AAV Vector Transfection Kits Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441959 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

AAV Vector Transfection Kits Market Size

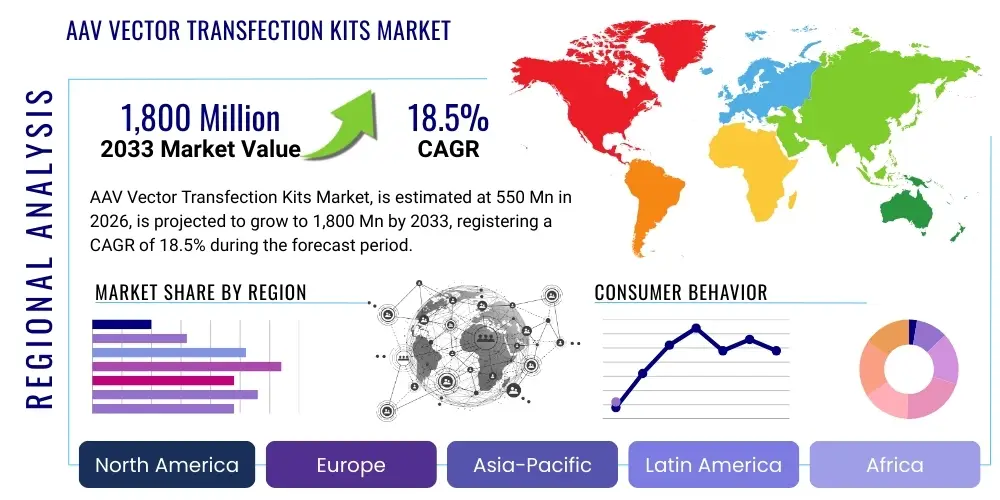

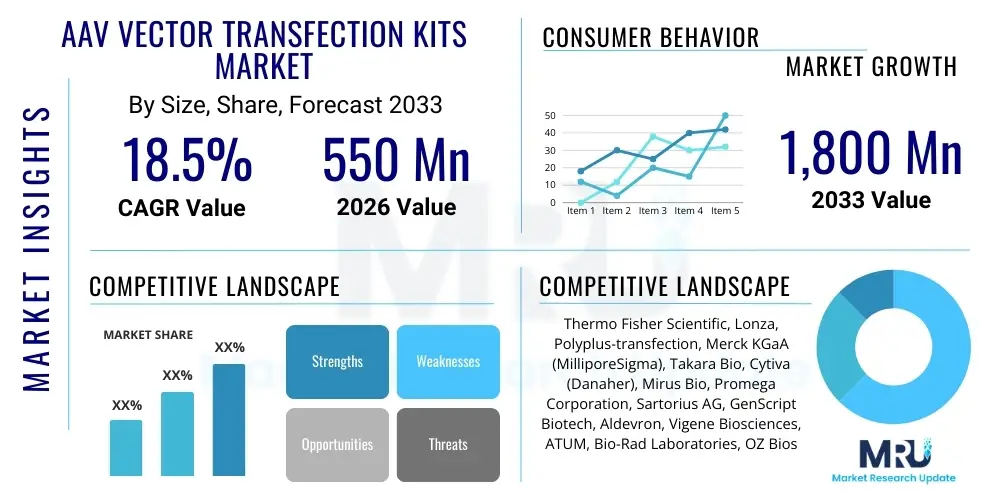

The AAV Vector Transfection Kits Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $550 Million in 2026 and is projected to reach $1,800 Million by the end of the forecast period in 2033.

AAV Vector Transfection Kits Market introduction

The AAV Vector Transfection Kits Market comprises specialized reagents, optimized media, and protocols designed to facilitate the efficient introduction of recombinant genetic material into host cells, primarily for the large-scale production of Adeno-Associated Virus (AAV) vectors. AAV vectors are indispensable carriers in the burgeoning field of gene therapy, recognized for their low immunogenicity and stable, long-term gene expression capabilities, making them the preferred delivery system for treating genetic disorders, oncology indications, and rare diseases. The effectiveness and yield of AAV production are heavily reliant on the transfection efficiency achieved using these dedicated kits, which often include proprietary lipid-based or polymer-based transfection reagents optimized for high-density suspension culture systems, particularly involving HEK293 cell lines.

Key applications of these kits span preclinical research, clinical trials, and commercial manufacturing of therapeutic gene products. The primary goal is to achieve transient co-transfection of three crucial plasmids—the therapeutic gene cassette, the helper plasmid (e.g., pHelper), and the AAV rep/cap plasmid—into producer cells with maximum efficiency and minimal cytotoxicity. Benefits derived from utilizing commercial kits over homemade reagent formulations include enhanced reproducibility, standardized quality control, reduced optimization time, and scalability required for Good Manufacturing Practice (GMP) compliance. These standardized solutions are critical in accelerating the translational pipeline from bench research to clinical application, ensuring robust viral titers essential for therapeutic dosing.

The market is predominantly driven by the explosive growth in global gene therapy approvals and the subsequent requirement for massive quantities of clinical-grade AAV vectors. Escalating investments in biotechnology infrastructure, significant venture capital funding flowing into cell and gene therapy startups, and ongoing advancements in upstream processing techniques—specifically, the shift toward suspension culture and intensified bioprocessing—are further propelling demand. Furthermore, the persistent challenge of yield limitation in AAV manufacturing mandates the adoption of highly efficient, reliable transfection systems, positioning these kits as pivotal components in the viral vector supply chain.

AAV Vector Transfection Kits Market Executive Summary

The global AAV Vector Transfection Kits Market is characterized by intense innovation centered on improving vector yield, reducing manufacturing costs, and achieving optimal scalability for commercial gene therapy production. Business trends highlight a strong emphasis on developing serum-free and animal component-free reagents that support high-density, suspension-adapted cell culture systems, facilitating compliance with stringent regulatory standards. Strategic collaborations between kit manufacturers and Contract Development and Manufacturing Organizations (CDMOs) are defining the supply chain landscape, aiming to integrate novel transfection technologies seamlessly into existing large-scale biomanufacturing workflows. Furthermore, mergers and acquisitions focused on securing specialized intellectual property related to novel polymer and lipid chemistries are accelerating market consolidation and technological differentiation, establishing a strong barrier to entry for new players.

Regionally, North America maintains market dominance, driven by substantial R&D expenditure in the U.S., a high concentration of leading biopharmaceutical companies and academic research institutions, and a supportive regulatory environment facilitating expedited approval of gene therapy products. Europe is the second largest market, experiencing robust growth fueled by established biotech clusters in countries like Germany, the UK, and Switzerland, alongside government initiatives promoting advanced therapeutic medicinal products (ATMPs). The Asia Pacific region, particularly China, Japan, and South Korea, is emerging rapidly as a high-growth area, primarily due to increasing governmental investment in domestic biomanufacturing capabilities, expanding patient populations requiring advanced therapies, and outsourcing activities from Western pharmaceutical companies seeking cost efficiencies.

Segment trends reveal a continued preference for specialized chemical-based transfection reagents over physical methods, attributed to their superior efficiency, ease of use, and adaptability to high-throughput screening and large-scale manufacturing. Within the application spectrum, kits tailored for commercial production represent the fastest-growing segment, reflecting the transition of numerous gene therapy candidates from clinical trials into market-approved products. The end-user analysis confirms that biopharmaceutical companies are the largest consumers, driven by their significant volume requirements, while academic and research institutes serve as crucial early adopters and innovators, influencing the future trajectory of transfection technology development through rigorous comparative studies and optimization protocols.

AI Impact Analysis on AAV Vector Transfection Kits Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the AAV Vector Transfection Kits Market reveals a focus on optimization, predictive modeling, and quality control. Users are primarily concerned with how AI can minimize the empirical trial-and-error often associated with optimizing transfection protocols, specifically questions related to: "Can AI predict the optimal ratio of plasmid DNA to transfection reagent?", "How can machine learning models improve AAV vector yield and purity?", and "What role does AI play in real-time monitoring of transfection conditions in bioreactors?" These inquiries highlight the expectation that AI and sophisticated computational tools will transition transfection protocol development from a laborious, manual process to a highly automated, data-driven science, thereby reducing time-to-market and enhancing manufacturing reproducibility and consistency.

The core theme emerging from these discussions is the expectation of enhanced efficiency and cost reduction through computational simulation. AI algorithms are anticipated to analyze vast datasets encompassing cell line parameters, media composition, plasmid quality, and reagent chemistry to identify non-linear correlations impacting transient transfection outcomes. This ability to rapidly assess complex parameter interactions will revolutionize protocol development, allowing manufacturers to define the "design space" for robust and high-yield AAV production protocols faster than traditional statistical methods. Furthermore, the integration of AI with automated liquid handling systems promises to accelerate the screening of new kit formulations and chemically optimized reagents, leading directly to the next generation of high-performance transfection kits.

Ultimately, the influence of AI will extend downstream into quality assurance and process control, ensuring that the AAV vector manufacturing process, which begins with efficient transfection, remains within strict quality parameters. Machine vision and deep learning models applied to imaging analysis of transfected cells can provide non-invasive, real-time feedback on cell health and transfection progression, enabling immediate process adjustments. For kit developers, AI offers predictive capabilities in formulation chemistry, allowing them to rationally design reagents with improved efficiency, stability, and lower inherent toxicity, thus directly addressing the scalability and yield challenges currently facing the market.

- AI optimizes reagent formulation and DNA-to-reagent ratios, maximizing transient transfection efficiency.

- Machine learning models predict optimal cell culture conditions, reducing empirical experimentation time significantly.

- AI-driven automation accelerates the high-throughput screening of novel transfection reagents and kit components.

- Computational biology facilitates the rational design of plasmid constructs compatible with specific transfection chemistries.

- Real-time process monitoring using AI enhances batch consistency and quality control (QC) during large-scale AAV production.

DRO & Impact Forces Of AAV Vector Transfection Kits Market

The AAV Vector Transfection Kits Market is primarily driven by the exponential expansion of the global gene therapy pipeline, coupled with a fundamental industry necessity to overcome current manufacturing bottlenecks. The success of multiple regulatory approvals for AAV-based therapies (e.g., Luxturna, Zolgensma) has validated the clinical and commercial viability of this vector platform, triggering massive investments into manufacturing capacity expansion worldwide. However, the market faces significant restraints, chiefly the technical complexity and inherent variability associated with transient transfection, which leads to inconsistent yields and batch failures. Furthermore, the high upfront cost of specialized, GMP-grade kits and the complexity of regulatory compliance in ATMP manufacturing restrict wider adoption, particularly for smaller academic labs or emerging CDMOs. Opportunities lie predominantly in developing fully integrated, ready-to-use transfection systems that are chemically defined, scalable to thousands of liters, and compatible with continuous bioprocessing technologies, addressing the industry's critical need for industrial-scale, low-cost AAV production. The long-term success hinges on innovation in non-viral delivery systems and process intensification strategies.

The Impact Forces analysis illustrates a strong interplay between market dynamics. The driving forces, centered on the urgent need for scalable vector production, are currently outweighing the restraining factors, propelling robust growth. The increasing prevalence of chronic and genetic diseases treatable by gene therapy substantially boosts demand for high-quality vectors, indirectly strengthening the demand for optimal transfection kits. However, the threat of substitution from alternative vector systems (e.g., lentivirus, novel lipid nanoparticles) and the continuous pressure from end-users to reduce the overall cost of goods sold (COGS) for gene therapies act as countervailing forces. To maintain market momentum, manufacturers must focus on technological breakthroughs that not only improve efficiency but also significantly lower the unit cost of transfection per viral particle produced, thereby neutralizing the economic constraints associated with existing proprietary reagents.

Innovation in process development is a critical impact force influencing market structure. The industry shift from adherent culture to suspension culture, optimized for industrial bioreactors, necessitates new transfection kit formulations specifically designed for high cell densities and serum-free media environments. Manufacturers who successfully integrate their reagents with automated, closed-system bioprocessing platforms gain a distinct competitive advantage, aligning their offerings with GMP standards and CDMO requirements. Regulatory guidance, particularly from the FDA and EMA regarding consistency and purity of vector production, forces kit providers to maintain exceptionally high quality standards and provide comprehensive documentation, creating a powerful external impact force driving standardization and reducing the attractiveness of lower-cost, non-validated alternatives.

Segmentation Analysis

The AAV Vector Transfection Kits Market is meticulously segmented based on the type of reagent chemistry, the scale of application, and the end-user profile, providing a detailed map of demand across the biopharmaceutical ecosystem. Analysis by product type reveals a dominance of proprietary chemical and lipid-based reagents, favored for their balance of high efficiency and low toxicity compared to physical methods. Segmentation by application highlights the growing significance of commercial manufacturing, which demands validated, high-volume kits, surpassing the traditional focus on preclinical research. Furthermore, the segmentation by end-user illustrates the critical role of CDMOs and large biopharmaceutical enterprises, which account for the majority of the revenue due to their high volume manufacturing needs and significant investment capacity in advanced production technologies. Understanding these segmented demands is crucial for strategic market positioning and product development tailored to specific industry needs.

Further granularity within the segmentation focuses on defining features vital for scalability. For instance, classifying kits based on their adaptability to suspension versus adherent cultures directly reflects modern biomanufacturing trends, where suspension culture-compatible kits are experiencing explosive growth due to their inherent scalability. Similarly, segmenting by the presence of regulatory documentation, such as Drug Master File (DMF) support, differentiates premium, GMP-ready products required for clinical trials and commercial production from research-grade reagents. This complex segmentation structure allows suppliers to target distinct customer groups with precision, offering specialized kits optimized for parameters like ultra-low cytotoxicity for sensitive cell lines or enhanced stability for long-term storage and transport, thereby addressing diverse operational requirements across the value chain.

- By Product Type:

- Lipid-Based Reagents

- Polymer-Based Reagents (e.g., PEI derivatives)

- Calcium Phosphate

- Electroporation Solutions (Kits only)

- By Application:

- Pre-clinical Research

- Clinical Trials

- Commercial Manufacturing

- By Culture Type:

- Suspension Culture Kits

- Adherent Culture Kits

- By End-User:

- Biopharmaceutical Companies

- Contract Development and Manufacturing Organizations (CDMOs)

- Academic and Research Institutes

Value Chain Analysis For AAV Vector Transfection Kits Market

The value chain for the AAV Vector Transfection Kits Market begins with intensive upstream activities focused on raw material sourcing and proprietary chemical synthesis. This stage involves acquiring high-purity lipids, polymers (such as polyethyleneimine derivatives), and specialized formulation excipients. Success in the upstream segment relies heavily on securing stable, qualified suppliers and maintaining rigorous quality control to ensure batch-to-batch consistency of the synthesized compounds, which are the core functional components of the transfection kits. Manufacturers invest heavily in optimizing chemical conjugation and formulation techniques to maximize DNA binding capacity, endosomal escape efficiency, and minimize cellular toxicity, establishing the technological foundation of the final product and securing competitive differentiation based on intellectual property surrounding novel reagent chemistries.

The midstream process involves formulation, packaging, sterilization, and exhaustive quality testing (e.g., endotoxin testing, functional efficiency assays). Distribution channels constitute a critical segment of the value chain, ensuring timely delivery of temperature-sensitive reagents to global biomanufacturing sites and research laboratories. Distribution is typically managed through a blend of direct sales forces, offering specialized technical support and regulatory expertise to large biopharma clients and CDMOs, and indirect channels via established global distributors and specialized life science suppliers who manage localized warehousing and logistics. The reliance on indirect channels is particularly strong in fragmented or geographically diverse markets, ensuring broad accessibility and minimizing logistical complexities related to customs and cold chain management.

Downstream analysis focuses on the integration and utilization of the kits by the end-users—specifically, viral vector manufacturing facilities. CDMOs and biopharmaceutical companies leverage these kits for transient AAV production, a process critically dependent on the kit’s performance, scalability, and regulatory documentation (DMF). Post-sales technical support and application specialist training are essential downstream services that capture customer loyalty and ensure optimal utilization of the complex protocols. The feedback loop from downstream users concerning yield metrics and cytotoxicity issues directly informs the upstream R&D activities of kit manufacturers, driving continuous product improvement and optimization for next-generation suspension cell systems and intensified bioprocessing methodologies.

AAV Vector Transfection Kits Market Potential Customers

The primary customer base for AAV Vector Transfection Kits consists of organizations actively engaged in the research, development, and manufacturing of gene therapies. Leading biopharmaceutical companies, particularly those with dedicated cell and gene therapy portfolios, represent the largest volume buyers. These customers require GMP-grade, highly scalable transfection solutions that can support multi-thousand-liter batch production to meet expected commercial demand for approved or late-stage clinical candidates. Their purchasing decisions are heavily influenced by performance metrics like vector titer, batch reproducibility, regulatory documentation (Drug Master Files), and compatibility with existing automated bioprocessing equipment, demanding robust, high-purity reagents.

Contract Development and Manufacturing Organizations (CDMOs) form the second most crucial customer segment, acting as centralized service providers for the biotech industry. CDMOs require a broad portfolio of highly efficient transfection kits that are flexible enough to accommodate diverse client projects, ranging from small preclinical batches to large-scale commercial runs. Their selection criteria prioritize robustness, technical support, and the ability to integrate seamlessly into proprietary, closed-system manufacturing platforms. Given their role in accelerating the gene therapy pipeline for numerous clients, CDMO procurement often involves large, multi-year supply agreements that favor suppliers capable of guaranteeing consistent, high-volume supply and strong technical collaboration.

Academic institutions, government research laboratories, and smaller biotech startups constitute the third significant segment, primarily focused on preclinical discovery and early-stage proof-of-concept studies. While their volume requirements are lower, these customers drive demand for highly efficient, easy-to-use research-grade kits suitable for optimization studies and small-scale vector production. These groups value cost-effectiveness, accessibility, and high levels of technical specificity, frequently serving as the initial testing ground for novel transfection technologies that may eventually be scaled up for clinical applications by the larger industry players, thereby acting as critical influencers in the long-term adoption cycle of new kit chemistries.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million |

| Market Forecast in 2033 | $1,800 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Lonza, Polyplus-transfection, Merck KGaA (MilliporeSigma), Takara Bio, Cytiva (Danaher), Mirus Bio, Promega Corporation, Sartorius AG, GenScript Biotech, Aldevron, Vigene Biosciences, ATUM, Bio-Rad Laboratories, OZ Biosciences, SBI (System Biosciences), Creative Biogene, In vivoGEN, OriGene Technologies, MaxCyte. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

AAV Vector Transfection Kits Market Key Technology Landscape

The AAV Vector Transfection Kits Market is undergoing rapid technological evolution, moving beyond basic polyethyleneimine (PEI) and traditional lipid formulations toward sophisticated, third-generation reagents designed for high-density, suspension-adapted HEK293 cell lines. A central technological focus is the development of proprietary, synthetic polymers and structurally novel cationic lipids that offer significantly improved transfection efficiency while drastically lowering cytotoxicity, which is a major limiting factor in large-scale biomanufacturing. These advanced formulations often incorporate components that enhance the stability of the DNA/reagent complex (lipoplexes or polyplexes), facilitate efficient endosomal escape, and are manufactured under chemically defined, animal origin-free conditions to meet strict regulatory standards for clinical use. Furthermore, there is growing intellectual property surrounding specialized buffers and enhancer solutions included in the kits, which optimize cell metabolism and overall productivity within the bioreactor environment, ensuring process robustness.

Another critical area of technological advancement involves the integration of high-throughput screening (HTS) and automation capabilities into the kit design. Manufacturers are developing reagents optimized for micro-scale and automated platforms, allowing researchers and process developers to quickly screen various plasmid ratios, cell densities, and transfection timing protocols with minimal material use. This focus on process optimization technologies, often leveraged with robotics and AI-driven data analysis, shortens the development cycle for AAV manufacturing protocols. The kits themselves are increasingly offered as modular systems, where the core transfection reagent is paired with specialized, proprietary cell culture media additives and boosters, allowing users to fine-tune the system for their specific serotype or cell line, providing a tailored approach to maximize vector yield and functional titer.

The future technology landscape is heavily influenced by the industry's pivot toward process intensification and continuous manufacturing. Transfection kits compatible with perfusion culture systems, capable of maintaining high efficiency over extended culture periods, represent the frontier of innovation. These next-generation kits must demonstrate minimal accumulation of toxic byproducts while sustaining high volumetric productivity. Furthermore, there is increasing interest in transient transfection enhancement techniques such as hypothermia or chemical modulators that temporarily alter cell physiology to boost DNA uptake and protein expression. These technological shifts necessitate robust research into non-toxic, biodegradable chemistries and specialized handling protocols, ensuring that the transfection step remains the most efficient part of the entire AAV vector production workflow, minimizing reliance on subsequent, often costly, downstream purification processes.

Regional Highlights

Regional dynamics play a significant role in shaping the AAV Vector Transfection Kits Market, largely correlating with the geographic distribution of gene therapy R&D and manufacturing capacity.

- North America: This region holds the largest market share, driven by the presence of major biopharmaceutical companies, extensive government and private funding in biotechnology, and a leading number of clinical trials and approved gene therapies. The United States, in particular, acts as the global hub for advanced therapy medicinal product (ATMP) development, necessitating substantial volumes of GMP-grade transfection kits. The strong regulatory framework, while stringent, also promotes the use of validated, high-quality commercial kits.

- Europe: Representing the second-largest market, Europe shows substantial growth, particularly in countries with established biotech clusters like Germany, the UK, Switzerland, and France. Growth is supported by initiatives from the European Medicines Agency (EMA) and significant academic investment in gene therapy research. The rising demand is heavily influenced by the need for European-based manufacturing to serve the regional patient population and comply with EU regulations.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive biomanufacturing infrastructure investment in China, South Korea, and Japan. Government policies encouraging biomedical innovation and the increasing establishment of CDMOs catering to global demand are accelerating market penetration. The adoption of advanced transfection kits is vital for these regions as they seek to rapidly scale up domestic viral vector production capabilities and meet international quality standards.

- Latin America (LATAM) & Middle East and Africa (MEA): These regions currently represent smaller market shares, characterized by nascent gene therapy R&D activity. Growth is slower but steady, primarily driven by international partnerships, academic collaborations, and government efforts to improve access to advanced medical treatments. Demand is concentrated in specialized clinical centers and select research institutes, utilizing kits for early-stage and local-specific therapeutic development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the AAV Vector Transfection Kits Market.- Thermo Fisher Scientific

- Lonza

- Polyplus-transfection

- Merck KGaA (MilliporeSigma)

- Takara Bio

- Cytiva (Danaher)

- Mirus Bio

- Promega Corporation

- Sartorius AG

- GenScript Biotech

- Aldevron

- Vigene Biosciences

- ATUM

- Bio-Rad Laboratories

- OZ Biosciences

- SBI (System Biosciences)

- Creative Biogene

- In vivoGEN

- OriGene Technologies

- MaxCyte

Frequently Asked Questions

Analyze common user questions about the AAV Vector Transfection Kits market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using commercial AAV vector transfection kits over custom, lab-prepared reagents?

Commercial AAV transfection kits offer superior batch-to-batch consistency, enhanced regulatory compliance (GMP-grade options, DMF support), and significantly reduced protocol optimization time. They ensure higher, more reliable vector yields crucial for clinical and commercial manufacturing scalability.

Which type of transfection reagent is currently dominant for large-scale AAV vector production?

Polymer-based reagents, particularly specialized derivatives of polyethyleneimine (PEI), alongside proprietary cationic lipid formulations optimized for high cell density, serum-free suspension cultures, dominate large-scale AAV vector production due to their balance of high efficiency and cost-effectiveness.

How is the shift towards continuous bioprocessing affecting the demand for AAV transfection kits?

The shift towards continuous bioprocessing increases the demand for specialized, chemically defined transfection kits capable of sustaining high efficiency and low cytotoxicity over prolonged perfusion culture periods, ensuring high volumetric productivity essential for intensified manufacturing strategies.

What is the most significant restraint challenging the growth of the AAV Vector Transfection Kits Market?

The most significant restraint is the high cost associated with GMP-grade, proprietary reagents and the inherent complexity of transient transfection protocols, which can lead to significant batch-to-batch variability and inconsistent vector yields if not rigorously controlled and optimized.

Which geographical region is projected to exhibit the fastest growth in this market and why?

The Asia Pacific (APAC) region, specifically countries like China and South Korea, is projected to exhibit the fastest growth due to aggressive governmental investments in domestic biomanufacturing capabilities, expanding clinical pipelines, and the rising role of APAC-based CDMOs in the global gene therapy supply chain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager