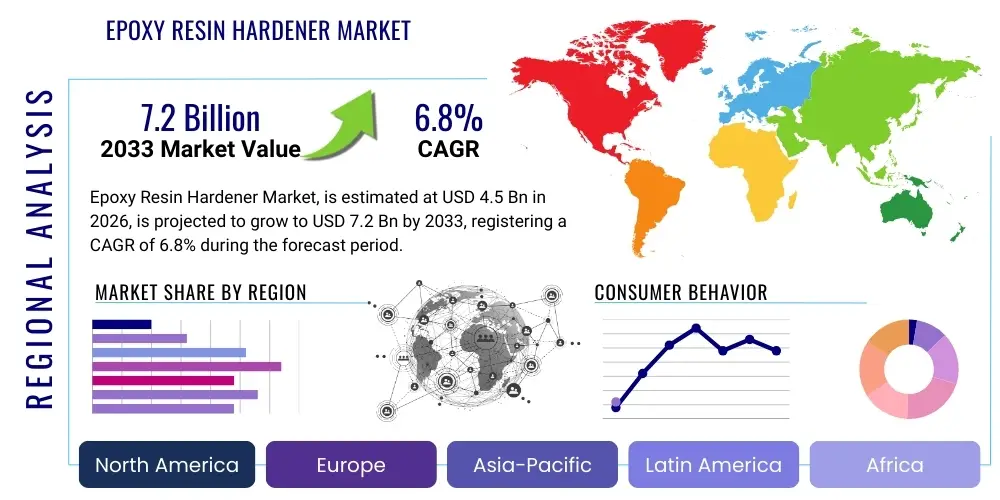

Epoxy Resin Hardener Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434601 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Epoxy Resin Hardener Market Size

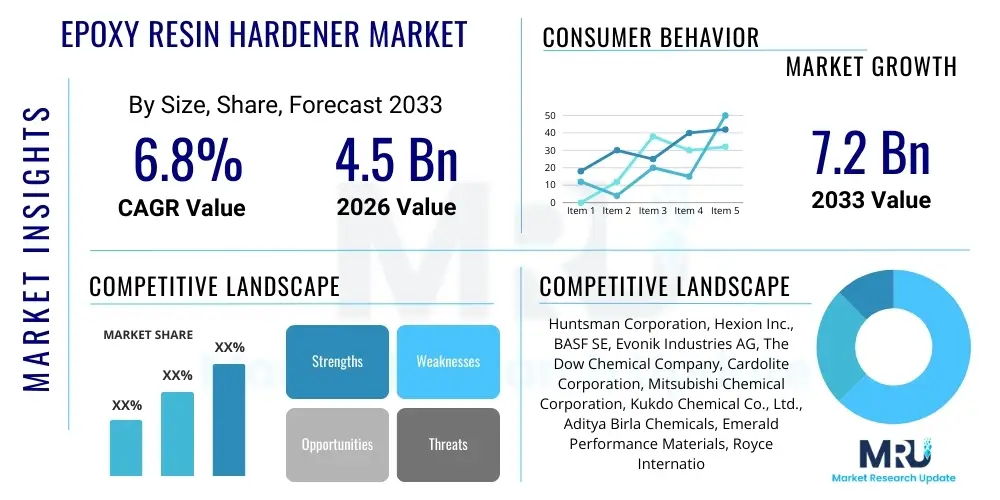

The Epoxy Resin Hardener Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Epoxy Resin Hardener Market introduction

The Epoxy Resin Hardener Market encompasses a critical segment within the broader specialty chemicals industry, essential for enabling the polymerization and curing of epoxy resins. Epoxy hardeners, also known as curing agents, determine the final characteristics of the cured material, including its mechanical strength, chemical resistance, thermal stability, and adhesion properties. These hardeners react with the epoxide groups in the resin structure to form a rigid, cross-linked thermoset polymer network. The selection of the appropriate hardener—such as amines, anhydrides, polyamides, or phenolic compounds—is paramount for achieving performance specifications required across various end-use applications, dictating everything from cure time to ultimate durability.

The primary applications driving this market include protective coatings for industrial infrastructure, high-performance adhesives for automotive and aerospace sectors, composite materials used in wind energy and construction, and electronic encapsulants for safeguarding sensitive components. The inherent benefits of cured epoxy systems, derived directly from the hardener's effectiveness, such as superior resistance to solvents, corrosion, and heat, position them as irreplaceable materials in demanding environments. This versatility allows epoxy systems to penetrate markets where high reliability and longevity are mandatory, particularly in infrastructure renewal and advanced manufacturing processes.

Driving factors propelling market expansion include robust growth in the construction industry, particularly in developing economies demanding durable flooring and protective coatings, coupled with increasing adoption in automotive manufacturing to reduce vehicle weight through lightweight composites and structural adhesives. Furthermore, the rising demand for high-solid and solvent-free epoxy systems, driven by stringent environmental regulations concerning Volatile Organic Compounds (VOCs), necessitates continuous innovation in hardener chemistry, favoring low-viscosity, high-performance amine and modified cycloaliphatic amine hardeners that facilitate eco-friendly formulations.

Epoxy Resin Hardener Market Executive Summary

The global Epoxy Resin Hardener Market is characterized by intense technological competition focused on enhancing sustainability and reducing cure cycles while maintaining superior performance metrics. Key business trends include strategic mergers and acquisitions aimed at consolidating raw material supply chains and expanding specialized product portfolios, particularly in high-growth segments like wind turbine manufacturing and electrical laminates. Companies are increasingly investing in bio-based and waterborne hardener chemistries to address evolving environmental mandates and consumer preference for greener products. The shift towards solvent-free systems is compelling manufacturers to develop advanced polyamine and amidoamine adducts offering improved handling characteristics and reduced health hazards during application, thereby redefining formulation standards across protective coatings and civil engineering.

Regional trends indicate that the Asia Pacific (APAC) region maintains market dominance, primarily driven by massive infrastructure investments in China and India, alongside burgeoning electronics and automotive production hubs across Southeast Asia. North America and Europe, while mature markets, demonstrate significant demand for specialty hardeners focusing on high-end applications, such as aerospace composites and marine coatings, where performance and regulatory compliance are critical. The European market, in particular, is witnessing a high uptake of rapid-curing hardeners suitable for prefabricated construction and fast-turnaround industrial maintenance projects, necessitating robust supply chains for specialty amine derivatives and curing catalysts. Furthermore, the Middle East and Africa (MEA) region is emerging as a growth hotspot due to large-scale oil and gas pipeline projects requiring extreme anti-corrosion protection provided by high-performance epoxy systems.

Segment trends highlight the dominance of Amine-based hardeners (e.g., polyamines, polyamides) due to their versatility and wide operational temperature range, although Anhydride hardeners are experiencing significant growth, especially in electrical insulation and composites requiring superior thermal stability. Demand for low-temperature curing agents is rising in civil engineering applications, allowing for year-round construction projects in cooler climates. Within end-use segments, Coatings, Adhesives, and Composites remain the largest consumers, with Composites showing the fastest projected growth rate, fuelled by electric vehicle battery housings and lightweight structural components in transportation. The overall market trajectory underscores a move toward customization, where hardeners are engineered precisely for specific performance criteria, moving away from commoditized offerings.

AI Impact Analysis on Epoxy Resin Hardener Market

Common user questions regarding AI’s impact on the Epoxy Resin Hardener Market primarily revolve around optimizing formulation complexity, predicting material performance under varied conditions, and automating quality control in manufacturing. Users are keen to understand how AI can manage the vast combinatorial space of epoxy resin and hardener pairings to achieve novel performance characteristics faster than traditional R&D methods. Key concerns center on the initial investment required for sophisticated modeling platforms and the need for specialized data scientists proficient in chem-informatics. Expectations are high that AI will significantly accelerate the discovery of sustainable, bio-based hardeners and improve supply chain resilience by predicting demand fluctuations and optimizing inventory levels for specialized chemical precursors.

AI is beginning to revolutionize the R&D cycle in specialty chemicals. Machine learning algorithms are deployed to analyze spectroscopic data and experimental results, predicting the curing kinetics and final mechanical properties of new epoxy formulations based on the chemical structure of the hardener utilized. This predictive capability drastically reduces the number of physical experiments needed, cutting costs and time-to-market for novel curing agents, particularly those designed for extreme thermal or chemical environments. Furthermore, AI-driven process optimization is enhancing manufacturing efficiency by monitoring reactor conditions in real-time and adjusting parameters to ensure consistent hardener quality and purity, which is critical for high-performance applications like aerospace composites where material consistency is paramount.

Supply chain management is another critical area benefiting from AI integration. Predictive analytics utilize historical sales data, geopolitical trends, and upstream raw material availability (e.g., petrochemical derivatives) to forecast potential supply disruptions for key hardener intermediates, such as isophorone diamine (IPDA) or phthalic anhydride. This allows manufacturers to proactively adjust procurement strategies, mitigating risks associated with volatile commodity prices and ensuring stable production of high-demand hardeners. Moreover, AI is instrumental in developing digital twins of curing processes in end-user industries (like composite manufacturing), allowing for simulated testing of various hardener combinations to optimize production throughput and minimize material waste.

- AI accelerates formulation discovery by predicting optimal hardener compositions and curing profiles.

- Machine learning optimizes reactor efficiency, ensuring consistent chemical purity and quality control during manufacturing.

- Predictive maintenance for manufacturing equipment reduces downtime, improving overall hardener production reliability.

- AI analyzes supply chain risks, forecasting shortages of key hardener precursors derived from petrochemicals.

- Digital twins simulate end-use application performance, reducing physical prototyping in sectors like aerospace and automotive composites.

DRO & Impact Forces Of Epoxy Resin Hardener Market

The Epoxy Resin Hardener Market dynamics are governed by a complex interplay of internal and external forces. Drivers include the global mandate for lightweighting in the transportation sector, fueling demand for composite matrix materials cured by high-performance hardeners, and the expansive growth of the wind energy sector requiring extremely durable and long-lasting blade coatings. Restraints primarily involve the volatility of raw material prices, particularly those derived from crude oil (petrochemicals), and increasing regulatory scrutiny regarding the handling and disposal of certain amine-based hardeners due to toxicity concerns. Opportunities lie in the commercialization of bio-based curing agents and the development of hardeners specifically designed for 3D printing applications, offering rapid cure times and specialized rheology. These forces collectively shape the market's direction, pushing innovation towards sustainable and high-efficiency formulations.

Impact forces act across the entire value chain. The threat of substitution is moderate; while polyurethane and silicone alternatives exist, they often cannot match the superior mechanical and chemical resistance offered by epoxy systems cured with specialized hardeners, particularly in extreme environments. However, stringent environmental regulations, particularly in the European Union (REACH), exert strong downward pressure, forcing companies to reformulate away from compounds flagged for toxicity or persistence, significantly impacting the viability of older hardener chemistries. Furthermore, the bargaining power of key buyers, particularly large coating formulators and aerospace composite manufacturers, is substantial, compelling hardener producers to maintain high quality standards and competitive pricing while continuously seeking performance enhancements, often necessitating significant investment in R&D and process intensification.

The market faces structural challenges related to specialized applications. For instance, the high demands of the electronics industry require hardeners with extremely low ionic content and precise thermal properties for encapsulation, creating high barriers to entry for new competitors. Conversely, the construction sector, requiring high volume and moderate performance, exerts pressure on cost efficiencies. The market’s response to these forces is visible in the segmentation of product offerings: commoditized polyamides for general coatings coexist with highly specialized, hyper-functionalized amine adducts for mission-critical aerospace components. This bifurcation dictates pricing strategies, R&D allocation, and regional focus for market participants.

Segmentation Analysis

The Epoxy Resin Hardener Market is primarily segmented by chemistry type, end-use application, curing mechanism, and physical form. This granular segmentation allows manufacturers and analysts to precisely track demand trends and tailor product development to specific industrial requirements. The chemistry type segmentation, including Amines, Anhydrides, Polyamides, and Phenolics, represents the fundamental building blocks of the market, with each class offering distinct characteristics in terms of reactivity, chemical resistance, and thermal stability. End-use application segmentation—covering Coatings, Adhesives, Composites, Encapsulation, and others—reveals where the highest volume and value demand originate, with Coatings and Composites typically leading in consumption volume globally, driven by infrastructure and manufacturing needs. This structure is essential for strategic planning, determining investment priorities in R&D, and customizing marketing approaches for diverse industrial buyers.

Further analysis into sub-segments reveals critical market nuances. Within Amines, specific sub-chemistries like aliphatic, cycloaliphatic, and aromatic amines cater to vastly different requirements; cycloaliphatics, for example, are crucial for high-UV resistance and weatherability in outdoor coatings, while aromatic amines are preferred for their superior thermal resistance in electrical and composite applications. Curing mechanism segmentation differentiates between room-temperature curing systems (essential for civil engineering and maintenance), heat-curing systems (dominant in manufacturing processes requiring high throughput, like automotive e-coating), and UV-curing systems (gaining traction in rapid assembly and electronics). The shift towards customized, low-VOC, and faster-curing formulations continues to drive innovation, particularly within the Amine and specialty Anhydride hardener segments, pushing the boundaries of material performance and application efficiency.

- By Chemistry Type:

- Amine-based Hardeners (Aliphatic, Cycloaliphatic, Aromatic, Polyamides, Amidoamines)

- Anhydride Hardeners (Phthalic Anhydride, Maleic Anhydride, Tetrahydrophthalic Anhydride)

- Phenolic Hardeners

- Mercaptans/Polymercaptans

- Isocyanates

- By Application:

- Coatings (Protective Coatings, Marine Coatings, Powder Coatings, Floor Coatings)

- Adhesives and Sealants (Structural Adhesives, Industrial Bonding)

- Composites (Wind Energy, Aerospace, Automotive, Construction)

- Electrical and Electronics Encapsulation

- Casting and Tooling

- By Curing Mechanism:

- Room Temperature Curing

- Heat Curing

- UV Curing

Value Chain Analysis For Epoxy Resin Hardener Market

The value chain for the Epoxy Resin Hardener Market begins with the upstream procurement of raw materials, primarily petrochemical derivatives derived from crude oil and natural gas, such as benzene, toluene, and propylene, which serve as precursors for key amines and anhydrides. Specialty chemical manufacturers then transform these intermediates into functional curing agents through complex synthesis processes like amination, esterification, and modification. The profitability at this stage is highly sensitive to fluctuating oil prices and the efficiency of chemical synthesis. Consistency in purity and molecular weight is paramount, especially for high-end applications like aerospace and electronics, demanding rigorous quality control and specialized manufacturing assets.

Downstream analysis focuses on the large industrial formulators and compounders who purchase the synthesized hardeners. These companies integrate the hardeners with epoxy resins, fillers, and additives to create proprietary end-use products (coatings, adhesives, composites). This integration step adds significant value, customizing the final product properties such as viscosity, cure speed, and mechanical performance. The distribution channel is bifurcated: direct sales channels are employed for large volume strategic accounts (e.g., major composite manufacturers or automotive OEMs), allowing for technical consultation and customized supply agreements. Indirect distribution utilizes specialized chemical distributors and regional agents, particularly for smaller purchasers or those requiring localized inventory management, ensuring wider market penetration across diverse geographical areas.

The final step involves the application and usage by end-user industries (e.g., construction companies, aerospace maintenance, electronics assemblers). Direct sales offer strong feedback loops, enabling hardener manufacturers to quickly identify performance gaps and drive product innovation based on real-world application challenges. The entire chain is heavily regulated, requiring strict adherence to environmental, health, and safety standards, particularly concerning the handling and transportation of volatile or corrosive amine-based hardeners. The complexity of the chemistry and the high cost of regulatory compliance act as substantial barriers, reinforcing the position of established, globally compliant suppliers.

Epoxy Resin Hardener Market Potential Customers

The potential customers for the Epoxy Resin Hardener Market are highly diversified industrial entities requiring robust bonding, protection, and structural integrity in their products or infrastructure. Primary buyers include major global coating manufacturers (e.g., specialized protective coating formulators for oil and gas, marine vessels, and industrial infrastructure) who consume high volumes of polyamides and modified amines for anti-corrosion applications. Furthermore, structural adhesive formulators, supplying the automotive and aerospace industries for lightweighting initiatives and battery assembly in electric vehicles, represent high-value customers demanding advanced, fast-curing, and toughened hardener chemistries.

A significant segment of customers resides in the advanced materials sector, specifically composite part manufacturers for wind turbine blades, aircraft structures, and high-performance sporting goods. These customers often require specialized anhydride or aromatic amine hardeners that facilitate high glass transition temperatures (Tg) and exceptional fatigue resistance. Additionally, the electrical and electronics industries are crucial buyers, utilizing ultra-pure, low-ionic hardeners for encapsulating sensitive components, semiconductors, and manufacturing printed circuit boards (PCBs), where reliability under high thermal stress is non-negotiable. Civil engineering and construction companies also form a steady base, procuring room-temperature curing amines for durable flooring, grouts, and concrete repair systems across commercial and infrastructure projects, underscoring the market's fundamental reliance on global construction activity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Huntsman Corporation, Hexion Inc., BASF SE, Evonik Industries AG, The Dow Chemical Company, Cardolite Corporation, Mitsubishi Chemical Corporation, Kukdo Chemical Co., Ltd., Aditya Birla Chemicals, Emerald Performance Materials, Royce International, Atul Ltd., Gabriel Performance Products, Olin Corporation, Polynt-Reichhold Group, Epic Resins, TCI Chemicals (India) Pvt. Ltd., Hardman Adhesives, Leuna-Harze GmbH, Cargill. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Epoxy Resin Hardener Market Key Technology Landscape

The technology landscape of the Epoxy Resin Hardener Market is continually evolving, driven by the need for enhanced functionality, sustainability, and application efficiency. A key technological focus is the development of next-generation latent hardeners, such as dicyandiamide (DICY) derivatives and encapsulated amines. Latent hardeners are chemically stable at room temperature, offering extended pot life, but cure rapidly and completely upon reaching a specific activation temperature. This technology is crucial for producing one-component (1K) epoxy systems used extensively in automotive e-coating, powder coatings, and electronics assembly, streamlining industrial processes and minimizing mixing errors inherent in two-component systems.

Another dominant trend involves the innovation in bio-based and waterborne hardener chemistries. Companies are utilizing renewable resources, such as cashew nut shell liquid (CNSL) derivatives, to synthesize polyamides and modified amines. CNSL-based hardeners offer inherent advantages, including flexibility, water resistance, and excellent adhesion, while significantly improving the sustainability profile of the final epoxy formulation, aligning with global green chemistry initiatives. Waterborne epoxy hardeners facilitate the creation of low-VOC coating systems, crucial for indoor air quality and compliance with stringent environmental regulations in North America and Europe, enabling superior performance without the use of harmful solvents, particularly in protective floor coatings and architectural finishes.

Furthermore, technology is advancing in rapid-curing and UV-curable hardener systems. Polymercaptans and specialized amine accelerators are engineered to achieve ultra-fast cure times, sometimes within minutes or seconds. This acceleration is indispensable in high-volume manufacturing lines, such as rapid assembly processes, composite prepreg production, and 3D printing applications utilizing epoxy formulations. The integration of advanced mixing technologies and application equipment, such as plural-component sprayers and automated dispensing systems, ensures the precise stoichiometry required for optimal curing performance of these specialized hardeners, maintaining consistency even with highly reactive chemistries.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, primarily due to large-scale infrastructure development, booming construction activities in China, India, and Southeast Asian nations, and the region's dominance in global electronics manufacturing. The demand is concentrated in protective coatings for new construction and significant consumption of anhydride hardeners for electrical laminates (PCBs) and casting applications. Government initiatives supporting renewable energy further propel the use of specialized amine hardeners in composite manufacturing for wind turbines.

- North America: This region is characterized by high demand for specialized, high-performance hardeners used in aerospace, automotive (especially electric vehicle structural bonding), and oil and gas infrastructure. Focus is heavily placed on regulatory compliance (low-VOC, solvent-free systems) and continuous innovation in toughening agents and fast-curing polyamines for industrial maintenance and repair. The market emphasizes value over volume, driving higher profitability for specialized chemical suppliers.

- Europe: Europe exhibits strong growth driven by stringent environmental standards (REACH) and significant investment in the wind energy sector. The market is a leader in adopting bio-based hardeners and waterborne formulations. High uptake of specialty cycloaliphatic amines is observed in marine and protective coatings due to their superior weatherability and chemical resistance, supporting the region’s expansive chemical and coating industry.

- Latin America (LATAM): The LATAM market growth is steady, fueled by urbanization and increasing investments in infrastructure, particularly in Brazil and Mexico. Demand is stable for standard amine and polyamide hardeners used in general industrial maintenance and protective coatings. Economic stability remains a key determinant of market expansion and technological adoption rates.

- Middle East and Africa (MEA): This region is heavily dependent on the oil and gas sector, requiring extremely high-performance anti-corrosion and chemical-resistant epoxy coating systems. Demand is strong for high-solids, temperature-resistant amine hardeners for pipeline linings, storage tanks, and structural components in harsh desert environments, emphasizing durability and longevity under extreme conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Epoxy Resin Hardener Market.- Huntsman Corporation

- Hexion Inc.

- BASF SE

- Evonik Industries AG

- The Dow Chemical Company

- Cardolite Corporation

- Mitsubishi Chemical Corporation

- Kukdo Chemical Co., Ltd.

- Aditya Birla Chemicals

- Emerald Performance Materials

- Royce International

- Atul Ltd.

- Gabriel Performance Products

- Olin Corporation

- Polynt-Reichhold Group

- Epic Resins

- TCI Chemicals (India) Pvt. Ltd.

- Hardman Adhesives

- Leuna-Harze GmbH

- Cargill

Frequently Asked Questions

Analyze common user questions about the Epoxy Resin Hardener market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for specialty epoxy hardeners?

The primary factor is the increasing global demand for lightweight, high-performance composite materials in the aerospace and wind energy sectors, requiring specialized hardeners (like anhydrides and high-functional amines) that offer superior mechanical strength and thermal stability essential for structural integrity and longevity.

How do environmental regulations affect the Epoxy Resin Hardener market?

Environmental regulations, particularly in Europe and North America, strongly mandate the reduction of Volatile Organic Compounds (VOCs). This drives demand away from solvent-based systems towards waterborne, high-solids, and solvent-free hardener chemistries, such as advanced modified polyamines and bio-based curing agents, enhancing market innovation towards sustainability.

Which type of hardener chemistry holds the largest market share?

Amine-based hardeners, including polyamines, polyamides, and their various adducts, currently hold the largest market share. This dominance is due to their immense versatility, broad range of cure speeds, and effectiveness in high-volume applications like protective coatings, general adhesives, and civil engineering flooring systems.

What is the significance of bio-based hardeners in the current market landscape?

Bio-based hardeners, often derived from sustainable sources like Cashew Nut Shell Liquid (CNSL), are gaining significance as they provide a reduced environmental footprint, improve flexibility and impact resistance of epoxy systems, and offer a viable solution for manufacturers seeking to comply with green building standards and corporate sustainability mandates.

Which application segment is expected to show the fastest growth rate?

The Composites segment, driven by rapid expansion in electric vehicle battery pack structural components and massive installation of new wind energy capacity globally, is projected to register the fastest growth rate, necessitating continuous development of high-Tg, fast-curing hardeners suitable for advanced manufacturing techniques.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager