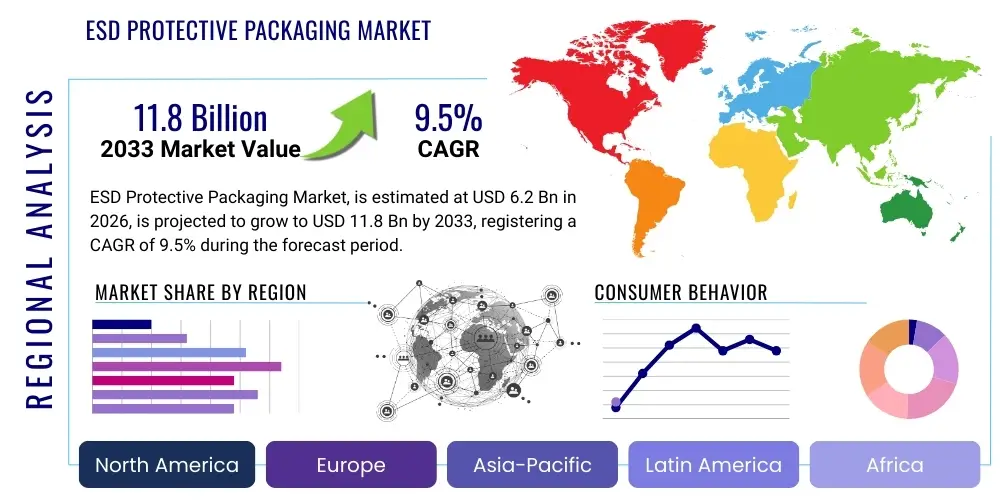

ESD Protective Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435424 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

ESD Protective Packaging Market Size

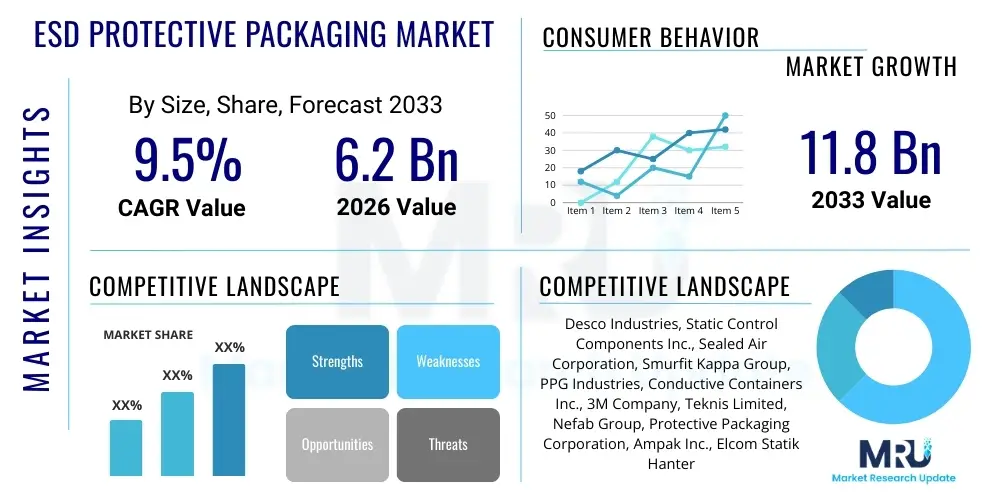

The ESD Protective Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 6.2 Billion in 2026 and is projected to reach USD 11.8 Billion by the end of the forecast period in 2033.

ESD Protective Packaging Market introduction

Electrostatic Discharge (ESD) protective packaging is fundamental for safeguarding sensitive electronic components, devices, and assemblies from potentially catastrophic damage caused by static electricity during critical phases such as manufacturing, handling, storage, and long-distance transportation. These specialized packaging materials are meticulously engineered using a combination of conductive, static-dissipative, and advanced electromagnetic shielding properties, specifically designed to prevent the uncontrolled buildup of static charge. Crucially, they facilitate the controlled and effective dissipation of any existing electrostatic charges to the ground potential, thereby maintaining the structural integrity and functional reliability of microelectronics, which are increasingly vulnerable to static events as their operational voltages decrease and component density rises.

The core product offerings within this highly specialized market segment are diverse, encompassing flexible solutions like specialized shielding bags, moisture barrier films, and laminates, alongside rigid and semi-rigid forms such as clamshells, thermoformed trays, injection-molded containers, and highly specialized cushioning foams. The materials employed typically include advanced composite structures utilizing carbon-loaded plastics (e.g., polyethylene, polypropylene), metallized polyester films that create a robust Faraday cage effect, and proprietary inherently dissipative polymers (IDPs). Major applications span across the entire technology ecosystem, including consumer electronics assembly, complex aerospace and defense systems, safety-critical automotive electronics—particularly those related to advanced driver-assistance systems (ADAS) and electric vehicle (EV) power components—critical healthcare devices (like diagnostic imaging equipment), and precision industrial automation machinery. The incessant trend toward component miniaturization and the increasing complexity of integrated circuits (ICs) necessitates robust, verifiable ESD protection, thereby positioning this market as indispensable to global technological progress.

The key strategic and operational benefits derived from utilizing certified ESD protective packaging are profound, directly impacting profitability and brand reputation. These benefits include substantial improvements in manufacturing yield rates by minimizing component failure, drastic reduction in costly warranty claims stemming from latent ESD component damage that manifests after installation, and enhanced product reliability throughout intricate global supply chains. Market growth is structurally driven by several critical factors, most notably the implementation and enforcement of stringent international industry standards (such as IEC 61340 series and ANSI/ESD S20.20), the global proliferation of Internet of Things (IoT) devices that rely on millions of highly sensitive sensors, and the escalating global investment in semiconductor fabrication capacity. Consequently, ESD packaging is increasingly viewed by sophisticated technology organizations not merely as a necessary operational cost, but as a critical enabling investment that secures product quality and long-term performance.

ESD Protective Packaging Market Executive Summary

The ESD Protective Packaging Market is experiencing a phase of robust expansion, propelled primarily by the unprecedented global demand for sophisticated electronic components required for next-generation technologies. A central business trend involves the intensive focus on developing sustainable and environmentally compliant ESD packaging materials, driven by global initiatives and regional legislative mandates aimed at reducing plastic waste. This shift is leading manufacturers to explore bio-based polymers and mono-material solutions that retain critical static dissipation capabilities while simplifying recycling processes. Furthermore, there is a pronounced strategic consolidation among suppliers, aiming to provide end-to-end ESD solutions that integrate physical packaging with sophisticated monitoring and traceability systems, enhancing overall supply chain visibility and control.

Regional trends highlight Asia Pacific (APAC) as the undisputed leader in both consumption and production, driven by colossal semiconductor manufacturing hubs in China, Taiwan, South Korea, and Japan, alongside emerging manufacturing powerhouse nations like Vietnam and India. North America and Europe demonstrate mature markets characterized by high adoption rates in high-reliability sectors such as aerospace, medical diagnostics, and automotive safety systems. Growth in these mature regions is focused on advanced material science, particularly conductive polymers and high-performance shielding laminates. From a geographical perspective, the Asia Pacific (APAC) region continues its historical dominance, serving as the nucleus of global semiconductor and electronics manufacturing. This dominance is reinforced by continuous heavy investment in cutting-edge fabrication facilities across territories like China, Taiwan, and South Korea, which dictate the largest volume consumption of ESD materials globally. Conversely, mature markets in North America and Europe are driving the demand for specialized, high-performance, and certified ESD solutions required by demanding sectors such as aerospace, military applications, and certified medical technology. Growth in these mature regions is characterized less by volume and more by value, focusing intensely on material breakthroughs, including advanced conductive coatings and high-durability, reusable protective systems suitable for closed-loop logistics.

Segmentation trends indicate that the materials segment, especially plastic materials (polyethylene, polypropylene), dominates the volume share due to cost-effectiveness and versatility, although high-performance materials like carbon-loaded fiberboard and specialized non-woven fabrics are exhibiting the highest growth rates. By product type, bags and pouches maintain significant market presence, crucial for small components, while rigid storage containers are seeing increased adoption in automated warehouse systems and long-distance transport, reflecting the industry's continuous investment in sophisticated logistics infrastructure. Analysis of segmentation trends reveals that while flexible packaging forms, such as bags and pouches, maintain the largest market share in terms of unit volume due to their versatility in component handling, the rigid and semi-rigid container segment (trays, material handling totes) exhibits superior growth rates. This acceleration is directly attributable to the industrial adoption of sophisticated automated warehousing and assembly lines (Industry 4.0), which require dimensionally stable and highly consistent packaging that can interface reliably with robotic handling systems. Materially, conductive polymers remain foundational, but the highest growth trajectory is observed in premium metal-shielding laminates and specialized foams that offer enhanced mechanical protection alongside validated static control, catering to the increasingly fragile nature of advanced electronic assemblies like heterogeneously integrated chiplets.

AI Impact Analysis on ESD Protective Packaging Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) integration in manufacturing lines and smart logistics networks will influence the requirements for ESD protective packaging. Common concerns revolve around whether advanced automation increases or decreases the potential for static buildup, the role of smart packaging in AI-driven inventory systems, and how AI can optimize material usage and quality control in packaging production. Key expectations include the use of AI for predictive failure analysis, leveraging embedded sensors in packaging to provide real-time environmental monitoring feedback (temperature, humidity, static charge), and optimizing packaging design based on automated handling risks specific to AI-controlled robotic systems. The pivotal theme emerging is the imperative for "Smart ESD Packaging," necessitating the evolution of packaging solutions to actively communicate their status and environment in real-time.

The primary theme emerging from user inquiries is the necessity for ESD packaging to evolve beyond passive protection into an active, data-generating component within the smart factory ecosystem. AI systems, which rely heavily on real-time data input, are demanding that packaging communicates its status, confirming its ESD integrity and location within complex, automated supply chains. This push towards "Smart ESD Packaging" is driving advancements in material science to incorporate RFID, NFC, and sensors without compromising static control properties, fundamentally changing the product lifecycle management landscape for electronics components. Furthermore, AI is fundamentally changing the manufacturing process of the packaging itself. Machine Learning algorithms are increasingly utilized for rigorous quality assurance and continuous process optimization.

Furthermore, AI is being deployed within packaging production processes to enhance quality assurance. ML algorithms analyze material properties, surface resistivity, and structural uniformity during manufacturing, identifying potential defects far more rapidly and accurately than traditional methods. This ensures the consistent quality of the barrier protection, crucial for sensitive components like high-density graphics processors and quantum computing components. Consequently, AI integration raises the baseline quality standard for all ESD protective solutions, necessitating investment in advanced manufacturing technologies by packaging suppliers. By identifying microscopic flaws or inconsistencies that human inspectors or traditional methods might miss, AI ensures an unprecedented level of material consistency and compliance with ultra-strict ESD standards, thereby establishing a higher quality baseline for all packaging manufacturers aiming to serve advanced electronics sectors.

- AI-Driven Quality Control: ML algorithms optimize material mixing and coating processes, ensuring uniform surface resistivity and compliance.

- Smart Logistics Integration: Packaging embedded with RFID tags facilitates AI-powered inventory tracking and real-time environment monitoring (AEO: temperature, humidity, ESD status).

- Predictive Failure Analysis: AI analyzes data from smart packaging sensors to predict potential static exposure risk during transportation routes.

- Automation Compatibility: Packaging designs must be optimized for handling by AI-controlled robotic systems, reducing friction points that generate static charge.

- Demand Forecasting Optimization: AI enhances the accuracy of forecasting demand for specific ESD material types across different end-user industries.

- Supply Chain Transparency: AI-managed blockchain systems utilize smart packaging data to provide immutable records of component handling history, verifying ESD compliance from fabrication to final assembly, minimizing liability risks.

- Material Efficiency Optimization: ML models predict the minimum viable thickness and material composition required to achieve specific static control levels, reducing material waste and optimizing resource utilization in manufacturing processes.

- Customization and Design Automation: AI tools rapidly generate and simulate custom packaging designs tailored for new component geometries, ensuring optimal physical and electrostatic protection specific to the automated handling environment of the client.

- Remote Diagnostics and Integrity Check: Smart packaging enables AI systems to perform remote diagnostics, verifying the mechanical and electrical integrity of the container before reuse in closed-loop logistics systems.

- Robotic Arm Gripper Interface: Packaging surfaces are increasingly designed with specific texture and geometry to minimize charge accumulation when interacting with robotic end-effectors made of certain plastics or composites, an essential aspect of automated production environments.

DRO & Impact Forces Of ESD Protective Packaging Market

The market dynamics are governed by a complex interplay of internal and external forces. The primary drivers include the exponential growth in the semiconductor industry, propelled by advancements in 5G technology, electric vehicles (EVs), and sophisticated data center infrastructure, all of which rely on highly sensitive components requiring absolute ESD protection. Simultaneously, increasing regulatory oversight and the adoption of globally harmonized standards (such as ANSI/ESD S541) mandate the use of certified protective packaging across international supply chains, enforcing market growth through compliance requirements. Primary drivers are unequivocally linked to the explosive, systemic growth in the global semiconductor industry, catalyzed by widespread deployment of disruptive technologies such as 5G telecommunications, the relentless expansion of hyper-scale data centers, and the paradigm shift toward Electric Vehicles (EVs) and autonomous driving platforms. These technologies require components—like advanced microprocessors, MEMS sensors, and high-frequency RF components—that possess unprecedented sensitivity to minute electrostatic events.

Restraints largely center on the relatively higher cost associated with high-performance ESD materials compared to standard packaging, posing a barrier to adoption in lower-margin or cost-sensitive consumer electronics sectors. Furthermore, challenges related to the recyclability and sustainability of multi-layer shielding films often restrict their use in regions with strict plastic waste regulations. Another significant restraint is the risk of counterfeit or substandard ESD packaging entering the market, which, while appearing compliant, fails to provide adequate protection, leading to substantial latent component damage for end-users. A significant and growing restraint is the technical difficulty associated with achieving effective recyclability for multi-layer shielding films and composite structures, leading to environmental non-compliance in regions with stringent recycling mandates, forcing manufacturers to innovate sustainable, yet equally effective, alternatives.

Opportunities are vast, particularly in the development of sustainable, bio-based, and compostable ESD polymers that meet both protective and environmental standards. The growing demand for specialized packaging for highly volatile lithium-ion batteries and advanced micro-electromechanical systems (MEMS) also presents significant revenue streams. Impact forces, driven predominantly by technological evolution and regulatory frameworks, ensure that the demand for high-quality, traceable ESD solutions will remain inelastic, compelling manufacturers to continuously innovate in material science and smart packaging integration to maintain competitive relevance. Key impact forces, driven primarily by continuous rapid technological obsolescence in electronics and increasingly restrictive environmental policy, ensure that the demand curve for innovative, traceable, and highly reliable ESD protective solutions remains steeply positive. This necessitates continuous, substantial research and development investment by packaging producers to meet the evolving demands for high-density, low-voltage component protection, securing their long-term competitive position.

Segmentation Analysis

The ESD Protective Packaging market is extensively segmented across multiple dimensions, including material type, product form, end-user industry, and region, allowing for tailored product development and targeted market strategies. Understanding these segments is critical for stakeholders to identify high-growth niches and optimize their supply chain offerings. Material segmentation, which includes conductive polymers, static dissipative plastics, and metallic shielding materials, determines the level of protection offered and the associated cost profile, while product form segmentation dictates application ease and logistical efficiency. A comprehensive segmentation analysis of the ESD Protective Packaging Market is essential for mapping competitive landscapes and identifying precise areas of strategic investment. The market structure is highly granular, differentiated across material properties, physical product forms, specific end-user application requirements, and geographical consumption patterns.

The market sees significant variation in demand across different end-user industries. The semiconductor and electronics manufacturing segment constitutes the largest revenue share globally due to the sheer volume and vulnerability of the components handled. However, high-reliability sectors such as aerospace and defense, and medical devices, though smaller in volume, drive the demand for premium, highly certified, and specialized ESD protective solutions, pushing innovation in extreme environment performance and material longevity. The dominance of the Electronics Manufacturing segment stems from the sheer volume of PCBs, ICs, and assembled devices produced globally. However, niche segments such as Aerospace and Defense, and Medical Devices, drive disproportionately high demand for materials with extreme durability, specialized certifications, and guaranteed long-term static control stability due to the mission-critical nature of their components.

Future growth is expected to be concentrated in the automotive electronics sector, spurred by the transition to electric vehicles (EVs) and autonomous driving systems, where electronic control units (ECUs) and sensors are becoming exponentially more complex and sensitive to static discharge. Consequently, packaging manufacturers are increasingly focusing on durable, reusable containers and trays designed for the rigorous demands of automated automotive assembly lines, contributing significantly to market value through robust, long-term asset provision. This segment prioritizes longevity, material robustness, and precise dimensional stability to ensure perfect interaction with high-speed automation and assembly tooling, thereby increasing the market value derived from specialized tooling and custom protective assets.

- By Material Type:

- Conductive Polymers: Utilizing materials heavily loaded with carbon black or metallic fibers (e.g., carbon-loaded PE, PP, PS) to achieve surface resistivity below 105 ohms/square, ensuring rapid discharge.

- Static Dissipative Polymers: Incorporating anti-static additives to allow for a slow, controlled discharge (resistivity between 105 and 1011 ohms/square), minimizing voltage peaks.

- Metal/Metallized Materials: Primarily shielding films utilizing aluminum or nickel layers to create a Faraday cage, essential for protecting against external electrostatic fields (AEO: providing electrostatic discharge shielding).

- Inherently Dissipative Polymers (IDPs): Materials whose molecular structure naturally prevents charge buildup, offering long-term, stable protection regardless of humidity.

- Non-Woven Fabrics and Papers: Used for interleaving and wrapping, often coated with conductive or dissipative agents.

- By Product Type:

- Bags and Pouches: Includes shielding bags, static dissipative bags, and specialized Moisture Barrier Bags (MBBs) crucial for handling moisture-sensitive devices (MSDs).

- Trays and Containers: Rigid and semi-rigid thermoformed trays, clamshells, and large Material Handling Containers (MHCs) designed for high-volume automated assembly and transport.

- Films and Laminates: Used for wrapping pallets (stretch film, shrink wrap) and creating custom enclosures for large assemblies, often metallized for shielding.

- Foams and Cushioning Materials: Conductive and dissipative foam inserts (polyurethane, polyethylene) providing both mechanical shock absorption and static control within secondary packaging.

- ESD Workstation Accessories: Including static dissipative mats, grounding cords, and wrist straps (market adjacent, but often bundled).

- By End-User Industry:

- Electronics Manufacturing: Dominant segment including semiconductor fabrication, PCB assembly, and final consumer device manufacturing (AEO: core market driver).

- Aerospace and Defense: High-reliability segment demanding specialized certifications, durability, and stable performance under extreme conditions.

- Automotive: Rapidly growing segment driven by complex ADAS components, infotainment systems, and high-voltage power electronics for EVs.

- Healthcare and Medical Devices: Focus on sterile, certified packaging for sensitive diagnostic equipment and implants.

- Industrial Automation: Protection of sensors, control panels, and robotics components used in smart factories (Industry 4.0).

- Telecommunications: Demand driven by infrastructure components, servers, and networking equipment (5G rollout).

Value Chain Analysis For ESD Protective Packaging Market

The value chain for ESD protective packaging commences with upstream activities involving raw material procurement, focusing on specialized chemical additives (carbon black, anti-static agents) and base polymers (PE, PP, PET). Raw material suppliers exert moderate influence due to the technical specificity required for conductivity or dissipation. The manufacturing stage, involving processes like extrusion, lamination, and thermoforming, is crucial, where material science expertise is applied to ensure compliance with strict ESD standards, often involving high capital investment in specialized equipment and testing facilities. The ESD protective packaging value chain commences at the upstream level with the complex procurement and processing of specialized raw materials. This includes securing essential chemical feedstocks, highly purified base polymers (PE, PP, PET), and critical performance-enhancing additives such as conductive carbon black, specialized metallic powders, and proprietary anti-static agents. Raw material suppliers wield considerable pricing power, particularly those providing specialized, certified additives, due to the high barrier to entry and the technical requirements for achieving precise electrical performance.

Midstream processes involve the conversion of base materials into final product forms—bags, trays, films, and containers—tailored to specific customer requirements regarding size, barrier properties, and reusability. Key players focus on maintaining strict quality control and certification during this stage. Downstream activities involve distribution and end-user integration. Direct distribution is common for high-volume or custom-engineered solutions, where packaging manufacturers work closely with large semiconductor fabs and aerospace contractors to ensure fit-for-purpose delivery and just-in-time inventory management. The manufacturing and conversion phase constitutes the midstream segment, encompassing specialized processes like precision extrusion, multi-layer co-extrusion, advanced metallization, lamination, and thermoforming. This stage demands significant capital investment in highly specialized machinery capable of handling conductive and dissipative materials while maintaining cleanroom standards to prevent contamination.

Indirect distribution relies heavily on specialized industrial packaging distributors and third-party logistics (3PL) providers, particularly for small-to-medium enterprises (SMEs) and standardized product lines. These distributors often maintain certified cleanroom storage and handling environments, adding value through inventory consolidation and expert consultation on compliance. Effective distribution channels are characterized by rapid response capability and global reach, essential for supporting the highly fragmented and geographically dispersed electronics manufacturing supply chain. Downstream activities involve distribution and end-user integration. Direct distribution is common for high-volume or custom-engineered solutions, where packaging manufacturers work closely with large semiconductor fabs and aerospace contractors to ensure fit-for-purpose delivery and just-in-time inventory management.

ESD Protective Packaging Market Potential Customers

The core customer base for ESD protective packaging includes any entity involved in the manufacturing, assembly, handling, or transportation of static-sensitive devices. High-priority potential customers are primarily Original Equipment Manufacturers (OEMs) in the technology sector, ranging from global giants producing smartphones and laptops to specialized firms developing complex medical imaging equipment or satellite communication systems. These customers require customized, high-reliability solutions tailored to their automated assembly processes. The most significant potential buyers are large-scale Original Equipment Manufacturers (OEMs) and Electronic Manufacturing Services (EMS) providers globally. These entities, encompassing everything from leading aerospace contractors and defense suppliers (who demand the absolute highest reliability and military-grade specifications) to mass-market consumer electronics brands, require bespoke, high-performance packaging solutions integrated seamlessly into their highly automated production cycles.

Another critical customer segment consists of Electronic Manufacturing Service (EMS) providers and semiconductor fabrication plants (Fabs). These entities consume massive volumes of standardized ESD packaging materials like shielding bags and conductive wafer trays daily. Their purchasing decisions are heavily influenced by supplier capacity, pricing, and compliance certifications, necessitating robust global supply agreements and proven quality assurance records from packaging suppliers. A second crucial segment involves specialized component manufacturers, including semiconductor fabrication plants (Fabs) and Passive Component Suppliers (e.g., resistors, capacitors, memory chips). Fabs utilize massive quantities of standard protective materials, such as conductive wafer carriers and specialty trays, often requiring cleanroom compatibility and ultra-low particle generation characteristics. Their demand is highly inelastic and correlated directly with global chip production capacity.

Emerging potential customers include specialized battery manufacturers (particularly for high-capacity EV and grid storage batteries, which require ESD control during assembly) and the growing network of third-party repair and refurbishment centers (R&D). As the lifespan of complex electronic products extends, the secondary market for component handling and repair increasingly necessitates certified ESD protection, offering a sustained, albeit fragmented, demand channel for protective films and temporary handling aids. Furthermore, research and development (R&D) laboratories, particularly those working on nascent technologies like quantum computing components, microfluidics, and advanced biosensors, represent high-value, albeit lower volume, customers demanding state-of-the-art, custom-engineered static control solutions that protect experimental and delicate assemblies during transit between specialized facilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.2 Billion |

| Market Forecast in 2033 | USD 11.8 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Desco Industries, Static Control Components Inc., Sealed Air Corporation, Smurfit Kappa Group, PPG Industries, Conductive Containers Inc., 3M Company, Teknis Limited, Nefab Group, Protective Packaging Corporation, Ampak Inc., Elcom Statik Hantering AB, Custom Materials Inc., ACL Staticide Inc., Polyone Corporation (Avient), Universal Static Control, Caltex Plastics, Shiner International, GWP Group, Transforming Technologies, CAPCO (Custom Advanced Packaging Company), Bradford Company, Sierra Static Control, Electrotek Static Controls Pvt Ltd., Meritronics, SCS Static Control Solutions, Prostat International Inc., Microfoam. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ESD Protective Packaging Market Key Technology Landscape

The technology landscape in ESD protective packaging is defined by the continuous evolution of materials science aimed at achieving better static control characteristics alongside environmental sustainability and improved mechanical performance. A key area of technological advancement is the development of Inherently Dissipative Polymers (IDPs). Unlike traditional materials that rely on external additives (like carbon black or anti-static agents) which can rub off or degrade over time, IDPs possess anti-static properties built into their molecular structure. This results in stable, long-lasting surface resistance regardless of environmental factors like humidity, crucial for long-term storage and reliability. The technological landscape of the ESD Protective Packaging market is rapidly evolving, driven by the dual pressures of protecting increasingly sensitive electronics and meeting demanding environmental mandates. A key area of innovation is the perfection and widespread adoption of Inherently Dissipative Polymers (IDPs). Unlike traditional surface-coated or additive-based anti-static materials, IDPs feature static control properties permanently embedded within their molecular chain, often achieved through specialized polymer chemistry like polyethylene oxide or polyaniline.

Another significant technological push involves the integration of advanced barrier technologies, especially for moisture-sensitive devices (MSDs). Moisture Barrier Bags (MBBs) utilize complex multi-layer lamination processes, often combining metallized shielding layers with specific polymer structures to prevent both static penetration and moisture ingress simultaneously. Recent innovations focus on reducing the thickness and weight of these laminates while maintaining superior barrier performance, improving efficiency in transportation and reducing material usage, aligning with sustainability objectives. Furthermore, significant advancements are focused on enhancing the performance of Moisture Barrier Bags (MBBs) and shielding films. Modern MBBs utilize complex, precision co-extrusion and lamination processes to combine robust physical protection layers with highly attenuated metallized layers, providing simultaneous defense against electrostatic fields, physical abrasion, and ambient moisture ingress. Technological breakthroughs involve the deployment of nano-composites, incorporating conductive nanomaterials (like carbon nanotubes or graphene derivatives) into the polymer matrix.

Furthermore, the digitalization of packaging is rapidly becoming a standard requirement. This involves embedding smart technologies such as high-frequency RFID chips or specialized NFC tags directly into the packaging material. These technologies facilitate real-time tracking, asset management, and environmental monitoring throughout the supply chain, enabling quick identification of non-compliant packages and providing data for automated inventory systems. This digital integration supports the industry trend toward Industry 4.0 and predictive logistics, transforming the packaging from a passive enclosure to an active data source. The most transformative technological shift lies in the integration of smart capabilities, transitioning packaging into an active component of the Internet of Things (IoT). This involves embedding passive and active sensor technologies, including printed electronics, flexible batteries, and miniaturized RF communication devices (RFID, NFC), directly into the packaging structure during the manufacturing process. These technologies enable sophisticated environmental monitoring, allowing for real-time data capture on shock events, temperature excursions, and verifiable static field exposure.

Regional Highlights

- Asia Pacific (APAC) Dominance: APAC holds the dominant share in the ESD protective packaging market, primarily driven by its position as the global hub for electronics manufacturing, semiconductor fabrication (especially in Taiwan, South Korea, and China), and large-scale consumer electronics assembly. The massive scale of high-volume, cost-competitive manufacturing in this region necessitates constant demand for packaging materials. Furthermore, governmental initiatives promoting domestic semiconductor growth (e.g., in India and China) are expected to accelerate regional market expansion significantly through 2033. APAC accounts for the largest and fastest-growing segment globally, fueled by its status as the world’s primary manufacturing center for electronics, semiconductors, and electronic devices.

- North American Market Maturity and Innovation: North America represents a mature, high-value market characterized by stringent quality requirements and early adoption of advanced ESD solutions. Demand is heavily concentrated in aerospace, defense, high-reliability computing, and medical device manufacturing. This region drives innovation in sustainable materials, high-performance IDPs, and smart packaging solutions, prioritizing specialized, low-volume, high-margin products requiring superior certifications (AEO: military standards compliance, FDA approval compatibility). The demand structure is defined by stringent requirements in defense, aerospace, advanced medical diagnostics, and the burgeoning data center industry (hyperscale computing).

- European Focus on Sustainability and Automotive: The European market is defined by a strong emphasis on environmental regulations and sustainability, compelling manufacturers to rapidly transition toward recyclable and bio-based ESD polymers. A significant growth vector is the burgeoning automotive electronics sector, particularly driven by German, French, and Italian automakers focusing on EV components, charging infrastructure, and sophisticated sensor arrays (ADAS). European regulations often lead global trends in material restrictions and waste management. The European market is strongly influenced by proactive environmental regulations, such as the WEEE Directive and various plastic reduction initiatives.

- Latin America (LA) Emerging Growth: Latin America presents an emerging market opportunity, driven primarily by the growth of automotive assembly, IT infrastructure modernization, and increased foreign direct investment into regional electronics assembly plants (e.g., in Mexico and Brazil). While smaller than major regions, the demand for standardized, cost-effective ESD protection is growing in parallel with local manufacturing scaling. The LA market is characterized by moderate but steady growth, closely tied to foreign direct investment in manufacturing and assembly operations, particularly in the automotive and general consumer electronics sectors in Mexico and Brazil.

- Middle East and Africa (MEA) Infrastructure Development: The MEA region’s market expansion is linked to substantial investments in telecommunications infrastructure (5G rollout), data center construction, and defense spending. Demand tends to be specialized, focusing on robust packaging suitable for challenging climatic conditions (high heat, low humidity), requiring materials with highly stable ESD performance characteristics. Market expansion in MEA is highly localized and project-driven, linked to substantial governmental investments in national telecommunications infrastructure (5G/6G deployment), data center construction, and significant defense technology upgrades.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ESD Protective Packaging Market.- Desco Industries

- Static Control Components Inc.

- Sealed Air Corporation

- Smurfit Kappa Group

- PPG Industries

- Conductive Containers Inc.

- 3M Company

- Teknis Limited

- Nefab Group

- Protective Packaging Corporation

- Ampak Inc.

- Elcom Statik Hantering AB

- Custom Materials Inc.

- ACL Staticide Inc.

- Polyone Corporation (Avient)

- Universal Static Control

- Caltex Plastics

- Shiner International

- GWP Group

- Transforming Technologies

- CAPCO (Custom Advanced Packaging Company)

- Bradford Company

- Sierra Static Control

- Electrotek Static Controls Pvt Ltd.

- Meritronics

- SCS Static Control Solutions

- Prostat International Inc.

- Microfoam

- ITW ECPS

- Dou Yee Enterprises

Frequently Asked Questions

Analyze common user questions about the ESD Protective Packaging market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between conductive, dissipative, and shielding ESD packaging materials, and when is each type utilized?

Conductive materials (surface resistivity below 1.0 x 105 ohms/square) are engineered with high carbon content to allow immediate electron flow, creating a safe path for charges to ground; they are primarily used within controlled ESD protected areas (EPAs). Dissipative materials (resistivity between 1.0 x 105 and 1.0 x 1011 ohms/square) control the speed of discharge, preventing component damage from rapid voltage spikes, ideal for general handling. Shielding packaging, typically featuring a metallized layer forming a Faraday cage, is mandatory for protecting sensitive components during transportation outside of certified EPAs by blocking external electrostatic fields, offering the highest level of comprehensive protection.

How does the shift to electric vehicles (EVs) and autonomous systems specifically impact the design and demand for robust ESD packaging?

The accelerated transition to EVs and autonomous driving technology significantly increases the complexity and volume of high-reliability electronic control units (ECUs), high-density sensors, and sensitive battery management systems, all highly vulnerable to static discharge. This necessitates a shift toward reusable, custom-molded, highly durable ESD containers and trays, often incorporating rigid conductive materials or IDPs, that can withstand the continuous stress of automated assembly lines and closed-loop logistics. The automotive sector requires materials with superior mechanical strength alongside guaranteed, stable static control performance over extended reuse cycles.

What role does sustainability and recyclability play in current ESD packaging material innovation and procurement decisions?

Sustainability is now a core requirement, moving procurement decisions away from complex, non-recyclable multi-layer composite films. Innovation is focused on developing fully recyclable mono-material ESD solutions, often utilizing advanced Inherently Dissipative Polymers (IDPs) derived from bio-based or recycled content. End-user industries, particularly in Europe and North America, increasingly mandate verified material content and end-of-life recyclability data to meet strict corporate Environmental, Social, and Governance (ESG) targets and comply with evolving regional plastic waste legislation.

What are the primary regulatory standards governing the quality and compliance of ESD protective packaging utilized in global supply chains?

Global ESD packaging quality and use are governed principally by standards established by the ESD Association. The two most vital standards are ANSI/ESD S20.20, which outlines requirements for establishing and maintaining an ESD control program (EPA), and ANSI/ESD S541, which specifically defines the necessary performance criteria for packaging materials, including minimum shielding attenuation and surface resistance limits. Adherence to these standards is mandatory for companies trading in international electronics markets, ensuring material quality and standardized handling procedures globally.

Why is real-time environmental monitoring and integration of smart packaging technology becoming crucial for high-value ESD sensitive components?

Real-time monitoring, facilitated by embedded IoT sensors and RFID/NFC technology in smart packaging, is essential because latent ESD damage frequently occurs during unmonitored transportation phases. Smart packaging actively logs critical environmental data—such as rapid temperature changes, extreme humidity excursions, and electrostatic field exposure—allowing AI-driven logistics systems to provide immediate alerts or rerouting decisions. This capability offers unprecedented supply chain transparency, minimizes liability by pinpointing exactly where a breach of protective integrity occurred, and verifies component safety throughout complex global transit, securing high-value assets like microprocessors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager