Epitaxy Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434151 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Epitaxy Equipment Market Size

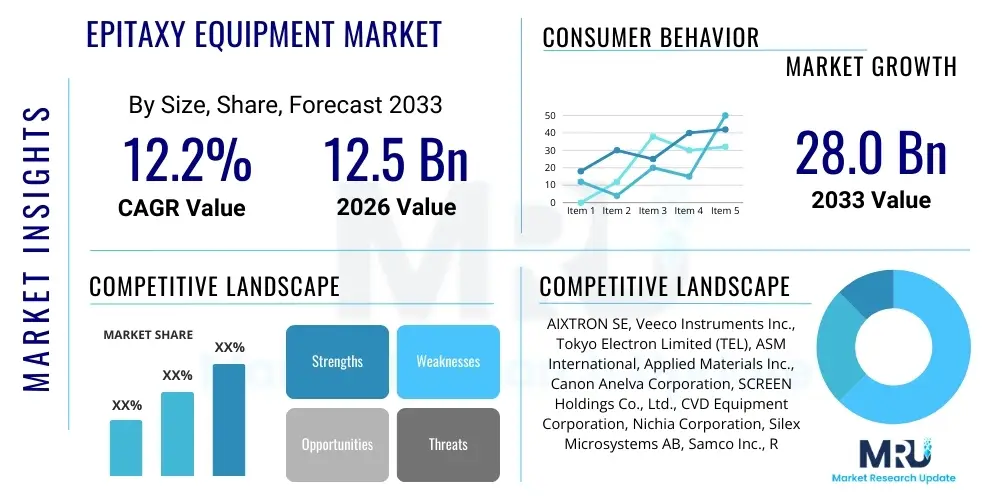

The Epitaxy Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.2% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 28.0 Billion by the end of the forecast period in 2033. This robust expansion is fundamentally driven by the escalating global demand for high-performance semiconductor devices, particularly in sectors requiring advanced compound semiconductors such as Gallium Nitride (GaN) and Silicon Carbide (SiC). These materials necessitate highly precise deposition techniques, making specialized epitaxy equipment indispensable for manufacturing next-generation power electronics, high-frequency radio frequency (RF) components, and sophisticated optoelectronics.

Epitaxy Equipment Market introduction

The Epitaxy Equipment Market encompasses sophisticated tools designed for the deposition of crystalline layers on a substrate, maintaining the substrate's crystallographic orientation. Epitaxy, derived from Greek words meaning "upon arrangement," is a critical process in semiconductor manufacturing, essential for creating multilayered structures that define the functionality of modern electronic and photonic devices. These equipment systems, primarily categorized as Metal-Organic Chemical Vapor Deposition (MOCVD), Molecular Beam Epitaxy (MBE), and Hydride Vapor Phase Epitaxy (HVPE) reactors, facilitate the controlled growth of ultra-thin films with precise thickness, composition, and doping profiles. The resultant epitaxial layers form the active regions of transistors, lasers, LEDs, and specialized sensor elements, directly impacting device performance, efficiency, and cost.

Major applications of epitaxy equipment span several high-growth industries. In the realm of optoelectronics, MOCVD tools are paramount for fabricating high-brightness LEDs and vertical-cavity surface-emitting lasers (VCSELs), integral components in display technology, automotive lighting, and 3D sensing systems used in consumer electronics. For power electronics, especially those utilized in electric vehicles (EVs) and renewable energy systems, epitaxy equipment is crucial for depositing wide bandgap materials (GaN and SiC) that enable highly efficient energy conversion and management. Furthermore, the expansion of 5G and future 6G communication networks drives significant investment in epitaxy equipment for producing high-electron mobility transistors (HEMTs) necessary for high-frequency RF applications.

The primary benefits delivered by advanced epitaxy equipment include unparalleled control over film thickness down to the atomic level, high material purity, and the capacity for uniform deposition across large wafers, which improves manufacturing yield and reduces production costs. Key driving factors stimulating market growth include aggressive technological transitions towards GaN and SiC based devices replacing traditional silicon components, substantial governmental and private sector investments in semiconductor fabrication plants (fabs), and the exponential growth of IoT devices, requiring highly integrated and energy-efficient circuits. Moreover, the increasing complexity of semiconductor device architectures, necessitating multi-junction solar cells and complex heterostructures, continually demands higher throughput and greater precision from epitaxy systems.

Epitaxy Equipment Market Executive Summary

The Epitaxy Equipment Market is undergoing a rapid evolution characterized by significant business trends focused on high-throughput solutions and advanced materials processing capabilities. Manufacturers are heavily investing in next-generation MOCVD platforms optimized for large-wafer SiC and GaN epitaxy, aiming to address the efficiency demands of the electric vehicle and sustainable energy sectors. The trend toward customized system configurations for niche applications, such as micro-LED manufacturing and advanced sensor fabrication, is also prominent, requiring closer collaboration between equipment suppliers and integrated device manufacturers (IDMs). Geographically, the market dominance is shifting further toward the Asia Pacific region, primarily driven by substantial capacity expansion initiatives in China, Taiwan, South Korea, and Japan, which are aggressively bolstering domestic semiconductor supply chains. Regulatory support and state-backed funding for establishing cutting-edge wafer fabs in these nations amplify the regional growth trajectory, positioning APAC as the central hub for epitaxy equipment deployment and innovation over the forecast period.

Segmentation analysis highlights the MOCVD segment maintaining its leadership position due to its versatility and established use in LED and laser diode production. However, the Hydride VPE (HVPE) segment is experiencing the highest proportional growth, particularly favored for thick layer deposition of GaN substrates required for high-power devices, offering high deposition rates critical for cost reduction. In terms of application, the Power Devices segment, fueled by global decarbonization efforts and the automotive industry’s shift to EVs, is anticipated to record the fastest CAGR, surpassing traditional application areas like general lighting LEDs. Wafer size trends indicate a clear migration toward larger diameters, specifically 6-inch and 8-inch SiC and GaN substrates, which necessitates continuous redesign and recalibration of existing epitaxy reactors to ensure uniformity and yield at scale. These segment-specific advancements reflect the broader industry requirement for higher energy efficiency, greater power density, and reduced manufacturing cycle times.

In summary, the Epitaxy Equipment Market forecast indicates sustained double-digit growth, underpinned by fundamental technological shifts in material science and electronic device architecture. Key players are prioritizing the integration of advanced process control (APC) systems utilizing real-time monitoring and AI-driven optimization to enhance epitaxial layer quality and reproducibility. Challenges related to high capital investment and the technical complexity of handling wide bandgap materials persist, but the massive opportunity presented by the electrification of transportation, the rollout of 5G/6G networks, and the proliferation of advanced display technologies ensures continued strong market momentum. Strategic acquisitions and vertical integration among equipment providers and material suppliers are expected to redefine the competitive landscape, pushing the boundaries of deposition technology precision and throughput capacity.

AI Impact Analysis on Epitaxy Equipment Market

Common user questions regarding AI's influence on the Epitaxy Equipment Market frequently revolve around how Artificial Intelligence can enhance process control, predict equipment failure, and optimize material utilization. Users are concerned with the application of machine learning (ML) algorithms to manage the highly complex, multi-variable environments within MOCVD and MBE reactors, where parameters such as gas flow, temperature profiles, and precursor concentration must be meticulously balanced. Key themes emerging from these inquiries include the potential for AI to dramatically improve yield rates by identifying subtle process deviations invisible to human operators, the implementation of predictive maintenance to minimize costly downtime in high-capital equipment, and the acceleration of R&D cycles through automated parameter optimization. There is a strong expectation that AI integration will transform epitaxy from a traditionally iterative, empirical process into a highly automated, data-driven manufacturing discipline, thereby reducing the time-to-market for new compound semiconductor devices and addressing the critical skill gap in specialized epitaxy engineering.

- AI-powered Process Optimization: Utilizes deep learning to analyze real-time sensor data from epitaxy reactors, adjusting growth parameters (e.g., V/III ratio, temperature ramps) dynamically to achieve optimal uniformity and defect reduction across large wafer batches.

- Predictive Maintenance (PdM): Machine learning models predict the likelihood of failure for critical reactor components (e.g., susceptors, gas panels, pumps) based on operational history and vibrational analysis, minimizing unscheduled downtime and maximizing equipment utilization.

- Automated Defect Classification (ADC): AI vision systems analyze in-situ and post-process wafer images to accurately identify and classify epitaxial defects (e.g., surface roughness, pits, dislocations), correlating defects back to specific process variables for root cause analysis.

- Recipe Optimization and Tuning: Reinforcement learning algorithms explore vast parameter spaces significantly faster than traditional methods, accelerating the development of new epitaxial structures for advanced wide bandgap materials like GaN and SiC.

- Yield Enhancement: AI facilitates the creation of digital twins of epitaxy reactors, allowing for virtual experimentation and fault simulation, leading to improved throughput and reduced material waste in high-volume manufacturing environments.

- Supply Chain and Inventory Management: AI tools optimize the scheduling and ordering of expensive and temperature-sensitive precursor chemicals, ensuring just-in-time delivery and minimizing inventory holding costs.

DRO & Impact Forces Of Epitaxy Equipment Market

The dynamics of the Epitaxy Equipment Market are dictated by a powerful interplay of Drivers, Restraints, and Opportunities, which collectively define the Impact Forces shaping its trajectory. The primary Driver is the inexorable global shift toward compound semiconductors—specifically GaN and SiC—driven by their superior performance characteristics necessary for high-efficiency power conversion and high-frequency communication. This technological imperative is compounded by massive governmental and industry investments in next-generation infrastructure, including the global rollout of 5G and preparations for 6G, alongside the aggressive push for vehicle electrification, which mandates highly efficient power stages enabled by epitaxial layers. These drivers create a sustained, non-cyclical demand for specialized deposition tools capable of handling these complex materials at production scale.

Conversely, significant Restraints challenge market growth and expansion. The foremost constraint is the exceptionally high capital expenditure required for purchasing and installing advanced epitaxy equipment, such as large-capacity MOCVD reactors, which acts as a barrier to entry for smaller manufacturers and limits rapid capacity expansion for existing players. Furthermore, the inherent technical complexity and sensitivity of the epitaxial process necessitate specialized operator training, rigorous process control, and high maintenance costs, contributing to a high operational overhead. Trade uncertainties and geopolitical tensions impacting global semiconductor supply chains also create volatility in equipment investment decisions, particularly concerning the acquisition of cutting-edge technology platforms.

Despite these restraints, substantial Opportunities exist that promise accelerated growth. The emergence of novel applications, particularly in advanced display technologies like micro-LEDs and in high-precision sensing markets (LiDAR, biometric sensors), opens new, highly lucrative revenue streams that require customized epitaxy solutions. Moreover, the industry’s focus on achieving greater sustainability provides an opportunity for suppliers to introduce energy-efficient and highly automated equipment, catering to the environmental, social, and governance (ESG) goals of major semiconductor manufacturers. The consolidation of compound semiconductor production onto larger wafer sizes (8-inch SiC) offers a crucial chance for equipment providers to innovate high-throughput, cluster-tool architectures, driving further equipment upgrades and sales. These Impact Forces confirm that while technical hurdles are high, the strategic necessity of epitaxy equipment in the modern electronic landscape guarantees robust market expansion, especially within wide bandgap material processing.

Segmentation Analysis

The Epitaxy Equipment Market is comprehensively segmented based on Type, Application, and Wafer Size, providing granular insights into material processing dynamics and end-user demand patterns. The Type segment primarily differentiates between the dominant deposition methods, each optimized for specific materials and device requirements. MOCVD remains the workhorse for III-V materials (e.g., GaN, GaAs) essential for LEDs and lasers, whereas MBE serves high-purity, ultra-thin film deposition necessary for specialized high-frequency and quantum devices. The Application segmentation clearly reflects the end-use demand, with Power Devices and Communication sectors driving the highest growth due to global infrastructure modernization and the energy transition, demanding highly reliable compound semiconductors. Wafer Size segmentation illustrates the ongoing industry trend toward manufacturing efficiency, as larger wafers reduce cost per die and require next-generation equipment upgrades to maintain deposition uniformity.

- By Type

- Metal-Organic Chemical Vapor Deposition (MOCVD)

- Molecular Beam Epitaxy (MBE)

- Hydride Vapor Phase Epitaxy (HVPE)

- Liquid Phase Epitaxy (LPE)

- By Application

- LED Manufacturing (Optoelectronics)

- Power Devices (SiC, GaN Power MOSFETs/HEMTs)

- Communication (RF Devices, 5G/6G Components)

- Sensors and Photonics (VCSELs, LiDAR)

- Solar Cells (Multi-junction PV)

- By Wafer Size

- 2-inch and 4-inch

- 6-inch

- 8-inch and above (12-inch Si)

Value Chain Analysis For Epitaxy Equipment Market

The Epitaxy Equipment Value Chain is characterized by highly specialized, capital-intensive steps, beginning with complex upstream material preparation and culminating in advanced semiconductor fabrication. Upstream analysis focuses on the suppliers of ultra-high purity precursor chemicals (such as Trimethylgallium, Silane, Ammonia) and the manufacturers of critical subcomponents, including high-precision vacuum systems, high-temperature susceptors, and proprietary gas delivery systems. The quality and stability of these precursors and components directly dictate the performance and uptime of the epitaxy reactors, necessitating stringent quality control and long-term supplier relationships. Midstream activities involve the design, assembly, and testing of the sophisticated epitaxy reactors themselves (MOCVD, MBE systems), dominated by a handful of global equipment manufacturers who possess deep intellectual property regarding reactor kinetics and thermal management. This stage requires significant R&D investment to continuously improve deposition speed, uniformity, and defect density for larger wafers.

Downstream analysis centers on the integration of the epitaxy equipment into high-volume manufacturing environments, primarily operated by Integrated Device Manufacturers (IDMs), Foundries, and specialized Compound Semiconductor manufacturers. These end-users utilize the equipment to deposit active layers onto prepared substrates (Si, sapphire, SiC, GaN), defining the core functionality of devices like power transistors, laser diodes, and high-frequency amplifiers. The efficiency of the downstream process—measured in yield and throughput—is critically dependent on the support services provided by the equipment vendors, including installation, process recipe development, and long-term maintenance contracts. This stage is highly cyclical and sensitive to global semiconductor market demand, prompting end-users to demand high reliability and low total cost of ownership (TCO) from their equipment suppliers.

The distribution channel for epitaxy equipment is predominantly direct, given the bespoke nature and high cost of the systems. Direct distribution ensures comprehensive technical support, detailed negotiation of performance guarantees, and secure intellectual property transfer required for proprietary process development. Indirect channels are rarely used for the primary reactor units but may include local representatives or sales agents for spare parts and consumable components. The entire value chain is deeply interdependent; bottlenecks in precursor supply or failures in component manufacturing can immediately halt high-cost downstream fabrication. The trend toward closer collaboration between equipment providers and material scientists is critical for accelerating the adoption of new materials like bulk GaN substrates, which require customized reactor designs and optimized process flows to achieve commercial viability.

Epitaxy Equipment Market Potential Customers

The potential customers and primary buyers of epitaxy equipment are concentrated within the high-technology semiconductor manufacturing sector, encompassing diverse entities crucial for the global electronics supply chain. The largest segment comprises Integrated Device Manufacturers (IDMs) and dedicated semiconductor foundries that operate large-scale fabrication facilities (fabs) and require high-throughput MOCVD and MBE systems for mass production of commodity and specialized chips. These entities purchase epitaxy equipment to control the quality of the active device layer internally, ensuring performance specifications for their end products, such as microprocessors, memory chips, and application-specific integrated circuits (ASICs). The transition to compound semiconductors is attracting significant investment from traditional silicon fabs seeking to diversify their production capabilities.

Another rapidly expanding customer base includes specialized manufacturers focused exclusively on compound semiconductor devices (e.g., companies producing GaN-on-Si, SiC power modules, or GaAs-based RF components). These specialty fabs require epitaxy equipment tailored for wide bandgap material growth, prioritizing layer purity, thickness uniformity across increasingly larger substrates (6-inch and 8-inch), and the ability to handle high operating temperatures. The demand from this segment is strongly correlated with the growth of the electric vehicle, industrial power conversion, and 5G telecommunications infrastructure markets, which are heavily reliant on these high-performance materials. Furthermore, research institutions and governmental laboratories also represent a significant, albeit smaller, customer base, purchasing advanced, often smaller-scale, MBE systems for fundamental material science research, prototyping, and early-stage device development.

The convergence of advanced display technologies, notably micro-LEDs, has created a distinct new customer segment: display panel manufacturers. These companies are investing heavily in customized MOCVD equipment capable of uniform, high-density deposition of very small, high-efficiency LEDs, critical for next-generation displays in smartphones, wearables, and large-format televisions. Overall, the buying decision for epitaxy equipment is characterized by long sales cycles, high evaluation costs, and a strong emphasis on proven process capability, technical support, and the manufacturer’s reputation for system uptime and long-term upgrade path viability. The key purchasing drivers across all customer groups are minimizing the total cost of ownership (TCO) and maximizing yield through superior film quality.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 28.0 Billion |

| Growth Rate | 12.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AIXTRON SE, Veeco Instruments Inc., Tokyo Electron Limited (TEL), ASM International, Applied Materials Inc., Canon Anelva Corporation, SCREEN Holdings Co., Ltd., CVD Equipment Corporation, Nichia Corporation, Silex Microsystems AB, Samco Inc., Riber, EpiGaN, Oxford Instruments plc, NuFlare Technology Inc., ClassOne Technology, KLA Corporation, Advanced Micro-Fabrication Equipment Inc. (AMEC) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Epitaxy Equipment Market Key Technology Landscape

The Epitaxy Equipment Market is defined by intense technological competition focused on increasing deposition rate, improving material quality, and enhancing wafer uniformity, particularly for larger substrate diameters used in compound semiconductor manufacturing. Metal-Organic Chemical Vapor Deposition (MOCVD) technology remains the dominant platform, continuously evolving with features like Planetary Reactor technology and Close Coupled Showerhead (CCS) designs. Recent advancements in MOCVD focus heavily on thermal management uniformity across 6-inch and 8-inch SiC/GaN wafers, utilizing complex gas flow dynamics and high-temperature graphite susceptors to achieve perfect stoichiometry and minimize defect generation, crucial for high-voltage power devices. Furthermore, the integration of advanced in-situ monitoring tools, such as pyrometers and reflectance monitoring systems, provides real-time feedback, enabling automated process control (APC) necessary for high-yield manufacturing.

Molecular Beam Epitaxy (MBE) technology, while offering the highest purity and atomic layer control, is seeing specialized enhancements to improve throughput, traditionally its weakness. MBE systems are incorporating cluster tool capabilities and larger wafer handling mechanisms, primarily targeting high-end applications like quantum computing components, advanced sensor arrays, and specific military/aerospace RF devices where ultra-precise layer control is paramount. Another critical technological development is in Hydride Vapor Phase Epitaxy (HVPE), which is gaining significant traction due to its extremely high growth rates, making it ideal for thick layer growth of bulk GaN substrates. HVPE advancements center on managing byproduct gases and scaling reactor capacity while maintaining crystal quality, directly addressing the cost challenges associated with bulk GaN substrate manufacturing.

The overall technological landscape is characterized by the pursuit of hybrid deposition techniques and increased automation. Equipment providers are exploring concepts like Atomic Layer Epitaxy (ALE) for ultra-thin film deposition control and are integrating machine learning algorithms to manage the complex parameter space of MOCVD reactors. The trend towards heterogeneous integration—growing compound semiconductors on silicon substrates (GaN-on-Si)—is driving the need for new equipment designs capable of managing the significant thermal and lattice mismatch challenges. Suppliers are focusing on flexible platforms that can switch between different materials (e.g., SiC and GaN) efficiently, maximizing equipment utility and reducing the capital burden on semiconductor fabricators striving for technological differentiation and lower manufacturing costs.

Regional Highlights

The global Epitaxy Equipment Market exhibits distinct regional dynamics, heavily influenced by local semiconductor manufacturing policies, technological focus, and end-market demand. The Asia Pacific (APAC) region stands as the dominant and fastest-growing market, primarily fueled by massive, state-backed investments in new fabrication facilities, particularly in China and Taiwan. These nations are aggressively building domestic supply chains for compound semiconductors to reduce reliance on Western technology, driving exponential demand for MOCVD and HVPE systems critical for LED, power device, and advanced communication component manufacturing. South Korea and Japan maintain strong positions due to their established expertise in memory, display technologies, and advanced materials, requiring constant equipment upgrades.

North America and Europe represent mature markets characterized by high-value, high-complexity manufacturing, R&D intensity, and specialization in wide bandgap materials (SiC and GaN). North America, driven by military/aerospace applications, advanced computing, and pioneering electric vehicle manufacturing, focuses on purchasing high-precision MBE systems and advanced MOCVD tools for R&D and specialized production runs. European growth is strongly tied to the automotive industry's push for electrification and the development of energy-efficient industrial power electronics, necessitating continuous investment in SiC-optimized epitaxy equipment. These regions often lead in adopting AI and automation technologies to enhance yield and maintain competitiveness against high-volume Asian manufacturers.

- Asia Pacific (APAC): Dominant market share due to unparalleled growth in semiconductor fabrication capacity, especially in China and Taiwan. Key focus areas include volume production of LEDs, memory devices, and high-volume GaN-on-Si power devices driven by consumer electronics and telecommunications.

- North America: Strong R&D focus, leading adoption of advanced MBE technology for aerospace, defense, and quantum computing. Significant investment in SiC epitaxy spurred by major electric vehicle and industrial power component manufacturers.

- Europe: Growth driven by stringent energy efficiency regulations and the robust automotive sector. High demand for MOCVD/HVPE equipment optimized for SiC and GaN power electronics, particularly in Germany, Italy, and Scandinavia.

- Rest of the World (Latin America and MEA): Emerging markets with moderate growth, primarily centered on localized assembly and packaging operations, relying on imported epitaxial wafers. Limited but increasing demand for epitaxy equipment for niche industrial and renewable energy projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Epitaxy Equipment Market.- AIXTRON SE

- Veeco Instruments Inc.

- Tokyo Electron Limited (TEL)

- ASM International

- Applied Materials Inc.

- Canon Anelva Corporation

- SCREEN Holdings Co., Ltd.

- CVD Equipment Corporation

- Nichia Corporation

- Silex Microsystems AB

- Samco Inc.

- Riber

- EpiGaN

- Oxford Instruments plc

- NuFlare Technology Inc.

- ClassOne Technology

- KLA Corporation

- Advanced Micro-Fabrication Equipment Inc. (AMEC)

Frequently Asked Questions

Analyze common user questions about the Epitaxy Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for MOCVD equipment?

The primary factor driving MOCVD demand is the increasing global production of compound semiconductor devices, particularly Gallium Nitride (GaN) and Indium Phosphide (InP) based devices, essential for high-brightness LEDs, micro-LED displays, and Vertical-Cavity Surface-Emitting Lasers (VCSELs) used in 3D sensing and advanced photonics.

How is the transition to SiC and GaN affecting epitaxy equipment design?

The transition mandates higher operating temperatures and more robust reactor materials to handle SiC and GaN growth precursors, driving the development of specialized high-temperature MOCVD and HVPE systems optimized for superior uniformity and minimal defect density on larger (6-inch and 8-inch) wide bandgap wafers.

Which geographical region dominates the sales of epitaxy equipment?

The Asia Pacific (APAC) region currently dominates the market share for epitaxy equipment, attributed to substantial capacity expansion in semiconductor foundries and government initiatives in countries like China and Taiwan aimed at establishing self-sufficient compound semiconductor supply chains for power and optoelectronics.

What are the main technical challenges in epitaxy equipment manufacturing?

The main technical challenges include achieving atomic-level thickness control and uniformity across large wafer diameters, mitigating material mismatch issues (especially in heterogeneous integration like GaN-on-Si), and developing predictive maintenance systems to manage the high operational complexity of the deposition process.

What role does Molecular Beam Epitaxy (MBE) play in the current market?

MBE plays a crucial role in highly specialized, niche applications requiring ultra-high purity and precise control over film composition, such as advanced quantum devices, specialized high-frequency RF components, and research applications where superior material quality outweighs the lower throughput compared to MOCVD.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager