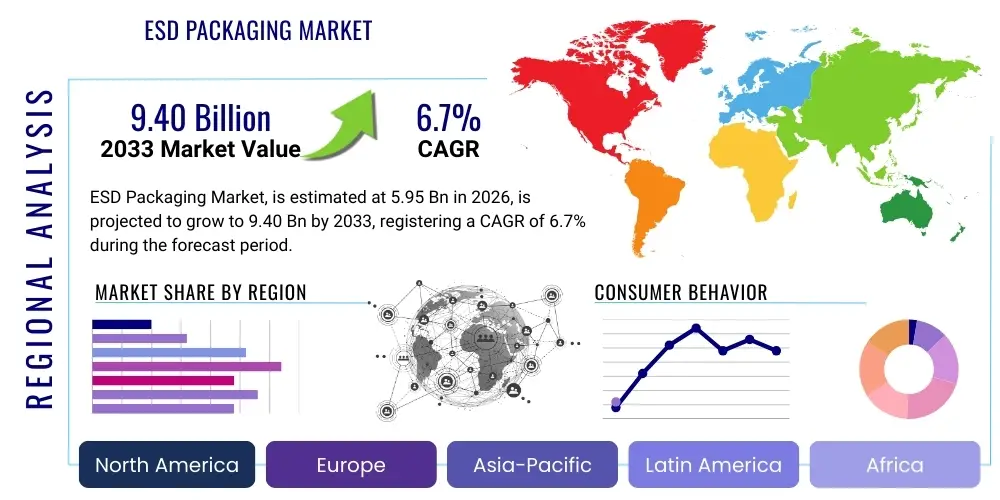

ESD Packaging Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440467 | Date : Jan, 2026 | Pages : 245 | Region : Global | Publisher : MRU

ESD Packaging Market Size

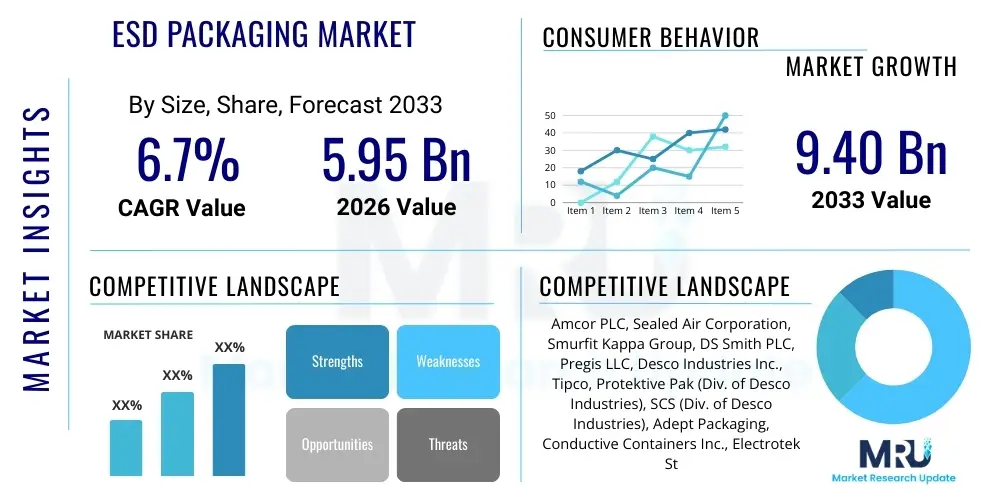

The ESD Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at USD 5.95 billion in 2026 and is projected to reach USD 9.40 billion by the end of the forecast period in 2033.

ESD Packaging Market introduction

The ESD Packaging Market is a specialized and increasingly vital segment within the broader global packaging industry, exclusively dedicated to safeguarding sensitive electronic components and finished devices from the detrimental effects of electrostatic discharge (ESD) events. ESD refers to the rapid, uncontrolled flow of electrical charge between two objects at different electrical potentials, which can occur through direct contact, an electrostatic field, or through inductive charging. Such events, though often imperceptible to humans, can inflict immediate catastrophic damage, rendering a component completely inoperable, or cause latent defects that lead to premature failure during subsequent operation. Products in this market are meticulously engineered to prevent these occurrences, utilizing materials that either dissipate static charges safely and slowly or create a Faraday cage effect to shield contents from external static fields. The diversity of ESD packaging solutions is extensive, encompassing anti-static bags, conductive corrugated boxes, static dissipative foams, grounding wrist straps, and specialized component trays, all designed with specific protective properties.

The imperative for robust ESD protection has expanded significantly beyond its traditional confines, now being indispensable across a multitude of high-technology sectors. Major applications include the entire electronics manufacturing ecosystem, from the fabrication of ultra-sensitive semiconductor wafers and integrated circuits to the assembly of complex printed circuit board (PCB) units and the final packaging of sophisticated consumer electronics like smartphones, tablets, and high-definition televisions. Furthermore, the burgeoning automotive industry relies heavily on ESD packaging for its growing array of vehicle electronics, encompassing engine control units (ECUs), advanced driver-assistance systems (ADAS), and electric vehicle (EV) battery management systems. The aerospace and defense sectors, with their stringent reliability requirements for avionics, communication systems, and critical sensor technologies, also represent a substantial application area. Even the medical and healthcare industry, with its proliferation of electronic diagnostic equipment, monitoring devices, and implantable technologies, depends on these specialized packaging solutions to ensure product integrity and patient safety.

The core benefits derived from the deployment of effective ESD packaging are multifaceted, primarily centered on enhancing product quality, reliability, and longevity, while concurrently minimizing costly manufacturing losses and warranty claims. By preventing ESD damage, manufacturers can significantly improve production yields, reduce rework, and lower overall operational expenses, thereby contributing directly to profitability. The market's consistent growth is primarily fueled by several overarching macroeconomic and technological drivers. The relentless global expansion and miniaturization trend within the electronics industry, coupled with the exponential rise in demand for increasingly sensitive and complex electronic devices (e.g., driven by IoT, 5G networks, artificial intelligence, and sophisticated automotive systems), represent fundamental demand-side catalysts. Additionally, the increasing stringency of industry standards and international regulations pertaining to ESD control and product reliability compels manufacturers to adopt advanced and compliant packaging solutions. Continuous innovation in materials science, leading to the development of more efficient, sustainable, and cost-effective ESD packaging formulations, further stimulates market expansion by addressing evolving industry needs and environmental considerations.

ESD Packaging Market Executive Summary

The global ESD Packaging Market is currently undergoing a period of dynamic expansion, primarily attributed to the pervasive and escalating demand for advanced electronic devices across all sectors, necessitating uncompromising protection for their inherently sensitive components. From a business trends perspective, the market is characterized by intense innovation, with leading manufacturers consistently channeling significant investments into research and development. This strategic focus aims to engineer superior ESD packaging materials that offer enhanced protective capabilities, improved sustainability profiles, and greater cost-efficiency. A notable trend is the emergence of 'smart' ESD packaging solutions, which integrate active components like sensors and RFID tags to enable real-time monitoring of environmental parameters and traceability throughout the supply chain. Furthermore, the competitive landscape is witnessing a surge in strategic collaborations, joint ventures, and mergers and acquisitions. These consolidative efforts are often driven by objectives to broaden product portfolios, assimilate cutting-edge technologies, optimize global manufacturing footprints, and fortify market penetration within key industrial verticals, thereby enhancing overall market competitiveness and service offerings.

Geographically, the Asia Pacific (APAC) region continues to assert its dominance as both the largest and most rapidly expanding market for ESD packaging. This preeminence is directly linked to its status as the world's primary manufacturing hub for electronics, semiconductors, and a rapidly expanding automotive sector. Countries such as China, South Korea, Japan, Taiwan, and India are at the forefront of this regional growth, underpinned by substantial governmental and private sector investments in high-tech manufacturing infrastructure, robust R&D ecosystems, and highly efficient supply chains. North America and Europe collectively represent substantial and mature markets, distinguished by high adoption rates of advanced ESD packaging solutions within specialized, high-value sectors such as aerospace and defense, medical devices, and precision industrial electronics. These regions are characterized by stringent quality assurance protocols, demanding regulatory frameworks, and a strong emphasis on the reliability and performance of critical electronic systems. Concurrently, emerging economies in Latin America, alongside the Middle East and Africa, are demonstrating promising, albeit nascent, growth trajectories, driven by nascent industrialization efforts, increasing domestic electronics consumption, and growing foreign direct investments in manufacturing capabilities.

Analysis of segmentation trends within the ESD Packaging Market reveals a nuanced evolution towards more sophisticated material compositions and highly specialized product designs. The demand for advanced conductive polymers and metalized films is experiencing accelerated growth, largely due to their superior electrostatic shielding and dissipation properties, which are critical for protecting increasingly sensitive microelectronic components. Concurrently, the static dissipative foams and thermoformed trays segment is expanding robustly, driven by specific requirements for secure component immobilization and precise charge dissipation during intra-plant handling and storage. From an end-user perspective, the traditional electronics manufacturing sector remains the largest and most foundational consumer; however, the automotive electronics segment is exhibiting remarkable growth momentum, fueled by the escalating complexity and criticality of electronic systems within modern vehicles. The medical and healthcare sector is also projected for substantial growth, reflecting the proliferation of high-precision electronic medical devices that demand uncompromising ESD protection. This pronounced diversification across various segments underscores the pervasive applicability, technological sophistication, and intrinsic value of ESD packaging solutions within the contemporary industrial landscape.

AI Impact Analysis on ESD Packaging Market

User inquiries frequently explore the transformative potential of artificial intelligence (AI) within the ESD Packaging Market, with prevailing themes highlighting significant advancements in manufacturing optimization, predictive quality assurance, and the development of intelligent, adaptive packaging systems. A key area of interest revolves around how AI can facilitate the precise selection of packaging materials and design configurations, moving beyond static, generalized solutions to dynamically tailored protection based on the specific sensitivities of electronic components, anticipated environmental stresses during transit, and overall supply chain parameters. Concerns often surface regarding the substantial initial capital expenditure required for AI infrastructure, the inherent complexities of integrating sophisticated AI algorithms into existing legacy packaging lines, and the imperative for specialized workforce training in data science and AI applications. Despite these perceived hurdles, there are high expectations for AI’s capacity to revolutionize operational efficiencies, leading to optimized material utilization, significant reductions in packaging waste, and profound enhancements in supply chain transparency and responsiveness. The overarching industry sentiment projects AI as a pivotal technology that will usher in an era of unparalleled precision, proactive risk management, and dynamic adaptability in ESD packaging, transitioning from conventional passive protection to truly intelligent and responsive systems.

- AI-driven predictive analytics will revolutionize material selection and packaging design by analyzing vast datasets related to component sensitivity, historical transit conditions, and material performance. This will enable precise customization, reducing instances of over-engineering and minimizing material waste while ensuring optimal protection levels.

- Automated quality control systems, powered by advanced AI and machine vision, can meticulously inspect ESD packaging materials and assembly processes in real-time. This allows for the immediate detection of even microscopic defects or inconsistencies, guaranteeing consistent protective performance across batches and dramatically reducing the incidence of product failure attributable to packaging compromises.

- The integration of AI with robotics and advanced automation in packaging lines will significantly enhance efficiency, speed, and precision in handling ultra-sensitive electronic components. This intelligent automation minimizes human intervention, thereby reducing the potential for human error and inadvertent static generation, leading to safer and more reliable packaging processes.

- Emerging 'smart' ESD packaging solutions, incorporating AI-enabled sensors, will provide real-time monitoring of critical environmental conditions such as temperature, humidity, vibration, and electrostatic charge levels throughout the entire supply chain. This data-driven approach allows stakeholders to receive immediate alerts regarding potential risks, enabling proactive intervention and ensuring the integrity of packaged electronics.

- AI algorithms can profoundly optimize inventory management and logistics for ESD packaging materials. By analyzing historical demand patterns, seasonal fluctuations, and upcoming production schedules, AI can forecast material requirements with unprecedented accuracy, ensuring timely availability, minimizing stockouts or overstocking, and ultimately streamlining the entire supply chain for greater cost-effectiveness.

- AI facilitates the development of personalized and adaptive packaging solutions where protection levels can be dynamically adjusted based on the specific requirements of individual products and the unique parameters of their transit journey. This flexibility allows for highly optimized and resource-efficient packaging, responding to real-world variables rather than relying on static, generalized designs.

DRO & Impact Forces Of ESD Packaging Market

The ESD Packaging Market is profoundly influenced by a complex interplay of diverse drivers, persistent restraints, and compelling opportunities, all collectively shaping its dynamic trajectory and presenting both growth impetus and strategic challenges. Foremost among the market drivers is the relentless and expansive growth of the global electronics industry. This includes the explosive demand for increasingly sensitive microelectronic devices that form the backbone of modern consumer electronics, sophisticated automotive systems, a burgeoning Internet of Things (IoT) ecosystem, and advanced telecommunications infrastructure. The ongoing trend of miniaturization in electronics implies that components become inherently more vulnerable to electrostatic discharge, thereby intensifying the need for robust and reliable ESD protection. Furthermore, the widespread adoption of advanced manufacturing processes, which frequently handle highly sensitive components in high volumes, critically relies on effective ESD solutions. A growing awareness among manufacturers regarding the substantial economic ramifications of ESD damage—including production delays, costly rework, warranty claims, and reputational damage—compels greater investment in high-performance ESD packaging. This imperative is reinforced by stringent international quality standards and regulatory frameworks, such as ANSI/ESD S20.20, which mandate specific ESD control protocols in handling, manufacturing, and packaging environments, pushing industries towards compliant and certified solutions. These factors coalesce to create a robust and enduring demand-side environment for specialized protective packaging solutions.

Despite the strong growth drivers, the ESD Packaging Market contends with several notable restraints that can impede its full potential and present strategic challenges for market participants. A significant restraint is the comparatively higher cost associated with specialized ESD packaging materials and their corresponding advanced manufacturing processes when juxtaposed with conventional, non-protective packaging options. This cost differential can be a prohibitive factor for certain businesses, particularly small and medium-sized enterprises (SMEs) operating with constrained budgets, leading them to opt for less effective or minimal ESD protection. Furthermore, concerns regarding the limited recyclability and broader environmental impact of specific types of advanced polymer-based ESD packaging materials represent a growing challenge. As global emphasis on sustainability intensifies, there's increasing pressure to develop eco-friendly alternatives, which themselves may initially entail higher development and production costs, potentially impacting market adoption rates. The existence and widespread adoption of alternative or supplementary ESD protection methods, such as integrated ESD-safe workstations, grounding equipment, and strict handling protocols within manufacturing facilities, can occasionally dilute the perceived urgency or necessity for advanced protective packaging specifically during transit and long-term storage, thereby impacting demand within niche segments.

Conversely, the market is replete with significant opportunities for innovation, technological advancement, and strategic expansion. The continuous evolution towards further miniaturization and increasing functional sophistication of electronic components inherently generates an escalating need for even more precise, effective, and tailored ESD protection solutions, thus serving as a potent catalyst for demand in novel materials and designs. The burgeoning global movement towards sustainability presents a substantial opportunity for manufacturers to innovate and commercialize bio-based, biodegradable, or easily recyclable ESD packaging solutions. These eco-friendly offerings can address mounting environmental concerns without compromising the critical static control performance, thereby attracting environmentally conscious businesses and consumers. Moreover, the integration of 'smart' technologies, such as embedded RFID tags, NFC chips, and various sensors, directly into ESD packaging offers immense potential for value addition. These intelligent features enable enhanced traceability, real-time condition monitoring during transit (e.g., temperature, humidity, shock, electrostatic events), and improved supply chain visibility, providing critical data for quality assurance and logistical optimization. Lastly, the expanding applications of electronic components in rapidly growing industries such as advanced robotics, autonomous vehicles, drones, renewable energy systems, and high-performance computing facilities further broaden the market's addressable scope, ensuring sustained growth and continuous technological evolution in the long term.

Segmentation Analysis

The ESD Packaging Market undergoes meticulous segmentation to effectively address the highly diverse and specialized requirements of a wide array of industries and applications. This comprehensive segmentation methodology provides a crucial framework for dissecting the market's intricate structure, enabling a granular understanding of demand patterns, growth trajectories, and competitive dynamics across distinct categories. The primary axes of market segmentation are strategically defined by the fundamental characteristics of the packaging solutions: the specific material utilized in their construction, the physical product form or type of packaging, and the ultimate end-user industry employing these critical protective solutions. Each resultant segment and sub-segment exhibits unique characteristics driven by a complex interplay of performance demands, cost sensitivities, specific functional requirements, and adherence to various regulatory and industry compliance standards. Collectively, this multifaceted segmentation illustrates the nuanced and technologically driven landscape of the ESD Packaging Market, highlighting areas of concentrated demand and future growth potential.

- By Material:

- Conductive Polymers: These materials, often infused with carbon black, carbon nanotubes, or metallic particles, provide low electrical resistance, allowing static charges to flow off rapidly and safely. Examples include conductive polyethylene, polypropylene, and polystyrene used for trays and boxes.

- Dissipative Polymers: Designed to slowly bleed off static charges, preventing rapid discharge. These typically involve polymers like polyethylene or polypropylene blended with anti-static additives. They are common in bags, films, and foams where a controlled discharge is preferred.

- Metalized Films: Multilayered films where a thin metallic layer (e.g., aluminum) is vacuum-deposited onto a dielectric substrate. These create a Faraday cage effect, offering superior static shielding against external electrostatic fields, commonly used for static shielding bags.

- Static Shielding Bags: Often a combination of metalized film and dissipative outer layers, providing both electrostatic discharge protection and physical shielding from external fields. These are crucial for packaging highly sensitive components.

- Others: This category encompasses a variety of specialized materials, including conductive foams (e.g., polyurethane, polyethylene foam impregnated with conductive agents), conductive fabrics, and paper-based solutions coated with anti-static or conductive treatments, used for specific applications like dunnage or interleaving.

- By Product Type:

- Bags: A ubiquitous form of ESD packaging, including static shielding bags, anti-static bags, and moisture barrier bags. These are highly versatile for individual component protection during shipping and storage.

- Trays: Thermoformed or injection-molded trays made from conductive or dissipative plastics, designed to securely hold and protect multiple components during automated assembly processes and transport.

- Boxes & Containers: Ranging from corrugated boxes with conductive coatings to injection-molded plastic containers, these provide robust physical and ESD protection for larger assemblies or bulk transport.

- Films & Sheets: Includes stretch films, bubble wraps, and tapes with anti-static or dissipative properties, used for wrapping, cushioning, and securing ESD-sensitive items.

- Foams: Conductive or dissipative foams (e.g., polyurethane, polyethylene) used as inserts, cushioning, and dunnage within larger containers to immobilize and protect components while dissipating static.

- Others: This segment includes a variety of ancillary products such as workstation mats, grounding straps, component carriers (e.g., tape and reel), and conductive totes, essential for maintaining an ESD-safe environment throughout the handling and processing lifecycle.

- By End-User Industry:

- Electronics: The largest segment, encompassing semiconductor manufacturing, printed circuit board (PCB) assembly, consumer electronics (smartphones, laptops, TVs), industrial electronics, and telecommunications equipment.

- Automotive: Rapidly growing due to the increasing electronic content in modern vehicles, including engine control units (ECUs), infotainment systems, ADAS components, and electric vehicle (EV) battery management systems.

- Aerospace & Defense: Demands high-reliability ESD packaging for critical avionics, communication systems, navigation equipment, and military-grade electronic components where failure is unacceptable.

- Medical & Healthcare: Utilizes ESD packaging for sensitive diagnostic equipment, medical implants, monitoring devices, and precision laboratory instruments to ensure functionality and patient safety.

- Others: Includes a diverse range of industries such as industrial machinery, renewable energy (solar, wind inverter components), data centers, and advanced robotics, all reliant on sensitive electronic circuitry.

Value Chain Analysis For ESD Packaging Market

The value chain within the ESD Packaging Market is an intricate, multi-tiered ecosystem that spans from the foundational sourcing of highly specialized raw materials to the ultimate delivery and consumption by end-user industries. At the upstream segment of this chain, the market is critically dependent on a specialized cohort of suppliers providing advanced polymers, crucial additives such as carbon black, carbon nanotubes, metallic pigments, and specific anti-static chemical compounds. These foundational components are essential for imparting the desired electrostatic dissipative or conductive properties to the final packaging materials. Upstream suppliers are pivotal innovators, investing in material science research to develop new formulations that not only enhance ESD effectiveness but also improve mechanical strength, flexibility, and increasingly, sustainability attributes. The consistent quality, performance, and cost-efficiency of these raw materials directly impact the integrity and market competitiveness of the manufactured ESD packaging, necessitating robust, collaborative relationships between packaging producers and their material suppliers. Any disruption or innovation at this stage has significant ripple effects throughout the entire value chain.

Progressing downstream, the value chain encompasses the complex and technology-intensive stages of conversion and fabrication, where raw materials are meticulously transformed into a diverse array of finished ESD packaging products. This segment involves highly specialized manufacturing processes such including precision extrusion for films and sheets, injection molding for trays and containers, thermoforming for custom designs, and advanced lamination and coating techniques for multi-layer bags and films. These manufacturing operations demand substantial capital investment in state-of-the-art machinery and profound technological expertise to ensure that the critical ESD properties are uniformly maintained and meet stringent performance specifications. Quality control at this stage is paramount, involving rigorous testing for surface resistivity, volume resistivity, and charge decay times. Following manufacturing, the distribution channel assumes a crucial role in efficiently bridging the geographical and logistical gap between ESD packaging producers and their varied end-users. This channel typically comprises both direct sales models, which cater to large-volume customers requiring bespoke solutions and close technical support, and indirect channels involving a network of specialized distributors, industrial wholesalers, and e-commerce platforms. Indirect channels are vital for achieving broader market penetration, particularly for smaller order quantities, diverse product ranges, and reaching a fragmented customer base, while direct channels facilitate tailored solutions and foster deeper client relationships.

The terminal stage of the value chain is represented by the diverse base of end-users, predominantly composed of global electronics manufacturers, automotive original equipment manufacturers (OEMs), aerospace contractors, and medical device companies. These customers' specific, often highly exacting requirements for ESD protection, which are driven by the intrinsic sensitivity of their products, stringent regulatory compliance mandates, and intricate supply chain logistics, are the ultimate determinants of demand and drivers of innovation within the market. This symbiotic relationship ensures that ESD packaging solutions continuously evolve and adapt in direct response to the rapid advancements in electronic components and manufacturing methodologies. Crucially, feedback loops from end-users regarding the performance, cost-effectiveness, environmental impact, and practical usability of packaging solutions are vital. This continuous feedback fuels a cycle of ongoing improvement and innovation across the entire value chain, prompting advancements from raw material suppliers through to manufacturing processes and often incorporating principles of the circular economy for enhanced material recovery, reuse, and recycling where technically and economically feasible. This iterative process ensures the market remains responsive to evolving industry needs.

ESD Packaging Market Potential Customers

The spectrum of potential customers for ESD packaging solutions is remarkably broad and dynamic, encompassing a multitude of high-technology, manufacturing, and industrial sectors, all unified by the non-negotiable imperative to safeguard sensitive electronic components and assemblies from the insidious threats posed by electrostatic discharge. At the forefront are electronics manufacturing service (EMS) providers and original equipment manufacturers (OEMs) specializing in an expansive range of products. This includes everything from high-volume consumer electronics like smartphones, laptops, and home entertainment systems, to highly specialized industrial control systems, complex networking hardware, and critical telecommunications infrastructure. For these customers, ESD packaging is not merely an optional accessory but a fundamental requirement to protect components throughout various stages: during raw material storage, automated assembly lines, inter-plant transfers, and final product shipment. Their demand is intrinsically linked to the relentless trends of miniaturization, increased component density, and higher operational frequencies in electronic devices, rendering them inherently more susceptible to static damage and making robust protective measures absolutely indispensable for ensuring product reliability and preventing costly field failures or warranty issues.

Beyond the foundational electronics sector, the automotive industry has rapidly emerged as a burgeoning and critical customer base for ESD packaging. Modern vehicles are undergoing a profound transformation, evolving into sophisticated, software-defined platforms laden with advanced electronic content. This includes a multitude of electronic control units (ECUs), intricate sensor arrays for advanced driver-assistance systems (ADAS), complex infotainment and telematics systems, and the sophisticated power electronics vital for electric vehicles (EVs) and hybrid powertrains. Each of these electronic modules necessitates meticulous ESD protection during its manufacturing, assembly into sub-systems, and distribution within a global supply chain to guarantee vehicle safety, reliability, and performance. Similarly, the aerospace and defense sectors represent another significant segment of consumers, characterized by extremely stringent reliability requirements for mission-critical electronic systems. This includes avionics, guided missile systems, high-performance radar components, satellite communication devices, and other military-grade electronics where any component failure can have catastrophic operational or safety implications. The exacting performance standards and prolonged operational lifespans demanded in these industries drive a consistent demand for premium, high-performance ESD packaging solutions capable of withstanding extreme conditions.

Furthermore, the medical and healthcare industry constitutes a crucial and expanding segment of potential customers. Manufacturers of advanced medical devices, sophisticated diagnostic equipment (e.g., MRI machines, CT scanners), patient monitoring systems, surgical instruments with embedded electronics, and high-precision laboratory equipment inherently rely on superior ESD packaging to protect sensitive internal components from damage during all phases of production, sterilization, and delivery. The unquestionable integrity and consistent functionality of these devices are paramount for accurate diagnosis, effective treatment, and ultimately, patient safety, making uncompromising ESD protection an indispensable requirement. Additionally, a diverse array of other emerging and established industrial sectors are increasingly contributing to the growing customer base. This includes industrial automation and robotics, renewable energy systems (e.g., inverters, control electronics for solar and wind power), data centers and cloud computing infrastructure, and the growing smart infrastructure sector. As these industries become more reliant on high-performance and sensitive electronic circuitry, their demand for tailored and effective ESD packaging solutions is projected to expand significantly, cementing the indispensable nature and continuously expanding market for these critical protective products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.95 billion |

| Market Forecast in 2033 | USD 9.40 billion |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor PLC, Sealed Air Corporation, Smurfit Kappa Group, DS Smith PLC, Pregis LLC, Desco Industries Inc., Tipco, Protektive Pak (Div. of Desco Industries), SCS (Div. of Desco Industries), Adept Packaging, Conductive Containers Inc., Electrotek Static Control, Botron Company Inc., Static Control Components Inc., Tandem Packaging, ACL Staticide, Static Shielding Packaging, Fraser Anti-Static Techniques, 3M Company (selected product lines), BASF SE (material solutions) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ESD Packaging Market Key Technology Landscape

The technological landscape of the ESD Packaging Market is characterized by continuous innovation and rapid evolution, fundamentally driven by the escalating demand for enhanced protection, optimized efficiency, and increasingly, improved sustainability credentials. A primary and profoundly impactful area of technological focus revolves around advanced material science, specifically the rigorous research and development of novel conductive and dissipative polymer formulations. These cutting-edge materials are meticulously engineered through the incorporation of specialized additives, such as precisely calibrated amounts of carbon black, advanced carbon nanotubes, various conductive fibers, or finely dispersed metallic particles, to achieve specific and tightly controlled surface resistance levels. The overarching objective is to produce plastics and foams that possess the inherent ability to either safely and gradually dissipate static charges, thereby preventing rapid and damaging discharge events, or to create an effective Faraday cage effect that completely shields sensitive electronic components from disruptive external electrostatic fields. Concurrently, these materials must retain desirable mechanical properties, including robust durability, essential flexibility, and optimized lightweight characteristics. Furthermore, intensive research into novel composite materials is actively exploring methodologies to imbue single packaging solutions with multiple functionalities, such as integrating superior anti-static properties concurrently with advanced moisture barrier protection, thereby offering a more comprehensive and consolidated protective solution.

Another critically significant domain of technological advancement within this market pertains to the sophistication and optimization of manufacturing processes employed for producing ESD packaging. This encompasses a broad spectrum of highly specialized techniques, including precision extrusion and advanced thermoforming, which enable the production of highly customized trays and containers with intricate designs, perfectly contoured to securely cradle and protect sensitive components. Innovations in coating technologies are also pivotal, facilitating the precise application of ultra-thin, yet highly effective, conductive or dissipative layers onto a diverse array of substrate materials. This capability significantly expands the range of materials that can be successfully endowed with reliable ESD protection, offering greater design flexibility and material choice. Furthermore, a transformative trend gaining substantial momentum is the profound integration of 'smart packaging' features. This involves embedding sophisticated sensors, RFID tags, or Near Field Communication (NFC) chips directly into the ESD packaging itself. These intelligent components enable real-time, dynamic monitoring of critical environmental conditions—such as temperature fluctuations, humidity levels, physical shocks, and crucially, any electrostatic events—throughout the entire transit and storage lifecycle. This continuous data stream provides invaluable insights for comprehensive quality assurance, proactive risk management, and precise optimization of the end-to-end supply chain, fundamentally shifting packaging from a passive to an active protective role.

The global imperative towards greater sustainability is also exerting a powerful influence, acting as a potent technological force that is spurring intensive development efforts towards bio-based, biodegradable, or readily recyclable ESD packaging solutions. This involves exploring and commercializing polymers derived from renewable biological resources, as well as designing packaging systems that can be efficiently and economically recycled without any compromise to their essential static control properties. The challenge lies in achieving environmental responsibility without sacrificing the stringent performance requirements for ESD protection. Additionally, advancements in additive manufacturing technologies, most notably industrial 3D printing, are progressively gaining traction within the ESD packaging domain. These technologies offer unprecedented capabilities for producing highly customized, low-volume ESD packaging solutions, as well as rapid prototyping, quickly and cost-effectively. This is particularly advantageous for specialized or unique electronic components that require bespoke protective enclosures, offering agility and precision that traditional manufacturing methods often cannot match. Collectively, these diverse technological advancements are converging to deliver more reliable, operationally efficient, and environmentally responsible ESD protection, continuously adapting to meet the increasingly complex and sensitive requirements of the global electronics and allied industries, ensuring robust safeguards for future technological innovations.

Regional Highlights

- Asia Pacific (APAC): Dominates the global ESD Packaging Market with a significant share and is projected to exhibit the highest growth rate. This preeminence stems from the region's unparalleled status as the global manufacturing epicenter for electronics, semiconductors, and a rapidly expanding automotive sector. Countries such as China, South Korea, Japan, Taiwan, and India host a massive concentration of production facilities for microelectronics, consumer electronics, and automotive components, driving immense, sustained demand for advanced ESD packaging. Robust government support for high-tech industries, coupled with a large, skilled workforce and efficient supply chains, further solidifies APAC's market leadership. The burgeoning middle class and increasing disposable incomes in these economies also fuel domestic consumption of electronic devices, amplifying the demand for protective packaging.

- North America: Represents a substantial and technologically advanced market for ESD packaging, characterized by a strong emphasis on research and development, innovation, and a high concentration of sophisticated industries. Key demand drivers include the robust aerospace and defense sectors, a leading medical device manufacturing industry, and extensive high-tech R&D facilities. The region's stringent quality standards, rigorous regulatory frameworks, and focus on high-value, sensitive electronics contribute significantly to the demand for premium, high-performance ESD packaging solutions. The presence of numerous global technology giants and early adopters of cutting-edge manufacturing processes further solidifies North America's position as a critical market for advanced protective packaging.

- Europe: Constitutes a mature and highly discerning market for ESD packaging, with significant demand originating from its well-established automotive electronics, industrial machinery, and precision medical device manufacturing sectors. Countries like Germany, France, the UK, and Italy are key contributors to market revenue, driven by their strong industrial bases and stringent quality control protocols. A distinct characteristic of the European market is its increasing emphasis on regulatory compliance related to environmental sustainability and circular economy principles. This focus actively influences market trends, fostering significant innovation in the development and adoption of eco-friendly, recyclable, and bio-based ESD materials, positioning Europe as a leader in sustainable packaging solutions within this domain.

- Latin America: An emerging market for ESD packaging, demonstrating promising growth prospects, primarily fueled by increasing foreign direct investments in electronics assembly and automotive manufacturing, particularly within Mexico and Brazil. The region's expanding industrialization efforts, coupled with a growing domestic consumption of electronic devices and continuous improvements in industrial infrastructure, collectively contribute to the escalating need for effective ESD protection solutions. As manufacturing capabilities mature and technological adoption increases, demand for specialized packaging solutions is expected to grow steadily, albeit from a smaller existing base compared to other major regions.

- Middle East & Africa (MEA): Currently a nascent but steadily growing market for ESD packaging. Growth in this region is primarily propelled by increasing governmental and private sector investments in industrial development, the expansion of telecommunications infrastructure, and the gradual establishment of local electronics manufacturing and assembly capabilities. Economic diversification initiatives aimed at reducing reliance on hydrocarbon revenues, coupled with accelerating digitalization efforts across various sectors, are progressively expanding the demand for ESD packaging. While still in its early stages, the MEA market presents long-term growth potential as its technological infrastructure and industrial base continue to develop and mature.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ESD Packaging Market.- Amcor PLC

- Sealed Air Corporation

- Smurfit Kappa Group

- DS Smith PLC

- Pregis LLC

- Desco Industries Inc.

- Tipco

- Protektive Pak (Div. of Desco Industries)

- SCS (Div. of Desco Industries)

- Adept Packaging

- Conductive Containers Inc.

- Electrotek Static Control

- Botron Company Inc.

- Static Control Components Inc.

- Tandem Packaging

- ACL Staticide

- Static Shielding Packaging Co.

- Fraser Anti-Static Techniques Ltd.

- 3M Company (select industrial packaging divisions)

- BASF SE (specialty polymer materials)

- DuPont de Nemours, Inc. (advanced materials)

- Dow Inc. (performance plastics)

- ITW Static Control

- CCI (Conductive Containers, Inc.)

- PCL Static Control

- Würth Elektronik GmbH & Co. KG (ESD products)

- Bradford Company (packaging solutions)

- Global Static Control

Frequently Asked Questions

Analyze common user questions about the ESD Packaging market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is ESD packaging and why is it essential for electronics?

ESD packaging refers to specialized materials and products engineered to protect electronic components from damage caused by electrostatic discharge (ESD). It is essential because static electricity can cause immediate catastrophic failure or latent defects in sensitive electronics during manufacturing, storage, and transit, leading to significant economic losses and compromised product reliability. Effective ESD packaging mitigates these risks, ensuring the integrity and operational longevity of electronic devices.

What are the primary types of materials used in ESD packaging?

The primary types of ESD packaging materials include conductive polymers (e.g., plastics filled with carbon or metal for rapid charge dissipation), static dissipative polymers (e.g., anti-static treated plastics for controlled charge dissipation), and static shielding materials (e.g., metalized films that form a Faraday cage to block external electrostatic fields). Each material offers distinct levels and mechanisms of protection tailored for various component sensitivities and application environments.

Which industries are the leading consumers of ESD packaging solutions?

The leading consumers of ESD packaging solutions are predominantly the electronics manufacturing industry (including semiconductors, PCBs, and consumer electronics), the rapidly expanding automotive industry (for vehicle electronics and ADAS), the stringent aerospace & defense sector (for avionics and critical systems), and the medical & healthcare industry (for diagnostic and sensitive medical devices). Any sector utilizing sensitive electronic components across its supply chain necessitates robust ESD protection.

How do global regulatory standards influence the ESD Packaging Market?

Global regulatory standards and industry guidelines, such as ANSI/ESD S20.20, profoundly influence the ESD Packaging Market by establishing mandatory requirements and best practices for electrostatic discharge control throughout manufacturing, handling, and packaging processes. These standards drive demand for certified and compliant ESD packaging solutions, compelling manufacturers to invest in effective protective measures to ensure product quality, minimize liabilities, and meet global trade requirements.

What emerging technologies and trends are shaping the future of ESD packaging?

Future trends and emerging technologies in ESD packaging include the accelerated development of sustainable, bio-based, and recyclable materials to address environmental concerns, the integration of 'smart packaging' features (e.g., embedded sensors, RFID) for real-time monitoring and enhanced supply chain visibility, advancements in material science for superior protection against increasingly miniaturized and sensitive components, and the adoption of AI and automation for optimized design, manufacturing, and quality control processes. Customization and intelligent adaptive solutions will also be key.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager