ESD Safety Shoes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434398 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

ESD Safety Shoes Market Size

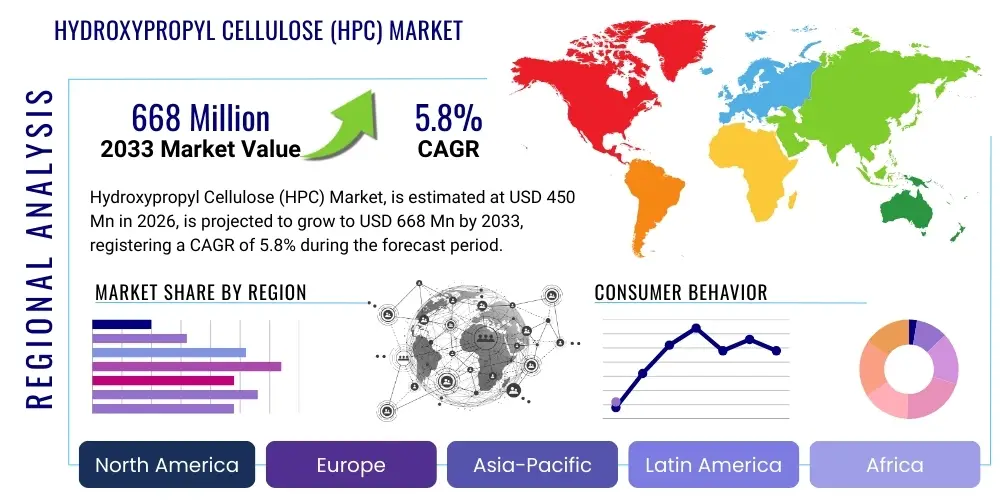

The ESD Safety Shoes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $1.95 Billion by the end of the forecast period in 2033.

ESD Safety Shoes Market introduction

The Electrostatic Discharge (ESD) Safety Shoes Market encompasses specialized protective footwear designed to dissipate static electricity from the wearer’s body to the ground in a controlled manner, preventing the buildup of charges that could potentially damage sensitive electronic components or ignite volatile materials. These shoes are critical safety equipment in environments where static control is paramount, such as semiconductor manufacturing, electronics assembly, cleanrooms, and chemical processing facilities. The product design adheres to stringent international standards (e.g., IEC 61340-5-1 and ASTM F2413), ensuring reliable resistance ranges that allow electricity to flow safely away without causing a dangerous shock to the worker.

Major applications for ESD safety shoes span across various high-tech and industrial sectors. In electronics manufacturing, including PCBs and microchips, ESD protection is non-negotiable as components are highly susceptible to damage from even minor static events, leading to costly failures and product recalls. Beyond electronics, these shoes are widely adopted in pharmaceutical laboratories and paint booths where flammable solvents or dusts pose an explosion risk if exposed to a static spark. The core benefit of these products lies in proactive risk mitigation, protecting both human personnel from potential static shocks and valuable assets from irreversible electrostatic damage.

The market is primarily driven by increasing automation in manufacturing processes, which integrates more sensitive electronic controls, coupled with stricter regulatory mandates globally concerning worker safety and product quality assurance in ESD-sensitive environments. Furthermore, rapid expansion of the semiconductor industry, fueled by the demand for 5G technology, IoT devices, and electric vehicles (EVs), necessitates enhanced cleanroom protocols and superior ESD protection tools, driving continuous innovation and adoption within the footwear segment.

ESD Safety Shoes Market Executive Summary

The ESD Safety Shoes Market is currently undergoing significant expansion, marked by a shift toward advanced materials and integrated smart features designed for enhanced conductivity and worker comfort. Key business trends indicate a strong focus on sustainable manufacturing processes and the incorporation of lightweight, durable, and highly breathable materials that meet rigorous safety standards while improving ergonomic performance for prolonged use. This demand is particularly high in Asia Pacific, driven by the proliferation of massive electronics and semiconductor manufacturing hubs in countries like China, South Korea, and Taiwan, which are prioritizing quality control and safety compliance in their supply chains. Western markets, including North America and Europe, are characterized by high regulatory enforcement and a premium placed on specialized, certified footwear tailored for cleanroom (ISO Class 4 and above) and defense applications.

Regionally, the market is heterogeneous. Asia Pacific exhibits the highest growth potential due to rapid industrialization and the establishment of new fabrication facilities (fabs). North America maintains a mature but steady growth rate, largely influenced by aerospace, medical device manufacturing, and adherence to stringent OSHA regulations. Segment trends show a clear preference for conductive safety shoes over dissipative shoes in high-risk zones, reflecting a demand for faster static dissipation. Moreover, the market is seeing increased segmentation based on safety rating (e.g., steel toe vs. composite toe) and specialized application requirements (e.g., sterile environments requiring autoclavable materials).

The segment trends reveal that innovation in sole technology, specifically the formulation of polyurethane (PU) and rubber compounds for optimal electrical resistance properties, remains a key competitive differentiator. There is also a notable movement towards customizable ESD footwear, allowing companies to mandate specific resistance levels tailored to their unique workspace requirements. Overall, the market remains resilient, underpinned by the indispensable nature of ESD protection in modern high-technology industrial settings, ensuring sustained demand regardless of minor economic fluctuations.

AI Impact Analysis on ESD Safety Shoes Market

Common user questions regarding AI’s impact on the ESD Safety Shoes Market frequently center on themes such as automated quality control, predictive maintenance of ESD performance, and AI-driven personalized fit and design. Users are concerned about whether AI can enhance the consistency of static dissipation properties throughout the manufacturing process and if smart monitoring systems can be integrated into footwear to track real-time conductivity and usage patterns. The underlying expectation is that AI will improve manufacturing efficiency, reduce material waste, and, crucially, elevate the reliability and longevity of the safety features in ESD footwear. Specifically, there is interest in how machine learning algorithms can analyze vast datasets concerning workplace environment variables (humidity, temperature) and worker movement to design optimal sole geometries and material formulations that minimize the risk of static accumulation.

While ESD safety shoes are physical protective equipment, AI primarily influences their lifecycle through optimization and data analytics. AI algorithms are increasingly being deployed in the production line for non-contact measurement of resistance consistency across the sole, ensuring every manufactured unit meets required conductivity thresholds without fail. Furthermore, predictive modeling using AI allows manufacturers to forecast material degradation based on simulated use environments, leading to the development of more robust material compounds. This analytical capability significantly reduces the incidence of non-compliant safety footwear entering the market, thereby improving overall worker protection and company compliance records. The integration potential of tiny, passively powered sensors into the shoe that report data back to a central AI safety management system represents a future growth vector.

The long-term impact involves AI-assisted regulatory compliance tracking. By integrating manufacturing data, material certifications, and end-user performance feedback, AI systems can automatically generate comprehensive compliance reports, ensuring that footwear selections match specific industry and regional standards (like CE, ANSI, or CSA). This transformation shifts the focus from simple product manufacturing to providing integrated ESD safety solutions, where the physical product is supported by intelligent systems managing its deployment, performance monitoring, and mandatory replacement schedule, thereby minimizing human error in safety management.

- AI optimizes manufacturing processes for consistent ESD resistance levels.

- Machine learning aids in developing advanced material compounds tailored for specific static dissipation requirements.

- Predictive modeling forecasts the lifespan and performance degradation of ESD shoes based on usage.

- AI-driven sensors may eventually be integrated for real-time monitoring of static charge dissipation in the workplace.

- Automated compliance reporting reduces administrative burden and ensures regulatory adherence for safety managers.

DRO & Impact Forces Of ESD Safety Shoes Market

The ESD Safety Shoes Market is shaped by a potent combination of stringent safety regulations, technological material advancements, and inherent industrial risks. Key drivers include the exponential growth of the global electronics industry, particularly in semiconductor fabrication where minimal static events can ruin entire batches of wafers, necessitating mandatory and high-quality ESD controls. Furthermore, the increasing global awareness and stricter enforcement of occupational health and safety standards (OSHA, European Directives) compel enterprises across all relevant sectors—from automotive electronics assembly to sensitive cleanrooms—to invest in certified protective gear. Opportunities are emerging through the development of specialized niche products, such as comfortable athletic-style ESD footwear and solutions integrating smart features for continuous monitoring, catering to a younger industrial workforce that prioritizes ergonomics.

Restraints primarily revolve around the higher cost associated with certified ESD footwear compared to standard safety shoes, which can deter adoption in price-sensitive developing markets or smaller enterprises. Additionally, the challenge of maintaining material integrity and consistent electrical resistance over the shoe’s lifespan, particularly under harsh industrial conditions, requires frequent replacement, adding to operational expenditure. The market also faces restraint from inconsistent regulatory interpretation across different regions and the issue of non-compliance stemming from workers improperly wearing or maintaining their ESD personal protective equipment (PPE), which compromises the entire static control program.

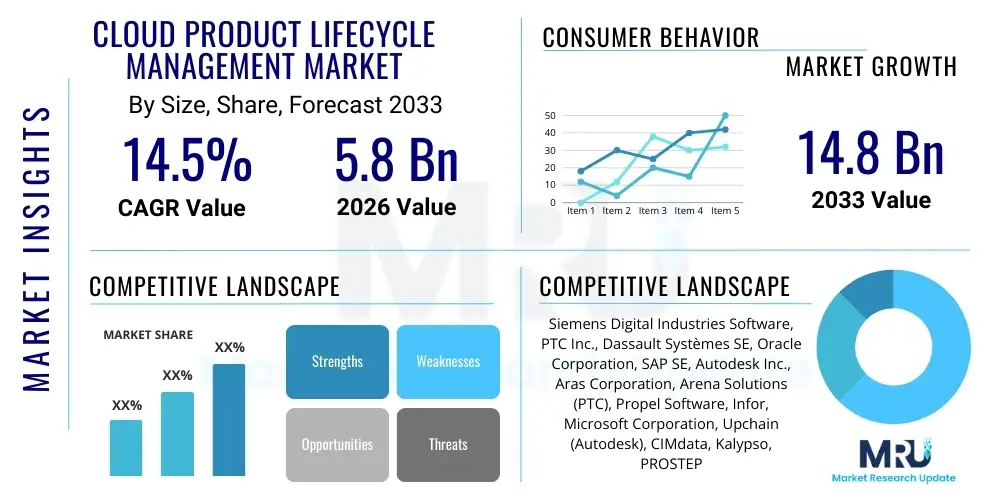

The competitive landscape is subject to strong impact forces. Porter’s Five Forces analysis highlights moderate rivalry among existing competitors, driven by brand reputation and distribution networks, but high pressure from supplier bargaining power due to the specialized nature of conductive polymers and certified components required for sole manufacturing. Buyer bargaining power is also significant, especially from large multinational corporations demanding volume discounts and stringent customization capabilities. The threat of new entrants is moderate, stabilized by the high barrier to entry associated with obtaining international safety certifications and establishing reliable material supply chains. Overall, the market dynamics favor established players capable of continuous R&D investment in material science and ergonomic design, capitalizing on the persistent need for reliable, certified static control solutions.

Segmentation Analysis

The ESD Safety Shoes Market is comprehensively segmented based on product type, material, application, and end-use industry, reflecting the diverse operational environments requiring static control. Product type segmentation distinguishes between ESD (Electrostatic Dissipative) shoes, which offer moderate resistance for controlled dissipation, and Conductive shoes, which offer very low resistance for rapid static discharge, typically used in highly sensitive environments like explosives manufacturing or certain defense applications. This differentiation is critical as improper resistance levels can either fail to dissipate charge effectively or pose a safety hazard to the wearer.

Segmentation by material is crucial, focusing on the composition of the sole and the shoe upper. The sole often utilizes specialized rubber, polyurethane (PU), or thermoplastic elastomer (TPE) compounds mixed with carbon particles or other conductive fillers to ensure consistent resistivity. The upper material varies based on the environment; leather is common in heavy manufacturing, while specialized synthetic fabrics are necessary for maintaining cleanliness and breathability in cleanroom environments. Further segmentation based on safety features includes standard toe protection (steel or composite toe) and specialized features like puncture resistance or slip resistance, ensuring the footwear meets multiple occupational safety requirements concurrently.

The end-use industry segmentation provides the clearest insight into demand drivers, with the Electronics and Semiconductor industry dominating the market share due to the extreme sensitivity of its products. However, significant growth is observed in the Automotive, Aerospace, and Pharmaceutical sectors as these industries integrate more sophisticated electronic controls and adhere to stricter quality standards regarding particle and static control. Geographic segmentation remains pivotal, with market strategies needing to adapt to regional regulatory bodies (e.g., ANSI in the US, EN ISO in Europe, and GB standards in China).

- By Product Type:

- Electrostatic Dissipative (ESD) Shoes

- Conductive Shoes

- By Material Type:

- Leather

- Synthetic Fabric (for Cleanrooms)

- Polyurethane (PU) Sole

- Rubber Sole

- By Toe Protection:

- Steel Toe

- Composite Toe (Non-metallic)

- Soft Toe

- By End-Use Industry:

- Electronics and Semiconductor Manufacturing

- Automotive and Aerospace

- Pharmaceutical and Biotechnology

- Chemical and Petrochemical

- Others (Data Centers, Defense)

Value Chain Analysis For ESD Safety Shoes Market

The value chain for the ESD Safety Shoes market begins with upstream activities, primarily involving the procurement of specialized raw materials. This includes certified conductive polymers, high-grade leather or advanced synthetic textiles for the upper, and crucial components like non-metallic conductive inserts and specialized stitching materials. The reliability of the final product hinges entirely on the consistency and quality assurance of these upstream suppliers, particularly those providing the proprietary conductive compounds that define the shoe's core functionality. Manufacturers often maintain long-term partnerships with these specialized material suppliers to ensure compliance with strict ESD standards and avoid contamination that could compromise electrical properties.

The midstream phase involves the core manufacturing process, which is complex due to the dual requirements of safety (impact, puncture resistance) and electrical performance (consistent resistivity). Manufacturing techniques include direct injection molding for soles to embed the conductive material uniformly and precision stitching to ensure electrical pathways are maintained throughout the shoe structure. Quality control is paramount at this stage, requiring continuous testing of sample shoes for resistivity ranges (between 10^5 and 10^9 ohms for dissipative footwear) and mechanical endurance, often exceeding standard PPE testing protocols due to the sensitivity of the end-user environment.

Downstream activities focus on distribution and reaching the end-user. Distribution channels are typically specialized, utilizing both direct sales models for large industrial clients (e.g., semiconductor fabs) who require bulk orders and customized specifications, and indirect channels through certified safety equipment distributors and specialized cleanroom supply houses. The role of indirect channels is essential for penetrating smaller enterprises and ensuring the availability of replacement units. The emphasis in the downstream market is on technical support, documentation of compliance certificates, and training for end-users on proper usage and maintenance, critical for maintaining the shoe's ESD properties throughout its service life.

ESD Safety Shoes Market Potential Customers

The primary customers for ESD safety shoes are organizations operating environments classified as Electrostatic Protected Areas (EPAs), where the presence of static charge poses a measurable threat to product quality or personnel safety. These end-users are highly regulated, technically sophisticated, and prioritize compliance and reliability over marginal cost savings. The largest cohort of buyers comes from the Electronics and Semiconductor industry, including integrated device manufacturers (IDMs), foundries, and contract electronic manufacturers (CEMs) involved in microchip fabrication, printed circuit board (PCB) assembly, and final product testing. Their demand is driven by the necessity to comply with global ESD standards (like IEC 61340) to minimize yield loss caused by latent or catastrophic electronic component damage.

Secondary but rapidly growing customer segments include the defense and aerospace industries, particularly facilities involved in assembling guidance systems, sensitive communication equipment, and pyrotechnic devices, where static discharge poses both functional failure and ignition hazards. Furthermore, the Pharmaceutical and Biotechnology sectors are increasingly adopting ESD footwear, not only for protecting sensitive lab equipment but also for preventing dust attraction in cleanrooms, where maintaining particle control is essential for sterilization and product purity. These buyers often require additional certifications, such as resistance to chemical spills and the ability to withstand autoclave cleaning processes.

The purchasing decisions within these customer bases are complex, involving safety managers, procurement specialists, and often, industrial engineers. The key determinants for purchase are compliance certification, documented resistance consistency, comfort/ergonomics (to ensure worker acceptance and sustained use), and the manufacturer's demonstrated supply chain stability and technical support capabilities. Since ESD footwear is a non-negotiable component of a facility’s ESD control plan, buyers typically source from reputable global suppliers who can guarantee product integrity and technical adherence to specific EPA requirements, often resulting in long-term procurement contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $1.95 Billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Uvex Safety Group, Honeywell International Inc., Cofra S.r.l., Elten GmbH, Jallatte, Bata Industrials, Sesto Senso S.r.l., Safety Jogger, PUMA SAFETY, Black Hammer Safety Footwear, Ejendals AB, Lowa, Delta Plus Group, KEEN Utility, Dr. Martens (Airwair International Ltd.), Securite, HECCO Safety Shoes, MTS Safety Shoes, Red Wing Shoes, STZ Safety Shoes. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ESD Safety Shoes Market Key Technology Landscape

The technological evolution of ESD safety footwear focuses heavily on material science innovation aimed at achieving permanent, reliable static dissipation properties alongside superior comfort and durability. A primary technological focus is the development of proprietary conductive compounds for the outsoles, often involving specialized formulations of polyurethane (PU) or advanced rubber mixed with carbon nanotubes or specific antistatic agents. This technology ensures the volumetric and surface resistance falls precisely within the required safety window (typically 106 to 108 ohms for dissipative models) for the entire lifespan of the shoe, resisting environmental factors like humidity and wear that often compromise older generations of antistatic materials.

Beyond material composition, advancements in construction technology are critical. Direct injection molding (DIM) techniques are widely utilized to seamlessly bond the conductive sole to the shoe upper, eliminating potential electrical discontinuities. Furthermore, the integration of composite (non-metallic) toe caps and puncture-resistant midsoles, often made from Kevlar or high-density plastic, addresses the dual necessity of protection against mechanical hazards while ensuring the footwear remains entirely non-magnetic and metal-free. This composite technology is particularly valuable in highly sensitive environments, such as MRI rooms or certain military applications, where magnetic interference is unacceptable.

A burgeoning technological trend is the incorporation of 'smart' elements, moving ESD shoes beyond passive protection into active monitoring tools. Although currently niche, this involves embedding miniature, durable sensor tags (e.g., RFID or passive NFC tags) into the shoe structure. While these tags do not actively measure conductivity, they enable automated inventory management, track usage duration, and facilitate compliance checks by confirming the worker is wearing the appropriate certified footwear for their zone. Future innovations are expected to include integrated monitoring systems that periodically verify the shoe's static dissipation path without requiring external manual testing, significantly improving real-time safety management in large-scale industrial operations.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing and largest market for ESD safety shoes, driven primarily by the colossal manufacturing bases in China, Taiwan, South Korea, and Vietnam. The region’s dominance is underpinned by its position as the global hub for semiconductor fabrication and consumer electronics assembly. Governments in this region are increasingly adopting international safety standards to protect the large industrial workforce and secure supply chain quality, fueling mandatory adoption. Investment in new Giga-factories and advanced cleanrooms dictates a continuous high demand for specialized, high-performance ESD footwear.

- North America: The North American market is characterized by high safety standards (ANSI, CSA) and strong demand from the aerospace, medical device manufacturing, and high-tech defense sectors. Growth here is steady and mature, focused on quality, durability, and ergonomic design. The market places a premium on highly certified products and solutions tailored for complex military or laboratory environments. Regulatory compliance is extremely strict, often leading to replacement cycles based on mandated longevity rather than just wear and tear, ensuring consistent revenue streams for manufacturers.

- Europe: Europe maintains a mature market influenced heavily by strict European Norm (EN) standards, particularly EN ISO 20345 (safety footwear) combined with ESD requirements defined in EN 61340. Germany, France, and the UK are leading consumers, particularly in the automotive electronics, chemicals, and precision engineering industries. The European market exhibits a strong preference for sustainable manufacturing practices and lightweight, comfortable designs, pushing innovation towards eco-friendly materials that still guarantee premium ESD performance.

- Latin America (LATAM): The LATAM market, while smaller, is growing steadily, largely fueled by foreign direct investment in automotive assembly plants (Mexico, Brazil) and regional expansion of pharmaceutical and light electronics manufacturing. Adoption is driven by multinational corporations implementing global safety standards in their regional facilities. Price sensitivity remains a factor, but the increasing integration into global supply chains necessitates adherence to international ESD protection protocols.

- Middle East and Africa (MEA): MEA represents an emerging market, driven by investments in petrochemical facilities, specialized industrial zones, and localized electronics assembly operations. Growth is concentrated in the Gulf Cooperation Council (GCC) countries, where large-scale infrastructure projects and emerging technology sectors necessitate modern safety equipment. Adoption is often dictated by project specifications tied to international engineering and safety consultancies, leading to demand for certified European or North American standard products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ESD Safety Shoes Market.- Uvex Safety Group

- Honeywell International Inc.

- Cofra S.r.l.

- Elten GmbH

- Jallatte

- Bata Industrials

- Sesto Senso S.r.l.

- Safety Jogger

- PUMA SAFETY

- Black Hammer Safety Footwear

- Ejendals AB

- Lowa

- Delta Plus Group

- KEEN Utility

- Dr. Martens (Airwair International Ltd.)

- Securite

- HECCO Safety Shoes

- MTS Safety Shoes

- Red Wing Shoes

- STZ Safety Shoes

Frequently Asked Questions

Analyze common user questions about the ESD Safety Shoes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between ESD, Conductive, and Antistatic safety shoes?

ESD (Electrostatic Dissipative) shoes provide a controlled range of electrical resistance (106 to 108 ohms), ensuring static is slowly dissipated without causing a shock. Conductive shoes have very low resistance (less than 105 ohms) for rapid charge grounding, typically used in hazardous material handling. Antistatic shoes have a higher resistance range (up to 109 ohms) and are suitable for less sensitive environments, often designed simply to prevent static buildup on the person.

Why are ESD safety shoes mandatory in semiconductor manufacturing environments?

In semiconductor manufacturing, electronic components (chips, wafers) are extremely vulnerable to damage from electrostatic discharge (ESD) events, which can occur at potentials far below the human perception threshold. ESD shoes are mandatory because they form a crucial part of the grounding path, continuously shunting static charges away from the worker’s body, thereby protecting high-value products from latent or catastrophic electronic failure.

How often should ESD safety footwear be tested or replaced?

While replacement frequency depends heavily on wear conditions, ESD footwear must be tested daily using a specialized wrist strap and footwear checker upon entering an Electrostatic Protected Area (EPA) to ensure the resistance pathway is operational. Most manufacturers recommend replacing the shoes every 6 to 12 months in continuous use environments, or immediately if testing reveals the electrical resistance falls outside the compliant range.

Do composite toe ESD shoes maintain their static dissipation properties compared to steel toe versions?

Yes, composite toe ESD safety shoes are engineered to maintain consistent static dissipation properties. The electrical conductivity relies on specialized sole materials, not the toe cap material. Composite (non-metallic) toe caps are often preferred in ESD environments as they prevent magnetic interference and do not require additional insulation to mitigate electrical shock hazards if they were to accidentally come into contact with live wiring, offering a safer and lighter option.

What major regulatory standards govern the ESD Safety Shoes Market globally?

Key global regulatory standards include the International Electrotechnical Commission (IEC) 61340-5-1, which defines EPA requirements; the American National Standards Institute (ANSI) Z41 or ASTM F2413 for safety compliance; and the European Norm (EN) ISO 20345, specifically with the addition of the 'SD' (Static Dissipative) or 'CD' (Conductive) marking according to the EN 61340 standard for electrical performance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager