ESD clothing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438109 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

ESD clothing Market Size

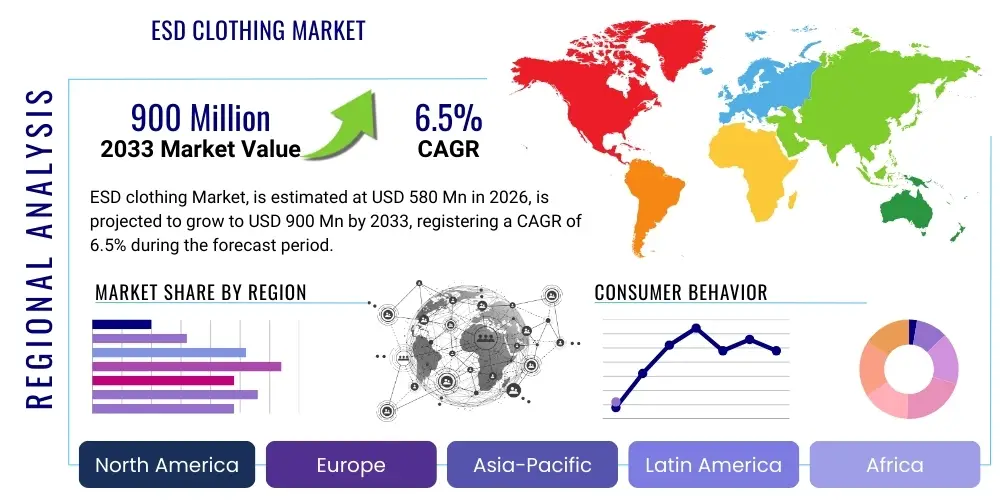

The ESD clothing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $580 Million in 2026 and is projected to reach $900 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for advanced static dissipation solutions across highly sensitive electronics manufacturing environments and the implementation of stringent regulatory frameworks governing workplace safety and quality control in industries prone to electrostatic discharge damage.

ESD clothing Market introduction

The Electrostatic Discharge (ESD) clothing market encompasses specialized garments designed to prevent or minimize damage caused by static electricity in sensitive working environments. These products, which include lab coats, smocks, jackets, and jumpsuits, are fabricated using conductive materials such as carbon-filled nylon or polyester fiber blends, ensuring that electrostatic charges generated by the wearer are safely dissipated or neutralized, preventing damage to susceptible electronic components. The primary applications of ESD clothing span electronics assembly, semiconductor manufacturing, aerospace components production, and critical healthcare settings where controlled environments are mandatory. The utilization of these garments guarantees enhanced product yield and reliability, significantly reducing material waste associated with static-induced defects.

ESD clothing functions as a critical element within a comprehensive electrostatic protective area (EPA), acting as the crucial interface between the human body, a major source of static charge, and sensitive equipment. The inherent benefits include superior protection against latent and catastrophic ESD failure, ensuring adherence to international standards such as ANSI/ESD S20.20, and improving overall operational efficiency. The continuous miniaturization of electronic components, making them exponentially more vulnerable to even minor static events, drives the necessity for high-performance ESD apparel. Furthermore, the increasing complexity of manufacturing processes in the Internet of Things (IoT) and automotive electronics sectors necessitates zero-defect environments, solidifying the market’s foundational demand.

Driving factors propelling market expansion include the exponential growth of the global consumer electronics industry, particularly in developing economies, coupled with rising investments in cutting-edge semiconductor fabrication facilities (fabs). Regulatory compliance mandates across North America and Europe emphasize worker and product safety, further stimulating adoption. Technological advancements in fabric design, leading to lighter, more comfortable, and highly durable conductive materials with superior wash cycle resistance, are enhancing user acceptance and promoting replacement cycles, thereby fueling sustainable market growth.

ESD clothing Market Executive Summary

The ESD clothing market is characterized by robust expansion, fueled primarily by structural business trends centered on the global electronics supply chain expansion and the rigorous enforcement of quality assurance protocols. Key trends indicate a shift towards highly integrated smart ESD garments capable of real-time monitoring of conductive properties and wearer grounding status. Business models are increasingly focused on tailored solutions for large-scale contract manufacturers (EMS providers) and specialized industrial segments, necessitating customization in design, fit, and material durability. Investment in R&D is heavily concentrated on developing advanced proprietary anti-static finishes and woven materials that maintain their protective efficacy across extended periods of use, offering a superior Total Cost of Ownership (TCO) compared to generic alternatives.

Regionally, the Asia Pacific (APAC) region dominates the market share due to its entrenched position as the global hub for electronics manufacturing, semiconductor production, and high-volume consumer goods assembly. Countries like China, South Korea, and Taiwan represent concentrated demand centers where the establishment of new Giga-Fabs necessitates continuous investment in advanced EPA solutions, including specialized clothing. North America and Europe, while possessing slower manufacturing growth rates compared to APAC, exhibit high demand for premium, high-specification ESD apparel, particularly within the aerospace, defense, and specialized medical device sectors where stringent quality control and certification requirements dictate purchasing decisions.

Segmentation trends highlight the dominance of the lab coats and smocks segment owing to their versatility and wide applicability across various manufacturing environments. However, the jumpsuits and coveralls segment is registering the fastest growth, driven by the increasing need for whole-body static control in ultra-clean and highly regulated environments, such as Class 100 or Class 10 cleanrooms required for advanced microelectronics fabrication. The application segment growth is robust in the automotive electronics sector, propelled by the transition toward Electric Vehicles (EVs) and autonomous driving systems, which rely heavily on sensitive, static-vulnerable components.

AI Impact Analysis on ESD clothing Market

Common user questions regarding AI’s influence on the ESD clothing market frequently revolve around how AI can enhance the protective function of the garments, optimize inventory management for highly specialized apparel, and predict the necessary maintenance or replacement cycles based on usage intensity. Users are keenly interested in whether AI-driven quality control systems in manufacturing facilities could mandate stricter adherence to ESD garment compliance by workers. Furthermore, inquiries focus on the potential for AI to integrate real-time conductivity data from smart garments into broader facility safety monitoring systems, ensuring proactive static protection and reducing the risk of component failure. The primary themes emerging from these analyses are the expectation of predictive maintenance, optimization of supply chain logistics for custom apparel, and the integration of AI-powered compliance monitoring to enforce strict EPA standards.

AI is set to revolutionize the manufacturing and implementation of ESD clothing, moving beyond passive protection to active, data-driven static control. In manufacturing, AI algorithms can optimize the weaving process of conductive fibers, predicting material stress points and improving overall garment longevity and consistent resistivity. This refinement ensures that the protective characteristics of the clothing remain stable over numerous wash cycles, a critical concern for end-users. On the supply chain side, machine learning models can analyze historical consumption data by department, predicting demand fluctuations for specific sizes and styles, thus enabling manufacturers and distributors to minimize costly inventory holding while guaranteeing immediate availability of critical PPE, especially during facility ramp-ups or expansions.

The most significant impact will be felt through the integration of AI with smart ESD apparel. By embedding micro-sensors that measure parameters like surface resistance and ground connection status, AI systems can process this continuous stream of data. These systems can immediately alert supervisors if a garment’s protective capability degrades below standard thresholds or if a worker is improperly grounded, providing actionable, real-time safety compliance enforcement. Furthermore, AI-driven analytics can correlate ESD events with specific workplace locations or activities, allowing manufacturers to tailor garment specifications (e.g., higher charge decay rates) for specific high-risk operational zones, leading to highly optimized and responsive static protection protocols across entire organizations.

- AI-powered quality control systems enhancing the consistency and longevity of conductive fabric performance.

- Predictive maintenance analytics optimizing ESD garment replacement schedules based on real-world wear and wash data.

- Integration of smart ESD clothing data with AI platforms for real-time compliance monitoring and automated violation alerts in EPAs.

- Machine learning models optimizing inventory forecasting for highly specialized and customized garment orders.

- AI-driven optimization of manufacturing processes to minimize material defects and ensure standardized surface resistance in apparel.

DRO & Impact Forces Of ESD clothing Market

The dynamics of the ESD clothing market are governed by a complex interplay of stringent industry standards (Drivers), significant investment requirements (Restraints), emerging technological applications (Opportunities), and powerful external economic and regulatory pressures (Impact Forces). The core drivers are the relentless pursuit of zero-defect manufacturing in highly sensitive sectors and the necessity for compliance with global quality and safety standards, particularly those mandated by ISO, IEC, and ANSI/ESD protocols. These regulations necessitate reliable, certified ESD protection for personnel working near sensitive electronics, compelling consistent adoption and replacement cycles. However, the high initial procurement cost associated with specialized, high-performance ESD garments, especially those required for stringent cleanroom environments, acts as a primary restraint, particularly for smaller manufacturing entities or those operating in cost-sensitive regional markets. This initial investment extends to the necessary infrastructure for monitoring and maintaining the garments' protective properties.

A significant opportunity arises from the rapid expansion of emerging technology fields, specifically the deployment of 5G infrastructure, electric vehicle manufacturing (EVs), and advanced medical device production. These sectors require components that are exquisitely sensitive to static discharge, thus driving demand for next-generation, high-efficacy ESD apparel designed to handle unique environmental challenges (e.g., high voltage environments or extremely clean conditions). Furthermore, opportunities exist in developing sustainable and eco-friendly ESD materials, catering to the growing corporate trend toward environmentally responsible sourcing and manufacturing practices. Innovations focusing on biocompatible and recyclable conductive fibers will open new market avenues and provide a competitive edge in mature economies like Europe and North America where sustainability mandates are becoming influential purchasing criteria.

The impact forces heavily influencing this market include global economic cycles affecting capital expenditure in electronics manufacturing, the geopolitical tensions impacting semiconductor supply chains, and rapid shifts in labor market regulations. The continuous trend toward factory automation, while reducing human interaction with components, paradoxically increases the reliance on the few remaining human operators to adhere strictly to EPA protocols, making reliable ESD clothing compliance even more critical. Moreover, the increasing severity and frequency of product recalls due to component failure attributable to improper handling heighten the perceived risk and therefore increase the emphasis placed on robust ESD protection systems, effectively reinforcing the market's fundamental requirement for high-quality, certified garments. This combination of regulatory mandates and economic risk mitigation ensures sustained momentum for market growth, despite cost-related challenges.

Segmentation Analysis

The ESD clothing market is structurally segmented based on product type, material composition, application, and geography, reflecting the varied operational requirements across different end-user industries. Product segmentation accounts for the distinct functional roles of apparel, ranging from full-body static control required in advanced semiconductor fabrication to lighter, breathable options used in general electronics assembly. Material composition segmentation differentiates based on the conductive elements used (e.g., carbon filament versus metallic fibers), which impacts resistivity, durability, and cost. Application segmentation is crucial as it dictates the level of static control required, with aerospace and defense typically demanding the highest performance specifications compared to consumer electronics. Geographic analysis reveals significant regional disparities in demand volume and regulatory stringency, with APAC dominating production and consumption volumes globally.

- By Product Type:

- ESD Lab Coats

- ESD Smocks

- ESD Jackets

- ESD Jumpsuits/Coveralls

- Other Accessories (Gloves, Shoe Grounders)

- By Material:

- Carbon Loaded Synthetics (Polyester, Nylon)

- Conductive Cotton Blends

- Proprietary Conductive Fabrics

- By Application:

- Electronics and Semiconductor Manufacturing

- Automotive Electronics (EV Components, ADAS)

- Aerospace and Defense

- Medical Devices and Healthcare

- Pharmaceutical and Biotechnology

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For ESD clothing Market

The value chain for the ESD clothing market begins with the upstream segment, which involves the sourcing and processing of specialized raw materials. This includes the production of synthetic base fibers (polyester, cotton) and, crucially, the incorporation of conductive elements such as carbon filaments, stainless steel fibers, or specialized conductive polymers. Key upstream activities involve stringent quality checks on fiber resistivity and ensuring consistency, as the foundational static-dissipative properties of the final garment are determined at this stage. Suppliers in this segment must possess advanced textile engineering capabilities to produce materials that are simultaneously durable, comfortable, and consistently conductive after multiple wash cycles, presenting a high barrier to entry and necessitating close relationships between textile manufacturers and garment producers.

The middle segment of the value chain focuses on the manufacturing and assembly of the ESD garments. This involves pattern cutting, specialized stitching techniques that maintain electrical continuity across seams (often using conductive threads), and the integration of grounding points like snaps or cuffs. Manufacturers must adhere to strict cleanroom protocols during production to avoid contamination, especially for garments destined for high-purity environments. Certification and testing are paramount at this stage, with garments undergoing rigorous testing for surface resistivity, charge decay time, and triboelectric charging properties, often conducted by independent labs to ensure compliance with standards like IEC 61340-5-1. Branding, ergonomic design optimization, and customization services based on end-user specific regulatory requirements or corporate aesthetics are also critical value-adding activities performed by manufacturers.

Downstream activities involve the distribution channel, which is typically split between direct sales to large, multinational corporations and indirect sales through specialized industrial distributors and safety equipment providers. Direct channels offer customized solutions and technical support, essential for complex aerospace or semiconductor clients. Indirect channels provide broad market access, inventory management, and regional reach for smaller businesses. The end-use segment involves facilities purchasing, utilizing, and maintaining the ESD garments, requiring services such as laundry management specialized in preserving conductive properties and periodic re-testing services. The efficiency and reliability of these downstream services significantly influence customer satisfaction and repeat business, emphasizing the need for robust logistical and post-sales support across all geographic regions.

ESD clothing Market Potential Customers

Potential customers for ESD clothing are primarily enterprises operating in industries where electronic components are manufactured, assembled, serviced, or utilized under controlled conditions. The largest consumer base resides within the electronics and semiconductor industry, encompassing major semiconductor fabrication plants (Fabs), integrated device manufacturers (IDMs), and outsourced semiconductor assembly and test (OSAT) providers. These entities require high volumes of specialized apparel, particularly jumpsuits and lab coats, to protect microchips and wafers, which are extremely susceptible to electrostatic damage. Purchasing decisions in this sector are driven by component yield rates, adherence to ANSI/ESD S20.20 standards, and the need for materials that also meet cleanroom particulate control standards (e.g., ISO Class 4 or higher).

The automotive sector, particularly companies involved in electric vehicle (EV) component manufacturing, autonomous driving systems (ADAS), and complex infotainment systems, represents a rapidly growing customer base. As vehicles incorporate increasingly sophisticated electronics, the necessity for robust static protection during assembly of sensitive sensors, control units, and battery management systems rises dramatically. These customers seek durable, chemically resistant ESD garments that can withstand industrial assembly line conditions while maintaining high conductive integrity. Furthermore, the aerospace and defense sectors constitute a crucial segment, characterized by extremely high specifications and low-volume, high-value purchases. Defense contractors and aircraft manufacturers require certified ESD garments for handling highly sensitive communications equipment, guidance systems, and munitions components, where failure is unacceptable and requires rigorous supply chain verification.

Beyond traditional manufacturing, the medical device industry and specialized research laboratories are significant buyers. Manufacturers of complex medical electronics, such as imaging equipment (MRI, CT scanners) and implantable devices (pacemakers), require strict contamination and static control. In these settings, ESD smocks and lab coats must often meet both electrostatic requirements and sterilization standards, demanding materials that are autoclavable or maintain effectiveness after exposure to specialized cleaning agents. Additionally, companies providing specialized repair and refurbishment services for electronic equipment also form a crucial, recurring customer segment, driven by the need to maintain static-safe workstations for handling consumer or industrial electronics that are returned for service.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580 Million |

| Market Forecast in 2033 | $900 Million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Honeywell International Inc., Desco Industries Inc., Botron Company Inc., QRP Gloves Inc., Sempurnakao Sdn Bhd, ACL Staticide Inc., Stat-Alert Static Control Products, Elcometer Inc., Dr. Schutz GmbH, Superior Uniform Group, Workrite Uniform Company, Inc., Static Control Components, VWR International, Wescorp Static Control Products, Antistat, Conductive Containers Inc., Cleanroom World, Simco-Ion, Electrotek Static Controls. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ESD clothing Market Key Technology Landscape

The technological landscape of the ESD clothing market is characterized by ongoing innovation aimed at enhancing material performance, improving wearer comfort, and integrating smart functionality for proactive compliance. The primary technological focus remains on textile engineering, specifically the development of advanced conductive fibers that offer lower surface resistivity (often in the range of 106 to 109 ohms per square) while being highly durable to repeated washing and abrasion. Newer generations of carbon-loaded polymers are being developed that minimize particulate shedding, making them suitable for ultra-clean environments (e.g., ISO Class 3). Furthermore, manufacturers are increasingly adopting proprietary weaving patterns that ensure consistent conductive grid placement, providing superior charge dissipation characteristics compared to older, simply striped fabrics, thereby guaranteeing the highest level of product protection against static events.

A burgeoning technological trend is the development and adoption of "smart" ESD apparel, integrating micro-electronics and sensor technology directly into the garments. These smart clothes are equipped with embedded sensors capable of continuously monitoring parameters such as the garment’s electrical integrity, the wearer’s static potential, and the quality of the connection to ground points (via wrist or foot straps). This technology allows for real-time data transmission to facility monitoring systems, flagging non-compliant behavior or equipment failure instantly, thus moving static control from a reactive to a highly proactive safety mechanism. This integration is crucial for compliance in highly automated environments where instantaneous feedback is required to prevent costly interruptions or component damage during critical processes like lithography or precision assembly.

Another important technological area involves the development of specialized laundry and maintenance systems for ESD clothing. Since the conductive properties of these garments can be severely degraded by improper washing agents or harsh drying cycles, technology is focusing on developing proprietary cleaning processes and detergents that preserve the integrity of the conductive fibers. Advanced tracking technologies, such as RFID tags embedded in the clothing, are utilized to monitor the garment’s usage history, number of washes, and certified lifespan. This data-driven maintenance approach ensures that garments are removed from circulation precisely when their ESD protective capabilities begin to wane, maintaining high safety standards and optimizing the replacement budget for end-users. The continuous enhancement of washability without compromising resistivity is a major competitive differentiator in the modern ESD apparel market.

Regional Highlights

The market dynamics of ESD clothing exhibit considerable variation across major geographic regions, primarily influenced by local regulatory stringency, the concentration of electronics manufacturing activity, and levels of industrial automation adoption. Asia Pacific (APAC) dominates the global market, not only in terms of production volume but also consumption, driven by the massive concentration of semiconductor foundries, electronics contract manufacturing (EMS), and consumer device assembly plants in countries like China, Taiwan, South Korea, and Vietnam. The sheer volume of manufacturing throughput and continuous investment in new fabrication facilities (Giga-Fabs) in the region ensures consistent high demand for standard and high-specification ESD apparel. Regulatory enforcement, while traditionally less stringent than in the West, is rapidly improving, further bolstering the need for certified protective gear, particularly in export-focused operations.

North America maintains a strong position, characterized by high demand for specialized, high-reliability ESD clothing, particularly within the aerospace, defense, medical device, and high-end automotive electronics sectors. The purchasing behavior in the US is heavily driven by strict adherence to ANSI/ESD S20.20 standards and stringent quality control protocols mandated by defense contracts and FDA regulations. While the volume of electronics assembly might be lower than in APAC, the value of the components protected is often higher, leading to a preference for premium, custom-fit, and technologically integrated ESD garments (e.g., smart apparel). Canada and Mexico also contribute significantly, particularly in automotive and general electronics assembly, driven by proximity to the robust US supply chain.

Europe represents a mature market characterized by robust quality standards and a strong emphasis on worker comfort, sustainability, and compliance with EU directives (e.g., ATEX directives relevant to intrinsic safety and static hazards). Demand is concentrated in highly sophisticated manufacturing sectors, including precision instrumentation, specialized automotive components, and pharmaceutical production. European buyers often prioritize products manufactured using sustainable processes and materials, driving technological innovation toward eco-friendly conductive fibers and closed-loop garment recycling programs. The market here is fragmented, catering to specific national regulations within the overarching EU framework, leading to a strong demand for certification and traceability throughout the garment lifecycle, ensuring that ESD clothing adheres to both static control and general workplace safety standards without fail.

- Asia Pacific (APAC): Dominates consumption driven by high-volume electronics manufacturing and semiconductor fabrication investments; characterized by rapid market growth and focus on cost-efficient, durable apparel.

- North America: Strong emphasis on premium, high-specification garments for aerospace, defense, and advanced medical device manufacturing; driven by strict ANSI/ESD S20.20 compliance.

- Europe: Focus on sustainability, high comfort levels, and rigorous compliance with both ESD standards (IEC 61340) and general EU workplace safety directives; strong adoption in precision engineering sectors.

- Latin America (LATAM): Emerging growth market driven by expansion of automotive assembly and increasing foreign direct investment in electronics manufacturing, particularly in Mexico and Brazil.

- Middle East and Africa (MEA): Nascent market, with growth opportunities tied to developing domestic electronics assembly operations and maintenance activities in oil and gas and telecommunications infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ESD clothing Market.- 3M Company

- Honeywell International Inc.

- Desco Industries Inc.

- Botron Company Inc.

- QRP Gloves Inc.

- Sempurnakao Sdn Bhd

- ACL Staticide Inc.

- Stat-Alert Static Control Products

- Elcometer Inc.

- Dr. Schutz GmbH

- Superior Uniform Group

- Workrite Uniform Company, Inc.

- Static Control Components

- VWR International

- Wescorp Static Control Products

- Antistat

- Conductive Containers Inc.

- Cleanroom World

- Simco-Ion

- Electrotek Static Controls

Frequently Asked Questions

Analyze common user questions about the ESD clothing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between ESD lab coats and smocks, and which sectors use them?

ESD lab coats typically provide longer coverage, often down to the knees, suitable for laboratories and general assembly environments where occasional static exposure occurs. Smocks are generally shorter and often used in cleanroom settings or dedicated workstations where mobility and high-level body static control are critical, primarily utilized in semiconductor and electronics manufacturing.

How often should ESD clothing be tested and replaced to maintain compliance?

ESD clothing should ideally be tested for surface resistance and electrical continuity periodically, often after every 50 to 100 wash cycles or in line with facility EPA maintenance protocols, typically every six to twelve months. Replacement frequency depends on the wear, tear, and loss of conductive integrity, generally necessitating replacement when resistivity exceeds the standard limit of 109 ohms.

What materials provide the best combination of static dissipation and cleanroom compatibility?

The best materials are typically high-density polyester blended with continuous woven carbon filaments. This blend provides stable static dissipative properties (106-109 ohms) while minimizing particulate shedding, thus meeting the stringent requirements for ISO Class 3 to Class 5 cleanroom environments required for advanced microelectronics fabrication.

What is the primary driving factor for the growth of the ESD clothing market in Asia Pacific?

The primary driving factor is the significant regional concentration and continuous expansion of the global electronics and semiconductor manufacturing industries, which requires mass procurement of specialized ESD apparel to protect increasingly sensitive components and maintain high production yields in newly established fabrication plants.

Can standard laundry procedures be used for cleaning ESD garments, and what are the risks?

No, standard laundry procedures must be avoided. Using conventional detergents, softeners, or high-heat drying can coat or damage the conductive fibers, severely compromising the garment’s static dissipative properties. Specialized ESD-safe detergents and strict washing/drying protocols are mandatory to preserve the apparel's protective function and electrical characteristics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager