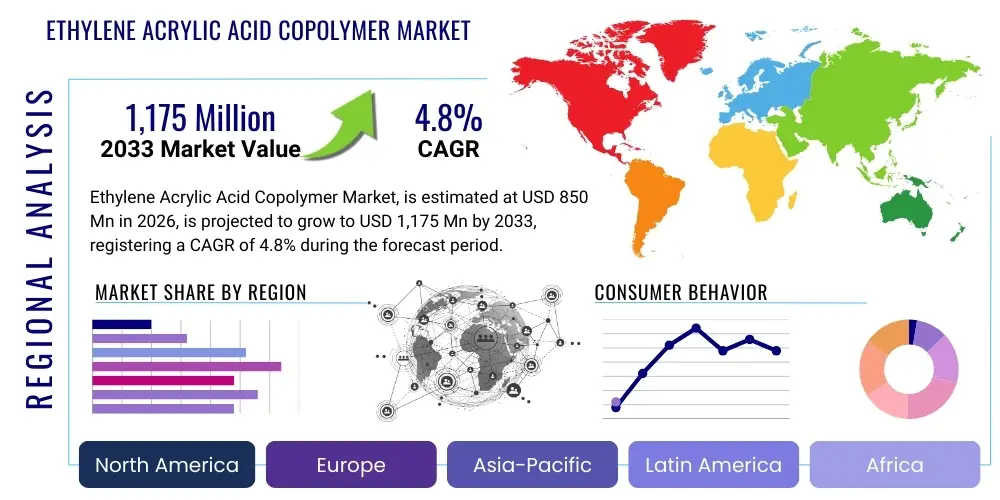

Ethylene Acrylic Acid Copolymer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437452 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Ethylene Acrylic Acid Copolymer Market Size

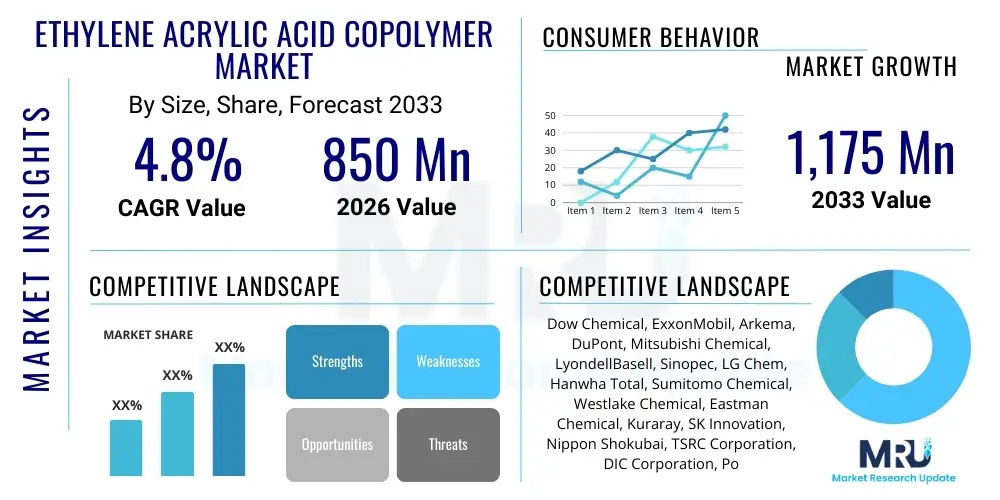

The Ethylene Acrylic Acid Copolymer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 850 million in 2026 and is projected to reach USD 1,175 million by the end of the forecast period in 2033.

Ethylene Acrylic Acid Copolymer Market introduction

Ethylene Acrylic Acid (EAA) copolymers represent a crucial category of thermoplastic resins synthesized through the copolymerization of ethylene and acrylic acid monomers. This unique chemical structure, characterized by the presence of carboxylic acid functional groups, imparts exceptional adhesion properties, high melt strength, and superior resistance to oils, greases, and chemicals. These attributes make EAA copolymers indispensable in demanding applications requiring hermetic seals and strong bonding across dissimilar substrates, particularly in the packaging and adhesives sectors. The versatility of EAA is further highlighted by its ability to be processed using conventional extrusion coating, film blowing, and injection molding techniques, providing manufacturers with flexible and cost-effective production methods.

The primary applications of EAA copolymers span across flexible packaging, where they serve as tie layers and sealant materials, contributing significantly to the shelf stability of various products, especially within the food and beverage industry. Beyond packaging, EAA is extensively utilized in powder coatings, providing excellent corrosion protection for metal substrates, and in hot-melt adhesives, where its strong bonding capability ensures reliability in automotive and construction applications. The intrinsic benefits of EAA, such as low heat seal temperature, puncture resistance, and clarity, position it as a premium material choice compared to conventional polyethylene, driving consistent demand growth in markets focused on sustainability and performance optimization.

The core driving factors underpinning the expansion of the EAA copolymer market include the rapid proliferation of high-barrier packaging solutions necessitated by stringent food safety regulations and the global shift toward flexible and lightweight packaging formats. Furthermore, the increasing adoption of sustainable materials in industrial coatings and the robust growth in emerging economies, particularly across the Asia Pacific region, contribute substantially to the demand trajectory. These macroeconomic and regulatory pressures ensure that EAA remains a highly relevant and growing segment within the broader specialty plastics market.

Ethylene Acrylic Acid Copolymer Market Executive Summary

The Ethylene Acrylic Acid Copolymer market is characterized by consistent growth driven primarily by structural shifts in global packaging standards and heightened consumer preference for convenience foods requiring enhanced barrier protection. Business trends emphasize the development of specialty EAA grades with higher acid content for superior adhesion performance and the integration of bio-based or recycled content to meet circular economy mandates. Major manufacturers are focusing on capacity expansion in high-growth regions and strategic partnerships with end-users, particularly large fast-moving consumer goods (FMCG) corporations, to secure long-term supply agreements and capitalize on application specific product development. Pricing dynamics remain sensitive to fluctuations in upstream ethylene and acrylic acid monomer costs, although the premium performance attributes of EAA often allow for price stabilization above commodity resin benchmarks.

Regionally, the Asia Pacific continues to dominate both consumption and production capacity, propelled by massive industrialization, expanding domestic consumer markets, and the substantial increase in packaged food consumption in countries like China and India. North America and Europe, while mature, exhibit stable demand, concentrating efforts on premium applications such as pharmaceutical packaging and highly durable industrial coatings, alongside strict regulatory emphasis on reducing volatile organic compounds (VOCs), which favors water-borne EAA dispersion formulations. The strategic imperative across all regions is the optimization of supply chains and localized manufacturing to mitigate geopolitical risks and complex logistics challenges inherent in specialty chemical distribution.

Segmentation trends indicate that the adhesive and flexible packaging applications remain the largest revenue generators, though the market is witnessing accelerated uptake in specialized segments such as hot-melt traffic paints and cable shielding, owing to EAA's excellent dielectric properties and weather resistance. By grade, EAA copolymers with higher acrylic acid content (typically exceeding 9 wt%) are experiencing faster growth rates, commanding higher prices due to their enhanced bonding strength required for difficult-to-bond substrates like aluminum foil and polyethylene terephthalate (PET). The market structure is moderately consolidated, with a few global leaders holding significant market share, focusing R&D efforts on improving processability and developing customized melt flow indexes (MFI) tailored for specific customer machinery and output requirements.

AI Impact Analysis on Ethylene Acrylic Acid Copolymer Market

Common user questions regarding AI's influence on the Ethylene Acrylic Acid Copolymer market typically revolve around optimizing complex polymerization processes, predicting raw material price volatility, and enhancing quality control in film and coating manufacturing. Users are keenly interested in how machine learning algorithms can minimize batch-to-batch variation, thereby reducing waste and improving product consistency, especially for high-purity EAA grades used in demanding medical or pharmaceutical packaging applications. Another significant theme is the utilization of AI for advanced simulation and modeling of EAA performance under diverse environmental conditions (e.g., predicting long-term adhesion strength or weatherability), enabling faster material formulation and reduced time-to-market for new products. Furthermore, there is growing inquiry into AI-driven supply chain management, optimizing inventory levels of ethylene and acrylic acid monomers and finished EAA pellets based on predictive demand analytics, mitigating the substantial risks associated with feedstock price fluctuations.

The integration of Artificial Intelligence and advanced analytics is set to revolutionize the Ethylene Acrylic Acid Copolymer manufacturing landscape, moving beyond conventional statistical process control. AI systems facilitate real-time monitoring of reactor conditions, including temperature, pressure, and catalyst dosage, allowing for minute adjustments that maximize yield and ensure precise molecular weight distribution, critical factors for optimal EAA performance in extrusion coating. This precision manufacturing, driven by predictive models, translates directly into reduced energy consumption per unit of production and significant operational efficiencies, particularly important given the energy-intensive nature of polymer synthesis. Moreover, AI aids in accelerating the discovery of novel EAA formulations, simulating how various co-monomer combinations and polymerization initiators affect final product characteristics such as melt elasticity, peel strength, and environmental stress crack resistance, drastically reducing reliance on extensive physical laboratory testing.

Beyond the production floor, AI algorithms are becoming indispensable tools in strategic market analysis within the EAA sector. They process vast datasets encompassing global commodity prices, regulatory changes concerning packaging waste, and consumer purchasing trends, providing manufacturers with highly accurate demand forecasts tailored by geography and end-use application. This foresight allows EAA producers to strategically allocate production capacity and inventory, minimizing obsolescence and maximizing responsiveness to dynamic market needs. The deployment of intelligent quality inspection systems utilizing computer vision also ensures that final EAA products, whether in pellet or film form, meet stringent quality benchmarks without human intervention, ensuring the integrity of materials destined for high-performance barrier applications.

- AI-driven Predictive Maintenance: Optimizing reactor uptime and preventing unplanned shutdowns in EAA synthesis plants, significantly lowering maintenance costs.

- Process Optimization and Yield Enhancement: Utilizing machine learning to control polymerization parameters (temperature, pressure, monomer feed rate) for consistent molecular architecture and maximized batch yield.

- Advanced Quality Control (AQC): Implementing computer vision systems to inspect EAA pellets and films for imperfections in real-time, ensuring adherence to high-purity standards for sensitive applications.

- Supply Chain and Price Forecasting: Employing algorithms to predict raw material (ethylene, acrylic acid) price volatility and forecast regional demand, informing strategic procurement and inventory management.

- Accelerated Material R&D: Simulating the performance of new EAA formulations and co-polymers, reducing the experimental cycle and speeding up time-to-market for specialized grades.

- Energy Consumption Reduction: AI fine-tuning of manufacturing processes to minimize energy input per unit of polymer produced, aligning with corporate sustainability goals.

DRO & Impact Forces Of Ethylene Acrylic Acid Copolymer Market

The dynamics of the Ethylene Acrylic Acid Copolymer market are shaped by a complex interplay of internal growth drivers, external constraints, and emerging technological opportunities, which collectively determine the market's trajectory and profitability. The primary drivers stem from the pervasive demand for high-performance packaging materials that offer superior barrier properties and hermetic seals, coupled with the global expansion of the processed food and pharmaceutical industries, necessitating reliable and safe sealing solutions. Furthermore, increasing regulatory pressure favoring solvent-free and low-VOC coating systems amplifies the demand for EAA in water-borne dispersion applications, substituting traditional solvent-based resins. However, the market faces significant restraints, most notably the high degree of raw material price volatility, specifically for ethylene and acrylic acid monomers, which directly impacts production costs and profit margins. Additionally, the increasing focus on material circularity presents a challenge, as EAA, while recyclable, often requires specialized infrastructure for separation from multilayer film structures, hindering its penetration in completely closed-loop systems compared to simpler polyethylene structures.

Opportunities for market growth are concentrated in the development of specialized, high-adhesion EAA grades targeted at difficult-to-bond substrates, such as bio-plastics and compostable packaging materials, aligning the polymer with future sustainability requirements. Expanding applications in photovoltaic (PV) encapsulation films, leveraging EAA's clarity and moisture barrier characteristics, also presents a lucrative pathway, supported by massive global investment in renewable energy infrastructure. The key impact forces influencing the market are the substitution threat posed by alternative resins like Ethylene Methacrylic Acid (EMAA) and specialized polyurethanes in certain adhesive applications, though EAA generally maintains a cost-performance advantage in standard packaging tie layers. Simultaneously, the bargaining power of major buyers (large packaging converters and FMCG companies) remains high, pressuring manufacturers on pricing and delivery terms, necessitating continuous efficiency improvements in production.

Technological advancement in polymerization catalysts and process design constitutes a significant long-term impact force, enabling the production of EAA with tighter control over molecular weight and acid content distribution, enhancing its end-use performance. Environmental regulations, particularly those banning specific additives or mandating recycled content targets, act as powerful external forces, compelling EAA manufacturers to innovate rapidly in formulation and sourcing. The market's resilience is therefore contingent upon its ability to continuously mitigate feedstock cost risks through hedging strategies, invest in energy-efficient production technologies, and actively participate in the development of recycling infrastructure suitable for complex multilayer packaging materials containing EAA, thus ensuring its continued relevance in a resource-conscious global economy.

- Drivers:

- Surging demand for flexible, high-barrier packaging solutions in the food and pharmaceutical sectors.

- Superior adhesion characteristics of EAA to diverse substrates (e.g., aluminum, paper, nylon).

- Growth in non-packaging applications such as industrial coatings, cable shielding, and hot-melt adhesives.

- Regulatory push favoring low-VOC, water-borne coating systems.

- Restraints:

- Significant volatility and cost escalation of key raw materials (ethylene and acrylic acid).

- Challenges associated with recycling complex multilayer structures containing EAA, raising sustainability concerns.

- Market competition from substitute polymers such as EMAA, Ionomers, and EVA in certain application niches.

- Opportunity:

- Development of high-performance EAA grades for photovoltaic (PV) backsheets and encapsulation films.

- Increasing adoption in specialized powder coatings for enhanced corrosion resistance in construction and automotive industries.

- Formulation of EAA copolymers compatible with bio-based and biodegradable films to address circular economy requirements.

- Impact Forces:

- Bargaining Power of Buyers: High, driven by large converters requiring specialized grades at competitive prices.

- Bargaining Power of Suppliers: Moderate to High, due to dependence on centralized ethylene and acrylic acid production capacity.

- Threat of New Entrants: Low, owing to high capital investment and complex technological requirements for polymerization.

- Threat of Substitutes: Moderate, as Ionomers and specialty adhesives can replace EAA in specific, high-end applications.

Segmentation Analysis

The Ethylene Acrylic Acid Copolymer market is rigorously segmented based on acrylic acid content (Grade), various end-use applications, and the target end-use industry, reflecting the material's adaptability to a wide array of performance requirements. Analyzing these segments is critical for understanding market dynamics, allowing producers to optimize their product portfolios and focus resources on the fastest-growing niches. The Grade segmentation, typically categorized by the weight percentage of acrylic acid, is fundamental as it dictates the functional properties, such as melt viscosity, thermal stability, and adhesion strength; higher acid content grades exhibit superior bonding and higher melt elasticity but also demand more complex processing and specialized equipment. The application segmentation demonstrates the material's ubiquity, ranging from staple uses in extrusion coating and hot-melt adhesives to advanced roles in powder coatings and composite structures, with packaging consistently holding the largest market share.

Within the application spectrum, flexible packaging dominates due to the exceptional sealant properties EAA offers, particularly as a tie layer between aluminum foil and polyethylene in aseptic packaging and stand-up pouches, protecting sensitive contents from oxygen and moisture ingress. Hot-melt adhesives represent the second most critical segment, leveraging EAA's polarity for robust bonding to metallic and cellulose surfaces, vital in bookbinding, assembly, and product labeling. The end-use industry segmentation further defines demand patterns, with the Food & Beverage sector being the primary consumer, driven by stringent safety requirements and the need for prolonged shelf life. The Pharmaceutical industry also exhibits strong growth, requiring ultra-high purity EAA grades for blisters and medical device packaging where material inertness and barrier performance are non-negotiable.

Growth projections indicate that while the traditional packaging sector will maintain volumetric leadership, the fastest expansion rates are expected in segments related to niche industrial applications and sustainable solutions. Specifically, the adoption of EAA in cable and wire jacketing—where resistance to moisture, chemicals, and physical abrasion is paramount—is accelerating, spurred by expansion in telecommunications and energy infrastructure. Furthermore, the push towards powder coatings in the construction and automotive sectors, aimed at replacing high-VOC liquid paints, is boosting demand for EAA dispersions which offer excellent film formation and adhesion profiles without the associated environmental hazards of solvent-based systems, thus diversifying the market's revenue base and ensuring long-term stability.

- By Grade (Acrylic Acid Content):

- Low Content EAA (e.g., 3% to 9% AA)

- Medium Content EAA (e.g., 9% to 15% AA)

- High Content EAA (e.g., 15% to 20% AA)

- By Application:

- Extrusion Coating/Lamination (Packaging Films, Foil Structures)

- Hot Melt Adhesives (HMA)

- Powder Coatings

- Thermoplastic Films and Sheets

- Others (Cable Jacketing, Sealants, Binders)

- By End-Use Industry:

- Food & Beverage (Aseptic Packaging, Sachets)

- Pharmaceutical and Medical Devices (Blister Packs, Sterile Barriers)

- Cosmetics and Personal Care

- Construction (Adhesives, Pipe Coatings)

- Automotive and Transportation (Assembly Adhesives)

Value Chain Analysis For Ethylene Acrylic Acid Copolymer Market

The value chain of the Ethylene Acrylic Acid Copolymer market is structured into distinct stages, starting from raw material sourcing and culminating in the delivery of finished goods to end-use industries, highlighting areas of potential cost control and value addition. The upstream segment is fundamentally dependent on the petrochemical industry for the supply of key monomers: ethylene, typically sourced from naphtha cracking or ethane cracking, and glacial acrylic acid (GAA), derived from the oxidation of propylene. This reliance on volatile commodity markets makes upstream integration and long-term supply agreements crucial for EAA manufacturers to stabilize input costs. Manufacturers who are backward-integrated into ethylene or acrylic acid production benefit substantially from cost advantages and supply security, giving them a competitive edge over non-integrated producers. The quality and purity of these monomers directly dictate the efficiency of the polymerization process and the final properties of the EAA copolymer.

The midstream phase involves the specialized, high-pressure copolymerization process where ethylene and acrylic acid are reacted in the presence of initiators to form the EAA resin, which is then typically pelletized. This manufacturing stage requires high capital investment in reactors, specialized handling systems for corrosive acrylic acid, and proprietary technology to control the polymer's molecular architecture, thus forming a significant entry barrier. Downstream activities involve processing the EAA pellets into various final forms, such as films, sheets, powders, or hot-melt sticks. These converters—including packaging film manufacturers, coating formulators, and adhesive producers—add value by customizing the EAA product to meet specific end-user performance criteria, such as film thickness, melt index modification, or particle size distribution for powder applications. Distribution channels vary significantly, ranging from direct sales to major integrated packaging converters to indirect sales through specialized chemical distributors who service smaller coating or adhesive formulators.

Direct distribution is favored for large-volume sales to established clients in the Food & Beverage and Pharmaceutical industries where technical support, consistent quality assurance, and just-in-time delivery are mandatory requirements. For smaller geographical markets or specialized application niches, indirect distribution through regional distributors provides localized inventory management, technical application support, and streamlined logistics. These distributors act as crucial intermediaries, breaking bulk and managing the complexity of diverse customer needs. The efficiency of the distribution network, particularly the optimization of warehousing and transport, is essential to maintaining the quality of the EAA pellets and minimizing lead times, thereby securing strong partnerships throughout the downstream value chain.

Ethylene Acrylic Acid Copolymer Market Potential Customers

The primary potential customers and end-users of Ethylene Acrylic Acid copolymers are major global entities within the packaging, consumer goods, and industrial manufacturing sectors, all of whom prioritize material performance related to adhesion, barrier, and sealant integrity. The largest customer base resides within the flexible packaging and converting industry, including multi-national firms specializing in the production of multilayer films, aseptic cartons, and flexible pouches. These customers utilize EAA predominantly as an essential tie layer that bonds non-polar polyolefins (like polyethylene) to polar substrates (like aluminum foil or nylon), ensuring the structural integrity and high barrier properties required for shelf-stable food and pharmaceutical products. The continued shift towards flexible packaging formats globally ensures that this customer segment remains the dominant revenue source and the focal point for product innovation.

Another significant customer segment includes manufacturers of industrial adhesives and specialty coatings. Within the adhesive market, customers are typically formulators producing hot-melt adhesive sticks, bulk glues for assembly operations (e.g., woodworking, automotive interiors), and specialized sealants, valuing EAA's exceptional thermal stability and strong specific adhesion to metal and glass. For the coatings sector, key customers are companies producing powder coatings for industrial machinery, architectural applications, and automotive parts, seeking EAA's corrosion resistance and low processing temperatures. These customers often require EAA in powder or dispersion form and demand stringent quality control over particle size distribution and acid functionality to achieve optimal coating performance and environmental compliance (low-VOC targets).

Furthermore, specialized industrial customers, such as cable and wire manufacturers and solar panel producers, represent fast-growing niche markets. Cable manufacturers use EAA for jacketing and shielding applications where chemical and moisture resistance is critical for protecting communication and power lines. Photovoltaic panel manufacturers employ EAA-based films for backsheets and encapsulation layers, capitalizing on its clarity, UV stability, and moisture barrier properties to ensure the long-term durability and efficiency of solar cells. These customers, driven by highly technical specifications and longevity requirements, typically require customized, high-purity EAA grades and represent high-value contracts for EAA suppliers, demonstrating the diversity of the material's customer base beyond conventional packaging.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,175 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dow Chemical, ExxonMobil, Arkema, DuPont, Mitsubishi Chemical, LyondellBasell, Sinopec, LG Chem, Hanwha Total, Sumitomo Chemical, Westlake Chemical, Eastman Chemical, Kuraray, SK Innovation, Nippon Shokubai, TSRC Corporation, DIC Corporation, Polimeri Europa, Sipchem. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ethylene Acrylic Acid Copolymer Market Key Technology Landscape

The manufacturing of Ethylene Acrylic Acid Copolymer relies heavily on high-pressure polymerization technologies, a complex and technically demanding process that necessitates stringent control over reaction conditions to achieve desired molecular architecture and compositional homogeneity. The dominant technological pathway involves free-radical polymerization conducted under extremely high pressures (often exceeding 1,500 bar) in specialized autoclave or tubular reactors. Technological advancements in this area focus primarily on catalyst system optimization and reactor design modifications aimed at enhancing conversion rates, improving energy efficiency, and precisely tailoring the distribution of acrylic acid groups along the polyethylene backbone. This precise control is essential because the location and concentration of the carboxylic acid groups fundamentally determine the EAA's adhesion strength, melt properties, and thermal stability in the final application.

Recent innovations are increasingly focused on developing sophisticated process control mechanisms, often utilizing in-line spectroscopy and advanced sensors to monitor real-time monomer concentration and polymer viscosity within the reactor. This move towards 'smart manufacturing' allows producers to minimize batch variation, significantly improving product consistency which is vital for high-specification customers in the medical and pharmaceutical packaging sectors. Furthermore, there is a dedicated technological push toward creating specialty grades via non-traditional methods, such as solution polymerization or emulsion polymerization, particularly for EAA dispersions used in water-borne coatings. These techniques allow for the production of fine-particle EAA dispersions that are environmentally friendly and suitable for low-VOC coating applications, bypassing the need for solvent use, thereby aligning with global sustainability initiatives.

Looking ahead, the technological landscape is being shaped by the need for enhanced material performance and circularity. This includes developing reactive extrusion and compounding technologies to incorporate functional additives or fillers, creating EAA composites with improved barrier or flame-retardant properties. Crucially, research into mechanical and chemical recycling technologies for EAA-containing multilayer films is gaining prominence. This involves developing sophisticated sorting technologies and mild chemical processes that can effectively separate or recover the EAA component from complex packaging structures, ensuring that the valuable functional polymer can be reintroduced into the supply chain, thus securing the material's long-term viability in a waste-conscious global economy.

Regional Highlights

The Ethylene Acrylic Acid Copolymer market exhibits distinct regional dynamics, driven by localized industrial growth, regulatory frameworks, and consumer preferences for packaged goods. Asia Pacific (APAC) stands as the undisputed powerhouse, leading both in terms of market volume consumption and new manufacturing capacity expansion. The immense growth in APAC is fueled by the region's burgeoning middle class, rapid urbanization, and corresponding boom in the processed food, beverage, and pharmaceutical industries, particularly in populous nations like China, India, and Southeast Asian countries. These regions mandate large volumes of flexible packaging, driving substantial demand for EAA as a key sealant and tie layer in multilayer laminates. Furthermore, APAC's strong infrastructure development, including investment in solar energy and telecommunications, contributes to the growing need for EAA in PV backsheets and cable jacketing applications, cementing the region's dominance and high growth rate throughout the forecast period.

North America and Europe represent mature yet highly stable markets, characterized by stringent regulatory standards concerning material safety, environmental impact, and product quality. Demand in these regions is less volumetrically driven but highly concentrated in high-value, specialized applications. In Europe, the strong emphasis on the circular economy and reduction of plastic waste influences the demand profile, favoring EAA grades that facilitate mono-material packaging or that are utilized in low-VOC coating systems, driving innovation towards sustainability-focused solutions. North America's demand is robust in the pharmaceutical and medical device sectors, requiring the highest purity EAA, alongside strong consumption in industrial adhesives and specialized construction coatings. While growth rates in these Western markets are typically lower than APAC, they command higher average selling prices due to the specialized nature and performance requirements of the EAA products consumed.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets that offer significant long-term growth potential. LATAM demand is strongly linked to the expansion of packaged goods consumption and local industrial output, with countries like Brazil and Mexico serving as key regional hubs. MEA, particularly the GCC nations, is seeing increased EAA use driven by infrastructure projects, including pipeline coatings and construction materials, and a developing regional food processing sector. However, these regions often face greater supply chain volatility and reliance on imports from established APAC and North American producers. Strategic localized investment in manufacturing or enhanced distribution channels within these developing regions will be crucial for capturing future market share and ensuring reliable supply in areas undergoing significant industrialization and consumer market growth.

- Asia Pacific (APAC): Market volume leader, driven by massive consumption in flexible packaging (China, India), strong infrastructure investment, and expansion of local manufacturing capacity.

- North America: Stable, high-value market focused on pharmaceutical packaging, advanced industrial adhesives, and low-VOC compliant coatings.

- Europe: Growth driven by stringent environmental mandates (e.g., circular economy policies), increasing demand for water-borne dispersions, and specialized food safety applications.

- Latin America (LATAM): Emerging demand fueled by urbanization and increasing adoption of modern packaging standards in Brazil and Mexico.

- Middle East & Africa (MEA): Growth potential tied to large-scale infrastructure projects (pipe coatings, construction adhesives) and developing local food processing industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ethylene Acrylic Acid Copolymer Market.- Dow Chemical Company

- ExxonMobil Chemical Company

- Arkema S.A.

- DuPont de Nemours, Inc.

- Mitsubishi Chemical Corporation

- LyondellBasell Industries N.V.

- China Petroleum & Chemical Corporation (Sinopec)

- LG Chem Ltd.

- Hanwha Total Energies Petrochemical Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Westlake Chemical Corporation

- Eastman Chemical Company

- Kuraray Co., Ltd.

- SK Innovation Co., Ltd.

- Nippon Shokubai Co., Ltd.

- TSRC Corporation

- DIC Corporation

- Polimeri Europa (EniChem)

- Sipchem (Saudi International Petrochemical Company)

- Axalta Coating Systems, Ltd. (in coating segment)

Frequently Asked Questions

Analyze common user questions about the Ethylene Acrylic Acid Copolymer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of Ethylene Acrylic Acid (EAA) copolymers over standard polyethylene in packaging?

EAA copolymers offer significantly superior adhesion properties, particularly to non-polymeric substrates such as aluminum foil, glass, and paper, due to the presence of polar carboxylic acid groups. They also exhibit higher melt strength, lower heat seal temperatures, and enhanced resistance to oils and greases, making them indispensable for high-barrier, multi-layer flexible packaging requiring hermetic seals and prolonged shelf life.

How is the volatility of raw material prices impacting the profitability of EAA manufacturers?

Profitability is directly and severely impacted by the high volatility of upstream raw materials, namely ethylene and glacial acrylic acid. Since EAA production is capital and energy-intensive, significant spikes in monomer costs compress margins, especially for non-integrated producers. Manufacturers often mitigate this risk through strategic hedging contracts and by developing specialized, higher-margin EAA grades that justify a premium price point.

Which end-use industry segment is driving the highest volume growth in the EAA market?

The Food and Beverage industry remains the largest volume consumer, driving growth through the increasing global demand for processed foods, convenience items, and aseptic packaging that necessitates superior sealant and barrier properties. Rapid urbanization and expanding consumer bases in the Asia Pacific region are key demographic factors underpinning this sectoral expansion.

Are Ethylene Acrylic Acid copolymers considered sustainable or recyclable in the context of the circular economy?

EAA itself is a thermoplastic and is theoretically recyclable. However, its primary use as a thin tie layer in complex, multi-material film laminates (e.g., plastic-aluminum-EAA) makes mechanical separation challenging. Industry efforts are focusing on developing new packaging designs where EAA can facilitate the creation of 'mono-material' structures (PE-EAA-PE) that are easier to recycle within existing polyethylene streams, improving the overall circularity profile.

What role does the acid content percentage play in determining the final application of EAA copolymers?

The acrylic acid content (measured as weight percent) is the most critical determinant of EAA performance. Higher acid content (e.g., 15-20%) leads to stronger adhesion to difficult substrates, higher melt elasticity, and better resistance to chemicals, making it suitable for demanding applications like foil seals and powder coatings. Lower acid content grades (e.g., 3-9%) are generally used for basic extrusion coating and less aggressive sealant layers due to their improved processability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager