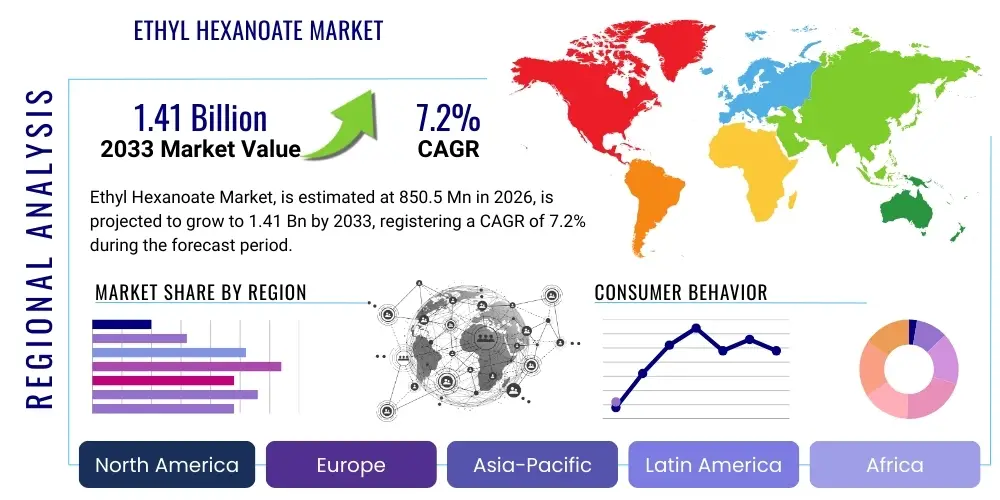

Ethyl Hexanoate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439221 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Ethyl Hexanoate Market Size

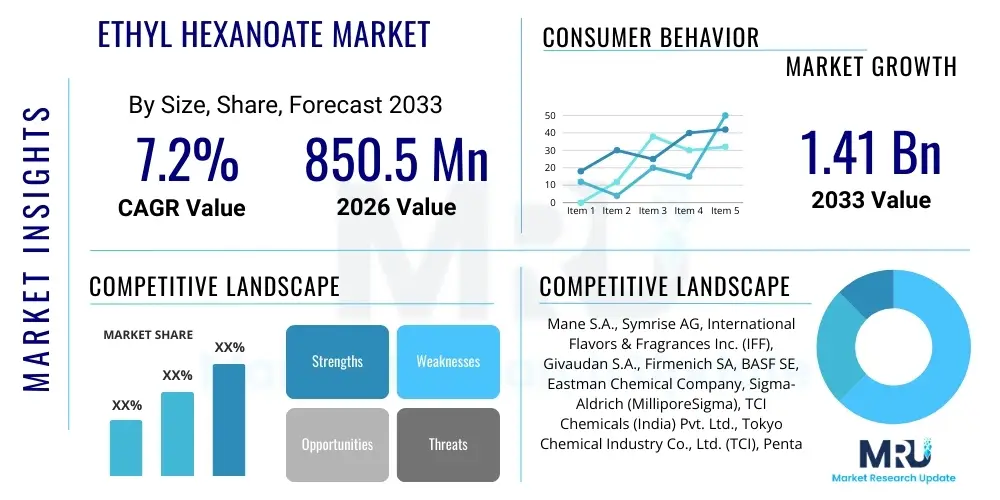

The Ethyl Hexanoate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 850.5 million in 2026 and is projected to reach USD 1.41 billion by the end of the forecast period in 2033.

Ethyl Hexanoate Market introduction

Ethyl hexanoate, also known as ethyl caproate, is an ester with the chemical formula CH3(CH2)4COOCH2CH3. It is primarily recognized for its distinctive fruity aroma, reminiscent of pineapple, apple, or banana, making it a highly valued ingredient in the flavor and fragrance industry. This colorless liquid is sparingly soluble in water but miscible with alcohol and ether, properties that contribute to its versatility across various applications. Its widespread use stems from its ability to impart a pleasant, sweet, and fruity note, significantly enhancing the sensory appeal of numerous consumer products.

Major applications for ethyl hexanoate span across several sectors, with a dominant presence in the food and beverage industry where it serves as a crucial flavoring agent in confectionery, dairy products, alcoholic beverages, and processed foods. Beyond consumables, it finds significant utility in the cosmetics and personal care sector, contributing to the aromatic profiles of perfumes, lotions, soaps, and other beauty products. Furthermore, its solvent properties and pleasant scent make it suitable for minor applications in pharmaceuticals and industrial solvents, albeit on a smaller scale compared to its primary roles.

The primary benefits of ethyl hexanoate include its strong and desirable fruity scent, its stability under various processing conditions, and its cost-effectiveness as a synthetic flavor compound. Key driving factors for the market include the ever-growing demand for processed foods and beverages, increasing consumer preference for exotic and natural-like flavor profiles, and the expansion of the personal care and cosmetics industry globally. Additionally, advancements in synthesis technologies and the development of new applications are continuously propelling market growth, reflecting its indispensable role in enhancing sensory experiences for consumers worldwide.

Ethyl Hexanoate Market Executive Summary

The Ethyl Hexanoate Market is experiencing robust growth driven by evolving consumer preferences for diverse and enhanced flavor profiles, particularly within the burgeoning food and beverage sector. Current business trends indicate a significant shift towards "clean label" ingredients and sustainable sourcing practices, which is influencing production methods and supply chain strategies for ethyl hexanoate manufacturers. There's also an increasing focus on product innovation, with companies exploring novel applications and customized blends to cater to specific regional tastes and industry demands. The market is highly competitive, characterized by both large chemical conglomerates and specialized flavor and fragrance houses vying for market share through technological advancements and strategic partnerships.

Regionally, the Asia Pacific market is poised for exceptional growth, fueled by rapid urbanization, rising disposable incomes, and the expansion of the food processing and cosmetics industries in countries like China and India. North America and Europe continue to be mature markets, demonstrating stable demand, albeit with stricter regulatory landscapes pushing for higher purity standards and sustainable production. Latin America and the Middle East & Africa regions are emerging as promising markets, driven by increasing consumer spending and the entry of international brands, presenting new opportunities for market expansion and distribution network development.

Segment-wise, the flavor and fragrance application segment continues to dominate the ethyl hexanoate market, attributable to its widespread use in enhancing the sensory experience of a vast array of consumer products. Within this segment, the food and beverage industry holds the largest share, with significant demand coming from the alcoholic beverages (especially wine and spirits), confectionery, and dairy sectors. The cosmetics and personal care segment is also a substantial contributor, with steady growth observed in perfumery and aromatherapy products. Furthermore, advancements in biotechnology and green chemistry are opening avenues for bio-based ethyl hexanoate, slowly gaining traction as a sustainable alternative, albeit still a niche segment compared to traditionally synthesized variants.

AI Impact Analysis on Ethyl Hexanoate Market

The impact of Artificial Intelligence (AI) on the Ethyl Hexanoate Market is beginning to manifest across several critical areas, addressing common user questions related to efficiency, innovation, and sustainability. Users frequently inquire about how AI can optimize synthesis processes to reduce costs and environmental footprint, enhance quality control to meet stringent regulatory standards, and accelerate the discovery of novel applications or formulation improvements. There's significant interest in AI's role in predicting market trends and consumer preferences, enabling manufacturers to respond more agilely to demand shifts. Furthermore, questions arise regarding AI's ability to improve supply chain transparency and resilience, mitigating risks associated with raw material sourcing and distribution for a global commodity like ethyl hexanoate. Overall, the prevailing themes revolve around AI as a transformative tool for operational excellence, product innovation, and competitive advantage.

- AI-driven algorithms can optimize chemical synthesis pathways for ethyl hexanoate, leading to higher yields, reduced reaction times, and lower energy consumption, thereby decreasing production costs and enhancing sustainability.

- Predictive analytics powered by AI can forecast market demand for ethyl hexanoate and its end-products, allowing manufacturers to optimize inventory management, production scheduling, and supply chain logistics, minimizing waste and improving responsiveness.

- AI-enabled sensory analysis and machine learning models can accelerate the discovery and formulation of new flavor and fragrance combinations utilizing ethyl hexanoate, tailoring products more precisely to evolving consumer tastes and regional preferences.

- Advanced AI systems can monitor and control fermentation processes for bio-based ethyl hexanoate production, ensuring optimal conditions, identifying potential contaminants, and improving batch consistency and purity.

- AI can enhance quality control by analyzing spectroscopic data and chromatographic profiles, detecting impurities or deviations in ethyl hexanoate composition faster and more accurately than traditional methods, ensuring product safety and compliance.

- Supply chain optimization through AI can provide real-time visibility into raw material availability, transportation routes, and potential disruptions, leading to more resilient and cost-effective delivery of ethyl hexanoate globally.

- AI can facilitate regulatory compliance by rapidly processing and interpreting complex chemical regulations across different jurisdictions, helping manufacturers ensure their ethyl hexanoate products meet all necessary safety and labeling standards.

DRO & Impact Forces Of Ethyl Hexanoate Market

The Ethyl Hexanoate Market is significantly shaped by a confluence of drivers, restraints, and opportunities, collectively forming the impact forces that dictate its trajectory. Among the primary drivers is the escalating global demand for processed and convenience foods, which heavily rely on flavor enhancers like ethyl hexanoate to provide appealing sensory profiles. The burgeoning growth of the alcoholic beverage industry, particularly in emerging economies, further bolsters demand, as ethyl hexanoate is crucial for imparting fruity notes in wines, beers, and spirits. Additionally, the continuous expansion and innovation within the cosmetics and personal care sector, where it is valued for its fragrant properties in perfumes and toiletries, contributes substantially to market momentum. The increasing consumer preference for diverse and exotic flavor experiences also encourages manufacturers to incorporate a broader range of esters, including ethyl hexanoate, into new product formulations, driving consistent demand.

However, the market also faces considerable restraints that temper its growth potential. Volatility in raw material prices, particularly for precursors derived from petrochemicals or agricultural sources, poses a significant challenge, impacting production costs and profit margins for manufacturers. The stringent regulatory landscape governing food additives and cosmetic ingredients in various regions, such as the European Union and North America, necessitates extensive testing and compliance, adding complexity and cost to product development and market entry. Concerns regarding the synthetic nature of ethyl hexanoate and the growing consumer demand for "natural" ingredients, despite its often natural occurrence, present a perceptual hurdle. Moreover, the availability of substitute flavor esters, while offering market diversity, also introduces competitive pressures that can limit the individual growth of ethyl hexanoate.

Opportunities within the Ethyl Hexanoate Market primarily lie in the burgeoning economies of Asia Pacific and Latin America, where rapid industrialization, urbanization, and increasing disposable incomes are fostering a surge in demand for processed foods, premium beverages, and personal care products. The development of sustainable and bio-based production methods for ethyl hexanoate, leveraging fermentation or enzymatic synthesis, presents a substantial opportunity to address environmental concerns and cater to the "green chemistry" movement, potentially broadening its appeal among environmentally conscious consumers and companies. Furthermore, technological advancements in purification and analytical techniques can lead to higher purity grades and novel applications, enhancing product quality and opening new market segments. Strategic collaborations between flavor houses, raw material suppliers, and end-product manufacturers can also foster innovation and optimize the value chain, creating new avenues for growth and reinforcing market resilience against external pressures.

Segmentation Analysis

The Ethyl Hexanoate market is meticulously segmented to provide a granular understanding of its diverse applications, grades, and regional consumption patterns. This segmentation allows for precise market analysis, enabling stakeholders to identify key growth areas, understand competitive dynamics, and tailor strategies effectively. The primary segmentation approaches revolve around the product's end-use applications, which dictate the required purity and volume, and the various grades available to meet specific industry standards. Understanding these segments is crucial for manufacturers to optimize production, for distributors to target specific customer bases, and for investors to gauge market potential.

- By Application

- Food and Beverage

- Confectionery

- Dairy Products

- Alcoholic Beverages (Wine, Beer, Spirits)

- Baked Goods

- Soft Drinks and Juices

- Processed Foods

- Cosmetics and Personal Care

- Perfumes and Fragrances

- Soaps and Detergents

- Lotions and Creams

- Hair Care Products

- Aromatherapy Products

- Pharmaceuticals

- Others (e.g., Industrial Solvents, Tobacco Flavorings)

- Food and Beverage

- By Grade

- Food Grade

- Industrial Grade

- Pharmaceutical Grade

- Cosmetic Grade

- By Purity

- 98% to 99%

- Above 99%

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Ethyl Hexanoate Market

The value chain for the Ethyl Hexanoate Market encompasses a structured flow of activities, beginning from the sourcing of raw materials to the final delivery to end-users, highlighting the interconnectedness of various stakeholders. Upstream activities involve the procurement of critical raw materials, primarily hexanoic acid (caproic acid) and ethanol. Hexanoic acid can be derived from petrochemical sources through oxidation or from natural sources through the fermentation of fats and oils, while ethanol is commonly obtained through fermentation of biomass or petrochemical processes. Suppliers of these base chemicals form the initial crucial link, and their pricing, quality, and supply consistency directly impact the cost and efficiency of ethyl hexanoate production. Any volatility or disruption in the supply of these precursors can ripple through the entire value chain, affecting downstream manufacturing and pricing.

Midstream activities predominantly focus on the manufacturing and synthesis of ethyl hexanoate. This involves chemical synthesis processes, most commonly esterification, where hexanoic acid reacts with ethanol in the presence of an acid catalyst. Manufacturers in this stage employ various techniques for reaction optimization, purification, and quality control to ensure the production of high-purity ethyl hexanoate meeting specific industry standards (e.g., food grade, cosmetic grade). Investment in advanced synthesis technologies, process automation, and robust quality assurance systems is critical here to achieve competitive advantages in terms of cost, yield, and product consistency. This segment also includes blending and formulation activities, where ethyl hexanoate might be combined with other compounds to create complex flavor or fragrance profiles.

Downstream activities involve the distribution channel, which bridges the gap between manufacturers and end-users. This typically includes a network of distributors, agents, and sometimes direct sales forces. Distribution can be direct, where large manufacturers sell directly to major industrial customers in the food and beverage or cosmetics sectors, or indirect, involving specialized chemical distributors who serve smaller clients and manage regional logistics. These distributors play a crucial role in inventory management, warehousing, and transportation, ensuring timely and efficient delivery. The end-users of ethyl hexanoate are primarily companies within the food and beverage industry, cosmetic and personal care product manufacturers, pharmaceutical companies, and other industrial sectors, who integrate ethyl hexanoate into their final products to impart desired sensory characteristics. Effective collaboration and communication across these stages are essential for optimizing cost, ensuring product quality, and meeting market demand efficiently.

Ethyl Hexanoate Market Potential Customers

The potential customers for ethyl hexanoate are diverse and span across multiple industries, primarily driven by its desirable fruity aroma and solvent properties. The largest segment of end-users comprises companies within the food and beverage sector, ranging from global conglomerates to artisanal producers. These include manufacturers of confectionery (candies, chocolates), dairy products (yogurts, ice creams), baked goods (cakes, pastries), alcoholic beverages (wines, beers, spirits, especially those requiring specific fruity notes), soft drinks, juices, and various processed foods where flavor enhancement is critical. These customers seek ethyl hexanoate to impart natural-like fruity profiles, improve palatability, and create unique sensory experiences for consumers, aligning with evolving taste preferences and product innovation trends.

Another significant customer base exists within the cosmetics and personal care industry. This includes manufacturers of perfumes and fragrances, where ethyl hexanoate is a key component in creating complex, appealing scents with fruity undertones. Additionally, it is utilized in the production of soaps, detergents, lotions, creams, hair care products, and aromatherapy formulations, contributing to their olfactory appeal. Companies in this sector are constantly innovating to meet consumer demand for new and sophisticated scents, making ethyl hexanoate a valuable ingredient for product differentiation and sensory branding. The demand from these customers is often influenced by fashion trends, seasonal preferences, and the pursuit of premium product formulations.

Beyond these dominant sectors, pharmaceutical companies represent a smaller yet critical segment of potential customers, using ethyl hexanoate in specific formulations where its solvent properties or a mild flavoring agent might be beneficial, particularly in pediatric medicines or oral care products. Furthermore, certain industrial applications, such as specialized solvent blends or tobacco flavorings, also constitute a niche customer base. The broad applicability of ethyl hexanoate across these varied sectors underscores its versatility and sustained market relevance, with manufacturers constantly seeking high-purity and cost-effective supplies to meet their specific product requirements and regulatory standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 million |

| Market Forecast in 2033 | USD 1.41 billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mane S.A., Symrise AG, International Flavors & Fragrances Inc. (IFF), Givaudan S.A., Firmenich SA, BASF SE, Eastman Chemical Company, Sigma-Aldrich (MilliporeSigma), TCI Chemicals (India) Pvt. Ltd., Tokyo Chemical Industry Co., Ltd. (TCI), Penta International Corporation, Advanced Biotech, Berje Inc., Vigon International, Inc., A.M. Todd Company Inc., Jiangxi Nanxiang Chemical Co., Ltd., Shandong Jinyimeng Group Co., Ltd., Ningbo Wanglong Technology Co., Ltd., Anhui Golden Flavor & Fragrance Co., Ltd., Hangzhou Dayang Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ethyl Hexanoate Market Key Technology Landscape

The technology landscape for ethyl hexanoate production is primarily dominated by esterification processes, which involve the reaction of hexanoic acid (also known as caproic acid) with ethanol in the presence of an acid catalyst. Conventional methods typically use strong mineral acids like sulfuric acid or hydrochloric acid as catalysts, carried out at elevated temperatures to achieve efficient conversion. While effective, these traditional approaches often face challenges related to catalyst removal, equipment corrosion, and the generation of undesirable by-products, necessitating subsequent purification steps such as distillation, extraction, and adsorption to achieve the required purity, especially for food and cosmetic grades. Continuous innovation in reactor design and process optimization aims to improve reaction kinetics and minimize energy consumption.

Beyond traditional chemical synthesis, advancements in biotechnology are shaping the future of ethyl hexanoate production, offering more sustainable and environmentally friendly alternatives. Enzymatic esterification, using lipases or esterases as biocatalysts, is gaining traction due to its ability to operate under milder conditions, reduce energy input, and enhance selectivity, often leading to higher purity products with fewer impurities. This method aligns with the growing industry demand for green chemistry and natural or bio-derived ingredients. Furthermore, microbial fermentation pathways are being explored, where specific microorganisms are engineered to produce ethyl hexanoate directly from renewable feedstocks, presenting a promising route for bio-based production that can potentially reduce reliance on petrochemical derivatives and offer a more sustainable supply chain.

The analytical technologies employed in the ethyl hexanoate market are crucial for quality control, purity assessment, and compliance with regulatory standards. Gas Chromatography (GC) and Gas Chromatography-Mass Spectrometry (GC-MS) are indispensable tools for identifying and quantifying ethyl hexanoate and its potential impurities, ensuring the product meets stringent specifications for flavor and fragrance applications. Nuclear Magnetic Resonance (NMR) and Infrared (IR) spectroscopy are also utilized for structural confirmation and detailed compositional analysis. These sophisticated analytical techniques are continuously being refined to provide faster, more accurate, and more sensitive detection capabilities, which are vital for maintaining product integrity, ensuring consumer safety, and supporting ongoing research and development efforts in the synthesis and application of ethyl hexanoate.

Regional Highlights

- North America: A mature market characterized by high consumption of processed foods, beverages, and premium personal care products. The U.S. and Canada are significant consumers, driven by strong consumer purchasing power and a well-established flavor and fragrance industry. Demand is stable, with a focus on product innovation and adherence to stringent regulatory standards for ingredient safety.

- Europe: Another mature market, with robust demand from the food and beverage industry, particularly in countries like Germany, France, and the UK. Strict regulations from the European Food Safety Authority (EFSA) and REACH drive a strong emphasis on product purity, sustainability, and traceability. The region is also a key hub for research and development in flavor and fragrance technology.

- Asia Pacific (APAC): The fastest-growing region, propelled by rapid industrialization, urbanization, and rising disposable incomes, especially in China, India, Japan, and South Korea. The expansion of the food processing, dairy, alcoholic beverage, and cosmetics industries is a major catalyst. Increasing consumer awareness and demand for diverse, exotic flavors are fueling significant market opportunities and attracting investment.

- Latin America: An emerging market exhibiting considerable growth potential. Countries such as Brazil, Mexico, and Argentina are witnessing an uptick in demand for flavored food and beverage products and personal care items. Economic development and the growing presence of international brands are contributing to market expansion, with local manufacturers also increasing their production capabilities.

- Middle East and Africa (MEA): A developing market with nascent but growing demand, primarily driven by increasing urbanization, Westernization of consumer tastes, and investments in the food processing and hospitality sectors. The UAE, Saudi Arabia, and South Africa are key markets. Opportunities exist for flavor and fragrance companies to tap into this evolving consumer base, though market penetration can be challenging due to diverse cultural preferences and economic disparities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ethyl Hexanoate Market.- Mane S.A.

- Symrise AG

- International Flavors & Fragrances Inc. (IFF)

- Givaudan S.A.

- Firmenich SA

- BASF SE

- Eastman Chemical Company

- Sigma-Aldrich (MilliporeSigma)

- TCI Chemicals (India) Pvt. Ltd.

- Tokyo Chemical Industry Co., Ltd. (TCI)

- Penta International Corporation

- Advanced Biotech

- Berje Inc.

- Vigon International, Inc.

- A.M. Todd Company Inc.

- Jiangxi Nanxiang Chemical Co., Ltd.

- Shandong Jinyimeng Group Co., Ltd.

- Ningbo Wanglong Technology Co., Ltd.

- Anhui Golden Flavor & Fragrance Co., Ltd.

- Hangzhou Dayang Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Ethyl Hexanoate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Ethyl Hexanoate primarily used for?

Ethyl Hexanoate is primarily used as a flavoring agent in the food and beverage industry, imparting fruity notes (pineapple, apple) to products like confectionery, dairy, and alcoholic beverages. It also finds significant application in the cosmetics and personal care sector for perfumes and fragrances.

What are the main drivers of the Ethyl Hexanoate Market?

The main drivers include the increasing global demand for processed foods and beverages, the expansion of the cosmetics and personal care industry, and growing consumer preferences for diverse and exotic flavor profiles in various products.

Are there any sustainable production methods for Ethyl Hexanoate?

Yes, alongside traditional chemical synthesis, sustainable methods like enzymatic esterification using biocatalysts and microbial fermentation from renewable feedstocks are being developed and adopted to produce bio-based Ethyl Hexanoate, aligning with green chemistry principles.

Which regions show the highest growth potential for Ethyl Hexanoate?

The Asia Pacific region, particularly countries like China and India, exhibits the highest growth potential due to rapid urbanization, increasing disposable incomes, and the booming food processing and cosmetics industries.

What are the key challenges faced by the Ethyl Hexanoate Market?

Key challenges include volatility in raw material prices, stringent regulatory requirements for food additives and cosmetic ingredients, and competition from alternative flavor compounds and the rising demand for "natural" labeled ingredients.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager