4K Ultra HD Television Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443327 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

4K Ultra HD Television Market Size

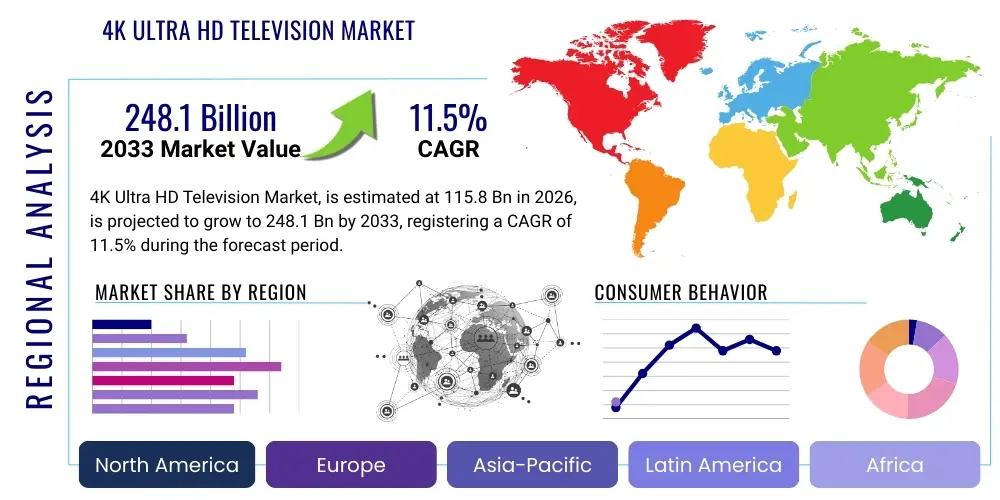

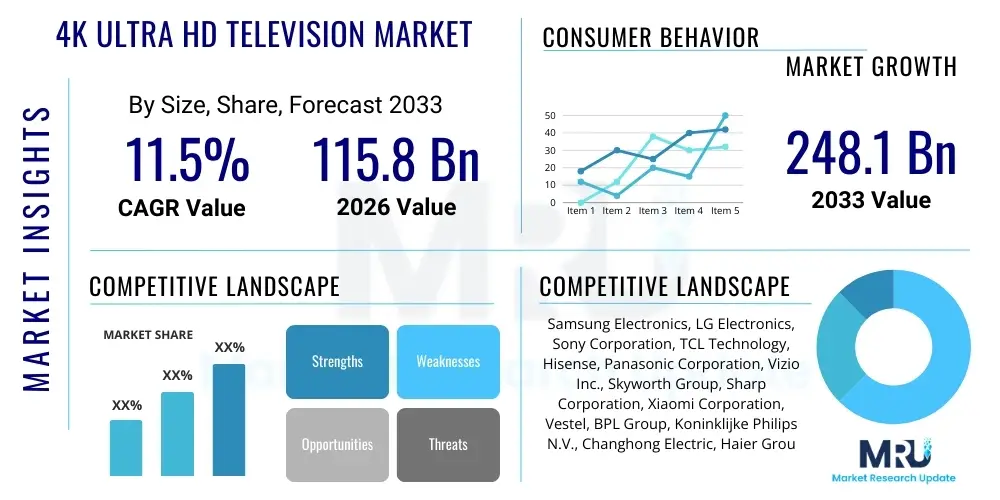

The 4K Ultra HD Television Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 115.8 Billion in 2026 and is projected to reach USD 248.1 Billion by the end of the forecast period in 2033.

4K Ultra HD Television Market introduction

The 4K Ultra HD Television Market encompasses the global sales and proliferation of television sets featuring a minimum resolution of 3840 x 2160 pixels, commonly referred to as 4K resolution. These devices offer four times the pixel count of standard Full HD (1080p) televisions, resulting in significantly enhanced image clarity, detail, and immersive viewing experiences. The market includes a wide array of display technologies, such as OLED, QLED, and traditional LED/LCD, catering to diverse consumer preferences regarding contrast ratio, color fidelity, and price points. The core product evolution is centered around integrating advanced processing capabilities, smart connectivity features, and high dynamic range (HDR) compatibility to maximize the potential of the high-resolution format.

Major applications for 4K Ultra HD televisions span across residential entertainment, commercial digital signage, and specialized professional monitoring environments. In the residential sector, they are indispensable for streaming high-quality video content, experiencing next-generation gaming consoles (PS5 and Xbox Series X), and integrating into sophisticated home theater setups. The primary benefits driving consumer adoption include unparalleled visual fidelity, improved color gamut representation through technologies like Quantum Dots, and increasing availability of native 4K content across major streaming platforms such as Netflix, Amazon Prime Video, and Disney+. Furthermore, improved upscaling technologies allow legacy content to benefit significantly from the higher pixel density, making the transition seamless for consumers.

Key driving factors propelling market expansion include the sustained decline in the average selling price of 4K panels, making the technology accessible to middle-income demographics globally. The continuous infrastructure upgrade in broadband connectivity and 5G deployment facilitates seamless 4K content delivery. The replacement cycle for older Full HD and HD TVs, coupled with aggressive marketing and product launches by leading manufacturers focusing on premium features like higher refresh rates (120Hz) and advanced AI-driven picture processing, further solidifies the market trajectory towards robust growth.

4K Ultra HD Television Market Executive Summary

The global 4K Ultra HD Television Market is characterized by intense technological competition, rapidly evolving display standards, and strong consumer demand for larger screen sizes and immersive smart features. Business trends indicate a strategic shift by manufacturers towards premium segments, particularly focusing on OLED and QLED technologies, where higher profit margins can be sustained despite global supply chain pressures. Key market players are heavily investing in proprietary processor chips to enhance image upscaling, motion handling, and smart functionality, thereby differentiating their product offerings in a highly commoditized segment. Consolidation among panel suppliers and a focus on localized manufacturing resilience are defining ongoing operational adjustments.

Regionally, the Asia Pacific (APAC) continues to dominate the market, driven by rapidly increasing disposable incomes, high population density, and aggressive promotional strategies in emerging economies like India and Southeast Asia, complementing the mature markets of China, Japan, and South Korea. North America and Europe demonstrate robust demand for high-end, large-format 4K TVs (65 inches and above), characterized by quick adoption of cutting-edge technologies like 8K readiness and MicroLED previews. Latin America and MEA are experiencing steady growth, fueled by urbanization and the expansion of digital broadcasting infrastructure, positioning them as significant growth pockets for mid-range 4K models.

Segment trends highlight the persistent dominance of screen sizes between 55 and 65 inches in developed markets, offering an optimal balance between viewing immersion and practical living space integration. Technology segmentation shows that LED/LCD remains the volume leader, but OLED and QLED technologies are capturing increasing market share in the value segment due to their superior contrast and color performance. Distribution channels are witnessing a continued shift towards e-commerce platforms, offering competitive pricing and greater product variety, although brick-and-mortar retail remains crucial for consumers seeking detailed demonstrations and consultation before purchasing premium models.

AI Impact Analysis on 4K Ultra HD Television Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the 4K Ultra HD Television Market predominantly revolve around three critical areas: image quality enhancement, smart interaction capabilities, and content personalization. Consumers are highly interested in how AI processors improve upscaling of non-native 4K content, ensuring sharpness and detail without artifacts. Key concerns also address the efficacy of AI in dynamic content optimization, such as real-time scene analysis for adjusting brightness and color (AI Picture Modes), and expectations surrounding future AI integration in smart home ecosystems, enabling seamless voice control and automated optimization of viewing settings based on ambient light and user habits. The overarching theme is the transition of the television from a passive display device to an intelligent, adaptive home hub.

AI is transforming the 4K television experience by shifting processing power from static algorithms to neural network-driven analysis. Modern 4K TVs utilize deep learning models trained on vast image databases to identify objects, textures, and scenes in real-time. This allows the TV’s processor to intelligently apply noise reduction, texture mapping, and contrast boosting with unprecedented accuracy, often exceeding the capabilities of human-engineered manual settings. Furthermore, AI algorithms power sophisticated smart television operating systems, learning user consumption patterns, optimizing recommendations, and managing connected smart devices.

This deep integration of AI not only addresses current challenges related to disparate content quality (from high-bitrate streams to lower-resolution cable broadcasts) but also prepares the groundwork for the next generation of visual experiences. As display technology reaches saturation in terms of pixel density, AI becomes the primary differentiator for picture quality, enabling highly optimized, personalized, and context-aware viewing. This technological leap mandates significant R&D investment from leading manufacturers to develop proprietary, powerful system-on-chips (SoCs) capable of executing complex AI computations locally and instantaneously.

- AI-Enhanced Upscaling: Utilizes deep learning to convert lower-resolution content (HD, FHD) to near-4K quality by accurately restoring lost texture and detail.

- Dynamic Picture Optimization: Real-time analysis of video content (scenes, objects, genres) to dynamically adjust brightness, color volume, and contrast settings frame-by-frame.

- Smart Platform Personalization: AI algorithms manage content recommendations, app prioritization, and profile-specific user interface customization based on viewing history.

- Voice and Gesture Control Integration: Advanced natural language processing (NLP) enables seamless, far-field voice commands for navigation and device control.

- Ambient Intelligence: Sensors and AI work together to automatically adjust screen brightness and tone based on room lighting conditions and time of day (e.g., adaptive tone mapping).

- Gaming Optimization: AI-driven latency reduction and motion smoothing specifically tailored for variable refresh rate (VRR) compatibility and high-speed input response.

DRO & Impact Forces Of 4K Ultra HD Television Market

The 4K Ultra HD Television Market is fundamentally influenced by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the Impact Forces shaping its competitive landscape and growth trajectory. Key drivers include the continuous price erosion of 4K panel technology and the widespread availability of native 4K content from major global distributors. Opportunities arise significantly from the rapid development of ancillary technologies such as 8K displays and MicroLED, which drive R&D investment and subsequent improvements in 4K display efficiency and performance. However, market restraints, primarily concerning economic volatility, geopolitical trade tensions affecting global supply chains, and consumer confusion regarding diverse display standards (HDR10+, Dolby Vision, various QLED iterations), necessitate cautious strategic planning by manufacturers.

The principal driver remains the accelerated consumer demand for larger screen formats, where the benefits of 4K resolution become most palpable. As average living spaces expand and prices for 65-inch and 75-inch models drop, 4K is becoming the minimum acceptable standard, accelerating the replacement cycle. Concurrently, the proliferation of next-generation gaming consoles requiring HDMI 2.1 features—such as 4K resolution at 120Hz, Variable Refresh Rate (VRR), and Auto Low Latency Mode (ALLM)—has galvanized a significant segment of technology-savvy buyers, forcing manufacturers to integrate these advanced connectivity standards rapidly.

However, the market faces significant restraints, including the energy consumption concerns associated with extremely large 4K and forthcoming 8K panels, leading to tighter regulatory standards in regions like Europe. Another crucial restraint is the infrastructural bottleneck in many regions regarding sufficient broadband capacity to reliably stream high-bitrate 4K content, impacting user experience and perceived value. The primary opportunity lies in the convergence of AI, IoT, and display technology, positioning the 4K TV as the central hub for the smart home ecosystem, opening new revenue streams through enhanced software services, advertising, and content subscription partnerships.

Segmentation Analysis

The 4K Ultra HD Television Market segmentation provides a crucial framework for understanding consumer behavior, technological adoption, and market revenue streams. The market is primarily segmented based on Display Technology, Screen Size, Component, and Distribution Channel. Display technology segmentation distinguishes between mature LED/LCD sets, premium OLED models offering perfect black levels, and emerging QLED (Quantum Dot LED) technology, which provides enhanced color brightness. Screen size segmentation is vital for analyzing geographical consumption patterns, with 55-inch to 65-inch models dominating mature markets, reflecting the preference for immersive viewing. Component analysis focuses on the underlying hardware, including display panels, smart TV processors (SoCs), and backlighting systems, crucial for understanding supply chain dynamics and technological differentiation.

Segmentation by Distribution Channel reflects the strategic shift towards maximizing reach and minimizing operational overhead. The Online segment, encompassing dedicated e-commerce platforms and manufacturer direct-to-consumer websites, continues to gain prominence due to aggressive discounting, detailed product information, and logistical efficiencies. Conversely, the Offline segment, comprising hypermarkets, specialized electronics stores, and regional retailers, remains essential for providing personalized sales consultation, demonstration of image quality (especially for high-end models), and immediate product availability. The balance between these channels is constantly monitored, as high-value transactions often rely on a multi-channel approach involving online research and in-store purchase.

Further granularity exists within the application segment, differentiating between residential use (the largest segment) and commercial/professional use (hotels, corporate lobbies, control rooms, and digital out-of-home advertising). The requirements for commercial use often prioritize durability, higher peak brightness for brightly lit environments, and robust connectivity management systems, contrasting with the residential focus on cinematic quality, smart features, and aesthetic design. Analyzing these segments is critical for manufacturers tailoring marketing strategies and product development roadmaps to specific consumer needs and economic sensitivities.

- By Display Technology:

- LED/LCD

- OLED (Organic Light-Emitting Diode)

- QLED (Quantum Dot LED)

- MicroLED (Emerging/High-end)

- By Screen Size:

- Below 50 Inches (e.g., 40-49 inches)

- 50 to 65 Inches

- Above 65 Inches (e.g., 75 inches and higher)

- By Component:

- Display Panels (Glass, Backlight Units)

- Smart TV Processors (SoCs)

- Connectivity Modules (Wi-Fi, Bluetooth)

- Peripheral Components

- By Distribution Channel:

- Offline Retail (Hypermarkets, Specialty Stores)

- Online Retail (E-commerce, Manufacturer Websites)

- By Application:

- Residential

- Commercial (Hospitality, Corporate, Digital Signage)

Value Chain Analysis For 4K Ultra HD Television Market

The value chain of the 4K Ultra HD Television Market is complex, involving multiple stages from raw material sourcing to final consumer delivery, highly dependent on globalized manufacturing networks. The upstream segment is dominated by specialized suppliers of critical components such as glass substrates, liquid crystal materials, light-emitting diodes (LEDs or organic materials for OLED), and sophisticated system-on-chips (SoCs) that handle processing and smart functionalities. Asia-Pacific, particularly South Korea, Taiwan, and China, holds a near-monopoly on high-generation panel manufacturing, which dictates global supply, pricing, and technological pace. Efficient upstream logistics and intellectual property management surrounding display technology are critical factors determining the profitability of downstream manufacturers.

Midstream activities involve the assembly and integration of components by major television brands. This process includes the physical manufacturing of the panel module, integration of proprietary processors, assembly of casing and speakers, and the installation of the Smart TV operating system (e.g., Android TV, WebOS, Tizen). Manufacturers often operate large-scale, automated facilities in regions offering cost efficiencies or proximity to key markets. Differentiation at this stage heavily relies on brand recognition, quality control, and the integration of unique software features, especially those driven by AI and proprietary processing algorithms which enhance picture quality beyond the raw panel specifications.

The downstream segment encompasses distribution, retail, and after-sales service. Distribution channels are bifurcated into direct and indirect routes. Direct sales involve manufacturers selling through their own online portals or flagship stores, offering greater control over pricing and customer data. Indirect channels, which form the bulk of sales, rely on vast networks of authorized distributors, large mass-market retailers, and increasingly, major global and regional e-commerce platforms. The trend towards direct digital engagement and sophisticated last-mile logistics is defining the competitive edge in the downstream market, demanding streamlined inventory management and rapid fulfillment capabilities.

4K Ultra HD Television Market Potential Customers

The primary segment of potential customers for the 4K Ultra HD Television Market encompasses affluent households in developed economies seeking upgrades from older HD or Full HD models, prioritizing cinematic quality, large screen sizes, and advanced smart home integration. These consumers are typically technology early adopters or those entering the replacement cycle who view the television as the central entertainment and information hub of the home. They are highly responsive to innovations in display technology (OLED, QLED) and connectivity standards (HDMI 2.1) and are willing to pay a premium for superior picture processing and design aesthetics. This segment is characterized by high rates of streaming service subscription and engagement with console gaming.

A secondary, high-volume segment consists of middle-income households in both mature and emerging markets. These consumers are primarily driven by value proposition, seeking 4K quality at competitive price points, usually favoring screen sizes between 50 and 55 inches. Their purchasing decisions are heavily influenced by promotional activities, seasonal sales, and brand reputation for reliability. For this group, the availability of comprehensive smart features and ease of use are more crucial than acquiring the absolute latest technological iteration (e.g., they prioritize value-focused QLED or high-quality standard LED models over premium OLED).

Furthermore, the commercial sector represents a growing segment, including hospitality providers, corporate organizations, and healthcare facilities. Hotels require robust, durable 4K displays for guest rooms and communal areas, often requiring specific hospitality-focused operating systems. Corporate entities utilize 4K displays for high-resolution video conferencing, control rooms, and executive signage, where clarity and reliability are paramount. These B2B segments demand specialized features such as enhanced security, centralized remote management, and higher operational hours tolerance, distinguishing them significantly from the residential end-user.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.8 Billion |

| Market Forecast in 2033 | USD 248.1 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung Electronics, LG Electronics, Sony Corporation, TCL Technology, Hisense, Panasonic Corporation, Vizio Inc., Skyworth Group, Sharp Corporation, Xiaomi Corporation, Vestel, BPL Group, Koninklijke Philips N.V., Changhong Electric, Haier Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

4K Ultra HD Television Market Key Technology Landscape

The technological landscape of the 4K Ultra HD Television Market is defined by relentless innovation aimed at improving contrast, color accuracy, and processing efficiency. The primary battleground remains display technology, led by the intense rivalry between OLED and QLED. OLED technology, championed primarily by LG and Sony, offers pixel-level lighting control, resulting in perfect blacks and infinite contrast ratios, ideal for cinematic viewing environments. QLED technology, spearheaded by Samsung, leverages Quantum Dots to achieve exceptional brightness and color volume, making it superior in brightly lit rooms and mitigating the risk of long-term burn-in associated with OLED. Manufacturers are continually refining both technologies, with advancements like QD-OLED (combining the best of both worlds) and MicroLED (self-emissive, highly modular, and future-proof) starting to enter the high-end commercial and premium residential sectors.

Beyond the panel itself, the evolution of processing power is critical. Modern 4K TVs rely on highly specialized System-on-Chips (SoCs) equipped with dedicated Neural Processing Units (NPUs) to execute complex AI algorithms. These processors manage crucial functions such as object-based clarity enhancement, dynamic tonal mapping for HDR content (e.g., Dolby Vision IQ), and sophisticated motion handling (interpolating frames to reduce blur). The integration of next-generation connectivity standards, notably HDMI 2.1, is also fundamental. HDMI 2.1 enables high-bandwidth features required for 4K resolution at 120 frames per second (4K@120Hz), critical for advanced gaming and future high-frame-rate content delivery, solidifying the TV's role as a multi-functional display device.

Further technological differentiation occurs in audio integration and smart platform development. Many manufacturers are incorporating advanced acoustic technologies like sound from display (in some OLED models) or multi-directional speaker systems integrated directly into the TV chassis to enhance immersion without requiring external soundbars. Concurrently, proprietary smart platforms (Tizen, WebOS) are being continuously updated to offer faster performance, seamless integration with voice assistants (Google Assistant, Alexa), and enhanced privacy features, ensuring the 4K TV remains competitive against dedicated media streaming devices. The confluence of these hardware and software advancements ensures the 4K television maintains its status as a technologically sophisticated consumer electronics product.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market globally, driven by high manufacturing concentration (China, South Korea, Taiwan) and massive consumer base growth, especially in emerging economies like India, Indonesia, and Vietnam. China leads in volume sales, supported by domestic brands offering aggressive pricing and rapid technology adoption. The replacement cycle and increasing affluence in urban centers are key growth factors.

- North America: Characterized by the highest average selling price (ASP) and rapid adoption of large-screen formats (65 inches and above). Consumers prioritize premium features such as OLED/QLED technologies, HDMI 2.1 compatibility for gaming, and robust smart platform integration, making this region critical for testing high-end product introductions.

- Europe: This region demonstrates strong demand for aesthetically pleasing designs and energy-efficient models, influenced by stringent EU regulations and a preference for well-established Japanese and European brands alongside global players. Western Europe drives premium segment growth, while Eastern Europe represents a strong volume opportunity in the mid-range 4K segment.

- Latin America (LATAM): Growth is primarily fueled by major sporting events (which often trigger upgrade cycles) and increasing penetration of fiber optic and digital TV services. Price sensitivity is high, favoring value-oriented 4K LED models, though Brazil and Mexico show pockets of demand for premium features.

- Middle East and Africa (MEA): This region is experiencing foundational growth, supported by urbanization and large-scale infrastructure projects, particularly in the GCC countries. The hospitality sector is a significant commercial buyer, while residential demand focuses on mid-to-large screen sizes, with regional connectivity being a key challenge.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the 4K Ultra HD Television Market.- Samsung Electronics Co., Ltd.

- LG Electronics Inc.

- Sony Corporation

- TCL Technology Group Corporation

- Hisense Group

- Panasonic Corporation

- Vizio Inc.

- Xiaomi Corporation

- Sharp Corporation

- Skyworth Group Co., Ltd.

- Koninklijke Philips N.V. (TP Vision)

- Vestel Group

- Changhong Electric Co., Ltd.

- Haier Group Corporation

- BOE Technology Group Co., Ltd. (Panel Supplier)

- Innolux Corporation (Panel Supplier)

- JVC Kenwood Corporation

- Toshiba Corporation

Frequently Asked Questions

Analyze common user questions about the 4K Ultra HD Television market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between OLED and QLED 4K TVs?

OLED (Organic Light-Emitting Diode) displays use self-illuminating pixels to achieve perfect black levels and superior contrast, while QLED (Quantum Dot LED) utilizes a backlight system enhanced by quantum dots, offering higher peak brightness and better performance in well-lit environments.

Is a 4K TV worth the investment if most content is still Full HD (1080p)?

Yes, 4K TVs utilize advanced AI-driven processors for upscaling, which significantly improves the quality of Full HD and standard definition content by enhancing detail and reducing visible artifacts, making the transition worthwhile even without consistent native 4K content.

What size 4K television is recommended for optimal viewing distance?

For 4K resolution, industry standards suggest viewing distances should allow the screen to fill approximately 30-40 degrees of your field of view. For a typical viewing distance of 8 to 10 feet, TVs in the 65-inch to 75-inch range are often recommended to maximize the perceived detail of 4K content.

How does the integration of HDMI 2.1 impact 4K TV performance?

HDMI 2.1 is crucial for advanced features such as 4K resolution at 120 frames per second (4K@120Hz), Variable Refresh Rate (VRR), and enhanced audio return channel (eARC), primarily benefiting next-generation console gamers and enthusiasts seeking high-bandwidth connectivity.

Which geographical region dominates the sales volume in the 4K Ultra HD Television Market?

The Asia Pacific (APAC) region dominates the market in terms of sales volume, driven by high population density, rising consumer disposable income, and the massive manufacturing presence and domestic consumption in countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager