3D Metrology System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441350 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

3D Metrology System Market Size

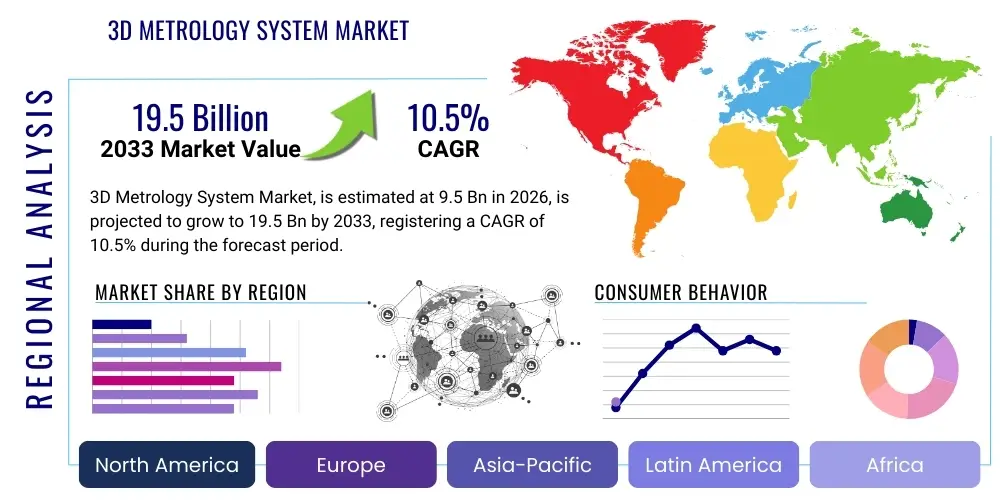

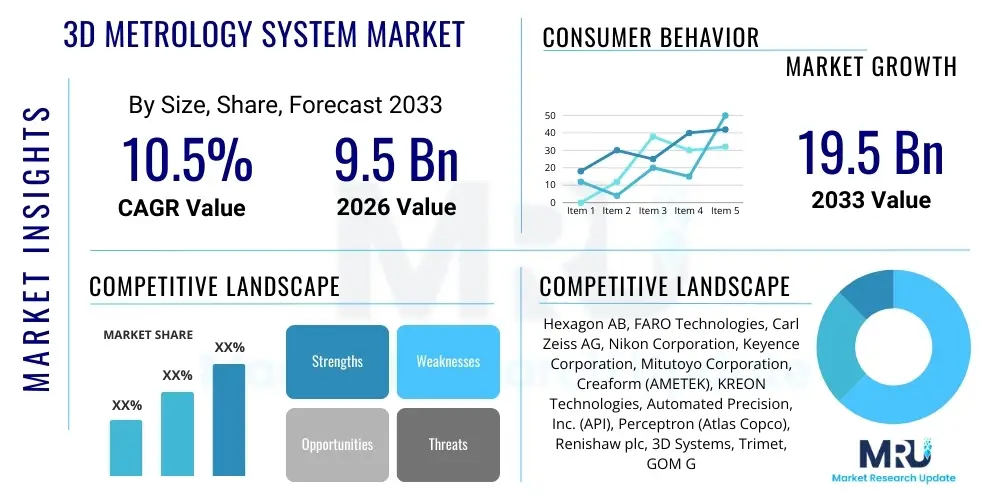

The 3D Metrology System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 9.5 Billion in 2026 and is projected to reach USD 19.5 Billion by the end of the forecast period in 2033.

3D Metrology System Market introduction

The 3D Metrology System Market encompasses highly advanced, precision measurement technologies designed to capture and analyze the three-dimensional geometric characteristics of physical objects. These systems are crucial for ensuring quality control, dimensional compliance, and reverse engineering across various sophisticated industries. Core products include Coordinate Measuring Machines (CMMs), 3D optical scanners (like laser and structured light), and portable measurement arms, which collectively offer unparalleled accuracy and speed in capturing complex physical data. The fundamental purpose of these systems is to compare manufactured parts against digital CAD models, ensuring components meet strict regulatory and functional specifications before assembly or deployment. This necessity for absolute precision is driving the widespread adoption of 3D metrology solutions in high-value manufacturing sectors globally.

Major applications of 3D metrology systems span the entirety of the product lifecycle, from initial design verification and prototyping to final inspection and assembly line quality assurance. In the automotive and aerospace sectors, these systems are indispensable for inspecting engine components, structural frames, and aerodynamic surfaces where tolerances are extremely tight and failure risk is intolerable. Furthermore, the healthcare industry utilizes 3D metrology for customized prosthetics, implants, and surgical planning, demanding micro-level precision. The primary benefits derived from integrating these technologies include significant reductions in manufacturing defects, decreased scrap rates, improved throughput, and enhanced product reliability, directly contributing to competitive advantage and compliance with international quality standards such as ISO 9000 and AS9100.

The market is currently being driven by the global transition towards Industry 4.0 and smart manufacturing initiatives, emphasizing automation, interconnected systems, and real-time data analysis. The increasing demand for lightweight and complex geometries, particularly in electric vehicle (EV) manufacturing and additive manufacturing (3D printing), necessitates advanced non-contact measurement solutions that can handle intricate surfaces and complex material structures rapidly. Technological advancements, such as enhanced sensor resolution, faster data processing capabilities, and the integration of machine learning algorithms for autonomous inspection, are further accelerating market growth, positioning 3D metrology as a foundational pillar of modern, high-precision manufacturing environments worldwide.

3D Metrology System Market Executive Summary

The global 3D Metrology System Market is experiencing robust expansion, driven primarily by the escalating demand for quality assurance and high-precision measurement in advanced manufacturing ecosystems. Key business trends indicate a strong shift from traditional tactile CMMs toward non-contact optical measurement technologies, including laser scanners and structured light systems, favored for their speed, portability, and ability to handle delicate materials and complex geometries. Manufacturers are increasingly integrating these systems directly into automated production lines, leveraging inline metrology to achieve 100% inspection rates and instantaneous feedback loops, which is critical for minimizing deviation and maximizing operational efficiency in automated facilities.

Regionally, the Asia Pacific (APAC) market is forecasted to exhibit the highest growth rate, fueled by massive investments in automotive and electronics manufacturing in countries like China, Japan, and South Korea, coupled with rapid urbanization and industrial infrastructure development. North America and Europe, while being mature markets, maintain dominance in revenue share due to the high concentration of key aerospace, defense, and medical device manufacturers who require stringent dimensional control. These regions are also pioneers in adopting advanced software solutions and incorporating AI into metrology workflows for automated defect identification and predictive quality management.

Segment trends highlight the dominance of Coordinate Measuring Machines (CMMs) in terms of current market share, particularly for large, high-accuracy components, while the 3D optical scanner segment is growing fastest due to its versatility and ease of integration into shop-floor environments. By application, quality control and inspection remain the largest segments, but the reverse engineering segment is showing significant traction as companies seek to digitize legacy parts and optimize existing designs. The key challenge for the market remains the high initial investment costs and the shortage of skilled personnel capable of operating and interpreting the sophisticated data generated by these advanced metrology systems, pushing vendors to develop more user-friendly and automated solutions.

AI Impact Analysis on 3D Metrology System Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the 3D Metrology System Market frequently center on themes of enhanced automation, predictive quality control, and the ability to process massive datasets generated by optical scanners. Key concerns revolve around whether AI can truly replace expert human judgment in complex inspection scenarios, the reliability of AI algorithms in detecting novel defects, and the cybersecurity implications of highly connected, autonomous measurement systems. Users are keenly interested in how machine learning can accelerate inspection cycles, moving beyond simple pass/fail criteria to proactive identification of manufacturing process drift, thereby reducing the dependency on manual programming and interpretation. Expectations are high that AI will transform metrology from a measurement tool into a prescriptive analytical instrument, optimizing production lines in real time and enabling truly intelligent manufacturing floors.

- AI enables automated feature recognition and adaptive scanning path generation, significantly reducing setup and programming time for inspection routines.

- Machine learning algorithms enhance defect detection sensitivity by analyzing large datasets, identifying subtle anomalies faster and more consistently than traditional statistical methods.

- Predictive metrology uses AI to correlate measurement data with production variables, predicting potential quality issues before they occur and facilitating proactive process adjustments.

- AI integration allows for real-time analysis of geometric tolerance deviations, providing instantaneous feedback to CNC machines for self-correction in closed-loop manufacturing systems.

- Deep learning improves data interpretation for complex surfaces and noisy scans, enhancing the accuracy and reliability of measurements derived from high-volume optical data.

- Artificial intelligence is crucial for developing autonomous metrology systems capable of operating without continuous human intervention in harsh or remote industrial environments.

DRO & Impact Forces Of 3D Metrology System Market

The 3D Metrology System Market is primarily driven by the imperative need for enhanced precision and efficiency across highly regulated industries, coupled with pervasive trends toward automation and digital manufacturing inherent in Industry 4.0. The increasing complexity of modern manufactured components, particularly in sectors like aerospace (lightweight composites) and electric vehicles (battery assemblies and motor components), necessitates measurement systems capable of handling extremely tight tolerances and intricate geometries quickly. Simultaneously, strict regulatory requirements related to product safety and dimensional compliance, particularly in medical devices and defense, mandate the adoption of certified and traceable 3D metrology solutions, acting as a consistent, powerful driver for market expansion. This operational necessity ensures that investment in advanced metrology remains a non-negotiable component of high-quality manufacturing strategies.

However, the market faces significant restraints, chiefly the high initial capital expenditure associated with sophisticated systems, such as large-scale Coordinate Measuring Machines and advanced non-contact scanners, which presents a barrier to entry for small and medium-sized enterprises (SMEs). Furthermore, the scarcity of highly skilled metrology engineers and data analysts capable of programming, operating, and interpreting the complex outputs of these systems poses a human resource challenge. The sensitivity of high-precision optical systems to shop-floor vibrations, dust, and temperature fluctuations also limits the widespread adoption of certain equipment outside of controlled laboratory environments, although ongoing technological advancements are addressing ruggedization and environmental stability.

Opportunities abound in the development of portable, handheld, and wireless metrology devices that cater to flexible manufacturing layouts and field service applications, lowering the cost of entry and expanding accessibility. Moreover, the integration of 3D metrology with additive manufacturing (AM) processes offers a crucial growth avenue, allowing for in-situ quality monitoring and validation of 3D-printed parts during or immediately after the build process. The major impact forces governing the market include intensified global competition driving manufacturers to optimize cost and quality (leading to metrology adoption) and rapid sensor and software innovation (reducing inspection time and increasing data utility), which together compel continuous technological upgrade cycles for end-users seeking a competitive edge in precision manufacturing.

Segmentation Analysis

The 3D Metrology System Market is comprehensively segmented based on the type of product, the application area, and the specific industry end-user. This segmentation helps manufacturers and solution providers target specific industrial needs, ranging from laboratory-grade precision measurement to robust, high-speed inline inspection on the shop floor. Product segmentation distinguishes between tactile systems (CMMs) and various non-contact optical solutions (scanners), reflecting diverse requirements for speed, accuracy, and measurement environment. Application segmentation clearly delineates the market utility across primary functions such as quality control, reverse engineering, and modeling, while end-user industries underscore the distinct demands and tolerance requirements inherent in sectors like automotive, aerospace, and medical device manufacturing. Understanding these distinct segments is vital for strategic market planning and technology development.

- Product Type:

- Coordinate Measuring Machines (CMMs)

- Bridge CMM

- Gantry CMM

- Horizontal Arm CMM

- 3D Optical Scanners

- Laser Scanners

- Structured Light Scanners

- Photogrammetry

- Video Measuring Machines (VMMs)

- Measuring Arms/Portable CMMs

- Coordinate Measuring Machines (CMMs)

- Application:

- Quality Control and Inspection

- Reverse Engineering

- Volume Measurement

- Prototyping and Tooling Inspection

- End-User Industry:

- Automotive

- Aerospace and Defense

- Heavy Machinery

- Electronics

- Medical Devices

- Energy & Power

- Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For 3D Metrology System Market

The value chain for the 3D Metrology System Market begins with the upstream suppliers of critical components, including high-precision sensors, advanced optics, sophisticated motion control systems, and specialized microprocessors. These foundational inputs determine the accuracy, speed, and overall performance capability of the final metrology device. Component procurement requires rigorous quality control, as the performance of the entire system hinges on the precision of its smallest parts. Original Equipment Manufacturers (OEMs) then undertake the complex process of system assembly, calibration, and integration, requiring highly specialized engineering expertise to marry hardware components with proprietary measurement and data processing software, which represents significant value addition.

Midstream activities involve system integrators and specialized solution providers who customize and deploy the metrology equipment according to specific end-user requirements, particularly concerning automated inline inspection and robotic integration. Distribution channels are varied, encompassing both direct sales forces, which handle large, complex contracts (especially for CMMs in aerospace), and indirect channels, such as regional distributors and value-added resellers (VARs), who provide localized support and smaller-scale system installation, particularly for portable measurement devices. The quality of after-sales service, including calibration, maintenance, and software updates, is a critical differentiator in this stage, heavily influencing customer loyalty and long-term system utility.

The downstream segment is dominated by end-users, who implement the systems for quality assurance and process control. The complexity of the software and data interpretation necessitates ongoing training and support, creating strong dependence on manufacturers and integrators. The indirect distribution channels often thrive by offering comprehensive training packages and localized technical support, bridging the gap between sophisticated technology and shop-floor reality. The increasing digitalization of manufacturing is reinforcing the value of the software segment within the chain, where data analysis, cloud connectivity, and integration with enterprise resource planning (ERP) systems are becoming paramount for maximizing the return on investment in metrology hardware.

3D Metrology System Market Potential Customers

Potential customers for 3D metrology systems are fundamentally organizations operating in sectors where dimensional accuracy, geometric fidelity, and compliance with stringent quality standards are non-negotiable determinants of product functionality and safety. The automotive industry represents one of the largest buyer groups, encompassing Original Equipment Manufacturers (OEMs), Tier 1 suppliers, and specialized component makers (e.g., body-in-white structures, powertrains, and sophisticated electronic casings). These entities require high-throughput, automated metrology solutions for rapid inspection of thousands of components daily to manage massive production volumes while ensuring zero defects, especially as production shifts towards electric vehicles and autonomous driving components.

The aerospace and defense sector constitutes another primary segment of high-value customers, characterized by extremely tight tolerance requirements, the use of expensive materials (e.g., titanium, advanced composites), and low production volumes. Buyers in this sector include aircraft manufacturers, MRO (Maintenance, Repair, and Overhaul) facilities, and defense contractors. They rely heavily on large-scale CMMs, laser trackers, and portable measurement arms for inspecting large airframe components, turbine blades, and precision tooling, where the cost of failure is astronomical and traceability must be maintained for decades. Precision in this segment is paramount, often driving the purchase of the highest-accuracy, laboratory-grade equipment.

Furthermore, the medical device and electronics industries are rapidly expanding customer bases. Medical device manufacturers require micro-level precision for implants, surgical instruments, and diagnostic equipment, making high-resolution optical and video metrology systems essential for validation and regulatory compliance. The electronics sector utilizes 3D metrology for inspecting small, complex components, circuit boards, and connectors where shrinking size mandates non-contact, rapid, and highly accurate inspection capabilities. These sectors often prioritize speed and portability to facilitate integration into cleanroom and laboratory environments, driving demand for advanced software and automated robotic inspection cells.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 19.5 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hexagon AB, FARO Technologies, Carl Zeiss AG, Nikon Corporation, Keyence Corporation, Mitutoyo Corporation, Creaform (AMETEK), KREON Technologies, Automated Precision, Inc. (API), Perceptron (Atlas Copco), Renishaw plc, 3D Systems, Trimet, GOM GmbH (Hexagon), Metrologic Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

3D Metrology System Market Key Technology Landscape

The 3D Metrology System market is defined by a dynamic technological landscape centered around achieving higher precision, greater speed, and increased portability. Traditional Coordinate Measuring Machines (CMMs), while foundational, continue to evolve with advancements in air bearing technology, thermal compensation software, and multi-sensor capabilities that allow them to integrate both tactile probes and high-speed laser scanners. The current trend is to move CMMs from environmentally controlled labs to the shop floor using robust designs and temperature-stable components, thereby enabling real-time inspection directly at the point of manufacture. This merging of traditional tactile accuracy with modern non-contact speed is driving efficiency gains across high-tolerance manufacturing operations.

The fastest-growing segment technologically is 3D optical scanning, encompassing laser scanning, structured light projection, and photogrammetry. Structured light scanners are particularly prominent due to their ability to capture dense point clouds quickly and in high resolution, making them ideal for complex, contoured surfaces often found in consumer electronics and medical devices. Laser scanning systems, meanwhile, focus on speed and volume, often deployed on portable measuring arms or integrated into robotic cells for inline inspection of large assemblies like car bodies. A crucial technological advancement is the enhanced integration of these scanning technologies with highly sophisticated software platforms that automate the alignment, comparison against CAD models, and generation of comprehensive inspection reports, minimizing human error and intervention.

Furthermore, connectivity and data integration are paramount, driven by the Industrial Internet of Things (IIoT) paradigm. Modern metrology systems are increasingly featuring IoT compatibility, enabling real-time data transmission to centralized quality management systems (QMS) and enterprise resource planning (ERP) platforms. This facilitates comprehensive data analysis, predictive maintenance for the metrology equipment itself, and closed-loop manufacturing feedback where measurement results automatically trigger corrective adjustments in production machinery. Key software technologies include advanced geometric dimensioning and tolerancing (GD&T) analysis tools, cloud-based data storage solutions, and increasingly, specialized algorithms powered by machine learning to filter noise, optimize scan paths, and perform automated defect classification, ensuring the systems are not just measuring, but actively informing and controlling the manufacturing process.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region in the 3D Metrology Market, driven by the massive scale of manufacturing investments, particularly in China, India, and South Korea. The rapid expansion of the automotive sector (including significant investments in EV battery production), consumer electronics manufacturing, and infrastructure development necessitates high volumes of quality inspection, favoring the adoption of high-speed, automated 3D scanning solutions for shop-floor implementation. Governments in the region are actively supporting digitalization and the adoption of smart factory initiatives, providing fertile ground for market expansion and integration of advanced metrology technology.

- North America: North America holds a substantial market share, primarily driven by robust demand from the technologically sophisticated aerospace and defense industries, which mandate the highest levels of accuracy and certification. The region is a leader in adopting advanced CMM technology, laser trackers, and high-end portable measurement solutions. The concentration of key technology innovators and the early implementation of Industry 4.0 principles, coupled with heavy investment in R&D for advanced medical device manufacturing, ensure continued revenue dominance, emphasizing solutions that prioritize traceability and regulatory compliance.

- Europe: Europe represents a mature but highly dynamic market, fueled by Germany’s strong presence in the high-precision automotive (premium segment) and mechanical engineering sectors. European manufacturers place a strong emphasis on maintaining quality standards and efficiency, driving demand for automated and inline metrology systems that integrate seamlessly into complex production environments. Focus areas include sophisticated dimensional analysis for customized products and rigorous quality control for parts related to renewable energy and complex machinery construction.

- Latin America (LATAM): The LATAM market is characterized by emerging industrialization, particularly in countries like Brazil and Mexico, which serve as major manufacturing hubs for global automotive companies. Market growth is stable, driven primarily by foreign direct investment and the need for localized suppliers to meet international quality standards. The adoption is focused on more cost-effective and ruggedized portable metrology solutions that can withstand varying environmental conditions typically found on local production floors.

- Middle East and Africa (MEA): The MEA market is gradually expanding, primarily anchored by investments in the energy (oil and gas) and construction sectors, and growing diversification into aerospace and defense industries in countries like the UAE and Saudi Arabia. Demand is driven by large-scale infrastructure projects that require dimensional control for immense components and sophisticated quality control for specialized equipment, favoring robust laser trackers and long-range measuring systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 3D Metrology System Market.- Hexagon AB

- FARO Technologies

- Carl Zeiss AG

- Nikon Corporation

- Keyence Corporation

- Mitutoyo Corporation

- Creaform (AMETEK)

- KREON Technologies

- Automated Precision, Inc. (API)

- Perceptron (Atlas Copco)

- Renishaw plc

- 3D Systems

- Trimet

- GOM GmbH (Hexagon)

- Metrologic Group

- Wenzel Group GmbH & Co. KG

- Zygo Corporation (AMETEK)

- Exact Metrology

- Scantech

- Starrett

Frequently Asked Questions

Analyze common user questions about the 3D Metrology System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between CMMs and 3D Optical Scanners?

CMMs (Coordinate Measuring Machines) are tactile systems that offer the highest traceable accuracy for point-specific measurements, ideal for controlled environments. 3D Optical Scanners are non-contact, capturing millions of points rapidly to generate dense point clouds, favored for speed, complex geometries, and shop-floor deployment, though typically with slightly lower absolute accuracy than laboratory-grade CMMs.

How is Industry 4.0 influencing the adoption of 3D metrology?

Industry 4.0 mandates automation and data connectivity, driving the demand for inline and near-line metrology systems. These systems provide real-time quality data directly to manufacturing execution systems (MES), enabling closed-loop feedback, predictive maintenance, and autonomous quality control to optimize production workflows without human delay.

Which end-user industry accounts for the largest market share in 3D metrology?

The Automotive industry currently accounts for the largest share due to high production volumes, strict quality regulations, and the complex geometries required for components like engine blocks, chassis, and increasingly, EV battery assemblies, necessitating high-throughput inspection capabilities.

What is the typical return on investment (ROI) for advanced 3D metrology systems?

The ROI for advanced 3D metrology is realized through significant reductions in scrap material, minimized rework time, improved product quality leading to fewer warranty claims, and substantial acceleration of the inspection cycle, often justifying the high initial investment within two to five years, particularly in high-volume or high-value manufacturing.

What are the key technological restraints limiting market growth?

The key restraints include the high capital investment required for procurement, the shortage of technically proficient personnel needed to operate and maintain the complex software, and the physical sensitivity of high-resolution optical systems to environmental factors such as vibration and temperature fluctuations on the shop floor.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager