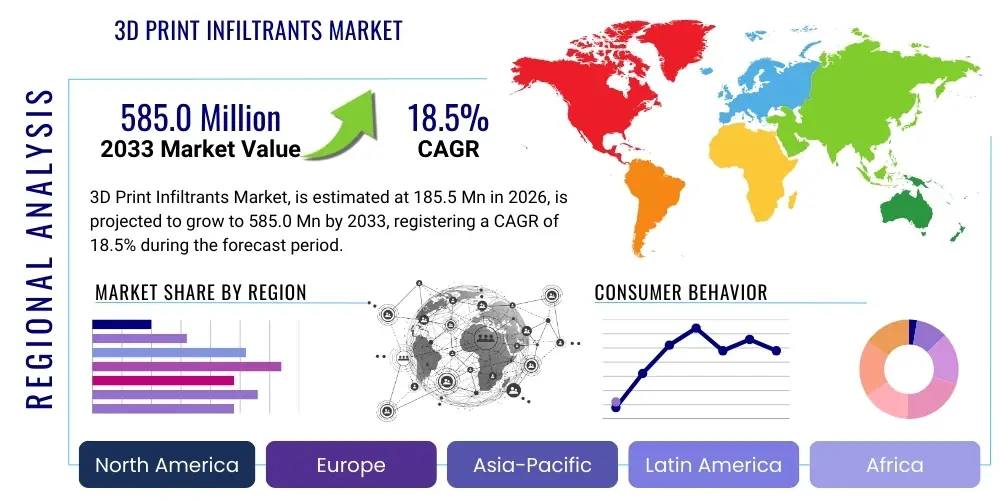

3D Print Infiltrants Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441682 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

3D Print Infiltrants Market Size

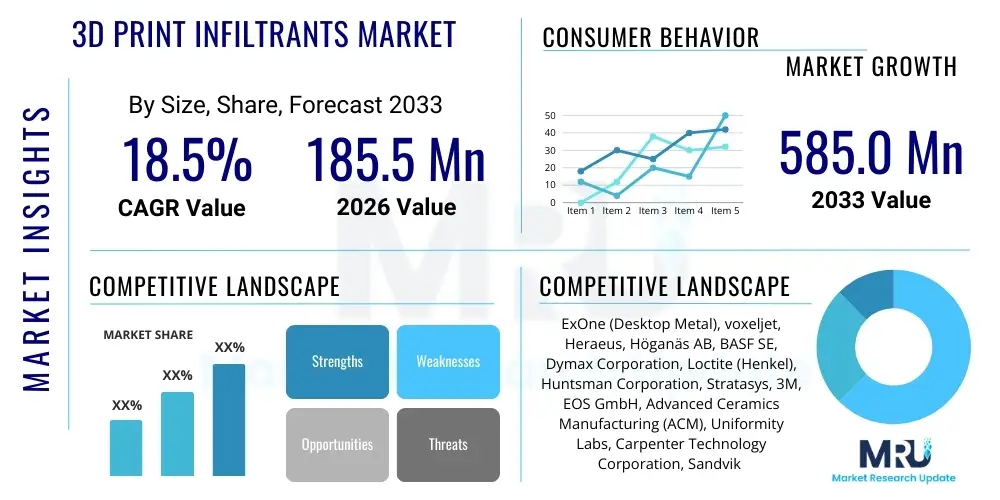

The 3D Print Infiltrants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $185.5 million in 2026 and is projected to reach $585.0 million by the end of the forecast period in 2033.

3D Print Infiltrants Market introduction

The 3D Print Infiltrants Market encompasses specialized materials, primarily metals, polymers, and resins, utilized to enhance the physical and mechanical properties of porous green or brown parts produced through additive manufacturing processes, most notably Binder Jetting (BJT). Infiltration is a crucial post-processing step where a low-melting-point material is drawn into the interconnected voids of a 3D-printed structure, subsequently densifying the component, sealing internal porosity, and significantly improving characteristics such as ultimate tensile strength, surface hardness, corrosion resistance, and overall dimensional stability. This technique bridges the gap between the speed and geometric freedom of 3D printing and the material performance demands typically associated with conventional manufacturing methods.

Major applications driving the demand for infiltrants include high-stress components in the aerospace and automotive sectors, where weight reduction and superior mechanical performance are paramount. Furthermore, the medical device industry uses infiltrants to achieve biocompatible, dense structures for surgical tools and implants, while consumer electronics benefit from enhanced durability and precise surface finishes. The ability of infiltration to convert porous, often fragile, 3D-printed parts into functional, end-use components is the core value proposition. Standard infiltrant materials include copper-based alloys, epoxy resins, cyanoacrylates, and various wax formulations, each selected based on the substrate material and the required final properties of the printed part.

The market growth is primarily fueled by the accelerating adoption of Binder Jetting technology across industrial manufacturing sectors, which inherently produces parts requiring post-sintering or post-infiltration densification. Benefits include achieving near-net-shape components with high material utilization, faster turnaround times compared to traditional sintering methods that can lead to warpage, and enabling the use of complex material combinations that are otherwise difficult to sinter fully. Driving factors also include technological advancements in infiltrant formulations, particularly the development of high-performance, temperature-resistant polymer infiltrants, and improved process control systems that automate the infiltration cycle, ensuring consistency and reliability across batches.

3D Print Infiltrants Market Executive Summary

The 3D Print Infiltrants Market is experiencing robust expansion driven by the industrialization of additive manufacturing (AM), particularly the scaling of metal and sand Binder Jetting technologies. Key business trends include intense focus on developing infiltrant materials that minimize reaction with the substrate during thermal processing, leading to superior metallurgical bonds and reduced component failure rates. Furthermore, strategic partnerships between chemical suppliers and major AM equipment manufacturers are defining material compatibility standards and process optimization protocols, ensuring smoother integration into large-scale production workflows. The competitive landscape is characterized by innovation in sustainable, solvent-free polymer infiltrants to address environmental concerns and stringent regulatory requirements.

Regionally, North America and Asia Pacific (APAC) dominate the market. North America maintains leadership due to early adoption of advanced AM technologies, significant investments in aerospace and defense applications requiring high-performance components, and a strong presence of key research institutions and large-scale service bureaus. Conversely, APAC, led by China and India, is rapidly growing, fueled by expansive industrial manufacturing bases, increasing adoption of BJT in automotive mass production, and government initiatives promoting localized additive manufacturing ecosystems. Europe also holds a significant share, driven by stringent quality control standards in the medical sector and high demand for precision tooling and prototyping in Germany and the UK.

Segmentation trends indicate that metal-based infiltrants, particularly copper and bronze alloys, currently hold the largest market share due to their widespread use in densifying steel and iron-based BJT parts, offering excellent cost-to-performance ratios. However, the polymer-based segment (resins, epoxies) is projected to exhibit the fastest growth rate. This accelerated growth is attributed to the increasing popularity of large-format sand casting molds and cores produced via BJT, which rely on polymer infiltration for enhanced strength and stability before casting, alongside growing applications in consumer goods requiring excellent surface aesthetics and water resistance.

AI Impact Analysis on 3D Print Infiltrants Market

User queries regarding AI's influence in the 3D Print Infiltrants market predominantly center on achieving process predictability, optimizing material usage, and ensuring quality assurance in complex infiltration cycles. Users frequently ask: "How can AI predict the optimal infiltration time and temperature for new alloy combinations?" and "Can Machine Learning (ML) reduce waste by optimizing the amount of infiltrant required for a specific porous structure?" The prevailing concerns revolve around the variability inherent in 3D-printed parts (such as non-uniform porosity distribution) and how AI can model and compensate for these defects during post-processing. Key expectations focus on leveraging AI to move beyond empirical trial-and-error methods toward predictive, closed-loop control systems for infiltration, thereby drastically improving yield rates and material performance consistency, which are critical for scaling AM into mass production.

AI's primary role is positioned as a critical tool for modeling the highly complex physics and material science governing the capillary action and chemical reactions during infiltration. By analyzing vast datasets comprising print parameters, green part density measurements, infiltrant viscosity, thermal profiles, and final mechanical test results, machine learning algorithms can establish robust correlation models. These models allow manufacturers to precisely define the necessary process window (e.g., soaking time, temperature gradient, atmosphere control) required to achieve specific material properties for various geometries, eliminating manual calibration and substantially reducing the cycle time associated with new product introduction (NPI).

Furthermore, integrating AI-driven quality control utilizing in-situ monitoring sensors (e.g., thermal cameras, acoustic emission sensors) allows for real-time defect detection during the infiltration process. If the AI detects inconsistencies, such as premature solidification or inadequate penetration depth, the system can automatically adjust process parameters or flag the component for inspection. This proactive quality management, underpinned by ML-based defect classification, minimizes the risk of producing non-conforming parts, thus offering significant operational savings and enhancing the reliability of infiltrated components used in safety-critical applications like aerospace and automotive engines. This level of process optimization is essential for realizing the full potential of high-throughput AM technologies.

- Process Parameter Optimization: AI algorithms determine the ideal temperature profiles and infiltration durations based on part geometry and initial porosity, minimizing process variation.

- Predictive Quality Control (PQC): Machine learning models analyze real-time sensor data during infiltration to predict internal defects (e.g., uneven densification) before final inspection.

- Material Consumption Modeling: AI optimizes the necessary volume of infiltrant based on the exact porosity map of the green part, leading to substantial material waste reduction.

- New Material Formulation: AI accelerates the discovery and testing of novel infiltrant materials by predicting their compatibility and reaction kinetics with various 3D-printed substrates.

- Automated Defect Compensation: AI systems autonomously adjust thermal gradients or pressure application to compensate for non-uniform porosity distribution within a single batch.

DRO & Impact Forces Of 3D Print Infiltrants Market

The 3D Print Infiltrants Market is fundamentally driven by the rising demand for near-full density, mechanically robust components produced via cost-effective additive manufacturing methods, particularly Binder Jetting. However, its expansion is constrained by complex process variables and cost barriers associated with specialized equipment and high-purity infiltrant materials. Significant opportunities lie in developing multi-material functionality and high-temperature ceramic infiltrants. These forces are currently shaped by intense rivalry among material suppliers and the bargaining power wielded by major aerospace and automotive end-users demanding stringent material specifications and volume pricing.

Drivers include the widespread recognition of infiltration as a reliable method to achieve high mechanical performance parameters (such as high ductility, fatigue resistance, and increased density up to 98%) in BJT parts without requiring the often challenging and expensive high-temperature sintering of the base material. The expansion of BJT into sand casting applications further drives demand for polymer and resin infiltrants to stabilize and strengthen large, fragile sand molds. Restraints primarily revolve around the inherent complexity of the infiltration process, where slight variations in porosity or thermal management can lead to incomplete densification or unwanted chemical reactions at the interface. High initial capital investment for specialized infiltration furnaces and quality control equipment also poses a barrier for smaller service bureaus, alongside environmental and health concerns related to handling certain chemical infiltrants and solvents.

Opportunities are vast, particularly in the development of novel ceramic and refractory metal infiltrants capable of enhancing parts destined for extreme operating environments (e.g., turbine blades, nuclear components). Furthermore, the integration of infiltrants to create functionally graded materials (FGMs)—where properties vary across the component—offers a powerful pathway for unique product development in biomedical and thermal management sectors. The impact forces analysis indicates that the threat of substitutes, primarily high-density laser powder bed fusion (LPBF), remains moderate, as infiltration offers a superior cost structure for large volumes. Supplier bargaining power is high for specialized high-purity powders and resins, while buyer bargaining power is increasing as end-users consolidate purchasing volumes and demand standardized material certifications, pushing the market towards greater process efficiency and cost reduction.

Segmentation Analysis

The 3D Print Infiltrants Market is segmented based on the material type of the infiltrant, the application method used, the specific end-user industry, and the final material state of the densified component. Understanding these segments is crucial for market participants as it reflects the diverse material requirements and performance benchmarks across various industrial applications. Material segmentation—polymer-based versus metal-based—is the most fundamental distinction, reflecting differences in required strength, conductivity, and operational temperature of the final part. Application methods, such as vacuum-assisted infiltration or conventional immersion, differentiate the operational complexity and achievable density levels.

The market landscape is heavily influenced by the end-use segmentation, with the automotive and aerospace sectors demanding highly reliable, metal-based densified components, while the consumer goods and tooling industries often rely on polymer infiltration for surface finish and cost-effectiveness. Geographically, segmentation helps in identifying regions with high Binder Jetting adoption rates versus those still primarily reliant on polymer-based technologies for aesthetic enhancement. The shift toward higher density and performance requirements across all industries is consistently favoring the development and commercialization of advanced metal alloy infiltrants designed for maximal interfacial integrity and minimal distortion.

Within the polymer segment, epoxies and cyanoacrylates are dominating due to their low viscosity and excellent capillary penetration into fine pores, making them ideal for improving the robustness and visual quality of complex plastic or sand parts. For the metal segment, copper and bronze are primary choices due to their compatibility with steel-based prints and relatively low melting temperatures, streamlining the thermal post-processing cycle. As 3D printing moves from prototyping to large-scale production, the requirement for automated, high-throughput infiltration systems is driving the growth of application-specific infiltration equipment providers, further refining the market segment dedicated to specialized processing techniques.

- By Material Type:

- Metal-Based Infiltrants (Copper, Bronze, Low-Melting Alloys)

- Polymer-Based Infiltrants (Epoxies, Resins, Cyanoacrylates)

- Ceramic-Based Infiltrants

- Wax and Soluble Infiltrants

- By Application Method:

- Vacuum Infiltration

- Atmospheric Immersion

- Capillary-Driven Infiltration

- Chemical Vapor Infiltration (CVI)

- By End-User Industry:

- Automotive

- Aerospace and Defense

- Industrial Machinery and Tooling

- Medical and Dental

- Consumer Goods and Electronics

- By Substrate Material:

- Metal Powders (Steel, Iron)

- Sand and Ceramic Powders

- Polymer Powders

Value Chain Analysis For 3D Print Infiltrants Market

The value chain for the 3D Print Infiltrants Market begins with the upstream sourcing of high-purity raw materials, primarily fine metal powders, specialized polymer resins, and chemical precursors. This upstream stage is characterized by a relatively concentrated supplier base focused on meeting stringent purity and consistency requirements, which directly influence the final performance of the infiltrant material. Suppliers must adhere to strict quality controls to ensure the raw materials exhibit precise melting points and viscosity profiles necessary for effective capillary action during infiltration. Research and development efforts at this stage focus on synthesizing new composite infiltrant materials that offer enhanced corrosion resistance or mechanical properties superior to conventional alloys.

The midstream phase involves the formulation and compounding of the infiltrant material by chemical and material science companies. This step includes optimizing the material composition (e.g., adding fluxing agents or stabilizers) and packaging it for compatibility with various 3D printing post-processing environments, particularly temperature-controlled furnaces used in BJT. This phase also includes the operation of 3D printing service bureaus, which perform the infiltration service as part of their comprehensive offering. Downstream distribution channels are critical, linking the specialized infiltrant manufacturers to the end-user base—either directly to large aerospace OEMs with in-house AM capabilities or indirectly through global chemical distributors and specialized 3D printing service networks.

Direct distribution channels are generally favored for high-volume industrial clients requiring customized technical support and long-term supply agreements, especially in the automotive and defense sectors where material traceability is paramount. Indirect channels, utilizing regional distributors and specialized resellers, focus on reaching smaller enterprises, educational institutions, and prototyping labs. The choice of channel often depends on the physical form of the infiltrant (e.g., ingots, wires, or liquid resins) and the required logistical complexity. Ensuring efficient and reliable delivery of these specialized materials, coupled with technical expertise in handling and application, is essential for maintaining market competitiveness and maximizing the yield for end-users relying on densified 3D-printed components.

3D Print Infiltrants Market Potential Customers

The primary potential customers and end-users of 3D print infiltrants are sophisticated industrial entities that utilize additive manufacturing for producing functional, highly complex, or custom components where structural integrity and precise material properties are non-negotiable. Leading among these are Automotive Original Equipment Manufacturers (OEMs), who leverage infiltrants to densify tooling, prototypes, and potentially high-volume powertrain components produced via Binder Jetting, aiming for parts that withstand high thermal and mechanical stress while offering reduced weight compared to fully cast components. Their requirement is driven by the need for quick iteration cycles and reliable material performance under demanding conditions.

Aerospace and Defense manufacturers constitute another critical customer segment, demanding infiltrants that meet extreme material specifications for applications such as specialized heat exchangers, complex structural brackets, and specialized engine components. In these sectors, the ability of infiltration to achieve near-full density (e.g., >95%) and mitigate component porosity is vital for preventing catastrophic failures in flight-critical parts. Furthermore, the Medical and Dental sector represents a rapidly expanding customer base, utilizing infiltrants, particularly biocompatible resins and specific metal alloys, to enhance the surface finish and structural integrity of custom implants, surgical guides, and dental prosthetics, ensuring compliance with strict regulatory standards and long-term in-vivo performance.

Industrial Machinery and Tooling providers are also significant end-users, applying infiltrants to enhance the wear resistance and durability of molds, dies, and complex jigs and fixtures produced via AM. This allows them to achieve custom tool geometries quickly while guaranteeing the longevity required for high-volume production lines. Finally, 3D printing Service Bureaus, which operate as intermediaries, represent a large volume purchaser of infiltrant materials, as they cater to diverse clients across all aforementioned industries, specializing in optimizing the infiltration process for a wide variety of geometries and material compositions, thereby serving as the interface between material suppliers and numerous small-to-medium enterprises adopting AM technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Million |

| Market Forecast in 2033 | $585.0 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ExOne (Desktop Metal), voxeljet, Heraeus, Höganäs AB, BASF SE, Dymax Corporation, Loctite (Henkel), Huntsman Corporation, Stratasys, 3M, EOS GmbH, Advanced Ceramics Manufacturing (ACM), Uniformity Labs, Carpenter Technology Corporation, Sandvik AB, Kennametal Inc., DDM, Renishaw plc, Arcam EBM (GE Additive), Lithoz GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

3D Print Infiltrants Market Key Technology Landscape

The technological landscape of the 3D Print Infiltrants Market is intrinsically linked to the advancements in Binder Jetting (BJT) technology, which necessitates efficient post-processing densification. The foundational technology involves controlled thermal processes, often using high-vacuum or inert atmosphere furnaces, to melt the infiltrant material and facilitate capillary action into the porous structure of the green or brown part. Key innovation focuses on improving the homogeneity of infiltration, minimizing component distortion, and managing the residual porosity. Techniques such as Vacuum Pressure Infiltration (VPI) are becoming standard, utilizing vacuum chambers to fully evacuate the air from the pores before introducing the liquid infiltrant, ensuring deep and consistent penetration across complex geometries, which is particularly vital for aerospace components.

A major area of technological development is the formulation of specialized infiltrant materials designed to minimize undesirable intermetallic formation or chemical reactions with the printed substrate. For instance, in metal infiltration, the use of carefully calibrated fluxes or protective atmospheres is crucial to prevent oxidation of the base metal powders during the heating cycle and promote optimal wetting by the molten infiltrant. Furthermore, advancements in polymer-based infiltration technologies focus on UV-curable and thermally-activated resins that offer faster curing times and superior mechanical properties post-curing, effectively addressing the need for rapid production cycles in tooling and consumer goods sectors. Techniques like pulsed heat infiltration are also emerging, which control the thermal exposure precisely to achieve full densification without compromising the dimensional accuracy of the printed object.

The integration of advanced monitoring and control systems—often leveraging IoT and sensors—is defining the cutting edge of infiltration technology. Modern infiltration equipment incorporates sophisticated pyrometry and gas flow control mechanisms to maintain extremely tight tolerances on temperature and atmospheric composition, which are critical for repeatability. Furthermore, the use of Computational Fluid Dynamics (CFD) modeling helps manufacturers simulate the infiltration process beforehand, predicting flow paths and optimizing part orientation within the furnace to ensure uniform densification. This predictive technology minimizes costly empirical trials, enabling faster qualification of new materials and complex parts, thus accelerating the market's industrial maturation.

Regional Highlights

- North America: Leading the market due to significant early adoption of Binder Jetting (BJT) by major players in the aerospace (e.g., Boeing, Lockheed Martin) and automotive sectors. The region benefits from robust R&D spending and a dense ecosystem of specialized 3D printing service bureaus requiring high-quality, certified infiltrant materials. Strong regulatory frameworks ensure high demand for traceable and consistent polymer and metal infiltrants, particularly within the medical device manufacturing hub of the United States.

- Asia Pacific (APAC): Expected to register the highest growth rate driven by massive industrialization, high investments in domestic manufacturing capabilities (China, Japan, South Korea), and the rapid scaling of BJT for both tooling (sand cores and molds) and metal part production. The region's focus on high-volume, cost-effective manufacturing processes makes infiltration an attractive post-processing solution for achieving mechanical strength without the high cost of fully dense sintering.

- Europe: A mature market characterized by stringent quality standards, especially in Germany (Industrial Machinery) and the UK (Aerospace). Europe exhibits a strong demand for high-performance ceramic and specialized metal infiltrants used in complex machinery and biomedical applications. The market is supported by strong collaborations between chemical companies and technology institutes focused on optimizing sustainable and energy-efficient infiltration techniques.

- Latin America (LATAM): A nascent market with growing adoption primarily in the automotive spare parts and localized medical device manufacturing sectors. Growth is steady, focused mainly on leveraging cost-effective polymer infiltration to enhance prototypes and small-batch production parts, relying heavily on imported infiltrant materials and technologies.

- Middle East and Africa (MEA): Growth is concentrated in the energy (oil and gas) and defense sectors, where AM is being explored for localized production of critical spare parts and tooling components requiring high durability and corrosion resistance achieved through metal infiltration. The implementation scale is smaller but characterized by high-value applications demanding premium material performance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 3D Print Infiltrants Market.- Heraeus

- Höganäs AB

- BASF SE

- Dymax Corporation

- Loctite (Henkel)

- Huntsman Corporation

- ExOne (Desktop Metal)

- voxeljet AG

- Stratasys

- 3M

- EOS GmbH

- Advanced Ceramics Manufacturing (ACM)

- Uniformity Labs

- Carpenter Technology Corporation

- Sandvik AB

- Kennametal Inc.

- DDM

- Renishaw plc

- Arcam EBM (GE Additive)

- Lithoz GmbH

Frequently Asked Questions

Analyze common user questions about the 3D Print Infiltrants market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of 3D print infiltrants in additive manufacturing?

The primary function of infiltrants is to densify and strengthen porous 3D-printed parts, typically produced via Binder Jetting. By filling the internal voids, infiltrants significantly improve the component's mechanical properties, surface finish, hardness, and corrosion resistance, transforming fragile green parts into durable, end-use functional components.

Which 3D printing technology most relies on infiltration for component performance?

Binder Jetting (BJT) technology relies most heavily on infiltration. BJT produces parts that are highly porous after printing and de-binding; infiltration is a critical post-processing step required to achieve the desired material density and strength necessary for industrial applications, particularly for metal and sand components.

What are the main types of infiltrant materials used in the market?

The main types include Metal-Based Infiltrants (predominantly copper and bronze alloys used for steel parts), and Polymer-Based Infiltrants (such as epoxies and resins used for enhancing the strength and surface quality of polymer or sand printed parts and tools).

How does infiltration compare to sintering in achieving part density?

While full sintering attempts to achieve density by fusing the base powder, infiltration achieves density by filling the remaining pores with a secondary material. Infiltration often results in parts with higher dimensional accuracy and requires lower process temperatures than full sintering, offering a crucial trade-off between final density, strength, and cost efficiency.

Which end-user industries are driving the demand for advanced metal infiltrants?

The Aerospace and Defense, and Automotive sectors are the main drivers for advanced metal infiltrants. These industries require high-performance, structurally sound components with excellent mechanical and thermal stability, which metal infiltration effectively delivers, especially for complex geometries produced in large batches.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager