ESR Measurement Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438861 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

ESR Measurement Market Size

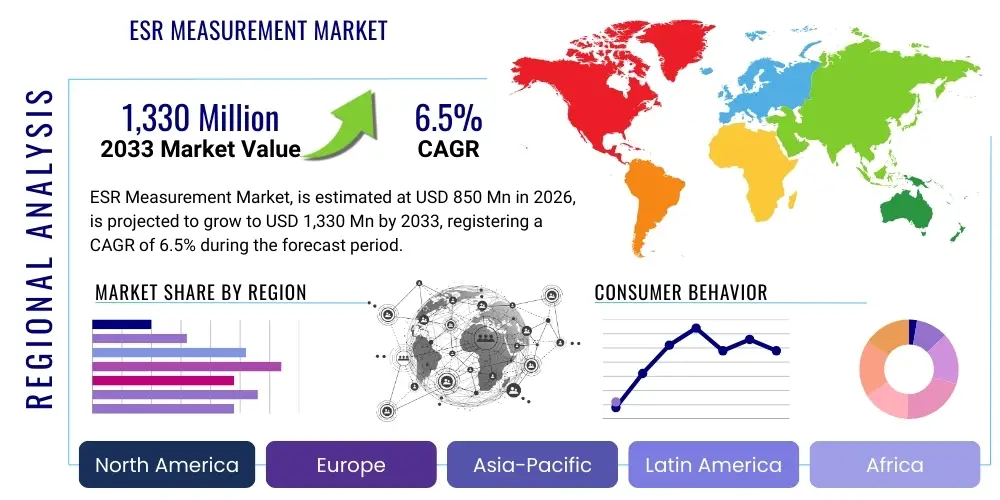

The ESR Measurement Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,330 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by the increasing global prevalence of inflammatory diseases, autoimmune disorders, and chronic infectious conditions, necessitating quick and reliable non-specific inflammation markers for diagnosis and monitoring. Furthermore, technological advancements leading to the development of highly automated and efficient erythrocyte sedimentation rate (ESR) analyzers contribute significantly to market expansion, enabling high-throughput testing in various clinical settings.

ESR Measurement Market introduction

The ESR Measurement Market encompasses instruments, reagents, and consumables utilized for determining the rate at which erythrocytes settle in anticoagulated whole blood over a specific period. This non-specific test, measuring acute phase reactants and reflecting underlying inflammatory processes, remains a cornerstone in diagnosing and monitoring conditions such as rheumatoid arthritis, temporal arteritis, polymyalgia rheumatica, and various infectious diseases. Product offerings range from traditional manual Westergren methods to modern, fully automated systems leveraging capillary photometry or modified sedimentation techniques, providing enhanced speed, accuracy, and standardization.

Major applications of ESR measurement span across clinical laboratories, large hospital networks, and specialized research institutes focused on immunology and chronic disease management. The test serves as a crucial, cost-effective tool for preliminary disease screening and evaluating treatment efficacy. The benefit of ESR testing lies in its simplicity, low cost, and ability to reflect systemic inflammation changes rapidly. Driving factors include the rising geriatric population, increased awareness regarding inflammatory biomarkers, and the ongoing shift towards automated laboratory workflows that minimize human error and improve turnaround times, particularly in emerging economies expanding their diagnostic infrastructure.

ESR Measurement Market Executive Summary

The ESR Measurement Market is characterized by a mature technological landscape undergoing a shift towards automation and integration with broader hematology systems. Business trends indicate strong demand for compact, semi-automated devices suitable for smaller clinical settings, alongside continued investment in large, fully automated analyzers for high-volume reference laboratories. Key market players are focusing on developing proprietary methods that offer faster results while maintaining correlation with the standard Westergren technique, addressing the clinical need for rapid diagnostic information. Strategic acquisitions and collaborations aimed at expanding regional distribution networks and integrating AI-driven interpretive features into instruments are prevalent.

Regional trends show North America maintaining dominance due to sophisticated healthcare infrastructure and high adoption rates of advanced automated systems. However, the Asia Pacific (APAC) region is poised for the highest growth rate, fueled by improving healthcare accessibility, substantial government investments in diagnostic laboratory capacity, and the massive patient pool suffering from chronic diseases. Segments trends highlight the fully automated segment leading revenue generation, driven by its efficiency and standardization capabilities, crucial for reducing variability across labs. In terms of application, hospitals and large reference laboratories remain the primary revenue generators, though specialized diagnostic centers are increasingly adopting dedicated ESR instruments.

AI Impact Analysis on ESR Measurement Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the ESR Measurement Market frequently revolve around whether AI can automate result interpretation, predict clinical outcomes more accurately than simple numerical values, and integrate ESR data seamlessly with other hematological parameters for comprehensive diagnostic profiling. Users are concerned about the reliability of AI algorithms in interpreting atypical sedimentation patterns and their ability to function effectively across diverse patient populations and instrument types. The key expectation is that AI will minimize subjectivity, enhance the predictive value of the test, and enable proactive disease monitoring by identifying subtle trends in ESR fluctuations. This analytical focus confirms that AI is perceived not as a replacement for the test itself, but as a crucial layer of data interpretation and integration.

The introduction of AI is set to revolutionize the post-measurement phase of ESR testing. AI and machine learning algorithms are being employed to analyze sedimentation curves generated by automated instruments, offering predictive insights beyond the raw ESR value. For instance, AI can correlate ESR changes with C-reactive protein (CRP) levels, patient history, and complete blood count (CBC) parameters to provide a composite inflammation score or highlight patterns indicative of specific autoimmune conditions, thereby enhancing the diagnostic utility of the test. This technological integration aims to move ESR from a generalized inflammatory marker to a more context-specific diagnostic aid, improving clinical decision-making and reducing the need for confirmatory, more expensive tests.

- AI algorithms enhance the interpretation of complex sedimentation curves, minimizing operator variability.

- Machine learning facilitates the integration of ESR data with other hematology and chemistry markers for comprehensive clinical scoring.

- Predictive modeling capabilities allow AI to forecast inflammatory flare-ups or treatment responses based on historical ESR patterns.

- AI optimizes laboratory workflow and instrument maintenance through predictive failure analysis and automated quality control checks.

- Natural Language Processing (NLP) integration aids in generating standardized, context-rich reports for clinicians, improving AEO compliance in medical reporting.

DRO & Impact Forces Of ESR Measurement Market

The ESR Measurement Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces. Key drivers include the escalating global burden of chronic diseases such as cancer, tuberculosis, and various autoimmune disorders, all requiring reliable inflammation monitoring tools. The continuous push for diagnostic standardization and automation in clinical laboratories worldwide also significantly propels the adoption of advanced, high-throughput ESR analyzers. Conversely, restraints primarily stem from the non-specificity of the ESR test; results can be affected by numerous variables like anemia, fibrinogen concentration, and red blood cell morphology, often necessitating simultaneous use of more specific markers like CRP. Opportunities lie in integrating ESR testing with microfluidics and Point-of-Care Testing (POCT) platforms, offering rapid results outside traditional laboratory settings, particularly in resource-limited environments. These forces dictate the competitive landscape and strategic direction of key market participants.

Impact forces in the market are prominently weighted towards technological innovation and regulatory pressures. The necessity for quick, standardized, and reproducible results drives continuous research into novel sedimentation techniques that overcome the limitations of gravity-based methods. For instance, capillary photometry offers rapid measurement, significantly impacting laboratory efficiency. Furthermore, stringent quality assurance requirements and international standards (like CLSI guidelines) compel labs to transition from manual to automated systems, further accelerating market penetration of sophisticated instruments. Economic factors, especially healthcare budget constraints in developed nations, impose pressure on pricing, favoring cost-effective, yet reliable, testing solutions. The high impact of infectious disease outbreaks (such as COVID-19, where ESR was used as a severity marker) underscores the enduring relevance of generalized inflammation tests.

Segmentation Analysis

The ESR Measurement Market is comprehensively segmented based on Type, Application, and Technology. This segmentation allows for precise market sizing and strategic analysis, revealing distinct growth patterns within different product categories and end-user sectors. The Type segment differentiates products based on their level of automation, reflecting the global trend toward efficiency and reduced manual interference in laboratory settings. The Application segment highlights the major end-users, with hospitals and large clinical laboratories dominating consumption due to their high sample volume requirements. Technology segmentation distinguishes between traditional and modern methodologies, indicating the preference for faster, more reliable optical and photometric measurements over time-intensive gravity methods. Understanding these segments is crucial for manufacturers tailoring their products and marketing strategies to specific regional needs and laboratory demands.

- By Type:

- Manual Devices (Westergren, Wintrobe)

- Semi-Automated Analyzers

- Fully Automated Analyzers

- By Application:

- Hospitals

- Clinical Laboratories and Diagnostic Centers

- Research Institutes

- Others (Blood Banks, Specialized Clinics)

- By Technology:

- Modified Westergren Method (Capillary Tube)

- Capillary Photometry/Kinetic Measurement

- Automated Pipetting Systems

- Micro-Sedimentation Techniques

Value Chain Analysis For ESR Measurement Market

The value chain for the ESR Measurement Market begins with the upstream activities of raw material sourcing, primarily focusing on high-grade plastics for consumables (tubes, pipettes), specialized glass for instrumentation optics, and chemical reagents (anticoagulants). Research and Development (R&D) forms a critical upstream component, driving innovation in automation speed, accuracy, and standardization compliance. Key upstream suppliers include component manufacturers specializing in optical sensors, microfluidic chips, and precise electromechanical components necessary for automated analyzers. Strategic partnerships with reliable suppliers are essential to maintain cost-efficiency and ensure the quality of diagnostic instruments.

The midstream stage involves instrument manufacturing, quality control, assembly, and software development. Major players like Beckman Coulter, HORIBA, and Siemens Healthineers invest heavily in manufacturing centers compliant with ISO and FDA standards. Distribution channels are highly complex, utilizing both direct sales forces, especially for large, integrated laboratory systems sold to major hospital networks, and indirect channels involving third-party distributors and regional wholesalers for wider market penetration, particularly in emerging markets. Effective inventory management and robust logistics networks are necessary to deliver fragile instruments and time-sensitive consumables efficiently to global laboratories.

Downstream activities center on the end-users—hospitals, clinical laboratories, and research centers—where the instruments are utilized for patient diagnostics. Post-sale services, including installation, technical support, maintenance, and regular calibration, represent a significant portion of the downstream value, ensuring instrument uptime and accurate results. Direct channels are preferred for high-value contracts and comprehensive laboratory solutions, facilitating direct customer relationship management and faster feedback integration into product development. Indirect channels, particularly in geographically dispersed regions, leverage local expertise for faster reach and immediate localized support, completing the value flow from innovation to patient diagnostics.

ESR Measurement Market Potential Customers

The primary customers for ESR Measurement products are institutions that handle high volumes of patient blood samples requiring inflammation assessment. Clinical Laboratories, encompassing independent reference laboratories and hospital-attached labs, represent the largest end-user segment. These facilities rely on fully automated, high-throughput analyzers to process thousands of samples daily, demanding instruments that minimize hands-on time and integrate seamlessly with Laboratory Information Systems (LIS). The need for standardization and accreditation (e.g., CAP, CLIA) drives their preference toward sophisticated automated solutions.

Hospitals, especially those with specialized units such as rheumatology, infectious disease, and oncology departments, are crucial buyers. They require rapid ESR results for emergency diagnostic scenarios and continuous patient monitoring, favoring semi-automated or small, dedicated automated units for immediate bedside or localized departmental use. Furthermore, Research Institutes focusing on drug development, immunology, and epidemiology constitute a smaller but highly specialized customer base, often requiring specific technologies or customization capabilities for experimental protocols related to inflammation studies and biomarker discovery, emphasizing precision and detailed data output.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,330 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, Beckman Coulter (Danaher), Siemens Healthineers, F. Hoffmann-La Roche Ltd, BD (Becton, Dickinson and Company), Bio-Rad Laboratories, HORIBA, Ltd., Sysmex Corporation, Alere (Abbott), Mindray Medical International Limited, Diatron Messtechnik GmbH, Sarstedt AG & Co. KG, Streck, Inc., Trivitron Healthcare, ELITechGroup, Drucker Diagnostics, Iridius Inc., RR Mechatronics Manufacturing B.V., Sebia, A. Menarini Diagnostics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ESR Measurement Market Key Technology Landscape

The technology landscape in the ESR Measurement Market is characterized by the ongoing transition from traditional, time-consuming methods to highly automated, rapid diagnostic techniques. The foundational technology remains the Westergren method, but modern instruments have significantly modified this approach for automation. The key advancement is capillary photometry, which utilizes optical density readings to measure the settling rate kinetics in small-volume capillaries. This technology drastically reduces the required sample size and, more importantly, cuts the measurement time from the standard one hour (for Westergren) to often under 20 minutes, addressing the critical need for faster diagnostic turnaround times in clinical settings. Furthermore, photometric analyzers offer objective interpretation of the sedimentation curve, minimizing the subjectivity associated with manual reading.

Another crucial technological development involves integrated hematology analyzers. Many modern high-end hematology systems now incorporate modified ESR modules, allowing simultaneous measurement of CBC and ESR from a single blood sample tube. This integration simplifies laboratory workflow, reduces the risk of sample identification errors, and lowers the requirement for specialized ESR dedicated equipment and separate sample processing. Companies focusing on this integration are gaining significant traction in large reference laboratories aiming for streamlined, comprehensive blood analysis solutions, leveraging existing automation track systems and LIS connectivity. This synergistic approach enhances overall laboratory efficiency and optimizes resource allocation.

Moreover, the adoption of microfluidic technology is emerging as a promising future direction. Microfluidic ESR measurement systems are designed for Point-of-Care (POCT) applications, offering highly portable and user-friendly devices capable of delivering results using minuscule sample volumes. While still nascent, this technology holds significant potential for decentralized testing, particularly in primary care clinics and remote areas where access to large automated laboratories is limited. Continuous technological refinement focuses on improving the correlation between these rapid, small-volume methods and the established Westergren standard, ensuring clinical validity across diverse technological platforms and enhancing AEO relevance by providing authoritative comparison data.

Regional Highlights

The global ESR Measurement Market exhibits varied regional dynamics influenced by healthcare expenditure, disease prevalence, and adoption of laboratory automation:

- North America: This region holds the largest market share, driven by a well-established healthcare infrastructure, high awareness regarding inflammation-related chronic diseases (e.g., cardiovascular and autoimmune conditions), and aggressive adoption of fully automated, high-throughput analyzers compliant with stringent clinical standards. The US and Canada are pioneers in integrating ESR testing into comprehensive diagnostic panels.

- Europe: Characterized by mature markets such as Germany, the UK, and France, Europe is a stable revenue generator. Strong emphasis on laboratory standardization (driven by centralized healthcare systems) ensures continuous demand for high-quality automated systems. Eastern Europe represents a growing sub-market as healthcare modernization efforts accelerate.

- Asia Pacific (APAC): Expected to register the highest CAGR due to massive patient populations, increasing healthcare spending (especially in China and India), and the expansion of diagnostic laboratory networks. Governments are investing heavily in establishing advanced clinical facilities, leading to rapid replacement of manual methods with semi-automated and automated instruments, offering vast opportunities for GEO penetration.

- Latin America (LATAM): Growth is steady, driven by urbanization and improved accessibility to private healthcare services. Market penetration of advanced automation is increasing, particularly in Brazil and Mexico, though price sensitivity remains a key factor influencing procurement decisions.

- Middle East and Africa (MEA): This region is witnessing moderate growth, primarily concentrated in the Gulf Cooperation Council (GCC) countries due to high per capita healthcare spending and investment in modern diagnostic infrastructure. ESR measurement is essential here for monitoring infectious and endemic diseases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ESR Measurement Market.- Abbott Laboratories

- Beckman Coulter (Danaher Corporation)

- Siemens Healthineers AG

- F. Hoffmann-La Roche Ltd

- BD (Becton, Dickinson and Company)

- Bio-Rad Laboratories, Inc.

- HORIBA, Ltd.

- Sysmex Corporation

- Mindray Medical International Limited

- Diatron Messtechnik GmbH

- Sarstedt AG & Co. KG

- Streck, Inc.

- Trivitron Healthcare

- ELITechGroup

- Drucker Diagnostics

- RR Mechatronics Manufacturing B.V.

- Sebia

- A. Menarini Diagnostics

- Iridius Inc.

- Westergren ESR Apparatus Manufacturers

Frequently Asked Questions

Analyze common user questions about the ESR Measurement market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the growth of the automated ESR measurement market?

The primary driver is the increasing global prevalence of chronic inflammatory diseases and autoimmune disorders, necessitating standardized, high-throughput methods for non-specific inflammation screening and monitoring in clinical laboratories. Automation also minimizes manual errors and improves workflow efficiency, meeting the demand for faster diagnostic turnaround times.

How does Capillary Photometry technology differ from the traditional Westergren method?

Capillary Photometry differs significantly by utilizing optical sensors to kinetically measure the red blood cell settling rate in micro-capillaries over a shorter duration (typically 20 minutes or less), whereas the traditional Westergren method relies on gravitational settling over exactly one hour, requiring a larger sample volume and manual reading, which introduces variability.

What role does Artificial Intelligence (AI) play in the future of ESR testing?

AI's future role involves enhancing data interpretation by analyzing complex sedimentation curves and correlating ESR results with other hematological parameters. AI improves the test's predictive value, aids in automated quality control, and integrates data into comprehensive patient inflammation profiles, moving the test beyond a simple numerical output.

Which region currently dominates the ESR Measurement Market, and why?

North America currently dominates the market. This dominance is attributed to high healthcare expenditure, established sophisticated diagnostic laboratory infrastructure, early and rapid adoption of high-end fully automated ESR analyzers, and stringent regulatory requirements that favor standardized, high-quality diagnostic solutions over manual testing methods.

What are the main segments of the ESR Measurement Market based on product type?

The main segments based on product type are Manual Devices (e.g., traditional Westergren racks), Semi-Automated Analyzers (which automate some steps like reading or mixing), and Fully Automated Analyzers (which handle sample aspiration, measurement, and data processing without operator intervention, typically using photometric technology).

Are there any major restraints affecting the market growth?

Yes, the key restraint is the non-specificity of the ESR test. Because ESR is influenced by multiple non-inflammatory factors (like age, gender, anemia, and protein levels), clinicians often require concurrent testing with more specific biomarkers like C-reactive protein (CRP) to confirm the source of inflammation, sometimes limiting ESR's standalone diagnostic utility.

What is the primary application area driving instrument procurement?

Clinical Laboratories and Diagnostic Centers represent the primary application area driving high-volume instrument procurement. These centralized facilities require robust, highly efficient, and scalable fully automated systems to manage the substantial workload generated by primary care physicians and specialist referrals for inflammatory disease screening and monitoring.

How does the integration of ESR into hematology analyzers impact the market?

Integration simplifies the laboratory workflow by allowing simultaneous CBC and ESR measurement from a single tube on existing instrumentation tracks. This reduces the need for dedicated ESR devices in large labs, minimizes sample handling errors, and optimizes resource utilization, thereby favoring manufacturers offering integrated diagnostic platforms.

What forecast CAGR is projected for the ESR Measurement Market?

The ESR Measurement Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between the forecast period of 2026 and 2033, driven by technological adoption and increasing global disease burden.

What is the key technological opportunity for market expansion?

A significant technological opportunity lies in the development and clinical validation of Point-of-Care Testing (POCT) ESR devices, potentially utilizing microfluidic technology. This allows rapid, decentralized testing in non-traditional settings, expanding accessibility, particularly in remote or primary care environments where immediate results are beneficial.

Which technology offers the fastest result turnaround time?

Capillary Photometry, also known as kinetic measurement, offers the fastest turnaround time, delivering results typically within 10 to 20 minutes, significantly faster than the 60 minutes required by the standard modified Westergren method.

Why is the Asia Pacific region expected to exhibit the highest growth rate?

The Asia Pacific region's high growth rate is attributed to rapidly expanding healthcare infrastructure, substantial government investments in diagnostic capabilities, increasing public health awareness regarding chronic diseases, and the sheer size of the potential patient pool migrating from manual to automated diagnostic methods.

What are the core requirements of potential customers in large hospitals?

Large hospitals require automated ESR solutions that offer high reliability, seamless integration with Laboratory Information Systems (LIS), minimum hands-on time, and rapid results (STAT capabilities) to support critical decision-making in specialized departments like rheumatology and infectious diseases.

How do manufacturers ensure quality and standardization in ESR measurement?

Manufacturers ensure quality by adhering to strict international standards such as CLSI guidelines (e.g., H2-A5), focusing on instrument calibration that correlates accurately with the standard Westergren method, and implementing robust internal and external quality control programs across all automated platforms.

Does sample quality impact the accuracy of automated ESR testing?

Yes, sample quality is critical. Factors such as the correct ratio of anticoagulant (often EDTA or citrate), the age of the sample, and the presence of microclots or excessive hemolysis can significantly affect the sedimentation process and lead to inaccurate or falsely elevated ESR results, irrespective of the automation level.

What is the significance of the ESR test in autoimmune disease monitoring?

In autoimmune diseases such as Rheumatoid Arthritis (RA) and Systemic Lupus Erythematosus (SLE), ESR is a crucial indicator used to monitor disease activity, assess the effectiveness of immunosuppressive therapy, and identify potential disease flares, providing a simple, longitudinal measure of systemic inflammation.

How are companies in the market addressing the need for cost-effective solutions?

Companies address cost-effectiveness by offering semi-automated or benchtop devices tailored for smaller laboratories and clinics with limited budgets. Additionally, they focus on optimizing consumable usage and developing integrated systems that utilize existing hardware to lower the overall cost per test.

Which factor is the largest contributor to market revenue?

The Fully Automated Analyzers segment, within the Type classification, is the largest contributor to market revenue. This is due to the higher capital cost of the instruments and the high-volume procurement by global reference laboratories and large hospital networks prioritizing efficiency and standardization.

What regulatory frameworks influence the sales of ESR instruments?

The sales are primarily influenced by regulatory bodies such as the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA), ensuring that all instruments and associated reagents meet strict safety, efficacy, and diagnostic performance standards (IVD regulations).

Is the ESR test being replaced by C-reactive protein (CRP) testing?

While CRP is often favored for its higher specificity, ESR is not being replaced entirely. Clinicians frequently use both tests concurrently, as they provide complementary information. ESR reflects chronic inflammation over a longer period, while CRP responds more rapidly to acute changes. Therefore, they remain essential, distinct tools in the diagnostic armamentarium.

What is meant by the "upstream analysis" in the value chain?

Upstream analysis refers to the initial stages of the value chain, primarily encompassing Research and Development (R&D) of new technologies, sourcing of specialized raw materials (plastics, glass, optics), and manufacturing of critical components required for building sophisticated ESR instruments and consumables.

What are the primary challenges in adopting automated ESR systems in emerging markets?

Primary challenges include high initial capital investment costs for automated analyzers, infrastructure limitations (such as unstable power supply or limited cooling), and the need for specialized technical training and maintenance expertise, particularly in remote clinical settings.

How do manufacturers ensure compatibility with Laboratory Information Systems (LIS)?

Manufacturers ensure LIS compatibility by developing instruments that support standard communication protocols (such as HL7 and ASTM), allowing seamless, bidirectional exchange of patient demographic data, test orders, and result reports, which is critical for efficient workflow management in modern laboratories.

What is the significance of micro-sedimentation techniques in the market?

Micro-sedimentation techniques are significant because they allow accurate ESR measurement using very small volumes of blood (often obtained via fingerprick), making the test feasible for pediatric patients, neonates, and situations where venous blood draw is challenging, thereby expanding the applicability of the test.

Who are the top global competitors in the automated ESR market?

The top global competitors include large diagnostics companies such as Beckman Coulter, HORIBA, Sysmex, and Siemens Healthineers, who leverage their existing global distribution networks and technological integration with comprehensive hematology platforms to offer highly standardized automated ESR solutions.

How does the geriatric population influence market demand?

The rising geriatric population significantly influences market demand because older individuals are more susceptible to chronic inflammatory conditions, infectious diseases, and autoimmune disorders, requiring frequent monitoring using inflammation markers like ESR, thereby increasing the volume of tests conducted globally.

What is the typical measurement time for a fully automated ESR analyzer?

Fully automated ESR analyzers using capillary photometry typically provide results rapidly, often within 10 to 20 minutes from the start of the analysis, providing a substantial time saving compared to the one-hour incubation period required for manual methods.

What is the role of distributors in the ESR measurement value chain?

Distributors play a crucial role in the indirect channel, particularly in regional and emerging markets. They manage localized inventory, provide essential first-line technical support and maintenance, handle logistics, and ensure regulatory compliance within specific geographical territories, crucial for expanding market reach efficiently.

How are environmental concerns impacting ESR consumable design?

Environmental concerns are driving manufacturers to focus on sustainable design, including reducing the volume of plastic waste generated by consumables (tubes and capillaries), developing eco-friendly packaging, and designing analyzers that are more energy-efficient, aligning with global green laboratory initiatives and AEO visibility for corporate responsibility.

What key strategic focus areas are market leaders prioritizing?

Market leaders are prioritizing technological convergence (integrating ESR with CBC/hematology), developing proprietary rapid methodologies (capillary photometry), investing in AI-driven interpretation software, and strategically expanding their geographic footprint in high-growth APAC and LATAM regions through robust distribution partnerships.

Which technology segment is likely to experience the fastest growth?

The Capillary Photometry/Kinetic Measurement technology segment is likely to experience the fastest growth, driven by its inherent advantages in speed, standardization, and the ability to be integrated seamlessly into high-throughput automated laboratory systems, addressing the industry's need for efficiency.

What is the approximate market size of the ESR Measurement Market in 2033?

The ESR Measurement Market is projected to reach approximately USD 1,330 Million by the end of the forecast period in 2033, reflecting consistent demand and technological advancements in diagnostic instrumentation.

How does standardizing the ESR measurement process benefit patient care?

Standardization, achieved through automated systems, minimizes inter-laboratory variability and manual errors. This provides clinicians with more reliable, comparable data over time, enabling better longitudinal monitoring of chronic conditions, leading to optimized treatment adjustments and improved patient outcomes.

Why are research institutes important customers, despite lower volume requirements?

Research institutes are important because they drive demand for specialized, highly precise technology and often act as early adopters for novel methodologies (like microfluidics). They contribute significantly to clinical validation studies and biomarker discovery, influencing future commercial product specifications and market trends.

What is the typical base year used for calculating the market forecast?

The base year utilized for calculating the market forecast for the ESR Measurement Market report is 2025, providing a standardized reference point for projecting future growth and trends up to 2033.

How does political stability in the MEA region affect market investment?

Political stability directly correlates with increased healthcare investment in the MEA region, particularly in GCC nations. Stability encourages the establishment of advanced diagnostic facilities, attracting international manufacturers to invest in distribution networks and training programs, thereby increasing market penetration for automated systems.

What is the primary objective of developing automated pipetting systems for ESR?

The primary objective of automated pipetting systems is to eliminate the manual steps of blood sampling, dilution, and filling of the sedimentation tube, ensuring accurate blood-to-anticoagulant ratios and minimizing biohazard exposure risks for laboratory personnel, thereby promoting safety and standardization.

What challenges exist in maintaining instruments in the downstream segment?

Challenges in instrument maintenance include ensuring timely technical support globally, managing the complexity of integrated systems, providing specialized training for repairs, and supplying proprietary consumables or replacement parts, all of which require robust post-sales infrastructure from manufacturers or certified distributors.

How does the COVID-19 pandemic experience relate to ESR market resilience?

The COVID-19 pandemic highlighted the continuing utility of ESR as a simple, general inflammation marker to assess disease severity and monitor patient recovery. This reinforced its position as an essential diagnostic tool, ensuring market resilience even during major global health crises and driving continued investment in high-volume testing capabilities.

What is the significance of the "Other" application segment?

The "Other" application segment, encompassing blood banks and specialized clinics (e.g., fertility or dialysis centers), is significant as it demonstrates the peripheral utility of ESR testing beyond core diagnostics. These specialized areas require dedicated, sometimes lower volume, equipment tailored to specific operational needs, contributing to market diversity.

What is the estimated market size in 2026?

The market size for the ESR Measurement Market is estimated at USD 850 Million in the base year of 2026, serving as the starting point for the 2026-2033 forecast period.

How important is the concept of standardization (CLSI guidelines) for market players?

Standardization, guided by organizations like CLSI, is fundamentally important. It ensures that automated results are clinically interchangeable with traditional methods, fostering trust among clinicians and driving the procurement of high-compliance instruments, thereby acting as a critical non-price barrier to entry for new competitors.

Which segments are covered in the report's analysis?

The report covers detailed market analysis based on three key segmentations: Type (Manual, Semi-Automated, Fully Automated), Application (Hospitals, Clinical Laboratories, Research Institutes), and Technology (Modified Westergren, Capillary Photometry, Automated Pipetting).

How does the shift towards personalized medicine affect ESR testing?

While ESR is non-specific, the shift towards personalized medicine impacts ESR testing by encouraging the integration of ESR data with more specific, patient-unique biomarker profiles (via AI analysis). This moves the test from a general screening tool to a component of a tailored inflammation score, increasing its contextual relevance in complex diagnostics.

What defines the difference between direct and indirect distribution channels?

Direct distribution involves the manufacturer selling instruments directly to the end-user (e.g., a large hospital network), allowing greater control and higher margins. Indirect distribution involves third-party distributors or dealers handling sales, logistics, and localized support, offering broader market reach, especially geographically.

What is the expected growth trend in the Latin American market?

The Latin American market is expected to exhibit steady growth, fueled by continuous improvements in healthcare spending, modernization of public health systems, and increasing patient demands for efficient diagnostic services, leading to greater adoption of moderately priced semi-automated systems.

How do technological advancements address the limitation of ESR non-specificity?

Technological advancements address non-specificity by providing detailed kinetic curve analysis (via photometry) and integrating AI capabilities to correlate ESR readings with other patient-specific clinical data. This contextualization helps differentiate specific inflammatory causes, enhancing the overall diagnostic value of the test.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager