Espresso Coffee Bean and Coffee Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433857 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Espresso Coffee Bean and Coffee Powder Market Size

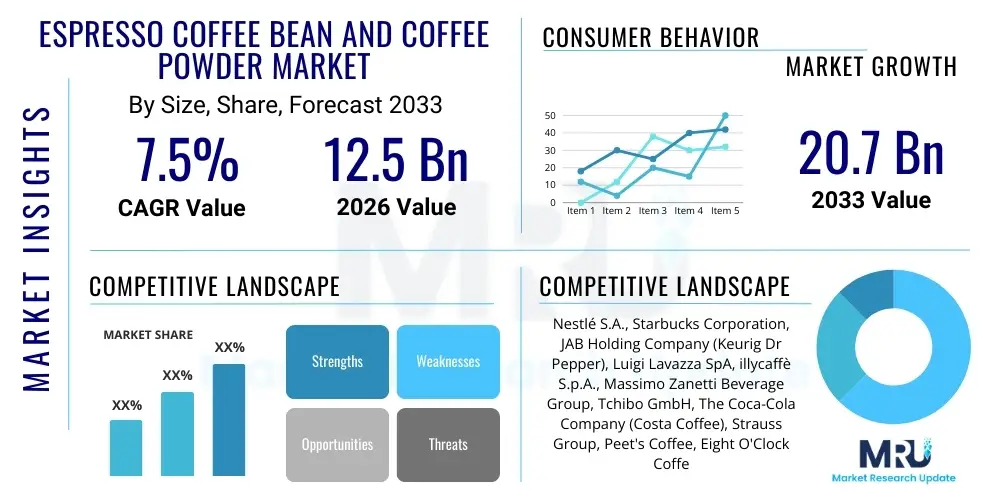

The Espresso Coffee Bean and Coffee Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 20.7 Billion by the end of the forecast period in 2033.

Espresso Coffee Bean and Coffee Powder Market introduction

The Espresso Coffee Bean and Coffee Powder Market encompasses the global trade and consumption of high-quality coffee products specifically formulated and processed for espresso brewing methods. This segment is characterized by stringent quality requirements regarding bean origin, roast profile (typically medium to dark), grind size, and density, ensuring optimal extraction under high pressure, critical for achieving the characteristic crema and robust flavor profile of true espresso. The market's foundational growth is intricately linked to cultural diffusion, where the sophisticated Italian-inspired coffee ritual has been adopted and localized globally, necessitating a consistent supply of beans suitable for high-pressure brewing systems. Market participants include multinational corporations with massive processing capabilities and small, artisanal roasters specializing in micro-lot, traceable specialty coffees. The demand matrix is shifting, increasingly favoring transparency regarding growing conditions, socio-economic impact on farmers, and sustainable environmental practices, transforming the procurement landscape into a highly ethical and complex operational challenge. Furthermore, the specialized nature of espresso preparation requires specific bean characteristics—often high-altitude Arabica—that provide the necessary acidity and aromatic complexity, differentiating this market significantly from commodity coffee segments.

Major applications of these products span across the ubiquitous HoReCa (Hotel, Restaurant, and Cafe) sector, which relies on high-volume consistency, specialized retail distribution (supermarkets, convenience stores), and the rapidly proliferating e-commerce channels, which serve the specialty home brewing segment. The demand surge is significantly underpinned by demographic shifts, particularly the increasingly affluent young adult demographic in fast-developing economies across Asia and Latin America adopting coffee consumption habits, often viewing espresso-based drinks as status symbols and integral parts of a modern lifestyle. Established markets, conversely, are experiencing a profound premiumization trend, where consumers, having refined their palates, are choosing ethically sourced, single-origin, and artisan-roasted coffees, demonstrating price inelasticity for perceived superior quality and sustainable sourcing credentials. Benefits derived from engaging with this market include access to superior flavor complexity, a robust and textural body in the final product, and the cultural association with sophisticated, European-style consumption patterns, which collectively reinforce consumer willingness to pay a substantial premium over standard drip or instant coffee products, solidifying the economic viability of the specialty segment.

Key driving factors include the rapid urbanization across regions like Southeast Asia and China, leading to greater exposure to Western cafe models, coupled with increased disposable income that fosters discretionary spending on luxury consumption items like high-end espresso. Technological advancements in packaging, particularly vacuum sealing and nitrogen flushing techniques, are crucial for preserving freshness and extending the shelf life of highly sensitive roasted beans, thereby facilitating long-distance distribution and supporting export growth from key processing hubs in Europe and North America. Moreover, the intense and rapidly escalating competition among global coffee chains necessitates consistent, high-quality sourcing of espresso ingredients, compelling market players to invest heavily in resilient, traceable supply chains and rigorous quality control measures from the initial harvesting stage on the farm to the final grinding and packaging processes. The convergence of macro-economic buoyancy, advanced technological applications, and deeply ingrained cultural shifts positions the espresso segment not merely as a growth sector but as a defining benchmark for quality and sustainability within the broader global coffee industry, promising sustained expansion despite external price volatility.

Espresso Coffee Bean and Coffee Powder Market Executive Summary

The global Espresso Coffee Bean and Coffee Powder Market is undergoing significant structural evolution, primarily steered by shifting business models emphasizing direct-to-consumer (D2C) engagement, facilitating personalized product offerings, and requiring substantial, proactive investment in verifiable sustainable sourcing and climate-resilient agricultural practices. Current business trends indicate a potent move toward hyper-customization, where consumers demand specific details regarding roast levels, precise varietals (with high-quality Arabica maintaining its dominance), and meticulously documented traceability information, transforming the procurement transaction into a highly detailed data exchange. Major global corporations are strategically pursuing vigorous mergers, acquisitions, and strategic partnerships to consolidate fragmented market share and vertically integrate their operations, a measure designed to secure reliable raw material access and exercise greater control over increasingly complex international distribution networks. This strategic vertical consolidation aims not only to optimize sophisticated supply chain efficiency but also to create buffers against the recurrent and severe volatility of coffee commodity prices, while simultaneously robustly addressing the pervasive consumer demand for demonstrable ethical and sustainable practices through globally recognized certification programs like Fair Trade, Rainforest Alliance, and proprietary corporate ethical sourcing standards.

Regional consumption trends distinctly highlight Europe, particularly mature markets such as Italy, Germany, and the United Kingdom, as the primary centers setting the benchmarks for quality, consumption frequency, and product innovation, particularly in sustainable packaging. Conversely, the Asia Pacific (APAC) region, spearheaded by rapidly modernizing economies including China, South Korea, and India, is unequivocally emerging as the dominant primary growth engine for volume expansion, driven by rapid adoption of Western-style cafe culture and persistently rising disposable incomes among the middle and upper classes. North America demonstrates robust and dynamic demand for highly specialized, high-end, and specialty coffee products, characterized by significant investment in novel cold brew espresso innovations and a strong, sustained focus on convenience realized through technologically advanced single-serve pods and highly efficient super-automatic machines. Furthermore, the increasingly complex regulatory environment, especially within the European Union concerning stringent food safety standards, origin labeling mandates, and upcoming deforestation regulations, significantly influences global import and processing standards, inevitably creating both high entry barriers for non-compliant actors and substantial opportunities for market players capable of demonstrating full compliance and transparency.

Analysis of segment trends conclusively reveals that the Whole Bean segment is capturing an accelerating share of market value, largely driven by affluent and discerning consumers who consciously prioritize peak freshness and the ceremonial ritual of grinding immediately prior to brewing, a practice particularly prevalent in specialty cafe environments and among serious home enthusiasts. In contrast, the high-volume Coffee Powder (Ground Coffee and standardized Pods/Capsules) segment maintains its high volume sales dominance, propelled significantly by the indispensable factors of convenience, rapid preparation, and reliable consistency required in high-throughput office environments and standardized residential brewing setups. Arabica coffee overwhelmingly dominates the product type segmentation due to its inherently superior flavor profile, complex acidity, and aromatic qualities that are optimally suited for the high-pressure extraction demands of espresso. Crucially, distribution channel analysis indicates that traditional supermarkets and hypermarkets remain the primary and dominant physical distribution channel for volume sales; however, e-commerce platforms are simultaneously registering the fastest growth rate, successfully offering small, artisanal roasters direct, low-overhead access to diverse global consumer bases, thereby profoundly disrupting established traditional retail pathways and increasing the competitive intensity across virtually all product and geographic segments.

AI Impact Analysis on Espresso Coffee Bean and Coffee Powder Market

User inquiries concerning AI's transformative role in the espresso market frequently revolve around achieving unprecedented levels of quality consistency, bolstering supply chain resilience against the unpredictable and severe impact of climate change on coffee production, and enabling the highly personalized consumer experiences that drive brand loyalty. Key thematic concerns articulated by market participants and consumers include analyzing how sophisticated AI models can effectively optimize complex agricultural practices (through smart farming techniques and accurate yield prediction), dramatically enhance efficiency in critical processing stages (specifically automated roasting and precision grinding optimization), and fundamentally improve downstream retail operations (via dynamic demand forecasting, highly granular inventory management, and personalized marketing campaigns). Users also widely express cautious concerns regarding the potential economic displacement of highly skilled human roasters and baristas if core judgment tasks become automated, yet this concern is typically balanced against the significant expectation that advanced AI tools could substantially elevate the inherent consistency, quality, and detailed traceability of premium espresso products, thereby powerfully justifying higher price points and guaranteeing perceived value for specialty offerings that rely heavily on reputation and trust. The emerging industry consensus strongly anticipates that AI will function not as a replacement but as a critical enabling tool for scaling high quality and consistency across operations without necessitating the sacrifice of authenticity or unique flavor profiles—a fundamental and crucial differentiator in the increasingly saturated and competitive specialty coffee landscape.

The application of AI extends deeply into the primary sector, providing innovative solutions to the persistent challenges faced by coffee farmers, particularly smallholders who are most vulnerable to climatic shifts. Machine learning algorithms are being trained on vast datasets encompassing soil moisture levels, historical yield data, micro-climate fluctuations, and pathogen prevalence to provide highly localized and prescriptive advice on fertilization, optimal harvesting times, and preventative measures against major diseases like coffee leaf rust. This precision agriculture, powered by AI, promises to stabilize production volumes, significantly improve the quality uniformity of green beans, and reduce reliance on costly chemical inputs, directly contributing to the sustainability metrics that modern espresso buyers demand. Furthermore, the integration of AI-enabled sensing and sorting technologies during the post-harvest processing stages (washing, drying, milling) ensures that only beans meeting the exact specifications for specialty espresso roasting proceed, dramatically reducing defects and enhancing the overall value derived from each batch of raw material, a critical step for maintaining premium espresso quality.

In the crucial roasting phase, AI transforms a traditionally intuitive and skill-dependent craft into a highly reproducible science. Advanced sensors monitor bean temperature, moisture egress, air flow, and volatile organic compound release in real-time, feeding this complex data into predictive models. These models instantaneously adjust burner heat and drum speed, allowing the roaster to replicate specific, complex flavor curves (profiles) with near-perfect precision across massive volumes, regardless of minor variations in the input green bean batch. This technology directly addresses one of the most significant challenges in the commercial espresso market: maintaining flavor consistency across global supply chains. At the retail end, AI drives optimal placement of espresso products, refining shelf strategy and informing pricing decisions based on real-time consumer purchasing data and localized competitor activity. Predictive maintenance scheduling for commercial espresso machines, facilitated by IoT and AI, minimizes downtime in busy cafes, ensuring uninterrupted supply of quality espresso and protecting the revenue streams of commercial application partners.

- AI-Driven Agricultural Optimization: Utilizing sensor data and satellite imagery combined with deep learning algorithms for predicting optimal coffee yield, performing early detection of pests and diseases, and optimizing irrigation and nutrient delivery schedules, thereby creating critical climate-resilient bean production systems.

- Precision Roasting Algorithms: Employing sophisticated machine learning models to rigorously analyze complex bean density, moisture content, and chemical composition, automating and finely tuning the roast profile to achieve highly consistent and reproducible flavor development, substantially minimizing human variability, energy waste, and product loss.

- Enhanced Quality Control (QC) and Grading: Implementing high-speed computer vision systems and spectral analysis during processing to instantaneously identify and remove subtle defects or off-grade characteristics in both green and roasted beans at industrial scale, ensuring that only certified premium quality beans enter the specialized espresso supply chain.

- Optimized Supply Chain Logistics and Forecasting: Using granular predictive analytics for dynamic demand forecasting based on real-time retail sales data, hyper-localized seasonal fluctuations, and macro-economic indicators, significantly reducing expensive inventory holding costs and critically minimizing stock-outs for high-demand, fast-moving items like popular espresso pods and specialized blends.

- Personalized Consumer Experience and Recommendation Engines: Deploying advanced AI systems within proprietary D2C platforms and cafe loyalty apps to intelligently recommend highly specific espresso blends, preferred roast profiles, or optimal brewing parameters based on a detailed analysis of the user's purchase history, identified brewing equipment (e.g., specific home machine model), and explicitly stated flavor preferences, thereby dramatically driving brand loyalty and average transaction value.

- Traceability, Compliance, and Transparency Assurance: Implementing secure blockchain technology systems, often monitored and integrated by AI tools, to provide immutable and verifiable records of bean origin, every processing step (from farm to cup), and validated ethical certifications, effectively meeting the accelerating and stringent consumer demand for supply chain transparency and product integrity.

DRO & Impact Forces Of Espresso Coffee Bean and Coffee Powder Market

The fundamental market structure and profitability of the Espresso Coffee Bean and Coffee Powder Market are rigorously governed by a complex and dynamic interplay of internal performance drivers and external mitigating forces. The primary and most powerful drivers stem from the accelerated global cultural shift towards aspirational cafe culture and home-based specialty brewing, particularly pronounced among younger, digitally connected demographics in rapidly industrializing nations, coupled with the persistent, financially significant trend of premiumization in established developed markets where frequent espresso consumption is firmly positioned as an accessible, everyday luxury. This sustained demand provides a robust baseline for market stability and revenue growth. Restraints, conversely, are major challenges that often include the high volatility and unpredictable fluctuation of green coffee commodity prices, which are themselves profoundly influenced by extreme weather patterns (e.g., El Niño/La Niña cycles) and persistent geopolitical instability within key growing regions across Africa and Latin America. Additionally, the escalating, complex operational costs associated with establishing, verifying, and maintaining certified sustainable and ethically compliant supply chains represent a substantial financial hurdle, particularly for mid-sized operators lacking the scale of multinational giants. Nevertheless, significant opportunities continually emerge through technological innovation, such as the rapid development of fully biodegradable and compostable capsule materials and the wide-scale integration of automation and AI in processing, which effectively appeals to the rapidly growing segment of environmentally conscious consumers and simultaneously improves labor efficiency and product quality consistency.

A thorough analysis using the framework of Porter’s Five Forces clearly reveals the nuanced competitive dynamics. The bargaining power of major buyers is assessed as moderate to high, particularly concerning large consolidated retail chains and dominant global coffee franchises (e.g., Starbucks, Costa, major supermarket groups) that command immense purchasing volumes and exert substantial downward pressure on wholesale pricing structures. The bargaining power of suppliers, while generally fragmented among millions of smallholders, becomes highly concentrated and significantly leverageable when dealing with specific, unique high-quality Arabica micro-lots or certified specialty regions, giving these growers moderate leverage and allowing them to demand significantly higher premiums above the C-price commodity index. The threat of new entrants is currently judged as moderate; while the initial capital investment required for industrial-scale roasting infrastructure, global logistics, and established brand marketing is prohibitively high, the concurrent rise of small, highly agile, digitally native D2C roasters utilizing efficient e-commerce platforms and compelling brand narratives presents a persistent and disruptive competitive challenge to established legacy brands. Finally, the consistently high availability of close substitute beverages (e.g., high-end tea, functional energy drinks, sophisticated soft drinks) keeps the overall competitive intensity within the broader beverage market extremely high, forcing espresso market players to perpetually innovate product offerings, continually enhance perceived quality through sourcing transparency, and strategically differentiate their brand identities to effectively maintain or increase market share.

The overriding strategic challenge for participants in the global espresso market is delicately navigating the crucial operational and financial trade-off between achieving deep cost efficiencies through global standardization of processing and meeting the highly specialized, evolving consumer demand for diverse, authentic, exceptionally high-quality, and demonstrably ethically sourced espresso products. Sustainable market success requires a sophisticated dual strategy: balancing impactful, culturally sensitive marketing campaigns that powerfully emphasize origin, unique flavor notes, and concrete sustainability credentials with the establishment of robust operational resilience against increasingly frequent supply chain disruptions caused by extreme weather and unpredictable regulatory changes, which chronically threaten long-term coffee production stability worldwide. Effective, proactive management of these intricate impact forces—specifically hedging against commodity price risk, demonstrating ethical leadership, and investing continuously in quality-enhancing technology—is the non-negotiable prerequisite for securing long-term profitability, enhancing brand reputation, and achieving superior market positioning within this intensely competitive sector.

Segmentation Analysis

The Espresso Coffee Bean and Coffee Powder Market is meticulously segmented based on product form, coffee type, distribution channel, and application, allowing market participants to target specific consumer needs and operational requirements with precision marketing and product development. The detailed segmentation highlights the crucial divergence between sophisticated specialty consumption, which overwhelmingly favors whole beans and high-grade, pure Arabica varieties for superior flavor complexity, and the broader mass-market demand for convenience, which is structurally dominated by consistently pre-ground coffee and the standardized format of coffee pods or capsules, driven by ease of use. Understanding these critical market divisions is fundamental for optimizing production schedules, managing inventory risk, and designing highly effective, channel-specific marketing strategies, especially in dynamic regional markets exhibiting rapid and pronounced shifts in consumer preferences towards highly automated or home-based brewing solutions.

- By Product Form:

- Whole Bean: Favored by specialty consumers and cafes for maximum freshness, requiring manual grinding.

- Ground Coffee/Powder: Offers immediate convenience, consistent particle size, ideal for high-volume commercial use and basic home brewing.

- Capsules/Pods: Highest convenience factor, standardized dosing, dominating the single-serve segment and highly dependent on machine compatibility.

- By Coffee Type:

- Arabica: Dominates the premium and specialty segments due to its superior aromatic quality, higher acidity, and complex flavor profiles necessary for espresso.

- Robusta: Primarily used in espresso blends for enhancing crema, body, and caffeine content, often favored in traditional Italian espresso blends and lower-cost alternatives.

- Blends (Arabica and Robusta): Formulated to achieve a balance of flavor, body, and cost efficiency, widely used in commercial cafe chains for consistency.

- By Roast Type:

- Light Roast: Increasingly popular in specialty coffee for preserving subtle origin characteristics; rare but growing in the espresso segment.

- Medium Roast: Balances acidity and caramelized sweetness, offering versatility and broad appeal in modern espresso preparation.

- Dark Roast: Traditional choice for classic espresso, prioritizing body, low acidity, and bittersweet chocolate/nutty notes; still dominant in high-volume commercial markets.

- By Distribution Channel:

- Off-Trade (Retail): Includes Supermarkets/Hypermarkets (dominant volume sales), Convenience Stores, and Online Retail (fastest-growing segment, key for D2C).

- On-Trade (Food Service): Encompasses Cafes/Coffee Shops (setting quality benchmarks), Restaurants, and Hotels (HoReCa), demanding high-volume supply and service support.

- By Application:

- Commercial (HoReCa): Focuses on consistency, machine compatibility, and bulk supply for high-throughput environments.

- Residential (Household): Driven by convenience, affordability, brand loyalty, and quality replication of the cafe experience at home, particularly in developed regions.

Value Chain Analysis For Espresso Coffee Bean and Coffee Powder Market

The value chain for espresso products is extensive, geographically dispersed, and remarkably complex, initiating with specialized upstream activities focused intensely on meticulous cultivation and raw material sourcing in geographically specific, high-altitude regions. Upstream analysis necessitates stringent scrutiny of precise farming practices, including selective harvesting (often manual picking), wet or dry processing methods, and meticulous grading of green coffee beans based on size, density, and defect count prior to exportation. Key cost centers at this initial stage involve highly variable labor costs, specialized land management practices (crucial for quality), adherence to increasingly strict international certification standards (e.g., organic, fair trade, carbon neutral), and the initial complex international transportation logistics to export consolidation centers. Establishing and maintaining robust, trust-based relationships with farmer co-operatives and individual specialty farms is absolutely critical for consistently securing specialty-grade Arabica beans, which command substantial price premiums and require exceptionally precise quality management throughout the entire pre-processing chain to successfully preserve the specific flavor profiles and high sugar content necessary for optimal espresso extraction methods.

Midstream processing activities encompass international importation, advanced inventory management, highly controlled roasting, precision grinding, and specialized protective packaging operations. Roasting, particularly when targeting the specific requirements for espresso extraction, demands sophisticated machinery (e.g., fluid bed or drum roasters) and specialized expertise to achieve the necessary internal density and color profiles without burning or dulling the delicate aromatic flavors. Precision grinding is paramount at this stage, as the uniformity of the ultra-fine particle size directly dictates extraction quality, rate, and resistance under high pressure, minimizing the detrimental phenomenon of channeling and ensuring a balanced taste. Packaging represents a vital investment area, increasingly utilizing sophisticated modified atmosphere packaging (MAP) or vacuum sealing, which is essential for preserving the inherent freshness—a key, non-negotiable consumer determinant of quality—and successfully extending the effective shelf life of the highly sensitive roasted product. Strategic cost optimization in the midstream primarily involves maximizing energy efficiency in the roasting process and implementing high levels of automation in high-speed precision grinding and complex capsule production lines, which is essential for maintaining competitive pricing and high margins in the high-volume, standardized segments.

Downstream analysis focuses intensely on optimizing heterogeneous distribution channels, which are clearly bifurcated into Direct (D2C via proprietary cafe outlets or advanced e-commerce platforms) and Indirect (via specialized wholesalers, large regional retailers, and dedicated food service distributors). The On-Trade segment (commercial cafes and HoReCa) necessitates specialized machine technical support, rapid replenishment logistics, and unwavering supply consistency, placing strong emphasis on stable long-term relationships and comprehensive service quality beyond just the product. The Off-Trade segment (retail, including supermarkets) relies heavily on high-impact visual shelf presence, aggressive promotional activities, and achieving highly efficient inventory turnover to maximize profitability within tight margins. Effective and agile distribution strategies are paramount for minimizing expensive logistics costs and ensuring rapid, wide-scale market penetration, with digital channels (e-commerce) providing valuable direct consumer feedback loops and enabling greater supply chain agility, crucially benefiting small-batch specialty roasters looking to successfully bypass the high capital expenditure and structural constraints of traditional, centralized distribution networks.

Espresso Coffee Bean and Coffee Powder Market Potential Customers

Potential customers for the wide array of espresso products are structurally categorized into powerful commercial operators (B2B) and the highly segmented residential consumers (B2C), each segment possessing distinct, non-negotiable purchasing criteria, volume requirements, and quality expectations that determine sourcing strategies. Commercial buyers, encompassing established global cafe chains, luxury hotels, corporate catering services (HoReCa), and institutional food service providers, prioritize operational consistency, guaranteed volume capacity, verified compatibility with high-performance espresso machines, and ironclad long-term supply contracts with competitive wholesale pricing. These high-volume B2B customers typically seek pre-ground powder or professionally customized whole bean blends that are specifically optimized for reliable performance in high-throughput commercial equipment, often valuing comprehensive technical support and dependable logistics over the unique, small-batch flavor profiles sought by niche specialty customers, although specialty cafes themselves represent a hybrid category prioritizing both exceptional quality and rigorous volume efficiency in their sourcing decisions.

Residential consumers form a highly diverse and complex customer base, ranging significantly from entry-level users who strongly prefer the unmatched convenience and standardization offered by proprietary capsules or pods (e.g., Nespresso compatible systems) to highly affluent, experienced enthusiasts who make substantial initial investments in premium home espresso equipment (e.g., high-end grinders and semi-automatic machines) and demand whole beans of meticulously sourced, single-origin Arabica varieties. The primary underlying motivation for the sophisticated residential segment is the aspiration to consistently replicate the professional cafe experience within the home environment, which necessitates accessing product forms that deliver peak freshness, uncompromising quality, and, increasingly, comprehensive ethical sourcing and sustainability guarantees. This segment exhibits pronounced brand loyalty and willingness to pay significant premiums to specific brands whose operational ethics and flavor standards align with their values, making transparent traceability, compelling brand narrative, and high perceived quality absolutely crucial marketing and sales elements.

A rapidly expanding and significant potential customer base exists within corporate offices, technology hubs, and sophisticated small-to-medium enterprises (SMEs) that strategically offer high-quality, authentic espresso as a key employee benefit or a high-impact client amenity to enhance workplace prestige and morale. These commercial customers typically opt for advanced automated bean-to-cup machines and require a consistent, reliable supply of quality coffee powder or beans that demand minimal skilled intervention or specialized training for operation. Strategically targeting this B2B workplace segment involves developing and offering highly tailored, hassle-free subscription services and robust, proactive machine maintenance and repair packages, emphasizing unparalleled ease of use, guaranteed consistency of output, and minimal waste, all suitable for high-volume, non-specialist environments where convenience is paramount to adoption and continued usage.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 20.7 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A., Starbucks Corporation, JAB Holding Company (Keurig Dr Pepper), Luigi Lavazza SpA, illycaffè S.p.A., Massimo Zanetti Beverage Group, Tchibo GmbH, The Coca-Cola Company (Costa Coffee), Strauss Group, Peet's Coffee, Eight O'Clock Coffee Company, Dunkin' Brands Group, Melitta Group, Segafredo Zanetti, Green Mountain Coffee Roasters (GMCR), Paulig Group, Death Wish Coffee, Blue Bottle Coffee, Stumptown Coffee Roasters, La Colombe Coffee Roasters, Caffè Nero Group Ltd., Tim Hortons (Restaurant Brands International), McDonald's Corporation (McCafe), Caribou Coffee Company, Gloria Jean's Coffees |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Espresso Coffee Bean and Coffee Powder Market Key Technology Landscape

The rapidly evolving technological landscape profoundly impacting the espresso market spans the entire value chain, commencing with highly sophisticated agricultural practices utilizing remote sensing and sensor technologies and culminating in advanced manufacturing techniques specifically tailored for single-serve capsule systems and automated brewing equipment. In the critical processing stage, the widespread adoption of advanced, closed-loop roasting technology ensures significantly greater energy efficiency and provides exceptionally precise temperature and airflow control, effectively mitigating unwanted inconsistencies caused by external environmental factors (like humidity) and guaranteeing the exact flavor profile repeatability that is rigorously required by high-end commercial clients and specialty consumers. Furthermore, specialized precision grinding equipment utilizing advanced cryogenic or roller milling techniques guarantees the ultra-fine and highly uniform particle size distribution that is absolutely crucial for achieving optimal espresso extraction under high pressure, drastically reducing undesirable channeling phenomena and consistently improving the overall quality, mouthfeel, and body of the final brewed product, thereby directly and fundamentally impacting consumer satisfaction and brand perception.

Packaging technology represents one of the most dynamic and crucial areas of continuous innovation, particularly concerning the necessary development of next-generation high-barrier film materials and sophisticated inert gas flushing systems (specifically high-purity nitrogen infusion) designed to drastically limit harmful oxygen exposure and successfully preserve the highly volatile aromatic compounds and oils naturally present in freshly roasted coffee, thereby substantially extending the crucial shelf life of both whole beans and finely ground coffee. Concurrent, parallel advancements in single-serve capsule technology focus acutely on circular economy sustainability goals, driving the rapid growth in fully compostable and naturally biodegradable polymer capsules specifically engineered to flawlessly maintain the necessary internal pressure integrity during the brewing cycle while aggressively addressing the pervasive environmental concerns universally associated with traditional, non-recyclable aluminum or multi-layered plastic pods, thereby successfully meeting the stringent demands of environmentally conscious regulatory bodies and the growing segment of ecologically sensitive consumers worldwide.

At the critical consumer and distribution level, sophisticated internet-of-things (IoT) enabled commercial espresso machines, smart automated dispensing systems, and home brewing devices are rapidly gaining widespread traction. These interconnected systems not only allow for efficient remote diagnostic monitoring and proactive preventative maintenance in complex commercial settings, but they also critically collect highly valuable, real-time data on precise consumption patterns, enabling sophisticated predictive inventory management and the establishment of highly personalized maintenance scheduling. These technological integrations dramatically enhance overall operational efficiency and consistency for large cafe operators and simultaneously provide invaluable, granular data for roasters and distributors, driving the next generation of highly automated, predictive, and responsive espresso supply chains, particularly benefiting the high-volume corporate coffee service industry and large-scale retail partners requiring seamless operation.

Regional Highlights

- Europe: This region consistently dominates the market value segment due to its deep-rooted cultural coffee traditions, particularly in Southern European countries like Italy and Spain which set global quality benchmarks, and the strong, persistent demand for high-end specialty coffee in prosperous Western European markets (Germany, UK). The region is structurally characterized by high per capita consumption frequency and serves as the global standard-setter for innovation in advanced capsule sustainability, ethical sourcing, and premium brand development.

- North America (NA): Exhibits extremely high per capita spending on specialty espresso and convenience-focused products. Market growth is fundamentally driven by the extensive presence of large, strategically dominant global coffee chains and the rapid, widespread increase in the adoption of sophisticated, high-performance home espresso equipment. NA is leading the trend in specialized cold brew espresso innovations, nitro coffee formats, and the development of technologically sophisticated ready-to-drink (RTD) espresso formats designed for on-the-go consumption.

- Asia Pacific (APAC): Positioned as the fastest-growing region globally in terms of volume expansion, fueled by accelerating urbanization, rapidly increasing disposable incomes, and the swift adoption of Western-style cafe and consumption habits. Key emerging markets like China, India, and South Korea are experiencing explosive, double-digit growth in cafe culture establishment and subsequent robust demand for high-quality imported espresso beans and technologically advanced brewing equipment.

- Latin America (LATAM): Serves as both a crucial, massive global production hub and a rapidly maturing internal consumer market. Major producers like Brazil, Colombia, and Guatemala are simultaneously experiencing surging internal coffee consumption, primarily driven by middle-class expansion and increasing regional economic stability, with consumption focusing primarily on domestically sourced, high-quality Arabica varieties, reducing reliance on export.

- Middle East and Africa (MEA): This is a high-potential, niche growth market driven primarily by large-scale, high-end hotel and tourism development and the proliferation of specialty cafes in the affluent Gulf Cooperation Council (GCC) countries. Consumption here is profoundly influenced by luxury branding, perceived exclusivity, and adherence to high imported European espresso quality standards. The African continent (e.g., Ethiopia, Uganda, Kenya) remains absolutely critical to the global supply chain for raw specialty bean procurement and is concurrently seeing steadily increasing domestic consumption rates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Espresso Coffee Bean and Coffee Powder Market.- Nestlé S.A.

- Starbucks Corporation

- JAB Holding Company (Keurig Dr Pepper)

- Luigi Lavazza S.p.A.

- illycaffè S.p.A.

- Massimo Zanetti Beverage Group

- Tchibo GmbH

- The Coca-Cola Company (Costa Coffee)

- Strauss Group

- Peet's Coffee

- Eight O'Clock Coffee Company

- Dunkin' Brands Group

- Melitta Group

- Segafredo Zanetti

- Green Mountain Coffee Roasters (GMCR)

- Paulig Group

- Death Wish Coffee

- Blue Bottle Coffee

- Stumptown Coffee Roasters

- La Colombe Coffee Roasters

- Caffè Nero Group Ltd.

- Tim Hortons (Restaurant Brands International)

- McDonald's Corporation (McCafe)

- Caribou Coffee Company

- Gloria Jean's Coffees

Frequently Asked Questions

Analyze common user questions about the Espresso Coffee Bean and Coffee Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Espresso Coffee Bean and Powder Market?

The primary factor driving market growth is the global premiumization trend, specifically the consumer shift towards high-quality, specialty coffee experiences, coupled with the rapid expansion of Western-style coffee consumption culture in emerging economies, notably the Asia Pacific region, supported by sustained increases in urbanization and disposable income levels.

How is sustainability and ethical sourcing affecting the procurement of espresso beans?

Sustainability mandates are profoundly impacting sourcing by substantially increasing demand for ethically certified and traceable beans (Fair Trade, Rainforest Alliance) and requiring enhanced supply chain transparency, often supported by integrated blockchain technology, which adds crucial complexity and verifiable cost but allows brands to secure higher price premiums and deeply solidify consumer trust.

Which specific product form currently holds the largest volume market share in the espresso segment?

The combined Ground Coffee and standardized Capsules/Pods segments currently hold the largest volume market share, driven primarily by unmatched convenience, operational standardization, and machine compatibility in high-volume commercial and efficient residential settings. However, the Whole Bean segment is exhibiting the fastest growth due to the specialty coffee movement prioritizing ultimate freshness and necessary brewing customization.

What are the key technological advancements significantly shaping future espresso quality and consistency?

Key technological advancements include the sophisticated deployment of AI-powered precision roasting algorithms for profile consistency and energy efficiency, the rapid development of fully compostable and biodegradable capsule materials to aggressively address environmental waste concerns, and the systematic use of inert gas packaging and high-barrier materials to maximize product freshness and crucial shelf stability.

What is the projected Compound Annual Growth Rate (CAGR) for the Espresso Coffee Bean and Powder Market between 2026 and 2033?

The Espresso Coffee Bean and Coffee Powder Market is definitively projected to grow at a robust Compound Annual Growth Rate (CAGR) of 7.5% over the forecast period spanning 2026 to 2033, fundamentally driven by sustained global demand for premium, high-quality brewing solutions across both commercial and increasingly discerning residential applications worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager