Equity Crowdfunding Platforms Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436740 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Equity Crowdfunding Platforms Market Size

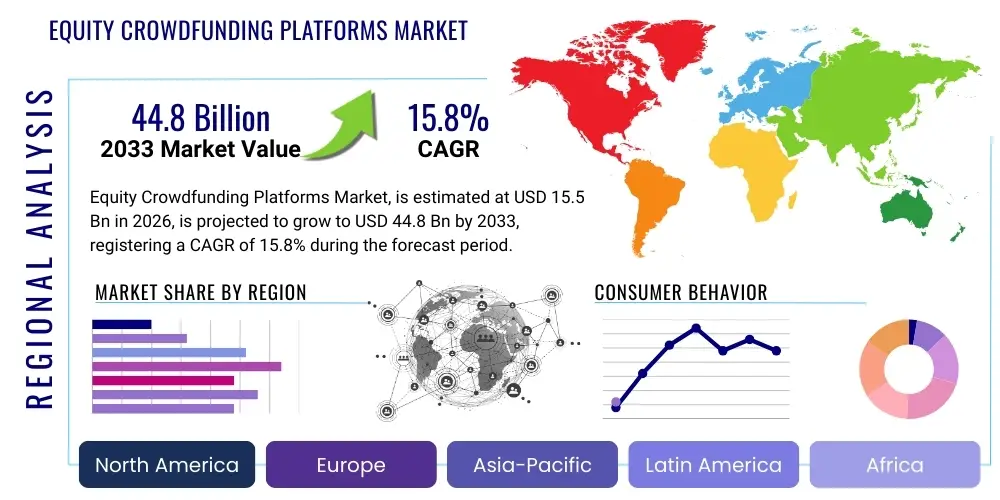

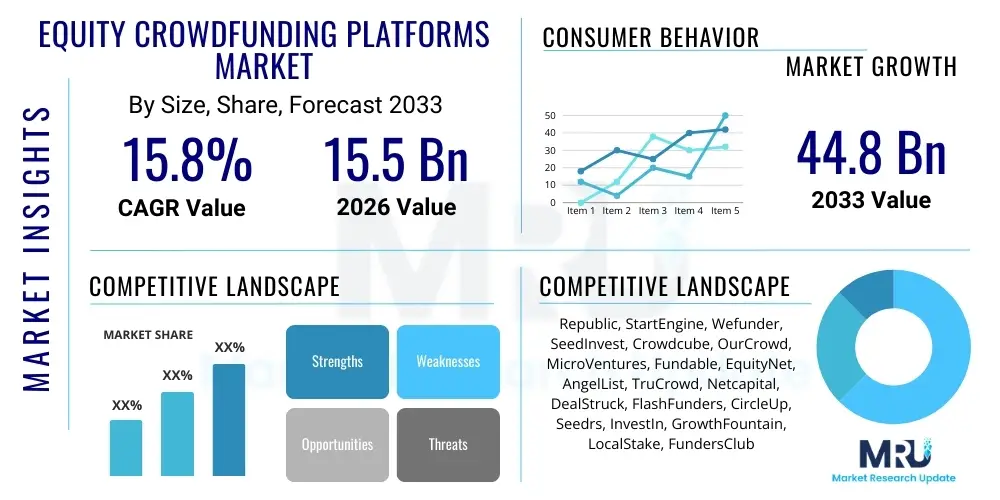

The Equity Crowdfunding Platforms Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 44.8 Billion by the end of the forecast period in 2033.

Equity Crowdfunding Platforms Market introduction

The Equity Crowdfunding Platforms Market encompasses digital platforms that facilitate the raising of capital for private companies or startups from a large pool of investors, typically retail investors, in exchange for equity, convertible notes, or revenue share. These platforms democratize access to private investment opportunities, traditionally limited to venture capitalists and accredited investors, by leveraging regulatory frameworks such as Regulation Crowdfunding (Reg CF) and Regulation A (Reg A) in the United States, and similar legislation across Europe and Asia. The core product offering involves providing a secure, transparent, and compliant online environment for issuing companies to present their business plans and financial data to potential investors, managing the transaction process, and ensuring post-investment communication.

Major applications of equity crowdfunding span various sectors, including early-stage technology startups seeking seed funding, real estate developers funding specific projects, and established small-to-medium enterprises (SMEs) looking for growth capital. Key benefits driving the market include increased accessibility to capital for entrepreneurs who might be overlooked by traditional financing sources, lower transaction costs compared to initial public offerings (IPOs) or traditional private placements, and the invaluable marketing and community-building effect derived from involving a large base of loyal customer-investors. The success of platforms often hinges on their ability to perform rigorous due diligence on issuing companies and maintain a high level of investor trust and transparency.

Driving factors propelling this market growth include the widespread digital transformation of financial services (FinTech), regulatory modernization across key economies making it easier for retail investors to participate, and the sustained global increase in entrepreneurial activity. Furthermore, high interest rates and tightening credit markets in traditional banking sectors often push early-stage companies toward alternative financing methods like equity crowdfunding. The increasing penetration of mobile internet and sophisticated platform technology also enhances user experience and transaction efficiency, making these platforms a preferred alternative for modern capital formation.

Equity Crowdfunding Platforms Market Executive Summary

The Equity Crowdfunding Platforms Market is characterized by robust growth fueled by favorable regulatory environments and accelerating digital adoption among both investors and issuers. Business trends show a strong movement towards niche platforms specializing in high-growth sectors like real estate, blockchain, and sustainable technology, offering specialized due diligence and investor networks tailored to these segments. There is also a significant trend toward primary market consolidation, where larger platforms are acquiring smaller, localized competitors to expand their geographical footprint and capture larger market shares, driving up competition in platform quality and investor security features. The integration of blockchain technology for tokenized equity is emerging as a critical evolutionary path, promising enhanced liquidity and transparency for secondary trading.

Regional trends indicate North America maintaining its dominance, primarily due to well-established regulatory frameworks (JOBS Act) and a high concentration of venture capital and startup activity. However, the Asia Pacific (APAC) region, particularly China, India, and Southeast Asia, is projected to exhibit the fastest growth rate, spurred by rapid digitalization, increasing disposable incomes, and regulatory relaxation enabling greater retail investor participation in private markets. Europe, guided by the European Crowdfunding Service Provider Regulation (ECSPR), is seeing a consolidation of cross-border offering capabilities, harmonizing the market and encouraging larger capital raises across multiple European Union jurisdictions.

Segment trends highlight the growing importance of non-accredited investors (retail investors) driven by lower minimum investment thresholds and increased public awareness regarding early-stage investment opportunities. Platform Type segmentation shows generalist platforms currently dominating, but niche platforms focusing on high-value sectors such as Real Estate and MedTech are gaining traction due to their ability to attract high-quality deal flow and sophisticated sector-specific investors. Furthermore, B2B offerings, where platforms facilitate connections between startups and established corporate venture arms, represent a high-value segment focusing on larger funding rounds and strategic partnerships, moving beyond traditional small-scale retail funding models.

AI Impact Analysis on Equity Crowdfunding Platforms Market

Common user questions regarding AI's impact on equity crowdfunding platforms generally revolve around efficiency improvements, risk mitigation, and investment selection. Users frequently ask: "How can AI improve the due diligence process for startups?", "Will AI lead to better investment returns by identifying successful deals early?", and "What are the ethical concerns regarding bias in AI-driven scoring systems?" There is high anticipation regarding AI's potential to automate complex compliance checks and reduce administrative overhead, but also concern about the black-box nature of proprietary algorithms influencing public investment decisions and potentially favoring specific demographic profiles of entrepreneurs or business models.

The key theme summarizing user expectations is the desire for AI to enhance both transparency and efficacy. Investors seek AI tools that offer predictive modeling for startup failure rates and potential returns, helping them navigate the inherent high risk of early-stage investing. Issuers hope AI can streamline the cumbersome documentation and regulatory filing processes, shortening the time-to-funding. Ultimately, the market anticipates AI moving crowdfunding platforms beyond mere transaction facilitation toward providing sophisticated, data-driven financial advisory services, although regulatory bodies are closely watching to ensure that AI adoption maintains fairness and investor protection standards.

- AI-Enhanced Due Diligence: Algorithms analyze historical performance, market comparisons, financial projections, and team credentials to provide objective risk scores for issuing companies, significantly accelerating the vetting process.

- Personalized Investment Matching: AI-driven recommendation engines connect investors with offerings based on their stated risk appetite, previous portfolio choices, and sector preferences, improving conversion rates for platforms.

- Fraud Detection and Compliance: Machine learning models continuously monitor transactional data and platform behavior to detect anomalies, suspicious fundraising activities, and ensure adherence to complex securities regulations (Know Your Customer/Anti-Money Laundering).

- Automated Investor Relations: Utilizing chatbots and natural language processing (NLP) to handle common investor queries, providing instant, personalized support regarding platform operations, company updates, and regulatory changes.

- Predictive Market Sentiment Analysis: AI tools scrape social media, news, and investor forums to gauge public interest and sentiment towards specific sectors or companies, providing platforms with actionable intelligence for deal structuring.

DRO & Impact Forces Of Equity Crowdfunding Platforms Market

The market dynamics of equity crowdfunding are shaped by powerful forces involving technological innovation, evolving regulatory landscapes, and shifting investor behavior. The principal drivers include the global search for higher yield investments amid prolonged low-interest-rate environments (though currently fluctuating), the inherent scalability of digital platforms offering access to diverse investment opportunities, and the increasing reliance on alternative finance sources by SMEs struggling with stringent traditional bank lending criteria. Restraints primarily center on regulatory hurdles, such as fragmented cross-border regulations that limit market size, the high failure rate associated with early-stage companies (leading to investor skepticism), and concerns about secondary market liquidity for private equity shares. Addressing these restraints often requires significant platform investment in compliance technology and robust investor education programs.

Opportunities for exponential growth arise from geographic expansion into underserved emerging markets where traditional finance is underdeveloped, the integration of blockchain technology to create fractional ownership and boost secondary market trading potential, and the development of specialized platforms catering to high-growth, underserved sectors like climate technology and deep tech. Furthermore, strategic partnerships between crowdfunding platforms and established financial institutions, such as wealth managers or private banks, open avenues for tapping into larger pools of accredited institutional capital, legitimizing the segment and providing a bridge between retail and institutional investment landscapes.

The impact forces analysis reveals that regulatory change holds the highest impact, either accelerating or stifling growth based on the permissiveness and clarity of new rules. Technological advancement, particularly concerning AI, is a medium-to-high impact force that drives efficiency and competitive advantage. Investor trust and platform transparency are foundational impact forces; a single high-profile fraud case can severely damage market perception and curb retail investor participation for extended periods. Platforms are therefore forced to invest heavily in security protocols and transparent governance structures, recognizing that maintaining public trust is paramount to sustained market expansion.

Segmentation Analysis

The Equity Crowdfunding Platforms Market is highly segmented based on the type of platform, the profile of the investors served, and the industry sector being funded. This granularity allows platforms to optimize their marketing, regulatory compliance procedures, and deal flow selection. Understanding these segments is critical for market participants to identify niche opportunities, such as specializing in Regulation A offerings for larger capital raises or focusing exclusively on high-net-worth accredited investors who require sophisticated due diligence reports. The evolution of regulatory frameworks continually influences segmentation, particularly by defining the eligibility criteria for different tiers of investors and the corresponding fundraising limits.

General Crowdfunding Platforms offer a broad range of deal types across multiple industries, appealing to a wide base of retail investors due to their diversity and low entry barriers. Conversely, Niche/Industry-Specific Platforms, such as those dedicated solely to real estate or biotech, offer deeper industry expertise, attracting more sophisticated accredited investors and higher-quality, sector-specific deals. The distinction between Accredited and Non-Accredited Investor platforms defines regulatory compliance complexity; platforms focused on accredited investors often manage larger checks and fewer regulatory limits on capital raised, whereas retail investor platforms prioritize investor protection measures and mass market outreach.

Sectoral segmentation highlights where the highest capital demand resides. Technology and IT remain the largest segment globally, benefiting from continuous innovation cycles and scalability. Real Estate crowdfunding is a rapidly maturing segment, offering tangible assets and predictable returns, which appeals to risk-averse investors. Healthcare and Life Sciences, while highly risky, attract significant capital due to the potential for high returns and social impact, especially when funding breakthrough medical technologies. Analyzing these segments provides strategic insights into regional investment appetites and where future regulatory efforts might concentrate to facilitate growth and mitigate risks.

- By Platform Type:

- General Crowdfunding Platforms

- Niche/Industry-Specific Platforms

- By Investor Type:

- Accredited Investors

- Non-Accredited Investors (Retail Investors)

- By Sector:

- Technology & IT

- Real Estate

- Healthcare & Life Sciences

- Financial Services (FinTech)

- Consumer Goods & Retail

- Sustainable and Green Technology

Value Chain Analysis For Equity Crowdfunding Platforms Market

The value chain for equity crowdfunding platforms is complex, spanning from deal origination to post-investment portfolio management. Upstream activities involve extensive sourcing and vetting of potential issuing companies. This crucial stage requires specialized internal teams or external due diligence partners to verify the company's financial health, legal standing, and market viability. Successful upstream analysis minimizes platform risk exposure and ensures a high quality of available offerings. Distribution channels form the core of the platform's operation, encompassing the digital infrastructure, compliance technology, and marketing efforts needed to attract a sufficient volume of both issuers and investors to achieve network effects.

Midstream activities center on transaction execution, including handling the secure transfer of funds, managing digital share certificates, and ensuring strict adherence to global and local securities regulations. This is where proprietary technology and robust compliance frameworks become critical differentiators. Downstream activities involve managing the investor-issuer relationship post-funding. This includes facilitating regular updates, managing shareholder communications, and providing necessary documentation for tax purposes. For platforms aiming to offer secondary trading, downstream activities extend to providing the technological framework for regulated liquidity events, significantly enhancing the attractiveness of the investment vehicle.

Distribution can be categorized into direct and indirect channels. Direct distribution is facilitated entirely through the platform's owned digital properties (website, mobile app), allowing the platform maximum control over the user experience and branding. Indirect channels involve strategic partnerships, such as collaborations with financial advisors, venture capital firms, or angel investor groups, who refer high-quality deal flow or large pools of investors to the platform. Both channels are essential; direct channels ensure scale and brand recognition, while indirect channels often provide access to higher value, often accredited, capital and more sophisticated deals, justifying the platform's overall margin structure.

Equity Crowdfunding Platforms Market Potential Customers

The primary customers of equity crowdfunding platforms are two distinct groups: the Issuers (the companies raising capital) and the Investors (the individuals or entities providing capital). Issuers typically consist of early-stage startups seeking seed or Series A funding, high-growth Small and Medium-sized Enterprises (SMEs) requiring expansion capital, and increasingly, established firms executing Regulation A offerings for larger, quasi-public raises. These companies are drawn to the platform's efficiency, the speed of fundraising, and the opportunity to mobilize their existing customer base as brand ambassadors and investors.

Investors are segmented into Accredited Investors (high net worth individuals, institutions, or venture funds) and Non-Accredited/Retail Investors (general public investors). Retail investors value the accessibility of platforms, allowing them to diversify small portions of their portfolio into private equity, which was previously inaccessible. Accredited investors leverage platforms to efficiently screen a large volume of pre-vetted deals, providing a structured funnel for deal flow that complements their traditional investment sourcing strategies. The platforms must provide tailored services to each segment; retail investors require extensive educational content and simplified interfaces, while accredited investors demand deep due diligence reports and personalized relationship management.

Furthermore, emerging customer segments include corporate venture arms and family offices utilizing these platforms not just for investment, but as a strategic mechanism to observe market trends and identify potential acquisition targets within high-growth sectors. By leveraging the platform's data on nascent companies and emerging technologies, these larger entities gain early insights. The evolution of the market is increasingly blurring the lines between private placement agents and crowdfunding platforms, suggesting that institutional capital is becoming a significant customer segment demanding compliance infrastructure capable of handling large-scale institutional investments alongside retail participation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 44.8 Billion |

| Growth Rate | CAGR 15.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Republic, StartEngine, Wefunder, SeedInvest, Crowdcube, OurCrowd, MicroVentures, Fundable, EquityNet, AngelList, TruCrowd, Netcapital, DealStruck, FlashFunders, CircleUp, Seedrs, InvestIn, GrowthFountain, LocalStake, FundersClub |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Equity Crowdfunding Platforms Market Key Technology Landscape

The technological backbone of the Equity Crowdfunding Platforms Market is shifting rapidly, moving beyond basic web portals to sophisticated, modular FinTech ecosystems. Central to this evolution is the deployment of robust identity verification and compliance technology, including sophisticated Know Your Customer (KYC) and Anti-Money Laundering (AML) systems. These technologies are crucial for meeting stringent regulatory requirements globally and managing investor eligibility across various jurisdictions, particularly as platforms seek cross-border scalability. Furthermore, proprietary or third-party escrow and payment gateway solutions are essential for securely handling large volumes of investor funds and ensuring the integrity of the capital transfer process, often requiring integration with established banking infrastructure.

The most transformative technology in this landscape is blockchain. Platforms are increasingly exploring the tokenization of equity, where startup shares are represented as digital tokens on a distributed ledger. This adoption promises significant advantages, primarily by streamlining cap table management, automating governance processes (such as dividend distribution and voting), and, most critically, creating the potential for genuine secondary market liquidity through security token exchanges. While regulatory hurdles remain for widespread tokenization, this technology is poised to redefine how private equity is owned and traded, making crowdfunding investments more attractive by addressing the long-standing issue of illiquidity.

Beyond transactional and compliance technologies, platforms are leveraging data analytics and artificial intelligence (AI) to enhance both the issuer and investor experience. AI is used for highly specialized risk scoring of potential startups, predictive modeling for sector growth, and optimizing fundraising campaigns based on historical data patterns. For investors, advanced data visualization tools provide interactive dashboards showing portfolio performance, risk exposure, and detailed metrics on funded companies. This commitment to cutting-edge technology minimizes operational friction, enhances investor confidence through transparency, and positions platforms as sophisticated providers of financial technology rather than simple digital bulletin boards for private company offerings.

Regional Highlights

Regional dynamics dictate the pace and shape of growth in the Equity Crowdfunding Platforms Market, heavily influenced by local regulatory maturity and entrepreneurial culture. North America, particularly the United States, remains the largest market driver globally. The foundational legislation (JOBS Act, Reg CF, Reg A) has created a mature ecosystem where established platforms facilitate multi-million dollar raises, supported by a high degree of technological adoption and a deep pool of both accredited and retail investors accustomed to diversified financial instruments. Canada is also expanding its framework, though typically follows the US lead. The region is characterized by high average funding rounds and dominance in the Technology and IT sectors.

Europe presents a fragmented yet rapidly unifying market. The implementation of the European Crowdfunding Service Provider Regulation (ECSPR) in November 2021 marks a critical milestone, enabling platforms to operate across all EU member states under a single regulatory umbrella. This harmonization is expected to unlock significant cross-border investment flows, particularly benefiting platforms in key economies like the UK (still influential despite Brexit, with strong platforms like Crowdcube and Seedrs), Germany, and France. Real Estate and Green Technology sectors show strong momentum across the continent, driven by specific regional investment mandates and public policy goals toward sustainability.

The Asia Pacific (APAC) region is poised for the highest growth trajectory, driven by massive urbanization, increasing internet penetration, and favorable regulatory reforms in jurisdictions like Singapore, Australia, and India. While regulatory complexity varies widely across the continent, the sheer volume of SMEs and the high capital demand create enormous opportunity. APAC platforms often blend crowdfunding models with localized community investment strategies, focusing heavily on FinTech and e-commerce startups. The Middle East and Africa (MEA) region is nascent but evolving, particularly in financial hubs like Dubai and certain African nations (e.g., South Africa) where governments are actively promoting FinTech development to diversify economies away from traditional resources, focusing on digital infrastructure and localized venture funding.

- North America (US & Canada): Market leader, driven by mature regulatory frameworks (Reg CF/A) and robust institutional backing. Focus on high-value technology, biotech, and Regulation A offerings. High adoption of advanced AI/KYC technologies.

- Europe (UK, Germany, France, EU): Significant growth expected due to regulatory harmonization (ECSPR). Increasing emphasis on cross-border deals and strong investment in real estate and sustainable energy projects.

- Asia Pacific (APAC) (China, India, Australia, Singapore): Highest growth potential fueled by high population density, rapid digital transformation, and strong governmental support for SME funding. Focus on localized FinTech and consumer technology.

- Latin America (LATAM): Emerging market characterized by evolving, country-specific regulations. High activity in Brazil and Mexico. Driven by addressing gaps in traditional banking access for startups.

- Middle East and Africa (MEA): Nascent market concentrated in FinTech hubs (UAE, South Africa). Focus on digital infrastructure and early-stage capital formation supported by government innovation initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Equity Crowdfunding Platforms Market.- Republic

- StartEngine

- Wefunder

- SeedInvest

- Crowdcube

- OurCrowd

- MicroVentures

- Fundable

- EquityNet

- AngelList

- TruCrowd

- Netcapital

- DealStruck

- FlashFunders

- CircleUp

- Seedrs

- InvestIn

- GrowthFountain

- LocalStake

- FundersClub

Frequently Asked Questions

Analyze common user questions about the Equity Crowdfunding Platforms market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between equity crowdfunding and traditional venture capital?

Equity crowdfunding democratizes investment by allowing retail (non-accredited) investors to buy shares in private companies, typically involving small individual check sizes and raising capital from a large crowd. Traditional venture capital relies on large investments from institutional, accredited funds or individuals, focusing on higher capital requirements and requiring substantial control and due diligence processes. Crowdfunding offers faster, more public-facing capital access, while VC provides deeper strategic guidance and larger funding rounds.

What are the primary regulatory challenges facing equity crowdfunding platforms?

The primary regulatory challenges include ensuring compliance with fragmented global securities laws, managing the high costs associated with Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements across jurisdictions, and navigating specific limits on capital raised and individual investment caps for retail investors (e.g., Reg CF limits). Furthermore, platforms face regulatory scrutiny regarding the transparency of due diligence and the accurate presentation of investment risks to the general public.

How does blockchain technology improve the Equity Crowdfunding market?

Blockchain technology, specifically through security tokenization, improves the market by offering fractional ownership, automating compliance and governance tasks (like dividend distribution), and significantly enhancing the potential for secondary market liquidity. By recording ownership on an immutable digital ledger, tokenization reduces administrative complexity, increases transaction security, and makes private equity shares more tradable and attractive to a wider investor base.

Which geographic region exhibits the fastest growth potential in equity crowdfunding?

The Asia Pacific (APAC) region, driven by countries like India, China, and Singapore, is projected to exhibit the fastest growth potential. This growth is fueled by rapid digital adoption, a vast population of SMEs needing alternative financing solutions, increasing disposable incomes, and regulatory relaxation aimed at fostering FinTech innovation and providing capital access to high-growth startups within the region.

What are the typical risks associated with investing in equity crowdfunding offerings?

The typical risks include high illiquidity, meaning investors may be unable to sell their shares for many years until a major exit event (acquisition or IPO); the high probability of startup failure, leading to total loss of capital; and dilution risk, where subsequent funding rounds reduce the investor's percentage ownership. These investments are generally considered high-risk, high-reward and suitable only for a small portion of an investor's total portfolio.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager