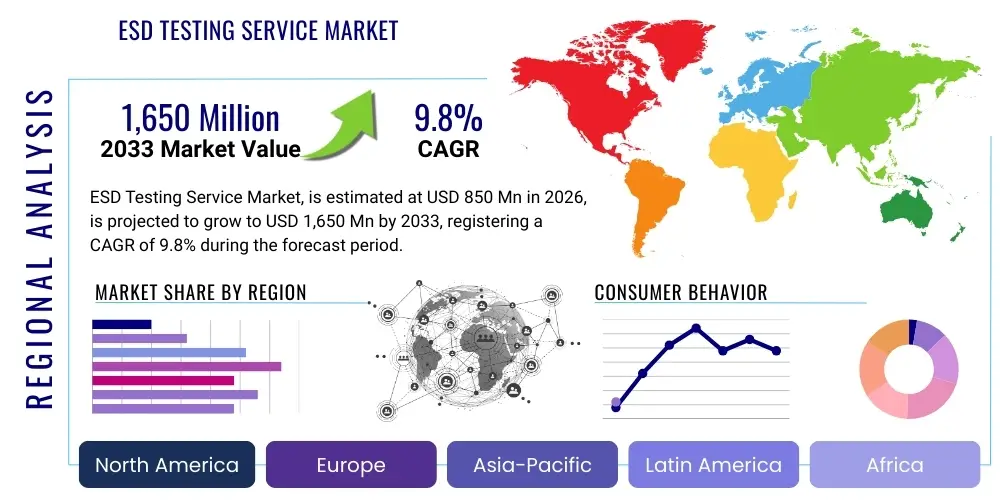

ESD Testing Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438379 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

ESD Testing Service Market Size

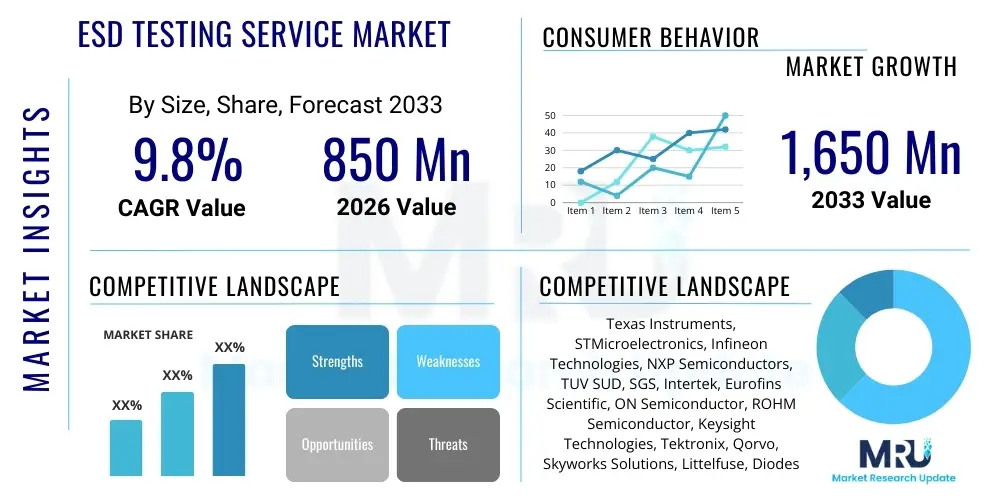

The ESD Testing Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at $850 Million in 2026 and is projected to reach $1,650 Million by the end of the forecast period in 2033.

ESD Testing Service Market introduction

The ESD Testing Service Market encompasses specialized verification and validation processes designed to assess the susceptibility of electronic components, integrated circuits (ICs), and completed electronic systems to electrostatic discharge (ESD) events. These services are critical for ensuring the reliability, longevity, and functional integrity of modern electronic devices across various demanding applications. Given the continuous trend towards miniaturization in semiconductor manufacturing, coupled with lower operating voltages, electronic components are becoming increasingly sensitive to transient electrical stresses, making comprehensive ESD testing an indispensable part of the product development lifecycle. The market is primarily driven by stringent regulatory compliance requirements, the escalating complexity of semiconductor designs, and the necessity to mitigate catastrophic field failures caused by latent or permanent ESD damage. Effective ESD testing helps manufacturers identify weak points in their products early, significantly reducing warranty costs and enhancing consumer trust, thereby justifying the robust investment in specialized testing facilities and expert consulting.

ESD testing services span a wide range of methodologies, including Human Body Model (HBM), Machine Model (MM), Charged Device Model (CDM), and increasingly, System-Level ESD testing (IEC 61000-4-2). These services are delivered by specialized independent laboratories, captive testing facilities of major semiconductor firms, and dedicated third-party verification providers. The product description of the service involves the deployment of highly calibrated simulators, sophisticated probing systems, and advanced measurement equipment capable of generating and analyzing ESD transients in a controlled environment. Major applications of these services are concentrated in sectors like consumer electronics, where device failure rates must be minimal; the automotive industry, which demands extreme reliability for safety-critical systems; and the aerospace sector, where mission failure due to component malfunction is unacceptable. The rising demand for high-speed data transmission equipment in the telecommunications sector also contributes significantly to market growth, as high-frequency components are particularly vulnerable to ESD events during manufacturing and handling.

The principal benefits derived from utilizing professional ESD testing services include accelerated time-to-market due to rapid design iteration support, guaranteed adherence to international standards (such as JEDEC and ISO specifications), and enhanced product quality assurance. Driving factors include the proliferation of IoT devices that incorporate highly sensitive sensors and microcontrollers, the rapid expansion of 5G infrastructure requiring robust base station components, and the move towards electrification in the automotive sector, necessitating rigorous testing of power electronics and associated control units. Furthermore, the global supply chain complexity increases the risk of component exposure to ESD during logistics and assembly, making pre-qualification and periodic re-testing services essential. The expertise offered by third-party providers often surpasses the capabilities of in-house teams, particularly for niche testing methodologies or complex failure analysis requirements, fueling the outsourcing trend within the ESD testing domain.

ESD Testing Service Market Executive Summary

The ESD Testing Service Market is positioned for strong growth, underpinned by fundamental shifts in the global technology landscape, primarily driven by the increasing density and performance requirements of advanced semiconductors and electronic systems. Current business trends indicate a significant push towards holistic system-level ESD testing, moving beyond traditional component-level qualification to address real-world transient immunity challenges in assembled devices. Furthermore, there is a pronounced consolidation among testing laboratories seeking to offer a broader portfolio of compliance services, including electromagnetic compatibility (EMC) alongside ESD verification. Key players are investing heavily in automated testing platforms capable of handling high-volume testing with greater precision and repeatability, responding directly to the rapid scaling of consumer electronics and automotive manufacturing. The emphasis on intellectual property protection and the need for independent, verifiable test reports further solidify the role of specialized third-party providers, indicating that outsourcing will remain a primary market driver.

Regionally, the market exhibits divergent yet robust growth patterns. Asia Pacific (APAC), led by manufacturing powerhouses like China, Taiwan, South Korea, and Japan, commands the largest market share due to its concentration of major semiconductor fabrication facilities (fabs) and outsourced semiconductor assembly and test (OSAT) providers, coupled with massive consumer electronics production volumes. North America and Europe, while representing more mature markets, demonstrate strong demand driven by high-value applications in aerospace, defense, and high-performance computing, emphasizing complex reliability standards and qualification processes. These regions are also at the forefront of developing new ESD testing standards and novel protection mechanisms. Emerging markets in Latin America and MEA are beginning to show accelerated adoption, largely driven by regulatory harmonization efforts and foreign direct investment in localized assembly and manufacturing operations, necessitating local compliance testing expertise.

Segmentation trends highlight the increasing dominance of System Level Testing (SLT) due to growing regulatory pressure to certify complete products rather than just individual components. Within the end-use segment, the Automotive sector is demonstrating the highest CAGR, primarily because of the stringent reliability requirements for autonomous driving systems, sensor integration, and sophisticated in-vehicle infotainment. Technological segmentation reveals a steady shift towards advanced methodologies like Transmission Line Pulse (TLP) testing, which provides deeper physical insights into the ESD failure mechanisms of new technology nodes, crucial for advanced IC design. Furthermore, the Service Model segment confirms that while large captive manufacturers maintain internal testing labs, the specialized nature of advanced testing and the need for accredited certification drives consistent market momentum towards Third-Party Service Providers, enabling capital expenditure avoidance and access to certified expertise across multiple international standards.

AI Impact Analysis on ESD Testing Service Market

Common user questions regarding AI's influence on the ESD Testing Service Market frequently revolve around its potential to automate complex failure analysis, predict weak spots in designs before physical prototyping, and optimize the testing parameter selection process. Users are keen to understand if AI can reduce the prohibitively high cost and time associated with iterative physical testing and whether machine learning algorithms can provide faster, more accurate diagnostics than traditional manual inspection methods. Key concerns center on the validation of AI-derived test protocols and the necessary expertise required to manage these sophisticated systems. Overall, the prevailing expectation is that AI will transform the market by transitioning ESD qualification from a reactive, empirical process to a proactive, predictive analytical discipline, thereby significantly enhancing the efficiency and effectiveness of ESD protection strategy development and verification.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is poised to revolutionize several aspects of the ESD testing workflow, moving beyond simple data logging to genuine predictive diagnostics. In design stages, AI can analyze vast historical datasets of material properties, layout parasitic resistances, and previous ESD failure points to predict the ESD susceptibility of new semiconductor designs with remarkable accuracy, drastically reducing the number of physical prototypes required. This capability allows design teams to employ predictive modeling for Human Body Model (HBM) and Charged Device Model (CDM) performance, optimizing on-chip protection structures (like clamps and buffers) iteratively within a simulation environment before tape-out. For service providers, this translates into offering high-value consulting services focused on simulation validation rather than purely physical verification, elevating the strategic importance of the testing partner.

Furthermore, during the physical testing phase, AI tools are used for advanced data pattern recognition, rapidly identifying subtle shifts or anomalies in current-voltage (I-V) curves captured during Transmission Line Pulse (TLP) measurements. These automated analytics significantly accelerate failure root cause analysis, a process traditionally requiring highly skilled engineers and lengthy microscopic inspection. AI-powered monitoring software can optimize the calibration and performance of ESD simulators, ensuring higher test repeatability and reducing equipment downtime. The increasing utilization of AI in test report generation also enhances compliance documentation efficiency, summarizing complex results and linking identified failure mechanisms directly to recommended design mitigation strategies, thereby streamlining the entire qualification cycle and setting a new benchmark for service delivery speed and depth of insight.

- AI-driven predictive modeling reduces physical prototyping requirements for ESD structures.

- Machine Learning algorithms optimize TLP testing parameters and accelerate I-V curve analysis for failure detection.

- Automated diagnostics improve root cause analysis efficiency, minimizing reliance on manual inspection techniques.

- AI enhances test equipment calibration and monitoring, ensuring high data repeatability and system uptime.

- Integration of AI tools facilitates the creation of comprehensive, standards-compliant test reports and design recommendations.

- Smart data analytics enable better correlation between simulation results and physical test outcomes (Simulation-to-Test correlation).

- Adoption of AI supports the development of sophisticated system-level test sequences that mimic real-world transient conditions more accurately.

DRO & Impact Forces Of ESD Testing Service Market

The dynamics of the ESD Testing Service Market are characterized by a strong interplay between regulatory enforcement, technological complexity, and the fundamental financial pressures on manufacturers. The primary drivers (D) include the relentless scaling down of semiconductor geometries, the explosive growth in high-reliability applications (e.g., electric vehicles and medical devices), and increasingly stringent global standards requiring mandatory certification of ESD robustness. Restraints (R) largely center around the high capital investment required for state-of-the-art testing equipment, the scarcity of certified, highly skilled ESD engineering experts, and the lack of universal standardization across different application sectors, which complicates international compliance. Opportunities (O) are abundant in emerging markets, in the development of specialized testing protocols for unique materials (like GaN and SiC power devices), and in leveraging automation and AI to deliver testing-as-a-service models efficiently. These forces collectively exert significant impact, necessitating continuous investment in both specialized personnel and advanced technology to maintain relevance and competitive advantage within the market ecosystem.

Key drivers strongly influencing market growth include mandatory compliance requirements for system-level immunity, particularly the IEC 61000-4-2 standard, which often dictates third-party testing for market access in numerous jurisdictions. The rising complexity of mixed-signal integrated circuits (ICs) that combine sensitive analog and high-speed digital sections on a single chip necessitates more sophisticated and nuanced testing methodologies to ensure performance under stress. Moreover, the increasing adoption of outsourced manufacturing models means that original equipment manufacturers (OEMs) rely heavily on accredited third-party labs to verify component quality received from geographically diverse supply chains. This reliance on independent verification minimizes liability risks associated with component-induced field failures, driving sustained demand for professional testing services rather than solely internal quality control checks. The competitive landscape itself acts as a driver, where superior ESD robustness becomes a crucial differentiator for component suppliers seeking contracts from Tier 1 manufacturers.

However, the market faces considerable restraints that limit expansion speed. The cost of acquiring and maintaining certified ESD test equipment, such as advanced TLP systems and automated failure analysis tools, presents a significant barrier to entry for smaller service providers and an operational cost challenge for established players. Furthermore, the expertise required to accurately interpret complex ESD failure modes and develop effective mitigation strategies demands specialized education and experience, leading to a critical shortage of qualified personnel globally. This talent gap often bottlenecks service capacity. Addressing these challenges through strategic partnerships, technological innovation (like remotely operated testing), and focused educational programs will be crucial for unlocking future growth potential and ensuring service quality across all regional markets, transforming restraints into long-term strategic investments.

Segmentation Analysis

The ESD Testing Service Market is structurally segmented based on the level of testing applied (Type), the hardware utilized (Component), the final end-user industry, and the operational model (Service Model). This segmentation reflects the highly diverse requirements inherent in the electronic manufacturing ecosystem, ranging from microscopic component-level analysis performed during semiconductor research and development to full system qualification required before commercial deployment. Analyzing these segments provides critical insights into specific high-growth niches, demonstrating that the market is moving away from standardized, routine checks toward specialized, customized testing protocols tailored to unique material characteristics and application environments, particularly in areas like high-power switching and RF communication.

By Type, the market heavily relies on Device Level Testing during the design validation phase, crucial for semiconductor vendors, but is increasingly shifting revenue generation towards System Level Testing. This trend is driven by regulatory bodies and major end-users, especially in automotive and industrial sectors, demanding proof that the final product maintains immunity when subjected to real-world transient events. The complexity of system-level testing, which involves multiple interfaces, cabling, and enclosure effects, often necessitates more intensive and specialized service provider involvement. Meanwhile, Wafer Level Testing, though smaller in volume, remains essential for high-volume manufacturing environments, offering early detection of process-induced defects before dicing and packaging, thereby improving overall yield and reducing downstream costs.

The segmentation by End-Use Industry clearly illustrates the criticality of electronics reliability across modern manufacturing. The Consumer Electronics segment generates the largest volume of tests due to sheer production scale, focusing on high-volume, rapid compliance verification. Conversely, the Automotive and Industrial segments, while lower in volume, command higher service pricing due to the extreme reliability and functional safety standards (e.g., ISO 26262) mandated for their products. These industries require extensive qualification periods and specialized stress testing, making them the fastest-growing and highest-value segments in the service market, demanding testing partners who possess both accredited laboratories and deep industry domain expertise necessary for complex certification procedures.

- By Type

- Device Level Testing (HBM, CDM, MM)

- System Level Testing (IEC 61000-4-2)

- Wafer Level Testing

- By Component

- ESD Simulators

- Probes and Accessories

- Test Fixtures

- Monitoring and Analysis Software

- By End-Use Industry

- Consumer Electronics

- Automotive

- Industrial

- Telecommunications

- Healthcare

- Aerospace & Defense

- By Service Model

- In-house Testing

- Third-Party Service Providers

Value Chain Analysis For ESD Testing Service Market

The value chain for the ESD Testing Service Market begins upstream with the manufacturers of specialized testing equipment and instrumentation, including ESD simulators, TLP systems, and precision probes. These manufacturers (e.g., Keysight, Tektronix) provide the essential capital assets that define the technical capabilities of the service providers. High quality and stringent calibration requirements are paramount at this initial stage, as the accuracy of the test results directly depends on the equipment's performance and certification. Suppliers of ancillary components, such as custom test fixtures and compliant handling tools, also form a critical part of the upstream segment, ensuring that samples are tested under conditions that accurately mimic real-world scenarios without introducing extraneous electrical noise or parasitic effects. Innovation at the upstream level, such particularly in ultra-high-speed transient generation and measurement, directly translates into better service offerings downstream.

The midstream of the value chain is dominated by the ESD testing service providers themselves. These entities—comprising captive corporate labs, independent third-party accredited laboratories (e.g., TUV SUD, SGS), and specialized boutique consulting firms—add value through expertise, accreditation, and execution. They leverage the upstream equipment to design and execute specific test protocols tailored to client needs and international standards. The primary value addition here lies in the interpretation of complex measurement data, detailed failure analysis, and the preparation of officially recognized certification reports necessary for market entry. Direct distribution occurs when major semiconductor firms or OEMs maintain large, centralized in-house testing facilities, fulfilling the majority of their routine validation needs internally, representing the 'In-house Testing' service model segment.

The downstream segment consists of the end-users: the Original Equipment Manufacturers (OEMs), Tier 1 suppliers, and semiconductor design houses that rely on the test reports for final product qualification, mitigating liability, and ensuring compliance. Indirect distribution is facilitated by third-party testing labs, which act as crucial intermediaries between component manufacturers and final system integrators. These labs offer accessibility to specialized equipment and expertise that end-users cannot justify owning internally, thereby democratizing access to high-end qualification services. The efficiency and reliability of the distribution channel, whether direct (captive labs serving internal clients) or indirect (accredited labs serving external clients), directly impacts time-to-market for electronic products globally.

ESD Testing Service Market Potential Customers

The potential customers for the ESD Testing Service Market are concentrated within industries that manufacture or heavily rely on mission-critical or high-volume electronic devices and integrated circuits. End-users fall broadly into two categories: those involved in the physical creation of the components and systems (Semiconductor Vendors, OSATs, EMS providers) and those who deploy these systems in their final products (Automotive OEMs, Telecom providers, Industrial Automation firms). The complexity and sensitivity of modern electronics mean that virtually every company involved in the value chain of advanced technology necessitates these services, either to validate the reliability of incoming components or to qualify their finished goods against regulatory benchmarks.

Semiconductor manufacturers and fabless design houses constitute the foundational customer base. They require Device Level and Wafer Level testing to validate their silicon designs, ensure manufacturing process robustness, and meet JEDEC standards before component shipment. Their purchasing decisions are driven by the need for advanced technical capabilities, such as TLP testing for characterizing ESD protection structures at the silicon level. The fast-moving Consumer Electronics sector, encompassing smartphone, laptop, and IoT device manufacturers, demands high-throughput System Level testing to comply with international standards like IEC 61000-4-2, prioritizing speed and cost-efficiency in large volumes of regulatory compliance testing.

Crucially, the Automotive and Aerospace sectors represent the highest-value customers due to their uncompromising requirements for functional safety and long-term reliability. Automotive Tier 1 suppliers (for ECUs, sensors, and power electronics) require specialized testing against standards such as ISO 10605, often demanding highly customized stress profiles that simulate specific vehicular environments. These clients seek partners with extensive industry accreditation and a deep understanding of functional safety standards, prioritizing quality and comprehensive failure analysis over mere test volume. The ongoing electrification of vehicles ensures this segment will remain the primary engine for high-value service expansion.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million |

| Market Forecast in 2033 | $1,650 Million |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Texas Instruments, STMicroelectronics, Infineon Technologies, NXP Semiconductors, TUV SUD, SGS, Intertek, Eurofins Scientific, ON Semiconductor, ROHM Semiconductor, Keysight Technologies, Tektronix, Qorvo, Skyworks Solutions, Littelfuse, Diodes Incorporated, Advantest, Cohu, Inc., Credence Systems, Chroma ATE Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ESD Testing Service Market Key Technology Landscape

The technological backbone of the ESD Testing Service Market is defined by high-precision transient generators and advanced measurement systems, crucial for simulating real-world and worst-case ESD events with high repeatability and accuracy. The foundational methodologies—Human Body Model (HBM) and Charged Device Model (CDM)—remain standard for basic component qualification but are increasingly being supplemented by more sophisticated techniques. Transmission Line Pulse (TLP) testing, including Very-Fast TLP (VF-TLP), represents a significant technological advancement. TLP testing provides detailed current-voltage characteristics of ESD protection devices, enabling engineers to precisely measure the device’s triggering and holding voltages and understand the physical failure mechanisms, which is impossible using traditional pass/fail methods. This technology is indispensable for validating protection circuits designed for advanced semiconductor nodes operating at extremely low voltages, where marginal performance differences can lead to system failures.

Beyond component characterization, the technology landscape is being shaped by the move towards sophisticated System Level ESD testing setups required to meet the demanding IEC 61000-4-2 standard. These advanced test benches require specialized near-field probes, high-bandwidth oscilloscopes, and shielded chambers to accurately measure the effects of ESD coupling on complex printed circuit boards (PCBs) and assembled systems. Critical technological requirements include accurate replication of the discharge path, reliable transient capturing capabilities in noisy environments, and automated test sequence generation for large systems. Furthermore, the rise of advanced materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) in power electronics demands new testing fixtures and specialized TLP parameters tailored to their unique thermal and electrical characteristics, driving innovation in custom probe and fixture design to handle higher current and voltage surges safely and accurately.

Software and automation are also pivotal technology drivers. Modern ESD testing involves generating massive amounts of data, necessitating powerful monitoring and analysis software that can integrate test results, manage calibration records, and generate compliance reports efficiently. The focus here is on reducing test setup time and minimizing operator variability. The development of integrated software platforms capable of correlating TLP data with design simulation tools allows for tighter feedback loops between testing and R&D. Furthermore, the emerging use of robotics and fully automated handling systems for component placement and testing is enhancing throughput, particularly in high-volume production test environments, significantly lowering the per-unit testing cost and ensuring continuous, repeatable testing cycles without human interference or handling-related damage, thereby maintaining the highest standards of measurement fidelity and overall service efficiency.

Regional Highlights

The global ESD Testing Service Market exhibits distinct regional dynamics, largely reflective of the concentration of semiconductor manufacturing, automotive production, and regulatory maturity. Asia Pacific (APAC) holds the dominant share, acting as the epicenter of global electronics production. This dominance is driven by high volumes of manufacturing in countries like China, Taiwan, South Korea, and Japan, which host the world’s largest semiconductor foundries, OSAT providers, and consumer electronics assembly plants. The continuous investment in establishing new fabrication facilities, coupled with the rapid growth of the regional electric vehicle (EV) market, ensures sustained high demand for both foundational and advanced ESD testing services. Furthermore, local regulatory bodies are increasingly aligning with international ESD standards, necessitating compliance testing for products intended for domestic consumption as well as export, further solidifying APAC's market leadership and high CAGR forecast.

North America represents a highly mature market characterized by demand for high-value, specialized testing services, particularly within the Aerospace & Defense and high-performance computing (HPC) sectors. This region is home to numerous advanced technology design houses and major semiconductor innovators who require cutting-edge validation, often involving proprietary or highly stringent military-grade ESD standards. Service providers in North America focus less on mass-volume compliance and more on complex failure analysis, intellectual property protection during testing, and development of next-generation ESD protection methodologies (e.g., using advanced TLP techniques). The presence of leading test equipment manufacturers and standardization bodies further cements North America’s role as a technological frontrunner, frequently setting the pace for new testing best practices and equipment deployment globally.

Europe maintains a strong market presence, particularly driven by its highly regulated Automotive and Industrial automation sectors. European manufacturers must adhere rigorously to environmental and safety standards, including the comprehensive application of ISO 10605 and IEC 61000-4-2, pushing consistent demand for accredited third-party testing labs. Countries like Germany, France, and the UK, with their substantial automotive R&D and manufacturing base, are key consumers of these services. European service providers often excel in offering bundled services, combining ESD verification with comprehensive Electromagnetic Compatibility (EMC) and functional safety testing, appealing to clients seeking holistic compliance solutions. Meanwhile, Latin America and the Middle East & Africa (MEA) are emerging regions, experiencing growth primarily through the localization of electronics assembly operations and increased foreign investment, signaling a rising long-term opportunity for international testing firms to establish accredited local service centers.

- Asia Pacific (APAC): Dominant market share fueled by mass manufacturing, semiconductor fabrication volume, and rapid growth in consumer electronics and automotive sectors (China, Taiwan, South Korea). Focus on high-throughput HBM/CDM and increasing SLT verification.

- North America: Mature market prioritizing specialized, high-reliability testing for Aerospace & Defense and HPC. Emphasis on advanced methodologies like VF-TLP and expert failure analysis consultation.

- Europe: Strong demand driven by rigorous automotive (ISO 10605) and industrial standards. Market characterized by bundled EMC/ESD testing services and adherence to strict regulatory environments.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging markets with accelerating growth due to increasing electronics assembly and governmental initiatives promoting localized technology adoption and regulatory harmonization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ESD Testing Service Market, encompassing specialized testing laboratories, major equipment manufacturers, and integrated device manufacturers providing captive services.- Texas Instruments

- STMicroelectronics

- Infineon Technologies AG

- NXP Semiconductors

- TUV SUD

- SGS SA

- Intertek Group plc

- Eurofins Scientific SE

- ON Semiconductor (Now Onsemi)

- ROHM Semiconductor

- Keysight Technologies

- Tektronix (a subsidiary of Danaher Corporation)

- Qorvo, Inc.

- Skyworks Solutions, Inc.

- Littelfuse, Inc.

- Diodes Incorporated

- Advantest Corporation

- Cohu, Inc.

- Credence Systems Corporation

- Chroma ATE Inc.

Frequently Asked Questions

Analyze common user questions about the ESD Testing Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Device Level and System Level ESD testing?

Device Level testing (HBM, CDM) assesses the robustness of individual integrated circuits (ICs) against ESD events during handling and assembly, focusing on component survivability. System Level testing (IEC 61000-4-2) evaluates the immunity of a complete, assembled electronic product to external ESD events that occur when the device is handled or operating in its intended environment, focusing on overall functional reliability.

Why is the Automotive sector driving significant growth in ESD testing services?

The automotive sector demands exceptional reliability for safety-critical systems like ADAS, ECUs, and power electronics, requiring stringent compliance with standards like ISO 10605. The move towards electric vehicles and highly automated driving increases component complexity and sensitivity, necessitating comprehensive, high-reliability testing that often exceeds consumer standards, thus driving high-value service demand.

How does Transmission Line Pulse (TLP) testing improve ESD service quality?

TLP testing provides detailed, quantitative current-voltage (I-V) characteristics of ESD protection devices, unlike traditional pass/fail tests. This data allows engineers to accurately characterize the performance of on-chip protection structures, identify weak spots, and optimize designs before mass production, crucial for advanced semiconductor technology nodes.

What role does Artificial Intelligence (AI) play in optimizing ESD testing?

AI optimizes ESD testing by providing predictive failure analysis during the design phase, reducing the need for physical prototypes. In the testing phase, ML algorithms accelerate the interpretation of complex TLP measurement data, rapidly identifying failure mechanisms and ensuring higher test repeatability and accuracy in generating compliance reports.

What are the main restraints impacting the growth of third-party ESD testing providers?

The main restraints are the substantial capital expenditure required to purchase and maintain high-end TLP and VF-TLP testing equipment, which have high calibration costs, and the acute global shortage of certified ESD engineers skilled in interpreting complex failure modes and developing advanced mitigation strategies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager