Ethyl Polysilicate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437222 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Ethyl Polysilicate Market Size

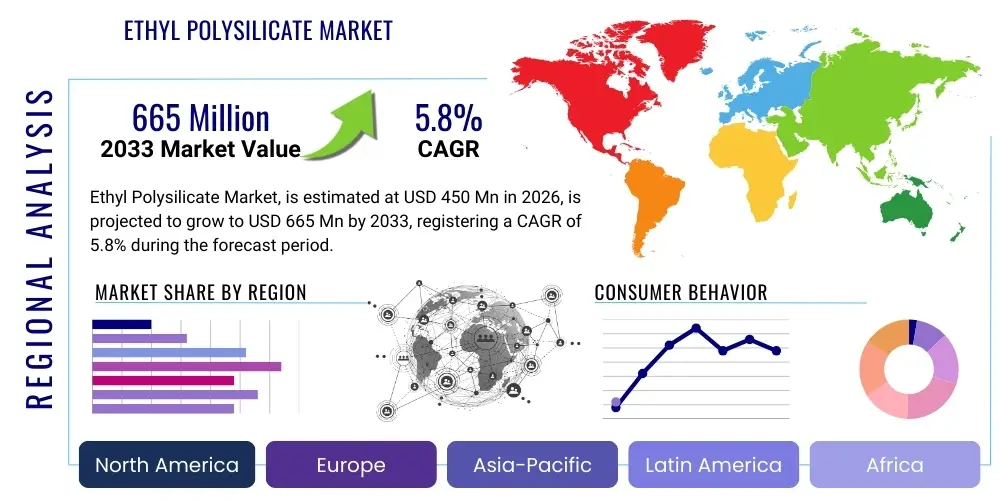

The Ethyl Polysilicate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 665 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by the escalating demand for high-performance protective coatings and binders across key industrial sectors, including construction, automotive, and specialized chemical synthesis. The unique properties of ethyl polysilicate, such as excellent thermal stability, high purity, and superior binding capacity, solidify its position as a critical intermediate product essential for next-generation material science advancements.

Ethyl Polysilicate Market introduction

The Ethyl Polysilicate Market centers around derivatives of silicic acid and ethanol, functioning primarily as highly effective cross-linking agents, binders, and precursors for silicon dioxide (silica). Ethyl polysilicate, also known as Poly(ethyl silicate) or condensed tetraethyl orthosilicate (TEOS), is distinguished by its variable silica content, which dictates its grade and specific end-use application. These products are liquid chemical intermediates prized for their ability to hydrolyze and condense, yielding a durable, inert silica network, making them indispensable in applications requiring superior heat resistance, chemical inertness, and exceptional adhesion characteristics.

Major applications of ethyl polysilicate span highly technical domains, including high-zinc dust primers and protective coatings for marine and industrial infrastructure, specialized binders used in precision investment casting (particularly in aerospace and medical device manufacturing), and as curing agents in specialized silicone rubbers. Key benefits driving market adoption include its low volatility, high silica yield upon curing, excellent solvent compatibility, and the ability to formulate coatings that provide robust protection against corrosion and abrasion. The driving factors underpinning market expansion are the rapid industrialization in the Asia Pacific region, increasing infrastructure spending globally, and the consistent requirement for materials that enhance the longevity and performance of critical assets, particularly within the energy and oil & gas sectors where protective maintenance is paramount.

Ethyl Polysilicate Market Executive Summary

The Ethyl Polysilicate Market is currently characterized by moderate fragmentation, with established chemical manufacturers dominating the specialized high-grade segments. Business trends indicate a strong shift towards developing low-VOC (Volatile Organic Compound) and water-borne ethyl polysilicate formulations to comply with increasingly strict global environmental regulations, driving innovation in product delivery and application methods. Strategic alliances and focused R&D investments in enhancing purity levels and reducing production costs are critical competitive factors shaping the immediate business landscape. The reliance on petrochemical inputs, however, remains a persistent challenge, subjecting market players to fluctuating raw material prices and geopolitical instabilities affecting supply chains.

Regional trends highlight the Asia Pacific (APAC) as the fastest-growing market, largely fueled by massive infrastructure projects, burgeoning shipbuilding activities, and the establishment of new manufacturing hubs, particularly in China and India, demanding vast quantities of protective coatings. North America and Europe, while mature, demonstrate stable demand driven by the maintenance requirements of aging infrastructure and the steady growth of high-precision investment casting industries, focusing heavily on premium, high-purity grades (e.g., 40% silica content). Segmentation trends emphasize the dominance of the application segment encompassing High-Performance Coatings, which accounts for the largest market share due to its wide usage in anticorrosion primers and high-temperature resistant finishes. The Investment Casting segment, although smaller in volume, commands higher revenue due to the premium pricing associated with precision industrial applications, underscoring a trend towards value over sheer volume in specific niche markets.

AI Impact Analysis on Ethyl Polysilicate Market

Common user inquiries regarding AI’s influence on the Ethyl Polysilicate market revolve around optimizing complex chemical synthesis processes, predicting raw material price volatility, and enhancing quality control in coating and casting applications. Users are concerned about how AI can streamline the hydrolysis and condensation reactions critical to ethyl polysilicate production, ensuring consistent purity and reducing batch variation. Expectations center on leveraging AI-driven predictive maintenance in production plants and using machine learning models to identify optimal formulation parameters for specialized coatings, thereby accelerating product development cycles. Furthermore, stakeholders seek clarification on how AI can assist in supply chain optimization, particularly in forecasting demand and managing the procurement of sensitive raw materials like silicon tetrachloride and ethanol, which are prone to price fluctuations.

The implementation of AI and machine learning models offers substantial potential for operational efficiency and product quality enhancement within the Ethyl Polysilicate sector. By integrating sensor data from synthesis reactors and applying deep learning algorithms, manufacturers can achieve tighter control over reaction kinetics, leading to superior product consistency and reduced waste. This capability is particularly valuable for producing high-grade ethyl polysilicates (e.g., 40% SiO2) used in demanding applications like aerospace casting, where minute variations can compromise final product integrity. AI tools are also becoming essential in simulating the performance of novel coating formulations, drastically cutting down the need for costly and time-consuming physical testing, thus driving down time-to-market for new specialized products designed for extreme environments.

- AI-driven optimization of chemical reaction parameters to ensure higher purity and yield consistency in ethyl polysilicate synthesis.

- Predictive maintenance analytics using machine learning to minimize unscheduled downtime in manufacturing facilities, improving overall equipment effectiveness (OEE).

- Enhanced supply chain risk management through AI forecasting of raw material pricing and demand fluctuations, enabling proactive procurement strategies.

- Accelerated R&D by utilizing generative AI for simulating and screening novel ethyl polysilicate derivatives suitable for sustainable, low-VOC coating systems.

- Automated quality control systems employing computer vision for instantaneous defect detection in investment casting shell formation and finished coating surfaces.

- Optimization of energy consumption and reduction of waste streams in polymerization processes through advanced algorithmic control.

DRO & Impact Forces Of Ethyl Polysilicate Market

The Ethyl Polysilicate market dynamics are shaped by a complex interplay of robust demand drivers rooted in industrial growth, significant restraints related to chemical processing and regulatory hurdles, and long-term opportunities arising from technological advancements and niche market expansion. The primary impact forces include the critical role of petrochemical inputs in determining operational costs and the constant threat of substitution from alternative organic and inorganic binders. Successful navigation of this market requires manufacturers to balance the need for high-volume, cost-effective production for general coatings against the specialized, high-margin requirements of precision industries like investment casting, demanding meticulous purity and performance specifications.

Key drivers center on the global surge in infrastructure development, which mandates large-scale application of anti-corrosion primers based on zinc silicates, where ethyl polysilicate serves as the essential binder. Furthermore, the stringent quality requirements in aerospace and energy sectors continuously elevate the demand for ethyl polysilicate-based ceramics and binders offering superior thermal and mechanical integrity. Conversely, the market faces significant restraints, including the complex logistics and safety concerns associated with handling raw materials like silicon tetrachloride, coupled with the capital intensity required for constructing and maintaining modern hydrolysis facilities. Environmental regulations targeting VOC emissions force manufacturers to invest heavily in reformulation, potentially increasing product costs and development timelines, thereby slowing market penetration in environmentally sensitive regions.

Opportunities for expansion are abundant in emerging technologies, particularly in advanced ceramics and sol-gel derived materials for optics and electronics, where the high purity silica precursor is indispensable. Developing customized, highly reactive grades tailored for fast-curing, cold-weather applications offers a direct pathway to market differentiation. The impact forces emphasize the intense competition from alternative silane-based systems and high-performance epoxy resins. Price elasticity remains a significant factor in high-volume coating applications, meaning cost optimization in production remains paramount. The overall market resilience, however, is bolstered by the irreplaceable role of ethyl polysilicate in zinc-rich coatings, establishing a baseline level of non-negotiable demand crucial for long-term stability.

Segmentation Analysis

The Ethyl Polysilicate Market is primarily segmented based on the silica content (grade), which dictates reactivity and end-use performance, and the application domain, reflecting diverse industrial requirements. Segmentation by type typically differentiates products based on the percentage of contained silica (e.g., 40%, 32%, 28%), with higher silica content products generally commanding a premium due to superior performance in high-specification binders. Segmentation by application highlights the vast consumption volumes within the Coatings sector, followed by specialized, high-value usage in Investment Casting and advanced Chemical Synthesis, providing critical clarity into distinct market profitability pools and growth vectors across the industrial landscape.

- By Type/Grade:

- Ethyl Polysilicate 40% (High Silica Content)

- Ethyl Polysilicate 32% (Medium Silica Content)

- Ethyl Polysilicate 28% (Standard Silica Content)

- Other Grades (Including custom formulations)

- By Application:

- High-Performance Coatings (Industrial, Marine, Protective Primers)

- Investment Casting (Precision Foundries)

- Chemical Synthesis & Intermediates (Adsorbents, Catalysts)

- Building Materials (Concrete Densifiers, Masonry Water Repellents)

- Optical and Electronic Materials (Sol-Gel Processing)

Value Chain Analysis For Ethyl Polysilicate Market

The value chain for the Ethyl Polysilicate Market begins with the upstream procurement of critical raw materials, primarily high-purity ethanol and silicon tetrachloride, both of which are commodity chemicals sensitive to global petrochemical and industrial output cycles. Manufacturing involves complex, energy-intensive chemical processing (hydrolysis and polycondensation) to synthesize the intermediate ethyl polysilicate grades. This stage demands specialized equipment and stringent quality control, especially for high-purity grades required by the aerospace and electronics industries. Upstream risks are centered on supply stability and price volatility of chemical precursors, necessitating robust risk management strategies by primary manufacturers.

The midstream involves the formulation, blending, and distribution of the finished product. Given the technical nature of ethyl polysilicates, distribution channels rely heavily on specialized chemical distributors equipped to handle, store, and transport volatile or corrosive substances, ensuring regulatory compliance across jurisdictions. Direct channels are common for very large-volume buyers (e.g., major coating companies) or for highly customized product formulations where technical service and direct manufacturer support are essential. Indirect distribution channels through regional specialty chemical dealers primarily cater to smaller foundries, localized construction chemical formulators, and research laboratories, optimizing localized inventory management.

Downstream analysis focuses on the end-use industries, where the product is converted into final goods, such as zinc-rich anti-corrosion primers, ceramic investment casting slurries, or concrete treatments. The profitability shifts downstream where value is added through technical formulation expertise, such as blending the ethyl polysilicate binder with zinc dust, refractory fillers, or specialized catalysts. End-users in the marine and energy sectors demand product longevity and certification, placing pressure on the entire value chain to maintain superior quality standards. The effectiveness of the supply chain heavily relies on efficient logistics for delivery to geographically dispersed construction sites, shipyards, and precision foundries globally.

Ethyl Polysilicate Market Potential Customers

Potential customers for ethyl polysilicate are highly diversified across heavy industries that require durable, high-performance binding and protective solutions, emphasizing longevity and resistance to extreme environmental conditions. The largest segment of buyers consists of major industrial coatings and paint manufacturers who utilize ethyl polysilicate as the critical binder component in zinc-rich primers, primarily targeting marine vessels, offshore structures, oil and gas pipelines, and large civil engineering infrastructure projects. These customers prioritize consistency, bulk supply capacity, and competitive pricing for high-volume standard grades.

A secondary, high-value customer base is found within the precision manufacturing sector, specifically investment casting foundries serving the aerospace, defense, and medical device industries. These buyers demand exceptionally high-purity ethyl polysilicate grades (40% SiO2) for ceramic shell molds, where minimal impurities are tolerated due to the precise metallurgical requirements of high-performance alloy parts. These customers often seek direct relationships with manufacturers to ensure custom formulation and certified quality assurance. Furthermore, construction chemical companies represent a growing customer segment, purchasing ethyl polysilicate for use as concrete densifiers and protective masonry treatments, valuing its ability to penetrate and chemically reinforce porous substrates, enhancing durability against weathering and chemical attack.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 665 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Evonik Industries AG, Momentive Performance Materials Inc., Wacker Chemie AG, Dow Inc., Shin-Etsu Chemical Co. Ltd., Jiangsu Bory Chemical Co., Ltd., Colcoat Co., Ltd., Guangzhou Lito Chemical Co., Ltd., Zhejiang Feiyang Chemical Co., Ltd., ABCR GmbH, Nanjing Union Chemical Co., Ltd., Jinan Pioneer Material Co., Ltd., Hangzhou Dayang Chemical Co., Ltd., Xuzhou Tenglong Chemical Co., Ltd., Siyi Chemical Co., Ltd., Tianjin Zhongxin Chem Co., Ltd., Gelest, Inc. (now a part of Mitusubishi Chemical), PCC Group, Silbond Corporation, Reaxis Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ethyl Polysilicate Market Key Technology Landscape

The production and application of ethyl polysilicate rely on several crucial chemical engineering technologies, centered primarily around the controlled hydrolysis and polycondensation of Tetraethyl Orthosilicate (TEOS). The primary synthesis technology involves batch or continuous flow reactors designed to precisely manage reaction temperature, pH, and water-to-TEOS ratios, which are critical determinants of the resulting silica content and molecular weight distribution, ultimately defining the product's functional grade (e.g., EP 40 versus EP 28). Recent technological advancements focus on utilizing advanced catalytic systems, often involving acidic or basic catalysts, to achieve higher conversion rates and narrow product distributions, thereby improving quality consistency essential for niche applications like semiconductor material precursors.

A significant technological shift is observed in application-side formulation, specifically the move towards water-based ethyl polysilicate systems (hydrolyzed ethyl polysilicates). These technologies require specialized stabilizing agents and blending techniques to maintain the reactive silicon intermediate in an aqueous solution without premature gelation, addressing regulatory pressures to minimize VOC emissions in protective coatings and construction chemicals. Furthermore, in the investment casting sector, technological innovation involves developing advanced refractory slurries where particle size distribution of the fillers and the reactivity profile of the ethyl polysilicate binder are finely tuned using high-shear mixing and dispersion technologies to ensure optimal shell strength, permeability, and surface finish for complex metal components.

Another emerging technology is the integration of sol-gel processing with ethyl polysilicate. This technique utilizes ethyl polysilicate as a starting material to synthesize highly porous silica monoliths, aerogels, or thin films used in thermal insulation, filtration, and advanced optical coatings. Manufacturing these high-tech materials requires precise control over drying and curing processes, often involving supercritical fluid extraction or controlled environment baking, ensuring the preservation of the delicate nanostructure derived from the silicon precursor. These technological efforts aim not only at product refinement but also at achieving greater scalability and cost-efficiency in producing these advanced silica-based materials.

Regional Highlights

- Asia Pacific (APAC): The APAC region dominates the Ethyl Polysilicate Market in terms of both volume consumption and growth rate, primarily driven by expansive shipbuilding activities in East Asia (China, South Korea) and massive government expenditure on national infrastructure projects, including bridges, ports, and railways. The high demand for protective zinc-silicate coatings for new construction and ongoing maintenance of industrial facilities ensures a strong, continuous market pull. Furthermore, the burgeoning manufacturing sector, particularly precision foundries serving the regional automotive and electronics supply chains, contributes significantly to the demand for specialized binding agents.

- North America: North America represents a mature, high-value market characterized by stringent quality requirements and a focus on specialized, high-performance applications. Demand is stable, primarily driven by the refurbishment of aging infrastructure (bridges, oil & gas storage tanks) and robust growth in the aerospace and defense sectors, which are major consumers of premium ethyl polysilicate grades (40% SiO2) for investment casting processes. Regulatory compliance regarding VOCs is a crucial factor, favoring advanced, low-emission formulations and driving technological adoption among key regional players.

- Europe: The European market maintains consistent demand, primarily concentrated in Germany, the UK, and France. Key drivers include the region's strong maritime industry, requiring marine protective coatings, and a sophisticated specialized chemicals sector. Europe is a leader in environmental standards, compelling manufacturers to innovate towards sustainable, water-based ethyl polysilicate technologies. The market is also supported by the steady requirements of the high-end ceramics and refractory materials industries, valuing the thermal stability and purity offered by ethyl polysilicate precursors.

- Latin America (LATAM): The LATAM market, while smaller, offers substantial potential, linked directly to fluctuating but significant investments in energy infrastructure, particularly offshore oil and gas exploration in Brazil and Mexico. The demand is often project-driven, requiring protective coatings for pipelines, rigs, and refineries. Economic volatility poses a challenge, but long-term prospects remain positive dueled to the rich natural resource base requiring extensive corrosion protection measures, thereby boosting consumption of ethyl polysilicate-based primers.

- Middle East and Africa (MEA): The MEA region is characterized by high demand originating from the enormous petrochemical and industrial construction sectors, particularly in the Gulf Cooperation Council (GCC) countries. The extremely harsh, saline, and high-temperature environments necessitate superior anticorrosion solutions, making zinc-rich ethyl polysilicate coatings indispensable for critical assets like desalination plants, refineries, and chemical processing facilities. Imports dominate the supply landscape, making efficient logistics and competitive pricing key competitive factors in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ethyl Polysilicate Market.- Evonik Industries AG

- Momentive Performance Materials Inc.

- Wacker Chemie AG

- Dow Inc.

- Shin-Etsu Chemical Co. Ltd.

- Jiangsu Bory Chemical Co., Ltd.

- Colcoat Co., Ltd.

- Guangzhou Lito Chemical Co., Ltd.

- Zhejiang Feiyang Chemical Co., Ltd.

- ABCR GmbH

- Nanjing Union Chemical Co., Ltd.

- Jinan Pioneer Material Co., Ltd.

- Hangzhou Dayang Chemical Co., Ltd.

- Xuzhou Tenglong Chemical Co., Ltd.

- Siyi Chemical Co., Ltd.

- Tianjin Zhongxin Chem Co., Ltd.

- Gelest, Inc. (now a part of Mitusubishi Chemical)

- PCC Group

- Silbond Corporation

- Reaxis Inc.

Frequently Asked Questions

Analyze common user questions about the Ethyl Polysilicate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of ethyl polysilicate in industrial applications?

Ethyl polysilicate (EPS) serves primarily as a high-performance inorganic binder and a silica (SiO2) precursor. Its main function is to cross-link and cure into a durable, heat-resistant silica matrix, making it essential for zinc-rich protective coatings (anticorrosion primers) and specialized ceramic shell molds used in investment casting for superior mechanical and thermal properties.

Which application segment holds the largest market share for ethyl polysilicate?

The High-Performance Coatings segment holds the largest market share. EPS is the critical component in formulating highly effective zinc-rich primers necessary for protecting critical infrastructure, marine vessels, and petrochemical assets against severe corrosion and environmental degradation, driving significant consumption volumes globally.

How do varying silica grades (e.g., EP 28% vs. EP 40%) impact end-use performance?

The silica grade dictates the concentration and degree of polymerization. Higher silica content grades (e.g., EP 40%) exhibit faster curing times and yield a denser, stronger silica bond upon hydrolysis. They are typically reserved for high-precision applications like investment casting where minimal shrinkage and maximum structural integrity are required, while lower grades are common in high-volume general coating formulations.

What are the main growth drivers for the ethyl polysilicate market in the Asia Pacific region?

Growth in APAC is predominantly driven by significant government and private investment in massive infrastructure development projects, including port expansion, new road networks, and substantial growth in regional manufacturing hubs and shipbuilding activities. These projects necessitate large volumes of protective and anticorrosion coatings where EPS is a standard requirement for long-term asset protection.

What are the environmental constraints facing manufacturers of ethyl polysilicate?

The primary environmental constraint relates to Volatile Organic Compound (VOC) emissions, as traditional ethyl polysilicate formulations contain organic solvents (ethanol) used as reaction byproducts or carriers. Manufacturers are increasingly mandated to shift R&D towards developing low-VOC or sustainable, water-borne hydrolyzed ethyl polysilicate systems to comply with stringent regulatory frameworks in North America and Europe.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Ethyl Polysilicate Market Size Report By Type (Ethyl Polysilicate 28, Ethyl Polysilicate 32, Ethyl Polysilicate 40), By Application (Adhesive Agent, Cross-linking Agent, Residential Binding Agent, Synthesis Of Silica, By End-Use Vertical, Chemicals, Metals, Paints And Coatings, Textiles, Pharmaceuticals, Optical), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Ethyl Polysilicate Market Statistics 2025 Analysis By Application (Silicone Rubber, High-purity Silica, Vitrified Bond, Silica Gel Material, Paint and Coating), By Type (Ethyl Polysilicate 28, Ethyl Polysilicate 32, Ethyl Polysilicate 40), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager