developing, with significant consumption linked to the oil and gas sector (EOR chemicals) and local industrial projects. Investment in local downstream chemical production is increasing, aiming to reduce reliance on imports and capitalize on regional petrochemical resources.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the EO and PO Block Copolymers Market.- BASF SE

- The Dow Chemical Company

- Huntsman Corporation

- Clariant AG

- Stepan Company

- Croda International Plc

- Solvay S.A.

- PCC Group

- Sanyo Chemical Industries, Ltd.

- Lotte Chemical Corporation

- Sinopec

- Galaxy Surfactants Ltd.

- E.I. du Pont de Nemours and Company

- KAO Corporation

- Mitsui Chemicals Inc.

- Shell Chemicals

- Evonik Industries AG

- Sasol Limited

- Nouryon

- Chem-Block

Frequently Asked Questions

Analyze common user questions about the EO and PO Block Copolymers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary functions of EO and PO Block Copolymers in pharmaceutical formulations?

Their primary functions in pharmaceuticals are serving as effective non-ionic surfactants, solubilizers, and emulsifiers, particularly crucial for enhancing the solubility and bioavailability of poorly water-soluble Active Pharmaceutical Ingredients (APIs). They are also utilized as stabilizers in nano-formulations and as thermoreversible gelling agents.

How does the ratio of EO to PO influence the copolymer's behavior?

The ratio of Ethylene Oxide (EO) to Propylene Oxide (PO) directly determines the Hydrophile-Lipophile Balance (HLB) of the copolymer. A higher EO content results in increased hydrophilicity (higher HLB), making the polymer more water-soluble and suitable for oil-in-water emulsification and general detergency applications.

Which end-use industry contributes most significantly to the market growth?

The Pharmaceutical and Healthcare sector is the most significant contributor to high-value market growth, driven by the increasing complexity of new drug candidates and the need for advanced excipients that facilitate drug delivery and enhance therapeutic efficacy.

What is the main restraint impacting the profitability of the EO and PO Block Copolymers market?

The main restraint is the high price volatility and supply chain instability of the key petrochemical feedstock raw materials, specifically ethylene oxide and propylene oxide, which are susceptible to fluctuations in global crude oil and natural gas prices.

In which region is the demand for industrial-grade EO and PO copolymers growing fastest?

Asia Pacific (APAC), particularly driven by industrial expansion in China and India, is experiencing the fastest growth in demand for industrial-grade EO and PO block copolymers, primarily utilized as defoamers, dispersants, and wetting agents in the textile, pulp and paper, and I&I cleaning industries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- EO and PO Block Copolymers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- EO and PO Block Copolymers Market Statistics 2025 Analysis By Application (Detergents, Hard Surface Cleaner, Textile and Leather, Personal Care, Paints and Coatings), By Type (10%EO, 20%EO, 30%EO, 40%EO, 50%EO, 70%EO, 80%EO), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager