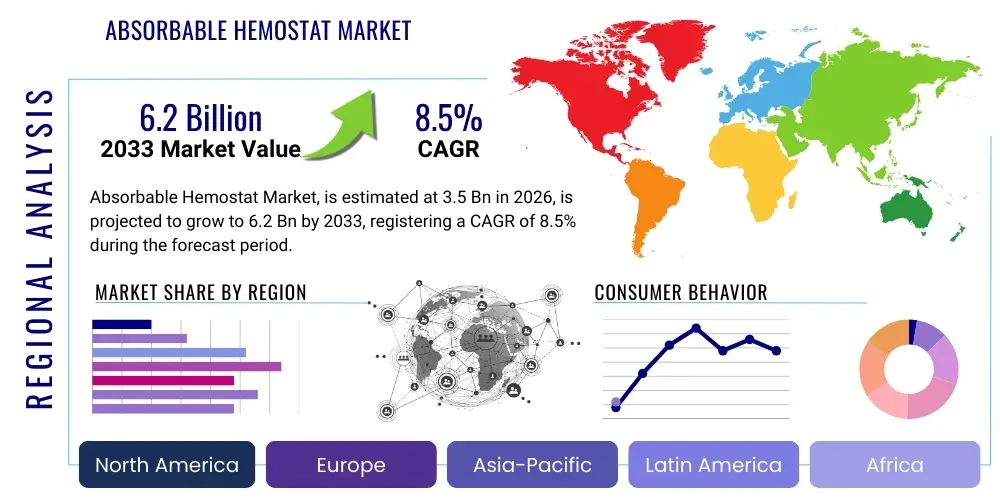

Absorbable Hemostat Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442225 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Absorbable Hemostat Market Size

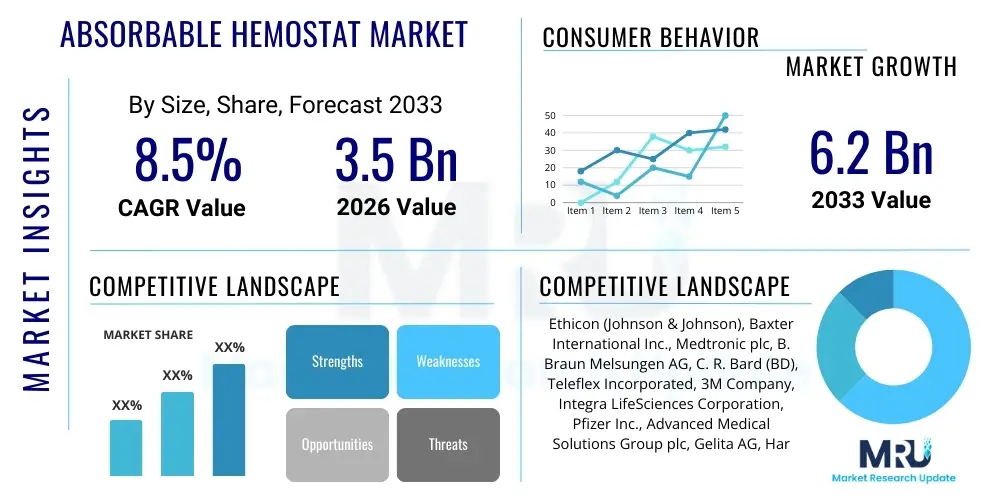

The Absorbable Hemostat Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

The consistent growth trajectory is primarily fueled by the increasing volume of surgical procedures globally, coupled with a rising prevalence of chronic diseases requiring surgical intervention. Absorbable hemostats offer superior benefits in terms of reducing operating time, minimizing blood loss, and mitigating the risk of post-operative complications, making them essential tools across various surgical disciplines, notably cardiovascular, neuro, and general surgery. Technological advancements leading to the development of novel materials and formulations, such as polysaccharide-based and synthetic polymer hemostats, are further expanding their clinical utility and adoption rates.

Absorbable Hemostat Market introduction

The Absorbable Hemostat Market encompasses a wide range of specialized medical devices and agents designed to control bleeding (hemostasis) during surgical operations or trauma, which are naturally absorbed by the body over time, thus eliminating the need for removal. These products are crucial in complex surgical fields, especially when conventional methods like sutures or cautery are ineffective or impractical, such as in diffuse bleeding areas, deep cavities, or near delicate neurological structures. Key products include oxidized regenerated cellulose (ORC), gelatin sponges, collagen-based pads, and advanced fibrin sealant patches, each offering distinct mechanisms of action to promote clot formation and subsequent wound healing.

Major applications span general surgery, cardiovascular surgery, neurosurgery, orthopedic surgery, and minimally invasive procedures. The primary benefits driving market adoption include reduced operative time, lower rates of transfusion, enhanced safety profiles, and improved patient outcomes by preventing complications associated with persistent intraoperative bleeding. The versatility of these products, available in various forms like sheets, powders, and sealants, allows surgeons to select the optimal agent based on the bleeding severity and surgical site characteristics. This adaptability ensures high clinical efficacy across diverse surgical scenarios.

Driving factors for the market include the demographic shift toward an aging population, which inherently requires more surgical interventions; significant investments in healthcare infrastructure in emerging economies; and continuous research and development efforts by key market players focused on creating faster-acting, biocompatible, and cost-effective hemostatic solutions. Furthermore, increasing awareness among healthcare professionals regarding the benefits of utilizing absorbable agents over traditional methods is consistently bolstering demand.

Absorbable Hemostat Market Executive Summary

The Absorbable Hemostat Market is exhibiting robust expansion driven by global increases in surgical volumes and a preference for advanced, minimally invasive surgical techniques that necessitate precise bleeding control. Business trends indicate a strong focus on strategic mergers and acquisitions, particularly aiming at integrating specialized technology developers to enhance product portfolios. Key manufacturers are heavily investing in R&D to launch next-generation products, such as flowable hemostats and combination products (combining mechanical barriers with thrombin), to address complex bleeding challenges in specialized surgeries like cardiovascular and spinal procedures. The regulatory landscape, while stringent, is generally supportive of innovations that improve patient safety and surgical efficiency, creating a fertile ground for market expansion.

Regionally, North America maintains market dominance due to high healthcare expenditure, sophisticated surgical infrastructure, and favorable reimbursement policies supporting the use of premium absorbable hemostats. However, the Asia Pacific (APAC) region is projected to register the fastest growth, propelled by the rapid modernization of healthcare facilities, increasing patient awareness, and governmental initiatives focused on improving access to advanced medical treatments. Europe also holds a significant market share, driven by stringent quality standards and a high volume of complex surgeries, particularly in Western European nations.

Segment trends highlight the growing preference for oxidized regenerated cellulose (ORC) products owing to their proven efficacy and long-standing clinical history. Simultaneously, advanced matrix and sealant hemostats, often incorporating thrombin, are gaining traction due to their ability to manage severe and high-pressure bleeding effectively. The hospital segment remains the primary end-user, though the ambulatory surgical center (ASC) segment is witnessing substantial growth, reflecting the trend toward outpatient surgical procedures and cost-effective healthcare delivery.

AI Impact Analysis on Absorbable Hemostat Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Absorbable Hemostat Market frequently center on themes such as optimization of surgical planning, predictive modeling for intraoperative bleeding risk, and efficiency gains in supply chain management for high-value surgical consumables. Users are keen to understand how AI tools can inform surgeons' decisions regarding the selection and optimal quantity of hemostatic agents based on real-time patient data and operative conditions. Additionally, significant concern revolves around integrating AI-driven insights into minimally invasive and robotic surgeries, ensuring that automated systems can reliably monitor and predict bleeding events that require immediate hemostat application, ultimately aiming for enhanced precision and reduced waste. The overarching expectation is that AI will transform the procurement and application process, moving from reactive utilization to proactive, data-informed intervention.

AI's role is particularly transformative in improving manufacturing yield and quality control for complex biological hemostats, where consistency is critical. Machine learning algorithms can analyze vast datasets from clinical trials to predict the performance characteristics of new hemostat formulations under various physiological conditions, dramatically accelerating the research and development cycle. Furthermore, AI tools are being deployed in hospitals to manage inventory dynamically, predicting usage patterns based on scheduled surgeries and historical data, thereby preventing shortages of critical hemostatic products and minimizing operational costs. This integration enhances surgical resource utilization efficiency.

- AI-driven Predictive Analytics: Used for forecasting the likelihood and severity of intraoperative bleeding based on patient comorbidities and surgical plan, guiding the proactive preparation of necessary hemostatic agents.

- Optimized Inventory Management: Machine learning models improve hospital stock keeping units (SKU) efficiency for different hemostat types, reducing waste and ensuring continuous availability during peak surgical periods.

- Robotic Surgery Integration: AI enhances visualization and sensor data analysis in robotic platforms, allowing for earlier detection of minor bleeding and precise application guidance for flowable hemostats.

- Quality Control and Manufacturing: Computer vision and ML optimize the consistency and efficacy of manufacturing biological and synthetic hemostats, ensuring high purity and absorption rates.

- Clinical Trial Acceleration: AI analyzes patient response data across trials, speeding up the regulatory approval process for novel hemostatic materials and formulations.

DRO & Impact Forces Of Absorbable Hemostat Market

The Absorbable Hemostat Market dynamics are shaped by a complex interplay of clinical demands and technological advances. The primary driver is the rising global incidence of trauma and chronic diseases necessitating surgical intervention, which directly increases the demand for effective bleeding control solutions. Concurrently, technological innovation, particularly the creation of advanced synthetic polymer and fibrin-based sealants, offers superior performance in challenging surgical environments, accelerating their adoption. However, market growth is significantly restrained by the high cost associated with premium biological hemostats and the stringent regulatory approval pathways, which can delay the introduction of novel products, especially those based on advanced biological matrices.

Opportunities within this market are substantial, particularly in emerging economies where healthcare infrastructure investment is surging, creating new consumer bases for advanced hemostatic products. Furthermore, the shift toward minimally invasive surgery (MIS) procedures presents a unique opportunity, as MIS often necessitates specialized, easy-to-apply hemostats like flowable gels and powders, optimizing procedures through small incisions. The impact forces acting on this market include both internal competitive pressures, driving down product costs and increasing innovation velocity, and external forces like public health crises (e.g., pandemics) that increase the backlog of elective surgeries, temporarily altering demand cycles but ultimately creating pent-up need.

The imperative to reduce hospital lengths of stay and associated healthcare costs acts as a strong positive impact force. Absorbable hemostats contribute to this by minimizing complications, reducing the need for costly blood transfusions, and accelerating recovery. Conversely, the market faces constraints related to the potential risk of foreign body reactions or poor absorption associated with some older material types, demanding continuous focus on material biocompatibility and clinical safety data from manufacturers to maintain consumer confidence and ensure compliance with global regulatory standards.

Segmentation Analysis

The Absorbable Hemostat Market is extensively segmented based on material type, product form, application area, and end-user. This granular segmentation allows manufacturers and healthcare providers to tailor solutions to specific surgical needs and bleeding control requirements. The material segmentation—encompassing oxidized regenerated cellulose (ORC), gelatin, and collagen—is critical, as each material offers a distinct physical structure and biological mechanism for accelerating hemostasis. The efficacy and absorption profile directly influence its use across different surgical settings, such as ORC for superficial bleeding versus advanced sealants for high-pressure vascular bleeds. The evolution of synthetic and combination hemostats continues to redefine the market landscape, pushing performance boundaries and expanding clinical utility.

Application-wise, general surgery and cardiovascular surgery dominate the market, reflecting the high incidence and complexity of procedures in these fields, often associated with significant blood loss risk. However, neurosurgery and orthopedic surgery segments are experiencing accelerated growth due to advancements requiring high precision and absorbable materials that minimize interference with adjacent delicate tissues or bone regeneration processes. Understanding these segment dynamics is crucial for strategic market positioning, allowing companies to focus their R&D efforts and marketing strategies on the most rapidly evolving and high-value surgical disciplines. The end-user analysis confirms that hospitals remain the cornerstone of demand, driven by their capacity to handle complex procedures and high procedural volumes.

- Material Type:

- Oxidized Regenerated Cellulose (ORC)

- Gelatin-Based Hemostats

- Collagen-Based Hemostats

- Polysaccharide-Based Hemostats

- Synthetic & Combination Hemostats (e.g., Fibrin Sealants)

- Product Type:

- Hemostatic Agents (Powders, Sponges, Sheets)

- Hemostatic Sealants (Fibrin, Synthetic)

- Flowable Hemostats (Matrix Agents)

- Application:

- General Surgery

- Cardiovascular Surgery

- Neurosurgery & Spinal Surgery

- Orthopedic Surgery

- Trauma & Emergency Care

- Other Surgeries (Gynecology, Urology)

- End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialized Clinics

Value Chain Analysis For Absorbable Hemostat Market

The value chain for the Absorbable Hemostat Market is complex, beginning with the sourcing and preparation of raw materials, which are often highly specialized biological or synthetic polymers such as bovine or porcine gelatin, refined cellulose, or advanced synthetic monomers. The upstream activities involve rigorous purification, sterilization, and preparation processes to ensure biocompatibility and absorbability. Suppliers of these primary materials must adhere to strict pharmaceutical-grade standards, impacting material costs significantly. Key challenges in the upstream phase include securing consistent, high-quality biological raw materials and navigating fluctuating commodity prices, particularly for animal-derived products, which necessitate robust traceability and quality assurance protocols.

The core manufacturing stage involves converting these materials into various product forms—sponges, powders, or injectable sealants—requiring specialized cleanroom facilities, advanced freeze-drying techniques, and cross-linking technologies to achieve optimal porosity, structure, and dissolution rates. Distribution channels are highly regulated, involving both direct sales forces targeting major hospital networks and indirect distribution through specialized medical device distributors. Direct distribution is favored for complex, high-value products like fibrin sealants, allowing for targeted technical support and educational outreach to surgical teams. Indirect channels are often utilized for standardized products like gelatin sponges, enabling broader market reach across smaller clinics and ASCs efficiently.

Downstream analysis focuses on the end-users—hospitals and ASCs—where product selection is influenced by clinical efficacy, pricing negotiated through group purchasing organizations (GPOs), and surgeon preference. Post-market surveillance and continuous clinical support form the final links, ensuring optimal product usage and feedback loops for further innovation. The efficiency of this distribution network is crucial, as the performance of hemostats can directly influence patient outcomes, making speed and reliability in the supply chain paramount. Effective logistical management is essential to deliver sterile, high-integrity products precisely when needed in the operating theater.

Absorbable Hemostat Market Potential Customers

The primary consumers and end-users of absorbable hemostats are surgical departments within large hospital systems, ambulatory surgical centers, and trauma centers globally. Hospitals, particularly those specializing in high-acuity procedures such as cardiovascular, neuro, and orthopedic surgery, represent the largest customer base due to the frequency and complexity of operations performed, where meticulous bleeding control is non-negotiable. These institutions prioritize products offering superior efficacy, documented clinical safety, and ease of use under pressure, often purchasing large volumes through established procurement contracts and GPOs. The decision-making unit typically involves surgeons, operating room management, and pharmacy committees, all weighing clinical benefits against cost implications.

Ambulatory Surgical Centers (ASCs) constitute a rapidly growing segment of potential customers, driven by the increasing shift of less complex procedures (like certain orthopedic or general surgeries) from inpatient hospital settings to outpatient facilities. ASCs favor absorbable hemostats that are highly standardized, cost-effective, and facilitate rapid patient turnover. The need for efficient, single-use products that minimize post-operative complications is particularly high in the ASC setting. Furthermore, military medical facilities and emergency response units are critical customers, requiring durable, easy-to-store hemostatic agents capable of managing severe bleeding in austere or high-pressure pre-hospital environments, emphasizing shelf stability and immediate efficacy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ethicon (Johnson & Johnson), Baxter International Inc., Medtronic plc, B. Braun Melsungen AG, C. R. Bard (BD), Teleflex Incorporated, 3M Company, Integra LifeSciences Corporation, Pfizer Inc., Advanced Medical Solutions Group plc, Gelita AG, Harvest Technologies (Terumo), Cohesion Technologies, CryoLife Inc., Z-Medica (Teleflex), Stryker Corporation, Becton, Dickinson and Company (BD), Hemostasis, LLC, Biom'Up, Tissuemed Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Absorbable Hemostat Market Key Technology Landscape

The technology landscape of the Absorbable Hemostat Market is characterized by a continuous evolution from simple mechanical agents to complex, biologically active systems. The core technologies currently dominating the market include the processing and purification of Oxidized Regenerated Cellulose (ORC), which relies on chemical modification of plant-based cellulose to create an acidic, absorbable fabric that promotes platelet adhesion and coagulation. Gelatin-based technology involves sophisticated foaming and cross-linking processes (often using glutaraldehyde or similar agents) to create porous, absorbable sponges that act as physical scaffolds for clot formation. Recent technological innovations focus on improving the speed of absorption and minimizing tissue reaction, leveraging finer material structures and enhanced manufacturing techniques.

A significant technological shift involves the rise of combination products, particularly those integrating biological components like thrombin or fibrinogen with mechanical matrices. Fibrin sealants, which utilize purified human clotting factors (fibrinogen and thrombin) to mimic the final stages of the natural coagulation cascade, represent the high-end technology in this sector. Advances here include developing two-component systems that are stable at room temperature and delivery systems that allow precise, homogeneous application via specialized cannulas or spray tips. Furthermore, synthetic polymer hemostats, often based on polyethylene glycol (PEG) or polysaccharide derivatives, are gaining prominence. These materials are engineered for optimal bioabsorption rates and reduced immunogenicity, offering an alternative to animal-derived products.

Emerging technologies focus on flowable and injectable hemostats (often hydrogels or specialized powders) that can conform to irregularly shaped bleeding sites, a critical feature in laparoscopic and robotic surgery. Research is also intensifying in nanotechnology and drug delivery systems, aiming to incorporate antimicrobial agents or growth factors directly into the hemostat matrix. This not only controls bleeding but also enhances the sterile surgical field and promotes faster wound healing. Automation and robotics are playing a minor yet growing role in application, particularly in developing specialized tips for robotic instruments to precisely deliver flowable agents in confined surgical spaces, pushing the boundaries of procedural safety and efficacy.

Regional Highlights

The market analysis reveals distinct consumption patterns and growth drivers across major global regions, reflecting variances in healthcare spending, surgical volumes, and regulatory environments.

- North America (Dominant Market Share): Driven by high adoption rates of advanced surgical technologies, favorable reimbursement mechanisms (especially in the US), and the presence of major key players (e.g., Ethicon, Baxter). The region leads in the uptake of expensive, high-efficacy combination hemostats and flowable agents, focusing on minimizing procedural risks in complex cardiovascular and neurosurgical cases.

- Europe (Mature Market with Steady Growth): Characterized by stringent quality control (CE Mark) and high penetration of absorbable hemostats, particularly in Western European nations like Germany, France, and the UK. Market growth is sustained by an aging population requiring orthopedic and general surgeries, with a strong preference for well-established ORC and gelatin products.

- Asia Pacific (APAC) (Fastest Growing Region): Experiencing exponential growth fueled by significant investment in hospital infrastructure, increasing medical tourism, and a burgeoning middle class demanding access to modern surgical treatments in countries like China, India, and Japan. Government initiatives to improve access to essential medical supplies and rising trauma incidences are key accelerators here.

- Latin America (LATAM) (Developing Market): Growth is primarily concentrated in Brazil and Mexico, driven by the increasing incidence of cardiovascular diseases and trauma. Market adoption is sensitive to pricing, favoring mid-range gelatin and cellulose products, though demand for premium sealants is growing in private healthcare sectors.

- Middle East and Africa (MEA) (Niche Growth): Characterized by disparity in market maturity; the GCC countries show high demand for high-end hemostats due to substantial healthcare spending, while African nations focus on cost-effective solutions, primarily driven by humanitarian aid and localized trauma care requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Absorbable Hemostat Market.- Ethicon (Johnson & Johnson)

- Baxter International Inc.

- Medtronic plc

- B. Braun Melsungen AG

- C. R. Bard (BD)

- Teleflex Incorporated

- 3M Company

- Integra LifeSciences Corporation

- Pfizer Inc. (Divested certain assets)

- Advanced Medical Solutions Group plc

- Gelita AG

- CryoLife Inc.

- Z-Medica (Teleflex subsidiary)

- Stryker Corporation

- Becton, Dickinson and Company (BD)

- Biom'Up

- Tissuemed Ltd.

- Hemostasis, LLC

- Mölnlycke Health Care AB

- Equimedical B.V.

Frequently Asked Questions

Analyze common user questions about the Absorbable Hemostat market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of absorbable hemostats over traditional methods?

Absorbable hemostats significantly reduce intraoperative and post-operative blood loss, minimize the necessity for blood transfusions, and improve surgical field visibility. Their ability to be left safely within the body eliminates the need for removal, thereby reducing operating time and lowering the risk of complications such as foreign body reactions or infections.

Which material type holds the largest share in the Absorbable Hemostat Market?

Oxidized Regenerated Cellulose (ORC) products currently dominate the market share. ORC materials are widely utilized due to their excellent safety profile, rapid hemostatic action, and extensive historical use across a broad spectrum of surgical specialties, maintaining strong surgeon preference worldwide.

How is minimally invasive surgery (MIS) impacting the demand for hemostats?

MIS procedures are driving increased demand for specialized, conformable hemostatic agents like flowable powders and gels. These products are essential as they allow surgeons to effectively control deep or diffuse bleeding through small incisions or cannulas where manual application of sheets or sponges is impossible, enhancing procedural efficiency.

What are the key regulatory hurdles facing new absorbable hemostatic products?

Novel hemostats, especially combination products utilizing biological components like thrombin, face rigorous regulatory scrutiny from bodies such as the FDA and EMA. Challenges include demonstrating biocompatibility, verifying consistent absorption rates, and providing extensive clinical trial data proving safety and efficacy equivalent to or superior to established products.

Which geographic region is expected to show the fastest growth rate in this market?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This accelerated growth is primarily attributed to rising healthcare expenditure, rapid modernization of surgical infrastructure, and increasing patient volumes demanding advanced surgical and trauma care in populous nations like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager