Epoxy Molding Compounds Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438953 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Epoxy Molding Compounds Market Size

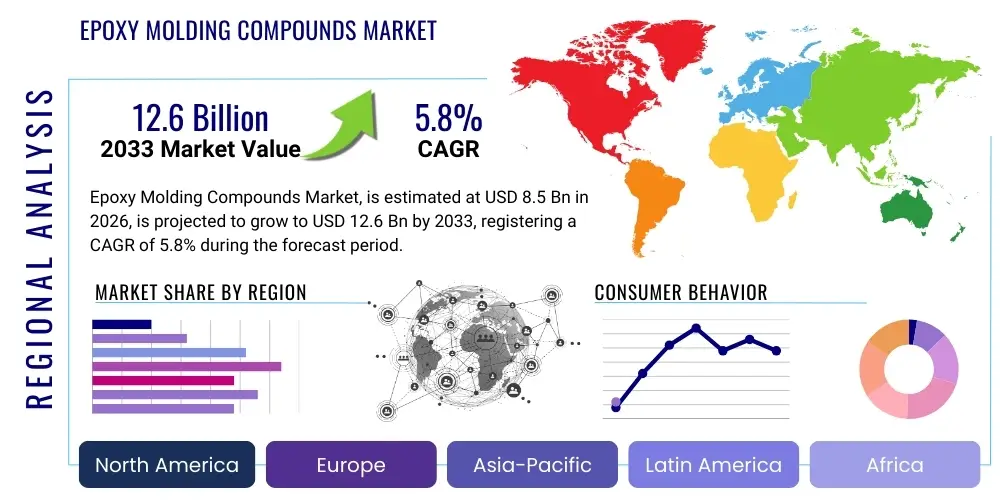

The Epoxy Molding Compounds Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 12.6 Billion by the end of the forecast period in 2033.

Epoxy Molding Compounds Market introduction

Epoxy Molding Compounds (EMCs) are specialized thermosetting materials predominantly used for encapsulating delicate electronic components, particularly semiconductors, integrated circuits (ICs), diodes, and transistors. These materials provide crucial protection against mechanical stress, thermal shock, moisture ingress, and chemical corrosion, significantly enhancing the reliability and lifespan of electronic devices. EMCs are formulated resins characterized by high purity, low coefficient of thermal expansion (CTE), excellent electrical insulation properties, and superior adhesion to various substrates. The chemical composition typically includes epoxy resins, curing agents, accelerators, fillers (such as silica), flame retardants, and stress modifiers. The demand for these sophisticated protective materials is intrinsically linked to the expansion of the global electronics industry, driven by miniaturization, high performance requirements, and increased complexity of electronic packaging.

The primary applications of Epoxy Molding Compounds span across several high-growth industries, most notably electronics and automotive sectors. In electronics, EMCs are indispensable for packaging memory chips, microcontrollers, and logic devices. The automotive industry utilizes them heavily in electronic control units (ECUs), sensor packaging, and advanced driver-assistance systems (ADAS) components, where robust performance under extreme operating conditions is mandatory. Furthermore, consumer electronics, including smartphones, tablets, and wearable technology, rely on high-performance EMCs for compact and durable packaging solutions. The continual evolution towards higher integration density and faster processing speeds in semiconductors mandates the development of EMCs with lower stress capabilities and superior thermal dissipation properties.

The key driving factors propelling market growth include the exponential demand for semiconductor devices globally, fueled by the proliferation of 5G technology, the Internet of Things (IoT), and the rapid electrification of vehicles. Benefits derived from using EMCs include improved thermal management, which is critical for high-power electronics, enhanced mechanical protection during assembly and operation, and excellent manufacturing throughput due to their suitability for mass production via compression or transfer molding techniques. The shift towards smaller, more powerful, and cost-effective electronic packages necessitates continuous innovation in EMC formulations, particularly those offering halogen-free and environmentally compliant characteristics to meet stringent global regulations.

Epoxy Molding Compounds Market Executive Summary

The Epoxy Molding Compounds market is experiencing robust growth, primarily dictated by global semiconductor demand and critical transitions in automotive and communication technologies. Business trends indicate a strong emphasis on developing low-stress, high-thermal conductivity, and eco-friendly (halogen-free) formulations to cater to advanced packaging techniques like wafer-level packaging (WLP) and system-in-package (SiP). Regionally, Asia Pacific maintains its dominance, serving as the global manufacturing hub for electronics and semiconductors, particularly in economies such as China, South Korea, Taiwan, and Japan. This region exhibits the highest growth potential due to continued investment in fabrication facilities (fabs) and outsourced semiconductor assembly and test (OSAT) operations. Segment-wise, the market is characterized by the continued dominance of the epoxy resin type, valued for its mechanical strength and electrical performance, while the adoption of liquid EMCs is growing rapidly for specific power electronics and sophisticated micro-packaging applications where flow characteristics are paramount. Furthermore, the discrete semiconductor segment, driven by power management and renewable energy applications, is projected to witness accelerated consumption of specialized EMC materials over the forecast period, emphasizing thermal stability and durability.

AI Impact Analysis on Epoxy Molding Compounds Market

Users commonly inquire about how Artificial Intelligence (AI) and machine learning (ML) are influencing the manufacturing quality, material development, and predictive failure analysis within the Epoxy Molding Compounds supply chain. The primary concerns revolve around leveraging AI for optimizing the complex chemical formulation process—specifically, finding the ideal balance between low viscosity for effective molding and achieving high mechanical strength post-curing. Users also seek information on how AI models can predict potential delamination or cracking risks based on manufacturing parameters and operational stress profiles (thermal cycling, humidity exposure). The overriding expectation is that AI will enhance material quality consistency, accelerate the discovery of novel, high-performance EMCs tailored for extreme environments (e.g., high-frequency 5G components or high-voltage electric vehicle inverters), and drastically reduce waste through improved predictive process control in large-scale molding operations.

- AI-driven Predictive Maintenance: Utilizing sensor data from molding equipment to predict wear and tear, optimizing machine uptime and consistency of the molding process, thereby reducing defects attributable to equipment variability.

- Accelerated Material Informatics: Employing machine learning algorithms to screen and optimize thousands of potential chemical compositions and filler ratios, dramatically shortening the R&D cycle for new EMC formulations with specific characteristics (e.g., extremely low CTE or enhanced thermal conductivity).

- Quality Control Automation: Implementing computer vision and deep learning models for real-time automated inspection of molded components, identifying microscopic defects, voids, or cracks with accuracy surpassing human capability.

- Process Parameter Optimization: Using AI to analyze complex interactions between temperature profiles, injection speed, pressure, and material batch variations to determine optimal manufacturing settings, leading to zero-defect manufacturing objectives.

- Supply Chain Resilience Modeling: Applying AI to forecast demand fluctuations in the semiconductor market and model potential disruptions in raw material sourcing (epoxy resins, silica fillers), enabling suppliers to manage inventory and production schedules proactively.

DRO & Impact Forces Of Epoxy Molding Compounds Market

The Epoxy Molding Compounds market growth is robustly driven by the burgeoning demand for advanced semiconductor packaging necessitated by 5G deployment and electric vehicle adoption, yet it is constrained by volatility in raw material pricing and the high complexity of formulating materials for emerging, highly integrated circuit architectures. Opportunities abound in the development of materials specifically engineered for high-frequency and high-power applications, alongside a strong push towards sustainable, bio-based alternatives. These dynamics collectively create significant impact forces, primarily centered around technological innovation to meet increasingly stringent performance requirements (thermal management, stress reduction) and compliance with evolving environmental regulations (halogen-free mandates).

Drivers: The dominant driver is the pervasive digitization across all sectors, leading to unprecedented demand for microelectronic components. The rollout of 5G infrastructure requires high-speed, high-reliability components encapsulated in specialized EMCs capable of managing increased thermal loads and maintaining signal integrity at high frequencies. Similarly, the automotive transition to electric vehicles (EVs) and autonomous driving systems necessitates robust power modules (IGBTs, MOSFETs) and sensor systems, all requiring high-durability and high-thermal-conductivity EMCs. Furthermore, the continuing trend of miniaturization in consumer electronics necessitates molding compounds that enable ultra-thin and complex packaging geometries without compromising mechanical strength.

Restraints: The market faces significant restraints, including the cyclical nature and inherent sensitivity of the semiconductor industry, which can lead to unpredictable demand volatility for molding compounds. A major challenge is the fluctuating cost and availability of key raw materials, such particularly highly refined epoxy resins, hardeners, and specialized inorganic fillers, which directly impacts manufacturing costs and market stability. Moreover, the stringent performance requirements for new-generation semiconductors often require extremely complex and expensive R&D efforts, presenting high barriers to entry for new players and challenging established manufacturers to continuously innovate under tight regulatory scrutiny, particularly regarding thermal stability and low coefficient of thermal expansion (CTE).

Opportunities: Significant growth opportunities lie in developing next-generation materials tailored for advanced packaging technologies, such as fan-out wafer-level packaging (FO-WLP) and 3D stacking technologies, which demand ultra-low viscosity and high flowability. The growing market for renewable energy components, including solar inverters and wind turbine control systems, provides a niche requiring EMCs with exceptional resistance to environmental stress and prolonged operational lifespan. The industry is also actively exploring environmentally conscious opportunities, including bio-based epoxy resins and sustainable flame retardant alternatives, aligning with global corporate sustainability goals and consumer preferences for greener electronic products, ensuring future market relevance and regulatory compliance.

Impact Forces: The most prominent impact force is technological substitution pressure, particularly from alternative encapsulation methods or advanced liquid encapsulants, which continuously challenge the traditional solid EMC format. Secondly, intense competitive pressure among major chemical manufacturers drives continuous innovation and margin compression, forcing companies to focus on vertical integration and proprietary material blends. Finally, the regulatory landscape, especially in Europe and North America concerning restrictions on halogenated flame retardants and certain solvents, acts as a powerful external force, compelling rapid reformulation and significant investment in compliant, high-performance, and thermally efficient product lines to maintain market accessibility.

Segmentation Analysis

The Epoxy Molding Compounds market is extensively segmented based on material composition, application area, and physical form, reflecting the diverse and specialized requirements of the electronics and automotive industries. Understanding these segments is crucial as the choice of EMC formulation directly influences the performance, reliability, and manufacturing cost of the encapsulated electronic device. The segmentation by resin type (e.g., standard epoxy, biphenyl epoxy) determines the thermal and mechanical characteristics, while segmentation by application (e.g., ICs, sensors, power modules) highlights the specific performance demands. Furthermore, the distinction between powder and liquid forms dictates the preferred molding process and suitability for complex geometries. Continuous innovation within these segments, particularly focusing on enhanced thermal management and moisture resistance, remains central to capturing market share in high-growth segments like 5G communication modules and automotive ADAS components, which require extremely stable and reliable encapsulation solutions.

- By Type:

- Epoxy

- Phenol-Formaldehyde

- Other Thermoset Resins

- By Application:

- Integrated Circuits (ICs) and Memory

- Discrete Semiconductors

- Power Modules (IGBTs, MOSFETs)

- Sensors and Optoelectronics

- LED Encapsulation

- By End-Use Industry:

- Electronics and Telecommunication

- Automotive and Transportation

- Industrial and Power

- Consumer Goods

- By Form:

- Powder Molding Compounds (Transfer Molding)

- Liquid Molding Compounds (Casting/Injection)

Value Chain Analysis For Epoxy Molding Compounds Market

The value chain for Epoxy Molding Compounds begins with upstream activities involving the synthesis and procurement of essential raw materials, primarily specialized epoxy resins (such as bisphenol-A based or biphenyl-type epoxies), hardeners, catalysts, and high-purity inorganic fillers, predominantly fused silica or crystalline silica. Quality control and consistency at this foundational stage are paramount, as the purity of these materials directly influences the performance, particularly the thermal and electrical properties, of the final EMC product. Key raw material suppliers, often specialized chemical companies, dictate pricing dynamics and supply stability. Downstream operations involve the compounders, who combine these raw ingredients through precise blending, kneading, and curing processes to produce the final solid pellets (powder form) or viscous liquids (liquid form) required by the end-users. This stage involves significant intellectual property surrounding proprietary formulation recipes designed to optimize flow, curing time, and long-term reliability.

The distribution channel is generally characterized by a mix of direct sales and specialized indirect distributors, depending on the volume and technical complexity of the required product. Major EMC manufacturers typically maintain direct relationships with large, multinational semiconductor manufacturers (IDMs and OSATs) to offer technical support, customize formulations, and ensure just-in-time delivery for high-volume orders. This direct channel facilitates rapid feedback loops essential for continuous product improvement tailored to specific electronic packaging challenges. Conversely, smaller end-users, especially those in niche industrial or low-volume specialized electronics sectors, often procure materials through specialized chemical distributors who manage warehousing, smaller batch deliveries, and regional technical consultation services.

The final phase of the value chain is the application process conducted by the end-users, primarily outsourced semiconductor assembly and test (OSAT) companies or in-house assembly units of integrated device manufacturers (IDMs). They utilize transfer molding (for powder EMCs) or dispensing/potting (for liquid EMCs) techniques to encapsulate the semiconductor dies. Efficiency and minimizing defects during the molding stage are critical, often requiring close collaboration between the EMC supplier and the molding equipment manufacturer. The overall health of the value chain is highly dependent on robust collaboration across all stages, ensuring material purity, formulation excellence, and seamless technical integration into the high-speed, high-precision semiconductor manufacturing environment.

Epoxy Molding Compounds Market Potential Customers

The primary customers for Epoxy Molding Compounds are entities engaged in the assembly, testing, and packaging of semiconductor devices and electronic components. This includes a vast ecosystem of Outsourced Semiconductor Assembly and Test (OSAT) providers, who handle the majority of global semiconductor packaging for various clients, including Amkor Technology, ASE Technology Holding, and JCET Group. These high-volume manufacturers require consistent quality, high-speed curing compounds, and technical support for large-scale transfer molding operations. Secondly, Integrated Device Manufacturers (IDMs) like Intel, Samsung, and Texas Instruments, who perform in-house packaging for certain critical or proprietary chips, represent key customers seeking highly specialized EMCs for advanced packaging nodes where stringent proprietary performance standards must be met internally.

Beyond the core semiconductor packaging industry, the automotive electronics sector constitutes a rapidly expanding customer base. Manufacturers of Electronic Control Units (ECUs), high-power modules for Electric Vehicles (EVs) such as inverters and converters, and sensor arrays for Advanced Driver-Assistance Systems (ADAS) are increasingly demanding robust EMCs that offer superior thermal dissipation, moisture resistance, and vibration tolerance. These automotive clients require materials certified to rigorous standards like AEC-Q100, necessitating specialized compounds that can withstand extreme temperature cycling and harsh operating environments within engine compartments or battery systems, making them highly strategic buyers for high-performance, durable formulations.

Furthermore, manufacturers in the telecommunications and consumer electronics domains are significant buyers. This includes companies producing 5G infrastructure components, high-density memory modules (DRAM, NAND), and high-brightness LED lighting solutions. For 5G base stations and advanced mobile devices, customers prioritize EMCs that enable ultra-thin profiling, superior signal integrity (low dielectric constant), and efficient thermal management to handle increasing data rates and power density. The diversity of customer requirements—ranging from ultra-high-volume commodity packaging to highly customized, high-reliability applications—mandates that EMC suppliers maintain broad portfolios and strong technical application support capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 12.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sumitomo Bakelite Co., Ltd., Henkel AG & Co. KGaA, Hitachi Chemical Company, Ltd. (Showa Denko Materials), Resonac Corporation (formerly Hitachi Chemical), Chang Chun Group, Kyocera Corporation, Shin-Etsu Chemical Co., Ltd., BASF SE, Huntsman Corporation, Dow Inc., Epic Resins, Hexion Inc., Nagase ChemteX Corporation, Jiangsu Xingye Plastic Co., Ltd., Hongye Chemical Group Co., Ltd., Wuxi South-East Resins Co., Ltd., Kukdo Chemical Co., Ltd., Sino-Japanese Epoxy Resin Co., Ltd., San-Ei Chemical Co., Ltd., and Hubei Zhongxun Materials Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Epoxy Molding Compounds Market Key Technology Landscape

The technological landscape of the Epoxy Molding Compounds market is defined by continuous innovation aimed at overcoming the limitations imposed by increasing heat generation and shrinking size in advanced electronic devices. A critical area of focus is the development of ultra-low stress EMCs, which mitigate the thermo-mechanical strain exerted on delicate silicon chips during thermal cycling, preventing microcracking and failure. This is often achieved through incorporating flexible components or specialized low-CTE fillers. Another major technological push involves high-thermal conductivity formulations, utilizing novel filler materials like advanced ceramic powders or engineered metallic additives to efficiently dissipate heat away from high-power components, essential for IGBT modules in electric vehicles and high-frequency communication chips.

Furthermore, the shift towards advanced packaging methodologies, such as Fan-Out Wafer Level Packaging (FO-WLP) and System-in-Package (SiP), necessitates the creation of EMCs with highly controlled rheological properties. These compounds must possess extremely low viscosity and high flowability to penetrate intricate chip geometries without introducing voids or wire sweep, while still curing rapidly and maintaining structural integrity. Manufacturers are leveraging nanotechnology to engineer surface-treated fillers that enhance dispersion uniformity and reduce viscosity without sacrificing mechanical performance. The emphasis is on developing liquid EMCs (LMC) suitable for dispensing and compression molding processes used in these advanced, highly integrated packaging formats, offering advantages over traditional powder transfer molding in certain applications.

Regulatory compliance heavily influences technological development, specifically driving the mandatory adoption of halogen-free flame retardant systems. Suppliers are actively investing in proprietary phosphorus-based or metallic hydroxide flame retardant additives that meet UL 94 V-0 standards without negatively impacting the material’s electrical, thermal, or mechanical properties, ensuring market access in environmentally stringent jurisdictions. The convergence of these technological drivers—thermal management, stress reduction, rheological control for advanced processes, and environmental compliance—defines the competitive edge and future direction of innovation within the Epoxy Molding Compounds sector, demanding sophisticated material science and process engineering expertise.

Regional Highlights

Asia Pacific (APAC) stands as the undisputed market leader in the Epoxy Molding Compounds industry, commanding the largest market share and exhibiting the highest projected growth rate throughout the forecast period. This dominance is intrinsically linked to the region’s established position as the global powerhouse for semiconductor manufacturing, electronics assembly, and consumer electronics production. Countries like China, Taiwan (home to major OSAT and foundry operations), South Korea, and Japan host the majority of the world’s fabrication plants (fabs) and outsourced assembly and testing facilities. Robust government initiatives supporting domestic semiconductor production, coupled with massive investments in 5G infrastructure and high-volume automotive electronics manufacturing, particularly in China and Southeast Asian nations, ensure continued high consumption rates of EMCs across all application segments.

North America and Europe represent mature, high-value markets characterized by demand for highly specialized, premium EMC formulations, particularly those catering to aerospace, defense, medical devices, and high-reliability automotive components. While the volume consumption is lower compared to APAC, these regions are critical innovation centers. North America, driven by leading technology companies and advanced military technology requirements, focuses heavily on ultra-high-reliability and thermally advanced compounds. European demand is strongly influenced by stringent environmental regulations (driving the adoption of halogen-free and sustainable EMCs) and the burgeoning electric vehicle market, necessitating high-performance molding compounds for sophisticated power management modules and complex sensor systems, often requiring custom, low-volume solutions.

Latin America, the Middle East, and Africa (MEA) currently hold smaller market shares but are poised for gradual growth, primarily driven by increasing localized electronics assembly operations, infrastructural development, and rising consumer adoption of mobile devices and automotive technology. In the Middle East, investments in smart city technologies and industrial automation are creating nascent demand for encapsulated electronic components. However, market growth in these regions is largely dependent on imported finished products or components packaged elsewhere, leading to slower expansion rates for local EMC consumption compared to major manufacturing hubs. Future growth hinges on increasing foreign direct investment in local assembly plants and the establishment of regional electronics manufacturing ecosystems.

The differential regional growth trajectory highlights that future success for EMC suppliers will require a dual strategy: maximizing efficiency and scale in the high-volume APAC market, while simultaneously focusing R&D and specialized technical support efforts on the high-margin, technologically demanding North American and European sectors, ensuring compliance with diverse and evolving regional regulatory frameworks, especially concerning sustainability and material toxicity.

- Asia Pacific (APAC): Global manufacturing hub; highest volume consumption driven by major OSATs, 5G deployment, and automotive electrification in China, Taiwan, and South Korea.

- North America: Focus on high-reliability, specialty EMCs for aerospace, defense, high-end computing, and strict adherence to material purity standards.

- Europe: Strong demand driven by Electric Vehicle power electronics and industrial automation; market emphasizes regulatory compliance, leading the shift towards halogen-free and sustainable materials.

- Latin America (LATAM): Emerging market with gradual growth fueled by localized electronics assembly and increasing consumer electronics demand.

- Middle East & Africa (MEA): Growth linked to infrastructure projects and technological imports; niche opportunities in specialized industrial and power electronics applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Epoxy Molding Compounds Market.- Sumitomo Bakelite Co., Ltd.

- Henkel AG & Co. KGaA

- Resonac Corporation (formerly Showa Denko Materials)

- Chang Chun Group

- Kyocera Corporation

- Shin-Etsu Chemical Co., Ltd.

- Hitachi Chemical Company, Ltd. (Prior to acquisition by Showa Denko)

- BASF SE

- Huntsman Corporation

- Dow Inc.

- Epic Resins

- Hexion Inc.

- Nagase ChemteX Corporation

- Jiangsu Xingye Plastic Co., Ltd.

- Hongye Chemical Group Co., Ltd.

- Wuxi South-East Resins Co., Ltd.

- Kukdo Chemical Co., Ltd.

- Sino-Japanese Epoxy Resin Co., Ltd.

- San-Ei Chemical Co., Ltd.

- Hubei Zhongxun Materials Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Epoxy Molding Compounds market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between powder and liquid Epoxy Molding Compounds (EMCs)?

Powder EMCs are typically solid pellets used in high-volume transfer molding for standard ICs and discrete semiconductors, offering excellent mechanical properties and cost efficiency. Liquid EMCs (LMCs) are highly flowable, used in casting or dispensing processes, and are preferred for power electronics, sensors, and advanced packaging like SiP or WLP, where superior void-filling capability and lower molding pressure are required, often resulting in better performance for complex geometries and delicate wire bonds.

How is the demand for Epoxy Molding Compounds linked to the 5G and IoT markets?

The deployment of 5G infrastructure and the proliferation of IoT devices necessitate exponentially more semiconductor components. These applications require EMCs that offer improved thermal management due to increased power density, superior dielectric properties to maintain high-frequency signal integrity, and enhanced reliability under continuous operation, thereby driving demand for high-performance, specialized compound formulations.

What role do Epoxy Molding Compounds play in the Electric Vehicle (EV) industry?

EMCs are critical for protecting high-power modules (IGBTs, MOSFETs) in EV inverters and converters, as well as sensors and battery management systems (BMS). In the EV sector, EMCs must provide exceptional thermal conductivity to dissipate heat efficiently, high resistance to temperature cycling, and long-term durability against vibration and moisture ingress, ensuring the safety and reliability of the vehicle's powertrain electronics.

What are the primary factors influencing the pricing of Epoxy Molding Compounds?

Pricing is primarily influenced by the cost volatility of key raw materials, especially specialty epoxy resins, hardeners, and high-purity inorganic fillers like fused silica. Other factors include the degree of specialization required (e.g., custom thermal conductivity or ultra-low stress properties), adherence to stringent quality and regulatory certifications (like halogen-free status), and the high R&D investment necessary for new, advanced formulations.

Which regions are leading the research and development in next-generation Epoxy Molding Compounds?

While Asia Pacific leads in manufacturing volume, the core R&D for advanced, high-performance EMCs is highly competitive across APAC (Japan, South Korea, Taiwan), North America, and Europe. Research is currently focused on materials for Fan-Out Wafer Level Packaging (FO-WLP), bio-based resins, and compounds engineered with superior thermal interface material (TIM) capabilities to meet the demanding requirements of future microelectronic architectures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager