Ethyl Silicate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436465 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Ethyl Silicate Market Size

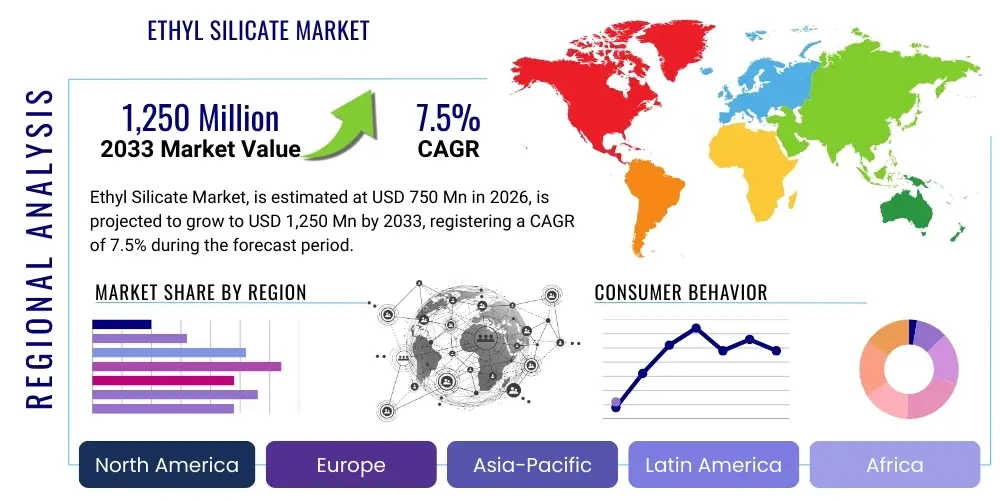

The Ethyl Silicate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 750 Million in 2026 and is projected to reach USD 1,250 Million by the end of the forecast period in 2033.

Ethyl Silicate Market introduction

Ethyl silicate, chemically known as tetraethyl orthosilicate (TEOS) or its polymerized form (polyethyl silicate, PES), serves as a versatile chemical intermediate and functional material across numerous industries. This compound is primarily valued for its ability to hydrolyze in the presence of water or moisture, yielding highly stable silicon dioxide (silica) and ethanol. This reaction mechanism makes ethyl silicate an indispensable component in the formulation of high-performance protective coatings, especially anti-corrosion paints like inorganic zinc primers, where it acts as a robust binder linking the zinc pigment to the substrate.

Beyond its application in protective coatings, ethyl silicate is critical in the precision investment casting industry. Here, it is utilized as the primary binder for forming ceramic shells due to its capacity to create strong, refractory molds capable of withstanding extreme temperatures during metal pouring. The material's unique properties, including low viscosity and controlled hydrolysis rate, ensure highly accurate and defect-free casting of complex metal parts, crucial for aerospace, automotive, and medical device manufacturing. Furthermore, its use extends to manufacturing specialized chemicals, synthesizing sol-gel materials, and acting as a cross-linking agent in various polymer formulations, highlighting its multifunctional role in advanced material science.

The market is predominantly driven by escalating demand for durable, anti-corrosive protective coatings in infrastructure and marine environments, coupled with the expansion of the high-precision manufacturing sector. The inherent benefits of ethyl silicate, such as superior thermal stability, excellent adhesion, and high resistance to abrasion and chemical attack, solidify its position as a premium raw material. Ongoing research focuses on developing modified or specialized grades of ethyl silicate (e.g., concentrated solutions or functionalized derivatives) to comply with increasingly stringent environmental regulations regarding volatile organic compound (VOC) emissions, ensuring its continued relevance and growth in sustainable industrial practices.

Ethyl Silicate Market Executive Summary

The Ethyl Silicate market is poised for steady expansion, fueled primarily by robust global infrastructure spending and stringent requirements for asset protection across demanding industries such as marine, oil and gas, and construction. Business trends indicate a shift toward high-solid and solvent-free formulations of ethyl silicate derivatives to address environmental concerns related to VOCs, prompting manufacturers to invest in advanced production processes, including optimized hydrolysis and purification techniques. Key industry players are focusing on backward integration to secure stable access to critical raw materials like silicon tetrachloride and ethanol, while also expanding their product portfolios to include specialized grades optimized for rapid curing and enhanced fire resistance, particularly in passive fire protection systems.

Regional trends reveal Asia Pacific (APAC) as the dominant and fastest-growing market, largely attributed to rapid industrialization, extensive shipbuilding activities in countries like China and South Korea, and massive government investment in urban and transportation infrastructure projects. North America and Europe, characterized by mature industrial bases, exhibit stable demand driven by maintenance, repair, and overhaul (MRO) activities, coupled with technological advancements in precision casting for high-value manufacturing sectors like aerospace. Regulatory frameworks concerning worker safety and chemical handling are impacting operational costs, particularly in developed regions, leading to increased adoption of automated dispensing and application systems.

Segmentation trends highlight the polyethyl silicate (PES) segment, specifically ES-40 and ES-32, maintaining market leadership due to their superior performance as binders in high-zinc-content protective coatings. The application segment growth is accelerating fastest in the anti-corrosive paints and coatings category, followed closely by the precision investment casting market, which demands highly consistent and reliable ceramic shell binders. End-user industries, particularly construction and marine, remain the largest consumers, demonstrating sustained demand for materials that extend the operational lifespan of critical assets. Strategic partnerships between ethyl silicate producers and major coatings formulators are becoming essential to accelerate product development and market penetration globally.

AI Impact Analysis on Ethyl Silicate Market

User inquiries regarding the role of Artificial Intelligence (AI) in the Ethyl Silicate market frequently center on optimizing synthesis processes, improving material predictability, and enhancing efficiency in complex supply chains. Key concerns revolve around whether AI can significantly reduce production costs, specifically by streamlining the highly controlled hydrolysis and purification stages, and if machine learning models can accelerate the discovery of new ethyl silicate derivatives with tailored curing characteristics or lower VOC content. Furthermore, users often seek information on AI's ability to predict the shelf life and long-term performance (e.g., coating adhesion or mold strength) of ethyl silicate-based products under varying environmental conditions, minimizing quality control failures and ensuring higher consistency in end-user applications.

The core theme summarizing user expectations is the potential of AI to transition the ethyl silicate manufacturing sector from traditional, parameter-heavy batch processes to highly optimized, continuous, and predictive operations. AI models, utilizing data from spectroscopy, chromatography, and reaction kinetics, can accurately control variables such as temperature, catalyst concentration, and residence time during synthesis, ensuring consistent product quality (e.g., silica content, molecular weight distribution) which is crucial for high-performance applications like aerospace casting. This predictive capability minimizes waste, reduces off-specification batches, and significantly enhances process sustainability, directly addressing the industry’s imperative for cost reduction and quality assurance.

Beyond manufacturing, AI-driven analytics are transforming the supply chain by predicting fluctuating demand from seasonal industries (like construction) and optimizing inventory levels for raw materials, especially ethanol and silicon tetrachloride, which are susceptible to price volatility. In R&D, generative AI is assisting material scientists by simulating the hydrolysis and condensation reactions of various silicate precursors, speeding up the formulation of next-generation low-VOC coatings. This integration of AI not only boosts operational resilience but also future-proofs the market by facilitating the rapid development of compliant and superior performance products, making the industry more responsive to regulatory and market shifts.

- AI optimizes reaction conditions (temperature, pH) during ethyl silicate synthesis, maximizing yield and purity.

- Machine learning algorithms predict and control the molecular weight distribution of polyethyl silicates for specific binding requirements.

- Predictive maintenance models utilize sensor data to monitor equipment health in harsh chemical processing environments, reducing downtime.

- Generative AI accelerates the design of low-VOC, high-solids ethyl silicate formulations.

- AI-enhanced visual inspection systems improve quality control for finished products used in precision casting molds.

- Advanced analytics optimize global logistics and raw material procurement, mitigating price fluctuation risks.

DRO & Impact Forces Of Ethyl Silicate Market

The dynamics of the Ethyl Silicate market are shaped by a complex interplay of driving forces, restraining factors, and emerging opportunities, all magnified by significant external impact forces such as regulatory changes and macroeconomic trends. The primary driver is the accelerating global demand for protective and anti-corrosive coatings, particularly in maritime, oil and gas, and aging critical infrastructure requiring long-term maintenance solutions. Ethyl silicate's ability to form durable, chemically inert, and thermally resistant silica binders positions it ideally to meet these stringent performance requirements. This demand is further amplified by the continuous growth in precision manufacturing sectors, notably aerospace and automotive, where high-integrity metal parts necessitate superior investment casting binders.

However, the market faces notable restraints, chiefly the volatility in the pricing and supply of key raw materials, specifically silicon tetrachloride and industrial ethanol. Production costs are highly sensitive to these fluctuations, potentially limiting margin expansion for manufacturers. Furthermore, regulatory scrutiny regarding the handling and transportation of ethyl silicate, combined with increasing pressure in developed economies to reduce VOC emissions—ethanol being a primary byproduct of its curing reaction—presents a persistent challenge. While high-solids formulations address this to an extent, compliance necessitates continuous research and development investment, creating barriers for smaller market entrants and driving consolidation.

Opportunities in the market primarily reside in the development of specialized, functionalized silicates tailored for emerging high-growth applications, such as nanotechnology, advanced ceramics, and specialized adhesion promoters for composite materials. The expansion of sol-gel technology, which heavily relies on tetraethyl orthosilicate (TEOS), into fields like optical coatings, insulation materials, and drug delivery systems, provides significant avenues for market penetration. The major impact forces include governmental infrastructure spending programs, which directly boost construction and maintenance activities, and global climate change policies that necessitate durable, energy-efficient protective coatings and materials, ensuring sustained, non-cyclical demand for high-performance ethyl silicate derivatives.

Segmentation Analysis

The Ethyl Silicate market is highly segmented based on product type, application, and end-user industry, reflecting the material’s diverse functional roles across the industrial landscape. Product type segmentation distinguishes between pure monomeric tetraethyl orthosilicate (TEOS) and various polymerized ethyl silicates, such as ES-32 and ES-40 (defined by their silica content), each serving distinct requirements concerning viscosity, curing speed, and silica yield. The polymerization process is critical as it dictates the suitability for applications ranging from thin-film electronic coatings to thick-layer investment casting molds. Analyzing these segments provides strategic insights into manufacturing capabilities and specialized market niches where premium pricing can be sustained.

Application segmentation reveals the market's primary reliance on protective coatings, where ethyl silicate is irreplaceable as a binder in inorganic zinc-rich primers, offering unparalleled galvanic corrosion resistance. Other significant applications include precision investment casting, where high purity and consistent hydrolysis rates are paramount, and chemical intermediates used in the synthesis of specialized organosilanes and fumed silica. The growth dynamics across these application areas are intrinsically linked to macroeconomic factors, such as global shipbuilding volumes impacting marine coatings demand, and industrial capital expenditure driving investment casting requirements, ensuring a diversified demand base for the product.

Finally, the end-user segmentation highlights the dominance of the construction and marine industries due to the sheer volume of steel structures requiring corrosion protection. These sectors demand bulk quantities of standard polyethyl silicates. Conversely, specialized sectors like aerospace and electronics, while consuming lower volumes, demand ultra-high purity TEOS or functionalized derivatives, commanding premium prices and driving technological innovation toward higher-specification products. Understanding this segmentation allows stakeholders to tailor their product offerings and marketing strategies to capture value across the entire spectrum, from commodity industrial binders to highly technical specialized intermediates.

- Product Type

- Tetraethyl Orthosilicate (TEOS)

- Polyethyl Silicate (PES) (e.g., ES-32, ES-40)

- Application

- Protective Coatings (Anti-corrosive Paints)

- Precision Investment Casting Binders

- Chemical Intermediates

- Ceramic Production

- Adhesion Promoters

- Sol-Gel Materials

- End-User Industry

- Construction and Infrastructure

- Marine and Shipbuilding

- Oil and Gas (Petrochemical)

- Automotive

- Aerospace and Defense

- Electronics

Value Chain Analysis For Ethyl Silicate Market

The value chain for the Ethyl Silicate market is complex, commencing with the upstream sourcing and synthesis of fundamental precursors. The primary raw materials are silicon tetrachloride (SiCl4) and industrial ethanol. Silicon tetrachloride production relies heavily on metallurgical silicon, an energy-intensive process, making the upstream segment susceptible to energy price volatility and commodity supply risks. Ethanol, derived either through fermentation or petrochemical routes, is readily available but subject to agricultural or oil market fluctuations. Manufacturers in this segment focus heavily on process efficiency, specifically optimizing the reaction between SiCl4 and ethanol to synthesize crude ethyl silicate, which then undergoes purification, hydrolysis, and polymerization to yield specific commercial grades like TEOS or PES.

The midstream involves the core manufacturing and distribution of various grades of ethyl silicate. Leading producers differentiate themselves through proprietary processes that ensure low impurity levels, consistent molecular weight distribution, and precise silica content in polymerized products, which are critical for high-performance applications. Distribution channels are typically multi-layered: direct sales for large-volume customers (e.g., major coating formulators or large foundries) and indirect distribution through specialized chemical distributors for smaller or geographically diverse clients. Logistics are complicated by the product's chemical properties, requiring specialized handling, storage, and adherence to stringent hazardous materials regulations, particularly concerning flash points and stability.

The downstream segment encompasses the conversion of ethyl silicate into final products. This transformation occurs primarily within the protective coatings industry (where it is formulated into zinc-rich primers) and the precision casting industry (where it forms the ceramic slurry binder). Direct buyers are highly technical, requiring not just the product but also application support and technical guidance on hydrolysis rates, mixing procedures, and curing parameters. Indirect influence is exerted by large infrastructure owners (governments, energy companies) who specify the use of high-performance anti-corrosive systems, thereby dictating market demand and quality standards throughout the value chain. Efficiency in this downstream segment relies on close collaboration between manufacturers and end-users to optimize final product performance.

Ethyl Silicate Market Potential Customers

Potential customers for ethyl silicate are predominantly industrial entities requiring high-performance binding agents, protective surface treatments, or specialized chemical intermediates. The largest segment of buyers comprises major protective coatings manufacturers, including multinational corporations specializing in marine, industrial maintenance, and protective paints. These companies purchase ethyl silicate, primarily the polyethyl silicate grades (ES-40), in bulk to formulate premium, long-life inorganic zinc-rich primers necessary for steel protection in harsh environments like offshore platforms, bridges, and chemical processing plants. Consistency in quality and large-volume supply reliability are key purchasing criteria for this customer group.

Another significant customer base lies within the high-value manufacturing sector, specifically investment casting foundries that produce intricate metal components for aerospace, medical, and power generation turbines. These customers require high-purity tetraethyl orthosilicate (TEOS) or modified ethyl silicate solutions to create durable, dimensionally stable ceramic shell molds. Their purchasing decisions are heavily influenced by the binder’s ability to minimize defects, improve casting yield, and withstand extreme thermal cycling. The demand from this sector is characterized by specialized, stringent quality requirements rather than sheer volume, positioning them as highly profitable, though discerning, buyers.

Emerging customer groups include manufacturers of advanced ceramic materials, insulating products, and specialized chemical synthesis firms utilizing TEOS as a precursor for fumed silica, zeolites, and sol-gel derived materials. Additionally, construction material manufacturers purchase ethyl silicate for surface consolidation and waterproofing treatments on concrete and masonry, leveraging its ability to form internal silica structures that enhance durability and reduce permeability. These diversified end-users ensure the market’s resilience against downturns in any single industrial sector, driving demand across a spectrum of technological maturity levels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 Million |

| Market Forecast in 2033 | USD 1,250 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wacker Chemie AG, Evonik Industries AG, Dow Inc., Momentive Performance Materials Inc., Shin-Etsu Chemical Co., Ltd., BASF SE, Nouryon, Gelest Inc. (Mitshubishi Chemical), Shandong Lanhai Industry Co., Ltd., Guangzhou GBS Chemical Co., Ltd., Nanjing Union Silicon Chemical Co., Ltd., Zhangjiagang Xinya Chemical Co., Ltd., Sichuan Xinhua Wanxiang Silicon Products Co., Ltd., Chicheng Chemical Group Co., Ltd., Runhe Chemical Industries Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ethyl Silicate Market Key Technology Landscape

The technological landscape of the Ethyl Silicate market is centered on enhancing synthesis purity, controlling the degree of polymerization, and developing application-specific modifications to meet demanding environmental and performance standards. The core manufacturing technology involves the reaction of silicon tetrachloride with ethanol, a process that requires meticulous control to manage the exothermic nature of the reaction and ensure high yields of the desired monomer (TEOS). Recent advancements focus on continuous flow reactors over traditional batch processing, allowing for better process control, reduced energy consumption, and superior consistency in product quality, which is crucial for high-end applications like semiconductor fabrication and advanced ceramic preforms.

A significant technological focus area is the development of optimized hydrolysis and condensation techniques for polyethyl silicates (PES). PES is the preferred binder for zinc-rich coatings, and its performance is highly dependent on the degree of pre-hydrolysis, which determines the final silica yield and curing characteristics. Manufacturers are utilizing advanced catalysis (often involving organic or inorganic acids) and precise solvent systems to tailor the silica backbone structure, resulting in binders that offer faster cure times, superior adhesion, and increased shelf stability. Furthermore, addressing environmental mandates drives research into utilizing supercritical CO2 as a solvent alternative or developing water-based emulsion systems for ethyl silicate, minimizing the reliance on traditional organic solvents and reducing overall VOC emissions.

Beyond traditional coatings and casting, cutting-edge technology involves the use of ethyl silicate derivatives in the sol-gel process for fabricating highly porous materials and nanostructured coatings. TEOS acts as the primary silica source in this chemical route, enabling the synthesis of highly uniform silica nanoparticles, aerogels (used for high-performance insulation), and anti-reflective optical coatings. Innovation in this space focuses on incorporating functional groups onto the ethyl silicate molecule before hydrolysis, yielding hybrid organic-inorganic materials that possess unique properties, such as flexibility combined with high hardness, opening new avenues in flexible electronics and bio-compatible materials development.

Regional Highlights

- Asia Pacific (APAC): APAC commands the largest share of the global Ethyl Silicate market, driven by massive investments in infrastructure development, burgeoning shipbuilding industries, and rapid urbanization, particularly in China, India, and Southeast Asia. The region’s lower labor costs and less stringent environmental regulations (compared to Western economies) initially supported high production volumes. However, regulatory shifts towards cleaner industrial practices are accelerating the adoption of high-performance, higher-purity ethyl silicate grades for large-scale construction and industrial coatings. The sustained demand for precision casting in India's and China's growing automotive sectors further solidifies APAC's market dominance and high growth rate.

- North America: This region maintains a stable, mature market characterized by stringent industrial safety standards and a focus on high-value applications. Demand is heavily concentrated in the maintenance and repair of aging infrastructure (bridges, pipelines, storage tanks) using high-specification zinc-rich coatings. The aerospace and defense sectors in the United States are significant consumers of high-purity TEOS for precision investment casting, where material integrity is non-negotiable. Innovation here focuses on compliance, with a strong push for low-VOC and user-friendly polyethyl silicate systems.

- Europe: Europe is a key innovation hub, characterized by advanced manufacturing and rigorous environmental mandates, particularly under REACH regulations. The market growth is primarily driven by technological upgrades in existing industrial facilities, demand for high-performance protective coatings in the North Sea oil and gas operations, and the transition toward electric vehicle manufacturing requiring specialized component casting. European manufacturers are leaders in developing sophisticated sol-gel derivatives and high-solids ethyl silicate binders to achieve maximum performance while minimizing environmental impact.

- Latin America (LATAM): The LATAM market growth is episodic, heavily influenced by commodity cycles, particularly in oil and gas and mining infrastructure, which are major consumers of anti-corrosive coatings. Brazil and Mexico are the primary markets, benefiting from foreign direct investment in manufacturing and infrastructure projects. Market expansion relies on increasing local industrialization and stabilizing economic conditions that encourage large-scale capital expenditure.

- Middle East and Africa (MEA): This region exhibits significant demand, especially from the massive hydrocarbon processing industry, marine vessel maintenance, and expansive construction projects in the GCC states (Saudi Arabia, UAE). Ethyl silicate is indispensable for protecting critical assets against high salinity, extreme temperatures, and chemical exposure inherent to oil and petrochemical environments. Market growth is closely tied to the execution of national development visions and major energy sector investments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ethyl Silicate Market.- Wacker Chemie AG

- Evonik Industries AG

- Dow Inc.

- Momentive Performance Materials Inc.

- Shin-Etsu Chemical Co., Ltd.

- BASF SE

- Nouryon

- Gelest Inc. (Mitshubishi Chemical)

- Shandong Lanhai Industry Co., Ltd.

- Guangzhou GBS Chemical Co., Ltd.

- Nanjing Union Silicon Chemical Co., Ltd.

- Zhangjiagang Xinya Chemical Co., Ltd.

- Sichuan Xinhua Wanxiang Silicon Products Co., Ltd.

- Chicheng Chemical Group Co., Ltd.

- Runhe Chemical Industries Co., Ltd.

- KCC Corporation

- Hexion Inc.

- Elkem ASA

- Fuji Silysia Chemical Ltd.

Frequently Asked Questions

Analyze common user questions about the Ethyl Silicate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Ethyl Silicate primarily used for in the industrial sector?

Ethyl Silicate (TEOS/PES) is primarily used as a high-performance binder in inorganic zinc-rich protective coatings for steel structures, offering exceptional anti-corrosive properties, and as a critical binder material in the precision investment casting industry for creating ceramic shell molds.

How does the hydrolysis of Ethyl Silicate contribute to its function?

Hydrolysis is the key chemical reaction where Ethyl Silicate reacts with moisture, releasing ethanol and forming highly stable, cross-linked silicon dioxide (silica). This resulting silica network acts as a robust, non-organic binder crucial for adhesion and thermal stability in coatings and molds.

Which product segment—TEOS or Polyethyl Silicate (PES)—dominates the market?

Polyethyl Silicate (PES), particularly grades like ES-40, dominates the market by volume, primarily due to its extensive use in high-volume applications such as protective coatings and industrial construction, where its high silica content is highly valued.

What are the key environmental concerns associated with the use of Ethyl Silicate?

The primary environmental concern stems from the ethanol released during the curing process, which is classified as a Volatile Organic Compound (VOC). The industry is actively addressing this through the development and adoption of high-solids and pre-hydrolyzed, low-VOC ethyl silicate formulations.

Which region is expected to experience the fastest growth in the Ethyl Silicate market?

Asia Pacific (APAC) is projected to exhibit the fastest market growth, driven by substantial infrastructure development projects, burgeoning marine activities, and expanding manufacturing sectors requiring high-quality protective materials across countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Ethyl Silicate Market Statistics 2025 Analysis By Application (Paints, Silicone Rubber, Synthesis of High-Purity Silica, Vitrified Bond, Silica Gel Material), By Type (Ethyl Silicate for Paint, Ethyl Silicate for Synthesis), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Ethyl Silicate Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Ethyl Silicate 40, Ethyl Silicate 32, Ethyl Silicate 28), By Application (Paint, Silicone rubber, Synthesis of high-purity silica, Vitrified bond, Silica gel material), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager