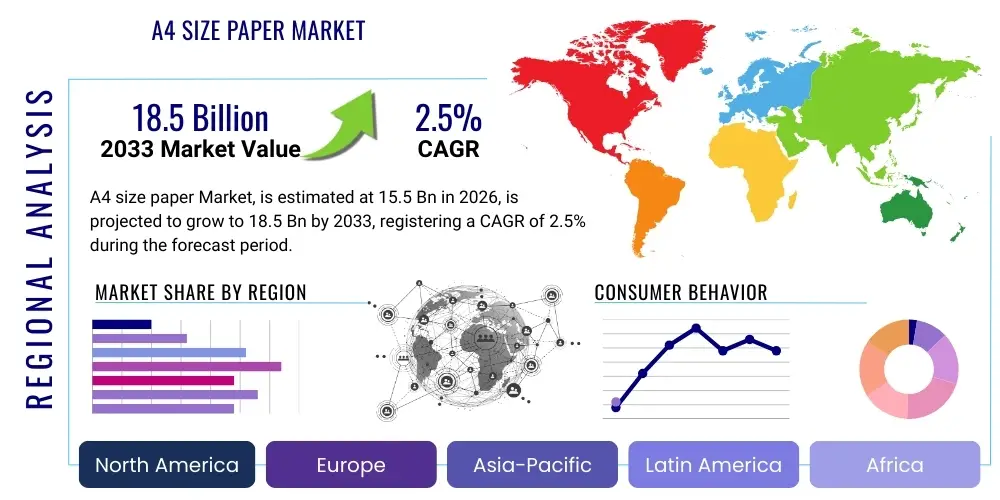

A4 size paper Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441586 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

A4 size paper Market Size

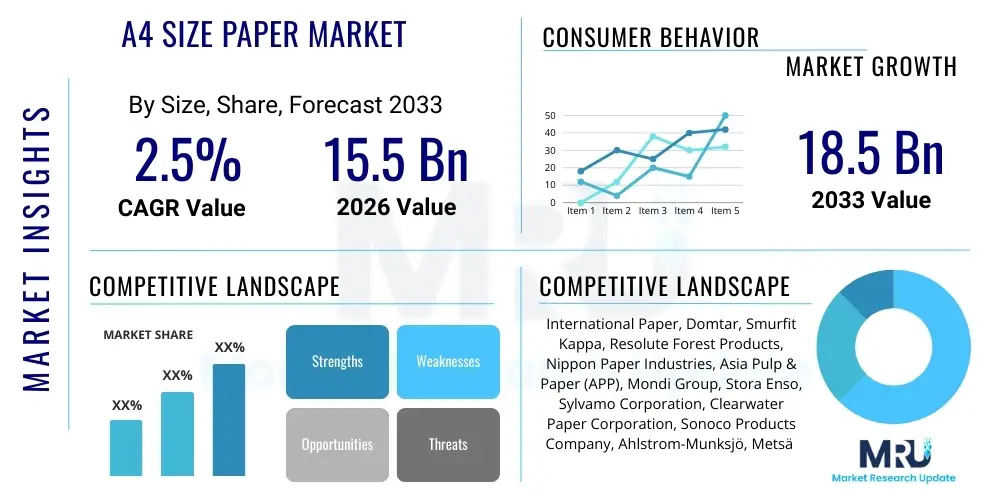

The A4 size paper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 2.5% between 2026 and 2033. The market is estimated at $15.5 Billion in 2026 and is projected to reach $18.5 Billion by the end of the forecast period in 2033.

A4 size paper Market introduction

The A4 size paper market encompasses the global production, distribution, and consumption of cut-size paper standardized according to the ISO 216 international standard, specifically measuring 210 mm by 297 mm. This staple product is universally recognized and essential for standard document creation, correspondence, copying, and printing applications across both professional and domestic settings. Despite the ongoing global trend toward digitalization and paperless operations, the A4 format maintains robust demand, driven by regulatory requirements, educational necessities, and persistent needs within developing economies where digital infrastructure penetration remains variable. Key applications span high-volume office printing, educational handouts, standardized governmental documentation, and consumer printing, highlighting its foundational role in administrative processes worldwide.

The product, predominantly manufactured from bleached chemical wood pulp, offers consistent quality, printability, and whiteness crucial for high-fidelity output. Recent market dynamics have shifted focus toward sustainability, pushing manufacturers to innovate in areas such as recycled content, certified responsible sourcing (e.g., FSC certification), and reduced environmental footprint during production. Benefits of A4 paper include its universal compatibility with standard office equipment, cost-effectiveness, and the tangible ease of use required for signed contracts or archival documentation. However, the industry faces structural challenges from declining consumption per capita in mature markets, necessitating strategic pivots toward optimized production efficiency and premium, specialized paper grades.

Major driving factors sustaining the market include persistent growth in the global education sector, especially in APAC and MEA regions, which rely heavily on traditional learning materials. Furthermore, governmental and legal sectors continue to generate high volumes of mandatory printed records. Technological advancements in printing efficiency and digital-to-print solutions (hybrid publishing models) also stabilize demand. However, the overarching factor influencing market trajectory is the increasing corporate commitment to Environmental, Social, and Governance (ESG) mandates, favoring sustainable paper products, which compels manufacturers to invest significantly in greener production technologies and material alternatives.

A4 size paper Market Executive Summary

The A4 size paper market exhibits nuanced growth patterns, characterized by maturity in developed regions countered by strong expansion in emerging economies. Key business trends indicate a definitive move toward consolidation among major global players, aimed at achieving economies of scale and streamlining supply chains in the face of fluctuating raw material costs (pulp, energy). Manufacturers are strategically differentiating their products by emphasizing attributes like brightness, quick-dry capability, and eco-certifications rather than solely competing on commodity pricing. The structural trend toward remote and hybrid work models initially dampened office consumption but simultaneously increased consumer-level home printing, creating localized pockets of demand shift.

Regionally, Asia Pacific (APAC) stands out as the dominant growth engine, fueled by rapid urbanization, massive investment in educational infrastructure, and burgeoning commercial activity in countries such as India and Southeast Asian nations. Conversely, North America and Europe demonstrate slow or marginal decline in overall volume but show increasing demand for high-margin, sustainably sourced, and recycled paper grades, reflecting stringent environmental regulations and consumer preferences. The Middle East and Africa (MEA) are positioned for substantial future growth, bolstered by government administrative requirements and steady population expansion, although market fragmentation and logistics remain challenges.

Segmentation analysis reveals that the 80gsm category remains the market standard due to its optimal balance of quality and cost, dominating commercial and educational applications. However, demand for lightweight 70gsm paper is growing in high-volume, cost-sensitive sectors. The segmentation by end-user highlights the commercial sector as the largest consumer, though the education segment offers the most predictable long-term stability. The future growth trajectory is inextricably linked to raw material segmentation, with recycled and alternative fiber sources gaining market share, driving capital investment into advanced recycling and de-inking technologies to maintain brightness and quality standards comparable to virgin pulp products.

AI Impact Analysis on A4 size paper Market

User queries regarding the impact of Artificial Intelligence (AI) on the A4 size paper market predominantly center on the potential for AI-driven automation to drastically reduce the need for physical documentation and streamline digital workflows. Common themes include how AI tools facilitate paperless compliance, optimize digital archiving, and predict print needs, thereby minimizing waste and inventory. Users are concerned about whether widespread deployment of generative AI tools for document summarization and digital correspondence will lead to a sharp, irreversible decline in physical printing volumes across corporate environments. They also inquire about the role of AI in optimizing the paper manufacturing supply chain, particularly regarding predictive maintenance, energy consumption reduction, and automated quality control, aiming to understand if operational efficiencies can offset structural demand decreases.

AI's primary influence is manifested through its role as an enabler of digital transformation, fundamentally altering the workflows that traditionally necessitated physical output. By automating data entry, managing digital contracts, and facilitating secure cloud storage, AI applications directly challenge the historical utility of A4 paper for records management and internal communication. While this drives volume reduction in sectors like finance and legal services in developed markets, AI concurrently assists manufacturers in achieving superior operational efficiency, making the remaining print demand more profitable. This paradoxical relationship means AI both accelerates demand decline structurally and enhances the sustainability and cost-competitiveness of the paper supply side.

Furthermore, AI algorithms are becoming critical for optimizing forestry practices and pulp production, ensuring highly efficient utilization of raw materials and reducing environmental impact, which aligns with the industry's sustainability goals. AI-driven predictive logistics manage inventory levels more precisely, reducing warehousing costs and preventing overproduction. However, the consensus indicates that while AI significantly reduces discretionary printing, mandated governmental and archival printing, alongside educational needs, will ensure a foundational level of sustained demand, requiring the industry to pivot from high-volume commodity sales to focused, high-value, sustainable product lines.

- AI accelerates digital workflow adoption, significantly reducing internal corporate printing volumes.

- AI tools for automated contract management and digital signatures diminish the need for hardcopy legal documents.

- Predictive analytics driven by AI optimize inventory management, preventing overstocking and reducing paper waste across the distribution channel.

- Machine learning enhances manufacturing efficiency by predicting equipment failure, optimizing energy consumption, and improving pulp processing yields.

- AI-enabled natural language processing aids in converting scanned physical documents into structured digital data, thereby reducing the necessity for manual paper archives.

- Generative AI shifts content creation and review primarily to digital platforms, limiting the initial draft printing stages common in content-heavy industries.

DRO & Impact Forces Of A4 size paper Market

The dynamics of the A4 size paper market are determined by a complex interplay of structural drivers, macroeconomic restraints, and emerging opportunities, all magnified by critical impact forces related to digitalization and sustainability. Primary drivers include consistent demand from the education sector globally and the regulatory requirement for physical record keeping in governmental and legal entities, particularly in high-growth regions of Asia and Africa. The increasing population base in these emerging markets ensures sustained, high-volume requirement for standardized paper products. Furthermore, the tangible nature of paper remains preferred for complex revision and archival security by many traditional organizations, stabilizing demand.

Restraints are dominated by the pervasive trend of digitalization, accelerated by the pandemic, leading to significant volume erosion in mature markets. High volatility in raw material costs, particularly wood pulp and energy prices, presents continuous margin pressures on manufacturers. Environmental concerns and pressure from NGOs and consumers regarding deforestation and waste generation further restrain growth, forcing expensive compliance and material substitution. The highly fragmented nature of local supply chains in some developing regions also presents logistical and distribution challenges, hindering market penetration and operational efficiency for global players. These restraints necessitate a focus on cost control and sustainable innovation.

Opportunities center around the shift toward premium, recycled, and specialty grades, which command higher margins and cater to environmentally conscious consumers and corporations. Manufacturers can capitalize on improved de-inking and recycling technologies to produce high-quality recycled A4 paper that meets strict brightness standards. Furthermore, expanding distribution networks in underserved emerging markets through partnerships with local stationery suppliers and leveraging e-commerce platforms presents significant growth avenues. The impact forces—sustainability imperatives and rapid digital adoption—are compelling the industry toward a fundamental transformation, demanding investment in sophisticated manufacturing technologies that minimize resource usage and maximize efficiency while optimizing the remaining high-value print workflows.

Segmentation Analysis

The A4 size paper market is segmented based on critical technical and commercial parameters, allowing for detailed market assessment and strategic targeting. Key segmentation criteria include the product's basis weight (gsm), the raw material composition, the primary end-user application, and the distribution channel utilized for sales. The analysis of these segments is vital for understanding shifting customer preferences, identifying high-growth niches, and allocating manufacturing resources effectively. Historically, end-user segmentation has been the most critical for forecasting volume, but segmentation by raw material (specifically recycled content) is rapidly becoming the most relevant metric for assessing market value and compliance with global environmental mandates.

- By Basis Weight (Grammage):

- 70 gsm (Grams per Square Meter)

- 75 gsm

- 80 gsm

- 90 gsm and Above (Premium Grades)

- By Raw Material:

- Virgin Wood Pulp

- Recycled Paper

- Alternative Fiber Sources (e.g., Bamboo, Bagasse)

- By End-User Application:

- Commercial/Office (Corporate, SME)

- Educational Institutions (Schools, Universities)

- Government and Legal Bodies

- Residential/Home Office

- Printing and Publishing Houses

- By Distribution Channel:

- Offline Retailers (Supermarkets, Stationery Stores)

- Online Retail/E-commerce Platforms

- Direct Sales (Business-to-Business Contracts)

- Wholesalers and Distributors

Value Chain Analysis For A4 size paper Market

The A4 paper value chain begins with highly capital-intensive upstream activities focused on sustainable forestry and pulp manufacturing. Upstream analysis involves timber harvesting (or securing recycled fiber), subsequent pulping (chemical or mechanical), and bleaching processes, which are critical determinants of the final product's cost, quality (brightness), and environmental footprint. Efficiency at this stage, particularly minimizing energy and water usage, is paramount due to the high operational costs involved. Key challenges upstream include fluctuating global pulp prices, the long investment cycles required for sustainable forestry management, and securing certifications (like FSC or PEFC) crucial for accessing global markets.

The midstream focuses on converting the manufactured pulp into large paper rolls (jumbo rolls) and subsequently converting these rolls into standardized A4 sheets using high-speed cutting, trimming, and packaging equipment. This stage is dominated by large-scale paper mills that achieve significant economies of scale. Quality control, especially ensuring precise cutting dimensions and consistent moisture content, is essential to prevent jamming in high-speed printers. Distribution channel efficiency is the defining element of the downstream segment. This involves a complex global network utilizing wholesalers, specialized paper distributors, and large-format retailers, moving the bulky product efficiently from centralized mills to dispersed end-users.

The increasing importance of e-commerce has introduced a significant indirect distribution channel, allowing smaller offices and residential users to purchase directly, bypassing traditional wholesale tiers. Direct sales via Business-to-Business (B2B) contracts remain vital for securing high-volume commercial and governmental clients. Overall, profitability within the A4 market hinges on vertical integration—controlling the supply of raw materials (upstream) and optimizing logistics (downstream) to minimize the impact of low product margins. Technological adoption in logistics, such as advanced warehouse management systems and demand forecasting, is crucial for maintaining competitive advantage in this mature market.

A4 size paper Market Potential Customers

Potential customers for A4 size paper span a wide demographic and organizational spectrum, ranging from multinational corporations requiring vast quantities for daily operations to individual students purchasing single reams for academic assignments. The primary and largest end-user segment remains the Commercial sector, encompassing banks, insurance companies, legal firms, and general corporate offices that generate substantial documentation for internal reports, client communication, and regulatory filings. These buyers often prioritize reliable supply chains, bulk pricing, and specialized, high-brightness paper suitable for color laser printing and archival needs. Strategic emphasis is often placed on multi-year supply contracts.

The second major segment, Education, provides consistent and relatively inelastic demand. Schools, colleges, and universities utilize A4 paper extensively for curriculum handouts, standardized testing, administrative records, and research printing. This segment is highly price-sensitive but less sensitive to high-end paper features, often favoring standard 80gsm or lighter 70gsm grades. Governmental and Legal bodies constitute another critical customer base, driven by statutory requirements for maintaining physical records, contracts, deeds, and official correspondence. This group typically demands highly secure and often long-lasting archival paper grades, making compliance and certification paramount in supplier selection.

Finally, the Residential/Home Office segment has seen growth, particularly since the shift toward remote work. While individual consumption is lower, the cumulative demand is substantial. These customers primarily procure through retail (both physical and online) channels and prioritize convenience, affordability, and compatibility with standard inkjet printers. Successful market penetration requires manufacturers to understand the distinct purchasing criteria and distribution preferences of each of these diverse buyer groups, ranging from large B2B contracts for commercial clients to optimized retail packaging and online fulfillment for residential consumers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $15.5 Billion |

| Market Forecast in 2033 | $18.5 Billion |

| Growth Rate | 2.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | International Paper, Domtar, Smurfit Kappa, Resolute Forest Products, Nippon Paper Industries, Asia Pulp & Paper (APP), Mondi Group, Stora Enso, Sylvamo Corporation, Clearwater Paper Corporation, Sonoco Products Company, Ahlstrom-Munksjö, Metsä Group, Papyrus AB, JK Paper Ltd., WestRock Company, Oji Holdings Corporation, Kotkamills Oy, Daio Paper Corporation, The Navigator Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

A4 size paper Market Key Technology Landscape

The technology landscape within the A4 size paper market is primarily driven by mandates for increased manufacturing efficiency, reduced environmental impact, and enhancements in paper quality for modern printing technologies. Key technological advancements are focused on the pulping and bleaching stages. Modern paper mills utilize advanced closed-loop systems to significantly reduce water consumption and recycle wastewater, meeting increasingly strict environmental standards. Energy efficiency improvements, including the adoption of cogeneration plants and advanced boiler technologies fueled by biomass, are crucial for lowering the cost per tonne and achieving carbon reduction targets. The integration of high-speed digital automation, sensor technology, and process control systems allows for real-time adjustments to pulp consistency and sheet formation, ensuring consistent product quality across massive production runs.

In terms of product innovation, de-inking technology for recycled fiber is paramount. Manufacturers are heavily investing in advanced flotation and washing techniques to produce high-brightness recycled A4 paper that visually competes with virgin fiber products. This technological leap is essential for capturing market share in environmentally sensitive regions. Furthermore, surface sizing and coating technologies are being refined to optimize A4 paper for specific high-definition printing methods, such as those used in commercial digital presses. These advancements focus on minimizing ink bleed, improving color vibrancy, and enhancing quick-dry properties, catering directly to the needs of sophisticated commercial users transitioning from offset to digital printing solutions.

Finally, the logistical and packaging elements of the technology landscape are seeing significant investment. Automated warehousing, robotic palletizing, and sophisticated supply chain software (like AI-driven demand forecasting) are utilized to manage the high volume and relatively low value of the product efficiently. Packaging technology has evolved to include moisture-resistant and tamper-evident materials, crucial for maintaining paper quality throughout the long and complex distribution channels, especially when shipping internationally or through humid climates. These technological improvements collectively enable the industry to maintain profitability despite flat or declining volumes in core Western markets, ensuring the A4 paper remains a reliable and increasingly sustainable product.

Regional Highlights

Regional dynamics heavily influence the A4 paper market, reflecting varying levels of digital maturity, regulatory environments, and demographic growth rates. While North America and Europe face consumption decline due to aggressive digital substitution, their markets are characterized by a premium focus on sustainable and high-quality paper. Asia Pacific (APAC) remains the undisputed volume driver, while Latin America and MEA offer substantial long-term growth potential due to demographic expansion and ongoing infrastructural development.

- Asia Pacific (APAC): Dominates the global market in terms of volume consumption, driven by mass urbanization, rapid economic growth, and immense investment in the educational sector across countries like China, India, and Indonesia. Manufacturing capacity in this region is extensive, often benefiting from lower operational costs, making it a critical hub for both regional supply and global export. Future growth will be highly reliant on governmental policies regarding printing mandates and the speed of digital penetration.

- North America: A mature and consolidating market experiencing volume contraction but pivoting toward higher-margin, specialized, and certified paper grades. Demand is stable in the legal and governmental sectors, but corporate use is decreasing due to advanced digital workflows. Sustainability certifications (e.g., SFI, FSC) are prerequisites for market access, driving manufacturers to focus heavily on recycled and responsibly sourced pulp.

- Europe: Similar to North America, the European market is shrinking in volume but highly focused on environmental compliance and circular economy principles. Regulations such as the EU Timber Regulation and strong consumer preference for recycled content drive technological investments in de-inking and processing. Western Europe leads in per-capita consumption of premium and specialized paper grades, while Eastern Europe shows moderate volume growth potential.

- Latin America: Characterized by diverse economies and fluctuating stability, this region shows moderate to strong growth potential, particularly in educational and government sectors. Brazil and Mexico are the largest markets, benefitting from established manufacturing bases. Market complexity arises from logistical challenges and varying standards of paper quality across different national markets.

- Middle East and Africa (MEA): Represents a crucial future growth frontier. Demand is accelerating due to rising literacy rates, government investment in administrative infrastructure, and population growth. While currently reliant on imports, increasing local manufacturing capacity, particularly in the UAE and Saudi Arabia, alongside substantial educational needs in African nations, promises sustained volume increase throughout the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the A4 size paper Market.- International Paper

- Domtar

- Smurfit Kappa

- Resolute Forest Products

- Nippon Paper Industries

- Asia Pulp & Paper (APP)

- Mondi Group

- Stora Enso

- Sylvamo Corporation

- Clearwater Paper Corporation

- Sonoco Products Company

- Ahlstrom-Munksjö

- Metsä Group

- Papyrus AB

- JK Paper Ltd.

- WestRock Company

- Oji Holdings Corporation

- Kotkamills Oy

- Daio Paper Corporation

- The Navigator Company

Frequently Asked Questions

Analyze common user questions about the A4 size paper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor restraining long-term growth in the A4 paper market?

The primary restraint is accelerated corporate digitalization and governmental adoption of paperless workflows, which structurally reduces the volume of printing, especially in mature North American and European markets. This shift is partially offset by growth in developing regions.

Which geographical region accounts for the largest current and future volume demand?

The Asia Pacific (APAC) region currently holds the largest volume share and is projected to drive the majority of future growth, fueled by population increase, expansion of educational facilities, and rapid urbanization.

How are environmental regulations influencing A4 paper manufacturing?

Stringent environmental regulations compel manufacturers to prioritize sustainable sourcing (FSC/PEFC certified pulp) and invest heavily in advanced de-inking technologies to increase the usage of high-quality recycled content, shifting focus from virgin fiber to circular economy models.

What basis weight is considered the global standard for A4 paper and why?

The 80 gsm (Grams per Square Meter) basis weight is the global standard, particularly for commercial and educational use, because it offers an optimal balance between quality, opacity, cost-effectiveness, and compatibility with most high-speed copiers and laser printers.

Is the A4 paper market expected to decline completely due to digital substitution?

No. While high-volume discretionary printing is declining, a core foundational demand remains stable, driven by mandatory governmental and legal record-keeping, archival needs, and persistent usage within global educational systems and the growing home office segment, ensuring stability in specialized niches.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager