Estate Planning Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433451 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Estate Planning Services Market Size

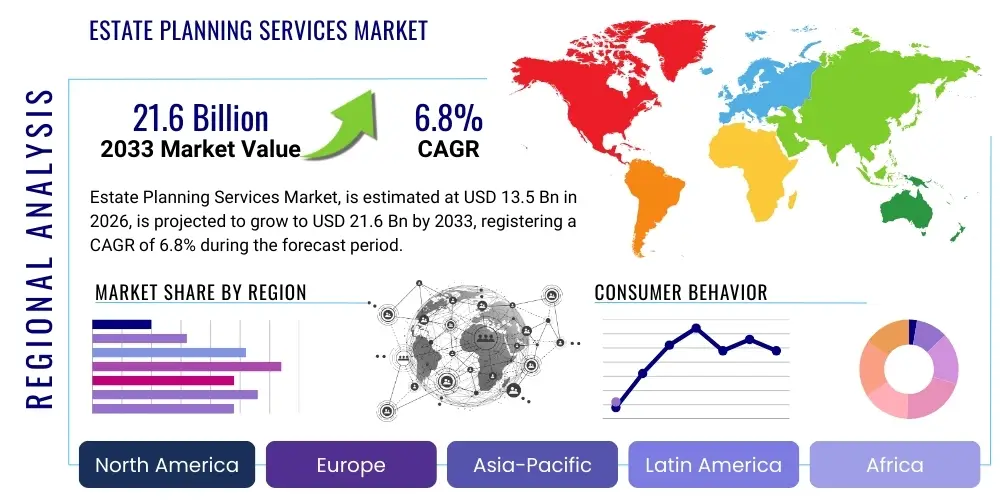

The Estate Planning Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 13.5 Billion in 2026 and is projected to reach USD 21.6 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the accelerating transfer of wealth across generations, particularly the Baby Boomer cohort passing assets to Millennials and Generation X, coupled with increasing consumer awareness regarding the necessity of proactive financial security and minimizing estate taxes. The complexity of global asset ownership and cross-jurisdictional legal requirements further necessitates specialized planning services, underpinning the robust market expansion trajectory.

Estate Planning Services Market introduction

The Estate Planning Services Market encompasses professional and technological offerings designed to manage an individual's asset distribution, medical decisions, and financial affairs upon incapacitation or death. Products primarily include the drafting of wills, establishment and administration of various trusts (revocable living trusts, irrevocable trusts), power of attorney documents, advance healthcare directives, and sophisticated wealth transfer strategies aimed at tax minimization and probate avoidance. Major applications span across high-net-worth individuals seeking complex tax and international asset structuring, mass affluent clients requiring basic probate solutions, and institutions needing corporate succession planning. Key benefits include ensuring asset preservation, fulfilling donor intent, reducing familial conflict, and guaranteeing legal compliance. The market is fundamentally driven by the rapid aging of global populations, significant generational wealth accumulation, increasing governmental scrutiny on wealth transfer mechanisms, and the concurrent rise of digital platforms making basic planning accessible to a broader demographic.

Estate Planning Services Market Executive Summary

The Estate Planning Services Market is undergoing a rapid transformation characterized by increasing digitalization and a convergence of legal, tax, and financial advisory services. Business trends indicate a strong shift towards hybrid models, combining traditional personalized legal consultation with highly efficient online document generation tools, driving down costs for mass affluent segments while enhancing complexity management for high-net-worth clients. Regional trends show North America maintaining dominance due to high wealth concentration and complex federal tax laws, while the Asia Pacific (APAC) region exhibits the fastest growth potential fueled by newly generated wealth in emerging economies like China and India, alongside the development of sophisticated trust laws. Segment trends highlight the surging demand for Trust Administration services, driven by the desire for enhanced privacy and control over asset distribution, and a noticeable pivot toward holistic planning that integrates estate documents with comprehensive retirement and investment strategies, demanding greater collaboration between specialized law firms and large financial institutions.

AI Impact Analysis on Estate Planning Services Market

Common user questions regarding AI in estate planning center on whether artificial intelligence can fully replace human lawyers, the security and accuracy of automated document generation (e.g., wills and trusts drafted by algorithms), and the ethical implications of using AI for sensitive financial and legal matters. Users also frequently question AI's capability to handle complex, bespoke estate structures, such as those involving international assets or specialized tax strategies, and how AI tools ensure compliance with constantly changing state and jurisdictional laws. The key theme emerging from these inquiries is a tension between the efficiency gains offered by automation and the need for personalized, nuanced judgment essential in high-stakes legal and financial advisory roles. Users expect AI to streamline administrative tasks and improve accessibility but remain skeptical about its ability to replicate the strategic insight and emotional intelligence provided by an experienced human advisor.

The advent of sophisticated Generative AI and Machine Learning models is redefining the service delivery landscape, pushing traditional providers to integrate technology or face disruption. AI is currently excelling in areas requiring large-scale data processing and repetitive documentation, such as generating initial drafts of standard legal forms, performing regulatory compliance checks, and managing client data intake. However, the true impact lies in decision support systems, where AI analyzes complex financial scenarios and suggests optimized estate structures based on current tax codes and jurisdictional best practices. This augmentation of human capability, rather than complete replacement, is enhancing efficiency, reducing the risk of human error in documentation, and allowing legal professionals to focus their expertise on high-value strategic counseling.

- AI significantly automates the drafting of standardized legal documents (e.g., basic wills, powers of attorney), improving speed and reducing transactional costs.

- Machine learning algorithms enhance regulatory compliance by rapidly identifying clauses that conflict with current state or federal probate laws.

- AI-driven tools are being used for complex scenario planning, simulating various tax outcomes based on different asset distribution strategies.

- Improved client data intake and management via AI chatbots and automated forms streamline the initial engagement process, enhancing user experience.

- Concerns regarding data privacy, legal liability for AI-generated errors, and potential bias in automated financial modeling are critical restraint factors.

DRO & Impact Forces Of Estate Planning Services Market

The market is primarily driven by the massive generational wealth transfer occurring globally, coupled with the increasing complexity of tax laws and regulatory environments across multiple jurisdictions, mandating professional expertise. Restraints include the persistent reluctance among younger generations to prioritize estate planning, the high cost associated with comprehensive legal services for middle-income demographics, and the fragmentation of regulations across different states or countries, complicating multi-jurisdictional planning. Opportunities are abundant in the integration of digital platforms with traditional services, targeting the underserved mass affluent market through subscription models, and leveraging AI for predictive analytics in tax and trust optimization. The key impact forces driving change are demographic shifts (aging populations), technological innovation (AI and blockchain for secure record-keeping), escalating regulatory complexity, and the competitive threat posed by large financial institutions entering the specialized estate planning sector, demanding constant adaptation and value addition from existing providers.

Segmentation Analysis

The Estate Planning Services Market is broadly segmented based on Service Type, Client Type, and Delivery Channel, reflecting the diverse needs of individuals and the mechanisms through which these services are delivered. Segmentation by Service Type demonstrates a focus on distinct legal and financial needs, ranging from basic document preparation to highly complex trust and tax mitigation strategies. Client Type segmentation distinguishes between the simple needs of the Mass Affluent market and the intricate, high-value requirements of High Net Worth Individuals (HNWIs) and Ultra-High Net Worth Individuals (UHNWIs). Finally, Delivery Channel segmentation highlights the ongoing shift from traditional, in-person consultation models (Law Firms, Accounting Firms) toward scalable, technology-enabled platforms (Online Legal Services, Financial Advisors offering bundled services).

- By Service Type:

- Will Preparation and Drafting

- Trust Creation and Administration (Revocable, Irrevocable, Special Needs, Charitable)

- Tax Planning and Mitigation (Estate, Gift, Generation-Skipping Transfer Tax)

- Power of Attorney and Healthcare Directives

- Probate and Estate Settlement Services

- By Client Type:

- High Net Worth Individuals (HNWI)

- Mass Affluent

- Institutional and Corporate Succession Planning

- By Delivery Channel:

- Law Firms and Independent Attorneys

- Financial Advisors and Wealth Management Firms

- Online Legal Service Platforms (Direct-to-Consumer)

- Accounting and Tax Advisory Firms

Value Chain Analysis For Estate Planning Services Market

The value chain for estate planning services is complex, starting with upstream activities focused on legal knowledge creation and technological development, moving through service delivery, and concluding with downstream activities related to execution and long-term administration. Upstream analysis involves legal research organizations, legislative bodies that define the operational boundaries, and specialized software developers providing document generation and compliance tools. Key inputs at this stage include deep jurisdictional legal expertise, proprietary tax calculation algorithms, and secure data storage solutions. The quality and timeliness of these inputs directly influence the accuracy and efficacy of the final estate plan, creating a high barrier to entry for firms lacking access to up-to-date legislative knowledge and sophisticated technology platforms.

The core service delivery stage involves the interaction between the planner and the client, encompassing needs assessment, strategic planning, document drafting, execution, and ongoing maintenance. Distribution channels are varied, including direct engagement through specialized estate law firms, which offer high-touch, customized services, and indirect distribution through financial advisors or wealth managers who bundle estate planning alongside investment products. Online platforms represent a rapidly growing indirect channel, providing scalable, low-cost solutions for standardized needs. The preference for direct channels often correlates with the client's wealth level and the complexity of their estate, requiring personalized counsel to navigate intricate tax liabilities and asset protection strategies.

Downstream activities focus heavily on the administrative and operational elements post-execution. This includes trust administration (managing assets according to trust terms), fiduciary services, and probate representation upon the client's death. The efficiency of these downstream services relies heavily on clear documentation and robust digital record-keeping established earlier in the chain. Furthermore, customer feedback loops and periodic plan reviews are essential components of maintaining value, ensuring the estate plan remains relevant amidst changes in family structure, financial status, and tax legislation. The integration of technology throughout the value chain, especially in secure digital asset management and blockchain-based documentation, is critical for optimizing both efficiency and compliance.

Estate Planning Services Market Potential Customers

Potential customers for estate planning services are highly diverse, segmented primarily by wealth level, life stage, and complexity of asset holdings. The primary and largest segment consists of individuals aged 50 and above, particularly Baby Boomers, who are actively preparing for retirement and the subsequent transfer of significant accumulated wealth. This group frequently requires complex instruments such as dynasty trusts, charitable giving strategies, and sophisticated tax minimization plans due to high asset valuation and potential exposure to estate and generation-skipping transfer taxes. Their purchasing decision is heavily influenced by reputation, fiduciary duty adherence, and the integration of estate planning with holistic financial advice.

A rapidly expanding customer base is the Mass Affluent segment—individuals with moderate wealth (typically $250,000 to $2 million in assets) who require foundational planning, including basic wills, simple revocable trusts, and durable powers of attorney. This segment is highly price-sensitive and is increasingly turning toward affordable, direct-to-consumer online platforms and bundled services offered by large financial institutions. Their need is driven by the desire to avoid probate and ensure the guardianship of minor children, favoring convenience and speed over bespoke legal counsel, thereby creating substantial demand for scalable technological solutions.

Additionally, institutional clients, including business owners and family offices, represent a high-value customer base requiring specialized services such as business succession planning, corporate fiduciary services, and complex international trust structuring. These clients prioritize expertise in cross-border regulations and integrated solutions that protect corporate assets while ensuring a smooth transition of ownership or control. Furthermore, younger generations (Millennials and Gen Z) are becoming increasingly relevant, especially those with digital assets or complex family structures, utilizing estate planning services earlier in their lives to protect intellectual property and digital legacies, favoring technologically adept and transparent providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 13.5 Billion |

| Market Forecast in 2033 | USD 21.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fidelity Investments, Vanguard, LegalZoom, Rocket Lawyer, Deloitte, PwC, Morgan Stanley, Merrill Lynch, Northern Trust, BNY Mellon, JPMorgan Chase, US Bank, EstateExec, Trust & Will, Schwab, regional specialty law firms. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Estate Planning Services Market Key Technology Landscape

The technology landscape in estate planning is rapidly evolving, moving beyond simple word processing to incorporate sophisticated tools for automation, security, and complex analysis. Core technologies include specialized Customer Relationship Management (CRM) platforms tailored for legal practices, which help manage the lengthy client lifecycle typical in estate administration, and advanced document automation software. This automation utilizes standardized templates and intelligent questionnaires to significantly reduce the time spent drafting repetitive legal documents, allowing professionals to scale their practices without sacrificing legal precision. Furthermore, technologies designed for secure digital asset inventory and management are becoming crucial, as clients increasingly hold significant value in cryptocurrencies, NFTs, and online accounts that must be accounted for in the estate plan.

Generative AI and Machine Learning represent the cutting edge of technological integration. AI is being deployed for predictive modeling to assess the likelihood of probate litigation, calculate potential tax liabilities under various succession scenarios, and ensure instantaneous regulatory compliance checks across multiple jurisdictions. These systems act as powerful research assistants for attorneys, synthesizing vast quantities of legal precedents and tax code updates faster than human researchers. The shift toward hybrid cloud infrastructure is also prevalent, ensuring both the scalability of data storage for long-term trust administration records and the high-level security required for handling sensitive financial and personal data, mitigating the risk of breaches that could lead to financial or legal exposure.

Blockchain technology, while still nascent in widespread adoption, offers significant potential for transforming the security and irrevocability of estate documentation and asset transfer. By recording wills, trusts, and digital asset titles on a distributed, immutable ledger, blockchain can provide irrefutable proof of execution and significantly streamline the process of transferring ownership post-mortem, reducing the time and cost associated with probate court intervention. Additionally, client portals utilizing biometric security and end-to-end encryption are standardizing the communication and document exchange process, enhancing client trust and meeting stringent data privacy regulations like GDPR and CCPA. The successful estate planning firm of the future will rely on seamless integration across these technological layers to deliver efficient, secure, and highly personalized services.

Regional Highlights

The global Estate Planning Services Market exhibits distinct characteristics and growth trajectories across major geographical regions, influenced heavily by local wealth distribution, cultural attitudes toward death and inheritance, and, most importantly, prevailing tax and probate legislation.

North America, particularly the United States, holds the dominant market share due to the immense concentration of wealth, highly complex and frequently changing federal and state tax codes (e.g., estate tax, gift tax), and a strong consumer culture of seeking professional financial advisory services. The market here is characterized by high demand for specialized trust services and tax mitigation strategies, driving continuous innovation among large financial conglomerates and specialized law firms.

Europe represents a mature but fragmented market. Demand is strong in the Western European nations (UK, Germany, France) driven by aging populations and wealth preservation concerns. However, the market is structurally complex due to varying national inheritance laws, succession rules (e.g., forced heirship in continental Europe), and different approaches to international asset reporting. Cross-border planning within the EU remains a significant catalyst for professional services.

Asia Pacific (APAC) is the fastest-growing region, fueled by rapid wealth creation in economies like China, India, and Southeast Asian nations. As this new wealth matures, there is an escalating need for sophisticated wealth management and succession structures, often involving complex cross-border business interests and a cultural shift towards professional, formalized estate planning rather than traditional informal wealth transfer methods. Singapore and Hong Kong are key regional hubs for trust formation and international planning.

Latin America (LATAM) and Middle East and Africa (MEA) markets are developing, driven by the concentration of wealth among Ultra-High Net Worth Individuals (UHNWIs) and family offices. While regulatory frameworks can be less standardized, the demand for asset protection, international structuring, and compliance with global financial transparency rules (e.g., CRS) drives the use of international estate planning centers and complex offshore structures.

- United States: Dominant market, high demand for federal estate tax mitigation and complex trust administration due to significant wealth accumulation.

- United Kingdom: Strong emphasis on inheritance tax planning and the use of flexible trusts, influenced heavily by continuous regulatory adjustments.

- Germany and France: Market shaped by compulsory heirship laws and localized succession rules, requiring deep knowledge of civil law codes.

- China and India: Rapid growth driven by newly generated wealth, increasing adoption of modern trust structures for business succession and privacy.

- Singapore and Hong Kong: Crucial hubs in APAC offering sophisticated international and offshore trust services, catering to regional HNWI needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Estate Planning Services Market.- Fidelity Investments

- The Vanguard Group

- LegalZoom

- Rocket Lawyer

- Deloitte Touche Tohmatsu Limited

- PricewaterhouseCoopers (PwC)

- Morgan Stanley

- Merrill Lynch (Bank of America)

- Northern Trust Corporation

- BNY Mellon

- JPMorgan Chase & Co.

- US Bank (U.S. Bancorp)

- Charles Schwab Corporation

- Trust & Will

- EstateExec

- Stewardship Counsel

- Wilmington Trust (M&T Bank)

- Wells Fargo

- KPMG

- EY (Ernst & Young)

Frequently Asked Questions

Analyze common user questions about the Estate Planning Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the growth of the Estate Planning Services Market?

Market growth is primarily driven by the massive generational wealth transfer from Baby Boomers, the increasing complexity of international tax laws, and rising consumer awareness regarding the necessity of proactive financial and legal security. The rise of digital asset ownership also mandates specialized planning services.

How does segmentation by Delivery Channel impact service pricing and accessibility?

Delivery channel segmentation significantly influences cost; online legal platforms offer low-cost, high-accessibility solutions for basic needs, while traditional law firms and specialized wealth managers command premium pricing for complex, personalized services requiring specialized tax and legal expertise.

What is the role of Artificial Intelligence (AI) in modern estate planning?

AI's role involves enhancing efficiency through automated document drafting, performing rapid regulatory compliance checks across multiple jurisdictions, and providing predictive analytics for optimizing tax strategies and scenario planning, thereby augmenting the capabilities of human advisors.

Which regional market holds the largest share and why?

North America, particularly the United States, holds the largest market share due to its high concentration of wealth, the existence of a complex federal estate tax system, and a mature industry structure involving large financial institutions and sophisticated legal practices.

What is the primary difference between a Will and a Trust in estate planning?

A Will provides instructions for asset distribution and guardianship after death and typically requires a public probate process. A Trust (especially a living trust) is a legal entity that holds assets, allows for management during life, and facilitates private, potentially tax-advantaged transfer of assets outside of probate upon death or incapacitation.

Is estate planning solely reserved for High Net Worth Individuals (HNWI)?

No, while HNWIs require complex tax mitigation and asset protection, estate planning is crucial for the mass affluent segment. Even basic planning (Wills, Power of Attorney) is necessary for middle-income earners to ensure minors are protected and to avoid lengthy, expensive probate processes for even modest assets.

How are changing family structures influencing demand for specialized planning?

The rise of blended families, unmarried partnerships, and non-traditional family structures increases the demand for specialized legal instruments (such as domestic partnership agreements and specific beneficiary designations) that go beyond standard marital provisions to ensure intent is legally recognized.

What risks are associated with using online, automated legal services?

The main risks include the lack of personalized legal advice, potential for errors if the user fails to understand complex legal nuances specific to their state, and inadequate coverage for complex estates involving international assets, potentially leading to future litigation or improper asset transfer.

What security measures are critical for estate planning providers dealing with sensitive data?

Critical security measures include robust encryption (both in transit and at rest), adherence to strict data privacy regulations (like GDPR/CCPA), two-factor authentication for client portals, and secure, often cloud-based, data storage solutions to protect highly sensitive financial and personal information.

How does international asset ownership complicate the estate planning process?

International asset ownership requires navigating complex conflicts of law, potential double taxation, and varying inheritance laws (e.g., civil law versus common law systems). This necessitates specialized expertise in cross-border treaties, international trust administration, and multi-jurisdictional compliance to ensure legality and tax efficiency.

What defines a fiduciary relationship in estate planning?

A fiduciary relationship requires the advisor (such as a trustee or executor) to act solely in the best interest of the client or beneficiaries, placing their needs above the advisor's own. This includes obligations of loyalty, confidentiality, and prudent management of assets, establishing a high standard of trust.

Why is ongoing maintenance and review crucial for an estate plan?

Estate plans must be regularly reviewed (ideally every 3-5 years) because tax laws, beneficiary circumstances (births, deaths, marriages, divorces), and the client's financial portfolio constantly change. Failure to update can render the plan legally obsolete or tax-inefficient.

How significant is the impact of blockchain on digital asset inheritance?

Blockchain is highly significant for digital asset inheritance as it offers immutable record-keeping and potentially secure, automated transfer of ownership for cryptocurrencies and tokens via smart contracts, addressing the current challenge of accessing and distributing decentralized digital wealth.

What are the key differences between estate planning services provided by law firms versus financial advisors?

Law firms primarily offer specialized legal document drafting, litigation avoidance, and probate expertise, while financial advisors focus on the funding of trusts, asset management, investment strategies, and integrating the estate plan into a broader financial security portfolio.

What specific technological integration is driving market efficiency?

The primary technological integrations driving efficiency include CRM systems tailored for legal workflows, intelligent document assembly software, and AI-powered regulatory monitoring tools that instantly flag compliance issues across complex, multi-state or international plans.

How do global economic volatility and inflation affect estate planning strategies?

Economic volatility and inflation necessitate dynamic estate planning strategies. High inflation erodes purchasing power, making asset protection and specialized trusts (like GRATs) more appealing, while volatility requires more flexible trust language and frequent revaluation of assets for tax purposes.

What is the primary constraint hindering market penetration in emerging economies?

The primary constraint in many emerging economies is the low level of public awareness regarding formal estate planning benefits, compounded by the prevalence of traditional, informal wealth transfer methods and a less mature or highly localized regulatory framework for trusts and probate.

Why are charitable giving strategies increasingly integrated into estate plans?

Charitable giving vehicles (like Charitable Remainder Trusts or Donor Advised Funds) are increasingly popular because they allow clients to fulfill philanthropic goals while simultaneously achieving significant income tax and estate tax deductions, making them dual-purpose planning tools.

What are the ethical considerations surrounding the use of AI in drafting legal documents?

Ethical considerations include ensuring the AI models are free from legal bias, establishing clear lines of liability when AI-generated documents contain errors, and maintaining the professional duty of competence when relying on automated legal interpretations.

How does the fragmentation of state laws in the US impact service providers?

Fragmentation mandates that service providers operate with deep jurisdictional knowledge, as wills and trusts executed in one state may have different tax or probate implications in another, requiring comprehensive cross-state regulatory compliance and highly specialized legal counsel.

What is the significance of the Generation-Skipping Transfer (GST) Tax in estate planning?

The GST Tax is a federal tax in the U.S. imposed on transfers made to beneficiaries two or more generations younger than the grantor (e.g., grandchildren). Sophisticated planning using GST-exempt trusts is essential for high-net-worth clients aiming to preserve multi-generational wealth.

How do financial institutions leverage estate planning services to retain clients?

Financial institutions use integrated estate planning services as a crucial value-added tool. By helping clients secure their legacies and structure their trusts, they solidify long-term fiduciary relationships, ensuring that client assets remain under the institution's management for years, often generations.

What is the main challenge associated with administering a Special Needs Trust?

The main challenge is ensuring the trust assets are used solely to supplement, not supplant, the government benefits (like Medicaid or Supplemental Security Income) the beneficiary is receiving. Mismanagement can jeopardize crucial governmental aid, requiring careful, highly specialized administration.

In the value chain, what constitutes the upstream activity for estate planning?

Upstream activity encompasses the continuous legal research, legislative monitoring, tax code analysis, and the development of specialized software (document automation engines, AI compliance checkers) that form the foundational legal knowledge base for service delivery.

How are providers adapting to the increasing prevalence of intangible assets?

Providers are adapting by requiring specific digital inventories, utilizing secure password management systems, and including clauses in legal documents detailing the transfer, access, and administration rights for intangible assets such as digital intellectual property, social media accounts, and cryptocurrency wallets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager