Escape Rope Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436072 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Escape Rope Market Size

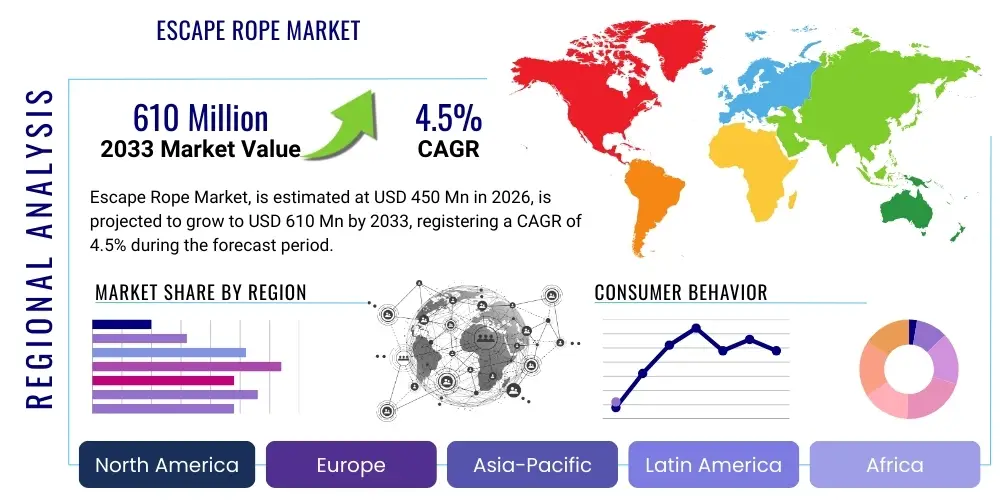

The Escape Rope Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% (CAGR) between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 610 Million by the end of the forecast period in 2033.

Escape Rope Market introduction

The Escape Rope Market encompasses the global trade of specialized safety ropes and related equipment designed primarily for emergency descent and rapid evacuation from elevated structures or hazardous environments. These ropes, which range from basic residential fire escape models to highly technical, static, and fire-resistant industrial rescue lines, are essential components in personal protective equipment (PPE) and disaster preparedness kits worldwide. The core function of these products is to provide a reliable, controlled, and swift means of egress when traditional exit routes are inaccessible due to fire, structural failure, or industrial accidents. Market dynamics are heavily influenced by stringent safety regulations across key industrial sectors and increasing urbanization leading to higher-rise building construction globally.

Escape ropes are defined by their load-bearing capacity, materials composition (such as high-strength nylon, polyester, or advanced aramid fibers like Kevlar), and crucial features like resistance to heat, abrasion, and UV degradation. Major applications span residential safety, large commercial buildings, industrial settings (including petrochemical plants, offshore drilling platforms, and construction sites), and critical public safety services such as fire and rescue operations and specialized military deployment. The proliferation of mandatory safety standards, particularly in high-risk occupational environments, ensures a steady demand base, making compliance a primary driving factor for market expansion.

The primary benefits associated with modern escape rope systems include enhanced individual safety during emergencies, portability, ease of deployment, and significantly improved chances of survival when trapped. Driving factors for market growth include the rising global incidence of natural disasters requiring rapid evacuation, heightened awareness regarding workplace safety, continuous innovation in high-performance materials to improve rope durability and lightness, and governmental initiatives mandating emergency preparedness in both public and private infrastructure. Furthermore, the growth in recreational activities like mountaineering and caving also contributes to the specialized segment of the market, although industrial and residential safety remains the dominant revenue driver.

Escape Rope Market Executive Summary

The Escape Rope Market is characterized by stable, moderate growth, underpinned by increasing global regulatory emphasis on safety and mandatory provision of emergency evacuation tools across multiple sectors. Key business trends indicate a shift towards advanced material science, focusing on producing lighter, stronger ropes with enhanced thermal resistance, crucial for industrial and high-rise applications. Regional trends show robust growth acceleration in the Asia Pacific region, fueled by rapid industrialization, massive infrastructure development, and the adoption of Western safety standards, particularly in manufacturing and construction industries. North America and Europe, while mature, remain dominant markets due to rigorous safety compliance requirements and high consumer awareness regarding residential preparedness.

Segmental trends highlight the dominance of industrial-grade static ropes, which command premium pricing due to their stringent testing requirements and specialized fiber compositions, such as aramid and UHMWPE (Ultra-high-molecular-weight polyethylene) ropes, which offer superior cut resistance. Concurrently, the residential segment is witnessing increased adoption of simple, fixed-length ropes and ladder systems, often driven by public awareness campaigns and insurance requirements for multi-story homes. The distribution channel is evolving, with B2B direct sales dominating the industrial segment, while the residential and recreational markets increasingly leverage e-commerce platforms for wider consumer reach and product customization.

Strategic movements within the competitive landscape involve mergers and acquisitions aimed at integrating advanced fiber technology providers into traditional rope manufacturing portfolios, thereby enhancing product performance and diversifying application specificity. Companies are also investing heavily in certification processes (e.g., NFPA, CE, ANSI) to gain credibility and mandatory access to high-value governmental and critical infrastructure contracts. The overarching market sentiment is cautiously optimistic, driven by non-discretionary spending on safety and the continuous need for equipment replacement and updates mandated by regulatory cycles, ensuring sustained demand throughout the forecast period.

AI Impact Analysis on Escape Rope Market

User inquiries regarding AI's influence on the Escape Rope Market typically center on how artificial intelligence can optimize the deployment, maintenance, and material science behind these critical safety tools. Common themes include the potential for AI-driven material stress testing and predictive failure analysis to enhance rope reliability, the use of AI in optimizing manufacturing processes for advanced fibers, and integrating escape systems with smart building technology. Users are concerned about whether AI can assist in dynamic route planning during emergencies, guiding individuals to the safest deployment location, or if smart sensors embedded in ropes could provide real-time integrity checks, minimizing the risks associated with aged or damaged equipment. The prevailing expectation is that AI will not replace the physical product but rather serve as a powerful augmentation tool, significantly boosting product lifecycle safety, maintenance protocols, and effectiveness during actual evacuation events, thereby increasing end-user trust and potentially justifying higher pricing for 'smart' systems.

- AI integration supports predictive maintenance and failure analysis of rope fibers, alerting users when load-bearing capacity degrades due to environmental exposure or strain.

- Manufacturing efficiency is enhanced through AI-driven quality control systems, optimizing the weaving patterns and coating applications for fire and abrasion resistance.

- Smart escape systems utilizing AI can integrate with building management systems (BMS) to dynamically assess fire location and structural integrity, recommending optimal, safe deployment points.

- Machine learning algorithms analyze vast material data sets, accelerating the development and selection of novel, ultra-high-strength, and thermally resistant synthetic fibers for next-generation escape ropes.

- AI-powered training and simulation platforms offer realistic virtual reality scenarios for users, teaching proper escape rope deployment techniques under stress without physical risk, thereby increasing adoption rates.

- Automated inventory management and compliance tracking systems, driven by AI, ensure that industrial and governmental agencies maintain certified and non-expired escape rope assets.

DRO & Impact Forces Of Escape Rope Market

The Escape Rope Market is primarily driven by mandatory safety regulations and continuous infrastructure development, countered by challenges related to perceived high costs and the necessity of specialized user training. Opportunities lie strongly in innovation around lightweight, multifunctional materials and expansion into developing economies with nascent safety standards. The interplay of these forces significantly shapes market trajectory; stringent global standards like those set by NFPA (National Fire Protection Association) serve as a massive driver, compelling industrial and commercial entities to allocate substantial budgets towards certified evacuation equipment. Conversely, the restraint posed by the need for meticulous inspection and replacement schedules, coupled with budget constraints in small to medium-sized enterprises (SMEs), dampens rapid expansion. However, the continuous construction of high-rise residential and complex industrial facilities globally ensures a sustained demand base, reinforcing the overall positive market outlook.

The driving forces are multifaceted, encompassing legislative mandates for worker safety, the increasing global construction of tall buildings where traditional escape routes are inadequate, and heightened consumer awareness spurred by media coverage of disaster preparedness. Furthermore, technological advancements leading to compact, user-friendly, and highly reliable escape systems are making these products more accessible and appealing to the mass residential market. The primary restraining factor, beyond initial product cost, involves liability issues and the critical importance of regular, documented training; a lack of training or improper use negates the safety benefit, making end-user education a significant adoption hurdle that manufacturers must continuously address through robust instructional materials and deployment videos.

Opportunities for growth are concentrated in the development of "smart" ropes equipped with integrated sensors for real-time stress monitoring and integration with rescue locator systems, appealing to high-value industrial and military buyers. Geographic expansion into underserved markets in Latin America and Southeast Asia, where rapid industrialization often precedes the full enforcement of safety codes, presents significant untapped potential. The key impact forces dictating market competition are the intensity of regulatory scrutiny, which favors established, certified brands, and the degree of material substitution risk, where innovation must constantly outweigh the cost advantage of traditional, lower-specification ropes. Ultimately, market acceleration is inextricably linked to investment cycles in public and private infrastructure and the cyclical updates to global safety legislation.

Segmentation Analysis

The Escape Rope Market segmentation provides a crucial framework for understanding diverse product applications and consumption patterns across various end-user industries. The market is broadly categorized based on rope type (e.g., static vs. dynamic), the material composition which dictates performance characteristics (e.g., Nylon, Aramid, Polyester), the specific application or end-user setting (e.g., Residential, Industrial, Military), and the distribution channel employed for reaching the target buyer. This comprehensive segmentation reflects the specialized nature of the product, where a rope suitable for a residential fire escape differs drastically in composition, testing, and cost from one designed for offshore platform rescue operations. Analyzing these segments helps stakeholders identify high-growth niches, allocate resources effectively for product development, and tailor marketing strategies to meet specific regulatory and performance demands of each segment.

The segmentation by material composition is arguably the most dynamic area, with continuous innovation focusing on fibers that offer superior strength-to-weight ratios, enhanced resistance to cutting, friction, and melting points, crucial for modern safety environments. High-performance fibers like aramid (e.g., Kevlar, Twaron) and specialized HMPE (High Modulus Polyethylene) ropes command significant market share in the high-end industrial and military segments due to their superior performance envelope, despite higher costs. Conversely, the volume-driven residential segment relies heavily on cost-effective, durable nylon and polyester blends that meet basic tensile strength requirements for single-use escape scenarios, reflecting the price sensitivity of household consumers compared to B2B institutional buyers.

Understanding the interplay between application and distribution channel is essential. The Industrial and Fire/Rescue segments typically rely on direct sales and specialized B2B distributors to ensure proper consultation, installation, and compliance with procurement specifications. This contrasts sharply with the Residential segment, which is increasingly serviced through general retailers, hardware chains, and major e-commerce platforms, capitalizing on convenience and comparative shopping. The detailed segment breakdown facilitates accurate forecasting, allowing manufacturers to optimize their supply chain and production schedules based on predictable demand from core sectors like construction safety, petrochemical operations, and mandated governmental readiness programs.

- By Type: Static Ropes, Dynamic Ropes, Semi-Static Ropes, Specialty Fire-Resistant Ropes.

- By Material: Nylon, Polyester, Polypropylene, Aramid Fibers (Kevlar/Twaron), UHMWPE (Dyneema/Spectra), Blended Composites.

- By Application: Residential Buildings, Commercial and Public Buildings, Industrial Safety (Oil & Gas, Construction, Mining, Utilities), Fire and Rescue Services, Military and Defense, Recreational/Sporting Activities.

- By Distribution Channel: Direct Sales (B2B), Specialized Retailers, General Retail Stores (Hardware), E-commerce Platforms.

Value Chain Analysis For Escape Rope Market

The value chain of the Escape Rope Market begins with complex upstream activities centered on raw material procurement, primarily focusing on advanced polymer manufacturing and fiber spinning. Key upstream suppliers include specialized chemical companies providing high-grade nylon, polyester, and proprietary aramid or UHMWPE fibers. The quality and consistency of these raw materials are paramount as they directly influence the rope's critical safety attributes, such as tensile strength, elongation, and heat resistance. Manufacturers must maintain robust relationships with a limited pool of certified fiber suppliers to ensure material traceability and adherence to safety standards like those required by NFPA or EN norms. The cost volatility of synthetic fibers and the proprietary nature of high-performance materials introduce early complexity and risk in the value chain, requiring advanced procurement strategies.

Midstream activities involve the highly technical process of rope manufacturing, including braiding, twisting, and specialized coating applications (e.g., UV stabilization, abrasion resistance, fire retardant treatments). Manufacturing requires precision machinery and highly skilled labor to achieve the required structural integrity and performance uniformity. Following manufacturing, rigorous testing and certification processes are integral, often involving third-party audits to validate compliance with international safety bodies. This testing phase adds significant value and acts as a critical barrier to entry, ensuring only compliant and certified products proceed to market. The customization of ropes—such as integrating hardware like hooks, descenders, or specialized termination points—further distinguishes midstream operations.

Downstream analysis focuses on the distribution channels and end-user integration. Direct distribution (B2B) is dominant for industrial, military, and large governmental contracts, involving direct sales teams providing technical consultation, installation guidance, and mandatory training services. This channel ensures precise delivery of highly specialized solutions. Indirect distribution utilizes specialized safety equipment distributors and general retail/e-commerce platforms, particularly for the residential and recreational markets. The post-sales service component, including mandatory inspection, recertification, and replacement services, forms a crucial part of the downstream value proposition, especially for industrial clients where rope lifecycle management is critical to operational safety compliance and regulatory auditing.

Escape Rope Market Potential Customers

The potential customer base for the Escape Rope Market is broad yet highly segmented by purchasing motive, spanning governmental institutions, large corporations, and individual consumers. Primary end-users in the B2B sphere include entities mandated by law to provide high-standard safety equipment, such as construction companies operating at height, utility service providers (telecom, power line), and extractive industries like mining and offshore oil and gas platforms. These buyers prioritize product certification (NFPA, ANSI, etc.), durability, and technical specifications, often engaging in large-volume, long-term procurement contracts requiring frequent equipment inspection and replacement cycles. Their purchasing decisions are driven by regulatory compliance and minimizing operational risk, rather than discretionary spending.

Another significant segment comprises public safety organizations, specifically municipal fire departments, specialized urban search and rescue teams (USAR), and military and defense forces. For these customers, the demand is centered on highly specialized, lightweight, rapid-deployment systems optimized for extreme conditions, tactical situations, and high-stakes rescue scenarios. The ropes used here must often meet stricter military specifications (Mil-Spec) or advanced fire-fighting standards, requiring suppliers to demonstrate capabilities in innovation and customization, often integrating high-tech materials like aramid and integrated electronic signaling capabilities.

The B2C market includes individual homeowners, particularly those residing in multi-story residential buildings, apartment complexes, or areas prone to natural disasters (e.g., earthquakes, wildfires). While this segment is more price-sensitive, demand is growing due to increased awareness of residential preparedness, often prompted by insurance requirements or local building codes mandating alternative escape routes. Furthermore, recreational enthusiasts, including climbers, cavers, and adventure sports participants, constitute a smaller but highly discerning customer group focused on lightweight, dynamic rope systems that prioritize performance, low weight, and handling characteristics for sporting applications, ensuring a diverse and resilient end-user ecosystem for manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 610 Million |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sterling Rope Co., Inc., Teufelberger Holding AG, PMI Ropes, Mammut Sports Group AG, New England Ropes (NER), Petzl, Black Diamond Equipment, Skylotec GmbH, Edelrid GmbH & Co. KG, BEAL S.A., Koller-Group, LIROS GmbH, Lankhorst Ropes, Samson Rope Technologies, Sioen Industries NV, Roco Rescue, Inc., Harken Industrial, RescueTech, Vandaele, A+P International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Escape Rope Market Key Technology Landscape

The technological landscape of the Escape Rope Market is rapidly evolving, driven primarily by material science innovations focused on maximizing safety performance while reducing weight and bulk. A key area of development is the integration of advanced synthetic fibers, moving beyond traditional nylon and polyester to incorporate aramid (known for exceptional thermal resistance and high melting points, vital in fire scenarios) and UHMWPE (providing superior abrasion and cut resistance, critical for industrial environments). Manufacturers are utilizing highly sophisticated braiding and core-sheath constructions, such as kernmantle rope design, where the load is primarily carried by the internal core (kern) protected by a durable outer sheath (mantle), ensuring redundancy and protection against wear and tear, significantly extending the rope's operational lifespan and safety profile.

Furthermore, specialized coating technologies represent a significant technological advancement. These coatings are applied to enhance specific performance metrics, including treatments that improve UV stability to prevent degradation from sun exposure, hydrophobic coatings to repel water and prevent structural weakening from moisture absorption, and proprietary treatments that boost resistance to chemicals and industrial solvents, which are often encountered in chemical plants and refining facilities. The precise calibration of these coatings ensures that the rope maintains optimal flexibility and handling characteristics without compromising its critical mechanical strength, balancing user-friendliness with life-saving reliability under diverse operational conditions globally.

The concept of "Smart Ropes" is emerging, driven by miniaturization of sensor technology and the Internet of Things (IoT). This involves embedding small, non-invasive sensors or RFID chips directly into the rope structure during manufacturing. These embedded elements enable real-time tracking of usage history, stress levels, maximum load events, and environmental exposure. This data is critical for compliance and safety officers, allowing for accurate, data-driven decisions regarding when a rope should be removed from service, moving beyond purely visual inspection. This technology addresses the major restraint of the market—uncertainty regarding rope integrity over time—by providing definitive, verifiable information, thereby significantly enhancing safety protocols, particularly in high-liability industrial sectors and specialized rescue operations where equipment failure carries catastrophic consequences.

Regional Highlights

- North America (NA): Represents a highly mature market characterized by stringent regulatory oversight (OSHA, NFPA standards) and high consumer spending on emergency preparedness. The U.S. and Canada are dominant consumers, driven by large-scale industrial activities (oil & gas, construction) and widespread adoption of high-quality, certified escape systems in commercial and high-rise residential properties. Demand is focused on certified, high-performance static ropes and innovative smart rope technologies for industrial applications.

- Europe: Driven by strong safety cultures, particularly in Germany, the UK, and Scandinavia, supported by comprehensive CE marking and EU Directives on workplace safety (e.g., EN standards). The market is sophisticated, featuring high demand for technical textiles and specialty ropes (e.g., mountaineering/recreation segment), alongside mandatory requirements for certified safety equipment in construction and infrastructure maintenance. Innovation is strong, with European companies leading advancements in fiber technology and sustainable material use.

- Asia Pacific (APAC): Forecasted to be the fastest-growing region, fueled by unprecedented infrastructure development, rapid urbanization, and increasing industrialization in countries like China, India, and Southeast Asian nations. Although regulatory enforcement is variable, the adoption of international safety standards is accelerating, particularly among multinational corporations operating in the region. This growth drives high volume demand for both residential and large-scale industrial escape systems, presenting massive opportunities for market penetration.

- Latin America (LATAM): Growth is steady, driven by expansion in mining, petrochemicals, and construction sectors, particularly in Brazil and Mexico. The market is often price-sensitive but shows increasing demand for compliance-driven equipment as regional safety regulations gradually mature and align with global benchmarks. Local manufacturing capabilities are growing, though reliance on imported, certified high-end products remains significant for critical applications.

- Middle East and Africa (MEA): Dominated by large-scale infrastructure projects (e.g., UAE, Saudi Arabia) and the massive presence of the oil & gas industry, which necessitates the use of premium, highly specialized, and fire-resistant escape ropes for offshore and refining facilities. Demand is non-discretionary and focused purely on performance and international certification, supporting high average selling prices for sophisticated, B2B-procured systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Escape Rope Market.- Sterling Rope Co., Inc.

- Teufelberger Holding AG

- PMI Ropes

- Mammut Sports Group AG

- New England Ropes (NER)

- Petzl

- Black Diamond Equipment

- Skylotec GmbH

- Edelrid GmbH & Co. KG

- BEAL S.A.

- Koller-Group

- LIROS GmbH

- Lankhorst Ropes

- Samson Rope Technologies

- Sioen Industries NV

- Roco Rescue, Inc.

- Harken Industrial

- RescueTech

- Vandaele

- A+P International

Frequently Asked Questions

Analyze common user questions about the Escape Rope market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between static and dynamic escape ropes?

Static ropes, primarily used for industrial safety and rescue, exhibit minimal stretch (low elongation) when loaded, which allows for controlled descent and easier raising/lowering systems. Dynamic ropes, favored in recreational climbing, possess high stretch capacity to absorb the energy of a sudden fall, preventing severe impact forces on the user and anchoring system. Escape ropes are predominantly static or semi-static to ensure stability during evacuation.

Which material is considered superior for fire escape ropes?

Aramid fibers, such as Kevlar or Twaron, are considered superior for fire escape applications due to their exceptional thermal stability and very high melting points, allowing them to retain significant strength even when exposed to intense heat or direct flame, significantly outperforming standard nylon or polyester materials in high-temperature environments.

How frequently must industrial escape ropes be inspected and replaced?

Industrial escape ropes must undergo thorough inspection before and after each use, and a detailed professional inspection typically occurs every six months to one year, depending on usage frequency and environmental exposure. Replacement is mandated immediately if inspection reveals core damage, abrasion exceeding defined limits, chemical exposure, excessive loading, or upon reaching the manufacturer's specified lifespan, which is often 5 to 10 years from the date of manufacture, regardless of usage.

What regulatory standards govern the quality of escape rope systems?

Key regulatory standards include NFPA (National Fire Protection Association) standards, particularly NFPA 1983 for life safety ropes and equipment in the United States, and EN (European Norm) standards, such as EN 1891 for low stretch kernmantle ropes. Adherence to these international certifications is crucial for commercial viability and legal compliance across industrial and rescue segments globally.

Is the Escape Rope Market impacted by sustainability trends?

Yes, the market is increasingly influenced by sustainability. Manufacturers are exploring eco-friendly materials, reducing waste in production, and investigating methods to recycle high-performance synthetic fibers used in ropes. Customers, particularly in Europe, are showing a preference for companies that demonstrate material traceability and implement environmentally conscious manufacturing processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager