Ethylene Octene Copolymer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436930 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Ethylene Octene Copolymer Market Size

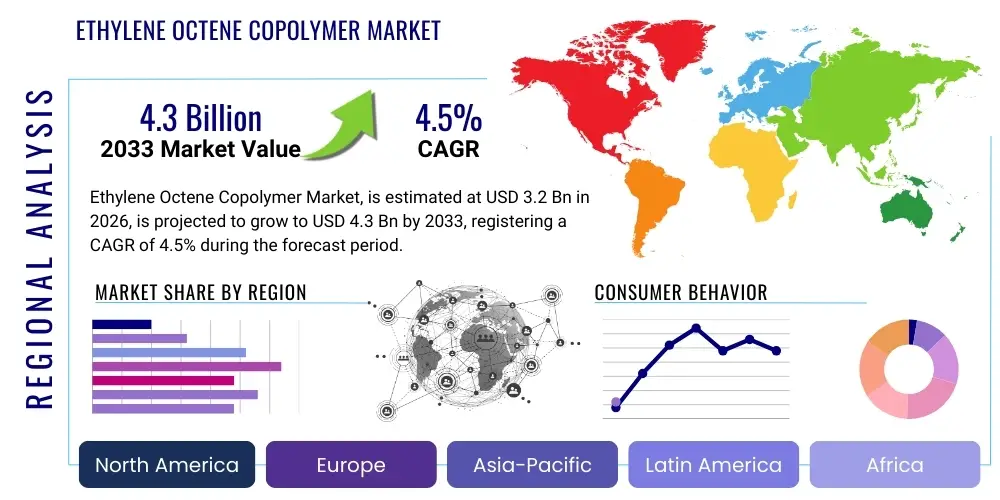

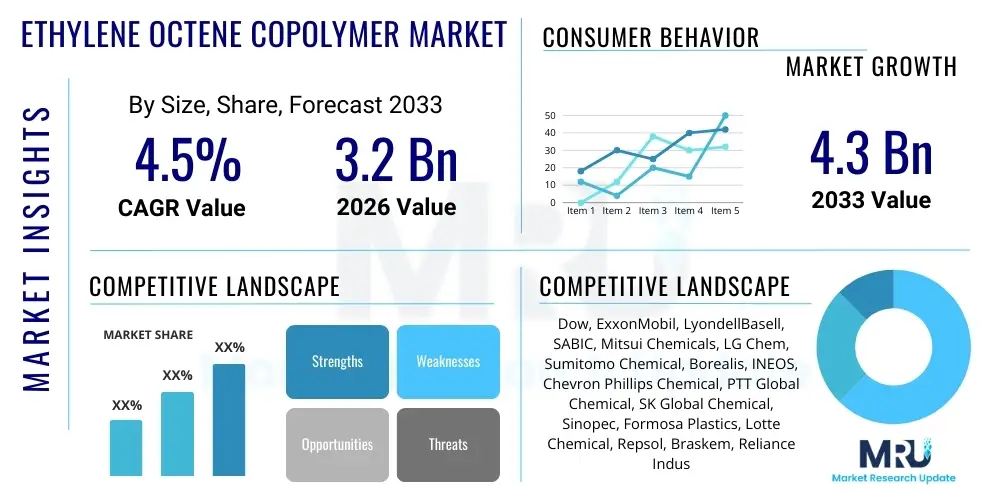

The Ethylene Octene Copolymer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 3.2 Billion in 2026 and is projected to reach USD 4.3 Billion by the end of the forecast period in 2033.

Ethylene Octene Copolymer Market introduction

Ethylene Octene Copolymers (EOCs) are high-performance polyolefins characterized by excellent flexibility, low-temperature toughness, and superior environmental stress cracking resistance (ESCR). These properties are achieved through the precise polymerization of ethylene with 1-octene co-monomers, resulting in a unique crystalline structure that provides enhanced elasticity and durability compared to traditional polyethylene resins. EOCs are frequently utilized as high-quality impact modifiers for polypropylene and other polyolefins, significantly enhancing the mechanical strength, particularly impact resistance, and long-term durability of end products without negatively affecting critical characteristics like clarity or manufacturing processability. The selection of 1-octene, a longer chain alpha-olefin, is pivotal as it allows for more effective control over the material's amorphous and crystalline phase separation, which directly translates into superior melt processing behavior and final product performance in demanding environments.

The primary applications of Ethylene Octene Copolymers span across several key industrial sectors, notably high-specification packaging, automotive manufacturing, and critical electrical infrastructure. In the packaging domain, EOCs are essential components in complex multilayer stretch films, robust shrink films, and heavy-duty industrial bags, where their puncture resistance and reliable heat seal strength are non-negotiable performance attributes. Within the automotive sector, EOCs contribute significantly to interior components, hoses, seals, and weather stripping, demanding materials that offer high flexibility, resistance to chemical exposure (oils and fuels), and stability against thermal cycling. Furthermore, their outstanding dielectric properties and thermal stability make them indispensable materials within the wires and cables industry, particularly for high-voltage insulation and protective jacketing requiring long-term reliability and extreme environmental resistance.

Market expansion for EOCs is fundamentally driven by the accelerating global demand for lightweight and highly durable flexible packaging solutions, a trend complemented by increasingly strict regulatory pushback towards environmentally compliant and highly recyclable materials. EOCs are critical enablers of lightweighting initiatives, especially in the automotive sector where mass reduction directly translates to improved fuel efficiency in internal combustion vehicles and extended range in electric vehicles. Key competitive benefits delivered by EOCs include superior heat sealability at lower temperatures, exceptional optical clarity for display packaging, and optimized melt flow characteristics, which are necessary for efficient, high-speed polymer processing and the production of complex molded articles. Sustained innovation in polymerization catalysis, particularly the refinement of metallocene technology, continually optimizes the production economics and facilitates the tailored development of new EOC grades, ensuring the market remains responsive to specialized needs in emerging fields such as medical technology and advanced consumer electronics.

Ethylene Octene Copolymer Market Executive Summary

The Ethylene Octene Copolymer market is characterized by robust growth momentum, primarily fueled by the sustained global preference for enhanced performance polymers in critical infrastructure and consumer goods packaging. Current business trends highlight a strategic global effort by leading chemical producers to expand specialized EOC capacity, particularly leveraging advanced metallocene catalyst systems to produce higher value, tailor-made grades. This strategic focus is essential to meet the burgeoning requirements from Asia Pacific's massive manufacturing base and the specialized needs of developed Western economies. Crucially, the market environment is marked by increasing efforts in vertical integration aimed at securing the stable supply of 1-octene co-monomer, mitigating the risk associated with upstream petrochemical market volatility and ensuring competitive pricing for high-volume consumers. Furthermore, the accelerating transition of the global automotive fleet towards electrification is creating a new, substantial demand vector for specialized EOC compounds required in flexible, durable, and highly reliable battery and charging cable insulation systems.

Geographically, the Asia Pacific (APAC) region solidifies its position as the critical engine of global market growth, dominating both consumption and large-scale manufacturing capacity. This regional dynamism is a direct consequence of enormous investments in foundational infrastructure across nations like China, India, and Vietnam, coupled with the rapid expansion of manufacturing capabilities across key consumer-driven sectors, including electronics and durable goods. Conversely, established markets in North America and Europe, while growing at a steadier rate, are focused on high-value applications, substituting legacy polymers with advanced EOCs in specialized areas such as high-purity medical films, stringent protective coatings, and precision-engineered automotive interior parts. Regulatory compliance, particularly concerning sustainability and safety standards, is a significant determinant of material adoption in these developed regions, favoring the high-quality assurance provided by established EOC suppliers. Latin America and the Middle East & Africa (MEA) are emerging as significant potential growth territories, spurred by petrochemical investment and rising local demand for modern packaging and construction materials.

Analysis of market segmentation reveals that the Films application category maintains its leading revenue position, capitalizing on the need for EOCs in high-integrity packaging systems that require superior puncture resistance and seal strength. However, the Injection Molding segment is projected to exhibit the fastest Compound Annual Growth Rate (CAGR), driven by the increasing application of EOCs in automotive interior components, durable consumer goods, and critical electronic housing units that demand both flexibility and resilience. A key segment trend is the sustained demand for ultra-high-clarity EOC grades, reflecting the premium placed on visual presentation in retail packaging and consumer electronics. Manufacturers are strategically concentrating their research and development efforts on diversifying their product offerings to provide highly targeted material solutions, ranging from ultra-low density EOCs ideal for soft-touch surfaces and elastic films to higher density variations engineered for structural modification, thus ensuring comprehensive coverage and deep penetration across diverse end-use markets.

AI Impact Analysis on Ethylene Octene Copolymer Market

Analysis of common user questions regarding the integration of Artificial Intelligence (AI) in the Ethylene Octene Copolymer industry highlights significant focus areas related to efficiency and material science innovation. The primary concerns and expectations center on leveraging AI to achieve unprecedented levels of operational precision in polymerization units, particularly minimizing the complex variability inherent in large-scale reactor processes. Users frequently inquire about the feasibility of employing machine learning to predict material properties based on subtle changes in upstream feedstock composition, thereby ensuring lot-to-lot consistency crucial for sensitive applications like medical tubing and high-performance wire insulation. A strong expectation exists that AI will dramatically accelerate the notoriously slow process of catalyst formulation and screening, enabling researchers to quickly identify and scale novel EOC structures with enhanced characteristics such as bio-compatibility or extreme thermal resistance, fundamentally compressing the product development lifecycle and driving significant cost reductions.

Furthermore, end-user manufacturers are keenly interested in how AI-driven analytics can optimize their downstream processing of EOC resins, such as injection molding cycles and film extrusion rates. Questions often surface regarding predictive maintenance schedules for multi-million dollar polymerization equipment, suggesting a shift toward proactive, data-informed asset management to reduce expensive, unplanned downtime. The application of sophisticated data fusion techniques, combining real-time sensor data, lab quality checks, and process modeling, is expected to create a "smart factory" environment. This environment would dynamically adjust production parameters to maintain optimal product quality and consistency, drastically reducing off-spec material generation and maximizing material utilization rates across the entire value chain, aligning perfectly with global resource efficiency objectives.

The commercial impact of AI is also viewed through the lens of market strategy and logistics. Specific user inquiries address the use of AI for granular, highly accurate demand forecasting, especially concerning geographically segmented specialized EOC grades. Improved forecasting capabilities enable chemical producers to optimize production schedules and manage complex global supply chains more effectively, ensuring raw materials like 1-octene are procured efficiently and minimizing inventory carrying costs across multiple global storage facilities. Ultimately, the successful deployment of AI is anticipated to create a significant competitive advantage for producers who can integrate these tools across R&D, manufacturing, and logistics, leading to a faster time-to-market for novel EOC solutions and a lower operational expenditure baseline compared to competitors relying solely on traditional process control methods.

- AI-driven optimization of polymerization reactor conditions, including highly precise control of temperature profiles and co-monomer injection rates, leading to maximized EOC yield.

- Machine learning algorithms applied to chemical structure databases to accelerate the research, development, and high-throughput screening of novel metallocene catalysts for specialty EOC grades.

- Implementation of predictive quality control using real-time spectral and rheological data analysis to immediately detect and correct deviations in EOC melt index and density characteristics.

- Utilization of digital twin technology for simulating the operational lifetime and degradation behavior of EOC components in demanding environments (e.g., automotive engine compartments).

- Automated analysis of global logistics and real-time demand signals to provide optimized production scheduling and inventory management, significantly reducing supply chain lead times and working capital requirements.

- Application of computer vision systems combined with AI to inspect finished EOC pellets for size, shape, and contamination, ensuring unparalleled quality assurance prior to shipment to converters.

DRO & Impact Forces Of Ethylene Octene Copolymer Market

The market for Ethylene Octene Copolymer is primarily propelled by the fundamental need for superior material performance, which is increasingly mandated by specialized applications in high-growth sectors such as advanced packaging and electric vehicle manufacturing. The chief driving factor remains EOC's unparalleled combination of low-temperature flexibility, exceptional impact resistance, and resistance to environmental stress cracking, making it a preferred material for durable films and flexible molded components that surpass the capabilities of traditional polyethylene grades. Furthermore, global regulatory pressures advocating for improved energy efficiency and enhanced product longevity incentivize the adoption of high-performance polymers like EOC, particularly in the construction and energy transmission sectors where material failure can have catastrophic economic consequences. These drivers are intrinsically linked to the global economic uplift and the continuous push for product innovation across critical manufacturing domains, ensuring sustained market relevance and expansion.

Despite these significant drivers, the market faces notable restraining factors that primarily stem from the upstream supply chain dynamics. The reliance on 1-octene as a key co-monomer presents a major challenge, as its production and pricing are directly tied to the highly volatile global petrochemical industry, leading to unpredictable raw material costs. Furthermore, the specialized nature of EOC production, demanding advanced catalytic technology—specifically metallocene systems—requires substantial capital expenditure for new or expanded production facilities. This high barrier to entry limits the proliferation of manufacturers and maintains a concentrated supply base, potentially creating bottlenecks during periods of peak demand. The lack of standardized recycling infrastructure for mixed polymer waste, although improving, also mildly restrains growth by complicating end-of-life management for EOC-containing products, though EOCs themselves are technically recyclable as polyolefins.

Significant opportunities are emerging from the push towards materials sustainability, notably through the research and commercialization of bio-based Ethylene Octene Copolymers derived from renewable feedstocks, which offer a pathway to meet corporate sustainability goals without sacrificing material performance. Penetrating niche, high-margin applications like specialized medical tubing, pharmaceutical packaging, and high-purity adhesive systems also presents a critical avenue for profitable expansion. The strongest impact forces currently favor market expansion, as the material's superior properties offer tangible economic and functional benefits to converters and OEMs, justifying the premium price points associated with EOCs. Effective strategic mitigation of feedstock price risk through long-term supply contracts and hedging strategies is vital for manufacturers to fully capitalize on these inherent growth opportunities and maintain margin stability against external economic fluctuations.

Segmentation Analysis

The Ethylene Octene Copolymer market is systematically segmented to capture the diverse routes to market and technical requirements across its broad application landscape. Segmentation by application is crucial, as the performance requirements vary drastically between, for example, a stretch film (demanding high elasticity and puncture resistance) and a wire jacket (requiring excellent dielectric strength and thermal stability). The Films application segment remains the largest revenue contributor due to the sheer volume utilized in industrial and consumer packaging. Conversely, segmentation by type, which differentiates between High-Density (HD-EOC) and Low-Density (LD-EOC) variants, allows producers to tailor material grades to specific mechanical properties—LD-EOCs for flexibility and HD-EOCs for stiffness and higher temperature resistance. This detailed segmentation is instrumental in both understanding current market structure and projecting future demand shifts based on specific industry trends.

- By Application:

- Films (Stretch Film, Shrink Film, Lamination Films, Heavy-Duty Bags)

- Injection Molding (Automotive Interior Components, Consumer Goods, Toys)

- Wires and Cables (Power Cables, Telecommunication Cables, Automotive Wiring Insulation and Jacketing)

- Extrusion Coating and Lamination (Paperboard Coating, Barrier Layers)

- Footwear (Mid-Soles, Foams, Specialty Soles)

- Others (Medical Devices, Hot Melt Adhesives, Polymer Impact Modification, Roofing Membranes)

- By Type:

- High-Density Ethylene Octene Copolymer (HD-EOC)

- Low-Density Ethylene Octene Copolymer (LD-EOC)

- By Catalyst Type:

- Metallocene Catalysts (Superior uniformity and clarity grades)

- Ziegler-Natta Catalysts (Cost-effective, high-volume grades)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Southeast Asia)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (Saudi Arabia, UAE, South Africa)

Value Chain Analysis For Ethylene Octene Copolymer Market

The value chain for Ethylene Octene Copolymer manufacturing is initiated in the upstream segment, which focuses on securing and refining the critical petrochemical feedstocks: polymer-grade ethylene and the essential co-monomer, 1-octene. Ethylene is usually sourced from crackers, while 1-octene requires dedicated oligomerization facilities, meaning the upstream supply is concentrated among large, integrated petrochemical giants with extensive infrastructure. The financial viability of the entire chain is inherently tied to the efficient management of crude oil and natural gas prices, which dictate the procurement costs of these monomers. Manufacturing in this segment involves highly specialized chemical processing utilizing advanced catalyst technology, primarily metallocene systems, to synthesize the precise polymer architecture required for high-performance EOC grades. Successful upstream players possess both scale and sophisticated catalytic intellectual property.

The midstream phase involves converting the raw EOC resin pellets into usable products for end-users, managed through complex distribution networks. The direct channel focuses on supplying large, established converters—such as major film extruders or global automotive Tier 1 suppliers—who purchase high volumes of standard or pre-agreed EOC grades directly from the producer. Conversely, the indirect distribution channel involves specialized polymer compounders, distributors, and trading houses. These intermediaries are crucial for market penetration into smaller or highly niche applications. Compounders often modify the EOC resin by adding functional materials (colorants, UV stabilizers, flame retardants) to meet highly localized or specialized application standards, effectively broadening the applicability of EOCs to markets that cannot handle internal resin modification and blending processes.

The downstream segment represents the final consumption markets where EOCs are transformed into final goods. Key potential customers include large converters and Original Equipment Manufacturers (OEMs) across four primary end-use sectors: packaging (for flexible, durable films), automotive (for lightweight interior and exterior components), wires and cables (for robust insulation systems), and construction (for sealants and piping modifications). Success in this segment requires the converters to possess high-precision processing equipment, such as advanced extruders and injection molding machines, capable of efficiently handling the unique rheological properties of EOCs. The ultimate success of the EOC product is judged at this stage based on the performance, longevity, and regulatory compliance of the final consumer or industrial product, making consistent quality supply a dominant factor in customer selection.

Ethylene Octene Copolymer Market Potential Customers

The potential customer base for Ethylene Octene Copolymers comprises highly technical, large-volume consumers who necessitate material properties surpassing those offered by conventional polyolefins. The largest group of buyers are industrial film converters who produce multilayer or specialized monolayer packaging, including heavy-duty shipping sacks, stretch hood films, and high-barrier food packaging. These customers prioritize EOCs due to their exceptional seal strength, low-temperature toughness, and resistance to environmental degradation, which minimizes product loss and enhances the reliability of the packaging throughout the supply chain. Purchasing decisions within this sector are often dictated by material certification for food contact and compliance with various international shipping standards, placing a high value on consistent quality assurance and reliable logistics from the EOC supplier.

Another critical set of potential customers resides in the automotive and transportation sector, including Tier 1 suppliers and major OEMs. These entities utilize EOCs for applications requiring soft-touch surfaces, flexible bellows, critical weather seals, and vibration dampeners, all contributing to vehicle lightweighting and enhanced comfort or safety. Specifically, the accelerated transition to electric vehicles (EVs) has created a high-demand customer segment focused on EOCs for battery module encapsulation and high-flex, high-reliability charging cable jackets, where thermal management and long-term durability are paramount. These buyers require materials that meet stringent long-term performance tests (e.g., thermal aging, chemical resistance) mandated by global automotive standards, leading them to prefer established suppliers capable of providing specialized, high-specification EOC grades consistently across global manufacturing sites.

Furthermore, the infrastructure and utilities sectors, particularly wires and cables manufacturers, form a specialized and growing customer base. These companies purchase EOCs for use as insulation and jacketing materials for power, telecom, and solar cabling due to their superior dielectric strength, low dissipation factor, and impressive resistance to abrasion and moisture ingress. Lastly, polymer compounders act as vital indirect customers, acquiring bulk EOC resin and blending it with performance additives (such as stabilizers or flame retardants) to create customized, ready-to-use compounds. These compounders then supply smaller manufacturers in niche markets like footwear components, medical devices (tubing, bags), and specialty adhesives, thereby expanding the reach of EOC technology to markets that require low volume but highly specialized material formulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 4.3 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dow, ExxonMobil, LyondellBasell, SABIC, Mitsui Chemicals, LG Chem, Sumitomo Chemical, Borealis, INEOS, Chevron Phillips Chemical, PTT Global Chemical, SK Global Chemical, Sinopec, Formosa Plastics, Lotte Chemical, Repsol, Braskem, Reliance Industries, PolyOne (Avient), TotalEnergies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ethylene Octene Copolymer Market Key Technology Landscape

The technological foundation of the Ethylene Octene Copolymer market is anchored in advanced polymer synthesis, primarily leveraging catalytic systems that ensure high levels of co-monomer incorporation and controlled molecular weight distribution. The dominant technology is the Metallocene catalyst system, a single-site catalysis method that enables the production of EOCs with extremely uniform molecular structures. This uniformity is critical for achieving superior performance attributes such as excellent optical clarity, minimized extractables, and highly consistent mechanical properties—qualities essential for high-end applications like medical films and demanding wire insulation where structural integrity cannot be compromised. While these technologies require precise reactor conditions and higher initial catalyst costs, the resulting premium material grades command higher market prices and offer distinct competitive advantages in performance-driven sectors.

The legacy Ziegler-Natta catalysts remain a relevant, secondary technology primarily used for producing commodity and general-purpose EOC grades in high volumes due to their lower operational complexity and cost structure compared to metallocenes. However, EOCs produced via Ziegler-Natta typically exhibit broader molecular weight distributions, which can slightly compromise the material's clarity and homogeneity, limiting their use in highly sensitive applications. Continuous innovation focuses on modifying these traditional systems to enhance co-monomer incorporation efficiency, aiming to narrow the performance gap with metallocene products without incurring the full capital expense of a metallocene plant transition. The choice between these two technologies is fundamentally a strategic decision balancing production volume goals against the required precision and specification level of the final EOC product.

Looking ahead, technological innovation is expanding into reactor design and feed stream diversity. Modern polymerization utilizes advanced slurry and gas-phase reactors engineered for maximum thermodynamic efficiency and scalability. Furthermore, the industry is heavily investing in research related to bio-based and sustainable monomers. Specifically, the development of EOCs utilizing bio-ethylene derived from renewable sources is gaining traction as major chemical firms commit to decarbonization and sustainable portfolio expansion. The integration of advanced computational chemistry and Artificial Intelligence is also accelerating technology development by allowing for virtual screening of thousands of potential catalyst and formulation combinations, thereby streamlining R&D cycles and leading to the faster commercialization of next-generation EOC materials tailored for future challenges, such as extreme weather resilience or improved fire safety standards.

Regional Highlights

The Asia Pacific (APAC) region stands as the powerhouse of the global Ethylene Octene Copolymer market, reflecting robust industrial expansion and unparalleled consumer market growth, particularly across China, India, and Southeast Asian nations. APAC’s dominance is underpinned by massive internal demand for films used in consumer goods packaging, agricultural applications, and large-scale infrastructure projects, driving continuous high-volume consumption. Additionally, the region hosts the largest global production capacity, facilitated by heavy strategic investment in petrochemical complexes and polymer conversion facilities by both regional players and Western multinational corporations seeking cost-efficient manufacturing bases. The rapid urbanization and expanding middle-class consumption patterns ensure that APAC will remain the primary market driver throughout the forecast period, requiring continuous, substantial supply of both commodity and increasingly specialized EOC grades.

North America and Europe constitute vital markets defined by technological maturity, stringent regulatory compliance, and a strategic focus on high-performance, specialty applications. In North America, low-cost access to ethane feedstock, primarily from the shale gas revolution, provides a significant cost advantage for ethylene production, supporting large domestic EOC manufacturing operations primarily serving the automotive and specialized film sectors. European demand is fundamentally driven by compliance with the continent's ambitious climate targets and high product quality standards. The mandatory lightweighting targets in the automotive industry, coupled with the need for low-smoke, non-halogenated EOC compounds in critical infrastructure cabling, compel steady growth focused on premium-priced metallocene EOCs. Both regions prioritize sustainable sourcing and advanced recycling technologies, shaping demand toward suppliers offering certified and environmentally conscious products.

The Middle East & Africa (MEA) region is rapidly evolving into a significant global exporter of base polyolefins, capitalizing on vast, cost-effective hydrocarbon reserves and major strategic investments in state-of-the-art petrochemical facilities, particularly in the Gulf Cooperation Council (GCC) states. While internal consumption in the MEA region is growing steadily, propelled by construction and localized consumer packaging demand, the primary strategic role of MEA producers is supplying Asian and European markets with bulk EOC resins. Latin America, led by Brazil and Mexico, exhibits strong localized consumption growth, largely tied to domestic packaging needs and the expansion of the footwear and apparel industries, which utilize EOCs for flexible components. However, market activity in Latin America can be sensitive to regional currency fluctuations and geopolitical stability, making localized supply chain management a complex operational necessity for international suppliers.

- Asia Pacific (APAC): Highest volume market for both production and consumption; growth driven by infrastructure (cables) and mass consumer packaging demand in China and India.

- North America: Focus on premium applications in automotive (EVs), medical devices, and high-specification barrier films. Supported by cost-competitive ethylene supply.

- Europe: Growth strongly tied to regulatory requirements for sustainable and high-durability materials; significant demand for metallocene EOCs in specialized wires/cables and automotive components.

- Middle East & Africa (MEA): Emerging as a major export hub leveraging abundant, low-cost raw material supply; increasing local demand from construction and retail sectors.

- Latin America: Steady localized demand from packaging and consumer goods industries; market stability influenced by regional economic conditions and import policies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ethylene Octene Copolymer Market.- Dow

- ExxonMobil

- LyondellBasell

- SABIC

- Mitsui Chemicals

- LG Chem

- Sumitomo Chemical

- Borealis

- INEOS

- Chevron Phillips Chemical

- PTT Global Chemical

- SK Global Chemical

- Sinopec

- Formosa Plastics

- Lotte Chemical

- Repsol

- Braskem

- Reliance Industries

- PolyOne (Avient)

- TotalEnergies

Frequently Asked Questions

Analyze common user questions about the Ethylene Octene Copolymer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of Ethylene Octene Copolymer (EOC) over standard LLDPE?

EOC offers significant advantages in low-temperature flexibility, enhanced environmental stress cracking resistance (ESCR), and superior impact strength. EOCs produced using metallocene catalysts also exhibit narrower molecular weight distribution, leading to better clarity and processability crucial for high-performance films and tough molded parts, especially compared to commodity Linear Low-Density Polyethylene (LLDPE).

How does the volatility of 1-octene feedstock impact the profitability of the EOC market?

1-octene is a specialty co-monomer derived from the oligomerization of ethylene, making its supply and price highly dependent on upstream petrochemical stability and crude oil costs. Significant volatility in 1-octene prices directly elevates the operational cost for EOC manufacturers, often pressuring profit margins unless these costs can be effectively passed on to specialized downstream markets requiring high-end EOC grades.

Which application segment holds the largest share in the Ethylene Octene Copolymer Market?

The Films segment, encompassing stretch films, shrink packaging, and heavy-duty industrial bags, currently holds the largest market share. This dominance is attributed to EOC's inherent properties that provide superior tear and puncture resistance, as well as excellent heat seal strength required for robust and reliable flexible packaging solutions across various consumer and industrial sectors.

What role does Metallocene catalyst technology play in EOC production?

Metallocene catalysts are essential for producing high-performance, specialty grades of EOC. They allow for precise control over the molecular architecture, enabling the uniform incorporation of octene co-monomers into the polymer chain. This precision results in superior physical properties such as high clarity, low extractables, and exceptional flexibility, crucial for demanding applications like medical devices and high-voltage cable insulation.

Is there a growing trend toward sustainable or bio-based Ethylene Octene Copolymers?

Yes, driven by global mandates for circular economy practices and consumer demand for eco-friendly materials, there is significant R&D focus on developing bio-based EOCs utilizing bio-ethylene derived from sugar cane or other renewable resources. While currently a niche segment, investment is accelerating to offer sustainable alternatives without compromising the superior performance characteristics inherent to standard EOCs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager