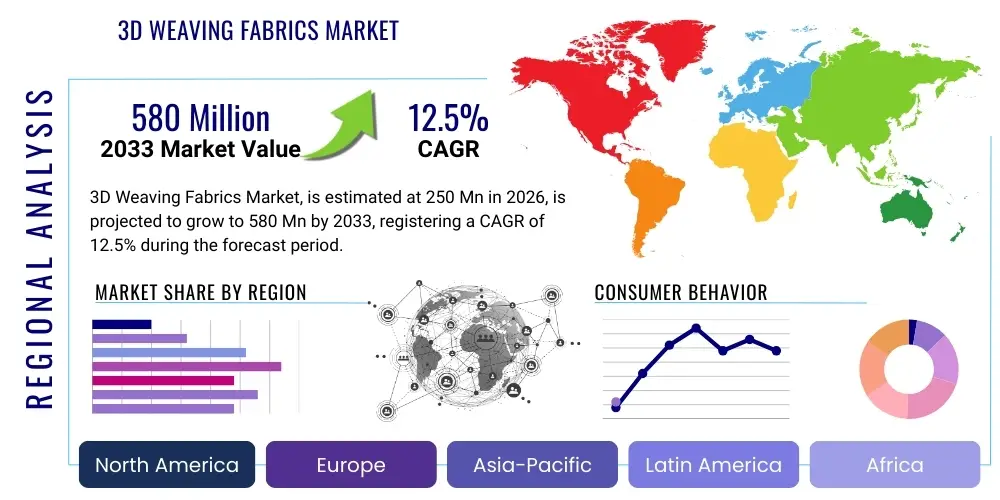

3D Weaving Fabrics Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442475 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

3D Weaving Fabrics Market Size

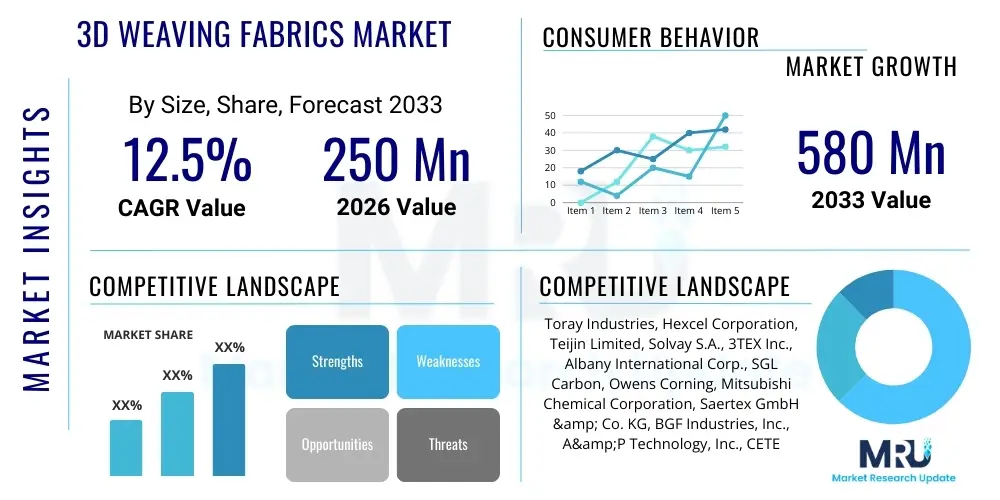

The 3D Weaving Fabrics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $250 Million in 2026 and is projected to reach $580 Million by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the escalating demand for high-performance, lightweight composite materials across critical industries such as aerospace, automotive, and wind energy. These fabrics, defined by their multi-axial interlacement, offer superior structural integrity, significantly reducing the risk of delamination compared to traditional 2D layered composites, making them essential for applications requiring exceptional mechanical strength and durability under extreme stress conditions.

The valuation reflects the increasing investment in advanced textile machinery capable of producing complex 3D preforms. Manufacturers are recognizing the efficiency gains and material waste reduction offered by near-net-shape manufacturing techniques inherent in 3D weaving. Furthermore, the rising adoption of carbon fiber and glass fiber 3D woven structures in the commercial aircraft sector, where stringent safety standards and weight reduction are paramount, significantly contributes to the market expansion and valuation trajectory over the forecast period. The market size projection is underpinned by continuous research and development focused on optimizing fiber orientation and geometric complexity to enhance component performance.

3D Weaving Fabrics Market introduction

The 3D Weaving Fabrics Market encompasses the manufacturing and application of textile structures where fibers are interwoven in three orthogonal directions (X, Y, and Z axes), creating monolithic preforms that are subsequently infiltrated with a polymer or ceramic matrix to form advanced composite parts. These fabrics are fundamentally different from conventional 2D woven fabrics, which only involve planar interlacement, by offering through-thickness reinforcement, drastically improving impact resistance, fatigue life, and fracture toughness. This technological leap allows engineers to design components with precise, tailored mechanical properties required for demanding structural applications where material failure is catastrophic, such as aircraft wings, engine casings, and high-pressure vessels.

The primary applications of 3D woven fabrics are concentrated in sectors demanding superior strength-to-weight ratios and high reliability. The aerospace and defense industries utilize these materials for structural components, missile nose cones, and thermal protection systems. In the automotive industry, 3D woven composites are increasingly employed in lightweight chassis components and battery enclosures for electric vehicles to enhance energy efficiency and safety. Furthermore, the market benefits significantly from the expansion of renewable energy, particularly wind turbine blades, where these fabrics ensure enhanced stiffness and longevity against environmental stresses. The core benefit derived from 3D weaving is the elimination of delamination, a common failure mode in traditional layered composites, ensuring structural longevity.

Driving factors for this specialized market include the global imperative for lightweighting to improve fuel efficiency and reduce emissions across transport sectors, coupled with technological advancements in automated weaving machinery that reduce production costs and time. The inherent ability of 3D weaving to produce complex, net-shape geometries minimizes post-processing waste, aligning with sustainable manufacturing goals. However, the market growth is also dependent on overcoming technical restraints such as the initial high capital investment for specialized looms and the need for standardized testing procedures specific to these complex fiber architectures. The versatility of raw materials, including carbon, glass, aramid, and ceramic fibers, continues to broaden the scope of applications, securing its crucial position in the future of advanced materials engineering.

3D Weaving Fabrics Market Executive Summary

The 3D Weaving Fabrics Market is poised for robust expansion, characterized by significant business trends focused on vertical integration and strategic partnerships between material suppliers and aerospace/automotive original equipment manufacturers (OEMs). Key business drivers include the necessity for increased production speed and cost-efficiency in composite preform manufacturing, pushing companies towards automation and the development of high-speed, multi-layer weaving technology. Investment influx is concentrated in regions prioritizing high-tech manufacturing and sustainable material solutions, particularly where stringent emissions regulations drive the adoption of lightweight materials. The competitive landscape is becoming increasingly specialized, with companies focusing on patented weaving patterns and fiber combinations tailored for specific end-use requirements, such as enhanced ballistic resistance or superior stiffness-to-weight performance.

Regionally, North America and Europe currently dominate the market due to the robust presence of major aerospace and defense contractors, high R&D spending, and early adoption of advanced materials standards. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by rapid industrialization, expanding domestic automotive and infrastructure sectors, and increasing government investment in localized advanced manufacturing capabilities, particularly in China and India. The regional dynamics are heavily influenced by raw material accessibility, notably carbon fiber production capacity, and the development of regional supply chains capable of handling large-scale 3D preform production necessary for applications like large wind turbine components.

Segment trends highlight the dominance of carbon fiber-based 3D woven fabrics, driven by their unparalleled strength and stiffness suitable for mission-critical structural components. However, glass fiber composites are seeing expanding usage in cost-sensitive industrial and construction applications. By application, the aerospace and defense segment remains the primary revenue generator due to the premium pricing and high performance requirements, while the automotive segment represents the fastest-growing opportunity, driven by the electric vehicle revolution and the necessity for mass-produced, lightweight structural components that offer improved crash energy absorption. Technological segmentation points towards increased demand for orthogonal and angle interlock weaving techniques, as these methods offer the most optimized balance between through-thickness reinforcement and in-plane properties.

AI Impact Analysis on 3D Weaving Fabrics Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the 3D Weaving Fabrics Market primarily revolve around optimizing complex manufacturing processes, ensuring quality control, and accelerating material design cycles. Common questions include: "How can AI optimize the weaving path for complex geometries?", "Can machine learning predict defects in real-time during weaving?", and "What role does AI play in simulating the mechanical performance of new 3D woven structures?". The consensus expectation is that AI will revolutionize productivity by enabling predictive maintenance for specialized weaving looms and facilitating rapid design iterations. Key concerns center on the initial data requirements needed to train robust AI models specific to highly variable fiber materials and intricate weaving architectures.

The analysis indicates a strong user expectation that AI will move the industry toward 'smart manufacturing.' Specifically, AI algorithms are anticipated to dramatically reduce material waste by calculating the optimal fiber volume fraction and yarn tension settings specific to each layer of the 3D preform, thereby minimizing off-specification production runs. Furthermore, machine vision systems integrated with AI are expected to provide continuous, high-resolution inspection of the weaving process, immediately identifying anomalies or fiber breakage that could compromise the final composite part's structural integrity, a critical capability for aerospace components where zero defects are mandatory.

Ultimately, the impact of AI is expected to democratize the design process, allowing non-specialized engineers to input required mechanical properties (e.g., stiffness, impact resistance) and have the AI generate optimized 3D weaving patterns and machine code. This shift from iterative physical prototyping to rapid digital simulation and optimization, powered by machine learning, will drastically shorten the time-to-market for novel composite materials. This digital transformation is critical for maintaining competitiveness, especially as the demand for customized, high-performance 3D woven composites continues to escalate across various end-user industries.

- AI-driven optimization of loom parameters (tension, speed, density) for maximum material homogeneity.

- Predictive quality control through machine vision and deep learning models identifying real-time structural defects.

- Accelerated material design and simulation, correlating weaving patterns with resultant mechanical properties (Digital Twin creation).

- Enhancement of supply chain logistics and inventory management for specialized high-cost fiber spools.

- Automated fault detection and predictive maintenance for specialized 3D weaving machinery, minimizing downtime.

- Customization engine development for rapid generation of weaving paths for complex, non-standard geometries.

DRO & Impact Forces Of 3D Weaving Fabrics Market

The 3D Weaving Fabrics Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces determining its future trajectory. A primary driver is the unparalleled demand for high-performance structural composites in safety-critical applications, where the delamination resistance offered by 3D structures provides a distinct competitive edge over conventional laminates. This intrinsic structural superiority is coupled with the pressure from global regulatory bodies to improve fuel efficiency and reduce carbon emissions, directly encouraging the adoption of lightweight composite components in transportation sectors. Simultaneously, the market is restrained by the steep initial capital expenditure required for specialized 3D weaving equipment, necessitating high production volumes to achieve cost parity with traditional composite methods, alongside a limited pool of skilled labor proficient in operating and maintaining these complex textile systems. The key opportunities lie in expanding applications into new, high-volume sectors like civil infrastructure and medical implants, alongside the development of advanced hybrid 3D woven preforms utilizing combinations of dissimilar fibers for multi-functional materials.

Impact forces are strongly positive, driven by technological maturation and expanding industrial acceptance. The inherent strength of the market is anchored in aerospace and defense programs, which set the standard for material performance and subsequently trickle down requirements to other industries. The ability to produce near-net-shape parts significantly reduces material waste and labor-intensive composite layup processes, offering an economic benefit that helps mitigate the high initial tooling cost over the long term. This manufacturing efficiency is a crucial impact force, promoting wider adoption across industrial machinery and heavy equipment manufacturing where material durability is paramount but traditional composite manufacturing complexities were previously prohibitive.

However, external impact forces such as volatile raw material costs, particularly for aerospace-grade carbon fiber, pose a constant challenge to market stability and pricing strategies. Standardization of testing methodologies for complex 3D woven structures remains an ongoing effort; without universally accepted performance metrics, adoption in new regulated industries can be slow. Nonetheless, ongoing collaborative research between academic institutions and industrial consortia focused on developing novel automated post-processing techniques (e.g., resin injection under pressure) further strengthens the market's long-term viability, positioning 3D woven fabrics as a cornerstone technology for the next generation of advanced composite manufacturing.

Segmentation Analysis

The 3D Weaving Fabrics Market is structurally segmented based on crucial attributes including material type, application, and weaving technology, allowing for targeted analysis of market dynamics and opportunity identification. Material type segmentation—which includes Carbon Fiber, Glass Fiber, Aramid Fiber, and others—is driven by performance requirements, cost sensitivity, and structural constraints of the end application. Carbon fiber dominates high-end segments due to superior specific stiffness and strength, whereas glass fiber caters to cost-efficient, high-volume industrial applications. Application segmentation—covering Aerospace & Defense, Automotive, Wind Energy, and Industrial—demonstrates the critical role of these fabrics in lightweighting initiatives across transport and energy generation. Furthermore, the market is differentiated by the specific weaving technology utilized, such as orthogonal and angle interlock weaving, each offering distinct advantages in terms of structural properties and manufacturing complexity.

The strategic importance of segmentation lies in understanding the differing value propositions across these categories. For instance, the demand profile in the Aerospace sector mandates complex, customized orthogonal interlock structures using high-modulus carbon fiber, justifying premium pricing. Conversely, the Wind Energy sector requires larger volumes of lower-cost preforms, often leveraging glass or lower-grade carbon fiber processed via simplified weaving patterns to maximize throughput. These distinctions dictate R&D focus; manufacturers targeting the automotive segment are heavily investing in high-rate, automated production capabilities suitable for mass-market vehicle platforms, whereas those focused on defense emphasize material robustness and thermal resistance.

Analyzing these segments reveals that while high-performance materials currently drive the revenue, the fastest growth is anticipated in the energy and industrial segments as the technology becomes more accessible and cost-effective. The differentiation based on weaving technique is particularly critical as it directly impacts the Z-axis reinforcement capability; orthogonal weaving provides the maximum through-thickness strength, highly valued in components subjected to severe impact or through-thickness loading, solidifying its position in advanced structural applications. The continuous evolution of hybrid structures, combining thermoplastic matrices with woven preforms, represents a significant upcoming sub-segment opportunity, offering enhanced recyclability and faster processing times compared to traditional thermoset composites.

- By Material Type:

- Carbon Fiber 3D Woven Fabrics

- Glass Fiber 3D Woven Fabrics

- Aramid Fiber 3D Woven Fabrics

- Other High-Performance Fibers (e.g., Ceramic, Basalt)

- By Application:

- Aerospace and Defense (Structural Components, Engine Parts, Radomes)

- Automotive (Chassis, Battery Housings, Body Panels)

- Wind Energy (Turbine Blades, Nacelles)

- Industrial (Pressure Vessels, Pipes, Robotics)

- Medical (Prosthetics, Orthopedic Devices)

- By Weaving Technology:

- Orthogonal Interlock Weaving

- Angle Interlock Weaving

- Layer-to-Layer Weaving

- Multi-layer Weaving

Value Chain Analysis For 3D Weaving Fabrics Market

The Value Chain for the 3D Weaving Fabrics Market is highly specialized and begins with the upstream procurement of high-cost precursor materials, primarily carbon fiber, glass fiber, and specialized polymer yarns. Upstream analysis focuses on securing stable, cost-effective supplies of these high-performance fibers, where pricing volatility and geopolitical stability often influence manufacturing costs. Fiber manufacturers, such as Toray Industries and Hexcel Corporation, hold significant leverage in the early stage of the chain. This stage also includes the highly specialized machinery manufacturers (e.g., high-speed looms) required for intricate 3D preform creation. The efficient management of raw material inventory and quality assurance at this stage is crucial, as any variability in fiber properties directly impacts the mechanical performance of the final composite structure.

The core of the value chain involves the 3D weaving process itself, where specialized textile manufacturers convert raw yarns into near-net-shape 3D preforms. This stage requires significant technical expertise and intellectual property related to weaving patterns and automation. Following the weaving, the downstream segment involves composite manufacturing, where the dry 3D preforms are infiltrated with a matrix material (typically epoxy, phenolic, or ceramic resin) through processes like Resin Transfer Molding (RTM) or Vacuum-Assisted RTM (VARTM). This matrix infusion process is critical for transforming the dry fabric into a rigid, load-bearing composite part. Quality assurance and non-destructive testing (NDT) methodologies are heavily emphasized in this downstream stage, particularly for safety-critical applications in aerospace and defense.

Distribution channels are typically direct or highly controlled indirect routes due to the bespoke nature and high value of the final products. Direct distribution is prevalent for high-volume or highly customized orders, especially those supplied to major OEMs in the aerospace and automotive sectors who often require integrated technical support and confidentiality. Indirect channels involve specialized composite distributors or value-added resellers who manage smaller, project-based requirements for industrial customers. The supply chain demands robust traceability and certification, ensuring that the entire process, from fiber origin to finished component, meets stringent industry standards. The high barrier to entry for both specialized weaving and composite manufacturing ensures that the competitive landscape remains focused on technical superiority and established supplier-customer relationships.

3D Weaving Fabrics Market Potential Customers

The primary customers for 3D Weaving Fabrics are large-scale manufacturers and defense contractors operating in sectors that prioritize safety, performance, and weight reduction above initial material cost. Key end-users include commercial and military aircraft manufacturers (e.g., Boeing, Airbus, Lockheed Martin) who require robust, fatigue-resistant structures for wings, fuselages, and engine components where failure is unacceptable. The integration of 3D woven materials into next-generation aircraft designs is driven by the need to achieve higher operational efficiency and payload capacity through significant weight reduction and enhanced structural resilience, making these aerospace OEMs the highest-value segment of buyers.

Another significant customer base resides within the high-performance automotive sector, increasingly expanding into the mass-market electric vehicle (EV) segment. Automotive OEMs are purchasing 3D woven preforms for structural components such as crash boxes, roof pillars, and complex battery casings. These buyers are motivated by the need for materials that can provide superior crash energy absorption and maintain structural integrity under impact, while simultaneously contributing to the overall lightweighting necessary to extend EV battery range. The buying criteria for this segment are strongly influenced by the manufacturer's ability to supply large volumes reliably and consistently, alongside meeting strict cost-down targets over the vehicle lifecycle.

Furthermore, major wind energy corporations and industrial equipment manufacturers constitute a rapidly expanding customer group. Wind turbine blade manufacturers specifically seek 3D woven glass and carbon fiber structures to enhance blade stiffness and longevity, particularly for increasingly large offshore turbines. Industrial buyers, including those producing pressure vessels, specialized piping, and composite tooling, require materials that offer enhanced resistance to thermal cycling and chemical corrosion. These diverse customer segments share a common need: a proven, reliable material solution that mitigates catastrophic failure modes inherent to traditional layered composites, thereby justifying the higher material cost associated with 3D weaving technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $250 Million |

| Market Forecast in 2033 | $580 Million |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Toray Industries, Hexcel Corporation, Teijin Limited, Solvay S.A., 3TEX Inc., Albany International Corp., SGL Carbon, Owens Corning, Mitsubishi Chemical Corporation, Saertex GmbH & Co. KG, BGF Industries, Inc., A&P Technology, Inc., CETEX Composites, Bally Ribbon Mills, Sigmatex (UK) Ltd., P-A-S Technologies, Inc., Composite Textiles Inc., Chomarat Group, Vectorply Corporation, VECCO Fabrics LLC |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

3D Weaving Fabrics Market Key Technology Landscape

The technological landscape of the 3D Weaving Fabrics Market is characterized by highly sophisticated loom designs, advanced automation, and innovations in yarn handling systems designed to manage fragile high-modulus fibers. The core technology centers around specialized multi-directional looms capable of creating complex fiber architectures, moving beyond traditional 2D shuttle-based weaving. Key advancements include the development of Jacquard-based systems that offer precise control over individual warp yarns, enabling the creation of intricate, non-uniform cross-sections and near-net-shape structures that minimize material wastage. Furthermore, significant R&D is focused on high-speed insertion mechanisms and automatic defect detection systems, aiming to elevate the productivity and quality consistency of the weaving process, which is essential for penetrating high-volume markets like automotive manufacturing.

A crucial technological trend involves the transition from simple orthogonal interlock structures to highly complex angle interlock and layer-to-layer weaving patterns. Angle interlock technology, in particular, offers superior in-plane shear strength while maintaining excellent through-thickness resistance, providing an optimized solution for components subjected to multi-axial stress fields. The ability to precisely control the angle of the Z-binder yarn placement allows engineers to tailor the composite’s properties to specific load cases, a capability traditional 2D layups cannot match. Research into hybrid fiber materials, combining, for example, high-modulus carbon with ductile aramid fibers within the same woven preform, represents another area of technological innovation, yielding composite structures with multi-functional properties such as simultaneous high strength and improved impact tolerance.

The integration of digital manufacturing tools, including Computer-Aided Weaving (CAW) software, is fundamentally changing how 3D preforms are designed and manufactured. These advanced software platforms allow for the simulation of the weaving process before production, predicting structural integrity and optimizing fiber paths to reduce internal stress concentrations and minimize post-infiltration porosity. Resin infusion technology, while downstream, is also tightly integrated with the weaving process; the design of the 3D preform's internal architecture must accommodate efficient and complete resin flow to ensure a void-free composite. Therefore, technological advancements are converging across textile engineering, material science, and computational modeling to continually push the boundaries of what is possible in composite structure creation.

Regional Highlights

- North America: North America, particularly the United States, represents the largest revenue share in the 3D Weaving Fabrics Market, predominantly driven by massive investment in the aerospace and defense sectors. The region benefits from established supply chains, high R&D expenditure, and the presence of leading composite material manufacturers and specialized weaving companies. The stringent regulatory requirements for aircraft safety necessitate the use of 3D woven composites for critical structural components, ensuring sustained demand. Furthermore, the burgeoning commercial space industry and the rapid deployment of advanced military platforms continue to propel market growth, focused heavily on carbon fiber and high-temperature ceramic woven structures. The transition towards electric vertical takeoff and landing (eVTOL) aircraft also contributes to the heightened demand for lightweight 3D composite solutions.

- Europe: Europe holds a strong position, characterized by significant industrial clusters in Germany, France, and the UK, focusing heavily on automotive lightweighting and wind energy applications. The region is a leader in implementing renewable energy solutions, driving the demand for large-scale 3D woven glass fiber and carbon fiber preforms for offshore wind turbine blades. European manufacturers are also actively developing complex automated weaving processes to meet the high production rates required by premium and electric vehicle manufacturers. Key drivers include stringent EU carbon emission targets and strong governmental support for sustainable, advanced manufacturing technologies, fostering innovation in resin systems compatible with 3D preforms.

- Asia Pacific (APAC): The APAC region is projected to register the highest growth rate during the forecast period. This rapid expansion is fueled by massive infrastructure development, increasing defense modernization budgets (especially in China and India), and the exponential growth of the domestic automotive and consumer electronics markets. While historically reliant on imports for high-end fibers, regional players are rapidly expanding local production capacities for both carbon fiber precursors and advanced weaving machinery. The market growth here is cost-sensitive but voluminous, necessitating the development of regional strategies focused on efficient, high-throughput manufacturing of 3D woven materials for mass-market applications and industrial machinery.

- Latin America: The Latin American market for 3D weaving fabrics is nascent but shows potential, primarily concentrated in high-value niche applications such as regional aerospace repair and maintenance (MRO) and specific industrial projects related to oil and gas infrastructure where structural integrity is paramount. Growth is constrained by lower overall R&D spending and limited access to specialized manufacturing technology, making it heavily reliant on imported materials and expertise. However, the expanding construction sector and governmental focus on developing localized manufacturing bases offer long-term growth opportunities, particularly for glass fiber-based 3D composites.

- Middle East and Africa (MEA): The MEA region is characterized by steady investment in defense spending and large-scale infrastructure projects. Demand is primarily driven by military applications, oil and gas piping, and specialized construction materials requiring high durability and corrosion resistance. The region is heavily influenced by large government contracts and foreign direct investment into specialized manufacturing capabilities, particularly in the UAE and Saudi Arabia. Market maturity is low, but the focus on diversifying economies away from oil revenue, particularly through developing localized high-tech manufacturing, presents a tangible future growth vector for advanced composite materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 3D Weaving Fabrics Market. These companies are instrumental in driving technological innovation, defining industry standards, and expanding global production capacity for complex composite preforms. Their strategic focus includes automating weaving processes, optimizing fiber architectures, and integrating upstream material supply chains to ensure consistency and cost-efficiency in end-product delivery.- Toray Industries, Inc.

- Hexcel Corporation

- Teijin Limited

- Solvay S.A.

- 3TEX Inc.

- Albany International Corp.

- SGL Carbon

- Owens Corning

- Mitsubishi Chemical Corporation

- Saertex GmbH & Co. KG

- BGF Industries, Inc.

- A&P Technology, Inc.

- CETEX Composites

- Bally Ribbon Mills

- Sigmatex (UK) Ltd.

- P-A-S Technologies, Inc.

- Composite Textiles Inc.

- Chomarat Group

- Vectorply Corporation

- VECCO Fabrics LLC

Frequently Asked Questions

Analyze common user questions about the 3D Weaving Fabrics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of 3D woven fabrics over traditional 2D composites?

The primary advantage is superior delamination resistance. Traditional 2D composites, being layered, are prone to failure between plies when subjected to impact or out-of-plane stress. 3D weaving incorporates Z-axis reinforcement, creating a monolithic structure with significantly enhanced fracture toughness and structural integrity, especially critical in high-stress aerospace applications.

Which industries are the major consumers of 3D Weaving Fabrics?

The major consumer industries are Aerospace and Defense, driven by the need for mission-critical, high-performance lightweight components, and the Automotive sector, rapidly adopting these materials for electric vehicle battery enclosures and structural safety components to improve range and crash energy management.

What materials are commonly used in 3D woven structures?

The most common materials are high-performance synthetic fibers, including Carbon Fiber (for maximum stiffness and strength), Glass Fiber (for cost-sensitive industrial and energy applications), and Aramid Fiber (known for impact resistance and ballistic protection). Hybrid structures combining these fibers are also increasingly used to achieve tailored mechanical responses.

What are the main technical challenges facing the 3D Weaving Fabrics Market?

Key technical challenges include the high initial capital investment required for specialized multi-axial weaving machinery, the complexity of designing optimal weaving patterns for non-standard geometries, and the current limitations in production speed required to compete with high-volume, traditional manufacturing methods.

How does 3D weaving contribute to sustainable manufacturing practices?

3D weaving contributes to sustainability by enabling the production of near-net-shape preforms. This process significantly reduces material waste compared to traditional composite manufacturing techniques, which typically involve substantial trimming and scrap of expensive raw materials like carbon fiber during the layup and cutting phases.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager