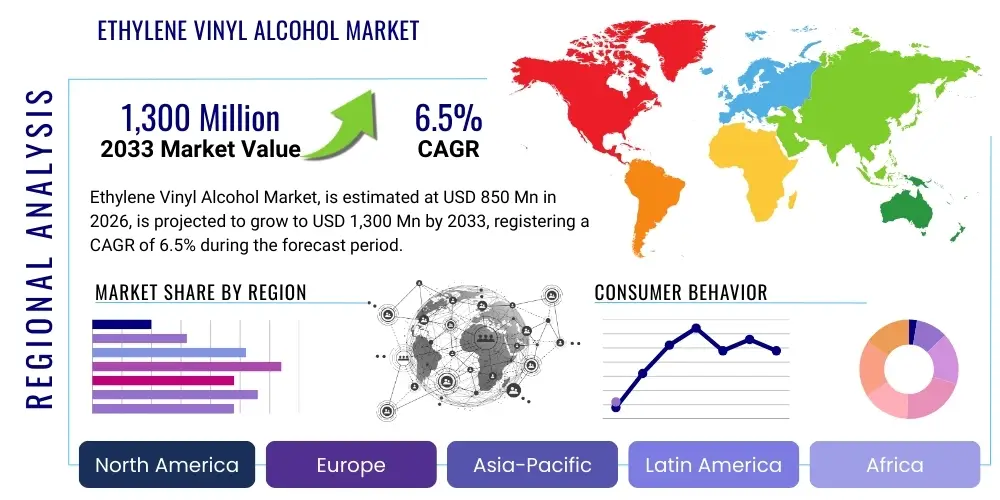

Ethylene Vinyl Alcohol Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437194 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Ethylene Vinyl Alcohol Market Size

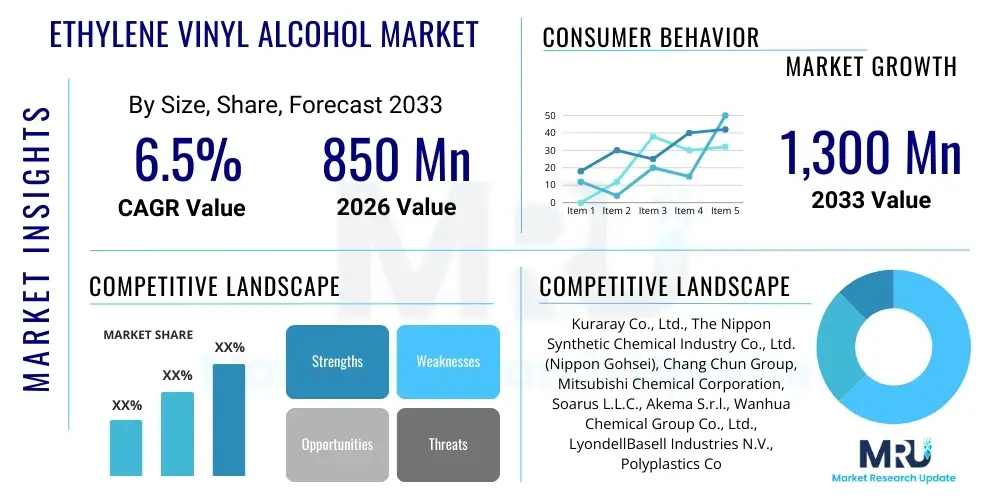

The Ethylene Vinyl Alcohol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,300 Million by the end of the forecast period in 2033.

Ethylene Vinyl Alcohol Market introduction

Ethylene Vinyl Alcohol (EVOH) is a high-performance copolymer renowned for its exceptional gas barrier properties, particularly against oxygen, making it indispensable in modern packaging solutions. This semi-crystalline thermoplastic is synthesized through the hydrolysis of ethylene vinyl acetate copolymer (EVA). The primary attributes driving its high commercial value are its superior resistance to chemicals, excellent transparency, and notable melt processability, which allows it to be efficiently integrated into multi-layer structures, typically through co-extrusion or lamination processes. EVOH is non-toxic and recyclable, aligning with growing global sustainability mandates.

The widespread adoption of EVOH is fundamentally anchored in the food and beverage industry, where extending product shelf life and maintaining quality integrity are paramount. Its near-perfect barrier against oxygen ingress prevents oxidation, spoilage, and flavor degradation in perishable goods such as processed meats, dairy products, and ready-to-eat meals. Beyond food, major applications span the automotive sector, utilized in multi-layer fuel tanks and lines to prevent the permeation of volatile organic compounds (VOCs) and maintain stringent emission standards. The medical and pharmaceutical sectors also rely on EVOH for sterile packaging and medical device components due to its chemical inertness and sterilization compatibility.

Market expansion is currently fueled by several macro-economic and industrial factors. Firstly, the burgeoning demand for sophisticated barrier packaging in emerging economies, driven by rising disposable incomes and changing consumer lifestyles preferring packaged and ready-to-cook foods, provides a significant impetus. Secondly, stringent global environmental regulations concerning food waste reduction and vehicle emissions necessitate the use of high-efficiency barrier materials like EVOH. Furthermore, continuous advancements in co-extrusion technologies are improving the cost-effectiveness and processability of EVOH films, making them accessible for broader commercial applications across diverse industries, cementing its status as a critical material in high-performance polymer engineering.

Ethylene Vinyl Alcohol Market Executive Summary

The Ethylene Vinyl Alcohol market is witnessing robust growth, underpinned by critical business trends focused on capacity expansion, strategic regional mergers and acquisitions (M&A), and increasing specialization in high-barrier film technologies. Key manufacturers are investing heavily in facilities across Asia Pacific, particularly in Japan and China, to cater to the escalating demand from the region's massive packaging and automotive industries. A notable business trend involves companies prioritizing sustainable formulations, including the development of easily recyclable or bio-based EVOH grades, responding to consumer and regulatory pressure for circular economy solutions. Furthermore, partnerships between EVOH producers and film converters are becoming essential to streamline the value chain and optimize the integration of EVOH into complex multi-layer structures.

Regionally, Asia Pacific maintains its dominance in both production capacity and consumption volume, driven by burgeoning urbanization, significant growth in the packaged food sector, and expanding automotive manufacturing base. North America and Europe, while exhibiting slower growth in production, remain critical high-value consumption hubs. These mature markets are characterized by stringent food contact regulations and rigorous environmental standards, driving demand for premium, thin-layer EVOH films in demanding applications such as retort pouches and pharmaceutical blisters. Latin America and the Middle East & Africa are emerging as high-potential markets, primarily due to modernization of the food processing infrastructure and increased foreign direct investment in retail and healthcare sectors.

In terms of segment trends, the food packaging application segment, encompassing rigid containers, flexible films, and aseptic packaging, continues to hold the largest market share, serving as the foundational pillar of EVOH demand. However, the non-food applications, specifically the automotive segment (fuel tanks and protective hoses), are projected to experience the fastest growth rate, fueled by the global transition towards stricter permeation standards (e.g., California’s LEV III and Euro 7 standards) aimed at reducing fuel vapor emissions. Technologically, lower ethylene content EVOH grades, offering superior oxygen barrier properties even in humid conditions, are gaining traction, though manufacturers are actively addressing the trade-off between barrier performance and processing costs across different application segments.

AI Impact Analysis on Ethylene Vinyl Alcohol Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Ethylene Vinyl Alcohol market typically revolve around optimizing complex polymerization processes, improving predictive maintenance for high-cost co-extrusion machinery, and leveraging data analytics for advanced material formulation. Users are particularly interested in how AI can help reduce raw material variability, predict the optimal ethylene content required for specific barrier performance under varying humidity levels, and enhance supply chain resilience in the face of volatile raw material prices (ethylene and vinyl acetate). The analysis indicates a strong expectation that AI will primarily serve as an optimization tool, moving beyond simple automation to enable high-throughput experimentation (HTE) in R&D and significantly increase energy efficiency in energy-intensive manufacturing processes, thereby addressing major operational cost concerns and accelerating the commercialization of novel, custom-grade EVOH polymers.

- AI-driven optimization of polymerization kinetics, leading to reduced batch cycle times and enhanced consistency in polymer molecular weight distribution.

- Predictive maintenance analytics applied to co-extrusion and film manufacturing lines, minimizing costly downtime and improving overall equipment effectiveness (OEE).

- AI modeling of polymer-environment interactions, allowing for precise prediction of barrier performance (Oxygen Transmission Rate) under diverse temperature and humidity conditions.

- Optimization of supply chain logistics and inventory management for volatile raw materials (ethylene and vinyl acetate monomer) using machine learning algorithms.

- Accelerated R&D through computational materials science, enabling the rapid screening and formulation of sustainable or bio-based EVOH alternatives.

DRO & Impact Forces Of Ethylene Vinyl Alcohol Market

The Ethylene Vinyl Alcohol market dynamics are significantly influenced by a unique interplay of compelling drivers, inherent restraints, and compelling strategic opportunities, collectively shaping the market's trajectory. Key drivers include the unparalleled oxygen and gas barrier properties of EVOH, which are crucial for maintaining food freshness and safety, thereby supporting the global shift towards extended shelf life requirements. This is strongly complemented by increasingly stringent regulatory requirements in the automotive sector concerning fuel permeation control. These factors exert a potent, positive impact force, driving consistent demand across mature and emerging economies.

Conversely, the market faces structural restraints that moderate growth. The relatively high cost of EVOH compared to standard barrier polymers like Polypropylene (PP) or Polyethylene Terephthalate (PET) often limits its usage in budget-sensitive applications. A critical technical restraint is EVOH's high sensitivity to moisture; its barrier performance significantly degrades in high-humidity environments, necessitating careful material combination within multi-layer structures. These restraints act as negative impact forces, compelling manufacturers to invest in developing grades with improved moisture resistance and focusing on sophisticated co-extrusion processes that minimize material usage.

Opportunities for expansion lie predominantly in the development of sustainable and innovative applications. The push for a circular economy creates significant potential for bio-based or compostable EVOH variants and improved recycling techniques for EVOH-containing multi-layer packaging. Furthermore, the diversification of EVOH application beyond traditional packaging, such as in construction materials, agricultural films, and high-performance industrial coatings, presents avenues for long-term revenue growth. The overall impact force matrix suggests that while cost remains a mitigating factor, the overwhelming advantages of EVOH in critical barrier applications, coupled with technological innovation addressing moisture sensitivity and sustainability, ensure a robust growth outlook.

Segmentation Analysis

The Ethylene Vinyl Alcohol market is comprehensively segmented based on its ethylene content, application type, and end-use industry, providing distinct insights into market dynamics and growth potential across various dimensions. The ethylene content segmentation is crucial as it directly determines the material's final properties: higher ethylene content improves processability and flexibility but slightly reduces oxygen barrier performance, while lower ethylene content offers superior barrier characteristics, especially critical for applications requiring long-term preservation. This technical variation dictates the suitability for specific end-uses, ranging from flexible films to rigid containers.

The primary segmentation by application focuses on categorizing the usage into films (monolayer and co-extruded), sheets, pipes & tubes, and bottles & containers. Co-extruded barrier films dominate this segment due to the necessity of combining EVOH's barrier capabilities with the structural strength and moisture resistance of other polymers (like PE or PP). The market is also heavily segmented by end-use industry, where Food & Beverage and Automotive remain the most vital sectors. The Food & Beverage sector dictates the overall volume demand, whereas the Automotive segment, particularly its focus on fuel system components, drives demand for high-specification, low-permeation EVOH grades. Understanding these segment interactions is vital for strategic market positioning.

The ongoing trend towards thinner barrier layers and improved processing efficiency is creating sub-segment differentiation within the films market. High-performance, low-cost EVOH variants suitable for mass-market flexible packaging are expanding rapidly, supported by technological advancements in multi-layer machinery. Conversely, specialty EVOH grades optimized for medical or chemical handling applications command higher price points but represent niche, stable markets. This diverse segmentation profile reflects EVOH’s role as a versatile, high-value additive that enhances performance across a spectrum of industrial requirements.

- By Ethylene Content:

- Low Ethylene Content (<32 mol%)

- Medium Ethylene Content (32 mol% to 38 mol%)

- High Ethylene Content (>38 mol%)

- By Application:

- Films (Co-extruded films, Laminated films)

- Sheets

- Bottles and Containers

- Pipes and Tubes

- Others (Trays, Blow Molded Parts)

- By End-Use Industry:

- Food & Beverage Packaging

- Automotive (Fuel Tanks, Hoses, Lines)

- Pharmaceutical & Medical Packaging

- Cosmetics & Personal Care

- Agricultural Films

- Industrial & Chemical Packaging

Value Chain Analysis For Ethylene Vinyl Alcohol Market

The Ethylene Vinyl Alcohol value chain initiates at the upstream level with the sourcing and production of critical petrochemical raw materials. The two primary precursors are ethylene, obtained from crude oil or natural gas cracking, and vinyl acetate monomer (VAM). The stability and price volatility of these commodities significantly influence the overall manufacturing cost of EVOH. Key upstream players are major chemical and petrochemical companies that produce VAM and ethylene, often integrating vertically to secure raw material supply. Efficiency in this stage is paramount, as EVOH production is energy-intensive and highly dependent on sustained access to these primary intermediates.

The midstream phase involves the specialized chemical synthesis of EVOH, typically involving the copolymerization of ethylene and vinyl acetate to form ethylene vinyl acetate (EVA), followed by hydrolysis to yield EVOH. This stage requires highly specialized polymerization reactors and proprietary technology, making the EVOH manufacturing sector highly concentrated among a few global chemical giants. Manufacturers focus on precise control of the ethylene content to produce different grades tailored for specific barrier requirements. Once produced, EVOH resin pellets are distributed to converters.

The downstream segment involves film and package converters and end-use industries. Since EVOH is rarely used as a monolayer film due to its cost and moisture sensitivity, the most critical downstream activity is multi-layer co-extrusion or lamination. Converters combine EVOH with structural materials (like PE, PP, or Nylon) to create high-barrier packaging formats, including rigid containers, flexible pouches, and thermoformed trays. Distribution channels are typically indirect, utilizing specialized chemical distributors and packaging wholesalers who deliver the finished films or containers to the end-user sectors, such as major food processors, pharmaceutical companies, and automotive Tier 1 suppliers. Direct sales often occur only between major EVOH producers and the largest, most sophisticated converters globally.

Ethylene Vinyl Alcohol Market Potential Customers

The primary customer base for Ethylene Vinyl Alcohol is diverse yet heavily concentrated within industries that prioritize barrier performance, shelf life extension, and chemical resistance. The largest segment of end-users consists of food and beverage processors, including multinational corporations specializing in processed meats, dairy products, condiments, and alcoholic beverages. These customers rely on EVOH packaging to meet stringent food safety standards, minimize waste, and enable global distribution of perishable goods through enhanced oxygen and aroma barrier properties in formats such as aseptic cartons and retort pouches.

A rapidly growing segment comprises automotive original equipment manufacturers (OEMs) and their Tier 1 suppliers. These customers utilize EVOH in fuel system components—specifically multi-layer plastic fuel tanks, filler pipes, and hoses—to comply with evolving governmental mandates requiring near-zero emissions of hydrocarbon vapors. The selection criteria for these customers are extremely rigorous, focusing on long-term chemical compatibility with various fuels (including ethanol blends) and durability under harsh operational conditions. Adoption in this sector is non-negotiable for compliance with modern environmental regulations.

Additionally, pharmaceutical and medical device manufacturers constitute high-value customers for EVOH. This sector demands materials that ensure sterile environments, prevent moisture ingress for sensitive drugs, and maintain the integrity of medical instruments. EVOH is used in blister packs, medical fluid bags, and specialized device housings where inertness and high barrier functionality are critical. Other potential buyers include producers of agricultural chemicals, cosmetics (where fragrance retention is vital), and high-performance building materials (for specialized pipes and radiant barrier systems), demonstrating the broad utility of this specialized copolymer in mission-critical applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,300 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kuraray Co., Ltd., The Nippon Synthetic Chemical Industry Co., Ltd. (Nippon Gohsei), Chang Chun Group, Mitsubishi Chemical Corporation, Soarus L.L.C., Akema S.r.l., Wanhua Chemical Group Co., Ltd., LyondellBasell Industries N.V., Polyplastics Co., Ltd., Solvay S.A., E. I. du Pont de Nemours and Company, Sekisui Chemical Co., Ltd., SABIC, SK Geo Centric, and Sinopec. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ethylene Vinyl Alcohol Market Key Technology Landscape

The manufacturing and application of Ethylene Vinyl Alcohol are characterized by sophisticated chemical synthesis and advanced conversion technologies designed to maximize the polymer's barrier potential while mitigating its processing challenges. The core manufacturing technology involves solution or suspension polymerization, where precise control over the ethylene-to-vinyl acetate ratio and subsequent degree of hydrolysis is crucial. Technological advancements in polymerization are focused on improving catalyst efficiency, optimizing reactor design for higher yields, and achieving stricter quality control over the final EVOH resin pellets, particularly concerning thermal stability which is vital for later melt processing operations.

In terms of application, the primary technological focus is on multi-layer co-extrusion and co-injection molding. EVOH is highly effective only when protected from moisture by surrounding layers of materials like polyethylene (PE) or polypropylene (PP), and bound using high-performance adhesive resins. Co-extrusion technology has seen significant evolution, with sophisticated machinery capable of producing structures with seven, nine, or even eleven distinct layers, allowing for ultra-thin EVOH barrier layers (often less than 5 microns). This technological proficiency ensures cost-efficiency by minimizing the expensive EVOH component while delivering maximum barrier performance, a key area of competitive differentiation among converters.

Furthermore, research and development efforts are intensely concentrated on developing novel EVOH grades and composite materials to address existing limitations. This includes creating EVOH variants with enhanced moisture barrier properties, either through chemical modification or nanotechnology integration, to maintain oxygen barrier integrity even under high relative humidity. Another significant technological push involves improving the dispersibility and compatibility of EVOH in recycling streams, exploring compatibilizers and specialized sorting techniques to align EVOH-containing packaging with emerging circular economy mandates and infrastructure improvements globally. The integration of advanced sensor technologies and process control systems also plays a vital role in ensuring quality and consistency during high-speed film production.

Regional Highlights

The Ethylene Vinyl Alcohol market exhibits distinct growth patterns and consumption characteristics across key global regions, heavily influenced by industrial development, regulatory frameworks, and consumer preferences for packaged goods.

- Asia Pacific (APAC): APAC is the global leader in both production capacity and overall market consumption. The dominance is driven by high population density, rapid industrialization, and massive growth in the packaged food and beverage sector, particularly in China, Japan, India, and Southeast Asian nations. Japan remains a technological hub for EVOH manufacturing (home to key global producers). Furthermore, the expanding automotive manufacturing industry, aiming to meet stricter emission standards, significantly contributes to demand, making APAC the fastest-growing region for EVOH consumption.

- North America (NA): North America is a mature, high-value market characterized by stringent food safety standards and strong demand for sophisticated packaging (e.g., modified atmosphere packaging and vacuum packaging). The U.S. automotive sector is a critical end-user, utilizing high-barrier EVOH in fuel tanks to comply with federal and state-level vapor emission control regulations (like CARB). Innovation is focused on utilizing EVOH in sustainable packaging formats and highly specialized medical applications.

- Europe: The European market is highly regulated, prioritizing sustainability and circular economy objectives. Demand for EVOH is driven by the necessity for extended shelf life in premium foods and beverages, along with rigorous application in the pharmaceutical sector. European manufacturers and converters are leading efforts to develop recyclable multi-layer structures and bio-based polymers to reduce plastic waste impact, positioning the region as a leader in sustainable EVOH utilization, albeit facing slower overall growth compared to APAC.

- Latin America (LA): The market in Latin America is categorized by increasing modernization of the food distribution network and rising foreign investment in the retail sector. Countries like Brazil and Mexico are witnessing increasing demand for flexible barrier films due to evolving consumer patterns favoring processed and long shelf-life products. However, economic volatility and infrastructural challenges occasionally restrain large-scale adoption, focusing demand primarily on imported EVOH resins.

- Middle East and Africa (MEA): MEA is an emerging market driven by infrastructural development and the need to transport and store goods under challenging climatic conditions (high temperatures). Demand is concentrated in food preservation (especially exports) and industrial packaging. Growth is dependent on the establishment of local conversion facilities and adherence to international quality standards in the healthcare and food sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ethylene Vinyl Alcohol Market.- Kuraray Co., Ltd.

- The Nippon Synthetic Chemical Industry Co., Ltd. (Nippon Gohsei)

- Chang Chun Group

- Mitsubishi Chemical Corporation

- Soarus L.L.C.

- Akema S.r.l.

- Wanhua Chemical Group Co., Ltd.

- LyondellBasell Industries N.V.

- Polyplastics Co., Ltd.

- Solvay S.A.

- E. I. du Pont de Nemours and Company

- Sekisui Chemical Co., Ltd.

- SABIC

- SK Geo Centric

- Sinopec

- Formosa Plastics Corporation

- LG Chem Ltd.

- INEOS Group Holdings S.A.

- Exxon Mobil Corporation

- BASF SE

Frequently Asked Questions

Analyze common user questions about the Ethylene Vinyl Alcohol market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary application driving the demand for EVOH?

The primary application driving EVOH demand is food and beverage packaging, specifically flexible films and rigid containers requiring high oxygen barrier properties to significantly extend product shelf life and maintain freshness.

Why is EVOH generally used in multi-layer structures rather than alone?

EVOH exhibits excellent gas barrier properties but is highly sensitive to moisture. It must be sandwiched between moisture-resistant layers (like Polyethylene or Polypropylene) to prevent water absorption, which otherwise drastically degrades its oxygen barrier performance.

Which EVOH grade is preferred for highly demanding barrier applications?

Low Ethylene Content (<32 mol%) EVOH grades are preferred for highly demanding barrier applications, as they offer the highest oxygen barrier performance, particularly necessary for long-term food preservation and specialized industrial uses.

What major restraint affects the widespread adoption of EVOH?

The major restraint is the relatively high material cost of EVOH compared to commodity barrier polymers, making it economically viable predominantly for high-value applications where shelf life extension or regulatory compliance (like automotive fuel systems) is critical.

How do stringent automotive emission standards impact the EVOH market?

Automotive emission standards, such as those governing fuel vapor permeation, significantly boost the EVOH market by mandating its use in multi-layer plastic fuel tanks and lines to prevent hydrocarbon evaporation, ensuring environmental compliance and material safety.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Thermoformable Film Market Size Report By Type (Polyvinyl Chloride (PVC), Polyethylene (PE), Acrylonitrile Butadiene Styrene (ABS), Ethylene Vinyl Alcohol (EVOH), Polyamide (PA)), By Application Type (Rigid Thermoforming Films And Flexible Thermoforming Films), By Application (Rigid Thermoforming Films, Flexible Thermoforming Films), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Thermoforming Films Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Polyvinyl Chloride (PVC), Polyethylene (PS), Acrylonitrile Butadiene Styrene (ABS), Ethylene vinyl alcohol (EVOH), Polyamide (PA)), By Application (Food, Chemical, Pharmaceutical, Electronic, Consumer goods, Cosmetics and personal care), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager