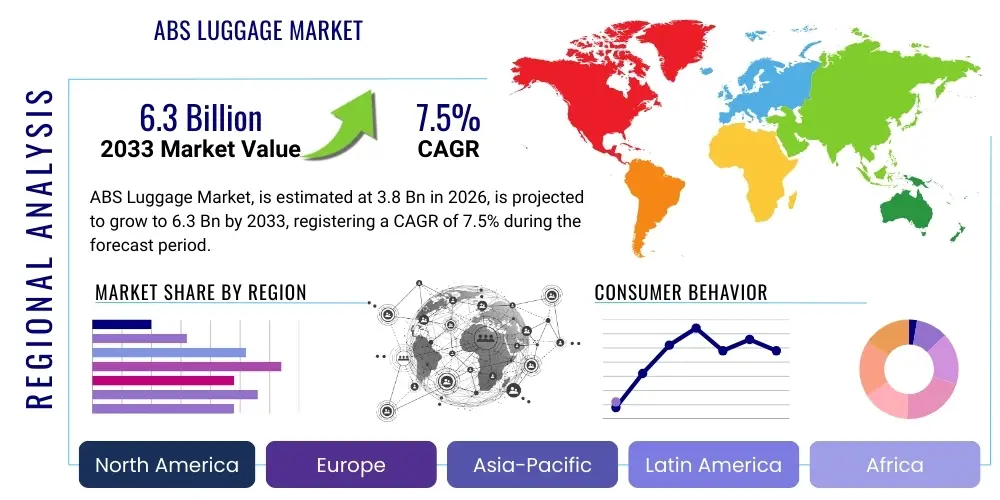

ABS Luggage Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442541 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

ABS Luggage Market Size

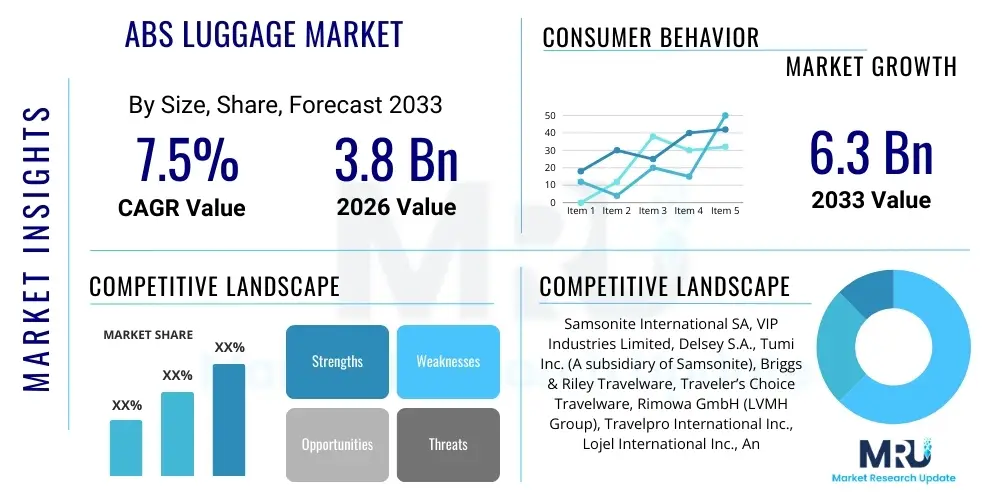

The ABS Luggage Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 6.3 Billion by the end of the forecast period in 2033.

ABS Luggage Market introduction

The ABS Luggage Market encompasses the production and sale of travel bags, suitcases, and carry-ons manufactured primarily from Acrylonitrile Butadiene Styrene (ABS) polymer. ABS is a lightweight, rigid, and highly durable thermoplastic known for its excellent impact resistance and aesthetic versatility, making it a preferred material in the modern luggage industry, particularly for hard-shell applications. The market segmentation is largely driven by product type, including carry-on luggage, medium-sized checked baggage, and large suitcases, catering to diverse travel needs ranging from short business trips to extended international vacations. The primary product description centers on high tensile strength, scratch resistance, and the ability to maintain structural integrity under pressure, which appeals directly to consumers seeking reliable and long-lasting travel solutions. The widespread adoption of ABS material reflects a critical shift away from traditional soft-sided luggage, driven by enhanced security features and superior protection for contents. The chemical composition of ABS allows for vibrant color options and unique textural finishes, adding a layer of cosmetic appeal that meets contemporary consumer demands for stylish travel gear, thereby positioning ABS luggage as a staple in the global travel and tourism sector.

Major applications for ABS luggage span across both leisure and business travel segments. In leisure travel, its robustness makes it ideal for handling the rough and tumble of airport conveyor belts and various modes of transportation, ensuring travelers’ personal belongings remain secure. For business travelers, the sleek, professional appearance, often coupled with built-in organizational features like laptop compartments and compression straps, provides functional efficiency. The key benefits driving market expansion include its cost-effectiveness compared to alternatives like polycarbonate or aluminum, providing a strong value proposition for mass-market consumers. Furthermore, the material’s lightweight nature significantly contributes to adherence to stringent airline weight restrictions, enhancing the overall convenience of the travel experience. These material properties, combined with continuous innovation in spinner wheel technology, integrated TSA-approved locks, and ergonomic handles, solidify ABS luggage's dominance in the mainstream market.

The primary driving factors propelling the ABS luggage market growth are the surging global travel and tourism industry, particularly the rise in middle-class disposable income across emerging economies, which fuels discretionary spending on quality travel accessories. Increased urbanization and globalization necessitate frequent business and personal travel, directly elevating demand for durable, efficient luggage solutions. Moreover, manufacturers are continuously innovating to improve the blend of ABS, sometimes incorporating PC/ABS alloys to achieve an even higher balance of flexibility and strength, addressing historical concerns regarding potential cracking under extreme impact. This commitment to material science improvement, coupled with aggressive marketing strategies targeting young, mobile populations, ensures sustained market expansion throughout the forecast period. The ease of manufacturing and molding ABS allows producers to quickly adapt to evolving fashion trends and functional requirements, maintaining high production efficiency and competitive pricing.

ABS Luggage Market Executive Summary

The ABS Luggage Market is undergoing significant evolution, characterized by robust growth driven by expanding global tourism and shifts in consumer preferences toward durable hard-shell baggage. Current business trends indicate a strong move toward direct-to-consumer (DTC) models and enhanced e-commerce presence, allowing niche brands to compete effectively with established industry giants. Key strategic shifts among manufacturers include focusing on sustainability through incorporating recycled ABS materials and designing modular luggage components for easy repair, catering to environmentally conscious consumers. Technological integration, such as smart luggage features—though moderated by airline restrictions—and advanced material finishing processes, defines competitive differentiation. Furthermore, consolidation is occurring in the industry, with major players acquiring specialized brands to broaden their product portfolios and gain access to diverse market segments, ensuring comprehensive coverage across varying price points and aesthetic demands, reflecting a mature yet dynamic competitive landscape.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, primarily fueled by massive infrastructural investments in travel logistics, the rapidly expanding middle-income demographic, and the ensuing proliferation of domestic and outbound travel, particularly from China and India. North America and Europe, while mature, maintain substantial market shares, focusing intensely on premiumization and advanced design features, alongside a growing demand for multi-functional travel systems suitable for diverse travel environments. Emerging markets in Latin America and the Middle East & Africa (MEA) are also exhibiting accelerated adoption rates, driven by improved air connectivity and rising disposable incomes. The segmentation trends reveal that the medium to large size checked luggage segment dominates revenue generation due to the necessity for storing items during longer international trips, while the carry-on segment maintains steady growth, benefiting from increased frequency of short-haul travel and stricter checked baggage fees imposed by budget airlines.

In terms of product specialization, the market is witnessing heightened popularity in sets of luggage (nested solutions) offering varying sizes, which appeals to families and bulk buyers seeking convenience and value. Distribution trends show a sustained reliance on specialized retail stores and department stores for physical examination and high-touch sales experiences, juxtaposed with the explosive growth of online sales channels offering competitive pricing and extensive product reviews. Sustainability and durability remain central themes influencing purchase decisions, compelling producers to focus their marketing efforts on the longevity and resilience of ABS composites. Overall, the market remains fundamentally strong, characterized by continuous adaptation to logistical challenges, evolving consumer aesthetics, and the overarching macroeconomic factor of accessible global travel, projecting continued stable revenue accretion through the forecast period.

AI Impact Analysis on ABS Luggage Market

Common user questions regarding AI's impact on the ABS Luggage market typically revolve around themes of personalization, supply chain efficiency, and retail innovation. Users frequently inquire about how AI can predict fashion trends in luggage design, optimize inventory management based on real-time travel data, and personalize the online shopping experience by recommending ideal suitcase sizes and features based on past travel behavior and stated destination types. Concerns also surface regarding the integration of AI-powered smart features into the luggage itself, such as automated weight sensors or biometric locking systems, and the subsequent regulatory and privacy implications. The consensus expectation is that AI will primarily revolutionize the backend operations and customer interfacing aspects rather than the core manufacturing process of the ABS shell itself, focusing on maximizing efficiency and delivering highly customized product offerings to the increasingly fragmented consumer base.

The application of Artificial Intelligence within the ABS luggage supply chain is poised to significantly reduce lead times and minimize obsolescence risks. AI algorithms can analyze complex datasets encompassing global flight schedules, seasonal travel peaks, localized economic indicators, and historical sales data to generate highly accurate demand forecasts. This predictive capability allows manufacturers to optimize raw material procurement (ABS resin, lining fabric, hardware components) and align production volumes precisely with anticipated market needs. Furthermore, in quality control, machine vision systems powered by AI can inspect the ABS shells for subtle defects, such as molding imperfections or surface irregularities, far faster and more consistently than human inspectors, ensuring that only high-standard products reach the consumer and reducing waste associated with faulty batches.

In the retail environment, Generative AI (GenAI) and machine learning models are transforming customer engagement. Virtual try-on experiences, where customers can visualize luggage in various travel settings or compare aesthetic features like color and texture digitally, are becoming standard, increasing consumer confidence in online purchases. AI also drives hyper-personalized marketing campaigns, using sentiment analysis derived from social media and review platforms to refine product development priorities. For instance, if consumer feedback strongly favors lightweight designs over maximum capacity in a specific region, AI quickly flags this trend, enabling rapid product iteration. This pervasive influence of AI on demand sensing, inventory optimization, and personalized consumer interaction fundamentally enhances market responsiveness and operational profitability for ABS luggage producers.

- AI optimizes supply chain logistics, improving forecasting accuracy for ABS resin procurement and inventory levels.

- Machine Learning (ML) algorithms drive personalized product recommendations in e-commerce, matching luggage size and features to individual travel patterns.

- AI-powered quality control systems utilize machine vision to detect microscopic defects in ABS shell molding, significantly enhancing product quality consistency.

- Generative AI assists in rapid prototyping and testing new aesthetic designs (colors, textures, molds) based on anticipated market trends.

- Predictive maintenance analytics, applied to manufacturing machinery, reduces downtime and increases the operational lifespan of production assets for ABS luggage fabrication.

DRO & Impact Forces Of ABS Luggage Market

The dynamics of the ABS Luggage Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively define the Impact Forces influencing market trajectory. Key drivers include the exponential growth in global air passenger traffic, fueled by accessible low-cost carriers and increasing discretionary spending on leisure activities, which necessitates durable and affordable travel gear. The inherent benefits of ABS—its excellent rigidity, impact resistance, and lightweight structure compared to traditional materials—solidify its position as a consumer favorite. This robust demand is somewhat countered by restraints, primarily stemming from intense price competition from substitute materials, such as pure polycarbonate (PC) which offers higher flexibility, and the cyclical nature of the travel industry, which remains vulnerable to global economic downturns, geopolitical instability, and health crises that restrict movement. Nonetheless, manufacturers continuously seek innovative blending techniques, often combining ABS with PC or other additives, to mitigate some of the material's limitations, such as susceptibility to stress cracking under extreme cold or repeated severe impact.

Opportunities in the market center around sustainability and technological integration. There is a burgeoning opportunity for manufacturers to differentiate their products by incorporating recycled or bio-based ABS alternatives, appealing to a growing segment of eco-conscious travelers willing to pay a premium for greener products. Furthermore, the integration of ‘smart’ features, such as proximity sensors, location tracking devices (compliant with airline regulations), and integrated digital scales, offers a compelling value addition, moving ABS luggage beyond a mere container into a connected travel accessory. Expanding market reach into untapped regional markets, particularly developing economies in Africa and Southeast Asia where travel infrastructure is rapidly improving and consumer purchasing power is increasing, represents a significant avenue for long-term growth. The strategic exploitation of e-commerce platforms also provides an opportunity for direct brand storytelling and deeper customer engagement, bypassing traditional retail intermediaries.

The combined Impact Forces exert strong pressure on product innovation and pricing strategies. The high volume of production achievable with ABS material keeps manufacturing costs relatively low, intensifying competition and demanding constant differentiation through design or ancillary features (e.g., specialized wheel systems, improved interior organization). The regulatory environment, particularly evolving airline requirements regarding carry-on dimensions and battery restrictions for smart luggage, acts as a pivotal external impact force, mandating continuous product adaptation. Success in this market is dictated by the ability of companies to efficiently manage their supply chains to maintain competitive pricing while simultaneously investing in material science to enhance durability and incorporating consumer-driven design elements that address modern travel complexities, such as TSA guidelines and multi-modal transport challenges. This balance between affordability, durability, and features dictates the market's momentum.

Segmentation Analysis

The ABS Luggage Market is comprehensively segmented based on several critical dimensions, including Product Type, Size, Distribution Channel, and Application, providing a detailed framework for understanding market dynamics and targeted strategic planning. Product Type segmentation primarily differentiates between standard luggage sets, individual suitcases, and specialty bags, recognizing the diverse needs of travelers, from family vacations requiring matching sets to solo business trips needing highly specific carry-on features. Size classification is crucial, directly correlating with airline constraints, dividing the market into carry-on (typically 20 inches and below), medium-sized checked bags (21-27 inches), and large checked bags (28 inches and above), reflecting variations in travel duration and purpose. This segmentation allows manufacturers to tailor their production volumes and marketing efforts precisely to the segments exhibiting the highest growth potential or greatest consumer demand.

Further breakdown by Distribution Channel is pivotal, separating sales through Offline channels, such as specialty luggage stores, department stores, and hypermarkets, from the increasingly dominant Online channels, which include company websites and third-party e-commerce giants. The offline channel continues to be vital for consumers who prefer to physically assess the product’s quality, weight, and wheel performance before purchase, especially in the premium segments. Conversely, the online channel offers unparalleled convenience, price transparency, and access to a wider inventory, often driving volume sales through competitive pricing and extensive consumer reviews. Application-based segmentation distinguishes between luggage purchased for Leisure Travel, which often emphasizes color, capacity, and aesthetics, and Business Travel, where durability, organizational features (like padded laptop sleeves), and a professional appearance are prioritized, guiding product feature development accordingly.

Analyzing these segments provides granular insights into consumer behavior and spending patterns globally. For instance, the younger demographic often drives demand in the online distribution segment, favoring customizable and stylish options, while older, established travelers may lean towards recognizable, premium brands available through reliable specialty retailers. The dominance of the medium-sized segment underscores the popularity of intermediate trips requiring more than a carry-on but less than a maximum capacity suitcase. Detailed segmentation analysis is thus indispensable for identifying white spaces in the market, optimizing inventory allocation across different retail formats, and developing successful, localized marketing strategies that resonate with specific end-user groups, ultimately ensuring sustained revenue growth and competitive advantage in a highly contested market landscape.

- By Product Type:

- Suitcases/Trolley Bags

- Duffel Bags (with ABS components)

- Backpacks (with ABS shells)

- By Size:

- Carry-on (up to 20 inches)

- Medium Checked (21 to 27 inches)

- Large Checked (28 inches and above)

- By Distribution Channel:

- Online (E-commerce Platforms, Company Websites)

- Offline (Specialty Stores, Department Stores, Hypermarkets)

- By Application:

- Leisure Travel

- Business Travel

- General Use/Other

Value Chain Analysis For ABS Luggage Market

The Value Chain for the ABS Luggage Market begins with Upstream Analysis, focusing on the procurement of raw materials, primarily ABS resin, which is a petrochemical derivative. Key suppliers include major chemical and polymer manufacturers who provide the feedstock. The efficiency and pricing of this initial stage are critically dependent on global crude oil prices and the stability of the petrochemical industry. Manufacturers must engage in strategic sourcing to manage volatility and ensure a steady supply of high-grade ABS pellets necessary for injection molding the luggage shells. Other upstream inputs include components such as aluminum or steel for trolley handles, high-quality textiles for interior lining, and specialized materials for wheels and locking mechanisms (e.g., TSA-approved locks). Optimization at this stage involves robust supplier relationships, bulk purchasing agreements, and stringent quality control over incoming materials to guarantee the final product's durability.

The midstream section involves manufacturing and assembly. ABS pellets are heated and injection-molded into the two halves of the shell, followed by cooling, trimming, and assembly, which includes fitting the lining, zipper systems, handles, and wheels. Quality manufacturing processes are paramount, ensuring the consistency of shell thickness and impact resistance. Following manufacturing, the Downstream Analysis centers on distribution and sales. The distribution channel is bifurcated into Direct and Indirect sales. Direct sales involve manufacturers selling directly to consumers (DTC) via their own branded stores or e-commerce sites, offering higher margins and greater control over branding and customer data. Indirect sales rely on a network of wholesalers, distributors, retail chains (department stores, hypermarkets), and third-party e-commerce marketplaces (e.g., Amazon, Alibaba), allowing for broad geographical penetration but often requiring margin sharing.

The robust selection of the distribution channel is critical for market success. Specialty luggage retailers remain important as they offer expert advice and allow consumers to interact physically with the product, a key factor for durability assessment. However, the rapidly expanding online channel facilitates global reach and reduces infrastructural overhead, making it increasingly vital for growth, especially for mass-market and mid-range ABS products. Effective logistics and inventory management across these disparate channels—ensuring products are available efficiently where demand dictates, often utilizing sophisticated predictive analytics—are the final determinants of value capture. This intricate value chain requires continuous optimization, from managing fluctuating polymer prices upstream to streamlining multi-channel fulfillment downstream, to maintain competitive edge and deliver value to the end consumer.

ABS Luggage Market Potential Customers

The primary End-Users and Buyers of ABS luggage are characterized by their diverse travel frequencies, budget considerations, and aesthetic preferences, generally falling into three major categories: frequent leisure travelers, intermittent business professionals, and value-seeking family units. Frequent leisure travelers prioritize lightweight, recognizable, and often vibrantly colored ABS luggage that can withstand varied environmental conditions and transport modes encountered during recreational trips. This segment is highly responsive to design innovation, such as built-in charging ports and specialized compartment designs, and typically purchases individual pieces or smaller sets frequently as trends evolve or as pieces wear out due to high usage volume. They often prioritize aesthetic appeal alongside functional durability, making them key targets for mid-range to premium ABS blends.

Business professionals represent a segment prioritizing subtle design, organizational efficiency, and robust security features. Their purchases often center around high-quality carry-on ABS suitcases that meet strict corporate travel guidelines and offer dedicated sections for electronics and documents. Durability is paramount as these individuals travel frequently, demanding luggage that reflects a professional image while offering reliable protection for sensitive equipment. They tend to favor established brands known for reliable warranties and superior rolling systems. This segment often relies on direct and specialized retail channels for purchase, emphasizing perceived quality and brand reputation over the lowest price point.

The third significant customer group comprises families or budget-conscious travelers seeking multi-piece nested sets that offer excellent value and volume capacity. This segment drives demand for medium and large checked bags and is highly sensitive to pricing, often seeking promotional deals through hypermarkets and large online marketplaces. For this group, the primary appeal of ABS lies in its durability-to-cost ratio, providing sufficient protection for family belongings without the expense of materials like pure polycarbonate or aluminum. Manufacturers often tailor marketing efforts toward the resilience and ease of handling (e.g., four-wheel spinners) when targeting this crucial volume-driving demographic, ensuring that ABS remains the material of choice for mass-market, durable travel solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 6.3 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsonite International SA, VIP Industries Limited, Delsey S.A., Tumi Inc. (A subsidiary of Samsonite), Briggs & Riley Travelware, Traveler’s Choice Travelware, Rimowa GmbH (LVMH Group), Travelpro International Inc., Lojel International Inc., Antler Luggage, American Tourister (Samsonite), VF Corporation (Eastpak, The North Face), Rock Luggage, Horizon Global Corporation, Randa Luggage, IT Luggage, Ricardo Beverly Hills, Eminent Luggage, Crown Luggage, Echolac International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ABS Luggage Market Key Technology Landscape

The technology landscape governing the ABS Luggage market extends beyond simple material science into advanced manufacturing processes and peripheral integrated systems. The core technology lies in high-precision injection molding techniques required to produce ABS shells with consistent thickness, texture, and structural integrity. Modern manufacturers employ sophisticated multi-cavity molds and highly automated robotic systems to maximize production speed while minimizing material waste. Emphasis is placed on temperature control during the molding process, as this directly affects the molecular structure and impact resistance of the final ABS shell. Furthermore, specialized surface finishing technologies, such as texture application (e.g., micro-diamond or scratch-resistant finishes) and UV protective coatings, are utilized to enhance both the aesthetic appeal and the long-term resilience of the luggage surface against abrasion and discoloration, providing a competitive edge in a saturated market.

Beyond material handling, the key technological differentiators reside in component innovation and integration. This includes the development of multi-directional, double spinner wheels utilizing high-grade ball bearings (e.g., Japanese-made components) and low-friction materials like polyurethane, significantly improving maneuverability and durability under heavy loads. Advanced telescoping handle systems use lightweight aluminum alloys and ergonomic locking mechanisms to ensure smooth operation and minimize wobble, addressing a common point of consumer frustration. Furthermore, the mandatory adoption of standardized security technologies, such as integrated TSA-approved combination locks, is non-negotiable, requiring precise engineering integration into the ABS shell design without compromising structural stability, ensuring global compliance and ease of security checks.

Looking forward, the technological frontier for ABS luggage involves pervasive integration of smart technology components, albeit carefully balanced against strict airline regulations regarding lithium-ion batteries. This includes micro-electronic systems for weight measurement, Bluetooth or cellular-enabled GPS/GPRS trackers for location monitoring, and biometric fingerprint scanners for enhanced security, transforming the traditional suitcase into a connected device. Though the inherent limitations of ABS material restrict integration opportunities compared to more conductive or flexible composites, the market is rapidly adapting by utilizing external mounting points or easily removable battery packs. These technological enhancements are crucial for meeting the demands of modern, digitally-aware travelers who seek convergence of travel gear with personal electronic ecosystems, driving incremental value capture for manufacturers embracing digital transformation.

Regional Highlights

Regional dynamics play a crucial role in shaping the ABS Luggage market, with varying levels of maturity and growth drivers across major geographical segments. Asia Pacific (APAC) currently stands as the fastest-growing market, primarily due to the rapid expansion of air travel infrastructure, burgeoning middle-class populations in India and China, and increasing domestic and outbound tourism. The region’s manufacturers benefit from lower production costs and proximity to raw material supply chains, making APAC a major global production hub for ABS luggage, satisfying both domestic consumption and export demand. High urbanization rates and rising disposable incomes in Southeast Asian countries like Vietnam, Indonesia, and Thailand further bolster market expansion, fueling the demand for affordable, yet durable, hard-shell solutions provided by ABS.

North America and Europe represent mature markets characterized by high consumer spending power and a strong preference for premium and mid-range branded luggage. These regions prioritize sophisticated design, integration of smart features, and comprehensive warranties. The competitive environment is driven by established global brands focusing on material blend innovation (e.g., PC/ABS composites) and design aesthetics (e.g., matte finishes, specialized textures). Demand in these regions is less volume-driven and more replacement-driven, with consumers frequently upgrading based on technological advancements or new fashion trends. Strict regulations regarding baggage size and weight also heavily influence product development in these saturated yet highly profitable markets, leading to specialized products optimized for specific airline requirements.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets exhibiting accelerated adoption rates. In LATAM, growing economic stability and increased intra-regional air connectivity are key drivers, with consumers seeking durable products that offer value for money—a niche perfectly served by ABS luggage. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, shows high demand for luxury and mid-to-high end ABS luggage, fueled by significant international business travel and the Hajj/Umrah pilgrimages which necessitate robust, high-capacity baggage. Regional market participants often focus on localized distribution strategies and culturally sensitive product designs to maximize penetration in these rapidly evolving territories.

- Asia Pacific (APAC): Dominates manufacturing and exhibits the highest growth rate due to expanding middle class, infrastructural development, and high volume of domestic travel in China and India.

- North America: Mature market focused on premium brands, smart luggage integration, and specialized, durable designs catering to frequent business travelers.

- Europe: Characterized by strong demand for sophisticated, stylish ABS luggage; high adoption of environmentally friendly materials (recycled ABS initiatives).

- Latin America (LATAM): Growing market driven by improving economic conditions and increased regional air connectivity; demand centers on value-for-money and durability.

- Middle East and Africa (MEA): High growth potential driven by increased international travel (business, tourism, pilgrimage) and investment in luxury travel retail channels in GCC countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ABS Luggage Market.- Samsonite International SA

- VIP Industries Limited

- Delsey S.A.

- Tumi Inc. (A subsidiary of Samsonite)

- Briggs & Riley Travelware

- Traveler’s Choice Travelware

- Rimowa GmbH (LVMH Group)

- Travelpro International Inc.

- Lojel International Inc.

- Antler Luggage

- American Tourister (Samsonite)

- VF Corporation (Eastpak, The North Face)

- Rock Luggage

- Horizon Global Corporation

- Randa Luggage

- IT Luggage

- Ricardo Beverly Hills

- Eminent Luggage

- Crown Luggage

- Echolac International

Frequently Asked Questions

Analyze common user questions about the ABS Luggage market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is ABS luggage and how does it compare to Polycarbonate (PC) luggage?

ABS (Acrylonitrile Butadiene Styrene) luggage is a hard-shell suitcase made from a rigid, durable thermoplastic polymer known for its lightweight nature and superior impact resistance. Compared to Polycarbonate (PC) luggage, ABS is generally more affordable and harder, but PC offers greater flexibility and resistance to stress cracking, though it is usually a higher-cost material.

Is ABS luggage durable enough for frequent international travel?

Yes, ABS luggage is highly durable and suitable for frequent travel due to its rigidity and inherent scratch resistance. While pure ABS can be brittle under extreme pressure or cold, modern ABS luggage often utilizes PC/ABS blends or advanced structural designs (ribbing) to maximize resilience, making it a reliable, cost-effective choice for international trips.

What are the primary factors driving the growth of the ABS luggage market?

Key growth drivers include the steady expansion of the global travel and tourism sector, particularly the rise of low-cost carriers and increasing disposable incomes in emerging markets, coupled with the inherent affordability and strong durability-to-weight ratio that ABS offers compared to competing materials.

How is sustainability impacting the production and consumer choice of ABS luggage?

Sustainability is driving innovation towards using recycled ABS (rABS) content and designing luggage for repairability and modularity, extending product lifespan. Consumers are increasingly seeking environmentally conscious brands, compelling manufacturers to publicly report on material sourcing and end-of-life recycling programs.

Which distribution channel dominates the sales of ABS luggage globally?

While traditional specialty and department stores remain important for high-touch sales, the Online Distribution Channel (e-commerce platforms and brand websites) currently dominates in terms of volume growth and market penetration, offering wide selection, price comparison tools, and logistical convenience for the mass market ABS segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager