Ester Transformer Oils Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433569 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Ester Transformer Oils Market Size

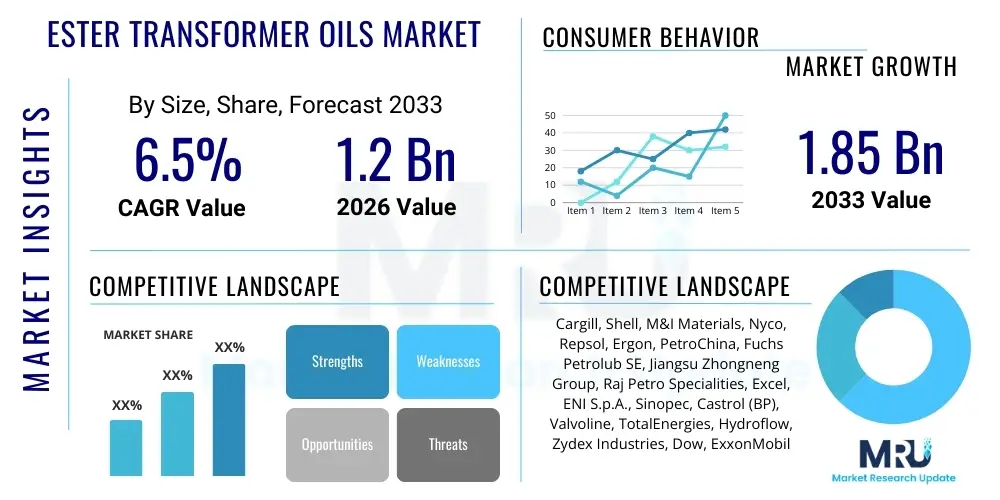

The Ester Transformer Oils Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033.

Ester Transformer Oils Market introduction

Ester transformer oils represent a crucial advancement in dielectric fluid technology, designed to replace conventional mineral oils in high-voltage electrical equipment. These fluids, derived from either natural seeds (natural esters) or synthesized compounds (synthetic esters), offer superior fire safety, environmental biodegradability, and enhanced moisture tolerance. Their high flash and fire points significantly reduce explosion hazards in densely populated areas, indoor installations, and sensitive ecological zones. The market expansion is intricately linked to global efforts toward grid modernization, renewable energy integration, and stringent regulatory requirements mandating safer, greener operational fluids within electrical infrastructure.

The primary applications of ester transformer oils span across distribution transformers, power transformers, specialized traction transformers (for railways), and rectifier transformers. Ester fluids, particularly natural esters, exhibit excellent thermal aging performance, allowing transformers to handle temporary overloads more effectively while slowing down the degradation of cellulose insulation paper. This characteristic contributes directly to extending the operational lifespan of high-value transformer assets. Consequently, major utilities and industrial consumers are transitioning to ester-based solutions to enhance system reliability and mitigate operational risks associated with traditional mineral oils.

Key benefits driving this transition include exceptional environmental compatibility, as both natural and synthetic esters are largely non-toxic and readily biodegradable, minimizing ecological impact in the event of leaks or spills. Furthermore, the inherent fire resistance of these fluids supports higher safety standards in substations located near commercial or residential complexes. The market growth is fundamentally propelled by escalating investments in smart grids, the continuous development of offshore wind and solar projects requiring robust and reliable electrical transmission, and heightened global focus on sustainable industrial practices, making esters indispensable for future power infrastructure.

Ester Transformer Oils Market Executive Summary

The Ester Transformer Oils Market is witnessing robust expansion driven by converging business trends centered around sustainability, regulatory pressure, and asset longevity. Financially, major utilities are reallocating capital expenditure towards insulating fluids that meet strict ecological mandates, favoring natural esters derived from renewable sources. Strategic collaborations between ester manufacturers and transformer OEMs are accelerating the adoption curve, standardizing the use of these fluids in new equipment designs globally. The business landscape is characterized by competitive innovation focused on improving cold-flow properties and enhancing the long-term stability of synthetic esters for extremely demanding applications, such as Ultra-High Voltage (UHV) transmission systems.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by massive governmental initiatives in China and India focused on expanding transmission and distribution networks and incorporating renewable energy sources. Europe remains a critical innovation hub, maintaining high adoption rates due to pioneering environmental directives (e.g., EHS guidelines) that favor biodegradable and non-toxic materials. North America is experiencing steady growth, largely spurred by the need to upgrade aging infrastructure and comply with internal safety standards for substations located in urban cores. The regional dynamics clearly illustrate a global transition from cost-centric material selection to performance- and safety-centric procurement strategies.

Segmentation analysis reveals that the Natural Ester segment dominates the market by volume, owing to its renewability and cost-effectiveness compared to synthetic counterparts. However, the Synthetic Ester segment is expected to exhibit the highest CAGR, particularly in specialized, high-performance applications where superior thermal oxidation stability and specific viscosity characteristics are mandatory, such as HVDC converters and specific types of industrial furnace transformers. Among applications, distribution transformers represent the largest consumer base, reflecting the widespread replacement and installation of safer units in population centers, while the increasing deployment of Extra High Voltage (EHV) equipment signifies growing demand in long-distance power transmission projects.

AI Impact Analysis on Ester Transformer Oils Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Ester Transformer Oils Market frequently revolve around predictive maintenance, optimization of fluid life cycles, and smart manufacturing processes. Users are keenly interested in how AI algorithms can predict oil degradation rates, optimize transformer load profiles based on fluid characteristics, and ultimately determine the optimal time for ester fluid replacement or regeneration, moving beyond traditional scheduled maintenance. Furthermore, inquiries focus on the role of machine learning in refining the synthesis and blending processes of synthetic esters to achieve specific, high-performance dielectric properties with greater consistency and speed, thereby minimizing production variability and material waste.

AI’s influence is primarily felt in enhancing the efficiency and reliability of the assets utilizing ester oils. By integrating real-time sensor data (such as temperature, moisture content, and Partial Discharge readings) with advanced machine learning models, transformer operators can gain unparalleled insight into the health status of the ester fluid and the insulating paper. This shift enables condition-based monitoring specific to ester characteristics, which differ significantly from mineral oil, maximizing the operational window while ensuring fire safety protocols are strictly maintained. This predictive capability reduces sudden transformer failures, a major cost component for utility providers, indirectly increasing the perceived value and reliability of ester-filled equipment.

In the manufacturing domain, AI and robotics are streamlining the production of complex ester compounds. Generative design and optimization algorithms are being utilized to simulate molecular structures, testing potential new formulations for improved dielectric strength, oxidation resistance, and lower pour points before physical synthesis begins. This acceleration in R&D cycles allows manufacturers to quickly adapt to evolving application requirements, such as the need for robust fluids in extreme cold climates or highly oscillating loads typical of solar farms. Ultimately, AI transforms ester oils from a static component into an active, monitored asset, contributing significantly to a resilient and intelligent power grid ecosystem.

- AI-driven predictive maintenance optimizes ester fluid change intervals, reducing unnecessary downtime.

- Machine Learning models analyze Dissolved Gas Analysis (DGA) in esters to detect incipient faults faster than traditional methods.

- Smart blending systems use AI to ensure precise formulation and quality control during synthetic ester manufacturing.

- Optimizing transformer loading using AI enhances the utilization rate of ester-filled equipment under varying environmental conditions.

- AI facilitates the analysis of vast environmental data, improving supply chain efficiency for natural ester raw materials (seed oils).

- Integration of ester oil health metrics into overall smart grid management systems improves holistic grid reliability.

DRO & Impact Forces Of Ester Transformer Oils Market

The Ester Transformer Oils Market is strongly influenced by a robust combination of environmental mandates (Drivers), competitive cost structures (Restraints), and increasing grid sophistication (Opportunities). The primary driver is the accelerating global shift towards enhanced fire safety and environmental compliance, particularly in urban, indoor, and ecologically sensitive installation sites. The high fire point (above 300°C) of esters, coupled with their rapid biodegradability and non-toxic nature, fulfills critical regulatory requirements (such as IEEE and IEC standards) and societal demands for cleaner energy infrastructure. This push is amplified by large-scale investments in renewable energy integration, requiring reliable and safe components in harsh and remote environments, cementing esters as the preferred dielectric medium.

However, market growth faces notable restraints, chiefly concerning the initial higher cost of ester fluids compared to standard mineral oil, which can deter adoption in price-sensitive developing markets. Although the total cost of ownership (TCO) often favors esters due to extended asset life and lower insurance premiums, the initial capital expenditure remains a hurdle for smaller utilities and private developers. Additionally, the necessity for specific handling procedures and compatibility checks with existing transformer components (like certain gaskets or paints) sometimes poses logistical challenges during retrofilling operations. While manufacturers are addressing these concerns through increased production scalability and improved fluid compatibility, the legacy infrastructure bias presents a persistent frictional force against rapid, universal adoption.

The market presents significant opportunities through ongoing technological advancements and emerging applications. The development of next-generation synthetic esters capable of operating reliably at extremely high voltages (UHV, above 800 kV) opens lucrative avenues in long-distance bulk power transmission, a previously mineral oil-dominated segment. Furthermore, the emerging market for green hydrogen infrastructure and specialized industrial applications, such as offshore drilling platforms and mining operations, provides new niches where the fire resistance of esters is critical. Exploiting the inherent ability of esters to absorb and manage moisture better than mineral oil also provides an opportunity to market them as insulation protectors, extending the overall service life of high-value transformers significantly.

Segmentation Analysis

The Ester Transformer Oils Market is comprehensively segmented based on product type, voltage class, application type, and end-user industry, reflecting the diverse requirements of the global power infrastructure landscape. Product type segmentation distinguishes between Natural Esters, derived from vegetable oils like sunflower or rapeseed, and Synthetic Esters, typically polyol esters or synthetic hydrocarbons. This fundamental split dictates environmental profile, thermal performance, and cost structure. Natural esters dominate due to their renewability and favorable environmental footprint, while synthetic esters cater to demanding applications requiring highly specific thermal and oxidative stability properties, often at a higher cost premium.

Segmentation by voltage class is critical as performance requirements escalate exponentially with voltage. The market covers Low Voltage (LV), Medium Voltage (MV), High Voltage (HV), Extra High Voltage (EHV), and Ultra High Voltage (UHV) systems. While ester oils are widely accepted across MV and HV distribution networks, their increasing qualification and usage in EHV and UHV transformers mark a significant penetration into the core power transmission infrastructure. Application segmentation further differentiates demand based on equipment type, primarily focusing on power transformers used in generation and transmission, and distribution transformers used for local power delivery, the latter being the largest consuming segment by volume.

The end-user segmentation highlights the primary sectors driving adoption. Utilities and power generation companies constitute the largest end-user group, driven by grid upgrade cycles and renewable integration projects. Industrial sectors, including manufacturing, petrochemicals, and heavy industry, represent a vital secondary market, prioritizing fire safety in complex internal electrical systems. The growing specialized transportation sector, notably high-speed rail and metro systems, also contributes significant demand for specific synthetic ester fluids optimized for traction applications and confined operational spaces where fire mitigation is non-negotiable. This multi-dimensional segmentation allows market players to tailor product development and strategic marketing efforts precisely to specific performance needs and regulatory environments globally.

- By Type:

- Natural Ester Transformer Oil (Vegetable Oil Based)

- Synthetic Ester Transformer Oil (Pentaerythritol Ester, Polyol Ester, Synthetic Hydrocarbon Esters)

- By Voltage Class:

- Low Voltage (LV)

- Medium Voltage (MV)

- High Voltage (HV)

- Extra High Voltage (EHV)

- Ultra High Voltage (UHV) (Emerging)

- By Application:

- Power Transformers (Transmission)

- Distribution Transformers (Local Grid)

- Railway Transformers (Traction)

- Rectifier Transformers

- Specialty Industrial Transformers

- By End-User:

- Utilities and Power Generation

- Industrial (Manufacturing, Mining, Oil & Gas)

- Commercial and Infrastructure (Data Centers, Buildings)

- Transportation (Railways, Marine)

Value Chain Analysis For Ester Transformer Oils Market

The value chain for the Ester Transformer Oils market initiates with the upstream sourcing and refining of raw materials. For Natural Esters, this involves agricultural procurement of seeds (e.g., rapeseed, soybean, sunflower), followed by crushing, extraction, and rigorous refining processes to produce the base vegetable oil. For Synthetic Esters, the upstream stage involves petrochemical sourcing of alcohols and acids, followed by complex esterification reactions. Quality control at this foundational stage is paramount, ensuring the base fluids meet stringent purity and dielectric performance specifications before further processing. Suppliers in this segment focus heavily on sustainable sourcing and efficient refining technologies to minimize costs and maximize yield.

The midstream segment involves the specialized processing, formulation, and blending of the base esters into finished transformer oil products. Manufacturers add performance-enhancing additives, such as antioxidants and metal passivators, to stabilize the fluid, improve its oxidation resistance, and enhance low-temperature fluidity (pour point). This stage requires specialized chemical expertise and advanced blending facilities compliant with international standards (like IEC 62770 and ASTM D6871). The distribution channel then plays a crucial role, connecting manufacturers to the end-users. Direct sales are common for large volume orders placed by major utilities and Original Equipment Manufacturers (OEMs), facilitating close technical collaboration and customized supply agreements.

Indirect distribution involves specialized chemical distributors and regional agents who cater to smaller industrial buyers, maintenance contractors, and retrofilling service providers. These indirect channels require strong technical support and localized inventory management, especially for urgent maintenance needs. The downstream segment encompasses the end-users—utilities, industrial facilities, and transport providers—who integrate the ester fluids into new transformers or use them for retrofilling existing units. The value chain concludes with aftermarket services, including fluid monitoring, testing, regeneration, and ultimately, responsible disposal, which is facilitated by the ester's biodegradability. The high performance and safety requirements of the industry necessitate a highly integrated and quality-controlled value chain from agricultural field or chemical plant to energized transformer.

Ester Transformer Oils Market Potential Customers

The primary consumers and potential customers of ester transformer oils are entities that own, operate, or maintain high-voltage electrical assets, particularly those prioritizing safety, environmental responsibility, and long-term asset integrity. Major electric utility companies, responsible for extensive transmission and distribution networks, represent the largest customer base. These organizations are increasingly mandated by regulatory bodies to utilize high fire-point fluids in populated areas or sensitive substations, making the adoption of ester fluids a mandatory compliance measure rather than an optional upgrade. Furthermore, utilities driving smart grid and renewable energy integration projects require the thermal resilience and extended lifespan offered by esters.

Industrial end-users, especially those involved in mining, steel production, petrochemical refining, and heavy manufacturing, constitute another crucial customer segment. Within these environments, electrical infrastructure often operates under high stress, and the catastrophic impact of a fire necessitates the use of flame-resistant fluids like esters. Data centers, which require extremely high reliability and fire protection within confined spaces, are rapidly becoming significant niche buyers. Lastly, Original Equipment Manufacturers (OEMs) of transformers are key influencers and direct customers, as they integrate ester oils into new transformer designs, offering them as a standard, premium, or mandated option to their utility clients across the globe.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill, Shell, M&I Materials, Nyco, Repsol, Ergon, PetroChina, Fuchs Petrolub SE, Jiangsu Zhongneng Group, Raj Petro Specialities, Excel, ENI S.p.A., Sinopec, Castrol (BP), Valvoline, TotalEnergies, Hydroflow, Zydex Industries, Dow, ExxonMobil |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ester Transformer Oils Market Key Technology Landscape

The technological landscape of the Ester Transformer Oils market is centered on enhancing fluid performance characteristics, specifically dielectric strength, cold flow properties, and oxidative stability, while ensuring cost-effective production. A primary area of innovation involves refining the esterification processes to achieve high purity and consistent molecular uniformity, particularly for synthetic polyol esters. Manufacturers are employing advanced catalyst systems and continuous flow reactors to improve synthesis efficiency, minimize impurities that can affect dielectric performance, and lower the overall production energy footprint. Furthermore, extensive research is dedicated to developing novel additive packages that specifically address the inherent limitations of esters, such as improving low-temperature performance without compromising the fluid’s biodegradability or thermal profile, making them suitable for widespread global deployment across diverse climates.

Another significant technological focus is the development and commercialization of specialized ester fluids tailored for Extra High Voltage (EHV) and Ultra High Voltage (UHV) applications. Achieving stable dielectric performance at these voltage levels requires fluids with exceptionally low dissipation factors and high impulse strength. This necessitates rigorous quality control and the utilization of advanced filtration and degassing technologies during the manufacturing and filling processes to remove trace moisture and dissolved gases. Successful implementation of esters in EHV/UHV systems is crucial for market penetration into core transmission grids, currently dominated by heavily refined mineral oils, thus presenting a major technological hurdle and opportunity for leading market participants.

The integration of Ester-based insulating fluids with modern monitoring and diagnostic technologies represents a key cross-sectoral technological trend. Sensor development, including highly sensitive dissolved gas analysis (DGA) sensors calibrated specifically for ester chemistries, allows for precise condition-based monitoring. Furthermore, advances in life cycle management technologies, such as on-site ester oil regeneration units, are becoming increasingly common. These systems leverage sophisticated filtration and adsorption techniques to remove degradation byproducts and moisture, extending the useful life of the fluid and the transformer insulation system. This technological ecosystem reinforces the economic viability and operational superiority of ester oils over traditional fluids by enabling predictive maintenance and optimizing resource utilization.

Regional Highlights

The market dynamics for ester transformer oils vary significantly by region, driven by differences in regulatory frameworks, power infrastructure maturity, and renewable energy adoption rates. Asia Pacific (APAC) currently dominates the market in terms of production and accelerating demand, largely fueled by massive grid expansion and modernization programs in China, India, and Southeast Asian nations. These countries are increasingly prioritizing fire safety and environmental compliance as they build new urban substations and integrate vast new renewable energy capacities, leading to high-volume adoption of natural ester fluids. Government incentives and infrastructural investment plans targeting 'green grids' are primary catalysts for the exceptional growth witnessed across APAC, making it the most critical region for future market expansion.

Europe holds the distinction as the innovation and regulatory leader for ester oils. Driven by the stringent EU environmental and safety directives, the region achieved high penetration early on, particularly in Western and Northern European countries. While the growth rate is maturing compared to APAC, continuous regulatory updates and high investment in offshore wind and subsea transmission lines ensure sustained demand, often favoring specialized synthetic esters for demanding marine and highly integrated urban applications. The focus here is less on volume expansion and more on technological refinement and ensuring full compliance with circular economy principles through robust recycling and regeneration infrastructure for all dielectric fluids.

North America, particularly the U.S., shows strong, steady adoption, driven primarily by utility-led initiatives to upgrade aging distribution assets and comply with internal safety codes (e.g., NFPA standards) concerning fire risk, especially in densely populated metropolitan areas and critical data center installations. While regulatory pressure is strong, market adoption is often project-specific and focused on mitigating risk in high-consequence areas. The availability of locally sourced base oils, such as soybean oil for natural esters, also supports market growth. Latin America and the Middle East & Africa (MEA) are emerging markets, characterized by rapid urbanization and infrastructure development. Adoption in MEA is particularly focused on industrial safety in petrochemical and power generation facilities, where high ambient temperatures often necessitate the superior thermal resilience offered by synthetic ester fluids.

- Asia Pacific (APAC): Highest growth market, driven by grid modernization, massive renewable energy projects (China, India), and increasing regulatory mandates for green infrastructure. High adoption of natural esters.

- Europe: Leading market for regulatory compliance and technological adoption. Sustained demand from offshore wind farms and urban safety regulations, favoring both natural and high-performance synthetic esters.

- North America: Steady growth driven by aging infrastructure replacement, utility focus on fire safety in urban substations, and compliance with local safety standards. Strong preference for natural esters derived from domestic sources.

- Latin America (LATAM): Emerging market characterized by new power plant construction and grid expansion, with growing environmental awareness influencing purchasing decisions in major economies like Brazil and Mexico.

- Middle East & Africa (MEA): Niche growth, primarily focused on industrial and specialized power projects (Oil & Gas, Desalination Plants), where high ambient temperatures and robust performance requirements boost demand for synthetic esters.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ester Transformer Oils Market.- Cargill, Incorporated

- Shell plc

- M&I Materials Ltd. (MIDEL)

- Nyco S.A.

- Repsol S.A.

- Ergon International, Inc.

- PetroChina Company Limited

- Fuchs Petrolub SE

- Jiangsu Zhongneng Group

- Raj Petro Specialities Pvt Ltd.

- Excel Transformer Oil Company

- ENI S.p.A.

- Sinopec Corp.

- Castrol (BP p.l.c.)

- Valvoline Inc.

- TotalEnergies SE

- Hydroflow Limited

- Zydex Industries

- Dow Inc.

- ExxonMobil Corporation

Frequently Asked Questions

Analyze common user questions about the Ester Transformer Oils market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between natural and synthetic ester transformer oils?

Natural esters are derived from renewable vegetable oils, offering superior biodegradability and moisture tolerance, making them ideal for distribution applications. Synthetic esters are chemically manufactured, providing higher oxidative stability and better low-temperature performance, suitable for highly specialized, high-stress EHV systems and harsh climates.

Why are ester oils considered safer than conventional mineral oils in transformers?

Ester oils, both natural and synthetic, possess significantly higher flash and fire points (typically >300°C) compared to mineral oil (<170°C). This high resistance to ignition drastically reduces the risk of transformer fire or explosion, making them mandatory for indoor and urban installations.

Can existing mineral oil transformers be retrofilled with ester oils?

Yes, many existing mineral oil transformers can be retrofilled with ester fluids, particularly natural esters. However, a rigorous compatibility assessment is required, focusing on gasket materials and internal component materials, along with a thorough cleaning process to ensure optimal performance and long-term fluid stability.

How does the environmental profile of ester oils influence market growth?

Ester oils are readily biodegradable and non-toxic, addressing growing environmental concerns and meeting strict global regulations (e.g., EU directives). This superior ecological profile significantly reduces cleanup costs and environmental liability in case of leaks, acting as a major market driver, especially in sensitive areas.

What is the current trend regarding the use of ester oils in EHV and UHV transformers?

There is a strong emerging trend for utilizing highly stable synthetic ester oils in EHV (Extra High Voltage) systems, driven by successful pilot projects and the need for enhanced fire resilience in critical long-distance transmission infrastructure. Continued R&D is focused on full qualification for UHV applications to unlock the largest transmission market segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager