Equestrian Helmets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436232 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Equestrian Helmets Market Size

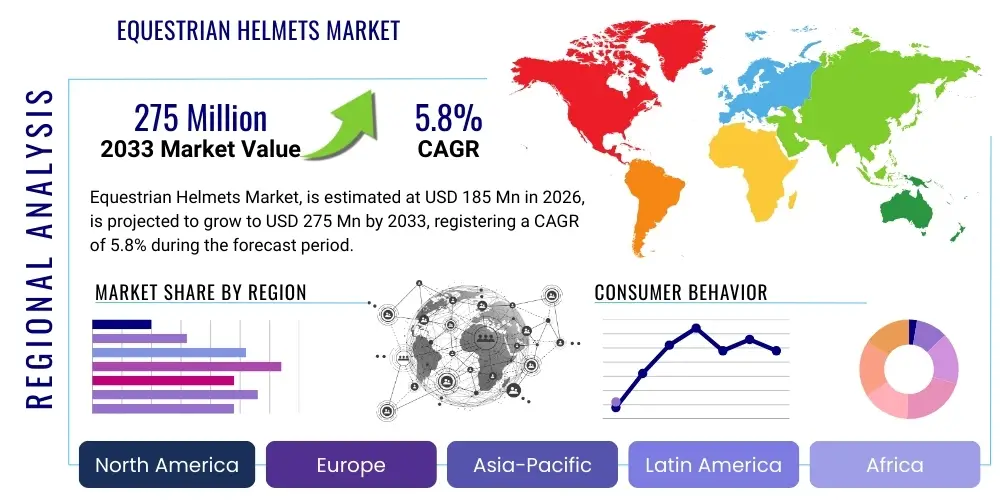

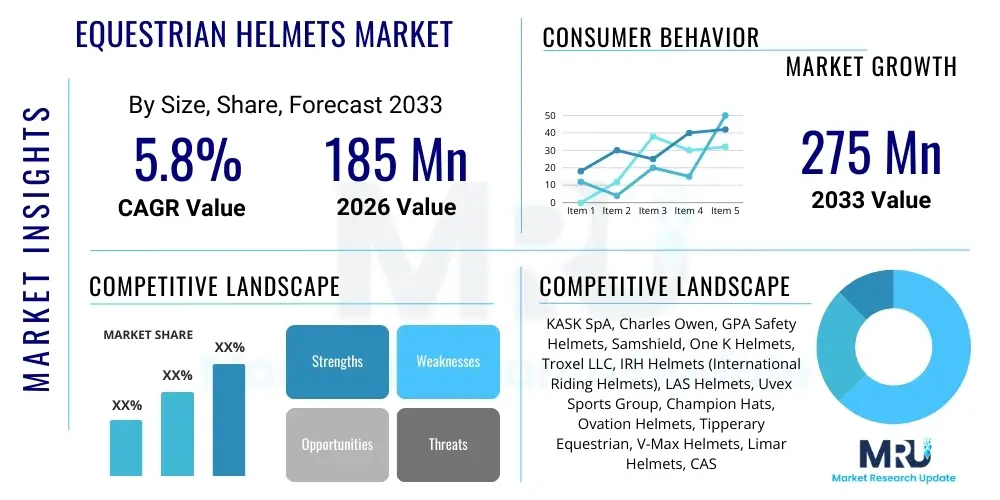

The Equestrian Helmets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 185 Million in 2026 and is projected to reach USD 275 Million by the end of the forecast period in 2033.

Equestrian Helmets Market introduction

The Equestrian Helmets Market encompasses the production, distribution, and sale of specialized head protection gear designed for riders engaged in various horse-related activities, including competition, training, and casual riding. These helmets are critical safety devices engineered to mitigate head injuries, ranging from concussions to severe skull fractures, resulting from falls or impacts with obstacles or the ground. Modern equestrian helmets are sophisticated products utilizing advanced materials such as reinforced fiberglass, carbon fiber composites, and specialized expanded polystyrene (EPS) liners, all mandated to meet rigorous safety certifications established by international bodies like the Safety Equipment Institute (SEI), ASTM International, and European standards (VG1, PAS 015).

The primary applications of these protective devices span across all major equestrian disciplines, including show jumping, dressage, eventing (cross-country), polo, and general recreational riding. Key benefits driving consumer adoption include mandatory adherence to sport regulations enforced by organizations like the Fédération Équestre Internationale (FEI), significant improvements in rider safety profile through enhanced impact absorption, and the incorporation of features that improve comfort, such as advanced ventilation systems, adjustable retention harnesses, and removable, washable liners. These innovations ensure compliance while providing optimal user experience during extended periods of use.

Driving factors for market expansion include the increasing global awareness regarding sports-related head trauma, particularly concussions, which has led to stricter implementation of safety standards across all major riding nations. Furthermore, the professionalization and increasing investment in equestrian sports, coupled with the rising disposable income in key regions enabling greater participation, fuel the demand for high-quality, certified protective gear. Continuous technological advancements, such as the integration of rotational energy management systems (like MIPS technology), further enhance product efficacy, pushing riders toward upgrading older or less protective equipment, thereby sustaining market momentum.

Equestrian Helmets Market Executive Summary

The global Equestrian Helmets Market exhibits robust growth, primarily propelled by the worldwide enforcement of mandatory safety standards and consumer inclination toward premium, technologically advanced protective solutions. Business trends indicate a strong focus on lightweight material research, customization options based on digital scanning for personalized fit, and the incorporation of multi-directional impact protection systems (MIPS) as standard features in mid-to-high-end product lines. Manufacturers are increasingly prioritizing supply chain resilience and transparency regarding material sourcing and sustainability, addressing the growing environmental consciousness among consumers. Strategic mergers and acquisitions among smaller, innovative technology providers and established helmet manufacturers are reshaping the competitive landscape, facilitating rapid integration of new safety features.

Regionally, Europe continues to dominate the market share, driven by a deep-rooted equestrian culture, high participation rates in competitive riding events, and early adoption of stringent safety regulations. North America, particularly the United States, represents a significant growth trajectory, characterized by high consumer spending power and a strong emphasis on brand reputation and safety certifications (SEI/ASTM). The Asia Pacific region, while currently holding a smaller share, is projected to witness the fastest growth rate, fueled by the rising adoption of Western-style riding and increasing investments in equestrian infrastructure in countries like China and India, making it a pivotal area for future market penetration and expansion strategies.

Segment trends reveal that the Eventing discipline segment demands the most advanced and robust helmets due to the high-risk nature of cross-country riding, driving innovations in shell strength and ventilation. By Material Type, advanced composites (Carbon Fiber and Fiberglass) are expected to experience accelerated demand over traditional materials due to their superior strength-to-weight ratio. The distribution channel analysis shows that specialized equestrian retail outlets and direct-to-consumer e-commerce platforms are gaining prominence, offering tailored product advice and detailed sizing information, which is crucial for safety-critical equipment, enhancing overall customer confidence and market reach.

AI Impact Analysis on Equestrian Helmets Market

Analysis of common user questions reveals significant interest in how AI can move equestrian helmet design beyond passive protection towards proactive safety and personalization. Users frequently query the ability of AI to ensure a perfect, customized fit using biometric data, enhance material optimization for specific impact velocities encountered in various riding disciplines, and enable real-time injury prevention or detection features. Key concerns focus on data privacy related to smart helmet metrics and the potential cost increase associated with integrating sophisticated AI components. Users expect AI to translate into verifiable, quantified improvements in protection standards without compromising comfort or aesthetics.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the R&D and manufacturing phases of equestrian helmets. AI algorithms are employed to analyze vast datasets concerning rider head shapes, impact biomechanics, and material performance under various environmental conditions, simulating millions of potential accident scenarios digitally. This predictive modeling capability allows manufacturers to optimize complex helmet geometries, determine the ideal density and placement of energy-absorbing materials, and validate the efficacy of new protective technologies, such as rotational impact liners, long before physical prototyping begins, dramatically reducing development cycles and enhancing intrinsic safety levels.

Furthermore, AI is pivotal in establishing mass customization in a market where proper fit is paramount to safety. Utilizing 3D scanning and computer vision technology, manufacturers can capture precise anatomical data of the rider's head. AI systems then process this data to generate personalized inner liners or retention systems that conform perfectly to the user, minimizing movement during impact—a crucial factor in reducing concussion risk. Beyond design, smart equestrian helmets are beginning to incorporate embedded sensors, managed by AI platforms, capable of monitoring subtle changes in the helmet's structural integrity over time or immediately detecting severe impacts, thereby initiating automated emergency response calls and transmitting GPS location, significantly improving post-accident outcomes.

- AI optimizes structural design parameters based on complex impact simulations.

- Machine Learning enhances quality control during manufacturing via computer vision systems.

- AI-driven biometric analysis facilitates highly personalized fit and comfort.

- Smart helmets use AI algorithms for real-time impact detection and emergency communication protocols.

- Predictive modeling shortens R&D timelines for new, safer material composites.

DRO & Impact Forces Of Equestrian Helmets Market

The Equestrian Helmets Market is primarily driven by rigorous international and local safety mandates, coupled with a heightened cultural emphasis on rider welfare, particularly in competitive circuits. Restraints include the high manufacturing cost associated with obtaining multiple global safety certifications (e.g., SEI, CE Mark) and the persistent issue of educating amateur riders on the importance of regular helmet replacement (typically every 3–5 years or after any significant impact). Opportunities abound in the development of modular and multifunctional helmets catering to different disciplines and in market expansion into rapidly professionalizing emerging economies. The impact forces acting upon the market are substantial, stemming from the non-negotiable requirement for protective gear in virtually all organized riding activities globally, making demand inelastic to general economic downturns but highly sensitive to changes in safety standards and material innovation cycles.

A key dynamic driver is the consumer demand for integration of proven technologies from adjacent markets, notably rotational impact protection systems (MIPS or proprietary equivalents), which address angular impact forces—a major cause of severe brain injury. This integration elevates the premium segment and raises the effective floor of expected safety features across the industry. Conversely, a significant restraint is the consumer reluctance to adopt higher-priced models, especially in non-competitive sectors, leading to a lingering presence of uncertified or expired helmets in the market, which safety organizations are actively trying to phase out through targeted awareness campaigns and regulatory tightening.

Market opportunities are strongly linked to material science breakthroughs. The search for lighter, stronger, and more sustainable composite materials, potentially incorporating recycled or bio-based polymers, offers manufacturers a competitive edge in both performance and meeting corporate social responsibility goals. Furthermore, the growth of therapeutic riding programs and equine rehabilitation sectors globally presents a niche but expanding segment for specialized, easily adjustable, and highly protective headgear. The collective impact forces ensure continuous innovation as manufacturers compete not just on price or style, but fundamentally on verifiable, certified safety performance, thereby constantly pushing the technological envelope of head protection.

Segmentation Analysis

The Equestrian Helmets Market is comprehensively segmented based on material type, technology adopted, end-user profile, riding discipline, and distribution channel, providing a granular view of market dynamics and consumer preferences. Analyzing these segments allows manufacturers to tailor product development and marketing strategies precisely. The Material Type segment differentiates products based on core construction (e.g., fiberglass versus carbon fiber), which directly impacts weight, cost, and overall protection levels. Technology segmentation highlights the adoption of advanced safety features like MIPS, ensuring rotational energy dissipation. Discipline segmentation (Show Jumping, Dressage, Eventing) is critical, as the design needs and aesthetic regulations vary significantly across these competitive areas.

The End-User segment differentiates between amateur/recreational riders and professional athletes, reflecting variations in budget allocation, frequency of replacement, and demand for highly customized features. Professionals generally require top-tier, certified, performance-optimized helmets, while recreational riders may prioritize comfort, basic safety compliance, and affordability. Understanding the interplay between these segments is vital for effective inventory management and channel strategy. For example, high-end, eventing-specific helmets are often distributed through specialized pro shops, whereas standard recreational helmets have wider availability through mass sporting goods retailers and online platforms.

Growth projections strongly favor segments incorporating advanced rotational impact technology, driven by overwhelming scientific evidence supporting their ability to reduce traumatic brain injury risk. Similarly, the trend towards personalization and aesthetic integration means segments offering customized colorways, finishes, and ventilation options are expected to capture premium pricing. The market remains inherently segmented by geographical safety compliance, necessitating region-specific product lines (e.g., meeting EN standards for Europe and ASTM/SEI for North America), which adds complexity but ensures localized regulatory adherence and consumer trust.

- By Discipline:

- Show Jumping Helmets

- Dressage Helmets

- Eventing/Cross-Country Helmets

- General Purpose/Recreational Helmets

- Polo Helmets

- By Material Type:

- Fiberglass

- Carbon Fiber Composites

- Advanced Thermoplastics (ABS/Polycarbonate)

- By Technology:

- Traditional EPS Liner Helmets

- Rotational Impact Protection Systems (MIPS, WaveCel, or proprietary systems)

- Smart Helmets (Integrated Sensors)

- By End-User:

- Amateur and Recreational Riders

- Professional Athletes

- Children and Youth

- By Distribution Channel:

- Specialty Equestrian Retailers

- Online Retail/E-commerce Platforms

- Sporting Goods Stores

- Direct Sales from Manufacturers

- By Price Range:

- Economy (Budget-focused)

- Mid-Range

- Premium/High-End

Value Chain Analysis For Equestrian Helmets Market

The value chain for the Equestrian Helmets Market begins with the upstream segment, which involves the sourcing and processing of essential raw materials. This includes high-performance materials such as carbon fiber and fiberglass textiles, specialized foams (Expanded Polystyrene - EPS and Expanded Polypropylene - EPP) for impact absorption, polycarbonate or ABS plastics for exterior shells, and various fabrics and leather components for liners and harnesses. Suppliers in this stage are typically specialized chemical and composite material manufacturers who must ensure consistency and certification of raw inputs, as material quality directly dictates the helmet's ability to meet stringent safety standards. Innovation at this stage, particularly in developing greener, lighter, and more efficient energy-absorbing foams, has a profound impact on the final product's performance and cost structure.

The central manufacturing segment encompasses design, engineering, assembly, and rigorous testing. This is where proprietary technology (like MIPS integration, advanced ventilation systems, and specialized retention mechanisms) is incorporated. Manufacturers invest heavily in R&D to optimize weight, fit, and aesthetics while securing multiple safety certifications (e.g., ASTM F1163, PAS 015, VG1). Post-production, the product moves into the distribution stage, characterized by both direct and indirect channels. Indirect distribution relies heavily on regional wholesalers and specialized equestrian distributors who manage inventory and supply niche retail outlets. Direct distribution channels, primarily e-commerce websites and flagship stores, allow manufacturers greater control over branding, pricing, and direct consumer feedback, enhancing profit margins on premium products.

The downstream segment includes retail sales and final consumption. Specialty equestrian retailers are crucial, as they offer expert sizing advice, fitting services, and detailed product knowledge necessary for safety equipment. The rapid growth of e-commerce necessitates robust online platforms with detailed sizing guides, virtual try-on tools, and transparent return policies to ensure proper fit, especially since ill-fitting helmets compromise protection. End-users—from amateur riders to professional competitors—drive demand based on brand trust, safety rating, aesthetic preference, and price point, completing the value cycle. Aftermarket services, including cleaning kits and replacement liners, also form a small but necessary part of the ongoing value chain, extending product lifecycle and user satisfaction.

Equestrian Helmets Market Potential Customers

Potential customers for equestrian helmets are highly diversified, encompassing anyone involved in riding activities, from children starting their first pony rides to Olympic-level athletes competing internationally. The primary segment comprises recreational riders and hobbyists who ride weekly or monthly; this group prioritizes a balance of safety compliance, comfort, and affordable price points. They are typically reached through large sporting goods retailers and general online platforms. The second major segment includes competitive riders across disciplines (Show Jumping, Dressage, Eventing), who constitute the premium customer base. These individuals require the highest level of certification, advanced features (rotational systems, superior ventilation), and aesthetic compliance with competitive rules, and they are willing to pay significantly higher prices, often replacing helmets annually or biannually.

A rapidly expanding customer base is institutional buyers, including riding schools, therapeutic riding centers, and governmental or military mounted units. Riding schools purchase large volumes of entry-level, durable, and easily adjustable helmets designed for communal use and quick sanitization. Therapeutic centers require specialized, often lightweight and non-intrusive designs suitable for riders with physical or cognitive challenges. Furthermore, parents purchasing gear for youth riders form a specific demographic, prioritizing strict safety ratings (often demanding the latest technology regardless of price) and adjustability to accommodate growing children, often influenced heavily by safety advocacy groups and pediatric recommendations.

Geographically, potential customers are concentrated in regions with strong equestrian traditions, notably Western Europe (Germany, UK, France) and North America (USA, Canada), characterized by high participation rates and structured competition schedules. However, emerging markets, particularly affluent segments in the Middle East and East Asia, represent high-growth potential. In these regions, the adoption of equestrian sports is accelerating, translating into a nascent but robust demand for imported, high-quality, certified protective gear, indicating a shift in customer demographics and purchasing power toward premium international brands.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185 Million |

| Market Forecast in 2033 | USD 275 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KASK SpA, Charles Owen, GPA Safety Helmets, Samshield, One K Helmets, Troxel LLC, IRH Helmets (International Riding Helmets), LAS Helmets, Uvex Sports Group, Champion Hats, Ovation Helmets, Tipperary Equestrian, V-Max Helmets, Limar Helmets, CASCO International GmbH, Equi-Theme, Aegis Helmets, Horka, HKM Sports Equipment, Pikeur |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Equestrian Helmets Market Key Technology Landscape

The technology landscape of the Equestrian Helmets Market is defined by a rapid transition from basic, single-impact protection shells to sophisticated systems designed to manage diverse kinetic energy transfer types. The most crucial innovation currently dominating the market is the integration of Rotational Impact Protection Systems, such as MIPS (Multi-directional Impact Protection System) or similar proprietary technologies developed by leading manufacturers. These systems utilize a low-friction layer positioned between the head and the helmet liner, designed to allow relative motion between the head and the helmet upon oblique impact. This reduces the rotational forces transmitted to the brain, which scientific studies have identified as a primary mechanism for concussions and diffuse axonal injury, establishing a new benchmark for safety performance that transcends the capabilities of traditional EPS-only designs.

Material science remains at the core of technological advancement. Manufacturers are continuously experimenting with advanced composite materials—primarily carbon fiber and high-grade fiberglass—to construct outer shells that offer superior penetration resistance and energy dispersion at minimal weight. Simultaneously, the inner liner technology is evolving, moving beyond single-density EPS foam to multi-density or layered foam structures (e.g., EPP, viscoelastic materials) designed to optimize energy absorption across a broader range of impact velocities. This focus on multi-layer protection ensures that the helmet performs effectively in both low-velocity tumbles and high-velocity falls, providing comprehensive cranial protection essential across various riding disciplines.

Furthermore, digital integration is becoming a significant technological differentiator, leading to the emergence of 'smart helmets.' These devices incorporate miniature, robust sensors (accelerometers and gyroscopes) designed to precisely measure impact forces and detect severe accidents. This data can be processed internally and linked via Bluetooth to a smartphone application, which, in turn, can automatically trigger emergency alerts, providing GPS coordinates to designated contacts or emergency services. Coupled with personalized 3D scanning technology used for creating custom-fit liners, these technological leaps underscore a market moving toward highly personalized, data-driven, and proactive safety solutions, significantly enhancing the overall safety proposition for riders.

Regional Highlights

- Europe: Europe maintains its position as the largest and most mature market for equestrian helmets, underpinned by a centuries-old equestrian tradition, high participation rates in competitive sports (especially FEI events), and the mandatory adherence to rigorous European safety standards (VG1, PAS 015). Countries such as Germany, the United Kingdom, and France exhibit high demand for premium brands and advanced technology. The strong regulatory environment necessitates that manufacturers continuously update their product lines to meet evolving safety directives, fostering rapid technological adoption.

- North America (USA and Canada): North America represents a substantial and technologically advanced market, driven by high consumer awareness regarding product certifications (primarily ASTM/SEI certified helmets) and a strong recreational riding culture. The region shows a high propensity for early adoption of premium safety features like MIPS. Marketing strategies often focus on brand association with professional riders and emphasizing the quantifiable safety benefits of rotational protection, contributing significantly to the market's value growth.

- Asia Pacific (APAC): The APAC region is anticipated to record the highest growth CAGR over the forecast period. This accelerated growth is attributed to rising disposable incomes, increasing Westernization of sports, and government initiatives promoting equestrian infrastructure, particularly in China, Japan, and Australia. While currently dominated by imports, domestic manufacturing and licensing agreements are expected to grow, providing accessible and certified options to a rapidly expanding amateur and competitive rider base.

- Latin America (LATAM): The LATAM market, while smaller, is focused on competitive riding, particularly in countries like Brazil and Argentina. Demand is typically concentrated in urban centers and among professional circuits. Price sensitivity is higher in general recreational segments, leading to a mixed demand for mid-range certified products and lower-cost alternatives, though safety regulations are gradually becoming more standardized across the major economies.

- Middle East and Africa (MEA): The MEA region exhibits specialized demand, driven by high-net-worth individuals involved in competitive racing, polo, and traditional equestrian activities. The market for ultra-premium, highly customized helmets is strong in the Gulf Cooperation Council (GCC) countries. Growth is steady, focused mainly on imported high-end European brands that meet international competition requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Equestrian Helmets Market.- KASK SpA

- Charles Owen

- GPA Safety Helmets

- Samshield

- One K Helmets

- Troxel LLC

- IRH Helmets (International Riding Helmets)

- LAS Helmets

- Uvex Sports Group

- Champion Hats

- Ovation Helmets

- Tipperary Equestrian

- V-Max Helmets

- Limar Helmets

- CASCO International GmbH

- Equi-Theme

- Aegis Helmets

- Horka

- HKM Sports Equipment

- Pikeur

- Devon-Aire

- Lamicell

- Fleck

- Eskadron

- Schockemöhle Sports

- Kingsland Equestrian

- Mountain Horse

- Toggi

- BÖCKER

- Shires Equestrian

- Wembley Equestrian

- Zilco International

- Euro-Star Reitmoden

- Horze International

- Mustang Manufacturing

- BR International

- Covalliero

- Equestrian Stockholm

- Pessoa Saddles

- Stubben

- Albion Saddlemakers

- Prestige Italia

- CWD Sellier

- Antarès Sellier

- Amerigo Saddles

- Equiline

- Animo Italia

- Veredus

- Zandona

- LeMieux

- Aigle

- Hunter Jumper Saddlery

- Saddleback Leather

- Kieffer Germany

- Otto Schumacher

- Passier

- HDR Saddlery

- EquiFit

- Rambo Newmarket

- Weatherbeeta

- Snaffle Bit Tack

- Dover Saddlery

- SmartPak Equine

- State Line Tack

- Big Dee's Tack

- The Cheshire Horse

- Millbrook Tack

- Corro

- Jeffers Equine

- Valley Vet Supply

- VTO Saddlery

- Equestrian Collections

- Horse Health Products

- Dengie Horse Feeds

- Nutrena Feeds

- Purina Animal Nutrition

- Triple Crown Feed

- Blue Seal Feeds

- Aditya Birla Group (Fiberglass Input)

- Toray Industries (Carbon Fiber Input)

- Hexcel Corporation (Composite Materials)

- BASF SE (Foam Technology Input)

- Dow Inc. (Polymer Solutions)

- Huntsman Corporation (Polyurethane Systems)

- Mitsui Chemicals (Advanced Plastics)

- SABIC (Thermoplastics)

- LyondellBasell (Polyethylene)

- 3M Company (Adhesive Systems)

- Sika AG (Bonding and Sealing)

- Aramco (Oil-derived Polymers)

- Huntsman P&A (Foam Manufacturing)

- Scott Safety (Protective Gear Expertise)

- Mips AB (Rotational Safety Technology Licensor)

- WaveCel (Proprietary Safety Technology)

- Koroyd (Impact Absorption Technology)

Frequently Asked Questions

Analyze common user questions about the Equestrian Helmets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most important safety technology in modern equestrian helmets?

The most important advancement is Rotational Impact Protection Systems (RIPS), such as MIPS. These systems utilize a low-friction layer designed to mitigate rotational forces transmitted to the brain during oblique impacts, significantly reducing the risk of concussions compared to helmets relying solely on traditional EPS linear absorption.

How often should an equestrian helmet be replaced, even without a fall?

Equestrian helmets should generally be replaced every three to five years, regardless of appearance or visible damage. This requirement is due to the gradual degradation of the essential internal materials, particularly the EPS foam and adhesive resins, caused by factors such as UV exposure, sweat, environmental conditions, and general wear and tear, which compromises their impact protection capabilities.

What safety certifications are mandatory for a high-quality equestrian helmet?

For high-quality and globally competitive helmets, manufacturers must adhere to certifications such as the ASTM F1163 standard enforced by the SEI (Safety Equipment Institute) in North America, and European standards like VG1 (mandatory across the EU) and PAS 015 (common in the UK). Compliance with multiple global standards signifies a rigorously tested and superior product.

How does the material of the outer shell impact helmet safety and cost?

The outer shell material, typically high-grade thermoplastic, fiberglass, or carbon fiber, impacts both safety and cost. Carbon fiber offers the highest strength-to-weight ratio and superior penetration resistance but is the most expensive. Thermoplastics provide a cost-effective solution while meeting baseline safety standards, often suitable for entry-level and recreational segments.

Are 'smart helmets' expected to become standard in competitive riding?

Yes, smart helmets are trending toward standardization, especially in higher-risk competitive disciplines like eventing. While traditional safety features remain paramount, the integration of sensors for automatic impact detection and emergency geo-location transmission offers critical post-accident assistance, elevating overall rider safety protocols and aligning with the professionalization of the sport.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Equestrian Helmets Market Size Report By Type (Show Helmet, Basic Helmet, Skull Helmet), By Application (Men, Women, Children), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Equestrian Helmets Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Show Helmet, Basic Helmet, Skull Helmet), By Application (Men, Women, Children), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager