360 Around View Monitor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443386 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

360 Around View Monitor Market Size

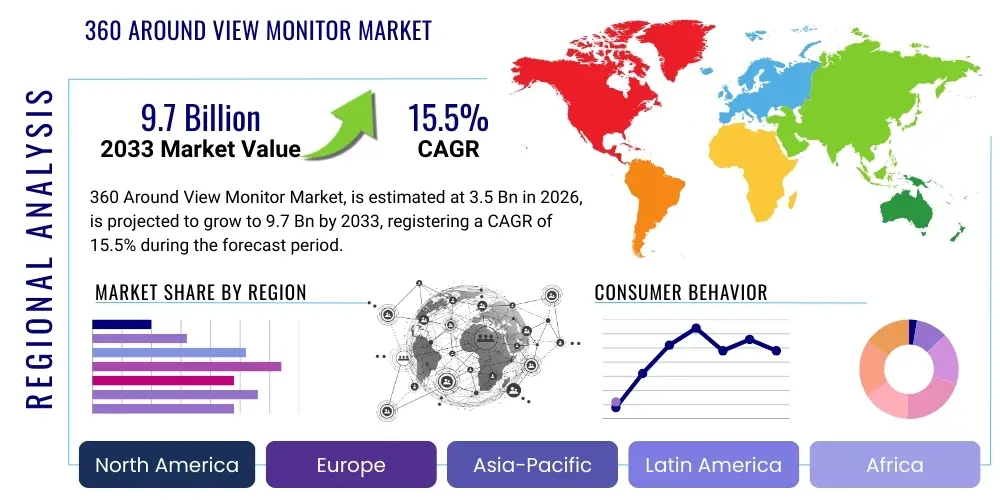

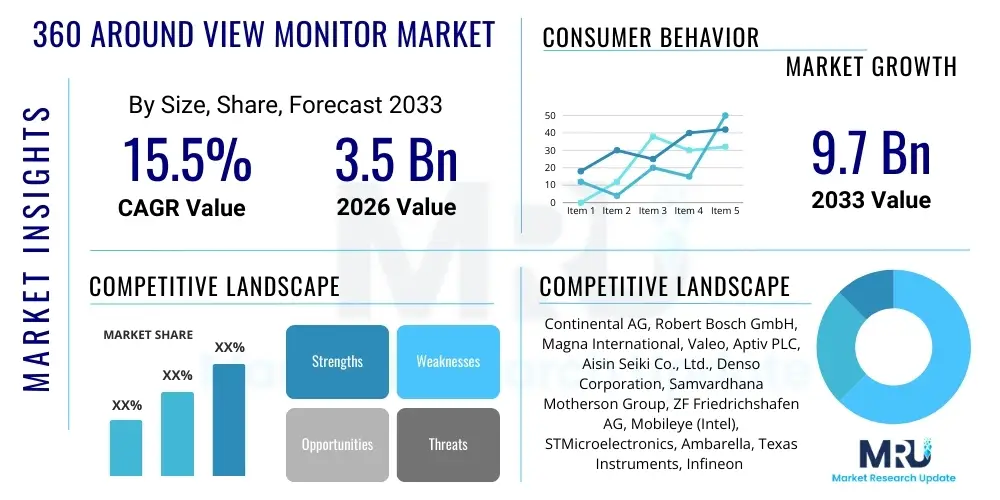

The 360 Around View Monitor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 9.7 Billion by the end of the forecast period in 2033.

360 Around View Monitor Market introduction

The 360 Around View Monitor (AVM) Market encompasses the sophisticated integration of multiple automotive cameras and advanced image processing software designed to provide the driver with a synthesized, real-time, bird's-eye view of the vehicle and its immediate surroundings. This technology significantly enhances situational awareness, particularly during low-speed maneuvers such as parking, navigating tight urban spaces, or off-roading, thereby serving as a critical component of modern Advanced Driver Assistance Systems (ADAS). The core product involves four to six wide-angle cameras strategically placed around the vehicle (front, rear, and under the side mirrors), sophisticated Electronic Control Units (ECUs) capable of high-speed image stitching and perspective correction, and high-resolution in-cabin displays.

Major applications of 360 AVMs are predominantly in passenger vehicles, where they enhance driver confidence and reduce the incidence of low-speed parking incidents. However, the technology is rapidly expanding into commercial vehicles (trucks, buses) and heavy equipment (construction, mining) to address blind spots inherent in larger chassis designs, greatly improving operational safety and efficiency in complex industrial environments. Key benefits driving adoption include reduced insurance liabilities, improved compliance with global safety mandates (e.g., rear visibility requirements), and enhanced consumer experience, positioning AVMs as a standard feature, rather than a luxury upgrade, across multiple vehicle segments.

The primary driving factors sustaining market growth include stringent global vehicle safety regulations necessitating improved peripheral visibility, the accelerating consumer demand for advanced in-vehicle technology, and the continuous integration of AVM functionality into higher levels of autonomous driving systems (L2+ and L3). Furthermore, the decreasing cost of high-resolution cameras and powerful automotive-grade microprocessors is making this technology more accessible across mid-range and entry-level vehicle segments, fueling volume expansion across emerging and established automotive markets globally.

360 Around View Monitor Market Executive Summary

The 360 Around View Monitor Market is defined by robust growth, driven primarily by evolving regulatory landscapes emphasizing vehicular safety and escalating consumer expectations for sophisticated ADAS features. Business trends indicate a strong move toward sensor fusion, where AVM data is increasingly integrated with ultrasonic sensors and radar systems to provide comprehensive object detection and predictive collision warnings, moving beyond mere visualization. Strategic partnerships between Tier 1 automotive suppliers and semiconductor manufacturers are intensifying competition, focusing on delivering highly optimized, low-latency processing units capable of handling complex stitching algorithms and real-time computation required for high-definition video feeds.

Regionally, Asia Pacific (APAC) stands as the dominant growth engine, fueled by rapid automotive production growth in countries like China, India, and South Korea, coupled with high consumer adoption rates of technology-laden vehicles. North America and Europe, while mature markets, contribute significantly due to mandates requiring advanced visibility systems and the accelerating penetration of premium and electric vehicles, which frequently incorporate AVMs as standard equipment. European market growth is also supported by rigorous NCAP safety ratings that incentivize the integration of proactive safety features like automatic parking assistance linked to AVM data.

Segment trends highlight the dominance of the Passenger Vehicle segment, particularly within the mid-range and luxury categories, due to high volume sales and early adoption. However, the Commercial Vehicle segment is poised for accelerated growth, driven by fleet management mandates focusing on reducing accidents and minimizing downtime. Technology segmentation shows a continuous shift from traditional analog camera systems to high-definition (HD) digital cameras utilizing Ethernet and automotive-specific communication protocols like Automotive Ethernet and CAN-FD, ensuring faster data transmission and superior image quality necessary for autonomous functions.

AI Impact Analysis on 360 Around View Monitor Market

User inquiries regarding the AI impact on 360 AVMs frequently revolve around three core themes: the transition from simple visualization to predictive assistance, the role of deep learning in enhancing perception beyond basic object detection, and the necessity of AI for reliable sensor calibration and environmental interpretation. Consumers and industry professionals are keenly interested in how Artificial Intelligence can transform the AVM from a passive viewing tool into an active safety system, capable of interpreting complex scenarios (e.g., distinguishing a curb from a low-lying pedestrian, or predicting the trajectory of a fast-moving cyclist) with greater accuracy than traditional computer vision algorithms.

The application of AI, specifically deep neural networks, within the AVM ecosystem enables advanced functionalities such as automated self-calibration, which is crucial for maintaining accurate image stitching over the vehicle’s lifespan and compensating for environmental factors like lens grime or varying lighting conditions. Furthermore, AI facilitates semantic segmentation—the process of identifying and labeling every pixel in the camera feed—allowing the system to understand the context of the surroundings. This capability is foundational for integrating AVM data seamlessly into autonomous driving stacks, moving the system beyond low-speed parking to high-speed situational awareness.

Market expectations center on AI-driven AVMs providing Level 2+ autonomy support, offering features like automatic obstacle avoidance during complex reversing maneuvers, or providing predictive warnings based on learned driving behaviors. This evolution requires high computational power at the edge (within the ECU) to ensure low latency, pushing the market towards specialized automotive AI chipsets optimized for vision processing and sensor fusion. AI is thus not merely enhancing the AVM; it is redefining it as a core perception layer essential for the future of connected and autonomous vehicles.

- Enhanced perception and environmental understanding through deep learning algorithms.

- Automated self-calibration and correction of camera misalignments and environmental occlusions.

- Integration of predictive collision modeling based on AVM visual data and trajectory calculation.

- Semantic segmentation for precise identification and classification of objects (pedestrians, vehicles, road markings).

- Reduction in processing latency through optimized AI inferencing at the edge.

- Facilitation of seamless transition to Level 2+ and Level 3 autonomous driving functions.

- Improved night vision and low-light performance using AI-based image reconstruction.

DRO & Impact Forces Of 360 Around View Monitor Market

The 360 Around View Monitor Market is shaped by a powerful confluence of driving forces, regulatory pressures, technological limitations, and substantial growth opportunities. The core driver remains the global push for enhanced vehicular safety, mandated by government bodies and safety organizations like NHTSA and NCAP, which prioritize reducing accidents caused by poor visibility. Furthermore, the rapid expansion of the Electric Vehicle (EV) market and the Luxury Vehicle segment significantly accelerates AVM adoption, as these vehicles often feature high-tech packages where AVMs are expected as standard. Opportunities are abundant in the aftermarket segment, particularly for older vehicles and commercial fleets seeking cost-effective upgrades to comply with new safety standards or improve operational efficiency, thereby providing a second revenue stream for manufacturers.

However, the market faces notable restraints. High computational requirements for real-time video stitching of multiple high-definition camera feeds pose technical challenges and increase system costs, particularly for mass-market implementation where price sensitivity is high. Calibration complexity, both initially during manufacturing and throughout the vehicle’s lifespan (especially after minor collisions or maintenance), remains a significant service barrier. Moreover, concerns related to data privacy and cybersecurity surrounding continuous video recording and data transmission from these systems are emerging as regulatory hurdles that must be addressed to ensure consumer trust.

The impact forces driving this market are strongly centered on technological advancements in sensor fusion and image processing hardware. The evolution from four-camera systems to six or even eight cameras, integrating seamlessly with LiDAR and radar data, intensifies the computational demand but simultaneously unlocks higher levels of predictive safety and autonomy. These forces are compelling Tier 1 suppliers to invest heavily in specialized hardware acceleration units and AI algorithms optimized for automotive environments (AEC-Q100 certified components), ensuring robustness and reliability under extreme operating conditions, thereby accelerating market maturity and broadening application scope.

Segmentation Analysis

The 360 Around View Monitor market is systematically segmented based on technology, component type, application, and end-user vehicle type, reflecting the diverse requirements and technological maturity across various automotive sectors. Segmentation by component is critical, differentiating between the core hardware elements—cameras, Electronic Control Units (ECUs), and display units—as their cost structures and technological lifecycles vary significantly. The technology segment is crucial, illustrating the shift towards digital high-definition systems and the adoption of high-speed automotive communication protocols, displacing older, lower-resolution analog systems, which impacts both data processing and image quality.

Segmentation by application highlights the primary use cases: parking assistance remains the dominant application, but the increasing use of AVM data for semi-autonomous functions, blind spot detection, and traffic jam assistance is rapidly gaining traction. End-user segmentation, distinguishing between passenger vehicles (PVs) and commercial vehicles (CVs), reveals differing market dynamics; PVs drive volume and feature sophistication, while CVs focus on ruggedness, reliability, and mandated safety compliance for heavy trucks and buses. Understanding these segments is vital for manufacturers to tailor their product offerings and R&D investments effectively, ensuring adherence to specific regulatory and operational demands.

The OEM (Original Equipment Manufacturer) vs. Aftermarket segmentation is also critical, with OEMs dominating revenue generation through factory integration during vehicle production, representing the primary long-term market opportunity. Conversely, the Aftermarket segment provides flexibility and growth potential in regions with aging vehicle fleets or for specialized vehicle modifications, though it often deals with lower-cost, simplified systems that may lack the full integration capabilities of OEM-installed units. This multilayered segmentation facilitates granular market forecasting and strategic planning across the competitive landscape.

- By Component:

- Cameras (Wide-angle, HD, Digital)

- Electronic Control Unit (ECU)/Image Processor

- Display Unit/HMI (Human Machine Interface)

- Wiring Harness and Connectivity Modules

- By Technology:

- Digital Systems (High Definition)

- Analog Systems (Standard Definition)

- By Application:

- Parking Assistance Systems

- Blind Spot Monitoring and Detection

- Low-Speed Collision Mitigation

- Off-Road and Maneuvering Assistance

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles, Buses)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For 360 Around View Monitor Market

The value chain for the 360 Around View Monitor Market begins with the upstream activities dominated by specialized semiconductor manufacturers and component suppliers. Upstream analysis focuses on the supply of critical high-performance components, including CMOS image sensors, highly integrated automotive-grade System-on-Chips (SoCs) for image processing, and lens optics designed for wide field-of-view and extreme operating temperatures. Key players in this stage, such as camera module producers and IC designers, leverage deep technological expertise to meet stringent automotive quality standards (AEC-Q100 and ISO 26262), controlling the fundamental cost structure and performance capabilities of the final AVM system.

The midstream of the value chain is characterized by Tier 1 suppliers, who serve as the integrators, taking raw components and developing proprietary software, stitching algorithms, and the final ECU hardware. These Tier 1 companies, such as Continental, Bosch, and Magna, invest heavily in R&D to optimize sensor fusion capabilities, handle complex real-time computational demands, and customize solutions based on specific vehicle platforms (downstream requirements). Their primary function is to transform disparate components into a cohesive, high-reliability system ready for vehicle integration.

Downstream activities involve the distribution channel and the final integration into the vehicle. The direct channel largely involves Tier 1 suppliers delivering AVM modules directly to OEMs for assembly line integration, representing the high-volume market. The indirect channel pertains to the aftermarket, where distributors and specialized installers procure AVM kits for retrofitting older vehicles or customizing fleets. The primary end-user/buyer is the OEM, who dictates specifications and volume, while secondary buyers include fleet operators and individual consumers purchasing aftermarket solutions. Efficient logistics and robust post-sales support, including system calibration services, are vital components of this downstream phase, ensuring customer satisfaction and safety compliance.

360 Around View Monitor Market Potential Customers

The primary potential customers and end-users of 360 Around View Monitor systems are predominantly centered within the automotive manufacturing ecosystem and large-scale vehicle fleet operators seeking enhanced safety and operational efficiency. The most influential buyer group is Original Equipment Manufacturers (OEMs), including global giants such as Volkswagen Group, Toyota, General Motors, and Tesla, who integrate AVMs as standard or optional features across their entire vehicle portfolio, spanning from entry-level SUVs to high-end luxury electric vehicles. These OEMs prioritize reliability, seamless integration with other ADAS features, and cost-effectiveness for mass production.

A rapidly growing segment of potential customers includes operators of heavy commercial vehicle (HCV) fleets and specialized industrial vehicles (mining trucks, construction equipment). For these customers, AVMs are essential tools for mitigating catastrophic blind spot accidents, minimizing equipment damage in confined work sites, and reducing insurance premiums. Procurement decisions in this sector are driven by total cost of ownership (TCO), ruggedness, and compliance with operational safety standards. Lastly, the aftermarket consumer represents a consistent stream of potential customers, comprising owners of older vehicle models, customizers, and smaller fleet operators looking for relatively easy-to-install systems to improve visibility and safety without purchasing a new vehicle.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 9.7 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Continental AG, Robert Bosch GmbH, Magna International, Valeo, Aptiv PLC, Aisin Seiki Co., Ltd., Denso Corporation, Samvardhana Motherson Group, ZF Friedrichshafen AG, Mobileye (Intel), STMicroelectronics, Ambarella, Texas Instruments, Infineon Technologies, Panasonic Corporation, Hitachi Automotive Systems, Fujitsu Ten, Pioneer Corporation, Garmin Ltd., Clarion Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

360 Around View Monitor Market Key Technology Landscape

The technology landscape of the 360 Around View Monitor market is characterized by a rapid evolution toward higher resolution, increased computational capability, and deeper integration with other vehicle safety systems. The foundational technology involves the use of high dynamic range (HDR) CMOS image sensors, which are essential for capturing clear imagery across varied and challenging lighting conditions, such as driving directly into sunlight or navigating poorly lit parking garages. Modern AVM systems increasingly rely on Gigabit Multimedia Serial Link (GMSL) or Automotive Ethernet for high-speed, high-bandwidth data transmission from the multiple cameras to the central ECU, addressing the inherent limitations of older, slower analog connections and ensuring minimal latency, which is critical for real-time driver feedback and autonomous function support.

A crucial technological differentiator lies in the advanced stitching algorithms and distortion correction software implemented within the Electronic Control Unit (ECU) or specialized vision processors. These sophisticated algorithms must seamlessly fuse feeds from four or more fisheye lenses, correcting for barrel distortion and perspective warping to generate a realistic, accurate, and visually intuitive bird’s-eye view. The latest generation systems leverage specialized hardware acceleration units, often integrating AI cores (Neural Processing Units or NPUs), to handle these computationally intensive tasks at the edge, reducing the reliance on the vehicle's central computing system and maintaining rapid processing speeds necessary for safety applications.

Furthermore, sensor fusion capability is paramount, driving the technology evolution. Contemporary AVM systems are rarely standalone; they are designed to fuse their visual output with data from ultrasonic sensors (for close-range object detection) and radar systems (for distance measurement). This integration enhances the system's ability to provide accurate overlaid trajectory lines, predictive path warnings, and automated braking intervention during low-speed maneuvers. Future technological advancements are focused on leveraging 8-megapixel cameras and higher to enable full video recording capabilities (dashcam functionality), while using deep learning models for proactive risk assessment, solidifying the AVM system's role as a core sensory input for Level 3 and Level 4 autonomous driving platforms.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to maintain its position as the largest and fastest-growing market globally, driven by high-volume automotive production in key economies (China, Japan, South Korea, India) and the swift adoption of advanced features in locally manufactured vehicles. Government initiatives prioritizing road safety and the high consumer preference for feature-rich, connected vehicles are primary accelerators in this region. The rapid expansion of EV manufacturing further solidifies APAC's dominance.

- North America: North America represents a mature yet continually expanding market, largely driven by strict safety regulations (such as rearview camera mandates) and high consumer willingness to pay for premium ADAS features in SUVs and light trucks. The market focuses heavily on technological sophistication, integration with advanced parking pilot systems, and the implementation of robust cybersecurity standards for vehicle data collected by AVM systems.

- Europe: The European market is characterized by strong regulatory influence from bodies like the European Union (EU) and high ratings achieved by Euro NCAP, which incentivize the mandatory inclusion of sophisticated driver assistance technologies. Growth is particularly robust in luxury and premium passenger vehicle segments, emphasizing high image quality, seamless connectivity, and robust performance under varying weather conditions unique to the region.

- Latin America (LATAM): This region is an emerging market for AVM technology, marked by increasing penetration in mid-range vehicles as local manufacturing capabilities expand. While price sensitivity remains a constraint, safety awareness is rising, pushing local OEMs and importers to adopt AVM systems, particularly in large commercial fleets where safety improvements offer clear ROI benefits.

- Middle East and Africa (MEA): Growth in MEA is highly localized, concentrated primarily in the GCC countries due to significant investments in luxury automotive imports and government initiatives aimed at modernizing urban transport infrastructure. The unique environmental challenges (dust, extreme heat) necessitate AVM systems with high durability and specialized sensor protection, driving demand for robust, automotive-grade solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 360 Around View Monitor Market.- Continental AG

- Robert Bosch GmbH

- Magna International

- Valeo

- Aptiv PLC

- Aisin Seiki Co., Ltd.

- Denso Corporation

- Samvardhana Motherson Group

- ZF Friedrichshafen AG

- Mobileye (Intel)

- STMicroelectronics

- Ambarella

- Texas Instruments

- Infineon Technologies

- Panasonic Corporation

- Hitachi Automotive Systems

- Fujitsu Ten

- Pioneer Corporation

- Garmin Ltd.

- Clarion Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the 360 Around View Monitor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental technology behind a 360 Around View Monitor system?

The system relies on sensor fusion technology, integrating four or more wide-angle cameras (typically CMOS image sensors) positioned around the vehicle. These camera feeds are processed by a central Electronic Control Unit (ECU) using complex, real-time stitching and distortion correction algorithms to generate a seamless, synthesized bird's-eye view (top-down perspective) of the vehicle’s immediate surroundings on the in-cabin display.

How is AI transforming the capabilities of AVM systems?

AI, specifically deep learning, is transforming AVM systems from passive visualization tools into active safety components. AI enables precise semantic segmentation (identifying objects and road features), predictive path modeling, automated self-calibration to maintain accuracy over time, and enhanced obstacle detection, greatly improving reliability in complex driving scenarios and supporting L2+ autonomous functions.

Which vehicle segment is driving the highest demand for AVM technology?

The Passenger Vehicle segment, particularly SUVs and luxury/premium vehicles, currently drives the highest volume and demand for sophisticated AVM systems, often integrating them with automated parking assistance features. However, the Commercial Vehicle segment (Heavy Commercial Vehicles and Buses) is projected to exhibit the fastest growth rate due to increased regulatory pressure for minimizing blind spots and enhancing fleet safety.

What are the primary challenges facing the widespread adoption of 360 AVMs?

The main challenges involve the high computational demands required for real-time, high-definition video stitching and processing, which increases hardware costs. Furthermore, maintaining highly accurate sensor calibration over the vehicle's lifespan, especially after maintenance or minor impacts, presents a logistical and technical complexity that system manufacturers are actively addressing through AI-driven self-calibration features.

How does the AVM market segmentation differ between OEM and Aftermarket sales channels?

The OEM channel dominates revenue by integrating custom, high-definition AVM systems directly during vehicle manufacturing, providing deep integration with the vehicle's network (CAN/Ethernet). The Aftermarket channel, while smaller in volume, focuses on providing modular, standardized retrofit kits, often prioritizing ease of installation and affordability for older vehicles or specialized fleet upgrades, typically offering less deep system integration than OEM solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager