3D Fabrics Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441542 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

3D Fabrics Market Size

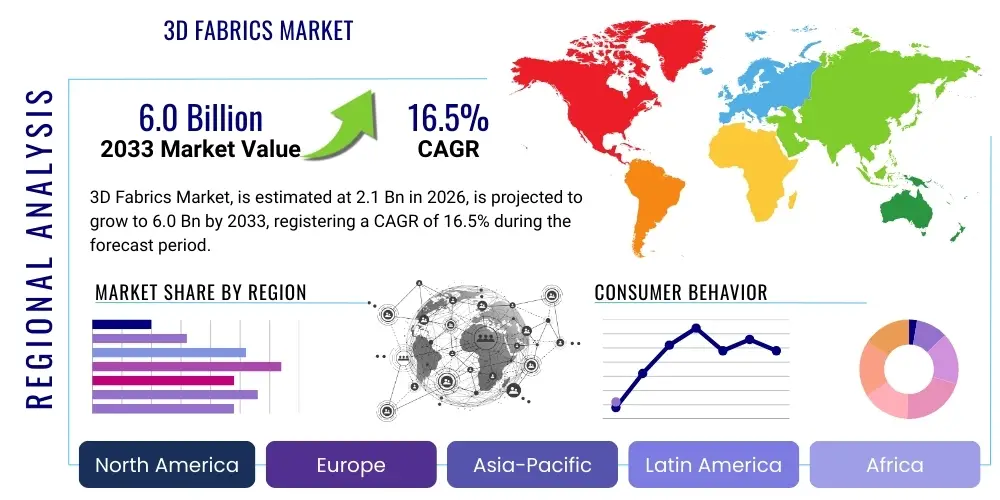

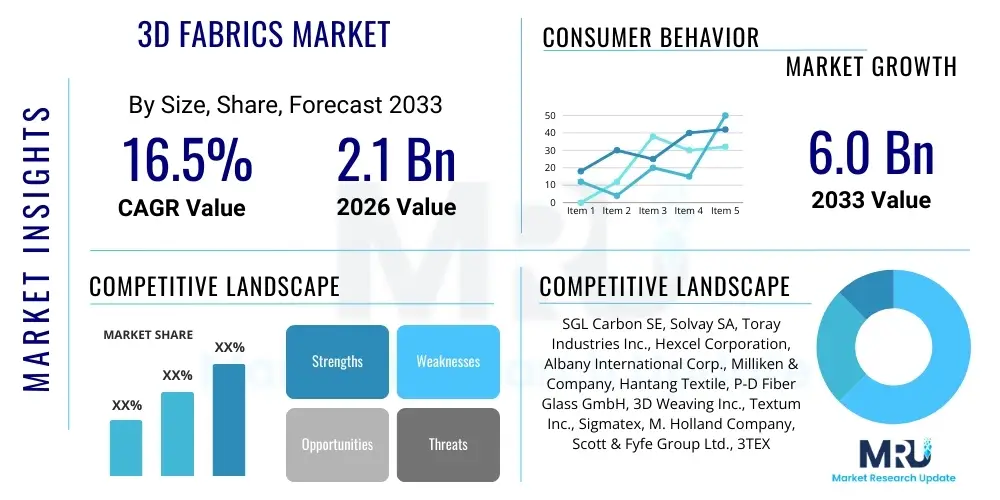

The 3D Fabrics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 6.0 Billion by the end of the forecast period in 2033.

3D Fabrics Market introduction

The 3D Fabrics Market encompasses advanced textile structures engineered with interconnected layers or specific geometric orientations, moving beyond traditional two-dimensional weaving or knitting methods. These materials, also known as multi-layered or multi-axial fabrics, fundamentally redefine the capabilities of composite reinforcement materials by incorporating fibers along the Z-axis (through the thickness). This unique architectural advantage grants 3D fabrics superior mechanical properties, including enhanced stiffness, improved resistance to fatigue, and, most crucially, unparalleled resistance to delamination, which is the separation of layers—a common failure point in standard laminated composites. The market spans a spectrum of products, from rigid preforms used in high-stress aerospace applications to highly flexible and breathable spacer fabrics integral to medical and consumer goods. The technological sophistication involved necessitates highly specialized machinery and design algorithms to achieve precise fiber placement and volume fraction control across all three spatial dimensions.

The core product description differentiates these textiles based on their fabrication method: 3D woven fabrics, which offer the highest structural stability and rigidity, often utilized for large, flat or gently curved components subjected to extreme loads; 3D braided fabrics, optimized for complex, curved, or hollow structures such as tubes, rods, and beams requiring radial and axial strength; and 3D knitted and non-woven spacer fabrics, which provide unique cushioning, ventilation, and pressure distribution capabilities, commonly used in mattresses, athletic gear, and medical supports. Major applications are concentrated in structural composites for the aerospace industry, notably in critical components like fan blades, engine casings, and fuselage sections where superior fracture toughness and minimal maintenance are non-negotiable requirements. The versatility of 3D fabrics allows them to replace heavier metal components, contributing substantially to fuel efficiency and performance improvements.

Market growth is predominantly driven by global imperatives for energy efficiency and sustainable design. The relentless push for lightweighting in transportation sectors, directly linked to stringent governmental regulations on fuel efficiency and the proliferation of electric vehicles (EVs), mandates the increasing use of advanced, robust, and lightweight materials like 3D fiber preforms. Furthermore, the increasing sophistication of defense and protective gear requires materials offering superior ballistic and impact protection, sectors where 3D textiles excel due to their integrated structure. Technological advancements in automated fabrication processes, combined with lower fiber material costs achieved through economies of scale and improved fiber precursor technologies, are making 3D fabrics increasingly cost-competitive against metals. This growing viability ensures robust market penetration across established industrial domains and emerging high-growth sectors, cementing their status as indispensable advanced materials for the future of engineering.

3D Fabrics Market Executive Summary

The 3D Fabrics Market is currently experiencing a dynamic phase of technological assimilation and application diversification, characterized by intense focus on automated manufacturing and material hybridization. Business trends reflect a strong industry commitment to optimizing the transition from design simulation to high-volume production, specifically targeting the reduction of material waste inherent in traditional composite manufacturing. Key players are forming strategic alliances with software providers and machinery manufacturers to integrate AI and machine learning into the design process, enabling rapid prototyping and ensuring structural integrity is maximized. The shift toward specialized, multi-material preforms that combine carbon, glass, and aramid fibers in customized configurations is a defining commercial trend, addressing highly specific performance requirements in niche markets.

From a regional perspective, the market displays clear stratification based on industrial maturity. North America and Europe retain dominance in terms of value, primarily due to established, high-spending aerospace and defense sectors that demand premium carbon fiber-based 3D structures. These regions lead in regulatory compliance and technological innovation, particularly concerning advanced testing and standardization of 3D composite preforms. Conversely, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by massive governmental investments in infrastructure, escalating domestic defense production capabilities, and a robust, expanding automotive manufacturing base, particularly focusing on electric vehicle (EV) component supply chains, where cost-effective 3D glass and polymer spacer fabrics are finding increasing utility.

Segmentation analysis underscores the enduring strength of the composite reinforcement segment, which utilizes 3D woven and braided preforms to create load-bearing structural parts. However, the fastest growth is observed in the technical textile segment, particularly 3D knitted and non-woven spacer fabrics. These materials are gaining traction rapidly in the medical sector for patient comfort, wound care, and specialized orthopedic applications, and in consumer goods like footwear and bedding where superior breathability and pressure distribution are essential features. The industry is also pivoting toward sustainable segmentation, with increasing R&D dedicated to producing 3D structures using bio-based and recycled polymer fibers, responding to escalating environmental concerns and consumer demand for eco-friendly engineered products.

AI Impact Analysis on 3D Fabrics Market

User inquiries regarding AI's impact on the 3D Fabrics Market frequently center on themes such as optimization of complex weaving and braiding patterns, predictive maintenance of specialized high-precision manufacturing equipment, automated quality control, and accelerated materials discovery. Users are keenly interested in how Artificial Intelligence can manage the immense computational complexity inherent in designing non-standard, multi-axial fiber orientations to achieve precise mechanical properties under various loading conditions, a task often too time-consuming and error-prone for traditional engineering methods. Common concerns revolve around the substantial initial capital investment required for implementing AI-driven manufacturing solutions, the complexity of integrating legacy machinery with new sensor and data processing systems, and the necessary upskilling of technical personnel to manage these advanced systems. Expectations are high for AI to deliver significantly faster design cycles, minimize material wastage through predictive modeling of defects, and enable real-time parameter adjustments in weaving or knitting machines based on dynamic quality feedback. AI is perceived as a critical enabling technology for achieving true mass customization and enhancing the production reliability and consistency of high-performance composite preforms, pushing 3D fabrics into broader commercial adoption.

- AI-driven optimization of fiber orientation, tension, and volume fraction parameters during 3D weaving and braiding, maximizing mechanical performance and reducing internal stresses.

- Implementation of computer vision and machine learning models for real-time, in-line defect detection (e.g., fiber misalignment, breakage, or uneven density) and automated quality assurance across production lines.

- Predictive maintenance analytics applied to specialized 3D textile machinery (looms, braiders), forecasting component failures and minimizing expensive unplanned downtime while optimizing operational efficiency.

- Accelerated materials informatics using neural networks to simulate and predict the mechanical, thermal, and fatigue behavior of novel 3D fiber architectures and hybrid material combinations before extensive physical prototyping.

- Automation of design generation for complex geometric preforms based on specific load requirements and structural envelopes (Topology Optimization), drastically reducing R&D cycles from months to weeks.

- Supply chain optimization using AI algorithms to manage complex sourcing and inventory of diverse high-performance fiber inputs (e.g., carbon, aramid, glass) and predicting optimal production scheduling based on demand forecasts.

- Integration of machine learning algorithms to fine-tune the subsequent resin infusion (RTM/VARTM) process parameters based on the specific porosity and permeability of the manufactured 3D preform, ensuring optimal composite consolidation.

DRO & Impact Forces Of 3D Fabrics Market

The market dynamics of 3D fabrics are primarily dictated by stringent performance demands across critical end-use sectors, counterbalanced by significant manufacturing complexities and elevated production costs. Key drivers underpinning market expansion include the overwhelming technological preference for composite materials over traditional metals in aerospace, automotive, and marine applications, mandated by stricter global emission standards and the imperative for substantial improvement in fuel economy and electric vehicle battery range. The core value proposition—the unique ability of 3D fabrics to prevent delamination, a critical and often catastrophic failure mode in 2D laminated composites—ensures their indispensable and growing role in structural components exposed to high-cycle fatigue, shock loading, and extreme stress, thereby guaranteeing sustained high-value demand.

However, market growth faces inherent restraints that temper rapid mass market penetration, notably the substantial high initial capital investment required for acquiring and installing specialized 3D weaving, knitting, and braiding equipment, which represents a significant financial hurdle for smaller enterprises. Furthermore, the necessary expertise for designing, simulating, and precisely manufacturing these complex preforms, including mastering the requisite software tools and operating sophisticated machinery, presents a severe skilled labor shortage and technical barrier to entry. The relatively high cost of precursor fibers, especially high-modulus carbon and specialized aramid fibers, compared to traditional commodity materials, also restricts widespread adoption in price-sensitive consumer and low-end industrial applications, requiring intensive optimization to justify the cost premium.

Opportunities for expansion are substantial and primarily revolve around technological democratization and market diversification. This includes the development of more cost-effective and faster manufacturing techniques, such as continuous composite manufacturing utilizing hybrid additive and subtractive processes, enabling the production of near-net-shape components. The increasing integration of highly flexible 3D spacer fabrics in fast-growing, non-traditional sectors like orthopedic supports, personalized wearable technology, and high-end sports equipment provides new, high-volume market potential less constrained by aerospace regulatory cycles. Impact forces influencing the market trajectory include technological breakthroughs that reduce fiber wastage and improve material deposition accuracy, increasingly strict global regulatory mandates favoring lightweight and energy-efficient materials, and competitive pressure stemming from continuous innovation in alternative advanced material solutions like high-performance polymers and nanostructured materials.

Segmentation Analysis

The 3D Fabrics Market is comprehensively segmented based on the type of constituent fiber utilized, the structural complexity and method of product construction, the specific application area where performance is paramount, and the geographical distribution of demand and production centers. This granular segmentation is essential for accurate market forecasting and allows industry participants to execute targeted strategic planning and fully understand regional market nuances and specialized technological requirements. Fiber type segmentation reflects the performance envelope, ranging from ultra-high-strength materials like carbon and aramid fibers used in aerospace to more cost-effective glass and polymer fibers utilized in construction and consumer goods. Segmentation by product type highlights the specific structural capabilities imparted by different manufacturing technologies, determining suitability for rigidity, flexibility, or contouring.

The segmentation by Product Type is particularly crucial as it dictates the end-use performance characteristics. 3D Woven Fabrics, due to their interlocking structure across the thickness, are prized for structural rigidity and high integrity, often serving as preforms for composite beams and panels. 3D Braided Fabrics are preferred for producing intricate, continuous, curved, or hollow structures, ideal for components requiring uniform strength around a central axis, such as shafts and tubing. Conversely, 3D Knitted Fabrics, especially spacer fabrics, leverage looping construction to create highly flexible, compressible, and breathable materials, essential for applications requiring cushioning and ventilation, like medical mattresses and athletic padding. This differentiation ensures that the product matches the specific functional requirements of the application.

Application segmentation reveals the industry sectors driving the highest value demand. Aerospace and Defense remains the leading segment due to the critical nature of the components and the ability of 3D composites to deliver superior performance under extreme conditions. However, the fastest growth is being observed in the Medical and Healthcare sector, driven by demand for advanced, porous scaffolds, biocompatible implants, and ergonomic patient support systems. The Automotive sector, particularly the electric vehicle market, is also rapidly increasing its adoption of 3D fabrics for battery pack housings and crash safety structures, demonstrating the material’s growing importance in mobility solutions.

- By Fiber Type: Carbon Fiber (High Modulus, Standard Modulus), Glass Fiber (E-glass, S-glass), Aramid Fiber, Natural Fibers (Hemp, Jute), Synthetic Polymer Fibers (PEEK, PET, Nylon), Others (Basalt, Ceramic).

- By Product Type: 3D Woven Fabrics (Orthogonal, Angle-Interlock), 3D Knitted Fabrics (Warp Knit, Weft Knit, Spacer Fabrics), 3D Braided Fabrics (2D Braided, Tri-axial Braided), 3D Non-Woven Spacer Fabrics.

- By Application: Aerospace and Defense (Airframe Structures, Engine Parts), Automotive (Body Panels, Chassis Components, Battery Housings), Marine (Hulls, Masts), Medical and Healthcare (Orthopedics, Implants, Prosthetics, Patient Support), Sporting Goods (Bicycle Frames, Helmets), Filtration Systems (High-Temperature Filters), Construction and Infrastructure (Bridge Reinforcement, Seismic Retrofitting), Geotextiles.

- By Region: North America (U.S., Canada), Europe (Germany, France, UK), Asia Pacific (China, Japan, India), Latin America (Brazil, Mexico), Middle East & Africa (GCC Countries).

Value Chain Analysis For 3D Fabrics Market

The value chain for the 3D Fabrics Market is inherently complex, starting with the upstream segment dominated by a highly concentrated group of specialized chemical and fiber manufacturers. These entities are responsible for the production of high-performance precursor fibers, such as high-grade polyacrylonitrile (PAN) necessary for carbon fiber production, high-tensile glass fibers, and aramid polymers. This initial stage is crucial as the quality, consistency, and cost of the precursor materials directly dictate the performance characteristics and final price of the resulting 3D fabric. Innovation at this stage focuses on developing sustainable precursor materials, increasing production capacity to achieve economies of scale, and reducing the energy intensity of the stabilization and carbonization processes. Additionally, the upstream supply includes highly specialized machinery providers who develop and market the sophisticated computer-controlled 3D weaving, braiding, and knitting equipment.

The midstream segment involves the specialized 3D fabric manufacturers, who serve as the core converters in the value chain. These companies acquire precursor fibers and utilize advanced textile manufacturing technologies, coupled with proprietary simulation and design software (CAD/CAE), to transform raw input into intricate, customized 3D preforms. Their competitive advantage lies in their technological expertise, ability to handle complex geometric specifications, and commitment to stringent quality controls required by sectors like aerospace. The integration of advanced computational design tools is critical here for optimizing fiber architecture (angle, density, and volume fraction) to meet exact application requirements. Distribution channels vary significantly based on the end application. For large, highly customized structural components (e.g., aerospace preforms), the distribution is predominantly direct, involving long-term development contracts and tightly integrated supply chains with downstream composite manufacturers.

The downstream analysis focuses on the final composite component manufacturers and the ultimate end-user industries. Downstream manufacturers utilize the 3D preforms by integrating them with various resin matrices (e.g., epoxy, phenolic, thermoplastic polymers) through processes like Resin Transfer Molding (RTM) or Vacuum-Assisted Resin Transfer Molding (VARTM) to produce the final solid composite part. End-users span transportation (aircraft, high-performance cars), energy (wind turbines, pressure vessels), and medical fields. The success of the downstream process relies heavily on the quality and precision of the midstream preform, as slight variations can impact the resin flow and final component integrity. For more standardized 3D spacer fabrics used in medical or consumer goods, distribution tends to be indirect, often through specialized distributors who serve multiple small to mid-sized product assemblers, offering readily available material stock and logistical support, balancing performance specifications with volume and cost efficiencies.

3D Fabrics Market Potential Customers

The primary customer base for 3D fabrics comprises highly sophisticated industrial manufacturers operating in environments where material failure risk is unacceptable and performance optimization is a continuous business objective. These include major Original Equipment Manufacturers (OEMs) and Tier 1 suppliers in the global Aerospace and Defense sector, such as companies manufacturing commercial jet components, military aircraft parts, and propulsion system casings, where the delamination resistance and high strength-to-weight ratio of 3D carbon composites are essential for safety and operational longevity. Another critical customer segment is the Automotive industry, particularly manufacturers of high-performance and electric vehicles (EVs), seeking to significantly reduce chassis weight, enhance crash energy absorption, and develop lightweight, fire-resistant battery containment systems using 3D glass and carbon fabrics.

Furthermore, the rapidly growing Medical and Healthcare sector represents a high-value customer group. This includes orthopedic device manufacturers requiring biocompatible, high-porosity scaffolds for tissue engineering, surgical mesh producers, and companies specializing in complex prosthetic and orthotic devices that demand flexible yet supportive 3D knitted and spacer fabrics. These buyers prioritize material compatibility, sterilization resilience, and ergonomic performance alongside structural integrity. The construction and infrastructure sector, while traditionally slower to adopt, is increasingly becoming a key customer, utilizing 3D geotextiles and reinforced concrete preforms for seismic retrofitting, bridge supports, and durable pavement systems, focusing on long-term material resistance to harsh environmental conditions and fatigue.

Finally, niche high-performance sectors, such as professional sporting goods manufacturers (including F1 racing, competitive cycling, and nautical industries) and specialized filtration media producers (for high-temperature or corrosive industrial environments), constitute important segments. These customers leverage the material's customized performance properties, demanding tailored 3D structures that provide superior rigidity, specialized fluid dynamics, or cushioning capabilities beyond the scope of traditional materials. Essentially, any purchasing entity whose success is fundamentally tied to minimizing weight while maximizing structural reliability and resistance to complex loading mechanisms is a prime target for the advanced capabilities offered by the 3D Fabrics Market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 6.0 Billion |

| Growth Rate | 16.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SGL Carbon SE, Solvay SA, Toray Industries Inc., Hexcel Corporation, Albany International Corp., Milliken & Company, Hantang Textile, P-D Fiber Glass GmbH, 3D Weaving Inc., Textum Inc., Sigmatex, M. Holland Company, Scott & Fyfe Group Ltd., 3TEX Inc., Saertex GmbH & Co. KG, Chomarat Group, Euro-Composites S.A., TenCate Advanced Composites, Baltex, Parabeam BV. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

3D Fabrics Market Key Technology Landscape

The technological landscape of the 3D Fabrics Market is inherently defined by the specialized and highly automated textile manufacturing processes required to precisely position fibers in three dimensions. The foundational technologies include sophisticated multi-axial weaving, which utilizes complex Jacquard mechanisms and shuttles to integrate binding yarns along the Z-axis (thickness) of the fabric. This process is essential for producing high-integrity preforms used in structural components requiring maximal shear strength and minimal delamination risk. Another critical technology is advanced 3D braiding, often employing robotic mandrels and large carriers, favored for manufacturing complex, curved, or hollow structures, enabling the production of continuous-fiber reinforced components like drive shafts, pressure vessels, and orthopedic rods with excellent radial stability and torsional stiffness.

Modern advances are heavily reliant on the synergistic application of Computer-Aided Engineering (CAE) and specialized software tools. These digital technologies enable engineers to simulate the performance and predict the mechanical behavior of novel 3D fiber architectures under diverse operational load conditions, including tensile, compression, and fatigue testing. This computational optimization allows for precise control over fiber volume fraction, tow placement, and orientation, significantly mitigating the need for extensive and costly physical prototyping while ensuring compliance with stringent industry standards, such as those in the aerospace sector. Furthermore, the relentless pursuit of speed and cost reduction has driven the adoption of highly automated, high-speed machinery coupled with robotics for material handling, drastically improving production throughput and consistency compared to traditional manual layup methods.

A burgeoning and transformative technological frontier involves the integration of 3D textile manufacturing with sophisticated Additive Manufacturing (3D printing) and smart functionality. This hybridization allows for the direct, precise deposition of matrix materials or functional elements, such as sensors, directly onto or within the complex 3D preform, creating multifunctional, near-net-shape components that require minimal post-processing and inherently possess smart capabilities (e.g., strain sensing or temperature monitoring). The development of thermoplastic 3D composites, which offer advantages in recyclability and faster processing cycles compared to traditional thermosets, is another key area of technological evolution, positioning 3D fabrics at the vanguard of material science and enabling the creation of self-monitoring and highly adaptable structural solutions for next-generation industrial applications.

Regional Highlights

- North America: This region maintains its dominance in the 3D Fabrics Market in terms of market value and technological leadership. Growth is intrinsically linked to the massive R&D expenditure by the aerospace and defense sectors, where major contractors necessitate high-modulus carbon fiber 3D preforms for mission-critical components. The U.S. government’s push for next-generation aircraft and highly reliable protective equipment continues to drive demand.

- Europe: Europe represents a mature market characterized by robust technical textile manufacturing and strong governmental backing for sustainable mobility. Demand is strongly fueled by the automotive industry's aggressive transition to electric vehicles (EVs), requiring lightweight structural components and innovative battery housings. Germany, France, and the UK are core innovation centers, focusing heavily on integrating automation and developing standardized processes for advanced 3D glass and carbon composites.

- Asia Pacific (APAC): Expected to exhibit the highest Compound Annual Growth Rate (CAGR) globally throughout the forecast period. The surging growth is primarily attributed to rapid industrialization, massive infrastructure projects in China and India, and the expansion of domestic defense and aerospace manufacturing capabilities. APAC is a key region for the adoption of 3D spacer fabrics in consumer goods and the construction sector, often prioritizing volume production and utilizing more cost-effective fiber inputs.

- Latin America: This is an emerging market characterized by steady but measured growth, heavily concentrated in construction, mining, and oil & gas sectors. Market penetration is closely tied to foreign investment in infrastructure development and technological transfer from North American and European firms operating composite manufacturing facilities in countries like Brazil and Mexico.

- Middle East and Africa (MEA): Growth in MEA is primarily supported by large-scale infrastructure projects, including smart city development and significant investment in regional defense modernization efforts. The specific high-growth niche in this region involves the application of 3D fabrics in specialized oil and gas infrastructure, such as corrosion-resistant composite pipes and containment vessels, leveraging the material’s extreme durability in harsh environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 3D Fabrics Market.- SGL Carbon SE

- Solvay SA

- Toray Industries Inc.

- Hexcel Corporation

- Albany International Corp.

- Milliken & Company

- Hantang Textile

- P-D Fiber Glass GmbH

- 3D Weaving Inc.

- Textum Inc.

- Sigmatex

- M. Holland Company

- Scott & Fyfe Group Ltd.

- 3TEX Inc.

- Saertex GmbH & Co. KG

- Chomarat Group

- Euro-Composites S.A.

- TenCate Advanced Composites

- Baltex

- Parabeam BV

Frequently Asked Questions

Analyze common user questions about the 3D Fabrics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of 3D fabrics over traditional 2D composites?

The primary advantage is the integration of fibers along the Z-axis (thickness), which drastically improves inter-laminar shear strength and fracture toughness. This unique structure virtually eliminates the risk of catastrophic delamination failure commonly observed in standard 2D laminated composites under impact or fatigue loading.

Which end-use industry is the largest consumer of 3D fabrics globally in terms of value?

The Aerospace and Defense industry is currently the largest consumer of 3D fabrics by value, utilizing high-modulus carbon fiber preforms for critical structural components that require extreme lightweighting, superior fatigue life, and high resistance to impact damage, such as airframe elements and propulsion systems.

What are the main types of 3D fabric construction methods and their typical uses?

The main construction methods include 3D weaving (for maximum rigidity in structural panels), 3D braiding (ideal for curved or hollow cylindrical parts like tubes and beams), and 3D knitting (used for flexible and highly cushioned spacer fabrics utilized in medical and consumer goods).

How is the high cost of 3D fabrics being addressed to increase commercial adoption?

The industry is addressing high costs primarily through technological scaling: increasing automation in weaving/braiding, utilizing advanced design software (AI/CAE) to optimize material placement and reduce fiber waste, and implementing continuous manufacturing processes to lower the cost per component cycle time.

What role do 3D fabrics play in the electric vehicle (EV) market?

In the EV market, 3D fabrics are crucial for lightweighting chassis components to maximize battery range, enhancing crashworthiness through controlled energy absorption structures, and providing durable, fire-resistant containment solutions for battery packs, often utilizing specialized glass and carbon fibers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager