Eroding Antifouling Paint Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436158 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Eroding Antifouling Paint Market Size

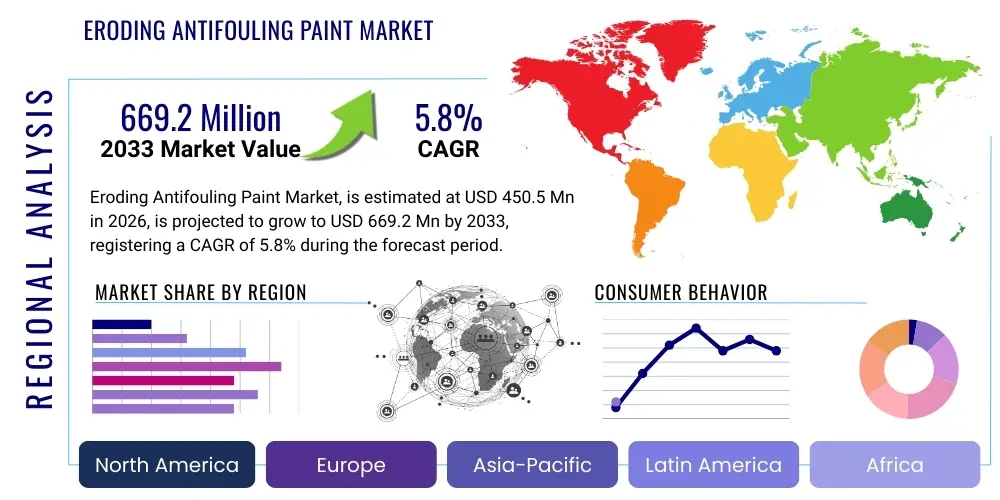

The Eroding Antifouling Paint Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 669.2 Million by the end of the forecast period in 2033.

Eroding Antifouling Paint Market introduction

Eroding antifouling paints, primarily based on copper compounds and specialized polymer matrices, represent the predominant technology used globally to prevent the adhesion and growth of marine organisms (biofouling) on submerged structures, particularly ship hulls. These coatings function through a controlled release mechanism: the binder polymer slowly degrades or hydrolyzes upon contact with seawater, continuously exposing and releasing the underlying biocides. This controlled erosion ensures a smooth hull surface is maintained, contributing significantly to fuel efficiency and reduced operational costs for the maritime industry.

The core product description centers on two primary types: Self-Polishing Copolymers (SPC) and Controlled Depletion Polymers (CDP). SPC technology is highly advanced, utilizing active chemical reactions with seawater to polish the paint surface, thereby maintaining consistent antifouling performance over longer dry-dock intervals (up to five years). CDP coatings rely more on water solubility and erosion of the binder, offering a more cost-effective solution often applied to smaller vessels or those with lower operational speeds. The efficacy of these paints is crucial, as biofouling increases hydrodynamic drag, leading to substantial greenhouse gas emissions and elevated fuel consumption.

Major applications of eroding antifouling paints span across the entire marine ecosystem, including large commercial vessels such as container ships, bulk carriers, and tankers, where coating integrity is paramount for global trade efficiency. Furthermore, these paints are vital for recreational boats, maintaining performance and aesthetic appeal, and are increasingly used on offshore structures, renewable energy platforms, and aquaculture nets to prevent structural degradation and disease transmission. The market growth is principally driven by stringent international environmental regulations (IMO guidelines), the necessity for improved vessel efficiency, and the expansion of global shipping activities.

Eroding Antifouling Paint Market Executive Summary

The Eroding Antifouling Paint Market is characterized by robust demand driven by the maritime sector's imperative to reduce operational expenditures and adhere to stringent environmental mandates focused on minimizing greenhouse gas emissions and invasive species transfer. Business trends indicate a strong focus on developing high-solids, low Volatile Organic Compound (VOC) formulations, moving towards next-generation SPC coatings that offer extended service life and enhanced performance characteristics, thereby reducing maintenance cycles. Strategic partnerships between major coating manufacturers and large shipyards are crucial for securing long-term contracts and implementing new application technologies, emphasizing specialized robotic application systems for uniformity and efficiency.

Regionally, Asia Pacific continues to dominate the market, primarily due to the concentration of shipbuilding activities and the presence of major fleet owners in countries like China, South Korea, and Japan. Europe and North America, while exhibiting slower fleet growth, drive technological advancements, focusing heavily on eco-friendly alternatives and compliance with local regulatory frameworks concerning biocide use. The emergence of sustainable bio-based and non-biocidal fouling release systems, while currently a restraint for traditional eroding paints, is simultaneously forcing innovation within the eroding paint segment to maintain market relevance by minimizing copper leaching rates and integrating novel synergistic biocides.

Segment trends reveal that the Self-Polishing Copolymer (SPC) segment maintains the highest revenue share, supported by its superior performance profile suitable for high-activity commercial vessels. The commercial vessel application segment remains the largest end-user, dictated by the sheer volume and size of global merchant fleets. Future growth is anticipated in the offshore structures and aquaculture segments, driven by global investments in offshore wind energy and the expansion of sustainable marine farming operations, requiring specialized coatings that withstand high flow rates and prolonged immersion periods.

AI Impact Analysis on Eroding Antifouling Paint Market

User inquiries regarding AI's influence in the antifouling paint market frequently center on how machine learning can optimize paint formulation processes, predict coating lifespan, and revolutionize application methods. Key themes include the use of AI for analyzing large datasets related to environmental conditions (salinity, temperature, currents) and correlating them with real-world paint performance metrics (erosion rate, biofouling index). Users are concerned about whether AI can accelerate the transition away from traditional biocides by identifying novel, effective, and environmentally benign alternatives through computational chemistry simulations. Expectations are high that AI-driven predictive maintenance scheduling will significantly extend the effective dry-docking cycle, maximizing vessel uptime and minimizing waste.

The integration of Artificial Intelligence and machine learning models provides sophisticated tools for optimizing the deployment and maintenance of eroding antifouling paints. AI algorithms can process sensor data collected from vessel hulls (e.g., measuring roughness, temperature, and speed) to predict the precise remaining lifespan of the coating, moving maintenance from fixed schedules to condition-based monitoring. Furthermore, AI assists chemists in the R&D phase by simulating millions of potential polymer and biocide combinations, dramatically reducing the time and cost associated with laboratory testing, thereby accelerating the launch of high-performance, compliant products.

- AI-driven Predictive Maintenance: Optimizing recoating schedules based on real-time hull performance data and environmental modeling, maximizing coating efficacy.

- Formulation Optimization: Utilizing machine learning to rapidly test and validate novel biocide combinations and polymer erosion profiles for superior performance.

- Robotic Application Refinement: AI-guided robotic systems ensuring uniform paint thickness and coverage during application, crucial for SPC performance consistency.

- Biofouling Pattern Prediction: Analyzing geographic and seasonal fouling intensity to recommend region-specific paint formulations and application strategies.

- Supply Chain Efficiency: Using predictive analytics to manage inventory of raw materials (copper, polymers, solvents) based on anticipated global shipbuilding and repair demands.

DRO & Impact Forces Of Eroding Antifouling Paint Market

The Eroding Antifouling Paint Market is primarily driven by global trade expansion demanding higher fleet efficiency, and underpinned by stringent environmental regulations enforced by the International Maritime Organization (IMO). These factors necessitate the use of high-performance coatings that minimize hydrodynamic drag, thereby reducing fuel consumption and associated carbon emissions. However, the market faces significant restraints, chiefly the escalating regulatory scrutiny concerning the toxicity of copper-based biocides, prompting intense pressure to develop environmentally acceptable alternatives. Opportunities exist in the specialized coating requirements for emerging sectors, such as offshore renewable energy infrastructure and advanced aquaculture systems, demanding tailored erosion rates and extreme durability. The impact forces are characterized by high market entry barriers due to complex R&D and regulatory approval processes, coupled with moderate pricing sensitivity influenced by volatile raw material costs, particularly copper oxides, and the long-term cost benefits derived from improved vessel efficiency.

The primary driver remains the economic necessity of high performance. A well-maintained antifouling coating can reduce frictional resistance by 5-10%, translating into significant annual savings for vessel operators, especially given the volatility of bunker fuel prices. This financial incentive aligns directly with regulatory pressures from the IMO’s Energy Efficiency Existing Ship Index (EEXI) and Carbon Intensity Indicator (CII), pushing owners toward premium, long-lasting eroding paints like advanced SPC technologies. Conversely, the market is restrained by the increasing adoption of niche non-biocidal alternatives, such as silicone-based fouling release coatings, particularly in regions with extremely sensitive marine environments or for specific low-speed vessel applications, challenging the dominance of traditional eroding products.

Opportunities are significant within the naval and specialized vessel sectors, where mission-critical performance outweighs initial cost considerations. Furthermore, the global drive towards sustainable shipping opens avenues for manufacturers who successfully innovate towards copper-free or highly controlled-release copper formulations that secure regulatory approval in major ports. The impact forces are heavily weighted towards technological superiority; companies capable of delivering extended dry-docking intervals (5+ years) through enhanced erosion control and sustained biocide efficacy will gain disproportionate market share, creating a competitive landscape defined by chemical innovation and robust field testing data.

Segmentation Analysis

The Eroding Antifouling Paint Market is comprehensively segmented based on the paint type, the specific application of the structure being coated, and the geographic region. This segmentation provides a granular view of demand drivers and competitive dynamics. By Type, the market is categorized into advanced Self-Polishing Copolymers (SPC) and more traditional Controlled Depletion Polymers (CDP), reflecting differences in technological sophistication and price points. The Application segments reflect the diverse end-user base, ranging from high-traffic commercial vessels, which represent the bulk of demand, to niche but growing sectors like offshore fixed structures and aquaculture.

- By Type:

- Self-Polishing Copolymers (SPC)

- Controlled Depletion Polymers (CDP)

- Hybrid Eroding Systems

- By Application:

- Commercial Vessels (Tankers, Container Ships, Bulk Carriers)

- Recreational Boats (Yachts, Leisure Craft)

- Offshore Structures (Oil Rigs, Wind Turbine Foundations)

- Aquaculture Nets and Cages

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Eroding Antifouling Paint Market

The value chain for eroding antifouling paints begins with the sourcing and manufacturing of critical raw materials (upstream analysis), primarily including copper compounds (e.g., cuprous oxide), specialty acrylic or metallic-containing polymers, and various co-biocides and solvents. Upstream suppliers are challenged by volatile commodity prices and the need to meet high purity standards for effective paint formulation. Manufacturers must engage in complex chemical synthesis and formulation R&D to optimize the controlled erosion rate and biocide release profile, representing the core value addition stage in this industry.

The middle segment of the chain involves formulation, testing, certification, and regulatory navigation. Due to the high regulatory burden associated with biocides (e.g., REACH in Europe, EPA in the US), market entry requires substantial investment in toxicological and efficacy testing. Distribution channels are varied but rely heavily on specialized maritime suppliers, distributors, and direct sales teams (technical sales engineers) who offer application support to shipyards and dry-dock facilities globally. Direct sales are predominant for large commercial contracts due to the requirement for highly specialized technical service and customized paint specifications.

Downstream analysis focuses on the end-users: primarily global shipyards (where the paint is applied during new build or maintenance) and vessel owners (who specify the required coating). The end-use phase includes application, monitoring of performance, and eventual recoating. Key value determinants at this stage include the coating’s longevity (extending dry-docking intervals), ease of application, and the quantifiable fuel savings delivered. Indirect channels include marine consultancies and classification societies (like DNV or Lloyd’s Register) that influence material specification based on efficiency standards and regulatory compliance.

Eroding Antifouling Paint Market Potential Customers

The primary customers for eroding antifouling paints are major entities within the global maritime industry, driven by operational efficiency requirements and environmental compliance mandates. The largest group consists of international shipping companies, encompassing operators of container vessels, crude oil tankers, LNG carriers, and bulk carriers, which require high-performance SPC coatings to minimize drag across long transit routes and maintain prolonged dry-dock intervals. These clients prioritize proven performance data, fuel savings guarantees, and adherence to specific global port regulations regarding biocide release.

A secondary, yet rapidly growing customer base includes owners and operators of recreational and leisure marine craft, ranging from small fishing boats to large luxury yachts. This segment typically utilizes both CDP and specialized SPC systems, balancing performance needs with aesthetic finish and often demanding lower VOC formulations suitable for local marinas. Furthermore, governmental agencies, particularly naval forces and coast guards, constitute a significant customer segment, requiring extremely durable, high-specification eroding paints for long mission cycles and varied operational environments, often involving military-grade performance requirements.

Beyond traditional shipping, niche industrial customers include energy companies operating offshore platforms (oil & gas, wind energy) and aquaculture enterprises. Offshore structures require coatings resistant to abrasion and high flow rates, while aquaculture operators use specialized eroding paints on nets and cages to prevent fouling that restricts water flow and promotes disease, directly impacting yield. These specialized applications demand coatings tailored for specific static or low-speed immersion conditions, differentiating them from the high-speed requirements of commercial shipping.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 669.2 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Akzo Nobel N.V., PPG Industries, Hempel A/S, Jotun, Sherwin-Williams Company, Chugoku Marine Paints, Ltd. (CMP), KCC Corporation, Nippon Paint Holdings Co., Ltd., BASF SE, Toray Industries, Kansai Paint Co., Ltd., Sea Hawk Paints, RPM International Inc., Kop-Coat Marine Group, Marine Science Inc., Marlin Yacht Paint, Boero Bartolomeo S.p.A., Carboline (RPM Company), Petit Paint, Jotun (Marine Coatings Division) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Eroding Antifouling Paint Market Key Technology Landscape

The technological landscape of the eroding antifouling paint market is highly dynamic, centered on balancing ecological requirements with performance mandates. The core technology, Self-Polishing Copolymers (SPC), remains dominant. SPC formulations utilize tailor-made methacrylate or acrylate polymers containing chemically bonded biocide moieties (usually organotin or specialized copper acrylate). The hydrolysis of the polymer backbone in seawater releases these biocides and simultaneously ablates a micro-layer of the paint, ensuring a continuously smooth surface, crucial for maintaining optimal laminar flow and reducing frictional drag. Recent technological advancements focus on achieving extremely low erosion rates (LETR coatings) to extend effective service life to seven or more years, minimizing dry-dock frequency.

Innovation is also highly concentrated on modifying the biocide package. Given the regulatory phasing out of certain traditional biocides, manufacturers are investing in synergistic combinations of modern organic biocides (such as zinc pyrithione or novel copper-free alternatives) alongside reduced levels of cuprous oxide. This multi-biocide approach ensures broad-spectrum protection against various regional fouling organisms (slime, weed, hard shell) while meeting environmental standards related to leached concentration limits. Furthermore, high-solid formulations are becoming standard to comply with VOC reduction mandates, improving both environmental profile and application efficiency by reducing the required film thickness.

The emerging technological focus includes incorporating nano-materials and advanced polymer architectures to enhance mechanical strength and erosion control predictability. Researchers are exploring zwitterionic or bio-mimetic polymers that resist protein adhesion, functioning as a non-stick layer while the underlying eroding mechanism handles micro-organism growth. Integration with digital technologies is also key: developing smart coatings that can provide real-time data on erosion rates or localized fouling buildup through embedded sensors, supporting the shift toward AI-driven predictive maintenance models for large commercial fleets.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest market due to the high volume of new shipbuilding activities, particularly in China, South Korea, and Japan. The region also hosts the largest global commercial fleet, driving immense demand for maintenance and recoating paints. Economic expansion and increased maritime trade routes solidify APAC's dominance, focusing primarily on high-performance SPC systems for large merchant vessels.

- Europe: Europe represents a mature market characterized by stringent environmental regulations (e.g., EU Biocidal Products Regulation, BPR). This region is a leader in technology adoption, pushing demand for highly compliant, low-leaching, copper-optimized, and alternative non-biocidal hybrid eroding systems. Demand is strong from recreational marine and specialized fleets, alongside significant offshore renewable energy projects.

- North America: This region is characterized by steady demand in both the commercial and recreational segments. Regulatory frameworks, notably those enforced by the EPA and state-specific rules (like California's), drive product innovation toward regional compliance. Emphasis is placed on coatings that offer long-term performance and reduced environmental impact on localized waterways.

- Latin America (LATAM): LATAM is an emerging market with growth potential driven by expanding commercial shipping routes, increased offshore oil and gas exploration, and growing aquaculture industries, particularly in countries like Brazil and Chile. The demand is often price-sensitive, balancing cost-effective CDP solutions with necessary high-performance SPCs for long-haul vessels.

- Middle East and Africa (MEA): Growth in MEA is fueled by strategic investments in port infrastructure and increasing regional maritime traffic, particularly in the Gulf region. The demand is unique due to extremely high water temperatures and salinity, requiring specialized coatings optimized for harsh operating conditions and high fouling pressure, driving the adoption of premium, durable SPC technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Eroding Antifouling Paint Market.- Akzo Nobel N.V. (International Paint)

- PPG Industries

- Hempel A/S

- Jotun

- Sherwin-Williams Company

- Chugoku Marine Paints, Ltd. (CMP)

- KCC Corporation

- Nippon Paint Holdings Co., Ltd.

- BASF SE

- Toray Industries

- Kansai Paint Co., Ltd.

- Sea Hawk Paints

- RPM International Inc.

- Kop-Coat Marine Group

- Marine Science Inc.

- Marlin Yacht Paint

- Boero Bartolomeo S.p.A.

- Carboline (RPM Company)

- Petit Paint

- Jotun (Marine Coatings Division)

Frequently Asked Questions

Analyze common user questions about the Eroding Antifouling Paint market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary mechanism of action for eroding antifouling paints?

Eroding antifouling paints operate via controlled hydrolysis of a polymer binder in seawater, leading to a steady, predictable release of biocides (typically copper-based) and continuous polishing of the surface. This mechanism maintains hull smoothness, reducing drag and fuel consumption.

How do Self-Polishing Copolymers (SPC) differ from Controlled Depletion Polymers (CDP)?

SPC paints are advanced systems where the biocide is chemically bonded to the polymer, allowing for a highly consistent and linear erosion rate over multiple years, ideal for high-speed commercial vessels. CDP paints rely on water solubility of the binder, offering a more variable, yet cost-effective, release mechanism suitable for lower activity vessels.

What are the main regulatory challenges facing the eroding antifouling paint industry?

The main challenges are strict international regulations, primarily from the IMO and regional bodies like the EU BPR, concerning the environmental impact and leaching rates of copper and co-biocides. This drives continuous R&D towards low-leaching and environmentally compliant formulations.

Which application segment holds the largest share in the market?

The Commercial Vessels segment holds the largest market share. This dominance is due to the vast size of the global merchant fleet (container ships, tankers, bulk carriers) and the critical need for long-lasting, high-performance coatings to ensure fuel efficiency and minimize dry-docking downtime.

How is AI influencing the future development and application of these coatings?

AI is increasingly used to optimize paint formulations by simulating material interactions and to implement predictive maintenance strategies. By analyzing real-time sensor data, AI helps operators determine the optimal time for recoating, maximizing the coating lifespan and vessel uptime.

Detailed Analysis and Market Dynamics Expansion for Character Count

Strategic Competitive Landscape and Product Innovation

The competitive environment within the eroding antifouling paint market is highly consolidated, dominated by a few multinational giants known for their extensive R&D capabilities and global distribution networks. These key players, including Akzo Nobel (through its International brand), Jotun, and Hempel, continuously invest significant capital into developing next-generation Self-Polishing Copolymer (SPC) technologies. The focus of this innovation is twofold: first, achieving compliance with increasingly stringent environmental legislation concerning copper content and Volatile Organic Compound (VOC) emissions; second, delivering coatings that guarantee measurable fuel savings over an extended service life, often five to seven years. The ability to provide robust, verifiable performance data, backed by proprietary hull performance monitoring systems, is a critical differentiator in securing high-value contracts with major fleet owners.

Recent product launches have emphasized hybrid systems that combine the controlled erosion mechanics of SPCs with specialized fouling-release properties (often incorporating fluoropolymers or silicones) to provide a synergistic effect against various biofouling types in diverse geographical waters. This trend towards customization ensures that ship owners can select a coating system tailored not just to their vessel type, but also to its specific trading pattern and anticipated fouling pressure. Furthermore, manufacturers are exploring advanced application techniques, including specialized two-component systems and formulations optimized for robotic application, which enhance coating integrity and reduce variability in film thickness, a key factor in maximizing the erosion efficiency and overall performance of the paint.

Small-to-mid-sized paint manufacturers often focus on niche markets, such as recreational boats or localized fishing fleets, where price sensitivity is higher and regulatory hurdles might be less complex than in the global shipping sector. These companies often specialize in Controlled Depletion Polymer (CDP) paints or region-specific formulations. However, the overarching market trend favors technological leaders who can offer global service support and integrated digital solutions for performance monitoring. This technological segmentation creates a high barrier to entry, ensuring that market consolidation remains a dominant feature, driven by strategic acquisitions focused on specialized biocide intellectual property or regional distribution strongholds.

Detailed Segment Analysis: Self-Polishing Copolymers (SPC)

The Self-Polishing Copolymer (SPC) segment constitutes the premium and largest portion of the eroding antifouling paint market by value. SPC technology represents the gold standard for high-activity vessels, where maximizing speed and minimizing fuel consumption are paramount. These systems function through a carefully engineered chemical reaction where the polymer matrix hydrolyzes at a controlled, linear rate upon contact with seawater. The consistent erosion process ensures the continuous exposure of fresh biocide, maintaining peak antifouling performance and, crucially, maintaining a continuously smooth, low-friction hull surface. This characteristic is often referred to as ‘polishing,’ directly translating into significant hydrodynamic benefits and subsequent reduction in CO2 emissions.

The complexity and superior performance of SPCs demand a higher upfront cost compared to traditional coatings, but the investment is justified by the extended dry-docking intervals (often extending from 36 months up to 60 or 84 months) and the tangible long-term fuel savings realized over the coating's lifespan. Technological evolution within SPCs is moving towards copper-acrylate free systems or low-leaching SPCs, necessitated by tighter environmental restrictions. These newer systems use advanced organic polymer structures combined with state-of-the-art co-biocides to achieve the required fouling control while minimizing the environmental footprint in port waters.

The future trajectory of the SPC segment is deeply intertwined with the digital transformation of the shipping industry. Integration with Big Data analytics and IoT sensors allows manufacturers to refine erosion models based on actual operational profiles (e.g., transit speeds, time in port, water temperature variations). This data-driven approach allows for the formulation of ‘smart’ SPC coatings optimized for specific vessel classes or routes, ensuring maximum efficacy and further cementing the segment's position as the technological backbone of the commercial marine coatings market.

Detailed Segment Analysis: Controlled Depletion Polymers (CDP)

Controlled Depletion Polymer (CDP) paints, also known as ablative or leaching paints, represent the traditional, cost-effective end of the eroding paint spectrum. These systems rely on the binder material being slightly soluble or porous, allowing seawater to penetrate and leach the biocide over time. As the biocide is released, the depleted binder material ablates or washes away, exposing a new layer of fresh paint and biocide. Unlike the chemical hydrolysis of SPCs, the erosion rate of CDP paints is heavily dependent on the water flow rate (speed of the vessel) and the operational activity, meaning the polishing action is less consistent than SPCs.

CDP paints are highly popular in the recreational marine sector, for vessels with low operational activity, and for smaller, coastal commercial fishing fleets where dry-docking cycles are shorter and budget considerations are paramount. While offering excellent initial antifouling protection, their performance duration is typically shorter than SPCs (usually 12 to 24 months), and they are more susceptible to the build-up of hull roughness over time if the erosion rate is too slow or too fast for the operational profile. This lack of consistent polishing means they do not offer the same level of hydrodynamic efficiency improvements as advanced SPC systems.

Market trends show a slow decline in the dominance of purely traditional CDP systems in high-performance applications, largely due to the mandatory requirement for fuel efficiency in large vessels. However, manufacturers continue to refine CDP formulations by integrating advanced co-biocides and slightly modifying polymer structures to provide enhanced erosion control, making them a viable and popular choice for the maintenance market of smaller and mid-sized vessels globally.

Impact of Environmental Regulations on Market Strategy

The regulatory framework governing the use of antifouling paints stands as the single most critical determinant of market strategy and product development. Following the global ban on organotin-based TBT coatings, the market has stabilized around copper-based eroding systems, but regulatory pressure is intensifying globally, particularly regarding the environmental consequences of copper leaching. The IMO’s mandate on greenhouse gas reduction (EEXI and CII) simultaneously mandates better performing coatings, creating a complex strategic challenge for manufacturers: deliver superior performance (smoothness) while reducing biocide release.

In regions such as the European Union and the United States, strict biocide approval processes (BPR and EPA registration) require extensive data demonstrating both efficacy and low toxicity. This regulatory environment favors large companies with the financial resources to conduct multi-year toxicology studies and registration fees. Smaller players often struggle to compete unless they possess unique, proven non-biocidal intellectual property. Consequently, major manufacturers are actively pursuing innovative biocide encapsulation techniques, specialized polymer delivery systems, and synergistic organic biocide packages that minimize environmental impact while maintaining necessary efficacy against local marine fouling pressures.

The long-term strategic focus is shifting towards developing and marketing copper-free or significantly reduced-copper antifouling paints, particularly for vessels operating predominantly in sensitive coastal or freshwater areas. While full non-biocidal fouling release coatings (e.g., silicones) are currently gaining traction, their application is speed-dependent. Eroding paint manufacturers must continually adapt their SPC formulations to prove they can meet the stringent environmental performance standards of non-biocidal systems while retaining the proven effectiveness and wide application window characteristic of chemically active coatings.

Operational Challenges and Supply Chain Vulnerabilities

Operational execution within the eroding antifouling paint market presents several inherent challenges, primarily related to the application process and raw material supply. The efficacy of SPC and CDP coatings is highly dependent on proper surface preparation and precise application conditions (humidity, temperature, film thickness). Failures in application, often executed in global shipyards under variable conditions, can severely compromise the controlled erosion mechanism, leading to premature failure and costly re-application. Manufacturers invest heavily in specialized training and technical service teams to supervise application processes globally, mitigating these risks.

Supply chain vulnerability is mainly centered on the primary biocide, cuprous oxide, a commodity subject to volatile global metal markets. Fluctuations in copper prices directly impact the production cost and pricing strategies of paint manufacturers, requiring advanced hedging strategies. Furthermore, the specialized polymers used in SPC coatings require complex synthesis processes, meaning the supply of these proprietary resins is often controlled by a limited number of specialized chemical firms, creating potential bottlenecks during periods of high demand from the shipbuilding or maintenance sectors.

Mitigation strategies include adopting multi-sourcing policies for key raw materials and integrating greater supply chain transparency through digital platforms. For application consistency, there is a growing trend toward using certified contractors and exploring automated or semi-automated paint application technologies, leveraging robotics and AI to ensure optimal thickness control and reduced human error, especially critical for achieving the specified performance guarantees of advanced eroding paint systems.

Market Opportunities in Offshore and Aquaculture Sectors

While commercial shipping remains the foundation of the market, the offshore and aquaculture sectors represent significant high-growth opportunities for specialized eroding antifouling paints. The rapid global expansion of offshore renewable energy, including fixed and floating wind turbine foundations, tidal energy devices, and associated infrastructure, necessitates coatings that can withstand static immersion and high turbulence for decades without significant maintenance. These structures often experience different fouling pressures than moving ships, requiring unique erosion profiles and mechanical toughness.

The aquaculture industry, particularly salmon, shellfish, and finfish farming, faces substantial economic losses due to net fouling, which restricts water flow, reduces oxygen levels, and increases disease risk. Eroding antifouling paints designed specifically for netting materials must be highly effective, environmentally non-toxic to the cultured species, and adhere well to flexible polymer fibers. This niche requires frequent recoating and specific regional formulations due to highly localized fouling pressures and strict local environmental regulations regarding discharge near farmed waters. Companies that can develop specialized, certified coatings for these high-value applications will unlock a dedicated and rapidly expanding revenue stream.

Exploiting these opportunities requires manufacturers to shift their R&D focus from the high-speed requirements of ship hulls to the static or slow-moving needs of fixed structures and nets. This involves developing polymer matrices with extremely low, controlled erosion rates and biocide packages optimized for static immersion environments, often leveraging synergistic non-copper components to meet the stringent ecological standards of near-shore installations.

Future Outlook: Bio-Mimicry and Sustainable Erosion

The long-term future of the eroding antifouling paint market points toward a convergence of conventional erosion technology with principles of bio-mimicry and material science focused on sustainability. Researchers are increasingly studying natural non-stick surfaces, such as shark skin or lotus leaves, to inform the design of polymer coatings that mechanically inhibit fouling while still providing the fuel efficiency benefits of controlled erosion. This hybrid approach seeks to reduce reliance on traditional biocides further.

Sustainable erosion involves developing polymers derived from renewable or naturally degradable sources that can still maintain the structural integrity required for high-performance marine use. The goal is to create coatings that, when they erode, release only benign degradation products into the marine environment, significantly beyond the current standards for copper leaching. This ambitious objective requires cross-disciplinary collaboration between polymer chemists, marine biologists, and computational scientists (utilizing AI for modeling) to discover and validate entirely new classes of marine coating materials that satisfy both performance and ultimate sustainability criteria, ensuring the long-term viability of the eroding paint segment against competing non-biocidal technologies.

The industry is also anticipating the widespread integration of digital twin technology for vessels. A digital twin of the hull coating would continuously simulate the paint's erosion rate and performance based on real-time operational data, allowing for ultra-precise maintenance planning and optimizing the performance life of the coating. Manufacturers who embed these digital services directly into their product offerings will lead the market transformation towards a service-oriented model, selling not just paint, but guaranteed hull performance and efficiency.

The market trajectory, while stable, will be defined by disruptive innovation driven by environmental compliance. Companies that successfully navigate the complex regulatory transition towards low-toxicity, high-performance SPC systems and effectively integrate digital technologies for predictive maintenance are positioned for significant growth, maintaining the eroding paint segment's vital role in the global maritime efficiency agenda. This ongoing evolution ensures that eroding paints remain the critical solution for managing biofouling risks across the diverse landscape of global marine activities.

Further Analysis on Global Market Dynamics

The global demand dynamics for eroding antifouling paints are intricately linked to the macroeconomic health of international trade. When global trade volumes increase, the utilization rates of the commercial fleet rise, leading to faster wear and tear on existing coatings and necessitating more frequent and higher-quality recoating cycles. Conversely, economic downturns can lead to delayed dry-docking and a temporary shift towards cheaper, shorter-lifecycle CDP coatings, although the long-term cost benefits of SPC often mitigate severe price-based substitution.

Regional dynamics, particularly in the APAC region, are complex. While shipbuilding (new demand) drives significant market volume in China and South Korea, the maintenance, repair, and overhaul (MRO) segment, primarily driven by fleet operational activity, provides stable revenue across all geographic clusters. The increasing geographical separation between where a ship is built (often APAC) and where it is maintained (often Europe or North America) requires paint manufacturers to maintain comprehensive supply chains and technical service capabilities globally, ensuring that specified products are available and correctly applied regardless of port location.

Furthermore, climate change and resulting shifts in ocean temperatures are subtly impacting the market. Warmer waters generally lead to higher levels of biofouling pressure, potentially shortening the effective lifespan of existing antifouling formulations. This environmental variable forces R&D teams to develop coatings that maintain performance efficacy across a broader range of thermal zones, emphasizing the necessity of robust biocide packages and stable erosion rates, reinforcing the value proposition of advanced SPC systems over less controlled CDP alternatives.

Financial and Investment Trends

The financial health of the eroding antifouling paint market is highly correlated with capital expenditure (CapEx) cycles in the shipping industry. New build construction requires significant volumes of premium coatings, while CapEx in the repair and maintenance segment (OpEx) provides recurring, stable demand. Investment trends show that major coating manufacturers are channeling capital into three critical areas: sustainable chemistry research (to future-proof biocide systems), digital infrastructure (for predictive performance monitoring), and efficiency improvements in manufacturing (to counteract volatile raw material costs).

Venture capital and private equity interest have been observed primarily in adjacent technologies, such as drone inspection systems for hull monitoring and novel non-biocidal substances, which indirectly pressure traditional eroding paint manufacturers to justify their value proposition through quantifiable performance improvements. For established players, strategic mergers and acquisitions often target smaller companies with unique expertise in specific biocide registration processes or specialized polymer synthesis, rather than outright capacity expansion, reflecting a maturity phase focused on innovation acquisition and compliance optimization.

The profitability margins in the premium SPC segment remain attractive due to the high value-in-use proposition (fuel savings), whereas the standard CDP segment faces stiffer price competition. Manufacturers leveraging vertical integration, particularly those who synthesize their own proprietary polymers, benefit from better cost control and supply security, providing a critical competitive edge in this technologically demanding sector.

Detailed Summary of Impact Forces

The primary impact force driving long-term strategic decisions in this market is the "Regulatory Imperative for Decarbonization." The IMO targets for carbon reduction cannot be achieved without optimal vessel efficiency, making high-performance hull coatings essential. This ensures that the market for premium eroding paints will continue to expand, despite the challenges associated with biocide regulation. Manufacturers are effectively selling carbon reduction capabilities bundled with antifouling protection.

A secondary, equally potent force is the "Technological Substitution Risk." The slow, controlled rise of non-biocidal fouling release coatings poses a long-term threat. Companies must continually demonstrate the superior efficacy and application simplicity of their eroding products, especially in high-fouling, low-speed operating profiles where fouling release systems are less effective. This constant competitive pressure drives rapid technological iteration within the eroding paint segment, ensuring continuous product improvement.

Finally, "Economic Efficiency Demands" dictate purchasing decisions. Vessel operators are moving away from merely procuring paint towards buying "guaranteed performance." This shift requires manufacturers to transition from being simple product suppliers to integrated service providers offering data-backed performance guarantees, digital monitoring tools, and maintenance consulting. This elevates customer expectations and reinforces the dominance of players capable of offering comprehensive, global, technical support packages.

Conclusion on Market Trajectory

The Eroding Antifouling Paint Market is poised for stable and consistent growth, fundamentally supported by the indispensable nature of its product to the efficient operation of global commerce. While subject to intense scrutiny regarding its environmental profile, the industry has successfully pivoted towards sophisticated, low-leaching SPC formulations that meet both ecological mandates and demanding performance requirements. Future success will be predicated on leveraging digital tools—AI for formulation and predictive maintenance—and continuing the strategic shift towards bio-compliant, hybrid coating systems, ensuring eroding paints maintain their foundational role in minimizing hydrodynamic drag and achieving global maritime sustainability goals.

The strong correlation between premium eroding paints and measurable reductions in fuel consumption ensures that demand remains inelastic, particularly in the commercial vessel sector. As global fleet capacity expands and regulatory pressure on operational efficiency mounts, the market for advanced, long-duration SPC coatings will outperform the broader industry growth rate, solidifying the market's long-term value proposition and investment stability.

The key takeaway for stakeholders is the imperative to innovate sustainably. The market rewards those who can preempt regulatory changes with certified, high-performance coatings that demonstrate tangible environmental benefits beyond mere compliance. Investment in R&D focusing on copper-alternative biocides and novel self-polishing polymer matrices is essential for securing a competitive advantage in the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager